Microtome Market by Product (Instruments, (Rotary), Accessories (Microtome Blades), Application (Disease Diagnosis, Medical Research), Technology (Fully Automated, Semi-automated, Manual), End User (Hospital, Clinical Labs) - Global Forecast to 2027

Market Growth Outlook Summary

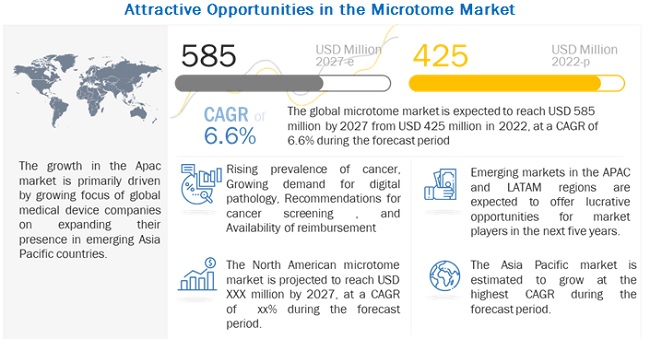

The global microtome market growth forecasted to transform from $425 million in 2022 to $585 million by 2027, driven by a CAGR of 6.6%. The expansion of this market is majorly due to rising prevalence of oncology cases as well as high demand of cancer screening, However, Lack of skilled professionals is one of the challenge for which may inhibit the growth of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID -19 Impact On Microtome Market.

Globally, Globally, the COVID-19 outbreak has impacted every aspect of the pharmaceutical, diagnostics, and medical industry, including the microtome market.

COVID-19 positively impacted the market due to a growing demand for high-throughput, sequencing-based diagnostic tests. For instance, Brooks Automation’s life science segment reported USD 199.6 million in revenue in 2021 compared to USD 129.8 million in 2020, with an increase of USD 69.8 million (54%). However, histopathology diagnostic services such as autopsy, screening services, teaching, training, and quality assurance were negatively impacted by COVID-19. The pre-analytic phase majorly involves the handling of biological material such as fresh tissue, frozen sections, formalin-fixed tissue, and organs of varying sizes. These tissues were considered a possible transmission route for SARS-CoV-2. As a result, certain guidelines were made for fresh tissue handling by RCPath (Royal College of Pathologists), ABPath (Association of Breast Surgery and Pathology), and BAGP (British Association of Gynecological Pathologists).

Research associations and other medical bodies are making various attempts to conduct clinical trials to develop suitable anti-COVID-19 drugs or testing devices, which is anticipated to fuel the growth of the microtome market.

The closure of manufacturing facilities disrupted supply chains and reduced recruitments. For instance, in the UK, universities, sponsors, charities, NHS institutions, and the NIHR Clinical Research Network decided to stop all non-COVID-19 related research in March 2020 and to pause the setup of new trials. In the 2022 recovery phase, restoring clinical trials will be a challenge because of restricted access at trial sites. Hence, the further delay in clinical trials might impact the growth of the overall microtome market in 2022.

After the FDA implemented regulatory cautions regarding how digital pathology systems can be used during the pandemic, many pathologists started working flexibly in remote locations in order to minimize COVID-19 exposure risks and provide timely diagnoses.

In conclusion, the emergence of new variants of COVID-19 will increase the demand for new clinical trials to identify and evaluate the effectiveness of drugs against COVID-19. This is an indicator of market growth during the forecast period.

The following are some of the government initiatives to delay screening or diagnostic tests for cancer:

- In March 2020, the Welsh government and the Scottish government suspended screening programs for breast, cervical, and bowel cancer.

- In the US, the Centers for Medicare & Medicaid Services classified screening as a low-priority service and suggested healthcare organizations to consider postponing screenings.

- The interim Chief Medical Officer of Scotland reported that urgent referrals of patients with cancer by primary-care physicians had been reduced by over 70% by mid-April compared with the weekly average over the past three years.

- Similar reductions have been reported in England. Assuming urgent cancer referrals have a conversion rate of 7%, Cancer Research UK has estimated that this reduction in referrals could mean around 2,000 fewer cancers are being diagnosed per week.

According to an article published in The Lancet (February 2021), new clinical trials for cancer drugs and biological therapies during the pandemic decreased by nearly 60%. Currently, many countries are undergoing lockdown relaxations, and most hospitals have resumed elective surgeries. As a result, the number of diagnostic tests conducted is increasing. Owing to the aforementioned factors, the overall growth rate of the microtome market is less when compared to the previous year (2020).

Global Microtome’s Dynamics

DRIVER: Rising prevalence of cancer

Cancer is a complex disease that develops through the multi-stage carcinogenesis process involving multiple pathways. As a result, there are various hurdles associated with cancer diagnosis, prognosis, and therapy. Cancer is the second-leading cause of death worldwide and accounted for 10 million deaths in 2020. Globally, about 1 in 6 deaths occur due to cancer (Source: WHO). In 2020, 19.3 million new cancer cases were reported, and this figure is expected to increase to 30.2 million by 2040. This increase in the incidence of cancer can be attributed to the growing geriatric (according to the World Population Ageing 2020 report, the global population aged 65 years and above was 727 million in 2020 and is expected to double by 2050 to reach 1.5 billion) as well as the total population.

