North America IT Services Market by Service Type, Deployment Mode, Organization Size, Business Function, Vertical (BFSI, Government and Defense, Healthcare, and Consumer Goods and Retail) and Country - Forecast to 2027

Updated on : Aug 20, 2025

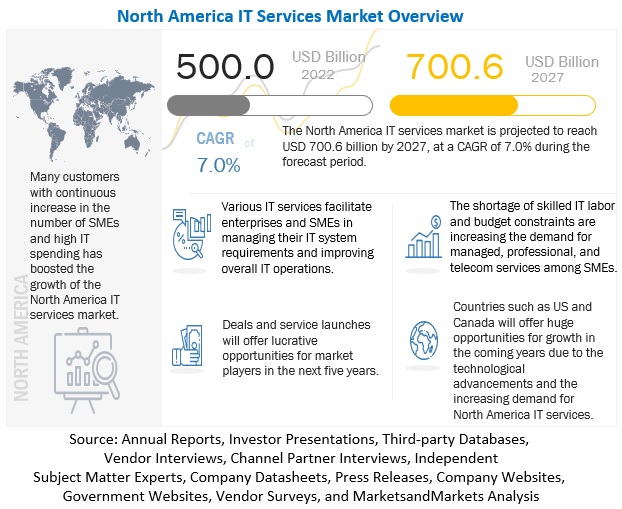

The global North America IT Services Market size was surpassed $500.0 billion in 2022 and is poised to reach over $700.6 billion by the end of 2027 at an effective CAGR of 7.0% during forecast period.

Among other services, IT services companies offer software development, application operations, maintenance, systems integration, data storage, and recovery, as well as consulting, hardware deployment, cloud computing, and cybersecurity. Organizations that choose IT services can guarantee a constant supply of services at lower labor and IT expenditures. They can become more competitive by implementing the most recent technologies and taking advantage of increased resources.

To know about the assumptions considered for the study, Request for Free Sample Report

Recession impact on the North America IT services market

The growth of the North America IT services market is anticipated to slow down due to concerns about a possible recession. The US economy's output of goods and services, or gross domestic product, shrank by 0.6 percent in the 3rd quarter after declining by 1.6 percent in 1st quarter of 2022. Two consecutive quarters of declining GDP are the usual threshold for a recession. According to a recent survey by the accounting company KPMG in 2022, more than eight out of ten CEOs believe a recession will occur within the next 12 months. 73% of the 1,300 CEOs of the largest corporations in the world surveyed agreed that a recession would restrict growth. A hiring freeze has been established by about 39% of CEOs, and 46% of them are thinking about reducing their workforce during the next six months. It is anticipated that Meta will eliminate thousands of jobs; about half of Twitter's employees were fired. They joined other organizations that recently announced layoffs, including Microsoft, Netflix, Snap, Lyft, Stripe, Peloton, and Shopify. Therefore, the North America IT services market will experience a transformation as it moves away from broad-based upgrading toward a focus on producing specific business value.

Market Dynamics

Driver: New connectivity complications increase demand for IT services

The most recent technology advancements, such as big data and analytics, the Internet of Things (IoT), Artificial Intelligence (AI), and Machine Learning (ML), have increased the connectivity and complexity of systems and network demands. Businesses lack the knowledge required to incorporate such technology into their operations. Additionally, they also lack the necessary infrastructure for implementing these technologies. As a result, purchasing new technology and maintaining it internally become more expensive. Therefore, businesses have become more open to establishing Bring-Your-Own-Device (BYOD) guidelines as the number of employees utilizing mobile applications has increased. Employees who use BYOD access to the corporate database using their own mobile devices. Although businesses quickly adopt new technology, creating more accessible and secure networks is still the main obstacle. The quality of the BYOD user experience is heavily reliant on the availability of consistent and powerful Wi-Fi connections. Customers are using bandwidth-intensive cloud-based services in their businesses, putting more strain on the network. Engaging managed service providers is a smart move for organizations looking to achieve business agility. The IT specialists at the organization thus have a huge opportunity. IT specialists use the most up-to-date tools and technology and offer strategic counsel to keep firms moving forward. They even use platforms for managed services to remotely administer enterprise systems, which aids in the expansion of businesses.

Restraint: Concerns over privacy and security

The main causes of cyber breaches and security issues are the rising use of mobile devices and the acceptance of the BYOD idea in numerous businesses. According to secondary data, cyber threat alerts are rising by 14% year over year, and the market lacks security features. Thus, it can be concluded that security-related worries are greatly increasing. Businesses must strive for stronger privacy and security services as they quickly adopt IT platforms and solutions. Despite the benefits, businesses believe that implementing cloud services will result in a loss of infrastructure control and a compromise on privacy. There are numerous third-party outsourcing arrangements used in IT services, which may raise security and confidentiality issues for the infrastructures used by web applications, databases, networks, endpoints, and virtualization. Thus, the biggest barrier to the adoption of cloud IT services continues to worry about security and privacy. Businesses that switch from internal services to outsourced cloud services confront numerous difficulties in keeping operational efficiencies, including network problems and expensive bandwidth. The provision of IT services in the cloud depends heavily on network maintenance, yet the high cost of bandwidth hampers efficient network management. Critical operations, including managed security services, managed data centers, and unified communications, may have delay problems as a result of insufficient bandwidth.

