Air Handling Units Market by Application (Commercial, Residential), Type (Packaged, Modular, Custom), Capacity (<=5,000 M3/H, 5,001 – 15,000 M3/H, 15,001 – 30,000 M3/H, 30,001 – 50,000 M3/H, >= 50,001 M3/H), & Region - Global Forecast to 2026

Updated on : September 02, 2025

Air Handling Units Market

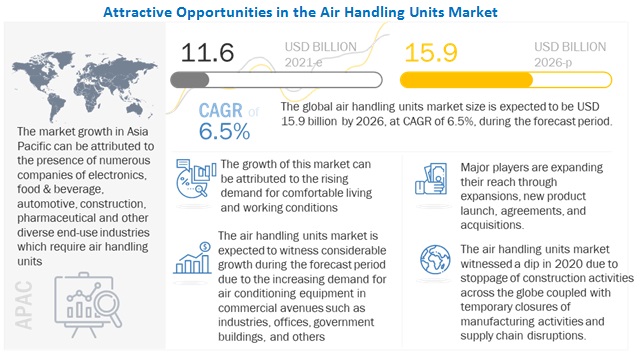

The global air handling units market was valued at USD 11.6 billion in 2021 and is projected to reach USD 15.9 billion by 2026, growing at 6.5% cagr from 2021 to 2026. The rising usage of air handling units across various application sectors such as commercial buildings, hospitals, industries, universities, data centers and server rooms is expected to fuel the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Air Handling Units Market

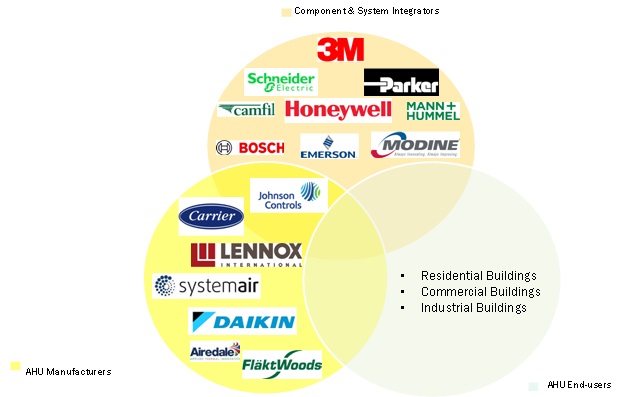

The air handling units market includes major Tier I and II suppliers like Daikin Industries Ltd. (Japan), Carrier Corporation (US), Trane Technologies plc (Ireland), Johnson Controls International plc (Ireland), and Systemair AB (Sweden). These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and Middle East & Africa. COVID-19 has impacted their businesses as well.

- In March 2020, Daikin Industries Ltd. determined the operating status of suppliers and parts inventory, implemented inventory adjustments between Daikin Group factories in China, and flexibly changed production plans.

- In early 2020, Carrier Corporation temporarily closed or reduced production at manufacturing facilities in North America, Asia, and Europe for safety reasons and in response to lower demand for their products.

- In the second quarter of fiscal 2020, Johnson Controls International plc experienced a temporary reduction of its manufacturing and operating capacity in China because of government-mandated actions to control the spread of COVID-19. In the third quarter of fiscal 2020, Johnson Controls International plc experienced similar reductions because of government-mandated actions in India and Mexico.

- In April 2020, TROX GMBH has set up a cross-functional Global Response Team to tackle the challenges presented by the new coronavirus. The Covid-19 pandemic has affected operations globally and hence the company has restricted all business-related travel and recommended the work from home option to its employees. The company has limited its manufacturing operations and project expansions.

The beginning of the year 2020, saw the greatest hardships for non-residential construction. As the extent of the COVID-19 pandemic began to materialize, a substantial part of the workforce employed in the AHU-related manufacturing in China was ordered to stay in quarantine. As a result, several manufacturing companies could not resume work, new construction projects were at a standstill, and AHU installers were restricted to access sites. While restrictions and the quarantine extended to other countries, delays in the supply of air conditioners and heat pumps piled up during the March–April 2020 period. AHU manufacturers closely watched their expenditure, wholesalers reduced their inventories, installers stayed away from work, and supply chains suffered interruptions. Costs for components, transport, and labor increased, but prices of equipment remained the same, putting pressure on manufacturers’ margins.

Air Handling Units Market Dynamics

Driver: Rising population and urbanization boosts need for air conditioning

Today, roughly 55% of the world’s population, 4.2 billion inhabitants, live in cities. This trend is expected to continue in the future. By 2050, the urban population is expected to double its current size, with nearly 7 of 10 people in the world expected to live in cities. This rising population is also contributing to increased demand for retail, commercial, and residential buildings. Mixed-use buildings such as commercial or retail with residential apartments and condominiums are being built in urban markets. Vacant warehouses and empty buildings are being converted into new commercial and residential spaces for tenants. This has placed additional emphasis on developers trying to understand what tenants want and need from a building design and amenities standpoint to ensure high occupancy rates. These factors are directly contributing to the demand for efficient air conditioning systems, which include air handling units.

Restraint: Sluggish growth of air handling units market in Europe and North America

The air handling units market in Europe and North America is mature and is witnessing a sluggish growth rate. The market for air handling units in Europe and North America has reached a level of maturity and also due to the slow economic growth in the European region, there is slow growth in the air handling units market in these regions. The European air handling units market growth is expected to remain slow compared to the North American market. This will happen due to the higher energy costs associated with the manufacturing of air handling units. These units generally require higher energy for their manufacturing and will lead to increased energy costs and decreased growth levels, especially in Europe. So, the sluggish growth in the air handling units market in Europe and North America will have an adverse impact on the global air handling units market and will act as a restraint.

