Optical Sorter Market Size, Share & Industry Growth Analysis

Optical Sorter Market by Offering (Feed System, Optical System, Image Processing, Separation System), Type (Cameras, NIR, Hyperspectral, XRT), Platform (Belt, Freefall, Lane), Application (Food & Beverages, Recycling) – Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The optical sorter market is projected to grow from USD 3.06 billion in 2025 to USD 5.79 billion by 2032, registering a CAGR of 9.5%. Market expansion is driven by the rising demand for automation, high-precision sorting, and quality control in food processing, recycling, and mining.

KEY TAKEAWAYS

-

By CountryThe US is estimated to account for a market share of 84.6% of the optical sorter market in 2025.

-

By OfferingThe software & services segment is projected to grow at a higher CAGR (10.5%) than the hardware segment from 2025 to 2032.

-

By ApplicationThe recycling segment is projected to witness the highest CAGR of 11.7% during the forecast period.

-

Competitive Landscape - Key PlayersTOMRA Systems ASA and Hefei Meyer Optoelectronic Technology INC. were identified as key players in the market, given their strong market share and extensive product portfolios.

-

Competitive Landscape - Startups/SMESOptimum Sorting and ZXY Technology have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas and underscoring their potential as emerging market leaders.

The optical sorter market is poised for strong growth, driven by strict food safety regulations, waste recycling mandates, and advances in AI-enabled sensor technologies globally.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Several trends and technological disruptions are reshaping customer operations in the optical sorter market, fundamentally transforming how industries deploy, manage, and optimize sorting systems. Industry insights indicate strong market growth due to the rising adoption of AI-powered machine vision, advanced imaging technologies, and automated quality control systems across the food processing, recycling, mining, and industrial manufacturing sectors. While this expansion creates more options for end users, it also intensifies competition among vendors, pushing them toward service-based and subscription-driven models, particularly through Software-as-a-Service (SaaS), remote monitoring, and analytics-driven platforms that emphasize scalability, uptime, and continuous performance optimization.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising deployment of sustainable packaging solutions

-

High emphasis on environmental and sustainability goals

Level

-

Low defect-detection accuracy or sensitivity

-

Requirement for high upfront investment

Level

-

Implementation of stringent waste management regulations

-

Integration with IoT and AI technologies

Level

-

Limitations of infrared and other sorting technologies

-

Disrupted supply chains and consumer health concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising deployment of sustainable packaging solutions

The global food industry has experienced significant growth in recent years, prompting manufacturers to boost their revenue from food and consumer goods. Additionally, due to evolving consumer preferences, packaged food producers are increasingly adopting sustainable and biodegradable packaging solutions. Advanced packaging and sorting technologies are implemented to improve product quality and build consumer confidence. Also, manufacturers of all sizes, from small to large, are scaling up their production capacities, supported by equipment suppliers who deliver automation-driven solutions. These upgrades help ensure product purity, minimize contamination, and support effective supply chain management.

Restraint: Low defect-detection accuracy or sensitivity

Optical sorting machines are commonly used to evaluate sorting accuracy by comparing them with the brands recommended by manufacturers. However, one of the major drawbacks of these machines is their relatively low defect-detection accuracy or sensitivity. Optical sorters typically face two critical types of errors: false negatives, where defective items are classified as good; and false positives, where good items are incorrectly rejected. These errors have a significant impact on overall system performance.

Opportunity: Implementation of stringent waste management regulations

Global sustainability goals and strict waste management regulations are prompting countries to adopt recycling programs on a much larger scale. As nations strive to reduce landfill waste and promote circular economic practices, industries invest in automated sorting solutions that can handle large volumes of mixed materials with increased precision. This rapid expansion of recycling initiatives creates a significant demand for optical sorting systems that can efficiently separate plastics, metals, paper, and other waste.

Challenge: Limitations of infrared and other sorting technologies

Sorting technologies, such as vision systems, infrared (IR), and X-ray, are increasingly used to separate various types of plastic products. As recycling systems evolve, the ability to sort a wider mix of plastics has become essential to reduce contamination in bales, allowing more types of commodity plastics to enter the recycling stream. However, infrared sorting faces limitations, particularly with plastics that contain carbon black pigment; and this absorbs IR light and prevents it from reflecting to the sensor, making accurate detection and sorting difficult.