Opportunity: Increasing demand for managed services among SMEs

Managed services give SMEs a lot of space to grow and accomplish their goals. The massive increase in SMEs IT spending helps SMEs to expand by installing new and improved IT services. The demand for the North America IT services industry will rise as a result of SMEs spending rises on IT due to the adoption of the cloud, service automation, and investigation of cutting-edge digital technologies. Small companies have received IT-managed services from these technologies efficiently and affordably. Managed service providers offer various benefits, such as options for reducing CAPEX and OPEX, decreasing Total Cost of Ownership (TCO), utilizing highly modern applications that are in demand, communicating efficiently with customers and partners, and maintaining corporate operations. SMEs rely on these service providers to connect to numerous sites and maintain their services robustly. Managed service vendors offer dependable, cheap services that preserve network operations, supporting SMEs in growing and focusing more on their core businesses. These service providers are giving SMEs great opportunities to grow, expand, and stay competitive.

Challenge: Risk of vendor lock-in

Due to a lack of industry standards, vendor lock-in is a significant barrier to adopting IT services. Most initiatives and solutions with a technological foundation target the vendor lock-in problem. The limited studies that have been conducted have only partially put a spotlight on the complexity of the vendor lock-in problem in the context of the cloud. For this, when utilizing vendor services, the majority of clients are not aware of the proprietary standards that obstruct the portability and interoperability of applications. For instance, when migrating data from one data center to another, it can be difficult to carry out the migration process successfully since it is likely that the data was altered in the system of the original provider for compatibility. In this highly competitive market, businesses rely on several suppliers to give them a competitive edge over their competitors. Companies are constantly seeking improvements and are prepared to switch to better IT services to serve customers successfully. A variety of factors, including incompatible technologies, expensive switching costs, inefficient business procedures, and legal limitations, can bring on vendor lock-ins. These problems are hindering the uptake of IT services and making it harder for vendors to survive the intense competition in the North America IT services market.

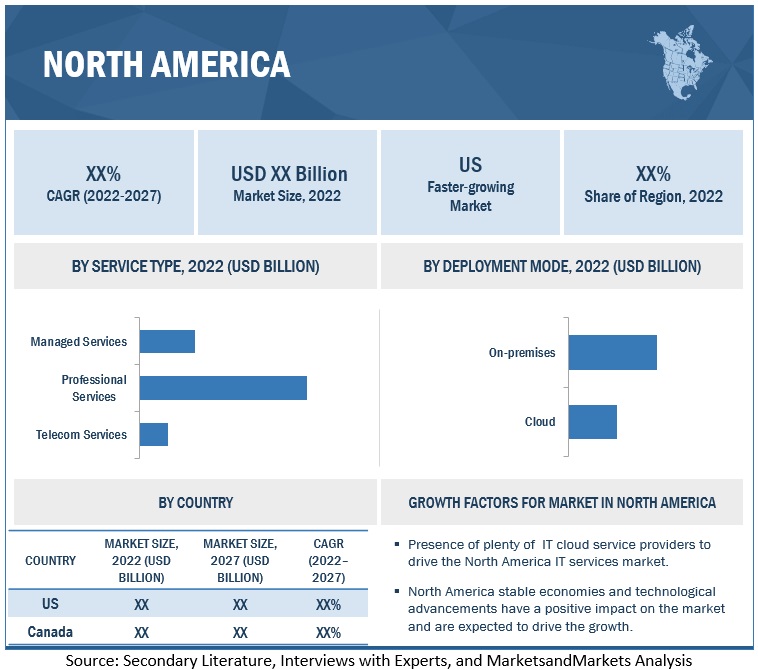

US to account for largest market size during forecast period

The geographic analysis of the North America IT services market is segmented into country, including US and Canada. The US is estimated to hold the largest market share in 2022 in the North America IT services market, and the trend is expected to continue until 2027. Further, the demand for IT cloud services is rising due to massive cloud installations across end-user industries. For instance, most of the world's leading cloud providers are based in the US, and the nation has a considerable share of cloud storage. The amount of data generated in the nation is now a key factor in adopting the cloud. As the Industrial Internet of Things (IIoT) develops inside the industry 4.0 platform, IT services are becoming increasingly popular within the hybrid IT-managed environment. During the projected period, demand for IT services will increase as Artificial Intelligence (AI) usage spreads throughout the healthcare and BFSI industries. Owing to the presence of big companies, such as IBM, Cisco, and HPE, IT services are easily available at competitive prices. End users in the US are also well versed with the technology; this boosts its adoption significantly. The US is a very competitive market, and it is anticipated that this will continue throughout the forecast period. Businesses are using effective competitive tactics to stay competitive in the market and keep their customers satisfied. According to secondary data, the US consultancy and program management company “Convergence Acceleration Solutions” (CAS Group), which specializes in business and technology transformation for significant communications service providers, has been acquired by Wipro. From strategy creation and planning through execution and deployment, the joint venture will offer clients services.

To know about the assumptions considered for the study, download the pdf brochure

As per organization size, SMEs segment to hold highest CAGR during forecast period

The North America IT services market organization size segment is subsegmented into SMEs and large enterprises. As per organization size, the SMEs segment is expected to hold the highest CAGR of 9.1% during the forecast period. The need for IT services is rising along with the number of SMEs around the world. Due to their adaptability and usability, IT services have taken on a major role in company operations and are predicted to continue expanding in the years to come. Small businesses are benefiting greatly from the implementation of managed services, including security and compliance and downtime reduction. By utilizing these IT services, SMEs can concentrate more on daily operations than on IT expenditure. According to secondary data, small firms were anticipated to spend almost USD 645 billion on IT services. Further, the demand for managed services to fulfill network specifications and security compliance is also being driven by the increase in SMEs globally. SMEs problems include unplanned downtime, cybersecurity threats, and a lack of experienced IT workers. SMEs can get assistance from managed service providers in overcoming these obstacles while controlling their IT expenses.

