Kraft Paper Market

Kraft Paper Market by Grade (Unbleached Kraft, Bleached Kraft, Unbleached Sack), Packaging Form (Industrial Bags, Wraps), End-use Industry (Food & Beverage, Building & Construction), & Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The kraft paper market is projected to reach USD 14.24 billion by 2030 from USD 12.50 billion in 2025, at a CAGR of 2.5% from 2025 to 2030. There are several factors that will lead to the growth of the kraft paper market during the forecast period. Among the key factors is the increasing need in terms of sustainable and environmentally friendly packaging. The rising concerns about environmental protection and subsequent limits on single-use plastics are making industries turn to more options on kraft paper packaging, as they are biodegradable. Another big factor is the growing online shopping market, where kraft paper is in high demand as wrapping material, a protective wrap during shipping. Also, the rise of the food & beverage sector is increasing the usage of kraft papers by requiring use in grocery bags or pouches, where durability and purity are vital.

KEY TAKEAWAYS

-

BY GRADEThe kraft paper market by type includes unbleached kraft, unbleached sack, bleached kraft, and bleached sack. Unbleached kraft dominates the market in terms of demand, as they have high-strength, cost-effective, making it a prefered choice for agricultural packaging.

-

BY PACKAGING FORMThe kraft paper market by application includes industrial bags, grocery bags, wraps, pouches, and envelopes. Industrial bags are the leading segment because of their superior strength and durability for heavy-duty applications such as cement, fertilizers, and chemicals.

-

BY END-USE INDUSTRYThe kraft paper market by end-use industry includes food & beverage, pharmaceutical, building & construction, personal care & cosmetic, and other end-use industries . Food & beverage dominates the market in terms of demand, due to the high demand of sustainble and cost-effective packaging solutions like sacks and bags.

-

BY REGIONThe Asia Pacific are expected to grow fastest, with a CAGR of 3.0%, driven by rapid industrialization and high demand from retail, food & beverage, and consumer goods.

-

COMPETITIVE LANDSCAPEMondi (UK), Billerud (Sweden), Smurfit WestRock (Ireland), Nordic Paper Holding AB (Sweden), and Segezha Group (Russia) are leading companies of kraft paper market. These companies are pursuing both organic and inorganic growth strategies, such as product launches, partnerships, acquisitions, and expansions, to increase their market presence.

The use of kraft paper is also increasing in the industrial sector, which applies it is used in manufacturing industrial bags to carry cement, fertilizers, chemicals, among others, since they are strong and durable. In addition, the increased interest among consumers in convenient and lightweight packaging is also fueling market growth. The kraft paper is strong, appealing, and flexible because of advances in techniques of printing and paper manufacturing. The transition to sustainable manufacturing and the overall increase in industrial and consumer demand will ensure robust growth of the kraft paper market.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Due to tighter regulations and growing awareness of sustainability, consumers in this market are calling for packaging that is free of plastic. Additionally, the need for easy-to-ship packaging solutions that protect products is being driven by the expansion of supply chain issues.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Population growth and rising consumer demand

-

Rising demand for sustainable packaging

Level

-

Fluctuations in raw material prices

-

Rising competition from alternative sustainable materials

Level

-

Expansion of personal care and cosmetics packaging

-

Growing demand in emerging markets

Level

-

Intense competition and price pressure

-

High capital investment for advanced machinery

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for sustainable packaging

The world is increasingly demanding green packaging as companies and individuals put more emphasis on taking environmental responsibility. Growing concern about the harm of plastic waste has led to the movement even faster towards friendly solutions. Kraft paper has gained popularity since it is renewable, biodegradable, and thus it is an excellent substitute for single-use plastics. It has also been very appealing to companies that have opted to have greener packaging by virtue of its lowering of ecological footprints. Regulatory interventions that focus on reducing plastic consumption have also contributed to the increased usage of kraft paper. There is a wide range of nations that are enforcing policies that either prohibit the use of plastic bags entirely or stricter standards of packaging, which is forcing manufacturers and retailers to consider more sustainable materials. Consumers today are keen on brands that embrace sustainability, and this is encouraging firms to use packaging that would appeal to them. The trend is evident in terms of the 2025 Sustainable Packaging Consumer Report presented by Smith. Among the 2,016 U.S. consumers surveyed, 54 percent of respondents claimed they had bought a product with sustainable packaging within the last 6 months. Moreover, 30 percent showed that they have a willingness to purchase a product with a brand that takes measures to ensure environmentally friendly packaging.