Due to the increasing prevalence of cancer, the demand for oncology diagnostics has increased significantly. This has compelled government organizations as well as healthcare providers and institutions to provide facilities for effective disease diagnosis and treatment. This is driving the demand for microtomes. During the frozen section procedure, surgeons remove a portion of the tissue. This biopsy is given to pathologists who freeze the tissue in a cryostat machine, cut it with a microtome, and stain it with various dyes so that it can be examined under a microscope. Similarly, histopathology is the microscopic study of the diseased tissue and is a vital part of anatomical pathology since the accurate diagnosis of cancer and other diseases usually requires the histopathological examination of samples. Microtomes are a key tool used in anatomical pathology examinations.

OPPORTUNITY: Growing focus on personalized medicine<

Precision medicine is an evolving approach to disease treatment and prevention that considers individual variability in genes, environments, and lifestyles. Precision medicine involves selecting drugs wholly tailored to a patient based on disease condition and history. Although this practice is expanding into all disease areas, oncology has seen the most progress.

In the last decade, key stakeholders in the pharmaceutical and biotechnology industries have invested significantly in the development of personalized medicine. Key pharmaceutical companies such as AstraZeneca have confirmed that approximately 90% of their clinical development revenue is currently obtained by precision therapeutics. Some of the leading pharmaceutical companies involved in precision medicine development include Novartis, Roche, Genentech, AstraZeneca, Pfizer, BMS, Merck, and Amgen.

By 2026, the personalized medicine sector is expected to reach ~USD 98 billion. With the rising focus on the development of personalized medicine, the number of personalized medications available in the market has steadily increased, and this trend is expected to continue in the coming years. For instance, the number of personalized medicines in the US market has grown from 132 in 2016 to 286 in 2020.

For the development of personalized medicine, pathology data is required to prescribe the right therapy at the right time. Microtomes offer specimen slide diagnosis, which is helpful in detecting cancer cells and enabling early diagnosis. Thus, the increasing focus on personalized medicine is positively impacting the growth of the microtome market.

CHALLENGE: Lack of skilled professionals

Histology laboratories play a vital role in healthcare, as histology is important for the accuracy, safety, and timeliness of disease diagnosis. Also, histology is essential in gaining a better understanding of disease mechanisms and the effects of drugs on tissues. The demand for histology services has increased significantly for clinical applications due to the increasing prevalence of cancer. Histopathology technologies account for more than 80% of the tests performed on cancer patients. However, there is a dearth of trained staff in these laboratories. For instance, as per an article published in The Pathologist in 2020, in the UK, only 3% of diagnostic laboratories had sufficient staff to deliver their diagnostic as well as routine tasks (such as reporting workload). A large number of histologists have reached retirement age, and fewer histologists are being trained. As a result, histology laboratories are under pressure to process an increasing number of specimens with limited staff. This is expected to hamper the growth of the microtome market.

“Disease Diagnosis in the end user segment to witness the highest shares during the forecast period.”

Based on the application, the microtome market is segmented into Disease Diagnosis and Medical Research. The Disease Diagnosis segment is expected to dominate the microtome market. The rapid growth in the geriatric population and the increasing diagnosis of highly prevalent chronic diseases such as cancer and cardiac diseases are the key factors driving the growth of the microtome market.

North America dominates the global microtome market

Based on the region, the microtome market is segmented into North America, Europe, Asia Pacific, and the Rest of the World (RoW). North America is expected to dominate the microtome market. Growth in the North American market is mainly driven by The easy accessibility to advanced technologies, growing opportunities for advanced cancer diagnostic testing and screening, favorable reimbursement scenario for anatomic pathology diagnostic tests, increasing healthcare expenditure, and the presence of high-quality infrastructure for hospitals and clinical laboratories in the region are the key factors driving the growth of the microtome market in North America.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Some of the major players operating in this market are Danaher Corporation (US), PHC holdings corporation (Japan), Cardinal Health (US), Boeckeler Instruments, Inc (US), SM Scientific Instruments Pvt. Ltd. (India), Bright Instruments (UK), Sakura Finetek USA, Inc (US), Jinhua Yidi Medical Equipment Co., Ltd (China), Ted Pella, Inc (US), Medimeas (India), SLEE medical GmbH (Germany), Histo-Line Laboratories (Italy), microTec Laborgeräte GmbH (Germany), MEDITE Medical GmbH (Germany), Erma Inc. (Japan)

