Surgical Robots Market Size, Growth, Share & Trends Analysis

Surgical Robots Market By Product [Instruments & Accessories, Robotic Systems (Laparoscopy, Orthopedic), Services], Application (Urological Surgery, Orthopedic Surgery), End User (Hospitals, Clinics, Ambulatory Surgery Centers) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global surgical robots market, valued at US$11.98 billion in 2024, stood at US$13.69 billion in 2025 and is projected to advance at a resilient CAGR of 14.7% from 2024 to 2030, culminating in a forecasted valuation of US$27.14 billion by the end of the period. The growth of the surgical robots market is driven by the increasing demand for minimally invasive surgeries, which offer benefits such as reduced postoperative pain, shorter hospital stays, faster recovery, and lower risk of complications. The rising prevalence of chronic diseases and the growing geriatric population are increasing the volume of complex surgical procedures that require high precision.

KEY TAKEAWAYS

-

BY RegionOn the basis of region, North America accounted for the largest share of 60–65% of the surgical robots market. North America holds the largest share of the surgical robots market due to its highly advanced healthcare infrastructure, strong adoption of cutting-edge medical technologies, and the presence of leading robotic surgery companies, including Intuitive Surgical, Stryker, Medtronic, and Johnson & Johnson.

-

BY OFFERINGBased on offering, the instruments & accessories segment accounted for the largest share of 55–60% of the surgical robots market in 2024. The instruments & accessories segment holds the largest share of the surgical robots because these components are required for every surgical procedure, creating consistent and recurring demand.

-

BY APPLICATIONBased on application, the general surgery segment accounted for the largest share of 28–32% of the surgical robots market because it encompasses a broad range of high-volume procedures that are ideally suited for robotic assistance, such as hernia repair, cholecystectomy, bariatric surgery, colorectal surgery, and foregut procedures.

-

BY END USERBased on end user, the hospitals & clinics segment held the highest growth rate in the surgical robots market during the forecast period because they are the primary centers where surgical procedures are performed and have the infrastructure, budgets, and clinical staff needed to adopt advanced robotic systems.

-

COMPETITIVE LANDSCAPEIntuitive Surgical and Medtronic Plc were recognized as star players due to their established strong product portfolios.

-

COMPETITIVE LANDSCAPENoah Medical and iotaMotion, Inc. have established themselves among startups and SMEs due to their strong product portfolios and business strategies.

The expansion of the surgical robots market is driven by the rising global preference for advanced, minimally invasive surgical techniques and the need for greater precision, control, and flexibility in complex procedures. Growth is further supported by rapid technological innovation, including the integration of artificial intelligence, machine learning, and real-time imaging that enhances surgical accuracy and improves clinical outcomes. The increasing burden of chronic diseases such as cancer and cardiovascular disorders, which require highly precise surgical interventions, is accelerating adoption. Additionally, the expanding applications of robotic systems beyond traditional procedures into fields such as orthopedics, neurosurgery, and bariatric surgery are broadening the market scope. Growing hospital investments in robotic infrastructure, expanding surgeon training and proctoring programs, improving reimbursement frameworks, and increasing global healthcare spending are further fueling market expansion. Increasing patient awareness and preference for safer procedures with faster recovery also contribute to market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The surgical robots market is undergoing a significant shift, driven by rapid technological advancements, shifting clinical expectations, and increasing pressure on healthcare systems to enhance efficiency and outcomes. The integration of robotics with advanced imaging, AI-enabled decision support, and digital surgery platforms is enhancing procedural accuracy and surgeon control, while new modular and portable robotic systems are expanding access beyond large tertiary hospitals to mid-sized facilities and ambulatory surgical centers. Advancements in haptic feedback, 3D visualization, instrument articulation, and ergonomic design are improving surgeon comfort and reducing variability in surgical performance. At the same time, competitive disruption from emerging players is driving the industry toward more flexible commercial models, such as pay-per-use and subscription-based robotics, thereby lowering cost barriers for providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Advantages of robot-assisted surgery