List of Top North America IT Services Comapnies

Some of the major North America IT services market Companies/vendors are IBM (US), Hewlett Packard Enterprise (US), Accenture (Ireland), Cisco (US), Wipro (India), HCL Technologies (India), Cognizant (US), Infosys (US), Rackspace (US), TCS (India), Fujitsu (Japan), Capgemini (France), Ericsson (Sweden), Huawei Technologies Co. Ltd. (US), Nokia Networks (Finland), GTT Communications (US), SAP (Germany), DXC Technology (US), NTT Data (Japan), and NEC Corporation (US).

Scope of the Report

|

Report Metrics |

Details |

| Market size available for years | 2017–2027 |

| Base year considered | 2022 |

| Forecast period | 2022–2027 |

|

Market value in 2027 |

USD 700.6 Billion |

|

Market value in 2022 |

USD 500.5 Billion |

|

Market Growth Rate |

7.0% CAGR |

| Segments Covered | Service Type (Professional Services, Managed Services, and Telecom Services), Business Function, Deployment Mode, Organization Size, Vertical, and Country |

| Geographies Covered | North America |

| List of top North America IT Services Companies Covered | IBM (US), Hewlett Packard Enterprise (US), Accenture (Ireland), Cisco (US), Wipro (India), HCL Technologies (India), Cognizant (US), Infosys (US), Rackspace (US), TCS (India), Fujitsu (Japan), Capgemini (France), Ericsson (Sweden), Huawei Technologies Co. Ltd. (US), Nokia Networks (Finland), GTT Communications (US), SAP (Germany), DXC Technology (US), NTT Data (Japan), and NEC Corporation (US) |

This research report categorizes the North America IT services market based on service types, organization sizes, deployment modes, business functions, verticals, and regions.

Based on the service types:

-

Professional services

-

System integration

-

Application Integration

- Application Development

- Application Testing

- Application Lifecycle Management

-

Infrastructure Integration

- Datacenter

- Mobility

- Network

- Other Infrastructure Integration

-

Application Integration

- Training and education

- Consulting

-

System integration

-

Managed services

- Managed security

- Managed network

- Managed data center and IT infrastructure

- Managed communication and collaboration service

- Managed mobility

- Managed information

- Telecom services

Based on the deployment modes:

- On-premises

- Cloud

Based on the organization sizes:

- Large enterprises

- Small and Medium Enterprises (SMEs)

Based on the business functions:

- Human Resources

- Finance and Accounting

- Sales and Marketing

- Supply Chain Management

- Operations and Support

- Manufacturing

Based on the verticals:

- Government and defense

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Media and entertainment

- Consumer goods and retail

- IT and telecom

- Other verticals (education, chemicals, energy and utilities, and travel and hospitality)

Based on the country:

- US

- Canada

Recent Developments:

- In November 2022, HCLTech launched Cloud Security As A Service On AWS. The foundation of this crucial capability is CSaaS, which uses the Borderless Security Reference Framework from HCLTech to better safeguard workloads both on-premises and on AWS. AWS customers can take advantage of a comprehensive solutions strategy based on industry best practices by using CSaaS. This strategy is based on benchmarks from the Center for Internet Security (CIS) and the AWS Well-Architected Framework. Both are used to set standards and practices for defending against cyber threats.

- In October 2022, IBM Consulting will now offer additional services and in-depth expertise to upgrade and manage the banking group's key banking systems and applications in an open, secure manner to support compliance with industry rules. This includes implementing the built-in security and compliance controls from IBM Cloud for Financial Services to assist businesses in overcoming regulatory obstacles impeding the modernization of their IT infrastructure and applications as well as lowering third and fourth-party risk across the entire supply chain.

- In August 2022, Wipro announced Modern Compute and Managed Applications Security Services accreditation setting Wipro’s AWS Managed Security Services apart for their continual protection, observation, and improvement of the security posture of the AWS environment. It enabled AWS clients to quickly obtain ongoing security management and monitoring approved by AWS.

- In September 2021, after noticing an increase in demand from companies in the public sector and the health industry, Cognizant built its new delivery center in Leeds to boost its services for clients. The action solidifies Cognizant's dedication to fostering the careers of young technologists and aligns it with the UK's levelling-up and North shoring agenda.

- In February 2021, Accenture launched a new business group with VMware to help organizations move to the cloud faster. The new business group aimed to bring together dedicated professionals with deep expertise in hybrid cloud and cloud migrations, cloud-native and application modernization, and security across key industries.

Frequently Asked Questions (FAQ):

What are IT services?

According to HCL Technology, the IT service provider assumes full accountability for the organization's overall IT operations, including 24x7 monitoring, on-demand IT assistance, and problem-solving. Further, one significant way that IT services differ from traditional IT services is that the IT service provider takes on the responsibility of providing the services to its clients and actively makes and communicates with clients about strategic IT decisions. Therefore, rather than only being on-demand service providers, IT service providers operate as technical consultants to their clients in IT installation.