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Product, technology, Application, End user and Region |

|

Geographies Covered |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy and RoE), APAC (China, India, Japan, and the RoAPAC), and Rest of the World (Latin America- and Middle East & Africa) |

|

Companies Covered |

Danaher Corporation (US), PHC holdings corporation (Japan), Cardinal Health (US), Boeckeler Instruments, Inc (US), SM Scientific Instruments Pvt. Ltd. (India), Bright Instruments (UK), Sakura Finetek USA, Inc (US), Jinhua Yidi Medical Equipment Co., Ltd (China), Ted Pella, Inc (US), Medimeas (India), SLEE medical GmbH (Germany), Histo-Line Laboratories (Italy), microTec Laborgeräte GmbH (Germany), MEDITE Medical GmbH (Germany), Erma Inc. (Japan), Campden Instruments. (UK), Lupetec (Brazil), AGD BIOMEDICALS PVT LTD (India), Lafayette Instrument Company (US), MILESTONE MEDICAL (US), Diapath S.p.A. (Italy), RWD Life Science Co.,LTD (China), LABOID INTERNATIONAL (India), Shenzhen Dakewei Biotechnology Co., Ltd. (China), Amos scientific Pty Ltd (Australia). |

This research report categorizes the microtome market into the following segments and subsegments:

|

Regional Split |

|

|

Product Split |

|

|

Technology Split |

|

|

Application Split |

Disease Diagnosis |

|

End-user Split |

Hospital Laboratories |

Recent Developments:

- In 2021, Diapath S.P.A. (Italy) launched the Dante Embedding System for anatomic pathology laboratories

- In 2020, Diapath S.P.A. (Italy) launched Cristallo, Galileo S2 Pro microtome.

Frequently Asked Questions (FAQ):

What is the projected market value of the global microtome market?

The global market of microtome market is projected to reach USD 585.2 million by 2027.

What is the estimated growth rate (CAGR) of the global microtome market for the next five years?

The global microtome market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.6% from 2022 to 2027.

Who are the major players offering microtome in the market?

Danaher Corporation (US), PHC holdings corporation (Japan), Cardinal Health (US), Boeckeler Instruments, Inc (US), SM Scientific Instruments Pvt. Ltd. (India), Bright Instruments (UK), Sakura Finetek USA, Inc (US), Jinhua Yidi Medical Equipment Co., Ltd (China), Ted Pella, Inc (US), Medimeas (India), SLEE medical GmbH (Germany), Histo-Line Laboratories (Italy), microTec Laborgeräte GmbH (Germany), MEDITE Medical GmbH (Germany), Erma Inc. (Japan). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 YEARS COVERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 REVENUE SHARE ANALYSIS ILLUSTRATION: DANAHER CORPORATION

FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.1 GROWTH FORECAST

FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 8 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 INDICATORS AND ASSUMPTIONS AND THEIR IMPACT ON THE STUDY

2.6.1 COVID-19-SPECIFIC ASSUMPTIONS

2.7 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 10 MICROTOME MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MICROTOME MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MICROTOME MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MICROTOME MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 14 GLOBAL MICROTOME MARKET: GEOGRAPHIC SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 MICROTOME MARKET OVERVIEW

FIGURE 15 RISING PREVALENCE OF CANCER TO DRIVE MARKET GROWTH

4.2 MICROTOMES MARKET, BY PRODUCT

FIGURE 16 FULLY AUTOMATED MICROTOME SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.3 ASIA PACIFIC: MICROTOME MARKET, BY PRODUCT AND COUNTRY

FIGURE 17 ROTARY MICROTOME SEGMENT WILL DOMINATE APAC MARKET DURING FORECAST PERIOD

4.4 GEOGRAPHIC SNAPSHOT OF MICROTOME MARKET

FIGURE 18 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 MICROTOME MARKET: DRIVERS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising prevalence of cancer

TABLE 2 INCREASING INCIDENCE OF CANCER, BY REGION, 2020 VS. 2030 VS. 2040 (MILLION)

TABLE 3 PROJECTED INCREASE IN GLOBAL NUMBER OF CANCER PATIENTS, 2015 VS. 2018 VS. 2035

5.2.1.2 Growing demand for digital pathology

5.2.1.3 Recommendations for cancer screening

5.2.1.4 Availability of reimbursement

5.2.2 CHALLENGES

5.2.2.1 Lack of skilled professionals

TABLE 4 NUMBER OF PATHOLOGISTS PER 100,000 POPULATION, BY COUNTRY, 2018

5.2.2.2 Availability of refurbished products

5.2.3 OPPORTUNITIES

5.2.3.1 Growing focus on personalized medicine

5.2.3.2 Emerging economies

5.3 IMPACT OF COVID-19 ON MICROTOME MARKET

5.4 RANGES/SCENARIOS

5.4.1 MICROTOME MARKET

FIGURE 20 PESSIMISTIC SCENARIO

FIGURE 21 OPTIMISTIC SCENARIO

FIGURE 22 REALISTIC SCENARIO

5.5 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED DURING MANUFACTURING AND ASSEMBLY PHASE

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 24 DIRECT DISTRIBUTION—PREFERRED STRATEGY FOR PROMINENT COMPANIES

5.7 TECHNOLOGY ANALYSIS

5.8 PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 INTENSITY OF COMPETITIVE RIVALRY

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 BARGAINING POWER OF SUPPLIERS