-

Technological advancements

Level

-

High cost of robotic systems

Level

-

Increasing penetration of surgical robots in ASCs

-

Growth opportunities in emerging markets

Level

-

Surgical errors

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Advantages of robot-assisted surgery

Robot-assisted surgery offers significant clinical and operational advantages that are strongly driving market adoption. These systems provide surgeons with enhanced precision, tremor filtration, and superior visualization through high-definition 3D imaging, enabling more controlled and accurate movements than conventional laparoscopic techniques. The improved dexterity and articulation of robotic instruments allow access to complex anatomical areas with minimal tissue disruption, resulting in smaller incisions, reduced blood loss, lower postoperative pain, and shorter hospital stays for patients. For healthcare providers, these benefits translate into fewer complications, faster recovery times, and improved procedural consistency, ultimately enhancing patient satisfaction and reducing overall treatment costs. As hospitals increasingly prioritize minimally invasive procedures and outcome-driven care, the superior clinical performance and reproducibility offered by robot-assisted surgery continue to accelerate the demand for surgical robotic platforms across specialties.

Restraint: High cost of robotic systems

The high cost of robotic systems remains a significant restraint, as these platforms require substantial long-term investments in technology, infrastructure, and specialized training. Surgical robots involve complex hardware, advanced sensors, imaging modules, and software ecosystems that demand continuous upgrades and maintenance, creating an ongoing resource burden for hospitals. Additionally, operating rooms must be redesigned or adapted to accommodate robotic workflows, and staff, including surgeons, nurses, and technicians, must undergo extensive training to use the systems safely and efficiently. These operational, logistical, and capability-building requirements make adoption challenging for many healthcare facilities, particularly those with limited budgets, lower procedure volumes, or constrained technical capacity. As a result, the overall resource intensity and commitment needed for robotic programs often delay or limit deployment, slowing market penetration despite strong clinical interest.

Opportunity: Increasing penetration of surgical robots in ASCs

The growing adoption of surgical robots in ambulatory surgical centers (ASCs) represents a major opportunity for the surgical robots market. ASCs are increasingly performing a higher volume of minimally invasive procedures due to their lower costs, faster patient turnover, and convenience-driven care models. As robotic platforms become more compact, modular, and easier to integrate into smaller clinical environments, ASCs are emerging as attractive settings for robot-assisted surgeries in orthopedics, urology, gynecology, and general surgery. The shift toward outpatient procedures, coupled with improvements in anesthesia, recovery pathways, and postoperative care protocols, is enabling more robot-assisted surgeries to be safely performed outside traditional hospital ORs. This expanding role of robotics in ASCs not only opens a new revenue channel for manufacturers but also accelerates broader market penetration by making robotic surgery more accessible, scalable, and aligned with value-based care trends.

Surgical errors

Surgical errors remain a critical challenge in the surgical robots market, as the complexity of robotic systems introduces new risks alongside the benefits they provide. Although robotic platforms enhance precision, errors can occur due to system malfunctions, software glitches, improper instrument handling, or inadequate training of the surgeon. These incidents, even if infrequent, raise concerns about safety, reliability, and accountability in high-stakes surgical environments. Moreover, the learning curve associated with mastering robotic techniques can temporarily elevate the risk of intraoperative complications, particularly in centers with limited experience or insufficient procedural volumes. Any surgical error involving robotic systems attracts heightened scrutiny from regulators, clinicians, and patients, which can impact trust, slow adoption, and increase the demand for stricter validation, training, and performance-monitoring protocols. As a result, managing and mitigating surgical errors remains essential for ensuring safe utilization and sustained market growth of robotic surgery.

