Surgical Microscopes Market Size, Growth, Share & Trends Analysis

Surgical Microscopes Market by Product Type (Devices, Accessories, Software), Application (Neuro and Spine Surgery, Plastic & Reconstructive Surgery, ENT Surgery, Oncology), End User (Hospital, Outpatient Facilities), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The surgical microscopes market is projected to reach USD 2.59 billion in 2030, from USD 1.51 billion in 2025, with a CAGR of 11.4%. Surgical microscopes are essential for enhancing surgical precision, minimizing tissue damage, and improving clinical outcomes across various medical specialties. The market for surgical microscopes is growing due to an increase in complex surgical cases in fields such as neurosurgery, oncology, and ophthalmology, which in turn increases demand for advanced visualization tools. These procedures require exact accuracy, especially when operating near critical anatomical structures, where even minor errors can lead to serious complications.

KEY TAKEAWAYS

-

BY PRODUCTThe surgical microscopes market comprises devices, accessories, and software. The devices segment is growing robustly due to the increasing demand for high-resolution, precision-guided surgical interventions in neurosurgery, ENT, ophthalmology, and spine surgery.

-

BY APPLICATIONThe surgical microscopes market is segmented by application into dentistry, ENT surgery, gynecology & urology, neuro & spine surgery, oncology, ophthalmology, and plastic & reconstructive surgery, among other applications. Dentistry is the fastest-growing segment, driven by the increased use of surgical microscopes in endodontic and implant procedures, where enhanced magnification and illumination improve treatment accuracy and efficiency.

-

BY END USERThe surgical microscopes market can be classified into hospitals, outpatient facilities, and other end users. Hospitals are the largest segment, primarily due to their high surgical volumes and the extensive range of specialties they cover, including neurosurgery, ophthalmology, ENT, and spine surgery.

-

BY REGIONThe surgical microscopes market is segmented by region into North America, Europe, Asia Pacific, Latin America, GCC Countries, and the Middle East & Africa. Asia Pacific is expected to grow at the fastest rate, driven by its well-developed healthcare system, rapid adoption of advanced surgical technologies, and strong demand for complex and minimally invasive surgeries across multiple specialties.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and collaborations. For instance, ZEISS Medical Technology entered a strategic partnership with the European Association of Neurosurgical Societies (EANS) to advance education and innovation in neurosurgery.

The market for surgical microscopes is expanding due to an increasing number of complex surgical cases in specialties such as neurosurgery, oncology, and ophthalmology, which is driving up demand for sophisticated visualization tools. These procedures require absolute precision, especially when surgery is performed near critical anatomical structures, where even minor mistakes can cause serious complications.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The surgical microscopes market is advancing rapidly due to technological innovations. Emerging technologies, including digital and hybrid visualization systems, AI-assisted autofocus, autozoom, and exposure control, as well as AR integration and compact, portable units, are reshaping the market landscape. Additional innovations, such as integrated video recording, streaming, and EHR compatibility, are aligning with evolving clinical workflows, thereby creating new growth opportunities across hospitals, outpatient clinics, and academic & research institutes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Global rise in geriatric population

-

Increase in general and specialty surgical procedures

Level

-

High initial capital and maintenance cost of surgical microscopes

Level

-

Growth potential in emerging economies

-

Global expansion of hospital infrastructure

Level

-

Dearth of skilled personnel for effective use of surgical microscopes

-

Stringent regulatory requirements for surgical microscopes

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Global rise in geriatric population

The increasing global elderly population is a significant factor contributing to the growing demand for microsurgical procedures. According to the United Nations Population Fund, the global share of individuals aged 65 and above rose from 5.5% in 1974 to 10.3% in 2024 and is projected to exceed 20% by 2074. This aging demographic is more susceptible to chronic conditions such as cataracts, macular degeneration, spinal stenosis, and neurodegenerative disorders—all of which require precision-guided surgical interventions. These procedures are typically performed in neurosurgery, ophthalmology, ENT, and spine specialties, where surgical microscopes are critical for enhanced magnification, illumination, and visual clarity. As the volume of these age-related surgeries continues to increase, healthcare providers are expanding investments in advanced surgical microscope systems, making this demographic trend a key long-term driver of market growth

Restraint:High initial capital and maintenance cost of surgical microscopes

High-end surgical microscope systems, featuring premium apochromatic optics, integrated fluorescence imaging, 4K/3D visualization, and robotic assistance functions, are typically priced between USD 250,000 and USD 300,000. These platforms incorporate sophisticated features such as motorized positioning, automated focus control, and heads-up display capabilities, reflecting significant R&D and manufacturing investments. In addition to the initial capital outlay, annual service contracts, calibration, software updates, and spare parts replacement impose ongoing costs equivalent to 8–12% of the purchase price. Such cumulative expenditures place considerable pressure on institutional capital budgets, particularly within smaller hospitals, ambulatory surgical centers, and outpatient facilities. In emerging markets, where access to flexible financing and leasing arrangements is often limited, these financial requirements constitute a significant barrier to adoption, effectively limiting uptake to larger, well-funded tertiary care institutions.

