Nuclear Power Plant Equipment Market by Reactor Type (Pressurized Water Reactor (PWR), Pressurized Heavy Water Reactor (PHWR), Boiling Water Reactor (BWR)), Equipment Type (Island Equipment, Auxiliary Equipment) Region - Global Forecast to 2027

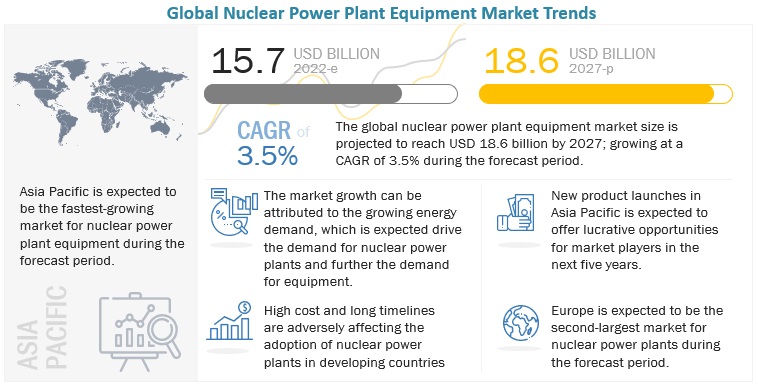

[155 Pages Report] The global nuclear power plant equipment market is estimated to grow from USD 15.7 billion in 2022 to USD 18.6 billion by 2027; it is expected to record a CAGR of 3.5% during the forecast period. Growing demand of energy for high performance is driving the nuclear power plant equipment market.

To know about the assumptions considered for the study, Request for Free Sample Report

Nuclear Power Plant Equipment Market Dynamics

Driver: Growing demand for clean energy

Nuclear energy as clean energy is a more reliable way of producing electricity on a large scale. The versatile nature of nuclear energy market could enable the transition to a cleaner world and a stronger global economy. In recent decades, clean energy sources have witnessed rapid innovations and cost reductions. Solar photovoltaic, wind power, hydropower, dispatchable geothermal (both deep and shallow), biomass, and concentrating solar power have experienced rapid technological and economic advances in the last decade. Nuclear energy has the potential to be coupled with several other energy sources in a synergistic fashion, which could result in integrated systems that are more than the sum of their parts. It produces energy by fission, which is the splitting of uranium atoms to release energy. Without the toxic consequences that come from burning fossil fuels, electricity is produced using the heat from fission to produce steam, which turns a turbine.

Restraints: Long Construction period and high cost of construction

The capital costs involved in nuclear power plants include the cost of site selection, construction, manufacturing, contracting, and finance. A large-scale nuclear reactor requires thousands of personnel to build enormous quantities of steel and concrete, thousands of parts, and several systems that provide electricity, cooling, ventilation, information control, and communication., The capital cost required is very high compared to alternative power generation technologies such as solar and wind. For coal power plants, it costs 1.88 cents to produce 1 kilowatt hour of energy, while for fossil fuel energy generation, the cost of building and operating a fossil fuel power plant is lower than that of a nuclear power plant. In Europe and the US, nuclear power plant construction cost is between USD 5,500/kW and USD 8000/kW roughly between USD 6 billion and USD 9 billion for each 1,100 MW plant. On the other hand, solar power plants cost about USD 2000/kW. Hence, the high cost has become a major restraining factor for the nuclear industry.

Opportunities: Rising need for sustainability and decarbonization globally

The world would need to harness all low-carbon energy sources to control greenhouse gas (GHG) emissions and limit the increase of global mean surface temperature to below 2° C relative to pre-industrial levels by the end of the century. Nuclear power plants produce virtually no greenhouse gas emissions or air pollutants during their operation and emit very low emissions over their entire life cycle. Fundamentally, nuclear energy for sustainable development is robust owing to its scalability and energy density. Along with hydropower and wind energy, nuclear power produces low GHG emissions per unit of electricity generated on a life cycle basis, including construction, operation, decommissioning, and waste management. On a life cycle basis, nuclear energy emits only a few grams of CO2 /kWh compared to 800 grams of CO2/kWh emission from coal. These advantages of nuclear energy help achieve sustainability and decarbonization goals across the energy sector.