According to Rackspace, IT services are defined as the development, administration, and delivery of information and business processes for organizations through technical expertise and commercial awareness. IT service providers support the management of elements crucial to a business's operations, such as the network, resources, services, and users. They support firms in the never-ending rush to adopt technology before it becomes irrelevant.

Which country are early adopters of North America IT services?

The US is at the initial stage of the adoption of IT services.

Which are key verticals adopting North America IT services?

Key verticals adopting the North America IT services market include: -

- BFSI

- IT & telecom

- Government and defense

- Consumer Goods and retail

- Media and entertainment

- Healthcare

- Other Verticals (energy and utilities, education, travel and hospitality, and chemicals)

Which are the key vendors exploring North America IT services?

Some of the major North America IT services market vendors are IBM (US), Hewlett Packard Enterprise (US), Accenture (Ireland), Cisco (US), Wipro (India), HCL Technologies (India), Cognizant (US), Infosys (US), Rackspace (US), TCS (India), Fujitsu (Japan), Capgemini (France), Ericsson (Sweden), Huawei Technologies Co. Ltd. (US), Nokia Networks (Finland), GTT Communications (US), SAP (Germany), DXC Technology (US), NTT Data (Japan), and NEC Corporation (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 MARKET EVOLUTION

-

5.3 MARKET DYNAMICSDRIVERS- Increased demand for cloud services- Rising digitization among enterprises- Rising complications in connectivity- Growing need for risk mitigationRESTRAINTS- Privacy and security concerns- Increasing number of regulations and complianceOPPORTUNITIES- Increasing demand for managed services among SMEs- Exponential growth in IP and cloud traffic- Growing demand for system integrators- Growing scope for exploring next-generation IT technology in BFSI and healthcare sectorsCHALLENGES- Lack of skilled workforce- Increase in vendor lock-in risks- Complexities involved in integrating IT infrastructure

-

5.4 CASE STUDY ANALYSISERICSSON HELPED NEWPORT UTILITIES BRING HIGH-SPEED BROADBAND TO RURAL COMMUNITIESDXC TECHNOLOGY HELPED INAIL FIGHT CYBER THREATS WITH AUTOMATION AND MLLUMEN TECHNOLOGIES PROVIDED REFINITIV’S CLIENTS WITH SUITE OF FULLY MANAGED TRADING AND DATA PROPOSITIONSCITRIX ENABLED AUTODESK INCREASE DIGITIZATIONRACKSPACE TECHNOLOGY PROVIDED ZACHRY CORPORATION WITH EXPERTISE AND SUPPORT

-

5.5 PATENT ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 ECOSYSTEM ANALYSIS

-

5.8 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCE AND MACHINE LEARNINGBIG DATA AND ANALYTICSCYBERSECURITYCLOUD COMPUTING

-

5.9 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS IN NORTH AMERICAREGULATORY IMPLICATIONS AND INDUSTRY STANDARDS- General Data Protection Regulation (EU) (2016/679)- SEC Rule 17a-4- ISO/IEC 27001- System and Organization Controls 2 Type II Compliance- Financial Industry Regulatory Authority- Freedom of Information Act- Health Insurance Portability and Accountability Act

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY CONFERENCES & EVENTS, 2022–2023

-

5.12 PRICING ANALYSISNORTH AMERICA IT SERVICES MARKET: PRICE TRENDSAVERAGE SELLING PRICE TRENDS

-

5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS

-

5.14 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONSERVICE TYPES: NORTH AMERICA IT SERVICES MARKET DRIVERS

-

6.2 PROFESSIONAL SERVICESSYSTEM INTEGRATION SERVICES- Application Integration Services- Infrastructure Integration ServicesTRAINING AND EDUCATION SERVICES- Rising need to ensure hassle-free implementation of IT servicesCONSULTING SERVICES- Increasing need to decrease complexity

-

6.3 MANAGED SERVICESMANAGED SERVICES: NORTH AMERICA IT SERVICES MARKET DRIVERSMANAGED SECURITY SERVICE- Rising need to protect critical assets from cyberattacksMANAGED NETWORK SERVICE- Increasing demand for managed network services among SMEsMANAGED DATA CENTER AND IT INFRASTRUCTURE SERVICE- Rising demand for better storage and processing capabilitiesMANAGED COMMUNICATION AND COLLABORATION SERVICE- Growing need for transparent, co-managed services for cloud collaborationMANAGED MOBILITY SERVICE- Rising need to assist IT decision-makers in selecting hardware and applicationsMANAGED INFORMATION SERVICE- Increasing complexity in business processes