Opportunity: Global expansion of hospital infrastructure

The global expansion of hospital infrastructure presents a significant growth opportunity for the surgical microscopes market. In developed economies, large-scale public investments are being directed toward modernizing healthcare facilities. For instance, the United Kingdom's New Hospital Programme (NHP) is expected to invest £37 billion to enhance hospital capacity and integrate advanced medical technologies. Similarly, Canada’s Ontario government has allocated over CAD 228 million for hospital upgrades in FY 2024–25, with a long-term commitment of CAD 60 billion toward major projects that will add approximately 3,000 new beds. In the US, over 6,100 hospitals, including more than 5,100 community hospitals, were operational as of 2023, underlining a robust platform for surgical technology deployment. Emerging economies are witnessing comparable trends, driven by both public and private investments. India’s leading hospital chains, such as Apollo Hospitals and Max Healthcare, have announced substantial bed expansions accompanied by capital investments exceeding INR 11,000 crore. In China, healthcare institutions have surpassed one million in number, including over 36,000 hospitals as of 2021. Regulatory liberalization, such as China's 2024 policy permitting foreign-owned hospitals in major cities, is further supporting infrastructure growth.

Challenge: Dearth of skilled personnel for effective use of surgical microscopes

A significant challenge in the surgical microscopes market is the dearth of skilled personnel capable of effectively operating advanced surgical visualization systems. As modern surgical microscopes incorporate increasingly sophisticated technologies, such as 3D imaging, robotic assistance, fluorescence guidance, and digital integration, the need for trained professionals who can fully utilize these features becomes critical. However, many healthcare facilities, particularly in emerging economies and rural regions, face a shortage of surgeons and operating room staff with the necessary technical expertise. According to a report published by the Association of American Medical Colleges (AAMC) in March 2024, the US alone is projected to face a shortage of between 10,100 and 19,900 surgical specialists by 2036. This skills gap not only limits optimal usage of surgical microscopes but also affects surgical outcomes and deters adoption among budget-constrained institutions.

Surgical Microscopes Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Advanced ophthalmic and neurosurgical microscopes with integrated digital visualization | High-precision optics, improved surgical accuracy, ergonomic design, supports digital documentation |

|

Ophthalmic surgical microscopes for cataract and vitreoretinal procedures | Enhanced red reflex, superior depth of field, stable illumination for delicate eye surgeries |

|

Surgical microscopes for ENT, spine, and reconstructive surgery | Outstanding 3D visualization, fluorescence imaging options, improved surgical workflow |

|

Versatile surgical microscopes for neurosurgery and plastic/reconstructive procedures | Compact design, modular configurations, advanced optical clarity for complex microsurgeries |

|

Ophthalmic surgical microscopes with digital integration | High-resolution imaging, seamless connectivity with surgical video systems, optimized for teaching and training |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The surgical microscopes market functions within a complex ecosystem comprising stakeholders across product innovation, manufacturing, distribution, regulation, and clinical application. Leading manufacturers drive technological advancements by developing high-resolution optics, ergonomic designs, and integrated digital visualization systems that enhance surgical precision and workflow efficiency. Distributors and medical device suppliers play a vital role in ensuring the availability of these systems to hospitals, outpatient centers, and specialty clinics through established logistics and service networks. Regulatory bodies such as the US FDA, European Medicines Agency (EMA), and other regional authorities oversee the approval and compliance of surgical microscopes, ensuring adherence to stringent safety and performance standards. Although reimbursement policies for surgical capital equipment are often limited or region-specific, procurement decisions are typically made at institutional levels based on budget, surgical specialty requirements, and system capabilities. Surgeons, operating room staff, and healthcare institutions are at the core of the ecosystem, selecting systems that best meet their procedural needs in specialties such as neurosurgery, ophthalmology, ENT, and plastic and reconstructive surgery. Additionally, academic societies, surgical associations, and advocacy groups contribute by shaping clinical standards, promoting training, and encouraging the adoption of innovative visualization technologies to improve patient outcomes.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Surgical Microscopes Market, By Product

The devices segment is growing robustly due to the increasing demand for high-resolution, precision-guided surgical interventions among prominent specialties, such as neurosurgery, ENT, ophthalmology, and spine surgery. Advances in core microscope technology, including improved optical systems, more advanced digital imaging, and modular configurations, are making these devices clinically relevant and more versatile. Moreover, the increasing number of hospital building projects, surgical center refurbishments, and the trend toward minimally invasive procedures worldwide are fueling considerable capital expenditure on high-end surgical microscopes.

