Microsurgical Instruments Market by Type (Operating Microscopes, Micro Sutures (Non-Absorbable & Absorbable), Forceps, Needle Holder), Microsurgery (Plastic, Ophthal, ENT, Orthopedic, GYN), End User (Hospitals, ASCs, Academia) - Global Forecast to 2024

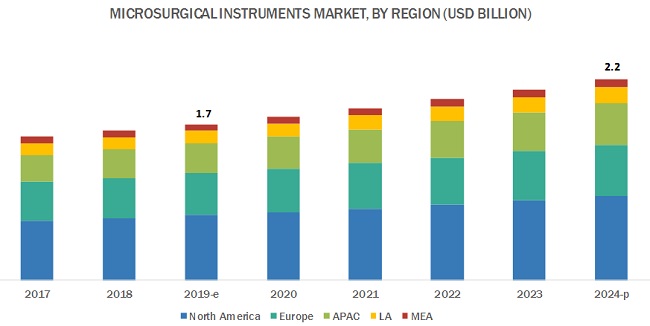

[138 Pages Report] The microsurgical instruments market is estimated to grow from USD 1.7 billion in 2019 to USD 2.2 billion by 2024, at a CAGR of 5.2%. Factors such as the benefits of microsurgery over traditional surgery; the increasing number of surgeries among the geriatric population & growing popularity of plastic and reconstructive surgeries; and the increasing prevalence of chronic diseases, lifestyle disorders, and cancer are driving the growth of the market.

Plastic & reconstructive microsurgeries segment accounted for the largest share of the microsurgical instruments market, by microsurgery type, in 2018

On the basis of the type of microsurgery, the market is segmented into orthopedic, neurological, ENT, ophthalmic, dental, gynecological & urological, plastic & reconstructive, and other microsurgeries. In 2018, the plastic & reconstructive microsurgeries segment accounted for the largest share of the microsurgery instruments market. Increasing awareness about cosmetic procedures, coupled with growing disposable incomes, is a major factor driving the demand for cosmetic treatments via microsurgeries. Additionally, the significant growth in the number of cosmetic and reconstructive microsurgeries performed and the extensive use of microsurgical instruments in plastic & reconstructive surgeries are also expected to support market growth in the coming years.

Operating microscopes segment accounted for the largest share of the microsurgical instruments market, by type, in 2018

On the basis of type, the market is segmented into operating microscopes, micro sutures, micro forceps, microsurgery needle holders, micro scissors, and other microsurgical instruments. In 2018, the operating microscopes segment accounted for the largest share of the microsurgery instruments market. The increasing number of ophthalmic surgeries performed have driven the adoption of operating microscopes as these are commonly used in glaucoma and cataract procedures.

North America will dominate the microsurgical instruments market during the forecast period

On the basis of region, the market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the market. This can primarily be attributed to the large pool of patients, rising geriatric population, increasing preference for minimally invasive surgeries, growing demand for surgical/operating microscopes.

Key Market Players

B. Braun Melsungen AG (Germany), ZEISS International (Germany), Danaher Corporation (US), Beaver-Visitec International Inc. (US), Global Surgical Corporation (US), Haag-Streit Surgical (Germany), KLS Martin Group (Germany), Microsurgery Instruments (US), Novartis AG (Switzerland), Olympus Corporation (Japan), Scanlan International (US), Stille (Sweden), and Topcon Corporation (Japan) are the major players operating in the microsurgical instruments market.

ZEISS International (Germany)

ZEISS is a prominent player in the microsurgery instruments market. The company’s products are used in dental, neuro, ENT, ophthalmic, spine, plastic & reconstructive, and gynecological microsurgeries. In order to further strengthen its position in the market, ZEISS focuses on the strategy of product launch. For instance, in October 2018, the company launched the EXTARO 300 dental microscope, which provides breakthrough visualization modes and enables efficient caries detection.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2024 |

|

Base Year Considered |

2018 |

|

Forecast Period |

2019–2024 |

|

Currency Used |

Value (USD Million) |

|

Segments Covered |

Type, Microsurgery Type, End User, and Region |

|

Geographies Covered |

North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa |

|

Companies Covered |

15 major players, including B. Braun Melsungen AG (Germany), ZEISS International (Germany), and Danaher (US), among others. |

In this report, the global market has been segmented based on type, microsurgery type, end user, and region.