Opportunities: Rapid transformation of IoT within air handling units

The Internet of Things (IoT) represents a scenario where AHUs/HVAC systems are connected to the Internet to allow the sharing of data. It collects data, stores them in the cloud, improves operations for better efficiency, and runs a predictive maintenance schedule. It also monitors, controls, and diagnoses the AHU and HVAC system over the internet in a cost-effective way. In addition, IoT enables low ongoing maintenance and repair costs of the HVAC system. IoT allows access to real-time performance data of AHUs and HVAC systems and interprets it correctly. For instance, IoT-enabled buildings can alert facility managers with early warnings of any operational abnormalities and allow for remote diagnosis and adjustment, which in turn could save costs by minimizing system failures. Moreover, AHUs and HVAC systems in commercial or residential buildings consume maximum energy. Implementing IoT in these applications would help in cost-saving, predictive maintenance, comfort control, and healthy building performance. This amalgamation of IoT with AHUs and HVAC systems provides a window of opportunity to companies operating in this industry.

Opportunities: Fluctuating raw material prices and lack of awareness about benefits of HVAC systems

Air handling units are made using various materials such as metal & alloys, polypropylene, and fiber-reinforced plastics. The fluctuating raw material prices make it challenging for the OEMs to procure high-quality raw materials and to manage the delivery timings imposed by suppliers, which further increases the cost of air handling units. With continuous technological developments, it is very important to make end users aware of the benefits of new products. In the case of HVAC systems, the awareness regarding cost- and environment-related benefits of HVAC systems is low; they are normally perceived to be expensive, which acts as a challenge for market penetration in developing, as well as underdeveloped economies. There also exists a lack of awareness regarding energy-efficient HVAC systems. Additionally, among the contractors of HVAC systems, there is a lack of awareness regarding the standards for HVAC systems. Recently, higher SEER standards such as 21 SEER units have been launched, about which residential HVAC construction firms are unaware, which ultimately hampers their business. Thus, it can hinder the growth of the air handling units market.

Air Handling Units Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Based on application, commercial segment accounted for the largest market share in 2020

The commercial application segment of the air handling units market lead the air handling units market in 2020, and is also projected to grow at the highest CAGR from 2021 to 2026, in terms of value. The increasing demand of air handling units from the commercial application sectors such as the shopping malls, hospitals, data centers, universities pharmaceutical & other industries, and laboratories is anticipated to drive the air handling units market.

Based on type, the packaged air handling unit segment accounted for the largest market share in 2020

The packaged type segment accounted for the largest share of the air handling units market in 2020. The growth of the segment can be attributed to the increasing demand of packaged air handling units from the commercial application segment such as the hospitals, commercial buildings, data centers, universities, laboratories, and server rooms, which ultimately contributed for the growth of global air handling units market.

Based on capacity, the ≤5,000 m3/h air handling unit segment accounted for the largest market share in 2020

The ≤5,000 m3/h capacity segment accounted for the largest share of the global air handling units market in 2020. These are small capacity air handling units, mainly used for small premises and are dominant in the residential sector, especially single family homes. The increasing demand for this capacity air handling units from both commercial and residential application segments is expected to drive the growth of the ≤5,000 m3/h capacity segment.

Asia Pacific accounted for the largest share of the air handling units market in 2020

Asia-Pacific was the largest market for air handling units in 2020. Increasing demand for air handling units from the rapidly growing industrial sector in the Asia Pacific region is one of the major factors responsible for the highest share and CAGR of this region. Rising urbanization and commercialization in developing countries of Asia Pacific such as India, Australia, Thailand, and Taiwan are also expected to contribute to the increased demand for air handling units. India is projected to witness the highest demand for air handling units in the Asia Pacific region, during the forecast period. Increasing standard of living and rising disposable income are creating demand for comfortable living conditions, thus driving the need for air conditioning equipment.

Air Handling Units Market Players

Daikin Industries Ltd. (Japan), Carrier Corporation (US), Trane Technologies plc (Ireland), Johnson Controls International plc (Ireland), Systemair AB (Sweden), Flakt Woods Group (Sweden), Trox GmbH (Germany), Lennox International, Inc. (US), Munters AB (Sweden), and Blue Star Limited (India) are among the key players leading the market.

Air Handling Units Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 11.6 billion |

|

Revenue Forecast in 2026 |

USD 15.9 billion |

|

CAGR |

6.5% |

|

Market Size Available for Years |

2016–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

Application, Capacity and Type |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies Covered |

Daikin Industries Ltd. (Japan), Carrier Corporation (US), Trane Technologies plc (Ireland), Johnson Controls International plc (Ireland), Systemair AB (Sweden), Flakt Woods Group (Sweden), Trox GmbH (Germany), Lennox International, Inc. (US), Munters AB (Sweden), and Blue Star Limited (India) among others |

This research report categorizes the air handling units market based on application, type, capacity and region and forecasts revenues as well as analyzes trends in each of these submarkets.

Based on Type:

- Packaged

- Modular

- Custom

- DX Integrated

- Low Profile (Ceiling)

- Rooftop Mounted

- Others

Based on Capacity:

- ≤5,000 m3/h

- 5,001 – 15,000 m3/h

- 15,001 – 30,000 m3/h

- 30,001 – 50,000 m3/h

- ≥50,001 m3/h

Based on Application:

- Commercial

- Residential

Based on Region:

- Asia-Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In May 2021, Trane Technologies plc established new operations base in Las Vegas, Nevada. The company will partner with local engineers, contractors, commercial building owners, and facility directors to provide energy management and HVAC systems, services, and aftermarket parts solutions.

