Metaverse in Healthcare Market Size, Share & Trends by Component (Hardware, Services, Software), Technology (AR/VR, MR, AI, Blockchain, IoT), Application (Telehealth, Diagnostics, Medical Training & Education), End User (Provider, Patients, Payers, Pharma) & Region - Global Forecast to 2028

Metaverse in Healthcare Market Size, Share & Trends

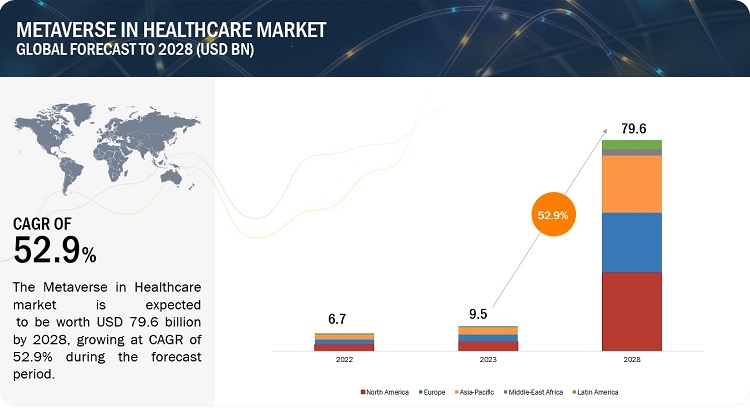

The global metaverse in healthcare market, valued at US$6.7 billion in 2022, stood at US$9.5 billion in 2023 and is projected to advance at a resilient CAGR of 52.9% from 2023 to 2028, culminating in a forecasted valuation of US$79.6 billion by the end of the period. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

The global metaverse in healthcare solutions market is expected to grow significantly in the coming years. The growth in this market is primarily be attributed to the increasing adoption of extended reality technology in healthcare sector, improved patient centric care, improved patient outcome, demand for healthcare cost reduction, accuracy of diagnosis and minimized errors and increasing the use of AR platforms to perform complex surgical procedures with higher precision and flexibility. On the other hand, the high cost of implementation, data privacy and security concern, health and mental issues from excessive use are expected to hamper the growth of this market during the forecast period.

Metaverse in Healthcare Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Metaverse in Healthcare Market Dynamics

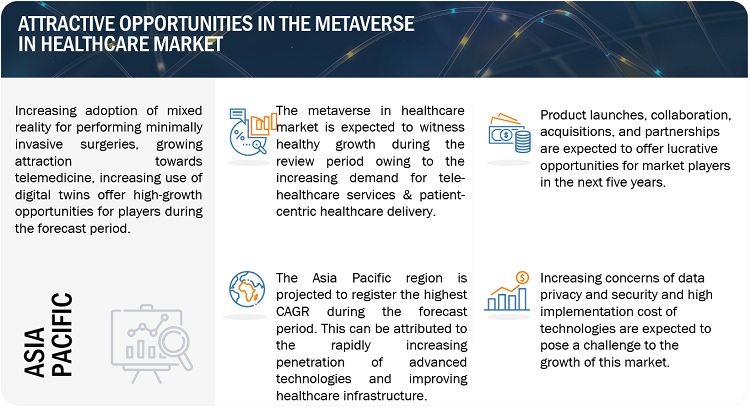

Driver: Increasing adoption of mixed reality for performing minimally invasive surgeries

In the healthcare industry, mixed reality (MR) is being used for the first time to convey important information to operating surgeons via a hands-free interface. MR helps healthcare providers simplify medical procedures while also keeping patients safe. One of the important sectors for the introduction of MR is healthcare, which includes surgical simulation, phobia therapy, robot training, and expert training, among other things.

Minimally invasive surgeries with the assistance of robots can help doctors perform complex procedures with greater precision and flexibility. Surgeons must be extremely accurate, focused, and analytical during medical procedures. They must assess several elements in order to make sound decisions during surgery. And the time window that medical practitioners are given to save a patient's life is sometimes only a fraction of a second. Mentioned below are a few examples of how the use of MR will make an impact in the healthcare industry:

- Real-time diagnostics

- Image-guided surgery

- Improving patient experience

- Empowering healthcare professionals

For instance, MR glasses can be used to overlay digital images on a patient's body, allowing a medical practitioner to perform real-time analysis. Patients can also use these devices to view their scans in real-time to gain a better understanding of their physical condition, if necessary. Some of the recent developments in the field of metaverse include:

- In May 2020, ThirdEye (US), a leader in AR and MR enterprise solutions, partnered with NuEyes (US), a pioneer in the field of low-vision technology. With this partnership, NuEyes introduced Pro 2, which employs ThirdEye's lightweight X2 MR Glasses to help patients with visual loss.

- Using AR and MR, AccuVein (US) enabled healthcare personnel to quickly see patients' veins. When using an AccuVein device for pre-insertion testing, doctors can quickly identify ideal vein targets. This not only improves first-time success and decreases escalation calls but also helps guarantee that catheters endure the duration of therapy.

Increasing use of digital twins

In healthcare, digital twins can be used to generate models that can be used for simulations and insights. It can be offered as an online healthcare service that collects data from patient records as well as real-time information from wearables to correlate data from patients, doctors, hospitals, and drug and device makers. The immersive and 3D visualization capabilities of the metaverse will allow the digital twin to be used to improve the creation of tailored medicine as well as the performance of medical equipment and healthcare organizations.