Microsurgical Instruments Market, by Type

- Operating Microscopes

- Micro Sutures

- Non-absorbable Micro Sutures

- Absorbable Micro Sutures

- Micro Forceps

- Microsurgery Needle Holders

- Micro Scissors

- Other Microsurgical Instruments

Microsurgical Instruments Market, by Microsurgery Type

- Orthopedic Microsurgeries

- Neurological Microsurgeries

- ENT Microsurgeries

- Ophthalmic Microsurgeries

- Dental Microsurgeries

- Gynecological & Urological Microsurgeries

- Plastic & Reconstructive Microsurgeries

- Other Microsurgeries

Microsurgery Instruments Market, by End User

- Hospitals

- Ambulatory Surgery Centers

- Academic & Research Centers

Microsurgical Instruments Market, by Region

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments

- In October 2018, Leica Microsystems (US) and Polytech Domilens (Germany), a full-service ophthalmic provider, intensified their sales partnership in Germany for Leica’s surgical microscopes.

- In January 2017, Haag-Streit (Germany) entered into a distributor partnership with Walman Instruments (US) to enhance its ophthalmic equipment product line.

- In December 2016, Topcon Corporation (Japan) acquired 51% shares of Mehra Eyetech Limited (India), which is the sole distributor of Topcon Ophthalmic equipment in India.

Key Questions Addressed in This Report

- What are the various types of microsurgical instruments offered by the top market players for specific microsurgeries in established & emerging regions?

- Who are the major players offering operating microscopes for specific microsurgeries in major geographies?

- What revenue impact will operating microscopes have in the market during the forecast period?

- What is the adoption pattern for microsurgical instruments and operating microscopes across the globe?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency Used for the Study

1.5 Market Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Research

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Research

2.1.2.1 Key Data From Primary Sources

2.2 Market Estimation Methodology

2.2.1 Revenue-Based Market Estimation

2.2.2 Usage Pattern-Based Market Estimation

2.2.3 Primary Research Validation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Microsurgical Instruments Market Overview

4.2 Microsurgical Instruments Market, By Type, 2019 vs 2024 (USD Million)

4.3 Microsurgical Instruments Market Share, By Microsurgery Type, 2019 vs 2024

4.4 Microsurgical Instruments Market, By End User, 2019 vs 2024 (USD Million)

4.5 Microsurgical Instruments Market: Geographical Snapshot

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Key Drivers

5.2.1.1 Benefits of Microsurgery Over Traditional Surgery

5.2.1.2 Increasing Number of Surgeries Amongst the Geriatric Population and Growing Popularity of Plastic & Reconstructive Surgeries

5.2.1.3 Increasing Prevalence of Chronic Diseases, Lifestyle Disorders, and Cancer

5.2.2 Key Restraints

5.2.2.1 High Cost of Advanced Surgical/Operating Microscopes

5.2.2.2 Reimbursement Challenges in the Medical Device Industry

5.2.3 Key Opportunities

5.2.3.1 Emerging Markets

5.2.3.2 Advancements in Microsurgical Technology

5.2.3.3 Expanding Application Areas of Surgical/Operating Microscopes During Microsurgery

5.2.4 Key Challenges

5.2.4.1 Lack of Skilled Surgeons to Perform Microsurgical Procedures

5.2.5 Key Trends

5.2.5.1 Customized Surgical Microscopes

5.2.5.2 The Use of Robots for Microsurgery

6 Microsurgical Instruments Market, By Type (Page No. - 41)

6.1 Introduction

6.2 Operating Microscopes

6.2.1 Large Number of Ophthalmic Surgeries Performed Worldwide to Support Market Growth

6.2.2 Operating Microscopes Market Split, By Microsurgery Type

6.2.3 Operating Microscopes Market Split, By End User

6.3 Micro Sutures

6.3.1 Micro Sutures Market Split, By Microsurgery

6.3.2 Micro Sutures Market Split, By End User

6.3.3 Non-Absorbable Micro Sutures

6.3.3.1 Non-Absorbable Sutures have A High Tensile Strength

6.3.4 Absorbable Micro Sutures

6.3.4.1 Low Degree of Tissue Reaction Post Microsurgery—A Key Advantages Driving the Adoption of Absorbable Micro Sutures

