Multiwall Bags Market by Product Type (Paper Bags and Plastic Bags), Layer (2-Ply, 3-PLy, and Others), Application (Food & Grains, Agriculture, Building & Construction, Chemicals, Retail, Pharmaceuticals, and Others), and Region - Global Forecast to 2025

Multiwall Bags Market

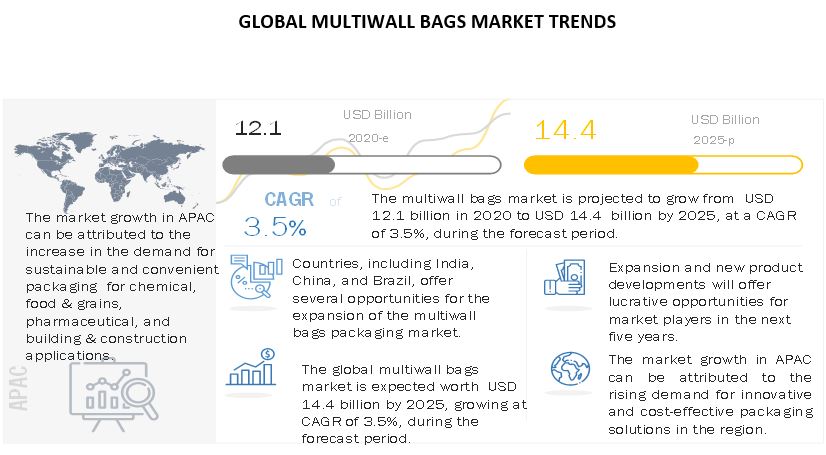

The global multiwall bags market was valued at USD 12.1 billion in 2020 and is projected to reach USD 14.4 billion by 2025, growing at 3.5% cagr during the forecast period. The multiwall bags market is expected to witness significant growth in the future due to its increased demand in end-use industries, such as food & grains, retail, and pharmaceutical. Growth in modern retailing, high consumer income, and acceleration in packaging activities, especially in the emerging economies, are likely to support the growth of the multiwall bags market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global multiwall bags market

The global multiwall bags market is expected to witness a moderate decrease in its growth rate in 2020-2021. The COVID-19 pandemic has led to economic disruption and has brought down production activities. Trade, travel, retail, and manufacturing activities have been affected, and the production of packaging materials and supply chain came to a standstill during the Q1 and Q2 of 2020. However, several countries have lifted lockdowns, which is expected to encourage market growth. The long-term effect of this crisis could be unprecedented and is expected to limit the growth of the multiwall sacks market

Multiwall bags Market Dynamics

Driver: Growth of end-use industry

There is a growing demand for multiwall bags from end-use industries, such as food & beverage, agriculture, construction, and healthcare. The use of plastic and paper offers advantages such as low weight, recyclability, and longevity. Multiwall bags are made from kraft paper and/or plastics. It helps in providing protection during transit and extends the shelf life of the product.

In the food & beverage industry, multiwall bags are used for packing ready to eat food products, dairy products, food commodities (rice, wheat, cereals), and FMCG (wheat flour, oil), among others. In the food & beverage industry, the inner layer of multiwall bags is food grade to preserve the shelf life and quality of the products. Over the years, the construction industry has witnessed a huge demand for multiwall bags in building materials such as cement and aggregates packaging. Plastic-based multiwall bags, particularly FIBC woven bags, have experienced increasing demand with the growth in cement consumption in the construction industry.

In the agriculture industry, multiwall bags are majorly used for packing agrochemical products such as pesticides and fertilizers. Farmer purchase seeds, pesticides, fertilizers, and other agricultural supplies in bulk. Multiwall bags are suitable for packing agrochemicals to maintain their chemical properties and quality. In the chemical industry, multiwall paper bags and jumbo bags are used for packing chemical products in solid and liquid forms. Multiwall bags are very important for packaging in the chemical industry to prevent any leakage or spill of the chemical, which might cause a hazardous impact on humans as well as the environment.

Amid the COVID-19 pandemic, flexible packaging products such as multiwall bags or sacks have been increasingly demanded from industries such as food & beverages, agriculture, and healthcare to maintain hygiene and protection of the products from any transmission. The food & beverage industry has witnessed high demand for packed food during the second quarter of 2020, leading to the high consumption of paper and plastic bags. The COVID-19 crisis had led to the stockpiling of food items, medical supplies, agriproducts, and consumer goods.

The US, India, China, Germany, the UK, and Brazil, among others, are the largest food-producing economies in the world. The consumption of paper and plastic bags has increased dramatically following the demand for packed food items. Demand for cement is expected to increase in emerging economies such as China, India, and GCC countries, which is further expected to fuel the growth of FIBC bags and multiwall paper bags. Demand for agrochemicals has augmented following the need for increasing agricultural yield across the world, which further boosts the growth of the packaging of agrochemicals and agricultural products. The healthcare industry, which is a low volume consumer of multiwall bags, has witnessed drastic growth in 2020, owing to the increased demand for pharmaceutical and medical supplies.

Restraint: Sustained use of single ply bags

Singly layer or ply bags are widely used in industries such as food & beverages, agriculture, retail, pharmaceutical, and consumer goods. These bags are manufactured using thermoplastics polymers such as polyethylene and polypropylene, which are easily available raw materials at very cheap costs. Single layer bags are used as flexible packaging products. They are easily available for small to medium density packaging. Most of the single layer plastic bags are used as single-use packaging bags.