Four technologies are used in digital twins to develop visual representations; acquire, store, and analyze data; and deliver important insights. These technologies are the Internet of Things (IoT), extended reality (XR), the cloud, and artificial intelligence (AI).

Restraint: Data privacy and security concerns

The increasing use of automated healthcare technologies offers greater reach and efficiency in healthcare delivery but has high-security risks due to the broader access offered. Cybercriminals frequently target the healthcare industry with cyberattacks to exploit and manipulate information to their benefit. Furthermore, as the number of patients increases, so does the volume of patient data. Despite the initial findings of metaverse applications being encouraging, a significant impact of metaverse technologies has not been witnessed yet. The growing public awareness of data privacy issues has put pressure on countries to enact stricter privacy legislation. However, developing technologies such as the metaverse, VR, and AR will make enforcing data privacy legislation more difficult in the future.

Multisensory experiences in the metaverse will broaden the scope of data privacy beyond traditional data points to include emotional, biometric, and physiological data, implying that users will be tracked at a forensic level. This will make enforcing data privacy regulations even more difficult. To begin with, it is uncertain if current data privacy standards, other than the GDPR (general data protection regulation), are legally applicable to emerging technologies. Although present regulations handle billions of data points given by users and tech corporations, the metaverse and similar technologies will provide companies with trillions of more intrusive data points. When it comes to enforcing data privacy regulations, there is currently a dearth of resources, which will only grow with the wider adoption of the metaverse in the healthcare industry.

High implementation cost

The healthcare industry needs to invest heavily to successfully and effectively integrate the metaverse into its processes. To reap the benefits of the metaverse, technological infrastructure must be upgraded, particularly in underdeveloped economies. This would necessitate huge infrastructure investment. Everything from an unbroken high-speed (5G) internet connection to advanced gadgets such as wearables requires a large investment. For a better experience, the metaverse incorporates technologies such as AR, VR, AI, HMDs, blockchain, IoT, and several other technologies. As a result, the development cost of the metaverse is bound to be high. The cost of constructing a metaverse varies depending on the features desired, the technology stack necessary, and the size and experience of the team. According to a report published by QSS Technosoft (US), the cost of building a metaverse in 2023 might range between USD 25,000 to USD 1 million. For healthcare, the cost of developing metaverse software is projected to be between USD 80,000 and USD 1 million. Its cost varies according to the complexity of the virtual environment and the number of medical procedures that can be simulated.

Opportunity: Increasing use of metaverse in medical education and training

The market for metaverse in education is expected to grow at a significant rate in the coming years. The application of XR in education has a promising future, and EdTech companies have an attractive opportunity to flourish in the metaverse. Leading market players are entering the ecosystem and embracing digital transformation, which is propelling market growth. XR technologies are significantly changing medical education, such as surgical training, medical test visualization, medical therapies, and drug development. Their key advantages include ease of use and convenience. Some of the key benefits of metaverse in medical training are as follows:

- Metaverse increases the effectiveness of on-the-job and on-campus training by imitating real-life scenarios, thus allowing students to learn more quickly and confidently. It also gives feedback and evaluates skill development.

- Employing digital twin technology to create test dummies can provide insights into a patient's response to therapies, surgical results, potential difficulties with medical products, and other aspects. XR enables medical students to practice in a simulated environment for extensive surgical education at a fraction of the cost of operating on cadavers.

- The customized content captured with XR can be used as desired. Live broadcasting of lectures allows for real-time interaction with lecturers.

- Using VR will aid in the execution of practical processes that are too dangerous or expensive to realistically model. It promotes correct conceptual understanding while remaining in a risk-free environment.

- XR transforms invasive surgeries by allowing doctors to film themselves executing medical procedures. Surgeons may visualize the patient's anatomy, including bones and tissue, before making an incision by superimposing AR and VR-based models on the patient.

- A large amount of data gathered in the metaverse will aid in decision-making and lessen the cognitive burden.

- Some of the recent developments in the metaverse education sector are as follows:

- In December 2022, Wolters Kluwer Health (Netherlands), a major global provider of healthcare information and point-of-care solutions, partnered with BioDigital XR (US). This collaboration will provide immersive, safe-to-fail environments with both VR and AR solutions to students throughout the healthcare landscape to enrich their learning curricula.

- In December 2021, Global Healthcare Academy (India), India's first Healthcare EdTech academy and a pioneer in value-added healthcare training solutions, partnered with 8chili (US) to bring healthcare training and medical education to the metaverse. The collaboration has already released more than 200 hours of VR content in a variety of subspecialties, such as dentistry, oral and maxillofacial surgery, orthopedics, skull base, spine, neurology, ENT, paramedics, nursing, and oncology.

- In November 2021, Novarad Corporation (US), a pioneer in the creation of medical imaging software, launched one of its AR software for higher education, which will be accessible at a significantly reduced cost to academic institutions. By displaying a 3D holographic view of any donor study performed with a CT machine using a Microsoft HoloLens 2 headset, the OpenSight Augmented Reality System for Education will anchor itself in classrooms to provide students and teachers with an immersive and participatory experience.