6.4 Micro Forceps

6.4.1 Growing Number of Microsurgeries Performed to Propel the Market for Micro Forceps

6.4.2 Micro Forceps Market Split, By Microsurgery Type

6.4.3 Micro Forceps Market Split, By End User

6.5 Microsurgery Needle Holders

6.5.1 Growing Number of Ophthalmic Procedures Performed to Drive the Demand for Microsurgery Needle Holders

6.5.2 Microsurgery Needle Holders Market Split, By Microsurgery Type

6.5.3 Microsurgery Needle Holders Market Split, By End User

6.6 Micro Scissors

6.6.1 One of the Major Advantages of Micro Scissors is That They Can Be Sterilized

6.6.2 Micro Scissors Market Split, By Microsurgery Type

6.6.3 Micro Scissors Market Split, By End User

6.7 Other Microsurgical Instruments

6.7.1 Other Microsurgical Instruments Market Split, By Microsurgery Type

6.7.2 Other Microsurgical Instruments Market Split, By End User

7 Microsurgical Instruments Market, By Microsurgery Type (Page No. - 55)

7.1 Introduction

7.2 Plastic & Reconstructive Microsurgeries

7.2.1 Increasing Awareness About Cosmetic Procedures, Coupled With Growing Disposable Incomes, is A Major Factor Driving the Demand for Cosmetic Treatments Via Microsurgeries

7.3 Orthopedic Microsurgeries

7.3.1 Increasing Incidence of Bone Ailments Such as Osteoporosis and Arthritis is A Major Factor Driving the Growth of the Market for Orthopedic Microsurgeries

7.4 Ophthalmic Microsurgeries

7.4.1 Technological Advancements in Ophthalmic Microscopes to Augment Market Growth

7.5 Ent Microsurgeries

7.5.1 Increasing Number of Patients Undergoing Minimally Invasive Ent Surgeries to Propel Market Growth

7.6 Neurological Microsurgeries

7.6.1 Rising Demand for Minimally Invasive Neurosurgical Procedures

7.7 Dental Microsurgeries

7.7.1 High Cost of Dental Surgical Microscopes May Hinder the Growth of This Segment

7.8 Gynecological & Urological Microsurgeries

7.8.1 Reconstructive Microsurgery has Been Associated With Significantly Improved Results in Infertility—A Key Factor Driving Market Growth

7.9 Other Microsurgeries

8 Microsurgical Instruments Market, By End User (Page No. - 64)

8.1 Introduction

8.2 Hospitals

8.2.1 Hospitals are the Largest End Users of Microsurgical Instruments as Most Surgeries Involving the Use of Instruments are Carried Out in Hospitals

8.3 Ambulatory Surgery Centers

8.3.1 Ambulatory Surgery Centers are Cost-Effective Alternatives to Hospitals as Treatment Centers, Which is Increasing the Volume of Surgeries Performed in These End Users

8.4 Academic & Research Centers

8.4.1 Government Support for Academic & Research Institutes to Develop Microsurgical Techniques and Refine Existing Techniques to Drive Market Growth

9 Microsurgical Instruments Market, By Region (Page No. - 69)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Significant Growth in Plastic Surgery Demand has Contributed to Market Growth in the US

9.2.2 Canada

9.2.2.1 Decreasing Fertility Rate to Augment the Demand for Microsurgical Treatment

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany Dominates the European Market