Single layer bags act as a substitute to multiwall bags for low-density packaging products. Single layer bags made from paper and plastics are used for groceries, retails, clothes, stationaries, confectionaries, medicines, and hot & cold beverages.

Despite the ban on single-use plastic bags in several countries around the world, the majority of the population is still comfortable using these bags. Improper disposal of single-use plastic bags further leads to an increase in plastic landfills. Single layer paper bags are biodegradable and widely used for packaging in food, retail, and pharmaceutical sectors.

The outbreak of the COVID-19 pandemic has also led to the resurrection of single-use packaging bags across several industries. Supermarkets or takeaway restaurants are using single-use packaging bags to stem the transmission of COVID-19 and maintain hygiene. Efforts to fight the coronavirus are boosting sales of plastics, and manufacturers are lobbying against bans.

Several packaging companies are exploring new opportunities for their single-use packaging bags, which are used in perishable food packaging, such as meat, fruits, and vegetables. Asian countries such as China, India, Japan, and South Korea are expected to witness a shift in sales of hanging open meat to packaged and frozen meat, which further increases the demand for single-use packaging bags.

Opportunity: Increasing e-commerce activities in the emerging countries

E-commerce has transformed business dynamics around the world. Factors such as real-time updates on new product launch, exclusive deals, promotional schemes, safety & hygiene, and one-touch purchase option have triggered exponential growth in e-commerce sales. Access to global or local stores through mobile applications and attractive or festive discounts are the factors that fuel the growth of e-commerce activities.

According to a report by India Brand Equity Foundation (IBEF) in September 2020, the e-commerce market in India is expected to grow from USD 39 billion in 2017 to USD 200 billion by 2026. This growth is triggered by an increase in internet and smartphone penetration. The country’s e-commerce revenue is expected to jump from USD 39 billion in 2017 to USD 120 billion in 2020, growing at an annual rate of 51%, the highest in the world.

The e-commerce industry in many countries has been impacting micro, small, and medium enterprises and has a favorable impact on other industries, especially in the light of the COVID-19 crisis. Amid the lockdowns and temporary closure of malls and other retail stores during the first three quarters of 2020, the demand for FMCG, consumer goods, electronics, and food & beverages augmented from online stores. The demand for these products has increased the volume of paper and plastic bags and sacks used for packing and transit.

In 2020, people are forced to stay at home due to the COVID-19 pandemic. They are ordering more through online channels. This, in turn, is generating the demand for paper and plastic pouches, bags, and sacks. This trend is expected to continue and increase in the near future. Multiwall bags or sacks are widely used as flexible packaging products in the e-commerce sector. Apart from consumer goods, sale of industrial goods through online stores is also increasing. China, India, France, Italy, and GCC countries are the countries that are actively engaged in the e-retailing of industrial goods.

Challenge: Difficulty and poor infrastructure for recycling multilayer plastics

The recycling of flexible plastic packaging is a major challenge faced by the packaging industry across the world. The process of recycling multi-layer flexible plastic packaging is complex as it involves more steps compared to the mono-layer flexible plastic packaging. Multi-layer flexible plastic packaging involves a mix of polymer, papers, adhesives, and inks, which makes it difficult to sort from bulk waste. Each layer needs to be analyzed, identified, and recycled individually. Multi-layer flexible plastic bags are difficult to identify, separate, and melt because they are made from multiple types of plastic or plastic mixed with other materials. During the recycling process, polyethylene (PE) films and other plastics used in multiple-layer flexible plastic packaging are stuck in the machine, causing disruption.

Recycling of plastic packaging waste is a process that requires state-of-the-art infrastructural facilities. It is a time-consuming process that needs expertise. Developing countries and even some developed countries still lack such facilities for recycling. In developing countries, most recycling facilities are outdated and are incapable of handling changes in waste streams.

The longevity of plastics entails a lot of effort to degrade. Plastic waste in the environment can impact human health as it moves up the food chain. This, in turn, has exerted pressure on companies and manufacturers to find viable solutions, either by improving the recycling rate or focusing on producing alternatives to plastics.

Plastics bags are widely preferred multiwall bags in the packaging market.

Based on product type, the plastic bags segment is projected to be the largest market for multiwall bags. The dominant market position of the segment can be attributed to the increase in the demand for these product type across various applications in food & grains, pharmaceutical and retail industries. The increase in the demand for plastic bags can be attributed to the rise in the demand for lightweight, cost-effective, and convenient packaging solutions.

Significant increase in the food & grains products during COVID-19 pandemic

By application, the food & grains segment is projected to be the largest segment in the multiwall bags market. People are resorting to panic-buying and bulk stocking due to the fear of lockdowns. More people are ordering daily staples, FMCG and fresh food through e-commerce & online channels, which leads to an increase in the demand for multiwall bags packaging. This in turn, boost the demand for multiwall bags solutions for food & grains application.