-

6.4 TELECOM SERVICESRISING DEMAND FOR ACCESSIBILITY AND RELIABILITY

-

7.1 INTRODUCTIONDEPLOYMENT MODES: NORTH AMERICA IT SERVICES MARKET DRIVERS

-

7.2 ON-PREMISESON-PREMISES DEPLOYMENT MODE ENABLES ORGANIZATIONS MAINTAIN DATA SECURITY

-

7.3 CLOUDINCREASING RELIANCE OF ORGANIZATIONS ON IT ASSETS TO ENHANCE PRODUCTIVITY

-

8.1 INTRODUCTIONORGANIZATION SIZES: NORTH AMERICA IT SERVICES MARKET DRIVERS

-

8.2 SMALL AND MEDIUM-SIZED ENTERPRISESINCREASING IT SPENDING TO MANAGE BUSINESS OPERATIONS

-

8.3 LARGE ENTERPRISESGROWING NEED TO DIGITALIZE AND UPGRADE BUSINESS PROCESSES

-

9.1 INTRODUCTIONBUSINESS FUNCTIONS: NORTH AMERICA IT SERVICES MARKET DRIVERS

-

9.2 HUMAN RESOURCERISING NEED TO IMPROVE EMPLOYEE ENGAGEMENT AND OPTIMIZE HR PROCESSES

-

9.3 FINANCE AND ACCOUNTINGEFFICIENT IT SERVICES HELP REMOVE REDUNDANT TASKS

-

9.4 SALES AND MARKETINGGROWING DEMAND FOR APPROPRIATE TOOLS TO ACHIEVE OUTCOME

-

9.5 SUPPLY CHAIN MANAGEMENTIT SERVICES ENABLE TIMELY PROCUREMENT

-

9.6 OPERATIONS AND SUPPORTRISING NEED TO IMPROVE PRODUCTIVITY AND QUALITY

-

9.7 MANUFACTURINGGROWING DEMAND TO ANALYZE, ACCESS, AND SHARE LARGE AMOUNT OF INFORMATION

- 9.8 OTHER BUSINESS FUNCTIONS

-

10.1 INTRODUCTIONVERTICALS: NORTH AMERICA IT SERVICES MARKET DRIVERS

-

10.2 GOVERNMENT AND DEFENSERISING DEMAND FOR TRANSFORMATION OF GOVERNMENT INFRASTRUCTURE

-

10.3 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)RISING NEED FOR DIGITAL TRANSFORMATION AND IMPROVED CUSTOMER EXPERIENCE

-

10.4 HEALTHCAREGROWING DEMAND FOR TOOLS TO SUPPORT USER SECURITY

-

10.5 MEDIA AND ENTERTAINMENTTECHNOLOGICAL INNOVATIONS TO FACILITATE PERSONALIZED SERVICES

-

10.6 CONSUMER GOODS AND RETAILRISING USE OF TECHNOLOGY TO ADDRESS MARKET VOLATILITY

-

10.7 IT AND TELECOMINCREASED USE OF SMARTPHONES TO DRIVE MOBILITY SOLUTIONS

- 10.8 OTHER VERTICALS

-

11.1 INTRODUCTIONNORTH AMERICA IT SERVICES MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Increasing number of IT cloud service providersCANADA- Rising adoption of cloud by IT service vendors

- 12.1 INTRODUCTION

- 12.2 MARKET EVALUATION FRAMEWORK

- 12.3 MARKET SHARE OF TOP VENDORS

- 12.4 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

-

12.5 EVALUATION QUADRANT FOR KEY PLAYERS, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE BENCHMARKING OF KEY PLAYERS

-

12.6 EVALUATION QUADRANT FOR STARTUPS/SMES, 2022RESPONSIVE COMPANIESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 12.7 COMPETITIVE SCENARIO

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSIBM- Business overview- Services offered- Recent developments- MnM viewHEWLETT PACKARD ENTERPRISE- Business overview- Services offered- Recent developments- MnM viewACCENTURE- Business overview- Services offered- Recent developments- MnM viewCISCO- Business overview- Services offered- Recent developments- MnM viewWIPRO- Business overview- Services offered- Recent developments- MnM viewHCL TECHNOLOGIES- Business overview- Services offered- Recent developmentsCOGNIZANT- Business overview- Services offered- Recent developmentsINFOSYS- Business overview- Services offered- Recent developmentsRACKSPACE- Business overview- Services offered- Recent developmentsTCS- Business overview- Services offered- Recent developments

-

13.3 OTHER PLAYERSFUJITSUCAPGEMINIERICSSONHUAWEI TECHNOLOGIES CO. LTD.NOKIA NETWORKSGTT COMMUNICATIONSSAPDXC TECHNOLOGYNTT DATANECDELOITTEVIRTUSTREAMDIGITALOCEANBLUELOCKNAVISITELUMEN TECHNOLOGIESINFOROPENTEXTCITRIXIFS

-

13.4 SMES/STARTUPSINVENTIVE WORKSTECHMATRIXMISSION CLOUD SERVICESOPTANIXSECUREKLOUDASCEND TECHNOLOGIESESSINTIALAUNALYTICS2ND WATCHCLOUDNOW

-

14.1 INTRODUCTIONRELATED MARKETSLIMITATIONS

- 14.2 CLOUD MANAGED SERVICES MARKET

- 14.3 MANAGED SERVICES MARKET

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE, 2019–2021

- TABLE 2 PRIMARY RESPONDENTS: NORTH AMERICA IT SERVICES MARKET

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 TOP PATENT OWNERS

- TABLE 5 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 KEY CONFERENCES & EVENTS, 2022–2023

- TABLE 8 MARKET: PRICE LEVELS

- TABLE 9 MARKET: AVERAGE SELLING PRICE LEVELS (USD)

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- TABLE 11 KEY BUYING CRITERIA FOR END USERS

- TABLE 12 MARKET, BY SERVICE TYPE, 2017–2021 (USD BILLION)

- TABLE 13 MARKET, BY SERVICE TYPE, 2022–2027 (USD BILLION)

- TABLE 14 MARKET, BY PROFESSIONAL SERVICE, 2017–2021 (USD BILLION)

- TABLE 15 MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD BILLION)