9.3.2 UK

9.3.2.1 Rising Prevalence of Eye Diseases is A Key Market Driver in the UK

9.3.3 France

9.3.3.1 Increasing Medical Tourism in France Will Augment the Market for Microsurgical Procedures

9.3.4 Rest of Europe

9.4 Asia Pacific

9.4.1 Japan

9.4.1.1 Japan Dominates the Market for Microsurgical Instruments in APAC

9.4.2 China

9.4.2.1 Rapid Economic Growth in China has Contributed to Healthcare Access and Demand

9.4.3 India

9.4.3.1 Growing Medical Tourism and Improvements in Healthcare Facilities Will Support Market Growth in India

9.4.4 Rest of Asia Pacific

9.5 Latin America

9.5.1 Brazil

9.5.1.1 Brazil Accounts for 10% of the Cosmetic Surgeries Conducted Globally

9.5.2 Mexico

9.5.2.1 Rising Geriatric Population to Augment for the Demand of Minimally Invasive Surgeries/Microsurgeries

9.5.3 Rest of Latin America

9.6 Middle East & Africa

9.6.1 Infrastructural Improvement Initiatives in the Middle East Will Support Market Growth

10 Competitive Landscape (Page No. - 97)

10.1 Microsurgical Instruments Market Share Analysis, By Top 3 Players (2018)

10.2 Competitive Scenario (2015-2019)

10.3 Competitive Leadership Mapping

10.4 Terminology/Nomenclature

10.4.1 Visionary Leaders

10.4.2 Innovators

10.4.3 Dynamic Differentiators

10.4.4 Emerging Companies

11 Company Profiles (Page No. - 104)

(Business Overview, Products Offered, Recent Developments, MnM View)*

11.1 B. Braun Melsungen AG

11.2 Beaver-Visitec International, Inc. (BVI)

11.3 Zeiss International

11.4 Global Surgical Corporation

11.5 Haag-Streit Surgical

11.6 Karl Kaps GmbH

11.7 KLS Martin Group

11.8 Danaher

11.9 Microsurgery Instruments Inc

11.10 Mitaka USA Inc.

11.11 Novartis AG

11.12 Olympus Corporation

11.13 Scanlan International

11.14 Stille

11.15 Topcon Corporation

*Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 131)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables(69 Tables)

Table 1 Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 2 Operating Microscopes Market, By Region, 2017–2024 (USD Million)

Table 3 Operating Microscopes Market, By Microsurgery Type, 2017–2024 (USD Million)

Table 4 Operating Microscopes Market, By End User, 2017–2024 (USD Million)

Table 5 Micro Sutures Market, By Type, 2017–2024 (USD Million)

Table 6 Micro Sutures Market, By Region, 2017–2024 (USD Million)

Table 7 Micro Sutures Market, By Microsurgery, 2017–2024 (USD Million)

Table 8 Micro Sutures Market, By End User, 2017–2024 (USD Million)

Table 9 Micro Forceps Market, By Region, 2017–2024 (USD Million)

Table 10 Micro Forceps Market, By Microsurgery Type, 2017–2024 (USD Million)

Table 11 Micro Forceps Market, By End User, 2017–2024 (USD Million)

Table 12 Microsurgery Needle Holders Market, By Region, 2017–2024 (USD Million)

Table 13 Microsurgery Needle Holders Market, By Microsurgery Type, 2017–2024 (USD Million)

Table 14 Microsurgery Needle Holders Market, By End User, 2017–2024 (USD Million)

Table 15 Micro Scissors Market, By Region, 2017–2024 (USD Million)

Table 16 Micro Scissors Market, By Microsurgery Type, 2017–2024 (USD Million)

Table 17 Micro Scissors Market, By End User, 2017–2024 (USD Million)

Table 18 Other Microsurgical Instruments Market, By Region, 2017–2024 (USD Million)

Table 19 Other Microsurgical Instruments Market, By Microsurgery Type, 2017–2024 (USD Million)

Table 20 Other Microsurgical Instruments Market, By End User, 2017–2024 (USD Million)

Table 21 Microsurgical Instruments Market, By Microsurgery Type, 2017–2024 (USD Million)

Table 22 Microsurgical Instruments Market for Plastic & Reconstructive Microsurgeries, By Region, 2017–2024 (USD Million)

Table 23 Microsurgical Instruments Market for Orthopedic Microsurgeries, By Region, 2017–2024 (USD Million)

Table 24 Microsurgical Instruments Market for Ophthalmic Microsurgeries, By Region, 2017–2024 (USD Million)