- In April 2020, Daikin Industries, Ltd. announced that they had underwritten approximately 2 million USD for a capital increase through third-party allocation by Locix, Inc., a Silicon Valley-based startup. Daikin Industries, Ltd. aimed to reduce labor hours at installation sites by utilizing Locix’s highly accurate local positioning technology, Locix LPS.

- In August 2019, Systemair AB acquired a distributor in Morocco. The company had 27 employees and a sales volume of approximately SEK 70 million in 2018. The sales company with office and warehouse in Casablanca had a license agreement to act under the name Systemair.

Frequently Asked Questions (FAQ):

What are air handling units?

An air handling unit (AHU) is a factory-made encased assembly consisting of a fan or fans and other necessary equipment to perform one or more of the functions of circulating, cleaning, heating, cooling, humidifying, dehumidifying and mixing of air. An AHU is used to control the temperature, humidity, air movement, and air cleanliness, and hence it forms an integral part of the heating, ventilation, and air conditioning system.

What are the major types of air handling units?

Major types of air handling units include packaged, custom, modular, DX integrated, low profile (ceiling) and rooftop mounted.

What are the most promising high-growth opportunities for the air handling units market by application?

The air handling units market is expected to be fueled primarily by commercial applications such as manufacturing industries, offices, buildings, retail stores, educational institutes and others. Market growth will also be fueled by applications in residential buildings.

Which are the key countries expected to fuel the air handling units market?

The air handling units market is expected to grow the fastest in India, China, the US, UAE, Russia and Thailand.

What are the key driving factors for the air handling units market?

The key driver for the growth of the air handling units market is the increasing urbanization and population levels. Rising global temperature and pollution levels are also increasing demand for air conditioning equipment which can help toxic effects.

What are the major challenges which may hinder the growth of the air handling units market?

Fluctuations in raw material prices, lack of awareness of benefits of HVAC systems and logistics disruptions caused by COVID-19 pandemic are major challenges for the air handling units market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 AIR HANDLING UNITS MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

TABLE 2 MARKET, BY CAPACITY: INCLUSIONS & EXCLUSIONS

TABLE 3 MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

TABLE 4 MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4 MARKET SEGMENTATION

FIGURE 1 MARKET: SEGMENTATION

FIGURE 2 MARKET: REGIONS COVERED

1.4.1 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 3 AIR HANDLING UNITS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 List of participating companies for primary research

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY, DESIGNATION, AND REGION

2.2 BASE NUMBER CALCULATION

2.2.1 SUPPLY-SIDE APPROACH

2.3 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 7 MARKET BREAKDOWN AND DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 49)

TABLE 5 AIR HANDLING UNITS MARKET SNAPSHOT

FIGURE 8 COMMERCIAL APPLICATION SEGMENT LED THE AIR HANDLING UNITS MARKET IN 2020

FIGURE 9 PACKAGED TYPE SEGMENT LEAD THE AIR HANDLING UNITS MARKET THROUGH 2020

FIGURE 10 ≤5,000 M3/H CAPACITY SEGMENT LED THE AIR HANDLING UNITS MARKET THROUGH 2020

FIGURE 11 ASIA-PACIFIC REGION TO REGISTER THE HIGHEST GROWTH DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL AIR HANDLING UNITS MARKET

FIGURE 12 GROWING POLLUTION LEVELS AND INCREASING COMMERCIALIZATION IN THE ASIA-PACIFIC REGION TO DRIVE THE MARKET DURING THE FORECAST PERIOD

4.2 AIR HANDLING UNITS MARKET, BY CAPACITY

FIGURE 13 15,001-30,000 M3/H CAPACITY SEGMENT PROJECTED TO GROW AT THE HIGHEST CAGR BETWEEN 2021 AND 2026

4.3 ASIA-PACIFIC AIR HANDLING UNITS MARKET, BY APPLICATION AND COUNTRY

FIGURE 14 COMMERCIAL APPLICATIONS AND CHINA ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE IN ASIA-PACIFIC AIR HANDLING UNITS MARKET IN 2021

4.4 AIR HANDLING UNITS: MAJOR COUNTRIES

FIGURE 15 INDIA, CHINA, MEXICO, RUSSIA, AND UAE TO OFFER LUCRATIVE OPPORTUNITIES DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET SEGMENTATION

TABLE 6 AIR HANDLING UNITS MARKET, BY TYPE

TABLE 7 AIR HANDLING UNITS MARKET, BY APPLICATION

TABLE 8 AIR HANDLING UNITS MARKET, BY CAPACITY

5.3 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE GLOBAL AIR HANDLING UNITS MARKET

5.3.1 DRIVERS

5.3.1.1 Rising population and urbanization boost the need for air conditioning

FIGURE 17 INCREASING POPULATION, 2010-2020

FIGURE 18 WORLD POPULATION GROWTH, 2010-2020

5.3.1.2 Growing demand for energy-efficient solutions

5.3.1.3 Rising demand from food & beverages, pharmaceutical, and chemical industries

FIGURE 19 GLOBAL PHARMACEUTICAL INDUSTRY GROWTH

FIGURE 20 GROWTH TRENDS IN CHEMICAL PRODUCTION (2021-2023)

