Anatomic Pathology Market by Product & Service (Instruments (Cell Processor, Microtome), Consumable, Histopathology, Cytopathology, Application (Disease Diagnosis (Cancer (Breast, Lung), End User (Hospital Laboratories), Region - Global Forecast to 2026

Market Growth Outlook Summary

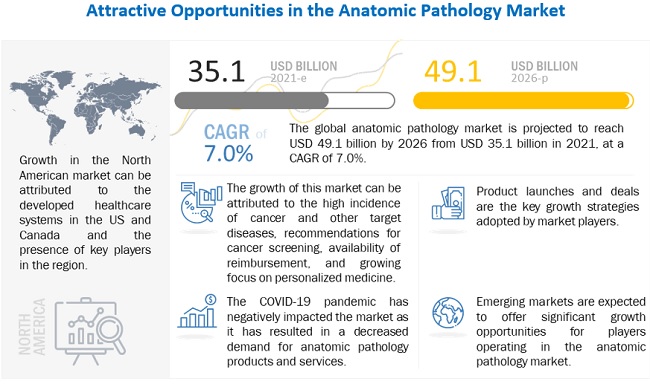

The global anatomic pathology market growth forecasted to transform from $35.1 billion in 2021 to $49.1 billion by 2026, driven by a CAGR of 7.0%. The growth of this market is majorly driven by the high incidence of cancer and other target diseases, recommendations for cancer screening, availability of reimbursement, and the growing focus on personalized medicine. In addition, emerging economies such as China, India, and Brazil are expected to offer significant growth opportunities for players operating in the market during the forecast period. However, the availability of refurbished products, the lack of skilled professionals, and product recalls are expected to hamper the market growth to a certain extent in the coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

Anatomic Pathology Market Dynamics

Drivers: High incidence of cancer and other target diseases

Cancer is the second-leading cause of death worldwide, accounting for 10 million deaths in 2020. Globally, about 1 in 6 deaths occur due to cancer (Source: World Health Organization). In 2020, 19.3 million new cancer cases were reported, and this figure is expected to increase to 30.2 million by 2040. This increase in the incidence of cancer can be attributed to the growing geriatric as well as the total population.

According to the World Population Ageing 2020 report, the global population aged 65 years and above was 727 million in 2020 and is expected to double by 2050 to reach 1.5 billion. Since the elderly are more susceptible to various diseases, this demographic trend is expected to result in a significant growth in the prevalence of several chronic diseases, including cancer, across the globe.

The incidence of cancer is the highest in developed regions; however, cancer mortality is relatively higher in underdeveloped regions due to a lack of access to treatment facilities and the late detection of cancer in several patients. According to the WHO, for many cancers, the incidence rate in countries with high or very high HDI1 is generally 2–3 times that of low- or medium-HDI countries. Approximately 70% of deaths due to cancer were reported in low-income and middle-income countries in 2018.

Opportunities: Increasing number of clinical trials pertaining to cancer drugs

Anatomic pathology products and services are used in oncology drug trials to analyze quantitative information, detect morphological structures, detect pharmacodynamic markers, and understand drug mechanisms. It is also used to stratify trial subjects based on the responses given by tissues to the drugs. Tissue diagnostics thus enable efficient trials and retrospective studies by reducing the cost and time involved in these processes. For example, in a Phase III study for Roche’s cancer immunotherapy—TECENTRIQ (atezolizumab)—the PD-L1 (programmed death-ligand 1) expression was assessed using an investigational immunohistochemistry (IHC) test, which was developed by Roche Tissue Diagnostics.

According to an article published by the Institute for Clinical Immuno-Oncology (ICLO) in 2017, there has been an increase in the number of oncology drug trials from 9,321 in 2006 to 18,400 in 2014.

CHALLENGES: Availability of refurbished products

The availability of refurbished anatomic pathology instruments is a major challenge to the growth of this market. LabX (US), AL-TAR (US), Rankin Biomedical Corporation (US), and Swerdlick Medical Systems (US) are some companies offering refurbished anatomic pathology instruments such as tissue processors, staining systems, and microtomes. A number of end users—mainly small and medium-sized laboratories—look for cost-effectiveness and opt for refurbished systems, particularly in the price-sensitive markets in developing countries. Considering these factors, the demand for refurbished anatomic pathology instruments is expected to increase in the coming years, as these systems offer the same functionalities as new equipment at lower costs. This is expected to hamper the revenue of companies offering branded anatomic pathology instruments in the market.

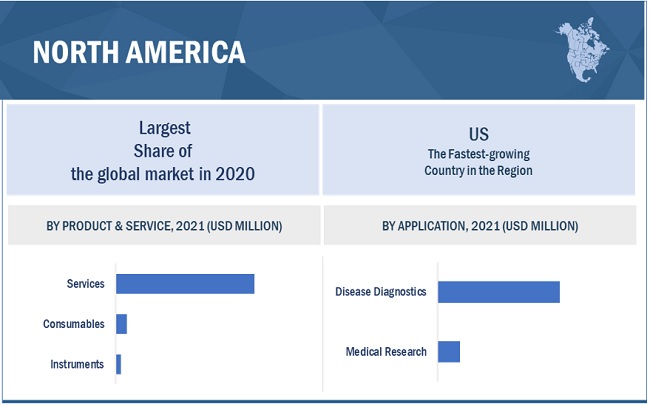

Anatomic Pathology Services accounted for the largest share of global anatomic pathology market in 2020.

Based on product & service, the market is segmented into services, consumables, and instruments. The services segment accounted for the largest market share in 2020. The large share of this segment can be attributed to the availability of reimbursements for diagnostic tests, rapid growth in the geriatric population, and the increasing incidence of cancer and other chronic diseases.