surgical-robots-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Surgical robotic systems and precision instruments designed for minimally invasive procedures across urology, gynecology, thoracic, and general surgery | Equipped with 3D visualization, multi-jointed instruments, and enhanced ergonomics to support highly controlled surgical maneuvers | Enhance surgical precision and dexterity, reduce tissue trauma and complications, support faster patient recovery, and improve consistency and reproducibility in complex minimally invasive procedures |

|

Orthopedic robotic platform that combines CT-based planning with robotic arm guidance for knee and hip arthroplasty | Enables surgeons to execute personalized implant alignment and bone preparation based on patient-specific anatomy | Improve accuracy of implant positioning, enhance joint stability and alignment, reduce post-operative variability, and support long-term functional outcomes in joint replacement surgeries |

|

Robotic guidance, navigation, and planning system used primarily in spine surgery | Integrates 3D planning, AI-enhanced imaging, and precise robotic guidance to support accurate screw placement and complex spinal corrections | Increase accuracy in spinal instrumentation, reduce intraoperative deviations, improve surgeon control in high-risk procedures, and enhance overall safety and predictability in spine surgeries |

|

Compact, handheld robotic-assisted platform designed for partial and total knee arthroplasty | Uses real-time intraoperative mapping to help surgeons achieve precise ligament balancing and bone reshaping without requiring preoperative CT scans | Support personalized knee reconstruction, improve precision in bone preparation, reduce variability in soft-tissue balancing, and enhance workflow efficiency for outpatient and ASC environments |

|

Multi-specialty robotic platforms that combine data analytics, navigation, and robotic guidance to optimize knee and hip arthroplasty as well as brain surgeries | Provide real-time anatomical data for personalized surgical execution | Increase accuracy of implant alignment, enhance surgical decision-making through real-time data, reduce complication risks, and standardize outcomes across orthopedic and neurosurgical procedures |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The surgical robots market operates within a complex and evolving ecosystem that includes robotic system manufacturers, healthcare providers, regulatory authorities, training organizations, and suppliers of robotic instruments and accessories. Leading companies such as Intuitive Surgical, Stryker, Medtronic, Zimmer Biomet, and Smith+Nephew develop advanced robotic platforms, handheld robotic systems, imaging-integrated navigation tools, and precision surgical instruments that support minimally invasive procedures across orthopedics, urology, gynecology, and general surgery. Supporting elements, including robotic arms, disposable instrument kits, visualization components, sensors, and software modules, ensure reliable performance, accuracy, and sterility throughout the surgical process. Healthcare providers ranging from large hospitals to ambulatory surgical centers drive adoption based on clinical demand, workflow efficiency, surgeon preference, and patient outcomes, while regulatory bodies establish safety, performance, and interoperability requirements for robotic platforms.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Surgical Robots Market, By Offering

In the surgical robots market, the instruments & accessories segment holds the dominant position because these components are required for every robotic procedure and must be replaced regularly, creating a recurring and continuous revenue stream for manufacturers. Unlike robotic platforms, which have long replacement cycles, robotic instruments such as staplers, energy devices, trocars, suturing tools, end-effectors, saws, burrs, and single-use consumables have limited usage life and must be replenished after a fixed number of procedures. This high utilization rate directly correlates with demand for instruments, linking it to surgical volumes and making it the largest and most stable part of the market. Additionally, ongoing advancements in instrument design, such as multi-jointed end-effectors, improved haptic tools, and specialty instruments tailored to specific fields like orthopedics, urology, or gynecology, further drive adoption. As hospitals expand their robotic programs and perform higher volumes of minimally invasive surgeries, the consistent need for procedure-specific accessories reinforces the segment’s leadership within the overall surgical robotics ecosystem.

Surgical Robots Market, By Application

In the surgical robots market, the general surgery segment holds the dominant position because it encompasses a broad range of high-volume procedures that are ideally suited for robotic assistance, such as hernia repair, cholecystectomy, bariatric surgery, colorectal surgery, and foregut procedures. These surgeries benefit significantly from the enhanced visualization, precision, and dexterity offered by robotic platforms, leading to improved outcomes, fewer complications, and faster recovery times. Hospitals prioritize robotic adoption in general surgery because it represents a large part of their annual surgical caseload, enabling them to maximize system utilization and achieve stronger return on investment. Moreover, advancements in multi-port and single-port robotic systems, along with growing surgeon preference for minimally invasive approaches, have further accelerated the shift toward robotics in general surgery. As a result, the wide procedural applicability, high patient demand, and strong clinical advantages collectively reinforce general surgery’s dominant share in the surgical robots market.