5.8.5 THREAT OF SUBSTITUTES

5.9 KEY STAKEHOLDERS & BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 25 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 2 END USERS

TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 2 END USERS

5.9.2 BUYING CRITERIA

FIGURE 26 KEY BUYING CRITERIA FOR TOP 2 END USERS

TABLE 6 KEY BUYING CRITERIA FOR TOP 2 END USERS

5.10 REGULATORY LANDSCAPE

TABLE 7 INDICATIVE LIST OF REGULATORY AUTHORITIES GOVERNING MICROTOME MARKET

5.11 PATENT ANALYSIS

5.12 KEY CONFERENCES & EVENTS IN 2022

TABLE 8 LIST OF CONFERENCES & EVENTS

5.13 PRICING ANALYSIS

TABLE 9 PRICE RANGE FOR MICROTOMES

5.14 TRADE ANALYSIS

TABLE 10 IMPORT DATA FOR MICROTOMES AND PARTS AND ACCESSORIES OF INSTRUMENTS & APPARATUS FOR PHYSICAL OR CHEMICAL ANALYSIS, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 11 EXPORT DATA FOR MICROTOMES AND PARTS AND ACCESSORIES OF INSTRUMENTS & APPARATUS FOR PHYSICAL OR CHEMICAL ANALYSIS, BY COUNTRY, 2016–2020 (USD MILLION)

5.15 ECOSYSTEM ANALYSIS

5.15.1 ROLE IN ECOSYSTEM

5.15.2 KEY PLAYERS OPERATING IN MICROTOME MARKET

5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

6 MICROTOME MARKET, BY PRODUCT (Page No. - 74)

6.1 INTRODUCTION

TABLE 12 MICROTOME MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 13 MICROTOME MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

6.2 MICROTOME INSTRUMENTS

TABLE 14 MICROTOME INSTRUMENTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 15 MICROTOME INSTRUMENTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 16 MICROTOME INSTRUMENTS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 17 MICROTOME INSTRUMENTS MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.1 ROTARY MICROTOMES

6.2.1.1 Rotary microtomes are widely used in histology laboratories

TABLE 18 ROTARY MICROTOME OFFERED BY MARKET PLAYERS

TABLE 19 ROTARY MICROTOME MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 ROTARY MICROTOME MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.2 CRYOSTAT MICROTOMES

6.2.2.1 Cryostat microtomes provide immediate results by quickly, reliably, and safely cutting accurate frozen sections

TABLE 21 CRYOSTAT MICROTOME OFFERED BY MARKET PLAYERS

TABLE 22 CRYOSTAT MICROTOME MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 CRYOSTAT MICROTOME MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.3 VIBRATING MICROTOMES

6.2.3.1 Vibrating microtomes are designed to cut fresh tissue specimens

TABLE 24 VIBRATING MICROTOME OFFERED BY MARKET PLAYERS

TABLE 25 VIBRATING MICROTOME MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 VIBRATING MICROTOME MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.4 OTHER MICROTOMES

TABLE 27 OTHER MICROTOME OFFERED BY MARKET PLAYERS

TABLE 28 OTHER MICROTOME MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 OTHER MICROTOME MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3 MICROTOME ACCESSORIES

TABLE 30 MICROTOME ACCESSORIES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 31 MICROTOME ACCESSORIES MARKET, BY TYPE, 2021–2027 (USD MILLION)

6.3.1 MICROTOME BLADES

6.3.1.1 Adoption of disposable blades has increased among end users

TABLE 32 MICROTOME BLADES OFFERED BY MARKET PLAYERS

TABLE 33 MICROTOME BLADES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 34 MICROTOME BLADES MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3.2 OTHER MICROTOME ACCESSORIES

TABLE 35 OTHER MICROTOME ACCESSORIES OFFERED BY MARKET PLAYERS

TABLE 36 OTHER MICROTOME ACCESSORIES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 OTHER MICROTOME ACCESSORIES MARKET, BY REGION, 2021–2027 (USD MILLION)

7 MICROTOME MARKET, BY TECHNOLOGY (Page No. - 89)

7.1 INTRODUCTION

TABLE 38 MICROTOME MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 39 MICROTOME MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

7.2 MANUAL MICROTOMES

7.2.1 LOWER COST AND USER COMFORT ASSOCIATED WITH THESE MICROTOME ARE DRIVING THEIR ADOPTION

TABLE 40 MANUAL MICROTOME OFFERED BY MARKET PLAYERS

TABLE 41 MANUAL MICROTOME MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 MANUAL MICROTOME MARKET, BY REGION, 2021–2027 USD MILLION)

7.3 SEMI-AUTOMATED MICROTOMES

7.3.1 SEMI-AUTOMATED MICROTOME SEGMENT TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 43 SEMI-AUTOMATED MICROTOME OFFERED BY MARKET PLAYERS