By Application, Disease diagnostics accounted for the largest market share in 2020

Based on application, the anatomic pathology market is segmented into disease diagnostics and medical research. The disease diagnostics segment accounted for a larger share of the market in 2020 due to the rapid growth in the geriatric population and the increasing incidence of cancer and other chronic diseases.

By End User, Hospital laboratories accounted for the largest market share in 2020

Based on end user, the anatomic pathology market is segmented into hospital laboratories, clinical laboratories, and other end users. Hospital laboratories accounted for the largest share in 2020. The large share of this segment can be attributed to the increasing number of patient visits to hospitals, the growing number of in-house diagnostic procedures performed in hospitals, growing awareness regarding early disease diagnosis, and the availability of reimbursements in developed markets for clinical tests performed in hospitals.

To know about the assumptions considered for the study, download the pdf brochure

North America accounted for the largest share of the anatomic pathology market in 2020

The global anatomic pathology market is segmented into North America, Europe, the Asia Pacific, and the Rest of the World (RoW). In 2020, North America accounted for the largest share of the market. Factors such as the rising prevalence of chronic diseases, increasing healthcare expenditure, the high-quality infrastructure for hospitals and clinical laboratories, and the presence of major market players in the region are driving the growth of the market in North America.

Some of the major players operating in this market are F. Hoffmann-La Roche Ltd. (Switzerland), Danaher Corporation (US), and PHC Holdings Corporation (Japan). In 2020, Roche held the leading position in the anatomic pathology market. The company offer anatomic pathology products which are widely used by people across globe across various end users. Danaher Corporation held the second position in the market in 2020.

Anatomic Pathology Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$ 35.1 billion |

|

Estimated Value by 2026 |

$ 49.1 billion |

|

Growth Rate |

Poised to grow at a CAGR of 7.0% |

|

Largest Share Segments |

Based On Product & Service - Anatomic Pathology Services Segment Accounted For The Largest Share Based On Application - Disease diagnostics accounted for the largest market share By End User - Hospital laboratories accounted for the largest market share |

|

Market Report Segmentation |

Product & Service, Consumable, Histopathology, Cytopathology, Application, End User and Regional & Global Level |

|

Growth Drivers |

|

|

Growth Opportunities |

|

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

This research report categorizes the anatomic pathology market into the following segments and subsegments:

By Product and Service

-

Services

- Histopathology

- Cytopathology

-

Consumables

-

Antibodies

- Primary Antibodies

- Secondary Antibodies

-

Kits & Reagents

- Stains & Solvents

- Fixatives

- Other Kits & Reagents

- Probes

- Other Consumables

-

Antibodies

-

Instruments

- Slide Staining Systems

- Tissue Processing Systems

- Cell Processors

- Microtomes

- Embedding Systems

- Coverslippers

- Other Instruments

By Application

-

Disease Diagnostics

-

Cancer

- Breast Cancer

- Gastrointestinal Cancer

- Lung Cancer

- Prostate Cancer

- Other Cancers

- Other Diseases

-

Cancer

- Medical Research

By End User

- Hospital Laboratories

- Clinical Laboratories

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific (RoAPAC)

-

Rest of the World

- Latin America

- Middle East & Africa

Recent Developments:

- In May 2021, Hologic received premarket approval (PMA) from the FDA for its ThinPrep GenesisTM processor for cytology processing and specimen transfer for downstream applications.

- In January 2019, PHC Holding Corporation completed the acquisition of Thermo Fisher Scientific’s Anatomical Pathology business to strengthen its position in the diagnostics segment.

Frequently Asked Questions (FAQs):

What is the size of Anatomic Pathology Market?

The global Anatomic Pathology Market in terms of revenue was estimated to be worth $35.1 billion in 2021 and is poised to reach $49.1 billion by 2026, growing at a CAGR of 7.0% from 2021 to 2026.

Why is Anatomic Pathology Market Growing?

The growth of this market is majorly driven by the high incidence of cancer and other target diseases, recommendations for cancer screening, availability of reimbursement, and the growing focus on personalized medicine. In addition, emerging economies such as China, India, and Brazil are expected to offer significant growth opportunities for players operating in the market during the forecast period.

Who all are the prominent players of Anatomic Pathology Market?

The major players in the anatomic pathology market are F. Hoffmann-La Roche Ltd. (Switzerland), Danaher Corporation (US), and PHC Holdings Corporation (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 51)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 ANATOMIC PATHOLOGY MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 55)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS (ANATOMIC PATHOLOGY MARKET)

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH 1: REVENUE SHARE ANALYSIS (BOTTOM-UP APPROACH)

2.2.1.1 Bottom-up approach for the instruments and consumables market

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 APPROACH 2: SECONDARY DATA & PRIMARY INTERVIEWS

2.2.3 APPROACH 3: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.2.3.1 Services market estimation based on the number of tests

2.2.3.2 Services market estimation based on procedures

FIGURE 7 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, OPPORTUNITIES, CHALLENGES, AND TRENDS IN THE ANATOMIC PATHOLOGY MARKET (2021–2026)

FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: ANATOMIC PATHOLOGY MARKET

2.6.1 COVID-19 SPECIFIC ASSUMPTIONS

2.7 LIMITATIONS

2.7.1 METHODOLOGY-RELATED LIMITATIONS

2.7.2 SCOPE-RELATED LIMITATIONS

2.8 GROWTH RATE ASSUMPTIONS

2.9 COVID-19 ECONOMIC ASSESSMENT

2.10 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 11 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 71)

FIGURE 12 ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2021 VS. 2026 (USD MILLION)

FIGURE 13 ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 14 ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 15 ANATOMIC PATHOLOGY MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 16 ANATOMIC PATHOLOGY MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 17 ANATOMIC PATHOLOGY MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 75)