Challenge: HIPAA regulations for healthcare metaverse

The US healthcare system is overseen by complex state and federal legislation, including HIPAA (Health Insurance Portability and Accountability Act) requirements. HIPAA compliance is established as a standardized way for safeguarding sensitive patient data and medical records, including PHI and ePHIs. HIPAA prohibits the random distribution of patient information without patient consent.

The metaverse has the potential to provide a wide range of healthcare services, from mental health therapy to dermatology appointments. The regulations involved will depend on how services are delivered, as well as how they are funded and paid for. For example, services billed to Medicaid or Medicare must adhere to regulations that may not apply to services paid for in cash. Some technology platforms are being developed to accept cryptocurrency payments for health services provided in the metaverse. The compatibility of current regulatory and payer systems with cryptocurrency payments is a grey area, especially given the cryptocurrency movement's emphasis on deregulation and decentralization.

Also, it is unclear how healthcare practitioners are licensed in the metaverse. Licensing and enforcement can also take place at the state level. It remains to be seen how state licensure rules translate to the metaverse and to what degree, if any, states impose or construct licensure-related legislation in the metaverse. To keep patients safe from data breaches and to regulate licensing, every model of technology must update its HIPAA rules. As the metaverse evolves, it is critical to remember that it is a collection of platforms, each with its own set of rules and regulations. To achieve comprehensive compliance, healthcare organizations will need to stay up to date on recent developments.

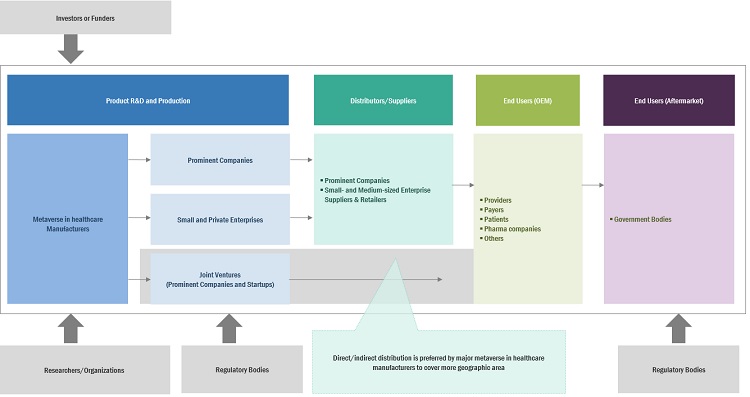

Metaverse in Healthcare Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of metaverse healthcare Solutions. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Microsoft (US), NVIDIA Corporation (US), XRHealth (US), CAE Inc. (Canada), Koninklijke Philips N.V. (Netherlands), ImmersiveTouch, Inc. (US), Wipro (India), Siemens Healthineers AG (Germany), Medtronic plc (Ireland), GE HealthCare (US), Intuitive Surgical (US), 8Chili, Inc. (US), MindMaze (Switzerland), AccuVein, Inc. (US), EON Reality (US), Brainlab AG (Germany), Novarad Corporation (US), Oodles Technologies (India), CMR Surgical (UK), Merative (US), BioflightVR (US), WorldViz, Inc. (US), Google (US), Oculus (Meta Platforms, Inc.) (US), and Augmedics (US).

Software to register the highest growth in the component segment of metaverse in healthcare industry in 2022.

On the basis of component, the software segment of the metaverse in healthcare market is expected to grow at the highest CAGR during the forecast period. The large share of this segment is attributed to the increased adaptation of AR/VR software in the healthcare industry and the significant rise in investments made in software development.

Medical education and surgery training accounted for the largest share off the metaverse in healthcare industry during forecast period based on application

Based on application, the medical education and surgical training segment accounted for the largest share of the metaverse in healthcare market. The large share of this segment can be attributed to factors such as the increasing budget of hospitals to improve the quality of care provided and reduce the cost of care.

The augmented and virtual reality segment accounted for the largest share of the metaverse in healthcare industry in 2022

Based on technology, the metaverse in healthcare market is segmented into augmented and virtual reality, mixed reality, artificial intelligence, blockchain, digital twin, Internet of Things, and medical wearables. The augmented and virtual reality segment accounted for the largest share of the market in 2022. The large share of the augmented and virtual reality segment can be attributed to the growing adoption of VR and AR in the healthcare industry, improved patient outcomes, and the growing focus on enhancing medical training, reducing costs, increasing accessibility, improving patient engagement, and driving innovation.

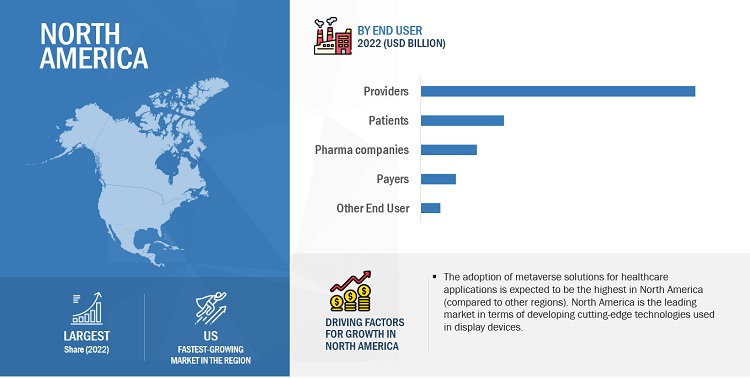

Healthcare providers is the highest growing end user segment of the metaverse in healthcare industry by end users market

Based on end user, the healthcare providers segment of the metaverse in healthcare market is expected to grow at a significant CAGR during the forecast period. The large share of this segment can be attributed to the rising need for an efficient healthcare system, growing patient volume, increasing number of hospitals and ambulatory care centers, growth in telehealth, and the rising adoption of metaverse technology in healthcare.