5.3.1.4 Adapting to a warmer climate and increasing pollution levels

5.3.2 RESTRAINTS

5.3.2.1 Sluggish growth of air handling units market in Europe and North America

5.3.3 OPPORTUNITIES

5.3.3.1 Rapid transformation of IoT within air handling units

5.3.3.2 New product innovation and development for residential and commercial applications

5.3.4 CHALLENGES

5.3.4.1 Fluctuating raw material prices and lack of awareness about benefits of HVAC systems

5.3.4.2 Supply chain, trade, and economic disruptions due to the COVID-19 pandemic

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 PORTER’S FIVE FORCES ANALYSIS: AIR HANDLING UNITS MARKET

TABLE 9 PORTER’S FIVE FORCES ANALYSIS: AIR HANDLING UNITS MARKET

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

6 INDUSTRY TRENDS (Page No. - 69)

6.1 SUPPLY CHAIN ANALYSIS

FIGURE 22 SUPPLY CHAIN ANALYSIS OF AIR HANDLING UNITS MARKET

TABLE 10 COMPANIES INVOLVED IN THE SUPPLY CHAIN OF AIR HANDLING UNITS MARKET

6.2 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: MAXIMUM VALUE IS ADDED DURING THE PRODUCTION PROCESS

6.2.1 PROMINENT COMPANIES

6.2.2 SMALL & MEDIUM ENTERPRISES

6.3 TRENDS/ DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 24 REVENUE SHIFT & NEW REVENUE POCKETS FOR AIR HANDLING UNIT MANUFACTURERS

6.4 ECOSYSTEM FOR AIR HANDLING UNITS MARKET

FIGURE 25 ECOSYSTEM MARKET MAP FOR AIR HANDLING UNITS MARKET

6.5 PATENT ANALYSIS

6.5.1 INTRODUCTION

6.5.2 DOCUMENT TYPE

FIGURE 26 PATENT ANALYSIS

FIGURE 27 PATENT PUBLICATION FILING TREND (2010–2021)

6.5.3 INSIGHT

6.5.4 JURISDICTION ANALYSIS

FIGURE 28 PATENT JURISDICTION ANALYSIS – TOP 10 COUNTRIES

6.5.5 TOP APPLICANTS AND OWNERS

TABLE 12 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

FIGURE 29 TOP APPLICANTS IN PATENT FILING – AIR HANDLING UNITS

6.6 TECHNOLOGY ANALYSIS

6.7 REGULATORY LANDSCAPE

TABLE 13 REGULATIONS ON AIR HANDLING UNITS - EUROPE

TABLE 14 REGULATIONS ON AIR HANDLING UNITS – CE REGULATIONS

TABLE 15 REGULATIONS ON AIR HANDLING UNITS – HARMONIZED STANDARDS

6.8 COVID-19 IMPACT ANALYSIS

6.8.1 COVID-19 HEALTH ASSESSMENT

FIGURE 30 COUNTRY-WISE SPREAD OF COVID-19

FIGURE 31 IMPACT OF COVID-19 ON DIFFERENT COUNTRIES IN 2020 (Q4)

FIGURE 32 THREE SCENARIO-BASED ANALYSIS OF COVID-19 IMPACT ON GLOBAL ECONOMY

6.8.2 COVID-19 IMPACT ON THE AIR HANDLING UNITS MARKET

7 AIR HANDLING UNITS MARKET, BY APPLICATION (Page No. - 92)

7.1 INTRODUCTION

FIGURE 33 MARKET, BY APPLICATION, 2021 & 2026 (USD MILLION)

TABLE 16 MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 17 MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

7.2 COMMERCIAL

7.2.1 COMMERCIAL APPLICATIONS OFFER THE HIGHEST GROWTH OPPORTUNITIES

TABLE 18 AIR HANDLING UNITS MARKET FOR COMMERCIAL APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 MARKET FOR COMMERCIAL APPLICATION, BY REGION, 2020–2026 (USD MILLION)

7.2.2 INDUSTRIAL

7.2.3 OFFICE

7.2.4 GOVERNMENT

7.2.5 HEALTHCARE

7.2.6 EDUCATION

7.2.7 RETAIL

7.2.8 AIRPORT

TABLE 20 AIR HANDLING UNITS MARKET FOR COMMERCIAL APPLICATION, BY SUB-SEGMENT, 2016–2019 (USD MILLION)

TABLE 21 MARKET FOR COMMERCIAL APPLICATION, BY SUB-SEGMENT, 2020–2026 (USD MILLION)

7.3 RESIDENTIAL

7.3.1 RESIDENTIAL APPLICATIONS IN ASIA-PACIFIC TO CREATE HIGHEST DEMAND DURING FORECAST PERIOD

TABLE 22 AIR HANDLING UNITS MARKET FOR RESIDENTIAL APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 AIR HANDLING UNITS MARKET FOR RESIDENTIAL APPLICATION, BY REGION, 2020–2026 (USD MILLION)

8 AIR HANDLING UNITS MARKET, BY CAPACITY (Page No. - 99)

8.1 INTRODUCTION

FIGURE 34 AIR HANDLING UNITS MARKET, BY CAPACITY, 2021 & 2026 (USD MILLION)

TABLE 24 MARKET BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 25 MARKET BY CAPACITY, 2020–2026 (USD MILLION)

8.2 ≤5,000 M3/H

8.2.1 ≤5,000 M3/H CAPACITY AIR HANDLING UNITS DOMINATE RESIDENTIAL APPLICATIONS

TABLE 26 ≤5,000 M3/H CAPACITY AIR HANDLING UNITS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 ≤5,000 M3/H CAPACITY AIR HANDLING UNITS , BY REGION, 2020–2026 (USD MILLION)