Surgical Robots Market, By End User

In the surgical robots market, the hospitals & clinics segment holds the dominant position because these facilities perform the highest volume of complex and minimally invasive procedures that benefit most from robotic assistance. Hospitals have the advanced infrastructure, trained surgical teams, and financial capacity required to integrate full-scale robotic systems into their operating rooms. They also manage a wide variety of specialties, such as general surgery, urology, gynecology, orthopedics, and cardiothoracic surgery, where robotic platforms are increasingly used to improve precision, reduce complications, and enhance patient outcomes. Additionally, hospitals prioritize robotics to strengthen their clinical reputation, attract patients seeking advanced treatment options, and differentiate themselves in competitive healthcare markets. With increasing emphasis on surgical excellence, multidisciplinary care, and technological modernization, hospitals and clinics remain the primary adopters and highest utilizers of robotic systems, reinforcing their leading position in the end-user segment.

REGION

Asia Pacific to be fastest-growing region in global surgical robots market during forecast period

The Asia Pacific region is expected to be the fastest-growing market for surgical robots due to rapid healthcare modernization, increasing investment in advanced surgical infrastructure, and a rising preference for minimally invasive procedures among patients and providers. Countries such as China, Japan, South Korea, India, and Australia are significantly expanding their robotic surgery programs through government funding, private hospital investments, and targeted initiatives to improve surgical outcomes and reduce complication rates. Growing medical tourism, especially in Southeast Asia, is further accelerating adoption as hospitals compete to offer the latest robotic capabilities. Additionally, the region’s large population base, rising burden of chronic diseases requiring surgical intervention, and increasing surgeon training programs create strong procedural demand. As local manufacturers enter the market with cost-effective robotic platforms, access to robotic surgery continues to widen, reinforcing Asia Pacific’s position as the fastest-growing region in the surgical robots market.

surgical-robots-market: COMPANY EVALUATION MATRIX

In the surgical robots market matrix, Intuitive Surgical (Star) leads with its unmatched global installed base, strong brand recognition, and comprehensive da Vinci platform ecosystem that spans instruments, accessories, training, and digital surgery solutions. CMR Surgical (Emerging Leader) is rapidly gaining traction with its versatile and cost-effective Versius robotic system, which features a modular design, improved maneuverability, and enhanced accessibility for hospitals and ambulatory centers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 11.98 Billion |

| Market Forecast in 2030 (Value) | USD 27.14 Billion |

| Growth Rate | CAGR of 14.7% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa |

| Related Segment & Geographic Reports |

Europe Surgical Robots Market APAC Surgical Robots Market |

WHAT IS IN IT FOR YOU: surgical-robots-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of top surgical robots: laparoscopic, orthopedic, neurosurgical, and other robotic systems |

|

| Company Information |

|

Insights on revenue shifts towards emerging therapeutic applications and device innovations. |

| Geographic Analysis |

|

Country-level demand mapping for new product launches and localization strategy planning |

RECENT DEVELOPMENTS

- July 2025 : The FDA clearance of the Vessel Sealer Curved instrument represents a meaningful enhancement in robotic energy devices. Its uniquely curved tip is designed to improve precision, maneuverability, and control in anatomically complex regions. This advancement supports safer tissue handling and vessel sealing, broadens the versatility of robotic platforms, and strengthens the manufacturer’s growing portfolio of advanced surgical instruments.

- May 2025 : The FDA’s approval of the da Vinci Single-Port system for transanal local excision marks a significant step in expanding robotic capabilities in colorectal surgery. By enabling natural-orifice access for lesion removal and excision procedures, the system reduces the need for external incisions, resulting in less tissue trauma, reduced scarring, and a faster postoperative recovery. This clearance enhances the clinical value of the SP platform and expands its application across various soft-tissue procedures.

- June 2024 : Stryker’s partnership with IRCAD North America strengthens its presence in surgical education and research. Through this multi-year collaboration, Stryker will provide advanced robotic platforms and enabling technologies to support a new experiential training center at Atrium Health in Charlotte. The initiative aims to enhance surgeon training, promote the adoption of robotics, and drive innovation in minimally invasive and orthopedic procedures.