North America accounted for the largest share of the metaverse In healthcare industry during the forecast period.

In 2022, North America accounted for the largest share of the market, followed by Europe, Asia Pacific, Middle East & Africa and Latin America. The adoption of metaverse solutions for healthcare applications is expected to be the highest in North America (compared to other regions). North America is the leading market in terms of developing cutting-edge technologies used in display devices.

To know about the assumptions considered for the study, download the pdf brochure

The products and services market is dominated by a few globally established players such Microsoft (US), NVIDIA Corporation (US), XRHealth (US), CAE Inc. (Canada), Koninklijke Philips N.V. (Netherlands), ImmersiveTouch, Inc. (US), Wipro (India), Siemens Healthineers AG (Germany), Medtronic plc (Ireland), GE HealthCare (US), Intuitive Surgical (US), 8Chili, Inc. (US), MindMaze (Switzerland), AccuVein, Inc. (US), EON Reality (US), Brainlab AG (Germany), Novarad Corporation (US), Oodles Technologies (India), CMR Surgical (UK), Merative (US), BioflightVR (US), WorldViz, Inc. (US), Google (US), Oculus (Meta Platforms, Inc.) (US), and Augmedics (US).

Scope of the Metaverse in Healthcare Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$9.5 billion |

|

Projected Revenue Size by 2028 |

$79.6 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 52.9% |

|

Market Driver |

Increasing adoption of mixed reality for performing minimally invasive surgeries |

|

Market Opportunity |

Increasing use of metaverse in medical education and training |

The study categorizes the metaverse in healthcare market to forecast revenue and analyze trends in each of the following submarkets.

By Component

- Introduction

- Software

-

Hardware

- AR Devices

- VR Devices

- MR Devices

- Displays

- Services

By Technology

- Introduction

- Augmented/ Virtual reality.

- Mixed Reality

- Artificial Intelligence

- Blockchain

- Digital Twin

- IoT

- Medical Wearables

By Application

- Digital therapeutics

- Medical diagnostics

- Telehealth And Telemedicine

- Medical Education and Surgery Training

- Drug Discovery and Personalised Medicine

- Other Applications

By End Users

- Introduction

- Healthcare Providers

- Payers

- Patients

- Pharma and Biopharma Medtech Companies

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- RoE

-

Asia Pacific

- Japan

- China

- RoAPAC

- Latin America

- Middle East & Africa

Recent Developments of Metaverse in Healthcare Industry:

- In March 2023 NVIDIA Corporation (US) partnered with Microsoft (US) , This collaboration will help connect Microsoft 365 applications and NVIDIA Omniverse to digitalize their operations, engage in the industrial metaverse, and train advanced models for generative AI and other applications

- In February 2023, Wipro (India) launched Decentralized Identity and Credential Exchange (DICE) ID, which enables the insurance and verification of tamper-proof, self-verifiable digital credentials for current or potential healthcare or financial service providers, as well as educational institutions.

- In November 2022, GE Healthcare (US) collaborated with MediviewXR(US) . This collaboration was aimed at developing the OmnifyXR medical imaging system.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the metaverse in healthcare market?

The metaverse in healthcare market boasts a total revenue value of $79.6 billion by 2028.

What is the estimated growth rate (CAGR) of the metaverse in healthcare market?

The global metaverse in healthcare market has an estimated compound annual growth rate (CAGR) of 52.9% and a revenue size in the region of $9.5 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing adoption of mixed reality for performing minimally invasive surgeries- Applications of metaverse in telemedicine- Increasing use of digital twins- Increasing importance of blockchain technology in healthcareRESTRAINTS- Data privacy and security concerns- High implementation cost- Health and mental issues from excessive useOPPORTUNITIES- Increasing use of metaverse in medical education and training- Use of metaverse in surgical applicationsCHALLENGES- HIPAA regulations for healthcare metaverse- Interoperability issues- Local government restrictions coupled with environmental impact

-

6.1 INDUSTRY TRENDSTRANSFORMATION IN CLINICAL TRIALSEMERGENCE OF IMMERSIVE THERAPEUTICSFUTURE TRENDS IN METAVERSE IN HEALTHCARE

- 6.2 RISE IN HEALTHCARE METAVERSE INVESTMENTS

-

6.3 TECHNOLOGY ANALYSISTECHNOLOGY STACKINFRASTRUCTURE LEVEL- 5G network- Internet of Things- Cloud and edge computingDESIGN AND DEVELOPMENT LEVEL- Blockchain- 3D modeling and real-time rendering- Artificial intelligence, natural language processing, and computer visionHUMAN INTERACTION LEVEL- Virtual reality- Augmented reality- Mixed reality