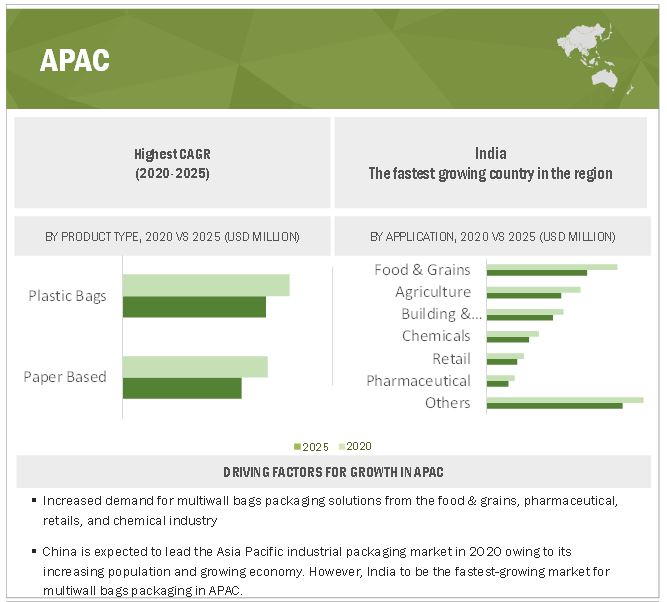

APAC region to lead the global multiwall bags market by 2025

The APAC region accounted for the largest market share in 2019. Factors such as improving global economy, expanding working population, rising domestic demand for ready-to-eat & convinence food products are expected to boost the market for multiwall bags. The market for multiwall bags in APAC is growing in the food, automotive, chemical, pharmaceutical, and construction industries due to the functional properties offered by multiwall bags, such as safety, cost-effectiveness, durability, strength, lightweight, environmental-friendliness, and logistical convenience.

Key Market Players

The multiwall bags market is dominated by a globally established players, such as Mondi Group (Austria), Berry Global Inc. (US), Sonoco Products Company (US), Hood Packaging Corporation (US), El Dorado Packaging, Inc. (US), Lincon Polymers Pvt. Ltd. (India), ProAmpac Holdings Inc. (US), Global-Pak, Inc. (US), LC Packaging (Netherlands), NNZ Group (Netherlands), Manyan Inc (Canada), United Bags, Inc. (US), Langston Companies, Inc. (US), Material Motion, Inc. (US), Commercial Packaging (US), MIDCO Global (US), Trombini (Brazil), San Miguel Yamamura Woven Products sdn bdh (Philippines), Oji Fibre Solutions (NZ) Ltd. (New Zealand), Nebig Verpakkingen BV (Netherlands), Sanghavi Global (India), Premier Polymer (India), Napco National (Saudi Arabia), Corman Bag (US), and Bag Supply Company, Inc. (US), among many others.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) and Volume (Million Square Meter) |

|

Segments covered |

Product type, layer, application, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies covered |

Mondi Group (Austria), Berry Global Inc. (US), Sonoco Products Company (US), Hood Packaging Corporation (US), El Dorado Packaging, Inc. (US), Lincon Polymers Pvt. Ltd. (India), ProAmpac Holdings Inc. (US), Global-Pak, Inc. (US), LC Packaging (Netherlands), NNZ Group (Netherlands), Manyan Inc (Canada), United Bags, Inc. (US), Langston Companies, Inc. (US), Material Motion, Inc. (US), Commercial Packaging (US), MIDCO Global (US), Trombini (Brazil), San Miguel Yamamura Woven Products sdn bdh (Philippines), Oji Fibre Solutions (NZ) Ltd. (New Zealand), Nebig Verpakkingen BV (Netherlands), Sanghavi Global (India), Premier Polymer (India), Napco National (Saudi Arabia), Corman Bag (US), and Bag Supply Company, Inc. (US) |

This research report categorizes the multiwall bags market based on product type, layer, applications, and region.

Based on product type:

- Paper Based

- Plastic bags

Based on the Layer

- 2-ply

- 3-ply

- others

Based on the application

- Food & grains

- Agriculture

- Building & Counstruction

- Chemical

- Retail

- Pharmaceuticals

- Others

Based on the region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In July 2020, Mondi Paper Bags, part of Mondi Group, has acquired two paper bag lines from Helwan Cement Company and InterCement Sacs, two major cement producers in Egypt. The acquired production lines will increase Mondi's capacity by approximately 60-80 million bags annually and strengthen Mondi's position in the Middle Eastern bag market, particularly in supporting suppliers to the construction industry.

- In June 2020, Mondi, a leading global packaging and paper group, is committed to playing its part in the supply of essential products during the COVID-19 outbreak and has recently developed packaging for QIAGEN's SARS-CoV-2 coronavirus test kit.

- In January 2020, Berry Global Inc. announced its plan to expand its hygiene, healthcare, and specialty films platform in North America.

- In September 2020, ProAmpac and Metropolitan Tea collaborated to introduce a package made with 100% home and industrial compostable materials.

Frequently Asked Questions (FAQ):

What is the current size of global multiwall bags market?

The global multiwall bags market size is projected to grow from USD 12.1 billion in 2020 to USD 14.4 billion by 2025, at a CAGR of 3.5% from 2020 to 2025.

How is the multiwall bags market aligned?

The multiwall bags market is highly fragmented, and has a large number of global, regional and domestic players who have a very strong presence in the market. These players have strong and well-established procurement and distribution networks, which help in cost-efficient production.

Who are the key players in the global multiwall bags market?

The key players operating in the multiwall bags market are Mondi Group (Austria), Berry Global Inc. (US), Sonoco Products Company (US), Hood Packaging Corporation (US), El Dorado Packaging, Inc. (US), Lincon Polymers Pvt. Ltd. (India), ProAmpac Holdings Inc. (US), Global-Pak, Inc. (US), LC Packaging (Netherlands), NNZ Group (Netherlands), Manyan Inc (Canada), United Bags, Inc. (US), Langston Companies, Inc. (US), Material Motion, Inc. (US), Commercial Packaging (US), MIDCO Global (US), Trombini (Brazil), San Miguel Yamamura Woven Products sdn bdh (Philippines), Oji Fibre Solutions (NZ) Ltd. (New Zealand), Nebig Verpakkingen BV (Netherlands), Sanghavi Global (India), Premier Polymer (India), Napco National (Saudi Arabia), Corman Bag (US), and Bag Supply Company, Inc. (US).