- June 2024 : Medtronic’s USD 8 million asset purchase and licensing agreement with Titan Medical expands its intellectual property portfolio in soft-tissue robotics. By acquiring key technologies and design concepts, Medtronic reinforces its development pipeline for the Hugo RAS system. This strategic move strengthens its competitive position and accelerates innovation in multi-specialty robotic surgery.

- June 2024 : The revised FDA labeling for Intuitive Surgical’s da Vinci Xi and X systems expands their approved use in radical prostatectomy procedures. This update reflects the system’s strong clinical performance in urologic surgery, enabling hospitals to apply the platform across a broader range of high-volume cancer surgeries. The expanded indication enhances system utilization and reinforces Intuitive’s leadership in soft-tissue robotics.

- March 2024 : CE Mark approval for Medtronic’s Hugo robotic-assisted surgery system authorizes its commercial use across Europe for urologic and gynecologic procedures. This achievement marks a significant regulatory milestone, enabling Medtronic to expand its robotic platform globally. The approval strengthens its competitive stance against established robotic systems and supports wider clinical adoption in European hospitals.

- April 2024 : Stryker’s acquisition of mfPHD enhances its portfolio of surgical infrastructure solutions by adding expertise in modular stainless-steel wall systems for operating rooms. This complements Stryker’s robotic platforms and OR integration technologies, enabling the company to deliver more comprehensive, robot-ready surgical suites. The acquisition supports Stryker’s strategy of optimizing OR workflows and improving procedural efficiency.

- March 2024 : The FDA’s 510(k) clearance of the da Vinci 5 system introduces Intuitive’s next-generation platform with advancements in instrumentation, imaging, system responsiveness, and surgeon ergonomics. The new system raises the bar for precision and reliability in minimally invasive soft-tissue surgery. This approval reinforces Intuitive’s market leadership and expands its technological edge in robotic surgery.

Table of Contents

Methodology

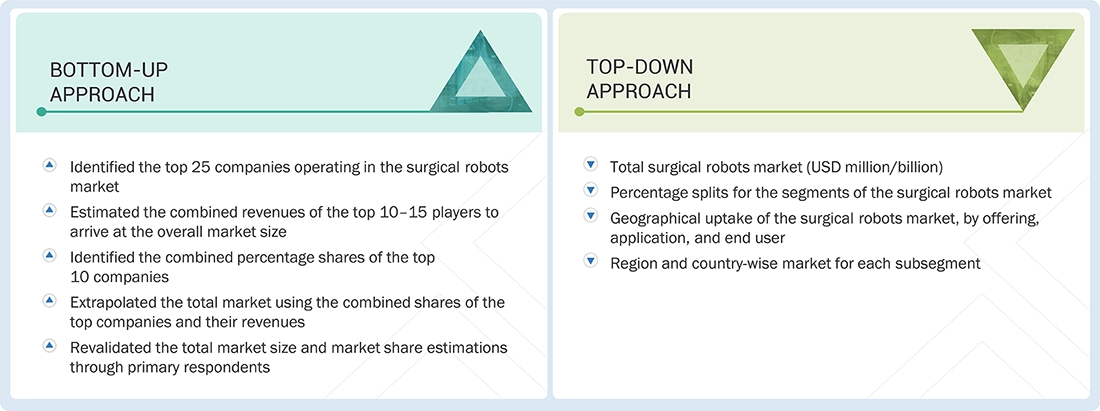

This study involved four major activities in estimating the current size of the surgical robots market. First, extensive secondary research was conducted to gather information on the market, including related and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was employed to identify and collect information relevant to the comprehensive, technical, market-oriented, and commercial study of the surgical robots market. It was also used to obtain important information about key players, market classification, and segmentation according to industry trends, as well as key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the surgical robots market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