Table 25 Microsurgical Instruments Market for Ent Microsurgeries, By Region, 2017–2024 (USD Million)

Table 26 Microsurgical Instruments Market for Neurological Microsurgeries, By Region, 2017–2024 (USD Million)

Table 27 Microsurgical Instruments Market for Dental Microsurgeries, By Region, 2017–2024 (USD Million)

Table 28 Microsurgical Instruments Market for Gynecological & Urological Microsurgeries, By Region, 2017–2024 (USD Million)

Table 29 Microsurgical Instruments Market for Other Microsurgeries, By Region, 2017–2024 (USD Million)

Table 30 Microsurgical Instruments Market, By End User, 2017–2024 (USD Million)

Table 31 Microsurgical Instruments Market for Hospitals, By Region, 2017–2024 (USD Million)

Table 32 Microsurgical Instruments Market for Ambulatory Surgery Centers, By Region, 2017–2024 (USD Million)

Table 33 Microsurgical Instruments Market for Academic & Research Centers, By Region, 2017–2024 (USD Million)

Table 34 Microsurgical Instruments Market, By Region, 2017–2024 (USD Million)

Table 35 North America: Microsurgical Instruments Market, By Country, 2017–2024 (USD Million

Table 36 North America: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 37 North America: Microsurgical Instruments Market, By Microsurgery Type, 2017–2024 (USD Million)

Table 38 North America: Microsurgical Instruments Market, By End User, 2017–2024 (USD Million)

Table 39 US: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 40 Canada: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 41 Europe: Microsurgical Instruments Market, By Country, 2017–2024 (USD Million

Table 42 Europe: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 43 Europe: Microsurgical Instruments Market, By Microsurgery Type, 2017–2024 (USD Million)

Table 44 Europe: Microsurgical Instruments Market, By End User, 2017–2024 (USD Million)

Table 45 Germany: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 46 UK: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 47 France: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 48 Rest of Europe: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 49 Asia Pacific: Microsurgical Instruments Market, By Country, 2017–2024 (USD Million

Table 50 Asia Pacific: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 51 Asia Pacific: Microsurgical Instruments Market, By Microsurgery Type, 2017–2024 (USD Million)

Table 52 Asia Pacific: Microsurgical Instruments Market, By End User, 2017–2024 (USD Million)

Table 53 Japan: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 54 China: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 55 India: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 56 Rest of Asia Pacific: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 57 Latin America: Microsurgical Instruments Market, By Country, 2017–2024 (USD Million

Table 58 Latin America: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 59 Latin America: Microsurgical Instruments Market, By Microsurgery Type, 2017–2024 (USD Million)

Table 60 Latin America: Microsurgical Instruments Market, By End User, 2017–2024 (USD Million)

Table 61 Brazil: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 62 Mexico: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 63 Rest of Latin America: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 64 Middle East & Africa: Microsurgical Instruments Market, By Type, 2017–2024 (USD Million)

Table 65 Middle East & Africa: Microsurgical Instruments Market, By Microsurgery Type, 2017–2024 (USD Million)

Table 66 Middle East & Africa: Microsurgical Instruments Market, By End User, 2017–2024 (USD Million)

Table 67 New Product Launches, Approvals, and Enhancements

Table 68 Mergers and Acquisitions

Table 69 Partnerships and Collaborations

List of Figures (24 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primaries

Figure 3 Research Methodology: Hypothesis Building

Figure 4 Micro Surgical Instruments Market Estimation: Overall Methodology

Figure 5 Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 Microsurgical Instruments Market, By Type, 2019 vs 2024 (USD Million)

Figure 8 Microsurgical Instruments Market, By Microsurgery Type, 2019 vs 2024 (USD Million)

Figure 9 Microsurgical Instruments Market Share, By End User, 2019 vs 2024

Figure 10 Microsurgical Instruments Market: Geographical Snapshot

Figure 11 Benefits of Microsurgery Over Traditional Surgery to Drive Market Growth

Figure 12 Operating Microscopes to Dominate the Microsurgical Instruments Market During the Forecast Period