TABLE 44 SEMI-AUTOMATED MICROTOME MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 SEMI-AUTOMATED MICROTOME MARKET, BY REGION, 2021–2027 (USD MILLION)

7.4 FULLY AUTOMATED MICROTOMES

7.4.1 LACK OF CLINICAL LABORATORY TECHNICIANS AND HIGH PREVALENCE OF CANCER HAVE DRIVEN SEGMENT GROWTH

TABLE 46 FULLY AUTOMATED MICROTOME OFFERED BY MARKET PLAYERS

TABLE 47 FULLY AUTOMATED MICROTOME MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 FULLY AUTOMATED MICROTOME MARKET, BY REGION, 2021–2027 (USD MILLION)

8 MICROTOME MARKET, BY APPLICATION (Page No. - 95)

8.1 INTRODUCTION

TABLE 49 MICROTOME MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 50 MICROTOME MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

8.2 DISEASE DIAGNOSIS

8.2.1 EXPANDING POOL OF GERIATRIC PATIENTS AND INCREASING DIAGNOSIS OF CHRONIC DISEASES DRIVING SEGMENT GROWTH

TABLE 51 INCREASING INCIDENCE OF CANCER, BY REGION, 2020 VS. 2030 VS. 2040 (MILLION)

TABLE 52 MICROTOME MARKET FOR DISEASE DIAGNOSIS, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 MICROTOME MARKET FOR DISEASE DIAGNOSIS, BY REGION, 2021–2027 (USD MILLION)

8.3 MEDICAL RESEARCH

8.3.1 INCREASING RESEARCH ACTIVITIES TO DRIVE ADOPTION OF MICROTOMES

TABLE 54 MICROTOME MARKET FOR MEDICAL RESEARCH, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 MICROTOME MARKET FOR MEDICAL RESEARCH, BY REGION, 2021–2027 (USD MILLION)

9 MICROTOME MARKET, BY END USER (Page No. - 99)

9.1 INTRODUCTION

TABLE 56 MICROTOME MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 57 MICROTOME MARKET, BY END USER, 2021–2027 (USD MILLION)

9.2 HOSPITAL LABORATORIES

9.2.1 HOSPITAL LABORATORIES ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

TABLE 58 MICROTOME MARKET FOR HOSPITAL LABORATORIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 MICROTOME MARKET FOR HOSPITAL LABORATORIES, BY REGION, 2021–2027 (USD MILLION)

9.3 CLINICAL LABORATORIES

9.3.1 PRESENCE OF ROBUST INFRASTRUCTURE TO PERFORM TESTS IN HIGH VOLUMES IS ESTIMATED TO DRIVE MARKET GROWTH

TABLE 60 MICROTOME MARKET FOR CLINICAL LABORATORIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 61 MICROTOME MARKET FOR CLINICAL LABORATORIES, BY REGION, 2021–2027 (USD MILLION)

9.4 OTHER END USERS

TABLE 62 MICROTOME MARKET FOR OTHER END USERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 63 MICROTOME MARKET FOR OTHER END USERS, BY REGION, 2021–2027 (USD MILLION)

10 MICROTOME MARKET, BY REGION (Page No. - 104)

10.1 INTRODUCTION

TABLE 64 MICROTOME MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 MICROTOME MARKET, BY REGION, 2021–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 27 NORTH AMERICA: CANCER INCIDENCE & MORTALITY, 2012–2035

FIGURE 28 NORTH AMERICA: MICROTOME MARKET SNAPSHOT

TABLE 66 NORTH AMERICA: MICROTOME MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 67 NORTH AMERICA: MICROTOME MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: MICROTOME MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 69 NORTH AMERICA: MICROTOME MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MICROTOME INSTRUMENTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 71 NORTH AMERICA: MICROTOME INSTRUMENTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: MICROTOME MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 73 NORTH AMERICA: MICROTOME MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: MICROTOME MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 75 NORTH AMERICA: MICROTOME MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: MICROTOME MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 77 NORTH AMERICA: MICROTOME MARKET, BY END USER, 2021–2027 (USD MILLION)

10.2.1 US

10.2.1.1 High burden of cancer and numerous conferences on anatomic pathology to drive market growth

TABLE 78 US: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 79 US: KEY MACROINDICATORS

TABLE 80 US: MICROTOME MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 81 US: MICROTOME MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 82 US: MICROTOME MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 83 US: MICROTOME MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 84 US: MICROTOME MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 85 US: MICROTOME MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 86 US: MICROTOME MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 87 US: MICROTOME MARKET, BY END USER, 2021–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Availability of research funding and rising incidence of cancer to drive market growth

TABLE 88 CANADA: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 89 CANADA: KEY MACROINDICATORS