-

6.4 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTES

-

6.5 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

- 6.6 VALUE-CHAIN ANALYSIS

-

6.7 ECOSYSTEM

-

6.8 PATENT ANALYSIS

-

6.9 CASE STUDY ANALYSISCASE STUDY 1: RIGOROUS TRAINING OF PROFESSIONAL ATHLETES WITHOUT PHYSICAL STRAINCASE STUDY 2: AUGMENTED REALITY FOR SURGERYCASE STUDY 3: VIRTUAL HOSPITALS AND CLINICSCASE STUDY 4: ENTERING DRUG DISCOVERY AND RESEARCHCASE STUDY 5: ENTERING MEDICAL TRAINING AND EDUCATION

-

6.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.11 KEY CONFERENCES AND EVENTS IN 2023–2024

-

6.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

- 7.1 INTRODUCTION

-

7.2 SOFTWAREINCREASING INVESTMENTS IN AR/VR TECHNOLOGY IN HEALTHCARE TO DRIVE GROWTH

-

7.3 HARDWAREAR DEVICESVR DEVICESMR DEVICESDISPLAYS

-

7.4 SERVICESSERVICES HELP IMPROVE PATIENT CARE, ENHANCE MEDICAL TRAINING AND EDUCATION, AND ENABLE REMOTE HEALTHCARE

- 8.1 INTRODUCTION

-

8.2 AUGMENTED AND VIRTUAL REALITYINCREASING DEMAND FOR AR/VR APPLICATIONS IN HEALTHCARE TO DRIVE GROWTH

-

8.3 MIXED REALITYINCREASING AWARENESS OF DIGITAL/VIRTUAL MEDICINE TO DRIVE GROWTH

-

8.4 ARTIFICIAL INTELLIGENCEWIDE AVAILABILITY OF COMPLEX DATASETS TO DRIVE GROWTH

-

8.5 BLOCKCHAININCREASING NEED TO REDUCE COST OF SECURE DATA EXCHANGE TO DRIVE GROWTH

-

8.6 DIGITAL TWININCREASING ADOPTION OF DIGITALIZATION IN HEALTHCARE TO PROPEL MARKET GROWTH

-

8.7 INTERNET OF THINGSADVANCEMENTS IN HEALTHCARE AND WIDE ACCEPTANCE OF REMOTE CARE TO DRIVE GROWTH

-

8.8 MEDICAL WEARABLESINCREASING FOCUS ON FITNESS AND HEALTH TO SUPPORT GROWTH

- 9.1 INTRODUCTION

-

9.2 DIGITAL THERAPEUTICSRISING INCIDENCE OF PREVENTABLE CHRONIC DISEASES TO DRIVE GROWTH

-

9.3 MEDICAL DIAGNOSTICSMETAVERSE ENVIRONMENT CAN OFFER ENHANCED MEDICAL DIAGNOSTICS

-

9.4 MEDICAL EDUCATION AND SURGICAL TRAININGMETAVERSE ADDING NEW DIMENSIONS TO MEDICAL EDUCATION AND SURGICAL TRAINING

-

9.5 TELEHEALTH AND TELEMEDICINEGROWING GERIATRIC POPULATION TO DRIVE MARKET GROWTH

-

9.6 DRUG DISCOVERY AND PERSONALIZED MEDICINEMETAVERSE TO HELP REDUCE TIME AND COST INVOLVED IN DRUG DISCOVERY

- 9.7 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 HEALTHCARE PROVIDERSINCREASING NEED TO IMPROVE PROFITABILITY OF HEALTHCARE OPERATIONS TO BOOST GROWTH

-

10.3 HEALTHCARE PAYERSINCREASING FOCUS ON OUTCOME-BASED PAYMENT MODELS TO DRIVE DEMAND

-

10.4 PHARMACEUTICAL, BIOPHARMACEUTICAL, AND MEDTECH COMPANIESENHANCED CLINICAL TRIALS AND BETTER COLLABORATION AND COMMUNICATION TO DRIVE GROWTH

-

10.5 PATIENTSINCREASED ACCESS TO CARE AND IMPROVED PATIENT OUTCOMES TO SUPPORT MARKET GROWTH

- 10.6 OTHER END USERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: IMPACT OF RECESSION ON METAVERSE IN HEALTHCARE MARKETUS- Increasing adoption of healthcare technologies to drive growthCANADA- Increasing focus on patient-centric care to support growth

-

11.3 EUROPEEUROPE: IMPACT OF RECESSION ON METAVERSE IN HEALTHCARE MARKETUK- Recent technological advancements and focus on better patient outcomes to drive growthGERMANY- Increasing number of AR/VR start-ups to boost growthREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: IMPACT OF RECESSION ON METAVERSE IN HEALTHCARE MARKETCHINA- Presence of large consumer base and increasing demand for quality healthcare to boost growthJAPAN- Adoption of wireless technology and government support to drive growthREST OF ASIA PACIFIC

-

11.5 LATIN AMERICALATIN AMERICA: IMPACT OF RECESSION ON METAVERSE IN HEALTHCARE MARKET

-

11.6 MIDDLE EAST AND AFRICAINVESTMENTS IN DIGITAL TECHNOLOGIES TO SUPPORT GROWTHMIDDLE EAST & AFRICA: RECESSION IMPACT ON METAVERSE IN HEALTHCARE MARKET

- 12.1 OVERVIEW

- 12.2 KEY STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 12.4 METAVERSE IN HEALTHCARE MARKET: R&D EXPENDITURE

- 12.5 MARKET RANKING ANALYSIS

- 12.6 COMPETITIVE BENCHMARKING

-

12.7 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.8 COMPANY EVALUATION MATRIX FOR START-UPS/SMESPROGRESSIVE COMPANIESDYNAMIC COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKS

-

12.9 COMPETITIVE SCENARIOPRODUCT/SERVICE LAUNCHES & APPROVALSDEALS

-

13.1 KEY PLAYERSMICROSOFT- Business overview- Products & services offered- Recent developments- MnM viewNVIDIA CORPORATION- Business overview- Products & services offered- Recent developments- MnM viewKONINKLIJKE PHILIPS N.V.- Business overview- Products & services offered- Recent developments- MnM viewCAE INC.- Business overview- Products & services offered- Recent developmentsXRHEALTH- Business overview- Products & services offered- Recent developmentsIMMERSIVETOUCH, INC.- Business overview- Products & services offered- Recent developmentsWIPRO- Business overview- Products & services offered- Recent developmentsSIEMENS HEALTHINEERS AG- Business overview- Products & services offered- Recent developmentsMEDTRONIC PLC- Business overview- Products & services offered- Recent developmentsGE HEALTHCARE- Business overview- Products & services offered- Recent developmentsINTUITIVE SURGICAL, INC.- Business overview- Products & services offered- Recent developmentsBRAINLAB AG- Business overview- Products & services offered- Recent developmentsNOVARAD CORPORATION- Business overview- Products offered- Recent developmentsOODLES TECHNOLOGIES- Business overview- Services offeredCMR SURGICAL- Business overview- Products offered- Recent developmentsMERATIVE- Business overview- Products & services offered- Recent developmentsWORLDVIZ, INC.- Business overview- Products & services offeredGOOGLE- Business overview- Products & services offered- Recent developmentsOCULUS (META PLATFORMS)- Business overview- Products & services offered- Recent developmentsMINDMAZE- Business overview- Products & services offered- Recent developments

-

13.2 OTHER PLAYERSAUGMEDICSACCUVEIN, INC.EON REALITYBIOFLIGHTVR8CHILI, INC.

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 RISK ASSESSMENT: METAVERSE IN HEALTHCARE MARKET

- TABLE 2 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IMPACT ANALYSIS

- TABLE 3 METAVERSE IN HEALTHCARE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 KEY PATENTS IN THE METAVERSE IN HEALTHCARE MARKET

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 10 KEY BUYING CRITERIA FOR METAVERSE COMPONENTS

- TABLE 11 METAVERSE IN HEALTHCARE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 12 METAVERSE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 13 METAVERSE IN HEALTHCARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 14 METAVERSE IN HEALTHCARE SOFTWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 15 METAVERSE IN HEALTHCARE HARDWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 METAVERSE IN HEALTHCARE SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 METAVERSE IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 18 METAVERSE IN HEALTHCARE MARKET FOR AUGMENTED AND VIRTUAL REALITY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 METAVERSE IN HEALTHCARE MARKET FOR MIXED REALITY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 METAVERSE IN HEALTHCARE MARKET FOR ARTIFICIAL INTELLIGENCE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 METAVERSE IN HEALTHCARE MARKET FOR BLOCKCHAIN, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 DESCRIPTION OF DIGITAL TWIN IN HEALTHCARE CONTEXT

- TABLE 23 METAVERSE IN HEALTHCARE MARKET FOR DIGITAL TWIN, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 METAVERSE IN HEALTHCARE MARKET FOR INTERNET OF THINGS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 METAVERSE IN HEALTHCARE MARKET FOR MEDICAL WEARABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 METAVERSE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 27 METAVERSE IN HEALTHCARE MARKET FOR DIGITAL THERAPEUTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 METAVERSE IN HEALTHCARE MARKET FOR MEDICAL DIAGNOSTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 METAVERSE IN HEALTHCARE MARKET FOR MEDICAL EDUCATION AND SURGICAL TRAINING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 METAVERSE IN HEALTHCARE MARKET FOR TELEHEALTH AND TELEMEDICINE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 METAVERSE IN HEALTHCARE MARKET FOR DRUG DISCOVERY AND PERSONALIZED MEDICINE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 METAVERSE IN HEALTHCARE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 METAVERSE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 34 METAVERSE IN HEALTHCARE MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 METAVERSE IN HEALTHCARE MARKET FOR HEALTHCARE PAYERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 METAVERSE IN HEALTHCARE MARKET FOR PHARMACEUTICAL, BIOPHARMACEUTICAL, AND MEDTECH COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 METAVERSE IN HEALTHCARE MARKET FOR PATIENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 METAVERSE IN HEALTHCARE MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 METAVERSE IN HEALTHCARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: METAVERSE IN HEALTHCARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: METAVERSE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: METAVERSE IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: METAVERSE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: METAVERSE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 45 US: METAVERSE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 46 US: METAVERSE IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 47 US: METAVERSE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 48 US: METAVERSE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 49 CANADA: METAVERSE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 50 CANADA: METAVERSE IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 51 CANADA: METAVERSE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 52 CANADA: METAVERSE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 53 EUROPE: METAVERSE IN HEALTHCARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 EUROPE: METAVERSE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 55 EUROPE: METAVERSE IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 56 EUROPE: METAVERSE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 57 EUROPE: METAVERSE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 58 UK: METAVERSE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 59 UK: METAVERSE IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 60 UK: METAVERSE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 61 UK: METAVERSE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 62 GERMANY: METAVERSE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 63 GERMANY: METAVERSE IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 64 GERMANY: METAVERSE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 65 GERMANY: METAVERSE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 66 REST OF EUROPE: METAVERSE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 67 REST OF EUROPE: METAVERSE IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 68 REST OF EUROPE: METAVERSE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 69 REST OF EUROPE: METAVERSE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: METAVERSE IN HEALTHCARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: METAVERSE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 72 ASIA PACIFIC: METAVERSE IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: METAVERSE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: METAVERSE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 75 CHINA: METAVERSE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 76 CHINA: METAVERSE IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 77 CHINA: METAVERSE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 78 CHINA: METAVERSE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 79 JAPAN: METAVERSE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 80 JAPAN: METAVERSE IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 81 JAPAN: METAVERSE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 82 JAPAN: METAVERSE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 83 REST OF ASIA PACIFIC: METAVERSE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 84 REST OF ASIA PACIFIC: METAVERSE IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 85 REST OF ASIA PACIFIC: METAVERSE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 86 REST OF ASIA PACIFIC: METAVERSE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 87 LATIN AMERICA: METAVERSE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 88 LATIN AMERICA: METAVERSE IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 89 LATIN AMERICA: METAVERSE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 90 LATIN AMERICA: METAVERSE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 91 MIDDLE EAST & AFRICA: METAVERSE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 92 MIDDLE EAST & AFRICA: METAVERSE IN HEALTHCARE MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 93 MIDDLE EAST & AFRICA: METAVERSE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 94 MIDDLE EAST & AFRICA: METAVERSE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 95 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN METAVERSE IN HEALTHCARE MARKET