Challenges: High cost of storage, transportation, and disposal of used fuel

Globally, 400,000 tons of spent nuclear fuel is produced from civil nuclear power plants. Several institutions worry about the transportation, storage, and disposal of nuclear waste because they see it as an increasing concern for the local environment ecosystem and is a financial burden for them. To facilitate the storage, transportation, and disposal of used fuels, companies or governments must spend a huge amount.

For example, in the US, 86,000 tons -of used nuclear fuel, which is currently being stored at a number of facilities across 34 states, will eventually have to be disposed. It costs ~USD 600/kg to store and then dispose spent nuclear fuel. The US government spends USD 6 billion each year for the disposal of nuclear waste. The project’s cost of clean-up for the Manhattan project is projected to be around USD 300 billion. Additionally, the government is creating brand-new, particularly made railcars to support future large-scale used fuel transportation. Hence the high cost of storage, transportation, and disposal of used fuels poses a significant challenge to the further growth of the nuclear industry.

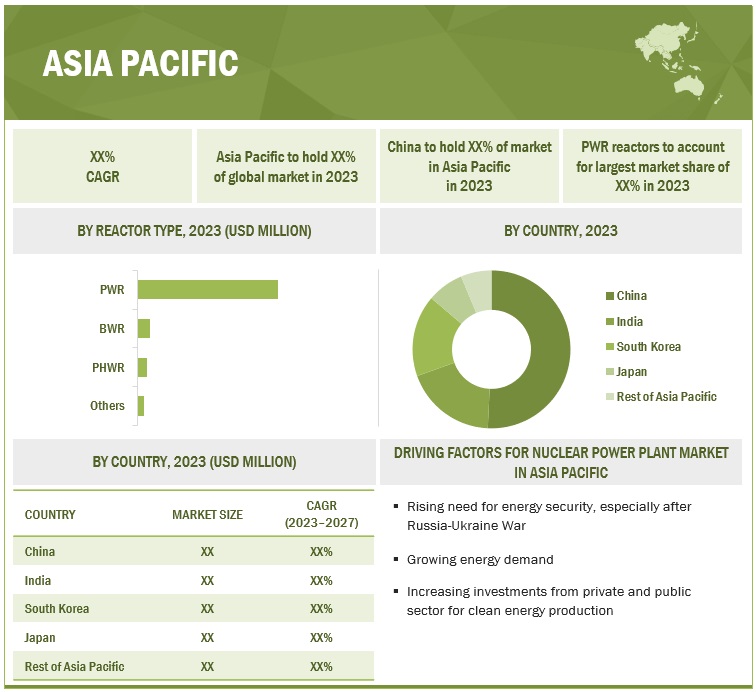

Asia Pacific is expected to dominate the global nuclear power plant equipment market.

Asia Pacific accounted for the largest market share in 2021. It is also the fastest-growing market during the forecast period. Asia Pacific dominated the Nuclear power plant and equipment market in 2021 and is likely to continue its dominance during the forecasted period as well. It is one of the principal geographical areas in the world where nuclear power market is expanding significantly. In Asia Pacific, there are ~140 operational nuclear power plants and 30–35 plants are under construction. The major nations in the region also have plans to develop an additional 60 to 70 reactors over the next few years. China produces 52 GW of nuclear power through its 54 reactors, 22 (24.7 GW) are under construction, and 42 (46.1 GW) are planned. China has the strong project pipeline in the world further strengthening the outlook toward the market in the country.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the global Nuclear power plant equipment market are General Electric (US), Mitsubishi Heavy Industries (Japan), Shanghai Electric (China), Toshiba Energy System & Solutions Corporation (Japan), Doosan Corporation (South Korea).