- TABLE 16 MARKET, BY SYSTEM INTEGRATION SERVICE, 2017–2021 (USD BILLION)

- TABLE 17 MARKET, BY SYSTEM INTEGRATION SERVICE, 2022–2027 (USD BILLION)

- TABLE 18 MARKET, BY APPLICATION INTEGRATION SERVICE, 2017–2021 (USD BILLION)

- TABLE 19 MARKET, BY APPLICATION INTEGRATION SERVICE, 2022–2027 (USD BILLION)

- TABLE 20 MARKET, BY INFRASTRUCTURE INTEGRATION SERVICE, 2017–2021 (USD BILLION)

- TABLE 21 MARKET, BY INFRASTRUCTURE INTEGRATION SERVICE, 2022–2027 (USD BILLION)

- TABLE 22 MARKET, BY MANAGED SERVICE, 2017–2021 (USD BILLION)

- TABLE 23 MARKET, BY MANAGED SERVICE, 2022–2027 (USD BILLION)

- TABLE 24 MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD BILLION)

- TABLE 25 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD BILLION)

- TABLE 26 MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 27 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 28 MARKET, BY BUSINESS FUNCTION, 2017–2021 (USD BILLION)

- TABLE 29 MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD BILLION)

- TABLE 30 MARKET, BY VERTICAL, 2017–2021 (USD BILLION)

- TABLE 31 MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- TABLE 32 NORTH AMERICA IT SERVICES MARKET, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 33 MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 34 US: MARKET, BY SERVICE TYPE, 2017–2021 (USD BILLION)

- TABLE 35 US: MARKET, BY SERVICE TYPE, 2022–2027 (USD BILLION)

- TABLE 36 US: MARKET, BY PROFESSIONAL SERVICE, 2017–2021 (USD BILLION)

- TABLE 37 US: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD BILLION)

- TABLE 38 US: MARKET, BY SYSTEM INTEGRATION SERVICE, 2017–2021 (USD BILLION)

- TABLE 39 US: MARKET, BY SYSTEM INTEGRATION SERVICE, 2022–2027 (USD BILLION)

- TABLE 40 US: MARKET, BY APPLICATION INTEGRATION SERVICE, 2017–2021 (USD BILLION)

- TABLE 41 US: MARKET, BY APPLICATION INTEGRATION SERVICE, 2022–2027 (USD BILLION)

- TABLE 42 US: MARKET, BY INFRASTRUCTURE INTEGRATION SERVICE, 2017–2021 (USD BILLION)

- TABLE 43 US: MARKET, BY INFRASTRUCTURE INTEGRATION SERVICE, 2022–2027 (USD BILLION)

- TABLE 44 US: MARKET, BY MANAGED SERVICE, 2017–2021 (USD BILLION)

- TABLE 45 US: MARKET, BY MANAGED SERVICE, 2022–2027 (USD BILLION)

- TABLE 46 US: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD BILLION)

- TABLE 47 US: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD BILLION)

- TABLE 48 US: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 49 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 50 US: MARKET, BY BUSINESS FUNCTION, 2017–2021 (USD BILLION)

- TABLE 51 US: MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD BILLION)

- TABLE 52 US: MARKET, BY VERTICAL, 2017–2021 (USD BILLION)

- TABLE 53 US: MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- TABLE 54 CANADA: MARKET, BY SERVICE TYPE, 2017–2021 (USD BILLION)

- TABLE 55 CANADA: MARKET, BY SERVICE TYPE, 2022–2027 (USD BILLION)

- TABLE 56 CANADA: MARKET, BY PROFESSIONAL SERVICE, 2017–2021 (USD BILLION)

- TABLE 57 CANADA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD BILLION)

- TABLE 58 CANADA: MARKET, BY SYSTEM INTEGRATION SERVICE, 2017–2021 (USD BILLION)

- TABLE 59 CANADA: MARKET, BY SYSTEM INTEGRATION SERVICE, 2022–2027 (USD BILLION)

- TABLE 60 CANADA: MARKET, BY APPLICATION INTEGRATION SERVICE, 2017–2021 (USD BILLION)

- TABLE 61 CANADA: NORTH AMERICA IT SERVICES MARKET, BY APPLICATION INTEGRATION SERVICE, 2022–2027 (USD BILLION)

- TABLE 62 CANADA: MARKET, BY INFRASTRUCTURE INTEGRATION SERVICE, 2017–2021 (USD BILLION)

- TABLE 63 CANADA: MARKET, BY INFRASTRUCTURE INTEGRATION SERVICE, 2022–2027 (USD BILLION)

- TABLE 64 CANADA: MARKET, BY MANAGED SERVICE, 2017–2021 (USD BILLION)

- TABLE 65 CANADA: MARKET, BY MANAGED SERVICE, 2022–2027 (USD BILLION)

- TABLE 66 CANADA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD BILLION)

- TABLE 67 CANADA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD BILLION)

- TABLE 68 CANADA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 69 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 70 CANADA: MARKET, BY BUSINESS FUNCTION, 2017–2021 (USD BILLION)

- TABLE 71 CANADA: MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD BILLION)

- TABLE 72 CANADA: MARKET, BY VERTICAL, 2017–2021 (USD BILLION)