What are the latest ongoing trends in the multiwall bags market?

The players operating in the multiwall bags market aim to offer a low-cost, sustainable, and environmentally friendly, owing to a shift in trend (use of lightweight, and recycled materials for the multiwall bags) among the end-users who are engaged in the production of food & grains, pharmaceutical, building & construction, retail, and chemical products. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table Of Contents

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MULTIWALL BAGS MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 MARKET SCOPE

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 UNIT CONSIDERED

1.5 STAKEHOLDERS

1.6 LIMITATIONS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 MARKET ENGINEERING PROCESS

2.2.1 TOP-DOWN APPROACH

FIGURE 1 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3 ASSUMPTIONS

2.4 FORECAST NUMBER CALCULATION

2.5 BASE NUMBER CALCULATION

3 EXECUTIVE SUMMARY

FIGURE 3 PLASTIC BAGS TO DOMINATE MULTIWALL BAGS MARKET

FIGURE 4 FOOD & GRAINS TO LEAD MULTIWALL BAGS MARKET IN 2020

FIGURE 5 2-PLY SEGMENT TO LEAD MULTIWALL BAGS MARKET IN 2020

4 PREMIUM INSIGHTS

4.1 ATTRACTIVE OPPORTUNITIES IN MULTIWALL BAGS MARKET

FIGURE 6 GROWING DEMAND FOR PAPER BAGS OFFERING OPPORTUNITIES

4.2 MULTIWALL BAGS MARKET, BY APPLICATION

FIGURE 7 FOOD & GRAINS TO BE THE LARGEST APPLICATION SEGMENT

4.3 MULTIWALL BAGS MARKET, BY LAYER

FIGURE 8 2-PLY PLASTIC BAGS TO ACCOUNT FOR THE LARGER MARKET SHARE

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 9 MARKET DYNAMICS: MULTIWALL BAGS MARKET

5.2.1 DRIVERS

5.2.1.1 Growth of end-use industries

5.2.2 RESTRAINTS

5.2.2.1 Sustained use of single ply bags

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing e-commerce activities in emerging countries

5.2.4 CHALLENGES

5.2.4.1 Difficulty and poor infrastructure for recycling multi-layer plastics

5.3 VALUE-CHAIN ANALYSIS

FIGURE 10 VALUE-CHAIN ANALYSIS

5.3.1 RAW MATERIALS

5.3.2 MANUFACTURER

5.3.3 DISTRIBUTION

5.3.4 MARKETING & SALES

5.3.5 END USERS

5.3.6 POST-SALE SERVICES

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 11 MULTIWALL BAGS: PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF BUYERS

5.4.2 BARGAINING POWER OF SUPPLIERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTES

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 IMPACT OF COVID-19: MACROECONOMIC INDICATORS

5.5.1 GLOBAL ECONOMIC SCENARIO AMID COVID-19 OUTBREAK

TABLE 1 INTERIM ECONOMIC OUTLOOK FORECAST, 2019-2021 (PERCENTAGE)

5.5.2 DISRUPTION IN PACKAGING INDUSTRY

5.5.3 DISRUPTION IN FOOD & BEVERAGE INDUSTRY

5.5.4 DISRUPTION IN AGRICULTURE INDUSTRY

5.5.5 DISRUPTION IN CONSTRUCTION INDUSTRY

5.5.6 NEW OPPORTUNITIES AMID COVID-19 OUTBREAK

6 MULTIWALL BAGS MARKET, BY PRODUCT TYPE

6.1 INTRODUCTION

TABLE 2 MULTIWALL BAGS MARKET SIZE, BY PRODUCT TYPE, 2018—2025 (MILLION TON)

TABLE 3 MULTIWALL BAGS MARKET SIZE, BY PRODUCT TYPE, 2018—2025 (USD MILLION)

6.2 PAPER BAGS

6.2.1 SEWN OPEN MOUTH BAGS

6.2.2 PASTED VALVE BAGS

6.2.3 PASTED OPEN MOUTH BAGS

6.2.4 PINCH BOTTOM BAGS

6.3 PLASTIC BAGS

6.3.1 U-PANEL BAGS

6.3.2 CIRCULAR BAG

6.3.3 FOUR PANEL BAGS

6.3.4 BAFFLE BAGS

7 MULTIWALL BAGS MARKET, BY LAYER

7.1 INTRODUCTION

7.1.1 PAPER BAGS BY LAYER

TABLE 4 MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY LAYER, 2018—2025 (MILLION TON)

TABLE 5 MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY LAYER, 2018—2025 (USD MILLION)

7.1.2 PLASTIC BAGS BY LAYER

TABLE 6 MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY LAYER, 2018—2025 (MILLION TON)

TABLE 7 MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY LAYER, 2018—2025 (USD MILLION)

7.2 2-PLY

7.3 3-PLY

7.4 OTHERS

8 MULTIWALL BAGS MARKET, BY APPLICATION

8.1 INTRODUCTION

8.1.1 PAPER BAGS

TABLE 8 MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 9 MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