Surgical Microscopes Market, By Application

The dentistry segment is notably growing due to its critical role in precision-focused procedures, such as microsurgical endodontics and implantology, which rely on magnification and improved illumination. This demand is further supported by the shift toward minimally invasive techniques and the increasing influence of Dental Service Organizations (DSOs) that invest in advanced equipment to standardize high-quality care across multiple practices.

Surgical Microscopes Market, By End User

Hospitals are the largest segment of the surgical microscopes market, primarily due to their high surgical volumes and the extensive range of specialties they cover, including neurosurgery, ophthalmology, ENT, and spine surgery. Being the hubs of advanced surgical care, hospitals tend to be the early adopters of precision visualization technologies to improve outcomes, facilitate minimally invasive procedures, and address clinical standards. Increased demand for high-performance devices, compatibility with digital OR infrastructure, and rising investments in high-tech surgical rooms further spur microscope adoption in this context.

REGION

Asia Pacific to be fastest-growing region in global surgical microscope market during forecast period

The Asia Pacific region is expected to register the highest CAGR in the surgical microscopes market during the forecast period, driven by increased healthcare investments, the rapid expansion of hospital and outpatient infrastructure, and the rapid adoption of advanced surgical technologies. The region is witnessing a surge in demand for minimally invasive surgeries, fueled by a growing burden of chronic diseases, neurological disorders, and ophthalmic conditions. Moreover, governments and private players are investing heavily in modernizing healthcare facilities, particularly in large markets such as China, India, and Southeast Asia. The availability of cost-effective manufacturing, growing medical tourism, and the entry of both global and regional players offering technologically advanced, yet affordable solutions further accelerate growth.

Surgical Microscopes Market: COMPANY EVALUATION MATRIX

In the company evaluation matrix for the surgical microscopes market, Carl Zeiss Meditec AG Company (Star) leads with scale, extensive distribution, and a broad solutions portfolio. Karl Kaps GmbH & Co. KG (Emerging Leader) is gaining momentum with innovative products and packaging technologies. While Carl Zeiss Meditec AG Company dominates through reach, Karl Kaps GmbH & Co. KG’s innovation positions it for rapid growth toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Carl Zeiss Meditec AG (Germany)

- Leica Microsystems, subsidiary of Danaher (US)

- Alcon Inc. (Switzerland)

- Haag-Streit Group (Switzerland)

- Olympus Corporation (Japan)

- Alltion (Guangxi) Instrument Co., Ltd. (China)

- Topcon Corporation (Japan)

- Global Surgical Corporation (US)

- Takagi Seiko Co., Ltd. (Japan)

- Karl Kaps GmbH & Co. KG (Germany)

- MITAKA KOHKI Co., Ltd. (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 1.51 BN |

| Market Forecast in 2030 (Value) | USD 2.59 BN |

| Growth Rate | CAGR of 11.4% (2025–2030) |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN), Volume (Thousands Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, GCC Countries, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Surgical Microscopes Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | ||

| Company Information | ||

| Geographic Analysis |

RECENT DEVELOPMENTS

- April 2025 : Leica Microsystems, a subsidiary of Danaher, partnered with Medana to provide advanced ophthalmology solutions for private sector projects exclusively and designated hospitals across Germany.

- April 2024 : Carl Zeiss Meditec AG acquired D.O.R.C. (Dutch Ophthalmic Research Center) from Eurazeo SE, an investment firm based in Paris, France.

- October 2023 : The Sanderson Center for Optical Experimentation (SCOPE) at UMass Chan Medical School and Leica Microsystems, Inc. have collaborated to establish the Partner in Microscopy site at UMass Chan.

- October 2022 : ZEISS Medical Technology entered a strategic partnership with the European Association of Neurosurgical Societies (EANS) to advance education and innovation in neurosurgery.

Table of Contents

Methodology

The study comprised four key activities aimed at estimating the current size of the surgical microscopes market. First, extensive secondary research was conducted to gather information on the market, including related and parent markets. The next step involved validating these findings, assumptions, and market size estimates through primary research with industry experts across the value chain. We employed both top-down and bottom-up approaches to arrive at a comprehensive estimate of the overall market size. Finally, we utilized market breakdown and data triangulation techniques to determine the sizes of segments and subsegments within the market.

Secondary Research

The secondary research process involved extensive use of various secondary sources, including directories, databases like Bloomberg Business, Factiva, and D&B Hoovers, as well as white papers, annual reports, company house documents, investor presentations, and SEC filings. This research was conducted to gather information valuable for a comprehensive, technical, market-oriented, and commercial study of the surgical microscopes market. It also helped obtain critical insights about key players in the industry, market classification, and segmentation based on current industry trends, down to the finest details. Additionally, a database of leading industry players was created through this secondary research.