Scope of the Report

|

Report Metrics |

Details |

| Market Size available for years | 2019–2027 |

| Base year considered | 2021 |

| Forecast period | 2023–2027 |

| Forecast units | Value (USD) |

| Segments covered | Equipment Type, reactor type and region. |

| Geographies covered | Asia Pacific, Americas, Europe, and Middle East & Africa |

| Companies covered | Westinghouse Electric Corporation (US), NuScale Power, LLC. (US), GE Hitachi Nuclear Energy (US), General Electric(US),Terrestrial Energy Inc.(Canada), Toshiba Corporation(Japan), Mitsubishi Heavy Industries LTD,(Japan), LARSEN & TOUBRO LIMITED (India), Dongfang Electric Corporation(China), BWX technologies,Inc.(US),Babcock and Wilcox (US), Areva SA (France), The State Atomic Energy Corporation (US), EDF (France), Atomstroyexport JSC (Russia), AEM-technology (Russia), China General Nuclear Power Group (US), Exelon Corporation (US) |

This research report categorizes the market based on reactor type, Equipment type and region.

Based on Reactor Type, the Nuclear power plant equipment market has been segmented as follows:

- Pressurized Water reactor (PWR)

- Boiling water Reactor (BWR)

- Pressurized Heavy water Reactor(PHWR)

-

Advanced reactor

- Fast breeder reactor (FBR)

- Reactor Bolshoy Moschnosti Kanalniy (RBMK)

- Pebble-bed reactors (PBR)

Based on Equipment, the Nuclear power plant market has been segmented as follows:

- Island Equipment

- Auxiliary Equipment

Based on the region, the market has been segmented as follows:

- Americas

- Asia Pacific

- Europe

- Middle East & Africa

Recent Developments

- In February 2022, GE agreed to sell nuclear power activities part to Electricite de France. Nuclear power is the generation of electricity through nuclear reactions. Nuclear fission, nuclear decay, and nuclear fusion reactions can all produce power. Currently, the great majority of nuclear power electricity is generated through nuclear fission of uranium and plutonium in nuclear power plants.

- In June 2022, The US Department of Défense awarded BWX a contract to construct the nation's first cutting-edge nuclear microreactor.

- In November 2022, GE entered into an agreement to sell GE Steam Power’s nuclear activities to EDF. EDF signs deal to acquire GE Steam Power's nuclear activities. The transaction also covers steam turbine technology such as the European pressurized reactors and compact modular reactors. The activities of GE Steam Power involve the production of conventional island equipment for the new nuclear power plants.

- In April 2021, The U.S. Naval Nuclear Propulsion Program awarded BWX a contract worth US$2.2 billion to produce the parts and fuel for naval nuclear reactors.

- In October 2021, A teaming agreement has been made between GE Hitachi Nuclear Energy (GEH) and BWXT Canada Ltd. (BWXT Canada) to work together on engineering and procurement to support the design, production, and commercialization of the BWRX-300 compact modular reactor.

Frequently Asked Questions (FAQ):

What is the current size of the Nuclear power plant equipment market?

The current market size of the global Nuclear power plant equipment market is 5.6 billion in 2021.

What are the major drivers for Nuclear power plant equipment market?

Growing demand of Energy for high performance, Electricity produced with less pollution, and security and supply are the major drivers.

Which is the fastest-growing region during the forecasted period in the Nuclear power plant equipment market?

Asia Pacific accounted for the largest market share in 2021. Asia Pacific dominated the Nuclear power plant equipment market in 2021 and is likely to continue its dominance during the forecasted period as well. It is one of the principal geographical areas in the world where nuclear power is expanding significantly. In Asia Pacific, there are ~140 operational nuclear power plants and 30–35 plants are under construction.

Which is the fastest-growing segment, by type during the forecasted period in Nuclear power plant equipment market?