TABLE 90 CANADA: MICROTOME MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 91 CANADA: MICROTOME MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 92 CANADA: MICROTOME MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 93 CANADA: MICROTOME MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 94 CANADA: MICROTOME MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 95 CANADA: MICROTOME MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 96 CANADA: MICROTOME MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 97 CANADA: MICROTOME MARKET, BY END USER, 2021–2027 (USD MILLION)

10.3 EUROPE

FIGURE 29 EUROPE: CANCER INCIDENCE & MORTALITY, 2012–2035

TABLE 98 EUROPE: MICROTOME MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 99 EUROPE: MICROTOME MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 100 EUROPE: MICROTOME MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 101 EUROPE: MICROTOME MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 102 EUROPE: MICROTOME INSTRUMENTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 103 EUROPE: MICROTOME INSTRUMENTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 104 EUROPE: MICROTOME MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 105 EUROPE: MICROTOME MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 106 EUROPE: MICROTOME MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 107 EUROPE: MICROTOME MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 108 EUROPE: MICROTOME MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 109 EUROPE: MICROTOME MARKET, BY END USER, 2021–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Increasing prevalence of chronic diseases to drive market growth

TABLE 110 GERMANY: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 111 GERMANY: MICROTOME MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 112 GERMANY: MICROTOME MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 113 GERMANY: MICROTOME MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 114 GERMANY: MICROTOME MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 115 GERMANY: MICROTOME MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 116 GERMANY: MICROTOME MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 117 GERMANY: MICROTOME MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 118 GERMANY: MICROTOME MARKET, BY END USER, 2021–2027 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 High prevalence of cancer to support market growth in France

TABLE 119 FRANCE: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 120 FRANCE: MICROTOME MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 121 FRANCE: MICROTOME MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 122 FRANCE: MICROTOME MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 123 FRANCE: MICROTOME MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 124 FRANCE: MICROTOME MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 125 FRANCE: MICROTOME MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 126 FRANCE: MICROTOME MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 127 FRANCE: MICROTOME MARKET, BY END USER, 2021–2027 (USD MILLION)

10.3.3 UK

10.3.3.1 Favorable government initiatives to drive market growth

TABLE 128 UK: MICROTOME MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 129 UK: MICROTOME MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 130 UK: MICROTOME MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 131 UK: MICROTOME MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 132 UK: MICROTOME MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 133 UK: MICROTOME MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 134 UK: MICROTOME MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 135 UK: MICROTOME MARKET, BY END USER, 2021–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 High prevalence of cancer and increasing per capita healthcare spending to support market growth in Italy

TABLE 136 ITALY: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 137 ITALY: MICROTOME MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 138 ITALY: MICROTOME MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 139 ITALY: MICROTOME MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 140 ITALY: MICROTOME MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 141 ITALY: MICROTOME MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 142 ITALY: MICROTOME MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 143 ITALY: MICROTOME MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 144 ITALY: MICROTOME MARKET, BY END USER, 2021–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 High incidence of chronic diseases to drive market growth in Spain

TABLE 145 SPAIN: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 146 SPAIN: MICROTOME MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 147 SPAIN: MICROTOME MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 148 SPAIN: MICROTOME MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 149 SPAIN: MICROTOME MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 150 SPAIN: MICROTOME MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 151 SPAIN: MICROTOME MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 152 SPAIN: MICROTOME MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 153 SPAIN: MICROTOME MARKET, BY END USER, 2021–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 154 LUNG CANCER INCIDENCE IN KEY ROE COUNTRIES, 2020 VS. 2040

TABLE 155 LIVER CANCER INCIDENCE IN KEY ROE COUNTRIES, 2020 VS. 2040

TABLE 156 ROE: MICROTOME MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 157 ROE: MICROTOME MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 158 ROE: MICROTOME MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 159 ROE: MICROTOME MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 160 ROE: MICROTOME MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 161 ROE: MICROTOME MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 162 ROE: MICROTOME MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 163 ROE: MICROTOME MARKET, BY END USER, 2021–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: CANCER INCIDENCE & MORTALITY, 2012–2035

FIGURE 31 ASIA PACIFIC: MICROTOME MARKET SNAPSHOT

TABLE 164 ASIA PACIFIC: MICROTOME MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 165 ASIA PACIFIC: MICROTOME MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 166 ASIA PACIFIC: MICROTOME MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 167 ASIA PACIFIC: MICROTOME MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 168 ASIA PACIFIC: MICROTOME INSTRUMENTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 169 ASIA PACIFIC: MICROTOME INSTRUMENTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 170 ASIA PACIFIC: MICROTOME MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 171 ASIA PACIFIC: MICROTOME MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 172 ASIA PACIFIC: MICROTOME MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 173 ASIA PACIFIC: MICROTOME MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 174 ASIA PACIFIC: MICROTOME MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 175 ASIA PACIFIC: MICROTOME MARKET, BY END USER, 2021–2027 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Presence of well-developed healthcare system to support market growth in Japan