4.1 ANATOMIC PATHOLOGY MARKET OVERVIEW

FIGURE 18 HIGH INCIDENCE OF CANCER TO DRIVE MARKET GROWTH

4.2 NORTH AMERICA: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE

FIGURE 19 SERVICES SEGMENT TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH MARKET

4.3 GEOGRAPHICAL SNAPSHOT OF THE ANATOMIC PATHOLOGY MARKET

FIGURE 20 COUNTRIES IN THE ASIA PACIFIC TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 78)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 ANATOMIC PATHOLOGY MARKET: DRIVERS, OPPORTUNITIES, CHALLENGES, AND TRENDS

5.2.1 DRIVERS

5.2.1.1 High incidence of cancer and other target diseases

TABLE 2 INCREASING INCIDENCE OF CANCER, BY REGION, 2020 VS. 2030 VS. 2040 (MILLION)

TABLE 3 PROJECTED INCREASE IN THE GLOBAL NUMBER OF CANCER PATIENTS, 2015 VS. 2018 VS. 2035

5.2.1.2 Recommendations for cancer screening

5.2.1.3 Availability of reimbursement

5.2.1.4 Growing focus on personalized medicine

TABLE 4 % OF PERSONALIZED MEDICINES IN OVERALL DRUG APPROVAL BY FDA, 2014 TO 2020

5.2.2 OPPORTUNITIES

5.2.2.1 Increasing number of clinical trials pertaining to cancer drugs

5.2.2.2 Emerging markets offer lucrative opportunities

5.2.2.3 Companion diagnostics

5.2.3 CHALLENGES

5.2.3.1 Availability of refurbished products

5.2.3.2 Lack of skilled professionals

TABLE 5 NUMBER OF PATHOLOGISTS PER 100,000 POPULATION, BY COUNTRY, 2018

5.2.3.3 Product failures and recalls

5.2.3.4 Inadequate infrastructure and low awareness in middle- and low-income countries

5.2.4 TRENDS

5.2.4.1 Reagent rental agreements

5.2.5 IMPACT OF COVID-19 ON THE ANATOMIC PATHOLOGY MARKET

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.4 RANGES/SCENARIOS

5.4.1 ANATOMIC PATHOLOGY MARKET

FIGURE 22 PESSIMISTIC SCENARIO

FIGURE 23 OPTIMISTIC SCENARIO

FIGURE 24 REALISTIC SCENARIO

5.5 PRICING ANALYSIS

TABLE 6 PRICES OF ANATOMIC PATHOLOGY PRODUCTS

5.6 VALUE CHAIN ANALYSIS

FIGURE 25 MAJOR VALUE IS ADDED DURING THE MANUFACTURING & ASSEMBLY PHASES

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 26 DISTRIBUTION—A STRATEGY PREFERRED BY PROMINENT COMPANIES

5.8 ECOSYSTEM ANALYSIS

5.8.1 ROLE IN THE ECOSYSTEM

FIGURE 27 KEY PLAYERS IN THE ANATOMIC PATHOLOGY ECOSYSTEM

5.9 TECHNOLOGY ANALYSIS

TABLE 7 TECHNOLOGICAL ADVANCEMENT IN THE ANATOMIC PATHOLOGY MARKET (2018–2021)

5.10 REGULATORY LANDSCAPE

FIGURE 28 510(K) APPROVAL PROCESS

5.11 PATENT ANALYSIS

5.12 TRADE ANALYSIS

5.12.1 TRADE ANALYSIS FOR TISSUE PROCESSING SYSTEMS

TABLE 8 IMPORT DATA FOR TISSUE PROCESSING SYSTEMS, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 9 EXPORT DATA FOR TISSUE PROCESSING SYSTEMS, BY COUNTRY, 2016–2020 (USD MILLION)

5.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 PORTER’S FIVE FORCES ANALYSIS (2020): ANATOMIC PATHOLOGY MARKET

5.13.1 THREAT OF NEW ENTRANTS

5.13.2 INTENSITY OF COMPETITIVE RIVALRY

5.13.3 BARGAINING POWER OF BUYERS

5.13.4 BARGAINING POWER OF SUPPLIERS

5.13.5 THREAT OF SUBSTITUTES

6 ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE (Page No. - 97)

6.1 INTRODUCTION

TABLE 11 MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 12 MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

6.1.1 PRIMARY NOTES

6.1.1.1 Key industry insights

6.2 SERVICES

TABLE 13 ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 14 ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.2.1 HISTOPATHOLOGY SERVICES

6.2.1.1 Rising incidence of cancer is a key factor driving market growth

FIGURE 29 STEPS IN HISTOPATHOLOGY SLIDE PREPARATION

TABLE 15 HISTOPATHOLOGY SERVICES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 16 HISTOPATHOLOGY SERVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2 CYTOPATHOLOGY SERVICES

6.2.2.1 Government focus on cervical cancer screening has boosted the growth of the cytopathology services market

TABLE 17 CYTOPATHOLOGY SERVICES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 18 CYTOPATHOLOGY SERVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3 CONSUMABLES

TABLE 19 ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 20 ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.3.1 ANTIBODIES

TABLE 21 ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 22 ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.3.1.1 Primary antibodies

6.3.1.1.1 High specificity and accuracy of primary antibodies to drive the market

TABLE 23 PRIMARY ANTIBODIES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 24 PRIMARY ANTIBODIES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.1.2 Secondary antibodies

6.3.1.2.1 Versatility of secondary antibodies ensuring their stable demand among end users

TABLE 25 SECONDARY ANTIBODIES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 26 SECONDARY ANTIBODIES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2 KITS & REAGENTS