8.1.2 PLASTIC BAGS

TABLE 10 MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 11 MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

8.2 FOOD & GRAINS

8.2.1 PAPER BAGS IN FOOD & GRAINS

TABLE 12 PAPER BAGS: MULTIWALL BAGS MARKET SIZE IN FOOD & GRAINS, BY REGION, 2018—2025 (MILLION TON)

TABLE 13 PAPER BAGS: MULTIWALL BAGS MARKET SIZE IN FOOD & GRAINS, BY REGION, 2018—2025 (USD MILLION)

8.2.2 PLASTIC BAGS IN FOOD & GRAINS

TABLE 14 PLASTIC BAGS: MULTIWALL BAGS MARKET SIZE IN FOOD & GRAINS, BY REGION, 2018—2025 (MILLION TON)

TABLE 15 PLASTIC BAGS: MULTIWALL BAGS MARKET SIZE IN FOOD & GRAINS, BY REGION, 2018—2025 (USD MILLION)

8.3 AGRICULTURE

8.3.1 PAPER BAGS IN AGRICULTURE

TABLE 16 PAPER BAGS: MULTIWALL BAGS MARKET SIZE IN AGRICULTURE, BY REGION, 2018—2025 (MILLION TON)

TABLE 17 PAPER BAGS: MULTIWALL BAGS MARKET SIZE IN AGRICULTURE, BY REGION, 2018—2025 (USD MILLION)

8.3.2 PLASTIC BAGS IN AGRICULTURE

TABLE 18 PLASTIC BAGS: MULTIWALL BAGS MARKET SIZE IN AGRICULTURE, BY REGION, 2018—2025 (MILLION TON)

TABLE 19 PLASTIC BAGS: MULTIWALL BAGS MARKET SIZE IN AGRICULTURE, BY REGION, 2018—2025 (USD MILLION)

8.4 BUILDING & CONSTRUCTION

8.4.1 PAPER BAGS IN BUILDING & CONSTRUCTION

TABLE 20 PAPER BAGS: MULTIWALL BAGS MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2018—2025 (MILLION TON)

TABLE 21 PAPER BAGS: MULTIWALL BAGS MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2018—2025 (USD MILLION)

8.4.2 PLASTIC BAGS IN BUILDING & CONSTRUCTION

TABLE 22 PLASTIC BAGS: MULTIWALL BAGS MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2018—2025 (MILLION TON)

TABLE 23 PLASTIC BAGS: MULTIWALL BAGS MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2018—2025 (USD MILLION)

8.5 CHEMICALS

8.5.1 PAPER BAGS IN CHEMICALS

TABLE 24 PAPER BAGS: MULTIWALL BAGS MARKET SIZE IN CHEMICALS, BY REGION, 2018—2025 (MILLION TON)

TABLE 25 PAPER BAGS: MULTIWALL BAGS MARKET SIZE IN CHEMICALS, BY REGION, 2018—2025 (USD MILLION)

8.5.2 PLASTIC BAGS IN CHEMICALS

TABLE 26 PLASTIC BAGS: MULTIWALL BAGS MARKET SIZE IN CHEMICALS, BY REGION, 2018—2025 (MILLION TON)

TABLE 27 PLASTIC BAGS: MULTIWALL BAGS MARKET SIZE IN CHEMICALS, BY REGION, 2018—2025 (USD MILLION)

8.6 RETAIL

8.6.1 PAPER BAGS IN RETAIL

TABLE 28 PAPER BAGS: MULTIWALL BAGS MARKET SIZE IN RETAIL, BY REGION, 2018—2025 (MILLION TON)

TABLE 29 PAPER BAGS: MULTIWALL BAGS MARKET SIZE IN RETAIL, BY REGION, 2018—2025 (USD MILLION)

8.6.2 PLASTIC BAGS IN RETAIL

TABLE 30 PLASTIC BAGS: MULTIWALL BAGS MARKET SIZE IN RETAIL, BY REGION, 2018—2025 (MILLION TON)

TABLE 31 PLASTIC BAGS: MULTIWALL BAGS MARKET SIZE IN RETAIL, BY REGION, 2018—2025 (USD MILLION)

8.7 PHARMACEUTICAL

8.7.1 PAPER BAGS IN PHARMACEUTICAL

TABLE 32 PAPER BAGS: MULTIWALL BAGS MARKET SIZE IN PHARMACEUTICAL, BY REGION, 2018—2025 (MILLION TON)

TABLE 33 PAPER BAGS: MULTIWALL BAGS MARKET SIZE IN PHARMACEUTICAL, BY REGION, 2018—2025 (USD MILLION)

8.7.2 PLASTIC BAGS IN PHARMACEUTICAL

TABLE 34 PLASTIC BAGS: MULTIWALL BAGS MARKET SIZE IN PHARMACEUTICAL, BY REGION, 2018—2025 (MILLION TON)

TABLE 35 PLASTIC BAGS: MULTIWALL BAGS MARKET SIZE IN PHARMACEUTICAL, BY REGION, 2018—2025 (USD MILLION)

8.8 OTHERS

8.8.1 PAPER BAGS IN OTHER APPLICATIONS

TABLE 36 PAPER BAGS: MULTIWALL BAGS MARKET SIZE IN OTHER APPLICATIONS,BY REGION, 2018—2025 (MILLION TON)

TABLE 37 PAPER BAGS: MULTIWALL BAGS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018—2025 (USD MILLION)