8.3 5,001-15,000 M3/H

8.3.1 5,001-15,000 M3/H CAPACITY AIR HANDLING UNITS TO SHOW HIGHEST GROWTH IN ASIA-PACIFIC REGION

TABLE 28 5,001-15,000 M3/H CAPACITY AIR HANDLING UNIT, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 5,001-15,000 M3/H CAPACITY AIR HANDLING UNITS , BY REGION, 2020–2026 (USD MILLION)

8.4 15,001-30,000 M3/H

8.4.1 15,001-30,000 M3/H CAPACITY AIR HANDLING UNITS TO SHOW HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 30 15,001-30,000 M3/H CAPACITY AIR HANDLING UNIT, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 15,001-30,000 M3/H CAPACITY AIR HANDLING UNITS , BY REGION, 2020–2026 (USD MILLION)

8.5 30,001-50,000 M3/H

8.5.1 30,001-50,000 M3/H CAPACITY AIR HANDLING UNITS ARE USED FOR LARGE COMMERCIAL APPLICATIONS

TABLE 32 30,001-50,000 M3/H CAPACITY AIR HANDLING UNIT, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 30,001-50,000 M3/H CAPACITY AIR HANDLING UNITS , BY REGION, 2020–2026 (USD MILLION)

8.6 ≥50,001 M3/H

8.6.1 ≥50,001 M3/H CAPACITY AIR HANDLING UNITS ARE USED FOR LARGE INDUSTRIAL AND COMMERCIAL APPLICATIONS

TABLE 34 ≥50,001 M3/H CAPACITY AIR HANDLING UNITS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 ≥50,001 M3/H CAPACITY AIR HANDLING UNIT, BY REGION, 2020–2026 (USD MILLION)

9 AIR HANDLING UNITS MARKET, BY TYPE (Page No. - 107)

9.1 INTRODUCTION

FIGURE 35 MARKET, BY TYPE, 2021 & 2026 (USD MILLION)

TABLE 36 MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 37 MARKET, BY TYPE, 2020–2026 (USD MILLION)

9.2 PACKAGED AIR HANDLING UNITS

9.2.1 PACKAGED AIR HANDLING UNITS ARE IN DEMAND DUE TO RISING COMMERCIALIZATION IN DEVELOPING COUNTRIES

TABLE 38 PACKAGED AIR HANDLING UNITS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 PACKAGED AIR HANDLING UNITS , BY REGION, 2020–2026 (USD MILLION)

9.3 MODULAR AIR HANDLING UNITS

9.3.1 INCREASED DEMAND FOR MODULAR AIR HANDLING UNITS DUE TO THEIR COMPACTNESS

TABLE 40 MODULAR AIR HANDLING UNITS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 MODULAR AIR HANDLING UNITS , BY REGION, 2020–2026 (USD MILLION)

9.4 CUSTOM AIR HANDLING UNITS

9.4.1 CUSTOM AIR HANDLING UNITS TO ACCOUNT FOR HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 42 CUSTOM AIR HANDLING UNITS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 CUSTOM AIR HANDLING UNITS , BY REGION, 2020–2026 (USD MILLION)

9.5 DX INTEGRATED AIR HANDLING UNITS

9.5.1 DEMAND FOR DX INTEGRATED AIR HANDLING UNITS TO INCREASE DUE TO HIGH ENERGY EFFICIENCY

TABLE 44 DX INTEGRATED AIR HANDLING UNITS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 DX INTEGRATED AIR HANDLING UNITS , BY REGION, 2020–2026 (USD MILLION)

9.6 LOW PROFILE (CEILING) AIR HANDLING UNITS

9.6.1 LOW PROFILE (CEILING) AIR HANDLING UNITS FIND DEMAND IN RESIDENTIAL AND SMALL COMMERCIAL APPLICATIONS

TABLE 46 LOW PROFILE (CEILING) AIR HANDLING UNITS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 47 LOW PROFILE (CEILING) AIR HANDLING UNITS , BY REGION, 2020–2026 (USD MILLION)

9.7 ROOFTOP-MOUNTED AIR HANDLING UNITS

9.7.1 HIGH GROWTH OPPORTUNITIES FOR ROOFTOP-MOUNTED AIR HANDLING UNITS IN THE ASIA-PACIFIC REGION

TABLE 48 ROOFTOP-MOUNTED AIR HANDLING UNITS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 ROOFTOP-MOUNTED AIR HANDLING UNITS , BY REGION, 2020–2026 (USD MILLION)

9.8 OTHER AIR HANDLING UNITS

TABLE 50 OTHER AIR HANDLING UNITS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 OTHER AIR HANDLING UNITS , BY REGION, 2020–2026 (USD MILLION)

10 AIR HANDLING UNITS MARKET, BY REGION (Page No. - 117)

10.1 INTRODUCTION

FIGURE 36 AIR HANDLING UNITS MARKET: REGIONAL SNAPSHOT (2021-2026)

TABLE 52 AIR HANDLING UNITS , BY REGION, 2016–2019 (USD MILLION)

TABLE 53 AIR HANDLING UNITS, BY REGION, 2020–2026 (USD MILLION)

10.2 ASIA-PACIFIC

TABLE 54 ASIA-PACIFIC AIR HANDLING UNITS MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 55 ASIA-PACIFIC MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

FIGURE 37 ASIA-PACIFIC MARKET SNAPSHOT

TABLE 56 ASIA-PACIFIC MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 57 ASIA-PACIFIC MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 58 ASIA-PACIFIC MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 59 ASIA-PACIFIC MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 60 ASIA-PACIFIC MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 61 ASIA-PACIFIC MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.2.1 CHINA