TABLE 27 KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 28 KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.3.2.1 Stains & solvents

6.3.2.1.1 Introduction of automation can limit the market growth

TABLE 29 STAINS & SOLVENTS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 STAINS & SOLVENTS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2.2 Fixatives

6.3.2.2.1 Adoption of non-toxic fixatives to drive market growth

TABLE 31 FIXATIVES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 32 FIXATIVES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2.3 Other kits & reagents

TABLE 33 OTHER KITS & REAGENTS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 34 OTHER KITS & REAGENTS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.3 PROBES

6.3.3.1 Increasing research to aid the market growth

TABLE 35 PROBES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 36 PROBES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.4 OTHER CONSUMABLES

TABLE 37 OTHER CONSUMABLES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 38 OTHER CONSUMABLES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.4 INSTRUMENTS

TABLE 39 ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 40 ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.4.1 SLIDE STAINING SYSTEMS

6.4.1.1 Availability of automated systems will drive market growth during the forecast period

TABLE 41 SLIDE STAINING SYSTEMS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 42 SLIDE STAINING SYSTEMS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.4.2 TISSUE PROCESSING SYSTEMS

6.4.2.1 Rising adoption of automation is a key trend in the tissue processing systems market

TABLE 43 TISSUE PROCESSING SYSTEMS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 44 TISSUE PROCESSING SYSTEMS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.4.3 CELL PROCESSORS

6.4.3.1 Cell processors are used to remove unwanted matter in samples—making them important instruments in the market

TABLE 45 CELL PROCESSORS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 46 CELL PROCESSORS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.4.4 MICROTOMES

6.4.4.1 Rotary microtomes are the most commonly used microtomes

TABLE 47 MICROTOMES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 48 MICROTOMES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.4.5 EMBEDDING SYSTEMS

6.4.5.1 Liquid paraffin is the most commonly used embedding medium

TABLE 49 EMBEDDING SYSTEMS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 50 EMBEDDING SYSTEMS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.4.6 COVERSLIPPERS

6.4.6.1 Coverslippers are widely used instruments in research

TABLE 51 COVERSLIPPERS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 52 COVERSLIPPERS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.4.7 OTHER INSTRUMENTS

TABLE 53 OTHER INSTRUMENTS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 54 OTHER INSTRUMENTS MARKET, BY REGION, 2021–2026 (USD MILLION)

7 ANATOMIC PATHOLOGY MARKET, BY APPLICATION (Page No. - 120)

7.1 INTRODUCTION

7.1.1 PRIMARY NOTES

7.1.1.1 Key industry insights

TABLE 55 MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 56 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

7.2 DISEASE DIAGNOSTICS

TABLE 57 ANATOMIC PATHOLOGY MARKET FOR DISEASE DIAGNOSTICS, BY DISEASE TYPE, 2016–2020 (USD MILLION)

TABLE 58 MARKET FOR DISEASE DIAGNOSTICS, BY DISEASE TYPE, 2021–2026 (USD MILLION)

7.2.1 CANCER

TABLE 59 ANATOMIC PATHOLOGY MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 60 MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

7.2.1.1 Breast cancer

7.2.1.1.1 Breast cancer accounts for the highest mortality rate among cancers in North America

TABLE 61 BREAST CANCER INCIDENCE, BY REGION, 2020 VS. 2040

TABLE 62 MARKET FOR BREAST CANCER, BY REGION, 2016–2020 (USD MILLION)

TABLE 63 MARKET FOR BREAST CANCER, BY REGION, 2021–2026 (USD MILLION)

7.2.1.2 Gastrointestinal cancer

7.2.1.2.1 The rising incidence of gastric cancer will boost the market growth

TABLE 64 COLORECTAL CANCER INCIDENCE, BY REGION, 2020 VS. 2040

TABLE 65 MARKET FOR GASTROINTESTINAL CANCER, BY REGION, 2016–2020 (USD MILLION)

TABLE 66 MARKET FOR GASTROINTESTINAL CANCER, BY REGION, 2021–2026 (USD MILLION)

7.2.1.3 Lung cancer

7.2.1.3.1 Lung cancer is the most common cancer in the world

TABLE 67 LUNG CANCER INCIDENCE, BY REGION, 2020 VS. 2040

TABLE 68 ANATOMIC PATHOLOGY MARKET FOR LUNG CANCER, BY REGION, 2016–2020 (USD MILLION)

TABLE 69 MARKET FOR LUNG CANCER, BY REGION, 2021–2026 (USD MILLION)

7.2.1.4 Prostate cancer

7.2.1.4.1 Prostate cancers are prevalent in the geriatric male population

TABLE 70 PROSTATE CANCER INCIDENCE, BY REGION, 2020 VS. 2040

TABLE 71 ANATOMIC PATHOLOGY MARKET FOR PROSTATE CANCER, BY REGION, 2016–2020 (USD MILLION)

TABLE 72 MARKET FOR PROSTATE CANCER, BY REGION, 2021–2026 (USD MILLION)

7.2.1.5 Other cancers

TABLE 73 MELANOMA INCIDENCE, BY REGION, 2020 VS. 2040

TABLE 74 ANATOMIC PATHOLOGY MARKET FOR OTHER CANCERS, BY REGION, 2016–2020 (USD MILLION)

TABLE 75 MARKET FOR OTHER CANCERS, BY REGION, 2021–2026 (USD MILLION)

7.2.2 OTHER DISEASES

TABLE 76 MARKET FOR OTHER DISEASES, BY REGION, 2016–2020 (USD MILLION)

TABLE 77 MARKET FOR OTHER DISEASES, BY REGION, 2021–2026 (USD MILLION)