8.8.2 PLASTIC BAGS IN OTHER APPLICATIONS

TABLE 38 PLASTIC BAGS: MULTIWALL BAGS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018—2025 (MILLION TON)

TABLE 39 PLASTIC BAGS: MULTIWALL BAGS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018—2025 (USD MILLION)

9 MULTIWALL BAGS MARKET, BY REGION

9.1 INTRODUCTION

9.1.1 PAPER BAGS BY REGION

TABLE 40 MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY REGION, 2018–2025 (MILLION TON)

TABLE 41 MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY REGION, 2018–2025 (USD MILLION)

9.1.2 PLASTIC BAGS BY REGION

TABLE 42 MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY REGION, 2018–2025 (MILLION TON)

TABLE 43 MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY REGION, 2018–2025 (USD MILLION)

9.2 EUROPE

9.2.1 PAPER BAGS BY COUNTRY

TABLE 44 EUROPE: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY COUNTRY, 2018—2025 (MILLION TON)

TABLE 45 EUROPE: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY COUNTRY, 2018—2025 (USD MILLION)

9.2.2 PLASTIC BAGS BY COUNTRY

TABLE 46 EUROPE: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY COUNTRY, 2018—2025 (MILLION TON)

TABLE 47 EUROPE: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY COUNTRY, 2018—2025 (USD MILLION)

9.2.3 PAPER BAGS BY APPLICATION

TABLE 48 EUROPE: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 49 EUROPE: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.2.4 PLASTIC BAGS BY APPLICATION

TABLE 50 EUROPE: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 51 EUROPE: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.2.5 GERMANY

9.2.5.1 Presence of several manufacturing companies

9.2.5.2 Paper Bags by Application

TABLE 52 GERMANY: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 53 GERMANY: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS,BY APPLICATION, 2018—2025 (USD MILLION)

9.2.5.3 Plastic Bags by Application

TABLE 54 GERMANY: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 55 GERMANY: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.2.6 UK

9.2.6.1 Increase in demand for food packaging products to boost market

9.2.6.2 Paper Bags by Application

TABLE 56 UK: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 57 UK: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.2.6.3 Plastic Bags by Application

TABLE 58 UK: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 59 UK: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.2.7 FRANCE

9.2.7.1 Rising export of food products to increase need for multiwall bags

9.2.7.2 Paper Bags by Application

TABLE 60 FRANCE: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 61 FRANCE: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.2.7.3 Plastic Bags by Application

TABLE 62 FRANCE: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 63 FRANCE: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.2.8 RUSSIA

9.2.8.1 Increase in demand for multiwall bags in various end-use industries

9.2.8.2 Paper Bags by Application

TABLE 64 RUSSIA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 65 RUSSIA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.2.8.3 Plastic Bags by Application

TABLE 66 RUSSIA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 67 RUSSIA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.2.9 REST OF EUROPE

9.2.9.1 Paper Bags by Application

TABLE 68 REST OF EUROPE: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 69 REST OF EUROPE: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.2.9.2 Plastic Bags by Application

TABLE 70 REST OF EUROPE: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 71 REST OF EUROPE: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.3 NORTH AMERICA

9.3.1 PAPER BAGS BY COUNTRY

TABLE 72 NORTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY COUNTRY, 2018—2025 (MILLION TON)

TABLE 73 NORTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY COUNTRY, 2018—2025 (USD MILLION)

9.3.2 PLASTIC BAGS BY COUNTRY

TABLE 74 NORTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY COUNTRY, 2018—2025 (MILLION TON)

TABLE 75 NORTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY COUNTRY, 2018—2025 (USD MILLION)

9.3.3 PAPER BAGS BY APPLICATION

TABLE 76 NORTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 77 NORTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.3.4 PLASTIC BAGS BY APPLICATION

TABLE 78 NORTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 79 NORTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.3.5 US

9.3.5.1 Food & beverage application segment to drive market

9.3.5.2 Paper Bags by Application

TABLE 80 US: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 81 US: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.3.5.3 Plastic Bags by Application

TABLE 82 US: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 83 US: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.3.6 CANADA

9.3.6.1 Increasing demand from manufacturing industry to accelerate demand for multiwall bags

9.3.6.2 Paper Bags by Application

TABLE 84 CANADA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 85 CANADA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.3.6.3 Plastic Bags by Application

TABLE 86 CANADA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 87 CANADA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.3.7 MEXICO

9.3.7.1 Continuous FDI inflows in manufacturing industry

9.3.7.2 Paper Bags by Application

TABLE 88 MEXICO: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 89 MEXICO: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.3.7.3 Plastic Bags by Application

TABLE 90 MEXICO: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 91 MEXICO: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.4 APAC

9.4.1 PAPER BAGS BY COUNTRY

TABLE 92 APAC: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY COUNTRY, 2018—2025 (MILLION TON)

TABLE 93 APAC: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY COUNTRY, 2018—2025 (USD MILLION)

9.4.2 PLASTIC BAGS BY COUNTRY

TABLE 94 APAC: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY COUNTRY, 2018—2025 (MILLION TON)

TABLE 95 APAC: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY COUNTRY, 2018—2025 (USD MILLION)

9.4.3 PAPER BAGS BY APPLICATION

TABLE 96 APAC: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 97 APAC: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.4.4 PLASTIC BAGS BY APPLICATION

TABLE 98 APAC: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 99 APAC: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.4.5 CHINA