TABLE 176 JAPAN: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 177 JAPAN: MICROTOME MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 178 JAPAN: MICROTOME MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 179 JAPAN: MICROTOME MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 180 JAPAN: MICROTOME MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 181 JAPAN: MICROTOME MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 182 JAPAN: MICROTOME MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 183 JAPAN: MICROTOME MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 184 JAPAN: MICROTOME MARKET, BY END USER, 2021–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Rising healthcare expenditure to drive market growth in China

TABLE 185 CHINA: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 186 CHINA: MICROTOME MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 187 CHINA: MICROTOME MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 188 CHINA: MICROTOME MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 189 CHINA: MICROTOME MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 190 CHINA: MICROTOME MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 191 CHINA: MICROTOME MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 192 CHINA: MICROTOME MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 193 CHINA: MICROTOME MARKET, BY END USER, 2021–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Growing healthcare sector to drive market growth in India

TABLE 194 INDIA: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 195 INDIA: MICROTOME MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 196 INDIA: MICROTOME MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 197 INDIA: MICROTOME MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 198 INDIA: MICROTOME MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 199 INDIA: MICROTOME MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 200 INDIA: MICROTOME MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 201 INDIA: MICROTOME MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 202 INDIA: MICROTOME MARKET, BY END USER, 2021–2027 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 203 ROAPAC: INCIDENCE OF CANCER, BY COUNTRY, 2020 VS. 2040

TABLE 204 ROAPAC: MICROTOME MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 205 ROAPAC: MICROTOME MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 206 ROAPAC: MICROTOME MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 207 ROAPAC: MICROTOME MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 208 ROAPAC: MICROTOME MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 209 ROAPAC: MICROTOME MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 210 ROAPAC: MICROTOME MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 211 ROAPAC: MICROTOME MARKET, BY END USER, 2021–2027 (USD MILLION)

10.5 REST OF THE WORLD

TABLE 212 LUNG CANCER INCIDENCE IN KEY LATIN AMERICAN COUNTRIES, 2018 VS. 2025

TABLE 213 LIVER CANCER INCIDENCE IN KEY LATIN AMERICAN COUNTRIES, 2018 VS. 2025

TABLE 214 BREAST CANCER INCIDENCE IN KEY LATIN AMERICAN COUNTRIES, 2018 VS. 2025

TABLE 215 AFRICA: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 216 ROW: MICROTOME MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 217 ROW: MICROTOME MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 218 ROW: MICROTOME INSTRUMENTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 219 ROW: MICROTOME INSTRUMENTS MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 220 ROW: MICROTOME MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 221 ROW: MICROTOME MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 222 ROW: MICROTOME MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 223 ROW: MICROTOME MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 224 ROW: MICROTOME MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 225 ROW: MICROTOME MARKET, BY END USER, 2021–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 160)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 226 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

11.3 MARKET SHARE ANALYSIS

TABLE 227 MICROTOME MARKET: DEGREE OF COMPETITION

11.4 COMPANY EVALUATION MATRIX

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 32 COMPANY EVALUATION MATRIX: MICROTOME MARKET

11.5 COMPANY EVALUATION MATRIX FOR SMES/START-UPS

11.5.1 PROGRESSIVE COMPANIES

11.5.2 STARTING BLOCKS

11.5.3 RESPONSIVE COMPANIES

11.5.4 DYNAMIC COMPANIES

FIGURE 33 COMPANY EVALUATION MATRIX FOR SMES/START-UPS: MICROTOME MARKET

11.6 COMPANY FOOTPRINT ANALYSIS

TABLE 228 OVERALL FOOTPRINT OF COMPANIES

TABLE 229 REGIONAL FOOTPRINT OF COMPANIES

TABLE 230 PRODUCT FOOTPRINT OF COMPANIES

11.7 COMPETITIVE BENCHMARKING

TABLE 231 MICROTOME MARKET: DETAILED LIST OF KEY START-UPS/SMES

11.8 COMPETITIVE SCENARIO

11.8.1 PRODUCT LAUNCHES

TABLE 232 KEY PRODUCT LAUNCHES

11.8.2 DEALS

TABLE 233 KEY DEALS

11.8.3 OTHER DEVELOPMENTS

TABLE 234 OTHER KEY DEVELOPMENTS

12 COMPANY PROFILES (Page No. - 171)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 DANAHER CORPORATION

TABLE 235 DANAHER CORPORATION: BUSINESS OVERVIEW

FIGURE 34 DANAHER CORPORATION: COMPANY SNAPSHOT (2021)

12.1.2 PHC HOLDINGS CORPORATION

TABLE 236 PHC HOLDINGS CORPORATION: BUSINESS OVERVIEW

FIGURE 35 PHC HOLDINGS CORPORATION: COMPANY SNAPSHOT (2021)

12.1.3 CARDINAL HEALTH

TABLE 237 CARDINAL HEALTH: BUSINESS OVERVIEW

FIGURE 36 CARDINAL HEALTH: COMPANY SNAPSHOT (2021)