7.3 MEDICAL RESEARCH

7.3.1 GROWING RESEARCH ACTIVITIES WILL DRIVE THE ADOPTION OF ANATOMIC PATHOLOGY PRODUCTS IN THIS APPLICATION SEGMENT

TABLE 78 ANATOMIC PATHOLOGY MARKET FOR MEDICAL RESEARCH, BY REGION, 2016–2020 (USD MILLION)

TABLE 79 MARKET FOR MEDICAL RESEARCH, BY REGION, 2021–2026 (USD MILLION)

8 ANATOMIC PATHOLOGY MARKET, BY END USER (Page No. - 133)

8.1 INTRODUCTION

8.1.1 PRIMARY NOTES

8.1.1.1 Key industry insights

TABLE 80 MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 81 MARKET, BY END USER, 2021–2026 (USD MILLION)

8.2 HOSPITAL LABORATORIES

8.2.1 HOSPITAL LABORATORIES ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET

TABLE 82 ANATOMIC PATHOLOGY MARKET FOR HOSPITAL LABORATORIES, BY REGION, 2016–2020 (USD MILLION)

TABLE 83 MARKET FOR HOSPITAL LABORATORIES, BY REGION, 2021–2026 (USD MILLION)

8.3 CLINICAL LABORATORIES

8.3.1 INCREASING OUTPATIENT SURGERIES TO DRIVE THE GROWTH OF THIS SEGMENT

TABLE 84 MARKET FOR CLINICAL LABORATORIES, BY REGION, 2016–2020 (USD MILLION)

TABLE 85 ANATOMIC PATHOLOGY MARKET FOR CLINICAL LABORATORIES, BY REGION, 2021–2026 (USD MILLION)

8.4 OTHER END USERS

TABLE 86 MARKET FOR OTHER END USERS, BY REGION, 2016–2020 (USD MILLION)

TABLE 87 MARKET FOR OTHER END USERS, BY REGION, 2021–2026 (USD MILLION)

9 ANATOMIC PATHOLOGY MARKET, BY REGION (Page No. - 139)

9.1 INTRODUCTION

TABLE 88 ANATOMIC PATHOLOGY MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 89 MARKET, BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 30 NORTH AMERICA: CANCER INCIDENCE & MORTALITY, 2012–2035

FIGURE 31 NORTH AMERICA: ANATOMIC PATHOLOGY MARKET SNAPSHOT

TABLE 90 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 94 NORTH AMERICA: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 95 NORTH AMERICA: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 96 NORTH AMERICA: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 97 NORTH AMERICA: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 98 NORTH AMERICA: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 99 NORTH AMERICA: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 100 NORTH AMERICA: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 101 NORTH AMERICA: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 102 NORTH AMERICA: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 103 NORTH AMERICA: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 107 NORTH AMERICA: ANATOMIC PATHOLOGY MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET, BY END USER, 2021–2026 (USD MILLION)

9.2.1 US

9.2.1.1 The US dominates the global anatomic pathology market

TABLE 112 US: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 113 US: MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 114 US: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 115 US: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 116 US: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 117 US: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 118 US: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 119 US: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 120 US: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 121 US: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 122 US: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 123 US: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 124 US: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 125 US: ANATOMIC PATHOLOGY MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 126 US: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 127 US: MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 128 US: MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 129 US: MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 130 US: MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 131 US: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 132 US: MARKET, BY END USER, 2021–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 High burden of cancer to support market growth

TABLE 133 CANADA: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 134 CANADA: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 135 CANADA: MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 136 CANADA: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 137 CANADA: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 138 CANADA: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 139 CANADA: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 140 CANADA: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 141 CANADA: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 142 CANADA: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 143 CANADA: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 144 CANADA: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 145 CANADA: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 146 CANADA: ANATOMIC PATHOLOGY MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 147 CANADA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 148 CANADA: MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 149 CANADA: MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 150 CANADA: MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 151 CANADA: MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 152 CANADA: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 153 CANADA: MARKET, BY END USER, 2021–2026 (USD MILLION)

9.3 EUROPE

FIGURE 32 EUROPE: CANCER INCIDENCE & MORTALITY, 2012–2035

TABLE 154 EUROPE: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 155 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 156 EUROPE: MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 157 EUROPE: MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 158 EUROPE: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 159 EUROPE: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 160 EUROPE: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 161 EUROPE: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 162 EUROPE: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 163 EUROPE: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 164 EUROPE: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 165 EUROPE: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 166 EUROPE: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 167 EUROPE: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 168 EUROPE: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 169 EUROPE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 170 EUROPE: MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 171 EUROPE: MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 172 EUROPE: MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 173 EUROPE: MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 174 EUROPE: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 175 EUROPE: MARKET, BY END USER, 2021–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Availability of reimbursement for colorectal cancer screening to support market growth

TABLE 176 GERMANY: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 177 GERMANY: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 178 GERMANY: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 179 GERMANY: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 180 GERMANY: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 181 GERMANY: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 182 GERMANY: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 183 GERMANY: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 184 GERMANY: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 185 GERMANY: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 186 GERMANY: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 187 GERMANY: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 188 GERMANY: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 189 GERMANY: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 190 GERMANY: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 191 GERMANY: MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 192 GERMANY: MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 193 GERMANY: MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 194 GERMANY: MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 195 GERMANY: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 196 GERMANY: MARKET, BY END USER, 2021–2026 (USD MILLION)