Figure 13 Orthopedic Microsurgeries to Hold the Largest Share of the Market During the Forecast Period

Figure 14 Hospitals to Hold the Largest Share of the Microsurgical Instruments Market in 2019

Figure 15 China is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Microsurgical Instruments Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 North America: Microsurgical Instruments Market Snapshot

Figure 18 Europe: Microsurgical Instruments Market Snapshot

Figure 19 Asia Pacific: Microsurgical Instruments Market Snapshot

Figure 20 B Braun Held the Leading Position in the Micro Surgical Instruments Market as of 2018

Figure 21 Key Developments in the Microsurgical Instruments Market, 2015–2019

Figure 22 Microsurgical Instruments Market, Competitive Leadership Mapping, 2018 (Overall Market)

Figure 23 B. Braun Melsungen AG: Company Snapshot (2018)

Figure 24 Zeiss International: Company Snapshot (2018)

This study involved four major activities in estimating the current size of the microsurgical instruments market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was conducted to obtain key information about market classification and segmentation, geographical scenario, key developments undertaken by major market players, and the identification of key industry trends. The secondary sources used for this study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles from recognized websites, databases, and directories.

Primary Research

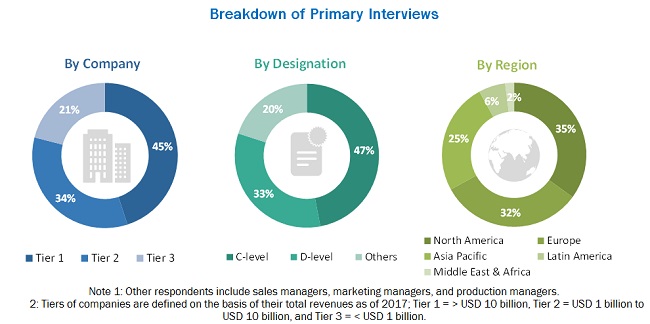

Extensive primary research was conducted after acquiring a preliminary understanding of the global microsurgery instruments market scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side [such as laboratory technicians, chief information officers, purchase managers in microsurgical instruments agencies, administrators (municipalities and public utility companies), personnel belonging to microsurgical instrument committees, hydropower generation companies, sewage and wastewater treatment plants, non-government organizations, and municipal corporations] and supply-side respondents (such as presidents, CEOs, VPs, directors, general managers, senior managers, product/sales/marketing/business development/client portfolio managers or specialists distributors/suppliers/channel partners, and business intelligence consultants) across North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Approximately 30% and 70% of primary interviews were conducted with both the demand- and supply-side respondents, respectively. The primary data was collected through questionnaires, e-mails, online surveys, and telephonic interviews. A breakdown of primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

- The key players in the microsurgical instruments market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology includes the study of the annual and quarterly financial reports of the top market players as well as interviews with industry experts to gather key insights on various market segments and subsegments.

- All segmental shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources.

- Major macroindicators that affect market segments and subsegments covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to understand their impact on market growth and revenues of various segments and subsegments.

- The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation:

After deriving the overall microsurgical instruments market value data from the market size estimation process explained above, the total market value data was split into several segments and subsegments. Data triangulation and market breakdown were undertaken to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data was triangulated by studying various qualitative & quantitative variables as well as by analyzing regional trends for both the demand and supply side macroindicators.

Report Objectives:

- To define, describe, and forecast the market on the basis of type, microsurgery type, end user, and region

- To provide detailed information regarding the major factors influencing the market (such as drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the market

- To analyze key growth opportunities in the microsurgery instruments market for key stakeholders and provide details of the competitive landscape for key market players

- To forecast the market value of various segments and/or subsegments with respect to five major regional segments—North America (US and Canada), Europe (Germany, UK, France, and RoE), Asia Pacific (Japan, China, India, and RoAPAC), Latin America (Brazil, Mexico, and RoLA), and the Middle East & Africa

- To profile the key players in the market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments undertaken by major players in the microsurgical instruments market, such as product launches, agreements, partnerships, collaborations, expansions, and mergers & acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies in the microsurgery instruments market

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Microsurgical Instruments Market