10.2.1.1 China’s manufacturing industry to increase demand for air handling units

TABLE 62 CHINA AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 63 CHINA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 64 CHINA MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 65 CHINA MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.2.2 JAPAN

10.2.2.1 Automotive and electronics industry to boost demand for AHU market in Japan

TABLE 66 JAPAN AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 67 JAPAN MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 68 JAPAN MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 69 JAPAN MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.2.3 INDIA

10.2.3.1 India to register the highest growth for AHU market in Asia-Pacific

TABLE 70 INDIA AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 71 INDIA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 72 INDIA MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 73 INDIA MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.2.4 SOUTH KOREA

10.2.4.1 Electronics and semiconductor industry to boost the demand for AHU in South Korea

TABLE 74 SOUTH KOREA AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 75 SOUTH KOREA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 76 SOUTH KOREA MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 77 SOUTH KOREA MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.2.5 THAILAND

10.2.5.1 Increasing commercial activities to boost the demand for AHU

TABLE 78 THAILAND AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 79 THAILAND MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 80 THAILAND MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 81 THAILAND MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.2.6 AUSTRALIA

10.2.6.1 Demand from food and beverage industry to contribute to market growth

TABLE 82 AUSTRALIA AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 83 AUSTRALIA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 84 AUSTRALIA MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 85 AUSTRALIA MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.2.7 TAIWAN

10.2.7.1 Electronics industry to boost demand for air handling units in Taiwan

TABLE 86 TAIWAN AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 87 TAIWAN MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 88 TAIWAN MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 89 TAIWAN MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.2.8 REST OF ASIA-PACIFIC

TABLE 90 REST OF ASIA-PACIFIC AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 91 REST OF ASIA-PACIFIC MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 92 REST OF ASIA-PACIFIC MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 93 REST OF ASIA-PACIFIC MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.3 EUROPE

TABLE 94 EUROPE AIR HANDLING UNITS MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 95 EUROPE MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

FIGURE 38 EUROPE MARKET SNAPSHOT

TABLE 96 EUROPE MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 97 EUROPE MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 98 EUROPE MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 99 EUROPE MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 100 EUROPE MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 101 EUROPE MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany’s automotive industry to increase demand for AHU market

TABLE 102 GERMANY AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 103 GERMANY MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 104 GERMANY MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 105 GERMANY MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Industrial applications to increase demand for air handling units in France

TABLE 106 FRANCE AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 107 FRANCE MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 108 FRANCE MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 109 FRANCE MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.3.3 UK

10.3.3.1 Aerospace industry to boost demand for AHU market

TABLE 110 UK AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 111 UK MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 112 UK MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 113 UK MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Food processing industry to drive the demand for AHU market

TABLE 114 ITALY AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 115 ITALY MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 116 ITALY MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 117 ITALY MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Increasing use in commercial applications to drive AHU demand in Spain

TABLE 118 SPAIN AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 119 SPAIN MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 120 SPAIN MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 121 SPAIN MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.3.6 RUSSIA

10.3.6.1 Use of air handling units in heavy industries to boost market

TABLE 122 RUSSIA AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 123 RUSSIA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 124 RUSSIA MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 125 RUSSIA MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.3.7 REST OF EUROPE

TABLE 126 REST OF EUROPE AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 127 REST OF EUROPE MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 128 REST OF EUROPE MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 129 REST OF EUROPE MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.4 NORTH AMERICA

TABLE 130 NORTH AMERICA AIR HANDLING UNITS MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 131 NORTH AMERICA MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

FIGURE 39 NORTH AMERICA MARKET SNAPSHOT

TABLE 132 NORTH AMERICA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 133 NORTH AMERICA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 134 NORTH AMERICA MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 135 NORTH AMERICA MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 136 NORTH AMERICA MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 137 NORTH AMERICA MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.4.1 US

10.4.1.1 Growing construction activities in the US to boost the AHU market

TABLE 138 US AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 139 US MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 140 US MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 141 US MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.4.2 CANADA

10.4.2.1 Canada’s food and beverage processing industry to increase demand for AHU market

TABLE 142 CANADA AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 143 CANADA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 144 CANADA MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 145 CANADA MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.4.3 MEXICO

10.4.3.1 Automotive and electronics industry to drive growth for the AHU market in Mexico

TABLE 146 MEXICO AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 147 MEXICO MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 148 MEXICO MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 149 MEXICO MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

TABLE 150 MIDDLE EAST & AFRICA AIR HANDLING UNITS MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 151 MIDDLE EAST & AFRICA MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 153 MIDDLE EAST & AFRICA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 154 MIDDLE EAST & AFRICA MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 155 MIDDLE EAST & AFRICA MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 156 MIDDLE EAST & AFRICA MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 157 MIDDLE EAST & AFRICA MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.5.1 SAUDI ARABIA

10.5.1.1 Oil and gas industry to recover after the slump due to pandemic

TABLE 158 SAUDI ARABIA AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 159 SAUDI ARABIA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 160 SAUDI ARABIA MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 161 SAUDI ARABIA MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.5.2 QATAR

10.5.2.1 Increasing construction activities in Qatar to support market growth

TABLE 162 QATAR AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 163 QATAR MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 164 QATAR MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 165 QATAR MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.5.3 TURKEY

10.5.3.1 Construction industry to boost the AHU market in Turkey.

TABLE 166 TURKEY AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 167 TURKEY MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 168 TURKEY MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 169 TURKEY MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.5.4 UAE

10.5.4.1 Use of AHUs in commercial applications boosts the market

TABLE 170 UAE AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 171 UAE MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 172 UAE MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 173 UAE MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 174 REST OF MIDDLE EAST & AFRICA AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 175 REST OF MIDDLE EAST & AFRICA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 176 REST OF MIDDLE EAST & AFRICA MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 177 REST OF MIDDLE EAST & AFRICA MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.6 SOUTH AMERICA