9.3.2 FRANCE

9.3.2.1 Government funding for cancer diagnosis & prevention to support market growth

TABLE 197 FRANCE: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 198 FRANCE: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 199 FRANCE: MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 200 FRANCE: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 201 FRANCE: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 202 FRANCE: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 203 FRANCE: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 204 FRANCE: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 205 FRANCE: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 206 FRANCE: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 207 FRANCE: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 208 FRANCE: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 209 FRANCE: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 210 FRANCE: ANATOMIC PATHOLOGY MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 211 FRANCE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 212 FRANCE: MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 213 FRANCE: MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 214 FRANCE: MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 215 FRANCE: MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 216 FRANCE: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 217 FRANCE: MARKET, BY END USER, 2021–2026 (USD MILLION)

9.3.3 UK

9.3.3.1 Government initiatives to drive market growth in the UK

TABLE 218 UK: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 219 UK: MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 220 UK: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 221 UK: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 222 UK: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 223 UK: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 224 UK: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 225 UK: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 226 UK: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 227 UK: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 228 UK: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 229 UK: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 230 UK: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 231 UK: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 232 UK: MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 233 UK: MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 234 UK: MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 235 UK: MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 236 UK: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 237 UK: MARKET, BY END USER, 2021–2026 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Growing geriatric population to support market growth in Italy

TABLE 238 ITALY: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 239 ITALY: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 240 ITALY: MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 241 ITALY: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 242 ITALY: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 243 ITALY: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 244 ITALY: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 245 ITALY: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 246 ITALY: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 247 ITALY: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 248 ITALY: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 249 ITALY: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 250 ITALY: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 251 ITALY: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 252 ITALY: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 253 ITALY: MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 254 ITALY: MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 255 ITALY: MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 256 ITALY: MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 257 ITALY: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 258 ITALY: MARKET, BY END USER, 2021–2026 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 High incidence of chronic diseases to drive the Spanish market

TABLE 259 SPAIN: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 260 SPAIN: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 261 SPAIN: MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 262 SPAIN: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 263 SPAIN: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 264 SPAIN: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 265 SPAIN: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 266 SPAIN: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 267 SPAIN: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 268 SPAIN: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 269 SPAIN: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 270 SPAIN: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 271 SPAIN: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 272 SPAIN: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 273 SPAIN: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 274 SPAIN: MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 275 SPAIN: MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 276 SPAIN: MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 277 SPAIN: MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 278 SPAIN: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 279 SPAIN: MARKET, BY END USER, 2021–2026 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 280 ROE: CANCER INCIDENCE, BY COUNTRY, 2020 VS. 2040

TABLE 281 ROE: LUNG CANCER INCIDENCE, BY COUNTRY, 2020 VS. 2040

TABLE 282 ROE: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 283 ROE: MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 284 ROE: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 285 ROE: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 286 ROE: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 287 ROE: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 288 ROE: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 289 ROE: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 290 ROE: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 291 ROE: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 292 ROE: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 293 ROE: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 294 ROE: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 295 ROE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 296 ROE: MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 297 ROE: MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 298 ROE: MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 299 ROE: MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 300 ROE: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 301 ROE: MARKET, BY END USER, 2021–2026 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: CANCER INCIDENCE & MORTALITY, 2012–2035

FIGURE 34 ASIA PACIFIC: ANATOMIC PATHOLOGY MARKET SNAPSHOT

TABLE 302 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 303 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 304 ASIA PACIFIC: MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 305 ASIA PACIFIC: MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 306 ASIA PACIFIC: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 307 ASIA PACIFIC: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 308 ASIA PACIFIC: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 309 ASIA PACIFIC: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 310 ASIA PACIFIC: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 311 ASIA PACIFIC: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 312 ASIA PACIFIC: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 313 ASIA PACIFIC: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 314 ASIA PACIFIC: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 315 ASIA PACIFIC: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 316 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 317 ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 318 ASIA PACIFIC: MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 319 ASIA PACIFIC: MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 320 ASIA PACIFIC: MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 321 ASIA PACIFIC: MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 322 ASIA PACIFIC: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 323 ASIA PACIFIC: MARKET, BY END USER, 2021–2026 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Presence of a well-developed healthcare system to support market growth in Japan

TABLE 324 JAPAN: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 325 JAPAN: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 326 JAPAN: MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 327 JAPAN: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 328 JAPAN: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 329 JAPAN: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 330 JAPAN: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 331 JAPAN: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 332 JAPAN: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 333 JAPAN: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 334 JAPAN: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 335 JAPAN: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 336 JAPAN: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 337 JAPAN: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 338 JAPAN: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 339 JAPAN: MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 340 JAPAN: MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 341 JAPAN: MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 342 JAPAN: MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 343 JAPAN: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 344 JAPAN: MARKET, BY END USER, 2021–2026 (USD MILLION)

9.4.2 CHINA

9.4.2.1 High investments in R&D to drive the market growth

TABLE 345 CHINA: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 346 CHINA: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 347 CHINA: MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 348 CHINA: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 349 CHINA: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 350 CHINA: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 351 CHINA: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 352 CHINA: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 353 CHINA: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 354 CHINA: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 355 CHINA: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 356 CHINA: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 357 CHINA: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 358 CHINA: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 359 CHINA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 360 CHINA: MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 361 CHINA: MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 362 CHINA: MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 363 CHINA: MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 364 CHINA: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 365 CHINA: MARKET, BY END USER, 2021–2026 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Expanding healthcare sector in the country to drive market growth

TABLE 366 INDIA: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 367 INDIA: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 368 INDIA: MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 369 INDIA: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 370 INDIA: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 371 INDIA: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 372 INDIA: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 373 INDIA: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 374 INDIA: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 375 INDIA: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 376 INDIA: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 377 INDIA: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 378 INDIA: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 379 INDIA: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 380 INDIA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 381 INDIA: MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 382 INDIA: MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 383 INDIA: MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 384 INDIA: MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 385 INDIA: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 386 INDIA: MARKET, BY END USER, 2021–2026 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 387 ROAPAC: INCIDENCE OF CANCER, BY COUNTRY, 2020 VS. 2040