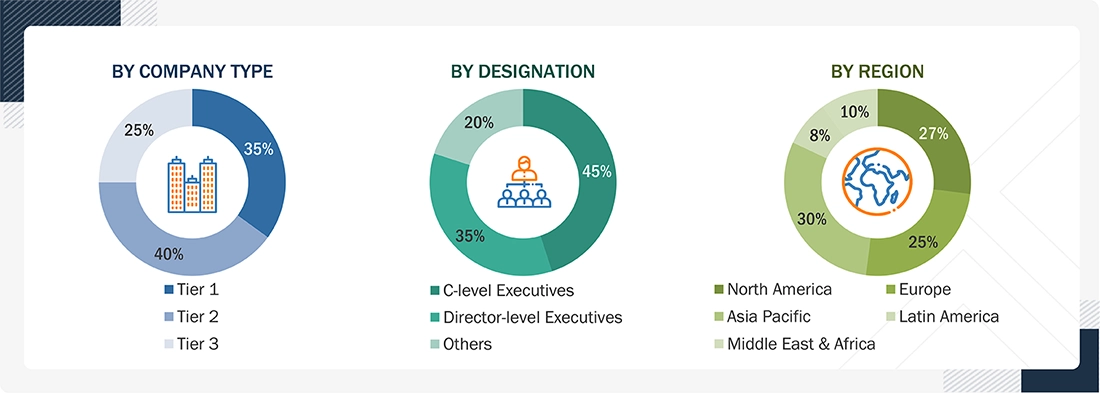

A breakdown of the primary respondents for the surgical robots market is provided below:

Note 1: C-level executives include CEOs, CFOs, COOs, and VPs.

Note 2: Other include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = USD 1.00 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global surgical robots market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping was conducted for the respective business segments and subsegments for the major players. Also, the global surgical robots market was split into various segments and subsegments based on:

- List of major players operating in the products market at the regional and/or country level

- Product mapping of various surgical robot manufacturers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from surgical robots (or the nearest reported business unit/product category)

- Revenue mapping of major players to be covered

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global surgical robots market

The above-mentioned data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets, and is presented in this report.

Surgical Robots Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the global surgical robots market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macroindicators and regional trends from both demand- and supply-side participants.

Market Definition

Surgical robots are the latest medicinal gadgets developed to aid surgeons in carrying out complicated surgeries with more control, precision, and flexibility than they would have achieved had they operated using traditional means. Such systems normally consist of robotic arms equipped with specialized equipment and high-definition cameras, which are manipulated by a surgeon through a console. Surgical robots facilitate minimal invasion of surgery and reduce recovery time of patients, hence minimizing problems and optimizing the overall surgical outcome.

Key Stakeholders

- Surgical robot and related device manufacturing companies

- Manufacturers of surgical robotic system equipment and instruments

- Suppliers and distributors of surgical robot systems

- Third-party refurbishers/suppliers

- Healthcare startups, consultants, and regulators

- Hospitals (public and private)

- Ambulatory surgery centers (ASCs)

- Academic medical institutes

- Surgeons, physicians, and operating room staff

- Government agencies

- Group purchasing organizations (GPOs)

- Corporate entities

- Government institutes

- Market research & consulting firms

- Contract manufacturing organizations (CMOs)

- Venture capitalists & investors

Report Objectives

- To define, describe, and forecast the surgical robots market by offering, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of this market (such as drivers, restraints, challenges, and opportunities)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall surgical robots market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the size of the market segments with respect to five main regions:

North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa - To profile the key players and analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches & approvals, acquisitions, expansions, partnerships, deployments, agreements, and collaborations in the overall surgical robots market

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakdown of the Rest of Europe surgical robots market into Russia, Switzerland, Denmark, Austria, and others

- Further breakdown of the Rest of Asia Pacific surgical robots market into South Korea, Taiwan, and others

- Further breakdown of the Rest of Latin America surgical robots market into Argentina, Colombia, Chile, Ecuador, and others

- Further breakdown of the Southeast Asia surgical robots market into Malaysia, Singapore, New Zealand, and others

Competitive Landscape Assessment

- Market share analysis, by region (North America and Europe), which provides market shares of the top 3–5 key players in the surgical robots market

- Competitive leadership mapping for established players in the US

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Surgical Robots Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Surgical Robots Market