Pressurized water reactor segment, by reactor type is the fastest-growing segment during the forecasted period PWR account for the vast majority of the contemporary reactors (about 80%).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

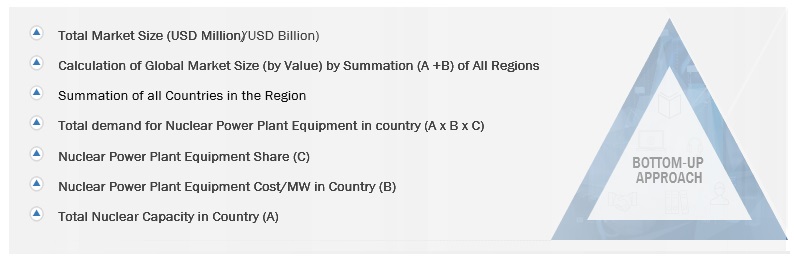

This study involved two major activities in estimating the current size of the Nuclear Power plant equipment market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

The research study on the market involved the extensive use of secondary sources referred to for this research study include press releases, white papers, certified publications, articles by recognized authors, directories, and databases of various companies and associations. Secondary research was used to obtain key information about the supply chain of the industry, key players offering various nuclear power plant equipment components, market classification, and segmentation according to the offerings of the leading players along with the industry trends to the bottommost level, regional markets, and key developments from the market- and technology-oriented perspectives.

Primary Research

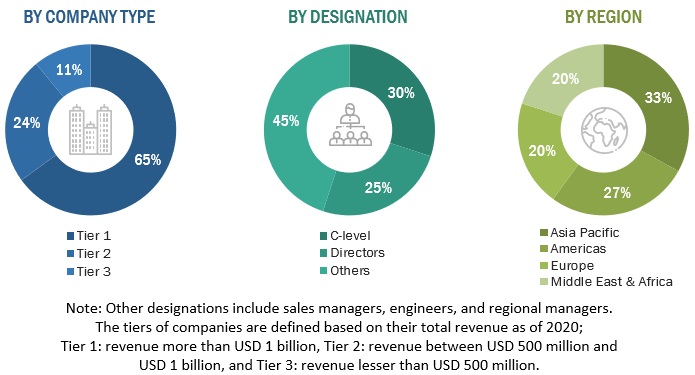

In the primary research process, primary sources from the supply side were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as chief executive officers (CEO), assistant general managers, nuclear design engineers, R&D test engineers, project officers, business development managers, and related key executives from various companies and organizations operating in the nuclear power plant and equipment market. In the complete market engineering process, top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process to list key information/insights throughout the report.

The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Note: Other designations include sales managers, engineers, and regional managers. The tiers of companies are defined based on their total revenue as of 2020; Tier 1: revenue more than USD 1 billion, Tier 2: revenue between USD 500 million and USD 1 billion, and Tier 3: revenue lesser than USD 500 million.

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the market and its dependent submarkets. The key players in the market were identified through secondary research. The research methodology included the study of the top market players and interviews with industry experts, such as chief executive officers (CEO), assistant general managers, nuclear design engineers, R&D test engineers, project officers, and business development managers, for key quantitative and qualitative insights related to the nuclear power plant equipment market. The following sections provide details about the overall market size estimation process employed in this study.

- The key players in the industry and market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Nuclear Power plant & Equipment Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market has been split into several segments and subsegments. Data triangulation procedure has been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying various factors and trends from the demand side. Along with this, the market size has been validated using top-down and bottom-up approaches.

Report Objectives

- To define and describe the market, based on equipment type and reactor type, in terms of value.

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- To estimate the market size in terms of value.

- To strategically analyze micromarkets1 with respect to individual growth trends, future expansions, and their contributions to the overall nuclear power plant equipment market.

- To provide post-pandemic estimation for the market and analyze the impact of the pandemic on the market growth.

- To analyze market opportunities for stakeholders and the competitive landscape for market leaders.

- To forecast the growth of the market with respect to four key regions: the Americas, Europe, Asia Pacific, and the Middle East & Africa, along with their key countries.

- To analyze competitive developments, such as investments & expansions, mergers & acquisitions, new product launches, contracts & agreements, and joint ventures & collaborations in the market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Nuclear Power Plant Equipment Market