9.4.5.1 Growing demand for bulk and industrial packaging to fuel market growth

9.4.5.2 Paper Bags by Application

TABLE 100 CHINA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 101 CHINA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.4.5.3 Plastic Bags by Application

TABLE 102 CHINA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 103 CHINA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.4.6 JAPAN

9.4.6.1 Increase in demand for packaged food to increase need for multiwall bags

9.4.6.2 Paper Bags by Application

TABLE 104 JAPAN: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 105 JAPAN: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.4.6.3 Plastic Bags by Application

TABLE 106 JAPAN: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 107 JAPAN: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.4.7 INDIA

9.4.7.1 Government investments in food processing industry to propel market growth

9.4.7.2 Paper Bags by Application

TABLE 108 INDIA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 109 INDIA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.4.7.3 Plastic Bags by Application

TABLE 110 INDIA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 111 INDIA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.4.8 SOUTH KOREA

9.4.8.1 Urbanization and demand for packaged food items to boost market

9.4.8.2 Paper Bags by Application

TABLE 112 SOUTH KOREA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 113 SOUTH KOREA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.4.8.3 Plastic Bags by Application

TABLE 114 SOUTH KOREA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS,BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 115 SOUTH KOREA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.4.9 REST OF APAC

9.4.9.1 Paper Bags by Application

TABLE 116 REST OF APAC: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 117 REST OF APAC: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.4.9.2 Plastic Bags by Application

TABLE 118 REST OF APAC: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 119 REST OF APAC: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.5 SOUTH AMERICA

9.5.1 PAPER BAGS BY COUNTRY

TABLE 120 SOUTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY COUNTRY, 2018—2025 (MILLION TON)

TABLE 121 SOUTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY COUNTRY, 2018—2025 (USD MILLION)

9.5.2 PLASTIC BAGS BY COUNTRY

TABLE 122 SOUTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS,

TABLE 123 SOUTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY COUNTRY, 2018—2025 (USD MILLION)

9.5.3 PAPER BAGS BY APPLICATION

TABLE 124 SOUTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 125 SOUTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.5.4 PLASTIC BAGS BY APPLICATION

TABLE 126 SOUTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 127 SOUTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.5.5 BRAZIL

9.5.5.1 Government initiatives to attract investments in packaging sector

9.5.5.2 Paper Bags by Application

TABLE 128 BRAZIL: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 129 BRAZIL: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.5.5.3 Plastic Bags by Application

TABLE 130 BRAZIL: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 131 BRAZIL: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.5.6 ARGENTINA

9.5.6.1 Increasing demand for multiwall bags in food packaging

9.5.6.2 Paper Bags by Application

TABLE 132 ARGENTINA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 133 ARGENTINA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS,

9.5.6.3 Plastic Bags by Application

TABLE 134 ARGENTINA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 135 ARGENTINA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.5.7 REST OF SOUTH AMERICA

9.5.7.1 Paper Bags by Application

TABLE 136 REST OF SOUTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 137 REST OF SOUTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.5.7.2 Plastic Bags by Application

TABLE 138 REST OF SOUTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 139 REST OF SOUTH AMERICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 PAPER BAGS BY COUNTRY

TABLE 140 MIDDLE EAST & AFRICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY COUNTRY, 2018—2025 (MILLION TON)

TABLE 141 MIDDLE EAST & AFRICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY COUNTRY, 2018—2025 (USD MILLION)

9.6.2 PLASTIC BAGS BY COUNTRY

TABLE 142 MIDDLE EAST & AFRICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY COUNTRY, 2018—2025 (MILLION TON)

TABLE 143 MIDDLE EAST & AFRICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY COUNTRY, 2018—2025 (USD MILLION)

9.6.3 PAPER BAGS BY APPLICATION

TABLE 144 MIDDLE EAST & AFRICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 145 MIDDLE EAST & AFRICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.6.4 PLASTIC BAGS BY APPLICATION

TABLE 146 MIDDLE EAST & AFRICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 147 MIDDLE EAST & AFRICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.6.5 TURKEY

9.6.5.1 Use of multiwall bags in end-use industries to boost the market

9.6.5.2 Paper Bags by Application

TABLE 148 TURKEY: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 149 TURKEY: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.6.5.3 Plastic Bags by Application

TABLE 150 TURKEY: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 151 TURKEY: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.6.6 SAUDI ARABIA

9.6.6.1 Demand for convenient packaging to fuel market growth

9.6.6.2 Paper Bags by Application

TABLE 152 SAUDI ARABIA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 153 SAUDI ARABIA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.6.6.3 Plastic Bags by Application

TABLE 154 SAUDI ARABIA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON

TABLE 155 SAUDI ARABIA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.6.7 SOUTH AFRICA

9.6.7.1 Growth in flexible packaging industry to drive demand

9.6.7.2 Paper Bags by Application

TABLE 156 SOUTH AFRICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS,

TABLE 157 SOUTH AFRICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.6.7.3 Plastic Bags by Application

TABLE 158 SOUTH AFRICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 159 SOUTH AFRICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.6.8 REST OF MIDDLE EAST & AFRICA

9.6.8.1 Paper Bags by Application

TABLE 160 REST OF MIDDLE EAST & AFRICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 161 REST OF MIDDLE EAST & AFRICA: MULTIWALL BAGS MARKET SIZE IN PAPER BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

9.6.8.2 Plastic Bags by Application

TABLE 162 REST OF MIDDLE EAST & AFRICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (MILLION TON)