TABLE 388 ROAPAC: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 389 ROAPAC: MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 390 ROAPAC: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 391 ROAPAC: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 392 ROAPAC: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 393 ROAPAC: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 394 ROAPAC: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 395 ROAPAC: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 396 ROAPAC: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 397 ROAPAC: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 398 ROAPAC: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 399 ROAPAC: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 400 ROAPAC: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 401 ROAPAC: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 402 ROAPAC: MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 403 ROAPAC: MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 404 ROAPAC: MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 405 ROAPAC: MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 406 ROAPAC: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 407 ROAPAC: MARKET, BY END USER, 2021–2026 (USD MILLION)

9.5 REST OF THE WORLD

9.5 REST OF THE WORLD

TABLE 408 ROW: ANATOMIC PATHOLOGY MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 409 ROW: ANATOMIC PATHOLOGY MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 410 ROW: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 411 ROW: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 412 ROW: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 413 ROW: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 414 ROW: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 415 ROW: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 416 ROW: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 417 ROW: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 418 ROW: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 419 ROW: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 420 ROW: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 421 ROW: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 422 ROW: ANATOMIC PATHOLOGY MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 423 ROW: ANATOMIC PATHOLOGY MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 424 ROW: ANATOMIC PATHOLOGY MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 425 ROW: ANATOMIC PATHOLOGY MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 426 ROW: ANATOMIC PATHOLOGY MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 427 ROW: ANATOMIC PATHOLOGY MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 428 ROW: ANATOMIC PATHOLOGY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 429 ROW: ANATOMIC PATHOLOGY MARKET, BY END USER, 2021–2026 (USD MILLION) 9.5.1 LATIN AMERICA

9.5.1.1 Cancer screening programs to support market growth

TABLE 430 LUNG CANCER INCIDENCE IN KEY LATIN AMERICAN COUNTRIES, 2018 VS. 2025

TABLE 431 LIVER CANCER INCIDENCE IN KEY LATIN AMERICAN COUNTRIES, 2018 VS. 2025

TABLE 432 BREAST CANCER INCIDENCE IN KEY LATIN AMERICAN COUNTRIES, 2018 VS. 2025

TABLE 433 LATIN AMERICA: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 434 LATIN AMERICA: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 435 LATIN AMERICA: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 436 LATIN AMERICA: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 437 LATIN AMERICA: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 438 LATIN AMERICA: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 439 LATIN AMERICA: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 440 LATIN AMERICA: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 441 LATIN AMERICA: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 442 LATIN AMERICA: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 443 LATIN AMERICA: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 444 LATIN AMERICA: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 445 LATIN AMERICA: ANATOMIC PATHOLOGY MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 446 LATIN AMERICA: ANATOMIC PATHOLOGY MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 447 LATIN AMERICA: ANATOMIC PATHOLOGY MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 448 LATIN AMERICA: ANATOMIC PATHOLOGY MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 449 LATIN AMERICA: ANATOMIC PATHOLOGY MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 450 LATIN AMERICA: ANATOMIC PATHOLOGY MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 451 LATIN AMERICA: ANATOMIC PATHOLOGY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 452 LATIN AMERICA: ANATOMIC PATHOLOGY MARKET, BY END USER, 2021–2026 (USD MILLION)

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 Increasing incidence of cancer in Africa to support market growth

TABLE 453 AFRICA: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 454 MEA: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 455 MEA: ANATOMIC PATHOLOGY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 456 MEA: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 457 MEA: ANATOMIC PATHOLOGY SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 458 MEA: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 459 MEA: ANATOMIC PATHOLOGY INSTRUMENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 460 MEA: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 461 MEA: ANATOMIC PATHOLOGY CONSUMABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 462 MEA: ANTIBODIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 463 MEA: ANTIBODIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 464 MEA: KITS & REAGENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 465 MEA: KITS & REAGENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 466 MEA: ANATOMIC PATHOLOGY MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 467 MEA: ANATOMIC PATHOLOGY MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 468 MEA: ANATOMIC PATHOLOGY MARKET FOR DISEASE DIAGNOSTICS, 2016–2020 (USD MILLION)

TABLE 469 MEA: ANATOMIC PATHOLOGY MARKET FOR DISEASE DIAGNOSTICS, 2021–2026 (USD MILLION)

TABLE 470 MEA: ANATOMIC PATHOLOGY MARKET FOR CANCER, BY TYPE, 2016–2020 (USD MILLION)

TABLE 471 MEA: ANATOMIC PATHOLOGY MARKET FOR CANCER, BY TYPE, 2021–2026 (USD MILLION)

TABLE 472 MEA: ANATOMIC PATHOLOGY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 473 MEA: ANATOMIC PATHOLOGY MARKET, BY END USER, 2021–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 274)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 474 OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS

10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS (INSTRUMENTS AND CONSUMABLES)

FIGURE 35 REVENUE SHARE ANALYSIS OF THE TOP PLAYERS IN THE ANATOMIC PATHOLOGY MARKET (INSTRUMENTS AND CONSUMABLES)

10.4 MARKET SHARE ANALYSIS (INSTRUMENTS AND CONSUMABLES)

FIGURE 36 ANATOMIC PATHOLOGY MARKET SHARE ANALYSIS, 2020 (INSTRUMENTS AND CONSUMABLES)

TABLE 475 ANATOMIC PATHOLOGY MARKET (INSTRUMENTS AND CONSUMABLES): DEGREE OF COMPETITION (2020)