- TABLE 96 FOOTPRINT OF COMPANIES IN METAVERSE IN HEALTHCARE MARKET

- TABLE 97 PRODUCT/SERVICE FOOTPRINT OF COMPANIES (25 COMPANIES)

- TABLE 98 TECHNOLOGY FOOTPRINT OF COMPANIES (25 COMPANIES)

- TABLE 99 REGIONAL FOOTPRINT OF COMPANIES (25 COMPANIES)

- TABLE 100 PRODUCT/SERVICE LAUNCHES & APPROVALS, JANUARY 2020–MARCH 2023

- TABLE 101 DEALS, JANUARY 2020–MARCH 2023

- TABLE 102 MICROSOFT: BUSINESS OVERVIEW

- TABLE 103 NVIDIA CORPORATION: BUSINESS OVERVIEW

- TABLE 104 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

- TABLE 105 CAE INC.: BUSINESS OVERVIEW

- TABLE 106 XRHEALTH: BUSINESS OVERVIEW

- TABLE 107 IMMERSIVETOUCH, INC.: BUSINESS OVERVIEW

- TABLE 108 WIPRO: BUSINESS OVERVIEW

- TABLE 109 SIEMENS HEALTHINEERS AG: BUSINESS OVERVIEW

- TABLE 110 MEDTRONIC PLC: BUSINESS OVERVIEW

- TABLE 111 GE HEALTHCARE: BUSINESS OVERVIEW

- TABLE 112 INTUITIVE SURGICAL, INC.: BUSINESS OVERVIEW

- TABLE 113 BRAINLAB AG: BUSINESS OVERVIEW

- TABLE 114 NOVARAD CORPORATION: COMPANY OVERVIEW

- TABLE 115 OODLES TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 116 CMR SURGICAL: COMPANY OVERVIEW

- TABLE 117 MERATIVE: COMPANY OVERVIEW

- TABLE 118 WORLDVIZ, INC.: BUSINESS OVERVIEW

- TABLE 119 GOOGLE: BUSINESS OVERVIEW

- TABLE 120 OCULUS (META PLATFORMS): BUSINESS OVERVIEW

- TABLE 121 MINDMAZE: BUSINESS OVERVIEW

- FIGURE 1 METAVERSE IN HEALTHCARE MARKET: RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

- FIGURE 4 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 5 METAVERSE IN HEALTHCARE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 6 MARKET PROJECTIONS FROM DEMAND-SIDE

- FIGURE 7 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 2 METAVERSE IN HEALTHCARE MARKET, BY COMPONENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 3 METAVERSE IN HEALTHCARE MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 4 METAVERSE IN HEALTHCARE MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 5 METAVERSE IN HEALTHCARE MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 6 GEOGRAPHICAL SNAPSHOT OF METAVERSE IN HEALTHCARE MARKET

- FIGURE 7 INCREASING ADOPTION OF MIXED REALITY SOLUTIONS IN HEALTHCARE APPLICATIONS TO DRIVE MARKET GROWTH

- FIGURE 8 SOFTWARE SEGMENT TO COMMAND LARGEST SHARE OF ASIA PACIFIC MARKET IN 2023

- FIGURE 9 MARKET IN CHINA TO GROW AT HIGHEST CAGR

- FIGURE 10 ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES

- FIGURE 12 US: NUMBER OF DATA BREACHES (2005–2022)

- FIGURE 13 METAVERSE MARKET: TECHNOLOGIES

- FIGURE 14 METAVERSE IN HEALTHCARE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 15 VALUE-CHAIN ANALYSIS (2022)