Restraint: Raw material price fluctuations

Uncertainty caused by fluctuating prices in raw materials, in particular wood pulp, continues to pose a major threat to kraft paper producers across the world. In India, the industry has been under pressure since FY24, owing to the increase in the cost of input and the overall average sales price declining as compared to the post-COVID boom in FY23. Although demand jumped in the initial recovery phase, it has stagnated in Q3FY24, partly due to a 20-25 percent increase in the domestic hardwood pulp prices. The low level of plantation activity under the COVID and rising demand trend of the wood-based products, like construction and furniture, has exacerbated the supply. More so than larger mills, which operate in states like Uttar Pradesh and Tamil Nadu, they were hit unfairly since they could not increase prices given the already competitive market. Global supply chain breakages, geopolitical tensions, and competitive imports in the form of cheaper ASEAN and Chinese imports aggravated this, as it led to an oversupply and low profit margins among domestic players.

Opportunity: Premium and luxury packaging trends

The demand for kraft paper, which is currently rising at a high rate, is due to the premium and luxurious packaging trends as companies aim to choose between durability and beauty. Eco-friendly alternatives are now a sought-after commodity because of the growing awareness of the presence of plastic in the rivers, oceans, and landfills, and as such, kraft paper is finding favor. It is bio-degradable and has a low-carbon footprint, coupled with the strength and versatility of high-end applications. International companies like Nike, Adidas, and Huawei have also turned to using kraft paper as their shopping bag and premium packaging materials due to the changing consumer expectations and desire to place emphasis on high- quality materials and processes. Properties such as moisture and crease resistance, elasticity, and anti-slip properties are other functional benefits that make it fit in luxury packaging.

Challenge: Intense competition and price pressure

The kraft paper market is highly fragmented, with major players as well as regional producers, and lots of small-scale manufacturer's dominant in the same market. International giants like Mondi and Smurfit Westrock can use their economies of scale, modern technologies, and large global distribution channels to lower their operating costs and incur high profit margins. On the other hand, small producers can find it difficult to sustain high production costs, as well as a limited scope of influence. The regional and local firms keep up with the competition by offering affordable and customized services to market niches and often lower their costs to win customers. Most manufacturers produce papers of comparable grades in kraft paper, and product differentiation is a difficult thing, thus making the price one of the key competitive levers. Such a high degree of dependence on price competition has the effect of eliminating profitability by both established and new players.

Kraft Paper Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

NeoPharm used plastic airbags for protective packaging, which caused the following problems: Increased plastic waste, conflicting with its ESG and sustainability commitments. Ineffective protection, resulting in a high rate of product damage during transit. As a global beauty and healthcare company, NeoPharm is dedicated to sustainability and ESG- focused operations. The company aimed to replace its plastic-based packaging with an eco-friendly, recyclable alternative, minimize environmental impact, and offer reliable product protection. Simultaneously, it needed a solution that was cost-effective, efficient, and simplified logistics. | Full shift to plastic-free, 100% recyclable packaging aligned with ESG goals. Reduction in transit damage. Lower labor costs through faster packaging cycles, saving the equivalent of two staff members. Streamlined logistics since kraft paper alone met all packaging needs. Enhanced customer experience and brand reputation with sustainable packaging. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The kraft paper market ecosystem constitutes an interlinked ecosystem of raw materials suppliers, manufacturers, distributors, and end-use industries- all of which have a crucial role to play in defining the market expansion. The value chain starts with suppliers of raw materials, which are mainly the pulp producers who supply the virgin fibers obtained using wood. The next significant connector is manufacturers who process pulp to kraft paper, including bleached kraft, bleached sack, unbleached sack, and bleached sack. These players involve investments in modern and advanced paper machines, energy- efficient process integration to satisfy the growing demand and attain environmental standards. Distributors and wholesalers are the intermediaries whose aid in the even flow of products into regional and international markets cannot be underrated, and they also help smaller converters and printers. The end-user industries that include food and beverages, construction, agriculture, and healthcare are the key consumers at the downstream level.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Kraft Paper Market, By Grade

The kraft paper market by grade is dominated by unbleached kraft paper due to its high tensile strength, the ability to withstand various applications at a cheaper cost, as well as flexibility to be used in different industries. It does not bleach and maintains its stripy-brown color, perfect as it is in the high-ten strengths processes of necessitating a heavy-duty packaging process. Its strength and ability to resist wear and tear make it the material of choice in grocery bags, wrapping papers, and industrial sacks, which are most popular in e-commerce, logistics, construction, and agriculture. Low cost of production is one of the most significant benefits of using unbleached kraft because fewer processing chemicals and fewer processes are involved. Such cost-efficiency is key when it comes to high-volume packaging, where companies are always looking to find affordable yet robust and reliable products.