OPTICAL SORTER MARKET SIZE, SHARE & INDUSTRY GROWTH ANALYSIS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Steinbeis Polyvert deployed Sesotec’s advanced optical sorting and analysis solutions, including VARISORT+ UNITY multi-sensor sorters with real-time material analysis, along with FLAKE PURIFIER+ and FLAKE SCAN systems. These technologies enable precise preliminary and final cleaning of plastic flakes, allowing accurate, data-driven separation despite varying material compositions and input types. | Enable the production of ultra-pure recycled PP and HDPE flakes, significantly improving sorting accuracy and throughput while meeting stringent industrial quality standards | Enhance recycling efficiency | Support sustainable material recovery | Contribute to circular economy objectives |

|

ALBA partnered with Hefei Meyer to deploy Meyer’s CI series multispectral polymer sorting machines, which use advanced multispectral identification and high-resolution detection. The system accurately identifies and removes non-PET materials, aluminum flakes, and contaminants from bottle flakes, while enabling secondary and tertiary sorting stages to meet stringent food-contact requirements. | Enable consistent production of export-quality, food-grade rPET | Improve material purity and reliability | Support large-scale, closed-loop plastic recycling | Meet strict food safety standards | Strengthen sustainable packaging and circular economy initiatives |

|

Cirrec partnered with TOMRA Recycling to install advanced flake sorting solutions, including INNOSORT FLAKE and AUTOSORT FLAKE systems. These units enable precise polymer and color separation and the removal of foreign polymers, metals, and other impurities through multi-stage sorting integrated directly into the recycling line. | The solution doubled Cirrec’s processing capacity to approximately 60,000 tonnes per year while ensuring consistent production of food-grade PET flakes. This enables the supply of high-quality recycled material for new food trays containing up to 70% recycled content, supporting circular economy goals in food packaging. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The optical sorted market ecosystem is represented by combining optical sorter hardware manufacturers, software and service providers (AI and machine vision software developers, cloud-based monitoring and analytics providers, robotics and IoT solution partners), automation and control system integrators, and end users across various industries, including food processing, recycling, mining, and industrial manufacturing. This integrated ecosystem enables innovation, operational efficiency and the adoption of smart, data-driven sorting solutions worldwide.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Optical Sorter Market, By Offering

The hardware segment leads the optical sorter market due to the high capital cost and critical role of physical components, such as high-resolution cameras, hyperspectral and NIR sensors, illumination systems, air ejectors, conveyors, and processing units. These components are essential for achieving high sorting accuracy, speed, and reliability across food processing, recycling, and mining applications, making hardware the largest revenue-contributing segment.

Optical Sorter Market, By Type

The hyperspectral cameras & combined sorters segment is expected to grow at a significant CAGR in the optical sorter market during the forecast period, supported by the increasing need for advanced material identification and multi-attribute sorting. These systems enable precise detection of chemical composition, contaminants, and complex material mixes, helping processors meet strict quality, food safety, and recycling purity requirements while improving yield and operational efficiency.

Optical Sorter Market, By Platform

The belt segment is projected to lead the optical sorter market during the forecast period. This growth is due to its ability to handle high throughput with stable and uniform material presentation. Belt-based systems support advanced multi-sensor integration, offer gentle handling of fragile and irregular materials, and deliver higher sorting accuracy, which makes them widely adopted across food processing and recycling applications.

Optical Sorter Market, By Application

The recycling segment is expected to grow at a significant CAGR in the optical sorter market during the forecast period. This growth is supported by the rising waste generation, stricter recycling regulations, and increasing investments in circular economy initiatives. Additionally, optical sorters enable high-purity material recovery, improved processing efficiency, and reduced reliance on manual sorting, thus driving strong adoption in recycling facilities.

REGION

North America to account for largest market share in optical sorter market during forecast period

North America is projected to account for the largest share of the optical sorter market during the forecast period. This growth is due to the region’s high adoption of advanced automation technologies; strong presence of large-scale food processing, recycling, and mining industries; and early integration of AI- and sensor-based sorting systems. The US and Canada exercise stringent food safety, quality control, and waste management regulations, which drive continuous investment in high-precision optical sorting solutions to improve compliance, reduce contamination, and enhance operational efficiency. This factor is also helping the growth of the market.

OPTICAL SORTER MARKET SIZE, SHARE & INDUSTRY GROWTH ANALYSIS: COMPANY EVALUATION MATRIX

In the optical sorter market evaluation matrix, TOMRA Systems ASA (Star) leads with a strong global presence, continuous technological innovation, and leadership in sensor-based sorting solutions across food, recycling, and mining applications. The company’s advanced AI-enabled, multi-sensor platforms, strong service network, and focus on sustainability and circular economy initiatives position it ahead of competitors and drive consistent market growth. On the other hand, Optimum Sorting (Emerging Player) focuses on cost-effective, application-specific sorting solutions that leverage AI-driven imaging and flexible system configurations to serve niche and mid-scale processing operations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- TOMRA Systems ASA (Norway)

- Hefei Meyer Optoelectronic Technology INC. (China)

- Bühler (Switzerland)

- STEINERT (Germany)

- Key Technology (US)

- Sesotec Group (Germany)

- PELLENC ST (France)

- Binder+Co (Austria)

- SATAKE CORPORATION (Japan)

- Hefei Taihe Intelligent Technology Co., Ltd (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.83 Billion |

| Market Forecast in 2032 (Value) | USD 5.79 Billion |

| Growth Rate | CAGR of 9.5% from 2025–2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Rest of the World |

WHAT IS IN IT FOR YOU: OPTICAL SORTER MARKET SIZE, SHARE & INDUSTRY GROWTH ANALYSIS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Food and recycling processing operator |

|

|

| Regulated food-grade and recycling company |

|

|

| Sustainability-focused recycling operator |

|

|

RECENT DEVELOPMENTS

- September 2025 : TOMRA Systems ASA launched FINDER COLOR, a next-generation color sorting system for high-purity metal recovery, delivering exceptional throughput and recovery levels across a broad range of metals.