- TABLE 73 CANADA: MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- TABLE 74 COMPANY FOOTPRINT, BY SERVICE TYPE

- TABLE 75 COMPANY FOOTPRINT, BY COUNTRY

- TABLE 76 OVERALL COMPANY FOOTPRINT

- TABLE 77 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY SERVICE TYPE

- TABLE 78 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY COUNTRY

- TABLE 79 OVERALL COMPANY FOOTPRINT FOR STARTUPS/SMES

- TABLE 80 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 81 MARKET: PRODUCT LAUNCHES, 2019–2022

- TABLE 82 MARKET: DEALS, 2019–2022

- TABLE 83 IBM: BUSINESS OVERVIEW

- TABLE 84 IBM: SERVICES OFFERED

- TABLE 85 IBM: SERVICE LAUNCHES AND BUSINESS EXPANSIONS

- TABLE 86 IBM: DEALS

- TABLE 87 HPE: BUSINESS OVERVIEW

- TABLE 88 HPE: SERVICES OFFERED

- TABLE 89 HPE: SERVICE LAUNCHES AND BUSINESS EXPANSIONS

- TABLE 90 HPE: DEALS

- TABLE 91 ACCENTURE: BUSINESS OVERVIEW

- TABLE 92 ACCENTURE: SERVICES OFFERED

- TABLE 93 ACCENTURE: SERVICE LAUNCHES AND BUSINESS EXPANSIONS

- TABLE 94 ACCENTURE: DEALS

- TABLE 95 CISCO: BUSINESS OVERVIEW

- TABLE 96 CISCO: SERVICES OFFERED

- TABLE 97 CISCO: SERVICE LAUNCHES AND BUSINESS EXPANSIONS

- TABLE 98 CISCO: DEALS

- TABLE 99 WIPRO: BUSINESS OVERVIEW

- TABLE 100 WIPRO: SERVICES OFFERED

- TABLE 101 WIPRO: SERVICE LAUNCHES & BUSINESS EXPANSIONS

- TABLE 102 WIPRO: DEALS

- TABLE 103 HCL TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 104 HCL: SERVICES OFFERED

- TABLE 105 HCL: SERVICE LAUNCHES AND BUSINESS EXPANSIONS

- TABLE 106 HCL: DEALS

- TABLE 107 COGNIZANT: BUSINESS OVERVIEW

- TABLE 108 COGNIZANT: SERVICES OFFERED

- TABLE 109 COGNIZANT: SERVICE LAUNCHES AND BUSINESS EXPANSIONS

- TABLE 110 COGNIZANT: DEALS

- TABLE 111 INFOSYS: BUSINESS OVERVIEW

- TABLE 112 INFOSYS: SERVICES OFFERED

- TABLE 113 INFOSYS: SERVICE LAUNCHES AND BUSINESS EXPANSIONS

- TABLE 114 INFOSYS: DEALS

- TABLE 115 RACKSPACE: BUSINESS OVERVIEW

- TABLE 116 RACKSPACE: SERVICES OFFERED

- TABLE 117 RACKSPACE: SERVICE LAUNCHES AND BUSINESS EXPANSIONS

- TABLE 118 RACKSPACE: DEALS

- TABLE 119 TCS: BUSINESS OVERVIEW

- TABLE 120 TCS: SERVICES OFFERED

- TABLE 121 TCS: SERVICE LAUNCHES AND BUSINESS EXPANSIONS

- TABLE 122 TCS: DEALS

- TABLE 123 CLOUD MANAGED SERVICES MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 124 CLOUD MANAGED SERVICES MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 125 MANAGED SERVICES MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 126 MANAGED SERVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION METHODOLOGY

- FIGURE 6 NORTH AMERICA IT SERVICES MARKET SNAPSHOT, 2020–2027

- FIGURE 7 TOP SEGMENTS IN NORTH AMERICA IT SERVICES MARKET

- FIGURE 8 PROFESSIONAL SERVICES SEGMENT TO LEAD MARKET BY 2027

- FIGURE 9 SYSTEM INTEGRATION SERVICES SEGMENT TO LEAD MARKET BY 2027

- FIGURE 10 INFRASTRUCTURE INTEGRATION SERVICES SEGMENT TO DOMINATE MARKET BY 2027

- FIGURE 11 APPLICATION LIFECYCLE MANAGEMENT SEGMENT TO LEAD MARKET BY 2027

- FIGURE 12 NETWORK SEGMENT TO BE LARGEST MARKET BY 2027

- FIGURE 13 MANAGED DATA CENTER AND IT INFRASTRUCTURE SERVICE SEGMENT TO BE LARGEST MARKET BY 2027

- FIGURE 14 OPERATION AND SUPPORT SEGMENT TO LEAD MARKET BY 2027

- FIGURE 15 CLOUD SEGMENT TO BE LARGER MARKET BY 2027

- FIGURE 16 SMES SEGMENT TO BE LARGER MARKET BY 2027

- FIGURE 17 NORTH AMERICA IT SERVICES MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- FIGURE 18 US TO ACCOUNT FOR LARGER MARKET SHARE BY 2027

- FIGURE 19 DRASTIC DEMOGRAPHIC CHANGE AND TECHNOLOGICAL EVOLUTION TO DRIVE NORTH AMERICA IT SERVICES MARKET GROWTH

- FIGURE 20 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2027

- FIGURE 21 CLOUD SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2027

- FIGURE 22 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE BY 2027

- FIGURE 23 OPERATIONS AND SUPPORT BUSINESS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2027

- FIGURE 24 GOVERNMENT AND DEFENSE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2027