Kraft Paper Market, By Packaging Form

The largest market share in the kraft paper market by packaging form is industrial bags due to their wide usage in various industries, as well as their capacity to hold heavy-duty applications. Kraft paper is sturdy, durable, and tear-resistant; thus, it is ideal when it comes to the production of multiwall and sack bags, which are used in packaging bulk items like cement, fertilizers, animal feed, and chemicals, among others, and granules like flour and sugar. All these industries need unaffected packaging that secures their contents in storage, handling, and long-distance transportation, which kraft paper industrial bags offer. Increasing demand in the construction industry, especially in the developing world, has increased the consumption of cement and other building materials supplied in the form of kraft paper bags. The expanding agriculture and food processing industries also use kraft paper bags as grain carriers, food ingredient packagers, and agricultural seed bags.

Kraft Paper Market, By End-use Industry

The food & beverage industry contributes the largest share in the kraft paper market because it has been observed to consume eco-friendly, safer, and durable packaging solutions widely. It is robust but flexible, and thus, it is widely utilized to pack most food products such as bakery products, snacks, confectionery, fresh food produce, and beverages, among others. It is embedded in pouches and sacks, wraps, and takeaway bags, which are widely in demand in the food service market. With the surge in popularity of quick-service restaurants, cafes, and online food delivery applications, printed kraft paper-based packaging has acquired a very high demand due to its functionality and eco-friendly packaging options in lieu of plastic. Sustainability is another huge factor to consider single-use plastics are subjected to severe control by governments across the world, necessitating food and beverage companies to use biodegradable material. Kraft paper that can address these needs and as food safety, breathability, and product freshness, is available. This enables it to be very suitable for the direct food contact application. ready foods, packed beverages, and foods are consumed quite rapidly; therefore, there is a need to enhance the use of kraft paper. It is also very appropriate in branding and marketing, which has been highly needed in appealing to consumers in a competitive industry, since it is of high quality in smart printing.

REGION

Asia Pacific to be fastest-growing market during forecast period

The rapid rise of logistics in countries such as China, India, and Southeast Asia has resulted in heightened use of kraft-based protective packaging. The effect of increasing penetration of the internet and the rising number of quick-commerce-driven platforms is also contributing to touting this demand, as organizations and consumers want sustainable systems but durable packaging. The other major driver is sustainability, with governments in the region implementing stringent measures to reduce the use of single-use plastics, compelling retailers and manufacturers to use more biodegradable paper such as kraft. Expansion of urbanization, an increase in population, and a subsequent rise in disposable income promote the consumption of packaged food, pharmaceuticals, and fast-moving consumer goods, which use kraft paper to create sacks, wraps, and others. Healthcare packaging, especially, is experiencing the heightened application of kraft paper in sterilizable wraps and medical pouches.

Kraft Paper Market: COMPANY EVALUATION MATRIX

In the kraft paper market matrix, Mondi (Star), leads the market. Mondi is a global leader in kraft paper and paper bag manufacturing and is the top producer of sack kraft paper worldwide. Stora Enso (Emerging Leader) is gaining traction. The company has strong presence in Europe and a growing footprint in North America and serves mature and emerging markets by providing customized renewable packaging.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 12.18 Billion |

| Market Forecast in 2030 (Value) | USD 14.24 Billion |

| Growth Rate | CAGR of 2.6% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | By Grade: Unbleached Kraft, Unbleached Sack, Bleached Kraft, and Bleached Sack By Packaging Form: Industrial Bags, Grocery Bags, Wraps, Pouches, and Envelopes By End-use Industry: Food & Beverage, Pharmaceutical, Building & Construction, Cosmetic & Personal Care, and Other End-use Industries |

| Regions Covered | North America, Asia Pacific, Europe, South America, the Middle East & Africa |