TABLE 178 SOUTH AMERICA AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 179 SOUTH AMERICA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 180 SOUTH AMERICA MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 181 SOUTH AMERICA MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 182 SOUTH AMERICA MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 183 SOUTH AMERICA MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 184 SOUTH AMERICA MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 185 SOUTH AMERICA MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.6.1 BRAZIL

10.6.1.1 Pharmaceutical industry to boost the demand for AHU market in Brazil

TABLE 186 BRAZIL AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 187 BRAZIL MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 188 BRAZIL MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 189 BRAZIL MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.6.2 ARGENTINA

10.6.2.1 Food and beverage processing industry to increase demand for AHU market

TABLE 190 ARGENTINA AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 191 ARGENTINA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 192 ARGENTINA MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 193 ARGENTINA MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.6.3 PERU

10.6.3.1 Peru’s manufacturing industry to boost the demand for air handling units

TABLE 194 PERU AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 195 PERU UNITS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 196 PERU MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 197 PERU MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

10.6.4 REST OF SOUTH AMERICA

TABLE 198 REST OF SOUTH AMERICA AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 199 REST OF SOUTH AMERICA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 200 REST OF SOUTH AMERICA MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 201 REST OF SOUTH AMERICA MARKET, BY CAPACITY, 2020–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 183)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

FIGURE 40 OVERVIEW OF STRATEGIES DEPLOYED BY AIR HANDLING UNIT MANUFACTURERS

11.3 REVENUE ANALYSIS

11.3.1 REVENUE ANALYSIS OF TOP PLAYERS IN THE AIR HANDLING UNITS MARKET

FIGURE 41 TOP FIVE PLAYERS – REVENUE ANALYSIS (2016-2020)

11.4 MARKET SHARE ANALYSIS: MARKET (2020)

FIGURE 42 DAIKIN INDUSTRIES LTD. CAPTURED THE LARGEST SHARE IN AIR HANDLING UNITS MARKET IN 2020

TABLE 202 BROMINE MARKET: DEGREE OF COMPETITION

11.5 COMPETITIVE LANDSCAPE MAPPING, 2020

11.5.1 STAR

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE

11.5.4 PARTICIPANTS

FIGURE 43 AIR HANDLING UNITS MARKET: COMPETITIVE LANDSCAPE MAPPING, 2020

11.6 COMPETITIVE BENCHMARKING

11.6.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 44 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE AIR HANDLING UNITS MARKET

11.6.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 45 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE AIR HANDLING UNITS MARKET

11.7 SME MATRIX, 2020

11.7.1 PROGRESSIVE COMPANIES

11.7.2 DYNAMIC COMPANIES

11.7.3 RESPONSIVE COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 46 AIR HANDLING UNITS MARKET: COMPETITIVE LEADERSHIP MAPPING OF EMERGING COMPANIES, 2020

TABLE 203 COMPANY APPLICATION FOOTPRINT, 2020

TABLE 204 COMPANY AHU TYPE FOOTPRINT, 2020

TABLE 205 COMPANY REGIONAL FOOTPRINT, 2020

TABLE 206 COMPANY OVERALL FOOTPRINT, 2020

11.8 KEY MARKET DEVELOPMENTS

TABLE 207 AIR HANDLING UNITS MARKET: NEW PRODUCT LAUNCH, JANUARY 2015–AUGUST 2021

TABLE 208 MARKET: DEALS, JANUARY 2015–AUGUST 2021

TABLE 209 MARKET: OTHERS, JANUARY 2015–AUGUST 2021

12 COMPANY PROFILE (Page No. - 205)

(Business overview, Products offered, Recent Developments, COVID-19 Related Developments, MNM view)*