12.1.4 BOECKELER INSTRUMENTS, INC.

TABLE 238 BOECKELER INSTRUMENTS, INC.: BUSINESS OVERVIEW

12.1.5 BRIGHT INSTRUMENTS LTD.

TABLE 239 BRIGHT INSTRUMENTS LTD.: BUSINESS OVERVIEW

12.1.6 ERMA INC.

TABLE 240 ERMA INC.: BUSINESS OVERVIEW

12.1.7 HISTO-LINE LABORATORIES

TABLE 241 HISTO-LINE LABORATORIES: BUSINESS OVERVIEW

12.1.8 JINHUA YIDI MEDICAL APPLIANCE CO., LTD.

TABLE 242 JINHUA YIDI MEDICAL APPLIANCE CO., LTD.: BUSINESS OVERVIEW

12.1.9 MEDIMEAS

TABLE 243 MEDIMEAS: BUSINESS OVERVIEW

12.1.10 MEDITE MEDICAL GMBH

TABLE 244 MEDITE MEDICAL GMBH: BUSINESS OVERVIEW

12.1.11 MICROTEC LABORGERÄTE GMBH

TABLE 245 MICROTEC LABORGERÄTE GMBH: BUSINESS OVERVIEW

12.1.12 SAKURA FINETEK USA, INC.

TABLE 246 SAKURA FINETEK USA, INC.: BUSINESS OVERVIEW

12.1.13 SLEE MEDICAL GMBH

TABLE 247 SLEE MEDICAL GMBH: BUSINESS OVERVIEW

12.1.14 SM SCIENTIFIC INSTRUMENTS PVT. LTD.

TABLE 248 SM SCIENTIFIC INSTRUMENTS PVT. LTD.: BUSINESS OVERVIEW

12.1.15 TED PELLA, INC.

TABLE 249 TED PELLA, INC.: BUSINESS OVERVIEW

12.2 OTHER PLAYERS

12.2.1 AGD BIOMEDICALS PVT. LTD.

TABLE 250 AGD BIOMEDICALS PVT. LTD.: BUSINESS OVERVIEW

12.2.2 AMOS SCIENTIFIC PTY LTD.

TABLE 251 AMOS SCIENTIFIC PTY LTD.: BUSINESS OVERVIEW

12.2.3 CAMPDEN INSTRUMENTS LTD.

TABLE 252 CAMPDEN INSTRUMENTS LTD.: BUSINESS OVERVIEW

12.2.4 DIAPATH S.P.A.

TABLE 253 DIAPATH S.P.A.: BUSINESS OVERVIEW

12.2.5 LABOID INTERNATIONAL

TABLE 254 LABOID INTERNATIONAL: BUSINESS OVERVIEW

12.2.6 LAFAYETTE INSTRUMENT COMPANY

TABLE 255 LAFAYETTE INSTRUMENT COMPANY: BUSINESS OVERVIEW

12.2.7 LUPETEC

TABLE 256 LUPETEC: BUSINESS OVERVIEW

12.2.8 MILESTONE MEDICAL

TABLE 257 MILESTONE MEDICAL: BUSINESS OVERVIEW

12.2.9 RWD LIFE SCIENCE CO., LTD.

TABLE 258 RWD LIFE SCIENCE CO., LTD.: BUSINESS OVERVIEW

12.2.10 SHENZHEN DAKEWEI BIOTECHNOLOGY CO., LTD.

TABLE 259 SHENZHEN DAKEWEI BIOTECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 213)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the microtome market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

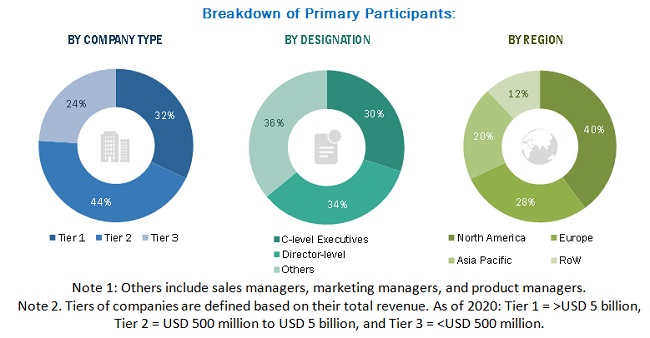

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (heads of private labs, Diagnostics and hospitals, Scientists, Researchers) and supply sides (microtomes and its accessories’ manufacturers and distributors).

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the microtome market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the microtome industry.

Report Objectives

- To define, describe, and forecast the global microtome market based on product, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments with respect to four main regions—North America, Europe, Asia Pacific and the Rest of the World (RoW)2

- To strategically profile key players and comprehensively analyze their product portfolios, market shares, and core competencies3

- To track and analyze competitive developments such as acquisitions, expansions, new product launches, and partnerships in the microtome market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Product Analysis: Product matrix, which gives a detailed comparison of the product portfolios of each company

- Geographic Analysis: Further breakdown of the European microtome market into specific countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Microtome Market