WHAT IS IN IT FOR YOU: Kraft Paper Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| APAC-based Kraft Paper Market | Detailed company profiles of kraft paper competitors (financials, product portfolio, production capacity) End-use industry mapping (food & beverage, pharmaceutical, building & construction, and others) | Identified & profiled 15+ kraft paper producers across APAC Mapped demand trends across high-growth segments Assessment of government regulations, sustainability initiatives, and trade dynamics |

| Sweden-based Kraft Paper Market | Market sizing and forecasting of kraft paper demand in Sweden, segmented by grade (unbleached kraft, unbleached sack, bleached kraft, and bleached sack), and packaging form (pouches, wraps, envelopes, grocery bags, and industrial bags) | Country-specific trends Recent developments in investments, and projects influencing kraft paper demand |

| Finland-based Kraft Paper Market | Market sizing and forecasting of kraft paper demand in Finland, segmented by grade (unbleached kraft, unbleached sack, bleached kraft, and bleached sack), and packaging form (pouches, wraps, envelopes, grocery bags, and industrial bags) | Country-specific trends Recent developments in investments, and projects influencing kraft paper demand |

| Chile-based Kraft Paper Market | Market sizing and forecasting of kraft paper demand in Chile, segmented by grade (unbleached kraft, unbleached sack, bleached kraft, and bleached sack), and packaging form (pouches, wraps, envelopes, grocery bags, and industrial bags) | Country-specific trends Recent developments in investments, and projects influencing kraft paper demand |

RECENT DEVELOPMENTS

- May 2025 : Mondi announced the successful start-up of its state-of-the-art paper machine at the Štetí mill in the Czech Republic in December 2024. Initial production trials showed outstanding performance, delivering high strength, excellent runnability, and consistent quality. This new paper machine enhances Mondi's ability to meet the growing demand for paper-based flexible packaging and further reinforces the Group’s vertically integrated Paper Bags business. It contributes to the optimization of production efficiency across Mondi's entire kraft paper portfolio.

- June 2025 : International Paper, a global leader in sustainable packaging, announced the strategic evaluation of a potential new packaging facility in Salt Lake City, Utah. This initiative aligns with the company’s broader growth strategy to expand its manufacturing capabilities across the US. By considering Utah as a new location, International Paper aims to strengthen its regional presence and more effectively meet the rising demand for high-quality, sustainable packaging solutions.

- May 2025 : Billerud developed a recyclable, heat-sealable paper that serves as a sustainable alternative to plastic for packaging applications requiring exceptional sealing performance and recyclability.

- July 2024 : Mondi entered a strategic partnership with CMC Packaging Automation, a global leader in fully automated, on-demand packaging solutions. As part of this collaboration, Mondi has been named the preferred kraft paper supplier for CMC's advanced packaging systems. Mondi and CMC will work on developing innovative packaging technologies that harness the strengths of both companies. This partnership aims to provide customers with superior product quality, improved operational efficiency, and enhanced environmental sustainability.

Table of Contents

Methodology

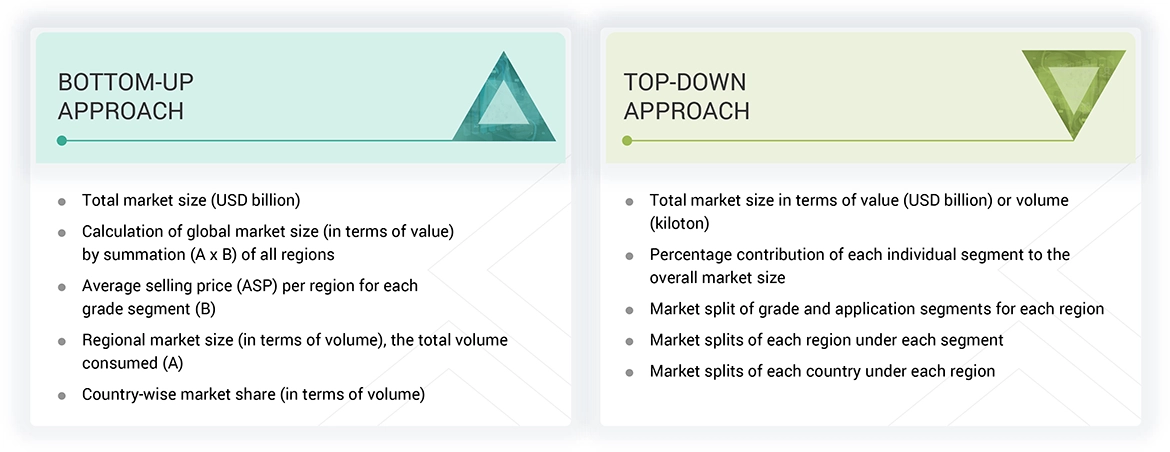

The study involved four major activities to estimate the current size of the global kraft paper market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of kraft paper through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the kraft paper market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments of the market.