12.1 DAIKIN INDUSTRIES, LTD.

TABLE 210 DAIKIN INDUSTRIES, LTD: COMPANY OVERVIEW

FIGURE 47 DAIKIN INDUSTRIES, LTD: COMPANY OVERVIEW

12.2 CARRIER CORPORATION

TABLE 211 CARRIER CORPORATION: COMPANY OVERVIEW

FIGURE 48 CARRIER CORPORATION: COMPANY OVERVIEW

12.3 TRANE TECHNOLOGIES PLC

TABLE 212 TRANE TECHNOLOGIES PLC: COMPANY OVERVIEW

FIGURE 49 TRANE TECHNOLOGIES PLC: COMPANY OVERVIEW

12.4 JOHNSON CONTROLS INTERNATIONAL PLC

TABLE 213 JOHNSON CONTROLS INTERNATIONAL PLC: COMPANY OVERVIEW

FIGURE 50 JOHNSON CONTROLS INTERNATIONAL PLC: COMPANY OVERVIEW

12.5 SYSTEMAIR AB

TABLE 214 SYSTEMAIR AB: COMPANY OVERVIEW

FIGURE 51 SYSTEMAIR AB: COMPANY OVERVIEW

12.6 FLÄKT WOODS GROUP

TABLE 215 FLÄKT WOODS GROUP: COMPANY OVERVIEW

12.7 TROX GMBH

TABLE 216 TROX GMBH: COMPANY OVERVIEW

12.8 LENNOX INTERNATIONAL INC.

TABLE 217 LENNOX INTERNATIONAL INC: COMPANY OVERVIEW

FIGURE 52 LENNOX INTERNATIONAL INC: COMPANY OVERVIEW

12.9 MUNTERS AB

TABLE 218 MUNTERS AB: COMPANY OVERVIEW

FIGURE 53 MUNTERS AB: COMPANY OVERVIEW

12.10 BLUE STAR LIMITED

TABLE 219 BLUE STAR LIMITED: COMPANY OVERVIEW

FIGURE 54 BLUE STAR LIMITED: COMPANY OVERVIEW

12.11 NANJING TICA CLIMATE SOLUTIONS CO., LTD.

TABLE 220 NANJING TICA CLIMATE SOLUTIONS CO., LTD: COMPANY OVERVIEW

12.12 AL-KO THERM GMBH

TABLE 221 AL-KO THERM GMBH: COMPANY OVERVIEW

12.13 SWEGON GROUP AB

TABLE 222 SWEGON GROUP AB: COMPANY OVERVIEW

12.14 OTHER KEY PLAYERS

12.14.1 AIREDALE INTERNATIONAL AIR CONDITIONING LTD.

TABLE 223 AIREDALE INTERNATIONAL AIR CONDITIONING LTD: COMPANY OVERVIEW

12.14.2 SABIANA SPA

TABLE 224 SABIANA SPA: COMPANY OVERVIEW

12.14.3 WOLF GMBH

TABLE 225 WOLF GMBH: COMPANY OVERVIEW

12.14.4 NOVENCO AS

TABLE 226 NOVENCO AS: COMPANY OVERVIEW

12.14.5 VTS GROUP

TABLE 227 VTS GROUP: COMPANY OVERVIEW

12.14.6 DESICCANT ROTORS INTERNATIONAL (DRI)

TABLE 228 DESICCANT ROTORS INTERNATIONAL (DRI): COMPANY OVERVIEW

12.14.7 AIRWOODS

TABLE 229 AIRWOODS: COMPANY OVERVIEW

12.14.8 EQUIPAMENTOS DE VENTILAÇÃO E AR CONDICIONADO, S.A.

TABLE 230 EQUIPAMENTOS DE VENTILAÇÃO E AR CONDICIONADO, S.A: COMPANY OVERVIEW

12.14.9 CLIMA TECH AIRCONDITIONERS GMBH

TABLE 231 CLIMA TECH AIRCONDITIONERS GMBH: COMPANY OVERVIEW

12.14.10 G.I. HOLDING GROUP

12.14.11 G.I. HOLDING GROUP: COMPANY OVERVIEW

12.14.12 AIRTÈCNICS

TABLE 232 AIRTÈCNICS: COMPANY OVERVIEW

12.14.13 TROSTEN INDUSTRIES COMPANY LLC

TABLE 233 TROSTEN INDUSTRIES COMPANY LLC: COMPANY OVERVIEW

12.14.14 MAICO VENTILATION PVT LTD

TABLE 234 MAICO VENTILATION PVT LTD: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, COVID-19 Related Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 254)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

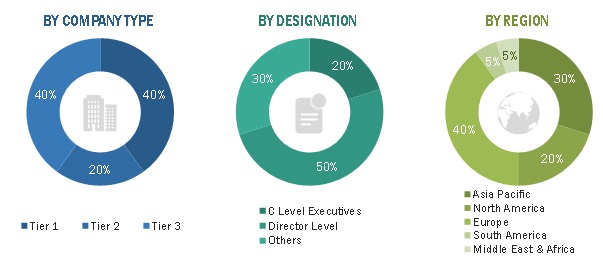

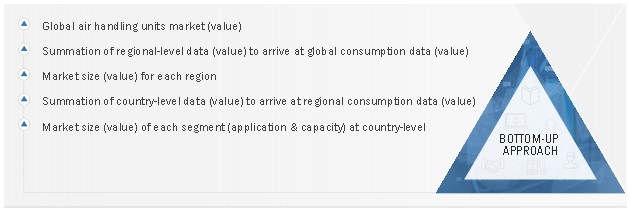

This study involved four major activities in estimating the current size of the air handling units market. Exhaustive secondary research was undertaken to collect information on the air handling units market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the overall size of the market. Thereafter, the market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the air handling units market.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. Data was also collected from websites and publications of entities, such as the Air Conditioning, Heating, and Refrigeration Institute (AHRI), American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE), Air Movement and Control Association (AMCA), Refrigeration Service Engineers Society (RSES), Air Conditioning Contractors of America (ACCA), United Association (UA), and American Society of Mechanical Engineers (ASME).

Primary Research

In the primary research process, experts from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents (VPs), marketing directors, and related key executives from major companies and organizations operating in the air handling units market. Primary sources from the demand side included purchase managers of companies, end users, suppliers, and distributors of air handling units.

Following is the breakdown of primary respondents interviewed:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the air handling units market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research

- The supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

- The research includes the study of reports, reviews, and newsletters of the key market players along with extensive interviews for opinions from leaders, such as directors and marketing executives

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Report

- To define, describe, and forecast the size of the global air handling units market, in terms of value; based on application, capacity, type, and region

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global air handling units market

- To provide the market share analysis of the major players in the air handling units market

- To analyze and forecast the size of various segments such as application, capacity, and type of the air handling units market based on five major regions—Norths America, Asia Pacific, Europe, South America, and the Middle East & Africa—along with key countries in each of these regions

- To analyze region-specific trends in North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To estimate and forecast the market, in terms of value (USD million) at global and country levels

- To analyze recent developments and competitive strategies, such as acquisitions, agreements, divestment, expansions, investment, joint ventures, mergers, and new product launches

- To strategically profile the key players in the market and comprehensively analyze their core competencies

The following customization options are Available for the report:

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Air Handling Units Market