TABLE 163 REST OF MIDDLE EAST & AFRICA: MULTIWALL BAGS MARKET SIZE IN PLASTIC BAGS, BY APPLICATION, 2018—2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE

10.1 OVERVIEW

FIGURE 12 COMPANIES ADOPTED ACQUISITIONS AS THE KEY GROWTH STRATEGY BETWEEN 2016 AND 2020

10.2 MARKET RANKING

FIGURE 13 MARKET RANKING OF KEY PLAYERS, 2019

10.3 SHARE OF KEY PLAYERS IN THE MULTIWALL BAGS MARKET

FIGURE 14 MONDI GROUP LED THE MULTIWALL BAGS MARKET IN 2019

10.4 COMPETITIVE LEADERSHIP MAPPING

10.4.1 STAR

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE

10.4.4 EMERGING COMPANIES

FIGURE 15 MULTIWALL BAGS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

10.4.5 STRENGTH OF PRODUCT PORTFOLIO

10.4.6 BUSINESS STRATEGY EXCELLENCE

10.5 COMPETITIVE SCENARIO

10.5.1 ACQUISITIONS

TABLE 164 ACQUISITIONS

10.5.2 EXPANSIONS & INVESTMENTS

TABLE 165 EXPANSIONS & INVESTMENTS

10.5.3 NEW PRODUCT DEVELOPMENTS

TABLE 166 NEW PRODUCT DEVELOPMENTS

10.5.4 PARTNERSHIPS

TABLE 167 PARTNERSHIPS

11 COMPANY PROFILES

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

11.1 MONDI GROUP

FIGURE 16 MONDI GROUP: COMPANY SNAPSHOT

FIGURE 17 MONDI: SWOT ANALYSIS

11.2 BERRY GLOBAL INC.

FIGURE 18 BERRY GLOBAL INC.: COMPANY SNAPSHOT

FIGURE 19 BERRY GLOBAL INC.: SWOT ANALYSIS

11.3 PROAMPAC HOLDINGS INC.

FIGURE 20 PROAMPAC HOLDINGS INC.: SWOT ANALYSIS

11.4 SONOCO PRODUCTS COMPANY

FIGURE 21 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

FIGURE 22 SONOCO PRODUCTS COMPANY: SWOT ANALYSIS

11.5 HOOD PACKAGING CORPORATION

FIGURE 23 HOOD PACKAGING CORPORATION: SWOT ANALYSIS

11.6 LC PACKAGING

11.7 GLOBAL-PAK INC.

11.8 EL DORADO PACKAGING, INC.

11.9 NNZ GROUP

11.10 MANYAN INC.

11.11 UNITED BAGS, INC.

11.12 LANGSTON BAG

11.13 MATERIAL MOTION INC.

11.14 COMMERCIAL PACKAGING

11.15 LINCON POLYMERS PVT. LTD

11.16 MIDCO GLOBAL

11.17 TROMBINI

11.18 SAN MIGUEL YAMAMURA WOVEN PRODUCTS SDN BDH (SMYWP)

11.19 OJI FIBRE SOLUTIONS (NZ) LTD.

11.20 NEBIG VERPAKKINGEN BV

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

11.21 OTHERS

11.21.1 SANGHAVI GLOBAL

11.21.2 PREMIER POLYMER

11.21.3 NAPCO NATIONAL

11.21.4 CORMAN BAGS

11.21.5 BAG SUPPLY COMPANY

12 APPENDIX

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

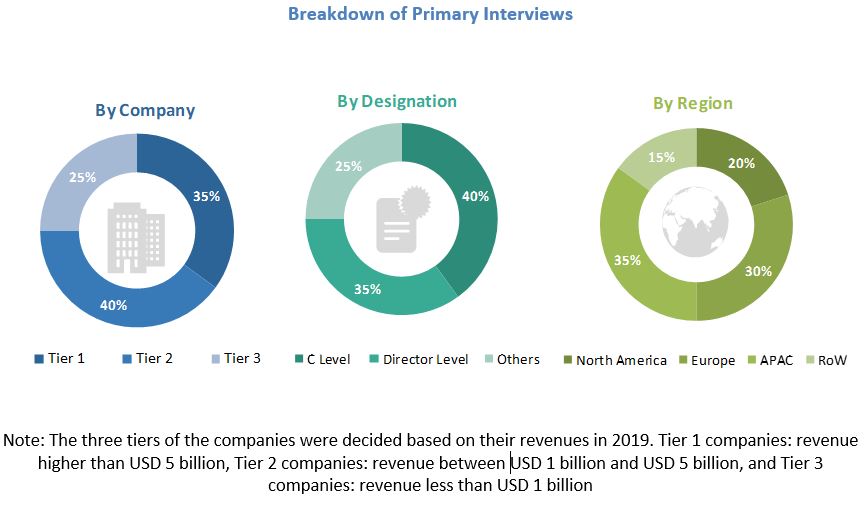

The study involved four major activities for estimating the current global size of the multiwall bags market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of multiwall bags through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the multiwall bags market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the multiwall bags market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the multiwall bags market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the multiwall bags industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the multiwall bags market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the multiwall bags market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Research Objectives

- To define, analyze, and project the size of the multiwall bags market in terms of value and volume based on product type, layer, application, and region.

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product launches, investments, expansions, agrements, and acquisitions, in the multiwall bags market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the multiwall bags report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the multiwall bags market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Multiwall Bags Market