Secondary Research

The market for the companies offering kraft paper is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were referred to identify and collect information for this study on the kraft paper market. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of kraft paper vendors, forums, certified publications, and white papers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the kraft paper market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of kraft paper offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

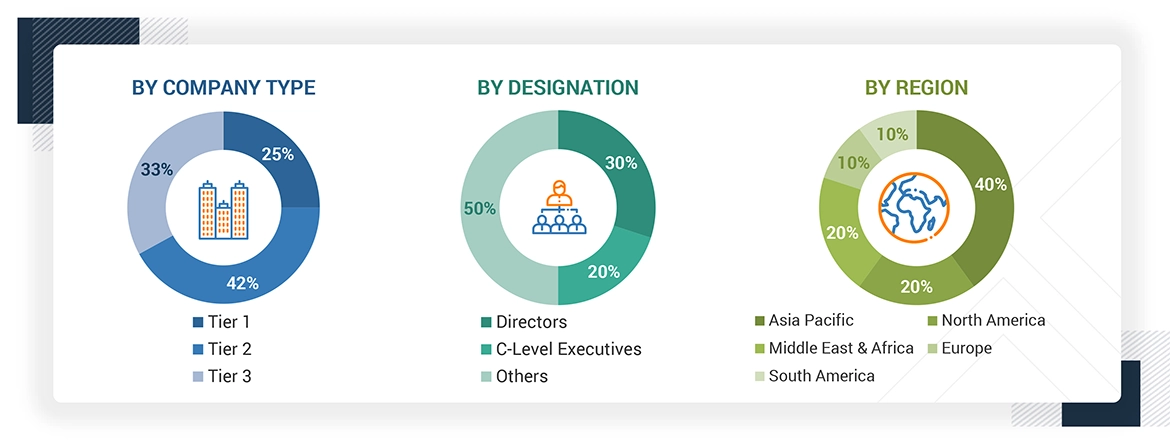

The following is the breakdown of primary respondents:

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 billion; Tier 2: USD 500 million–1 billion; and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global kraft paper market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Kraft paper is a highly durable type of packaging paper. It is manufactured through the sulfate pulping process, which involves the chemical conversion of wood into wood pulp. Depending on the treatment, kraft paper is available in two primary forms: natural (unbleached), which retains a light brown color, and bleached kraft paper, which appears white. Among all commonly used packaging papers, kraft paper is considered the strongest option, making it ideal for applications where durability and resistance to tearing are essential. Its coarse texture and robust nature provide excellent performance as a packaging material. In some cases, kraft paper is intentionally produced with a slightly rough surface to enhance friction, helping prevent bags or packages from slipping off pallets during handling and transportation. Kraft paper is highly versatile and supports various printing methods such as letterpress, flexography, and offset printing, allowing for customization and branding. Its wide range of packaging forms includes multiwall bags, shipping sacks, industrial tapes, envelopes, and wrapping papers.

Stakeholders

- Raw Material Suppliers

- Kraft Paper Manufacturers

- Packaging Converters

- Distributors and Wholesalers

- Research & Development Entities

- Industry Associations and Regulatory Bodies

- End Users

Report Objectives

- To define, describe, and forecast the size of the global kraft paper market based on grade, packaging form, end-use industry, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as product launches, acquisitions, partnerships, and expansions in the kraft paper market

- To provide the impact of AI on the market.

Key Questions Addressed by the Report

Which factors are propelling the growth of the kraft paper market?

Rising demand for sustainable packaging is one of the primary factors propelling the growth of the kraft paper market.

What are the major challenges to the growth of the kraft paper market?

Intense competition and price pressure are major challenges impacting the growth of the kraft paper market.

What are the major opportunities in the kraft paper market?

Growth in personal care and cosmetics packaging will provide profitable opportunities for kraft paper market players in the near future.

What are the major factors restraining the growth of the kraft paper market?

The primary factor limiting the growth of the kraft paper market is fluctuations in raw material prices.

Who are the major players in the kraft paper market?

Major players in the kraft paper market include Mondi (UK), International Paper (US), Stora Enso (Finland), Billerud (Sweden), and APP Group (Indonesia).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Kraft Paper Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Kraft Paper Market