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 37 ANATOMIC PATHOLOGY MARKET: COMPANY EVALUATION QUADRANT, 2020

10.6 COMPANY EVALUATION QUADRANT: SMES/START-UPS

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 RESPONSIVE COMPANIES

10.6.4 DYNAMIC COMPANIES

FIGURE 38 ANATOMIC PATHOLOGY MARKET: COMPANY EVALUATION QUADRANT FOR SMES & START-UPS, 2020

10.7 COMPETITIVE SCENARIO

10.7.1 PRODUCT LAUNCHES

TABLE 476 KEY PRODUCT LAUNCHES

10.7.2 DEALS

TABLE 477 KEY DEALS

10.7.3 OTHER DEVELOPMENTS

TABLE 478 OTHER KEY DEVELOPMENTS

10.8 COMPETITIVE BENCHMARKING

10.8.1 PRODUCT AND REGIONAL FOOTPRINT ANALYSIS

TABLE 479 PRODUCT AND REGIONAL FOOTPRINT ANALYSIS OF TOP PLAYERS IN THE ANATOMIC PATHOLOGY MARKET FOR INSTRUMENTS AND CONSUMABLES

TABLE 480 PRODUCT FOOTPRINT OF COMPANIES

TABLE 481 REGIONAL FOOTPRINT OF COMPANIES

11 COMPANY PROFILES (Page No. - 287)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 F. HOFFMAN-LA ROCHE LTD.

TABLE 482 F. HOFFMAN-LA ROCHE LTD.: BUSINESS OVERVIEW

FIGURE 39 COMPANY SNAPSHOT: F. HOFFMAN-LA ROCHE LTD. (2020)

11.1.2 DANAHER CORPORATION

TABLE 483 DANAHER CORPORATION: BUSINESS OVERVIEW

FIGURE 40 COMPANY SNAPSHOT: DANAHER (2020)

11.1.3 PHC HOLDINGS CORPORATION

TABLE 484 PHC HOLDINGS CORPORATION: BUSINESS OVERVIEW

11.1.4 ABCAM PLC.

TABLE 485 ABCAM PLC.: BUSINESS OVERVIEW

FIGURE 41 COMPANY SNAPSHOT: ABCAM PLC. (2020)

11.1.5 HOLOGIC, INC.

TABLE 486 HOLOGIC, INC.: BUSINESS OVERVIEW

FIGURE 42 COMPANY SNAPSHOT: HOLOGIC, INC. (2020)

11.1.6 AGILENT TECHNOLOGIES

TABLE 487 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 43 COMPANY SNAPSHOT: AGILENT TECHNOLOGIES (2020)

11.1.7 BECTON, DICKINSON AND COMPANY

TABLE 488 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

FIGURE 44 COMPANY SNAPSHOT: BECTON, DICKINSON AND COMPANY (2020)

11.1.8 SAKURA FINETEK USA INC.

TABLE 489 SAKURA FINETEK: BUSINESS OVERVIEW

11.1.9 MERCK KGAA

TABLE 490 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 45 COMPANY SNAPSHOT: MERCK KGAA (2020)

11.1.10 BIO SB

TABLE 491 BIO SB: BUSINESS OVERVIEW

11.2 OTHER PLAYERS

11.2.1 BIOGENEX

11.2.2 MILESTONE MEDICAL

11.2.3 HISTO-LINE LABORATORIES

11.2.4 DIAPATH S.P.A.

11.2.5 SLEE MEDICAL GMBH

11.2.6 AMOS SCIENTIFIC PTY LTD.

11.2.7 MEDITE MEDICAL GMBH

11.2.8 CELL SIGNALING TECHNOLOGY

11.2.9 CELLPATH LTD.

11.2.10 JINHUA YIDI MEDICAL APPLIANCE CO. LTD.

11.2.11 MICROS AUSTRIA

11.2.12 R. K. SCIENTIFIC INSTRUMENT PRIVATE LIMITED

11.2.13 LUPETEC

11.2.14 MEDIMEAS

11.2.15 BRIGHT INSTRUMENTS

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 334)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

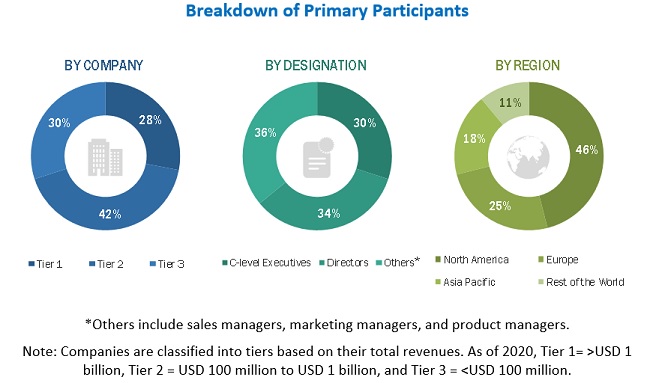

The study involved four major activities in estimating the current size of the anatomic pathology market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (Hospital Laboratories, Clinical Laboratories, and Other End Users) and supply sides (anatomic pathology manufacturers and distributors).

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Anatomic Pathology Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the anatomic pathology market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the anatomic pathology industry.

Report Objectives

- To define, describe, and forecast the global anatomic pathology market based on product & service, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, opportunities, challenges, and trends)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall anatomic pathology market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions, namely, North America, Europe, the Asia Pacific, and the Rest of the World

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and collaborations in the anatomic pathology market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Company information: Detailed analysis and profiling of additional market players (up to 5)

- Geographic Analysis: Further breakdown of the anatomic pathology market into specific countries/regions in the Rest of Europe, Rest of Asia Pacific, and Rest of the World.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Anatomic Pathology Market

What are the growth opportunities and latest trends in Anatomic Pathology Market?

What are the regional revenue expansion opportunities?

Which is the key segment to focus on for revenue growth?