Primary Research

In the primary research process, we conducted interviews with various sources from both the supply and demand sides to gather qualitative and quantitative information for this report. On the supply side, we interviewed industry experts, including CEOs, vice presidents, marketing & sales directors, technology & innovation directors, and other key executives from prominent companies and organizations involved in the surgical microscopes market. For the demand side, we engaged with industry experts, purchase and sales managers, doctors, and personnel from research organizations. This primary research was essential to validate market segmentation, identify key players in the industry, and gather insights on important industry trends and market dynamics.

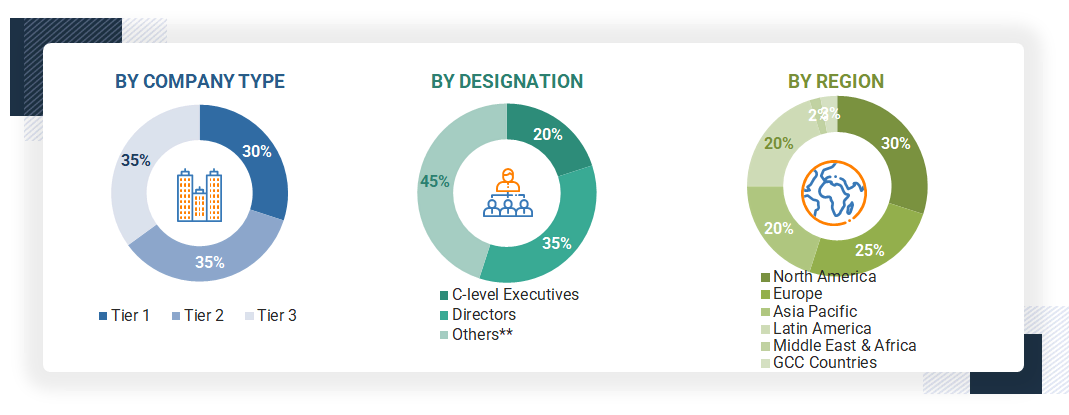

A breakdown of the primary respondents for the surgical microscopes market is provided below:

**Others include sales, marketing, and product managers.

Note 1: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 2: Companies are classified into tiers based on their total revenue. As of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the surgical microscopes market includes the following details.

The market sizing was undertaken from the global side.

- Country-level Analysis: The size of the surgical microscopes market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products and services in the overall surgical microscopes market was obtained from secondary data and validated by primary participants to arrive at the total surgical microscopes market. Primary participants further validated the numbers.

-

Geographic Market Assessment (By Region & Country): The geographic assessment was done using the following approaches:

- Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

- Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated by industry experts who were contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall surgical microscopes market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Surgical Microscopes Market Size: Bottom-up Approach and Top-down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

A surgical microscope is a binocular instrument with a motorized zoom lens system that is manually operated to provide an enlarged view of fine and hard-to-reach structures in the operating field during surgical procedures.

Stakeholders

- Surgical microscope manufacturing companies

- Distributors, suppliers, and channel partners of surgical microscopes

- Senior management

- Finance department

- Procurement department

- Hospitals

- Ambulatory surgical centers

- Outpatient clinics

- Academic & research institutes

- Trade associations and industry bodies

- Regulatory bodies and government agencies

- Business research and consulting service providers

- Market research and consulting firms

- Venture capitalists and investors

Report Objectives

- To define, describe, segment, analyze, and forecast the global surgical microscopes market by product type, application, end user, and region

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets concerning individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the surgical microscopes market in North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa, and the GCC countries

- To profile the key players in the surgical microscopes market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as agreements, collaborations, and partnerships; expansions; acquisitions; and product launches & approvals in the surgical microscopes market

Key Questions Addressed by the Report

What is the expected addressable market value of the surgical microscopes market over 5 years?

The surgical microscopes market is projected to reach USD 2.69 billion by 2030, at a CAGR of 11.4% during the forecast period.

What are the strategies adopted by the top market players to penetrate emerging regions?

Major players use partnerships, expansions, distribution agreements, product launches, and product approvals as key growth strategies.

Which segments have been included in this report?

The report includes segments by product type, application, end user, and region.

Which region occupies the largest share of the surgical microscopes market globally?

In 2024, the Asia Pacific held the largest share, driven by advanced healthcare infrastructure, technological advancements, and growing popularity of minimally invasive surgeries.

Who are the top industry players in the global surgical microscopes market?

Key players include Carl Zeiss Meditec AG (Germany), Leica Microsystems (US), Alcon Inc. (Switzerland), Haag-Streit Group (Switzerland), Olympus Corporation (Japan), Alltion (Guangxi) Instrument Co., Ltd. (China), Topcon Corporation (Japan), and Global Surgical Corporation (US).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Surgical Microscopes Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Surgical Microscopes Market