- FIGURE 16 METAVERSE IN HEALTHCARE MARKET: ECOSYSTEM

- FIGURE 17 NUMBER OF PATENTS PUBLISHED, JANUARY 2013 TO MARCH 2023

- FIGURE 18 TOP METAVERSE IN HEALTHCARE PATENT OWNERS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 20 KEY BUYING CRITERIA FOR METAVERSE COMPONENTS

- FIGURE 21 METAVERSE MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 22 NORTH AMERICA: METAVERSE IN HEALTHCARE MARKET SNAPSHOT

- FIGURE 23 ASIA PACIFIC: METAVERSE IN HEALTHCARE MARKET SNAPSHOT

- FIGURE 24 KEY DEVELOPMENTS OF MAJOR PLAYERS BETWEEN JANUARY 2020 AND MARCH 2023

- FIGURE 25 METAVERSE IN HEALTHCARE MARKET: REVENUE SHARE ANALYSIS OF KEY PLAYERS

- FIGURE 26 R&D EXPENDITURE OF KEY PLAYERS (2021 VS. 2022)

- FIGURE 27 METAVERSE IN HEALTHCARE MARKET RANKING ANALYSIS OF KEY PLAYERS (2022)

- FIGURE 28 METAVERSE IN HEALTHCARE MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)

- FIGURE 29 METAVERSE IN HEALTHCARE MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES (2022)

- FIGURE 30 MICROSOFT: COMPANY SNAPSHOT (2022)

- FIGURE 31 NVIDIA CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 32 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2022)

- FIGURE 33 CAE INC.: COMPANY SNAPSHOT (2022)

- FIGURE 34 WIPRO: COMPANY SNAPSHOT (2022)

- FIGURE 35 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2022)

- FIGURE 36 MEDTRONIC PLC: COMPANY SNAPSHOT (2022)

- FIGURE 37 GE HEALTHCARE: COMPANY SNAPSHOT (2022)

- FIGURE 38 INTUITIVE SURGICAL, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 39 GOOGLE: COMPANY SNAPSHOT (2022)

This research study involved the extensive use of both primary and secondary sources. Various factors affecting the industry were studied to identify segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, and key player strategies.

Secondary Research

This research study involved widespread secondary sources; directories; databases, such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the metaverse in healthcare market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the metaverse in healthcare market. Primary sources from the demand side included personnel from hospitals (small, medium-sized, and large hospitals), ambulatory centers, diagnostic centers, TPAs, and stakeholders in corporate & government bodies.

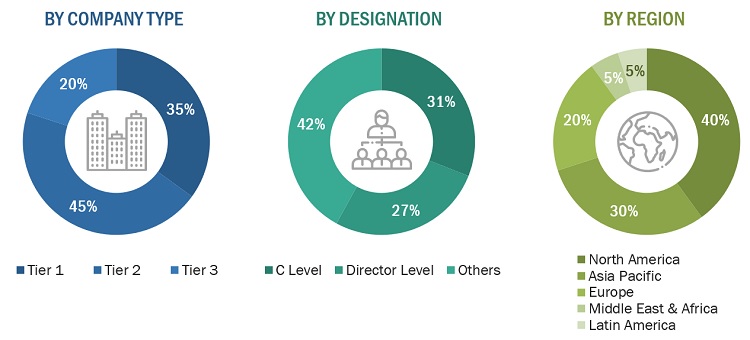

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the metaverse in healthcare market was arrived at after data triangulation from different approaches. After each approach, the weighted average of approaches was taken based on the level of assumptions used.

Data Triangulation

The individual shares of each metaverse in healthcare product & service, and end-user segment were determined by assigning weights based on their utilization/adoption rate. Regional splits of the overall metaverse in healthcare market and its subsegments are based on the adoption or utilization rates of the given products and services in the respective regions or countries

Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Definition

Metaverse is an online experience of shared 3D virtual worlds created through the convergence of physical and virtual spaces where users interface within this virtual world. This space allows them to meet virtually and be involved in several digital activities that offer real-time experiences. The metaverse is an intersection of many enabling technologies, including artificial intelligence, virtual reality, augmented reality, the internet of medical devices, and robotics, among others, through which new approaches to delivering high-quality healthcare treatments and services can be investigated.

Key Stakeholders

- Healthcare IT service providers

- Healthcare institutions/providers (hospitals, medical groups, physician practices, diagnostic centers, and outpatient clinics)

- Venture capitalists

- Government bodies

- Corporate entities

- Accountable care organizations

- Academic research institutes

- Healthcare payers

- Market research and consulting firms

- Metaverse technology vendors

- VR headset manufacturers

Objectives of the Study

- To define, describe, and forecast the metaverse in healthcare market by component, technology, application, end user, and region

- To provide detailed information about the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their market shares and core competencies in the market

- To benchmark players within the market using Competitive Leadership Mapping framework which analyzes key market players and start-ups on various parameters within the broad categories of business strategies, market share and product offering

- To track and analyze competitive developments such as partnerships, agreements, and collaborations; mergers & acquisitions; product developments; and geographical expansions in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the RoAPAC market into South Korea, Australia, New Zealand, and others

- Further breakdown of the RoE market into Belgium, Russia, the Netherlands, Switzerland, and others

- Further breakdown of the RoLA market into Argentina, Colombia, Chile, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Metaverse in Healthcare Market