- FIGURE 25 US TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 26 EVOLUTION OF NORTH AMERICA IT SERVICES MARKET

- FIGURE 27 NORTH AMERICA IT SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 BENEFITS OF CLOUD SERVICE

- FIGURE 29 RANSOMWARE AND PHISHING INCIDENTS ON VARIOUS CHANNELS

- FIGURE 30 NUMBER OF PATENTS PUBLISHED, 2011–2021

- FIGURE 31 TOP TEN PATENT APPLICANTS (GLOBAL), 2021

- FIGURE 32 SUPPLY CHAIN ANALYSIS

- FIGURE 33 ECOSYSTEM ANALYSIS

- FIGURE 34 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 35 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 37 KEY BUYING CRITERIA FOR END USERS

- FIGURE 38 MANAGED SERVICES SEGMENT TO GROW AT HIGHEST CAGR BY 2027

- FIGURE 39 CONSULTING SERVICES SEGMENT TO GROW AT HIGHEST CAGR BY 2027

- FIGURE 40 APPLICATION INTEGRATION SERVICES SEGMENT TO GROW AT HIGHER CAGR BY 2027

- FIGURE 41 APPLICATION TESTING SEGMENT TO GROW AT HIGHEST CAGR BY 2027

- FIGURE 42 MOBILITY SEGMENT TO GROW AT HIGHEST CAGR BY 2027

- FIGURE 43 MANAGED MOBILITY SERVICE TO GROW AT HIGHEST CAGR BY 2027

- FIGURE 44 CLOUD SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE BY 2027

- FIGURE 45 SMES SEGMENT TO GROW AT HIGHER CAGR BY 2027

- FIGURE 46 SALES AND MARKETING SEGMENT TO GROW AT HIGHEST CAGR BY 2027

- FIGURE 47 HEALTHCARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 49 MARKET EVALUATION FRAMEWORK

- FIGURE 50 NORTH AMERICA IT SERVICES MARKET: VENDOR SHARE ANALYSIS

- FIGURE 51 HISTORICAL REVENUE ANALYSIS, 2017–2021 (USD MILLION)

- FIGURE 52 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 53 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS

- FIGURE 54 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 55 EVALUATION QUADRANT FOR STARTUPS/SMES

- FIGURE 56 IBM: COMPANY SNAPSHOT

- FIGURE 57 HPE: COMPANY SNAPSHOT

- FIGURE 58 ACCENTURE: COMPANY SNAPSHOT

- FIGURE 59 CISCO: COMPANY SNAPSHOT

- FIGURE 60 WIPRO: COMPANY SNAPSHOT

- FIGURE 61 HCL TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 62 COGNIZANT: COMPANY SNAPSHOT

- FIGURE 63 INFOSYS: COMPANY SNAPSHOT

- FIGURE 64 RACKSPACE: COMPANY SNAPSHOT

- FIGURE 65 TCS: COMPANY SNAPSHOT

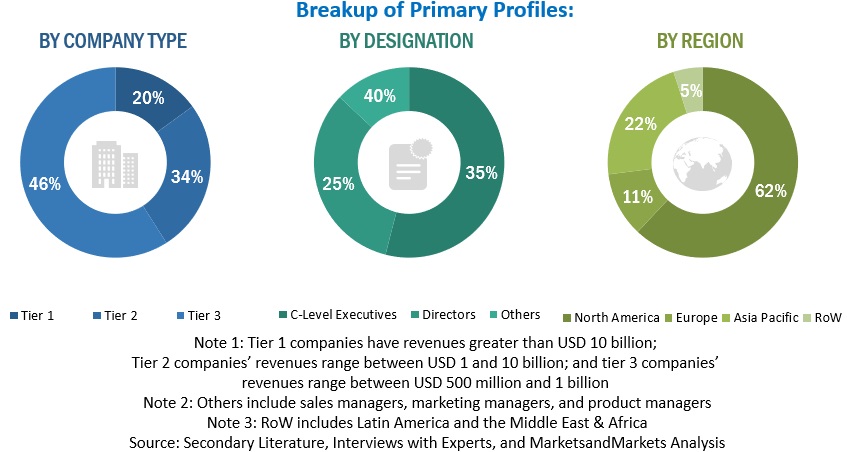

The study involved 4 major activities to estimate the current market size of North America IT Services Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers such as Cisco Cloud Index; certified publications; and articles from recognized associations, such as data center knowledge and government publishing sources. The research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, Bloomberg BusinessWeek, Statista.com, respective Company websites, to identify and collect information useful for this technical, market-oriented, and commercial study of the cloud computing market. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), Chief Technological Officers (CTOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing cloud computing services. The primary sources from the demand side included the end-users of cloud computing services, which included Chief Information Officers (CIOs), IT technicians and technologists, and IT managers at public and investor-owned utilities.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the North America IT Services market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the North America IT Services market.

Report Objectives

- To define, describe, and forecast the North America IT services market basis professional, managed, and telecom services, organization size, deployment type, business function, and vertical.

- To forecast the market size of the subsegments with respect to the North American regions (along with countries)

- To strategically analyze micro-markets with respect to individual growth trends, future prospects, and contributions to the total market

- To provide a detailed information regarding the major factors influencing the growth of the market (Drivers, Restraints, Opportunities, and industry-specific Challenges)

- To analyze the opportunities in the market for the stakeholders and details of the competitive landscape for the market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in North America IT Services Market

Very well-researched and informative market study. The market looks interesting.