- March 2025 : Bühler (Switzerland) partnered with West-Link (US) to open a state-of-the-art optical sorting research and training center in Stockton, California. The partnership aimed to provide food processors in the western US with access to Bühler’s latest optical sorting technologies, hands-on training, and testing services, strengthening local support and service capabilities.

- July 2024 : STEINERT launched the STEINERT UMP Multipol, an innovative overband magnet designed to enhance the quality of ferrous concentrates by effectively removing non-magnetic impurities. Its unique feature of alternating magnetic poles causes the material to be turned over multiple times beneath the conveyor belt, ensuring thorough cleaning of ferrous fractions.

Table of Contents

Methodology

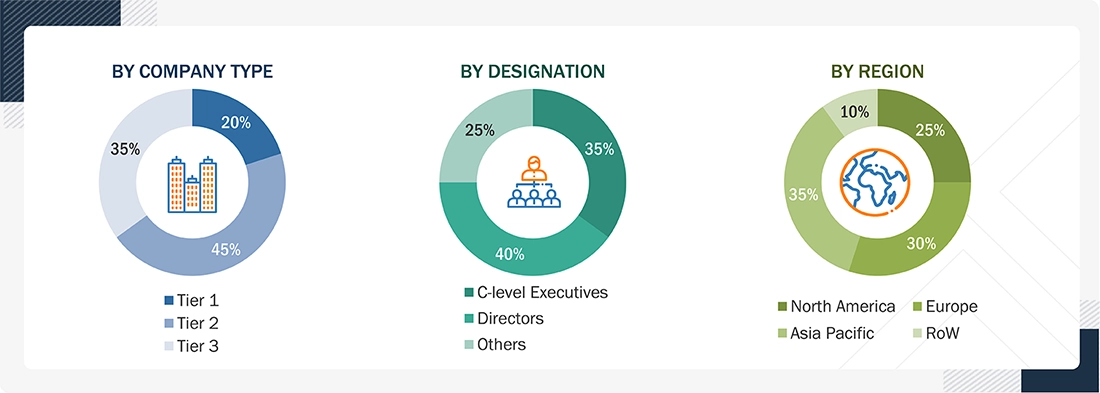

The research process for this study involved the systematic gathering, recording, and analysis of data on customers and companies operating in the optical sorter market. This process involved the extensive use of secondary sources, directories, and databases (Factiva and Oanda) to identify and collect valuable information for the comprehensive, technical, market-oriented, and commercial study of the optical sorter market. In-depth interviews were conducted with primary respondents, including experts from core and related industries, as well as preferred manufacturers, to obtain and verify critical qualitative and quantitative information and assess growth prospects. Key players in the optical sorter market were identified through secondary research, and their market rankings were determined through a combination of primary and secondary research. This research involved studying the annual reports of top players and conducting interviews with key industry experts, including CEOs, directors, and marketing executives.

Secondary Research

Various sources were utilized in the secondary research process to identify and collect information relevant to this study. These include company annual reports, press releases, investor presentations, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases.

Secondary research was used to gather key information about the industry’s value chain, the total pool of market players, market classification according to industry trends at the most detailed level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

Primary research was also conducted to identify the segmentation types; key players; competitive landscape; and key market dynamics, including drivers, restraints, opportunities, challenges; industry trends; as well as the key strategies adopted by players operating in the optical sorter market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Extensive primary research was conducted following the acquisition of knowledge about the optical sorter market scenarios through secondary research. Several primary interviews were conducted with experts from the demand (application, region) and supply side (offering, type, platform) across four major geographic regions, namely North America, Europe, Asia Pacific, and RoW. Approximately 60% and 40% of the primary interviews were conducted from the supply and demand sides, respectively. These primary data were collected through questionnaires, emails, and telephonic interviews.

- The three tiers of companies have been defined based on their total/segmental revenue as of 2024: Tier 1 = > USD 1 billion, Tier 2 = USD 1 billion to USD 500 million, and Tier 3 = < USD 500 million

- Other Designations include Sales, Marketing, and Product Managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods were implemented to estimate and validate the size of the optical sorter market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through a combination of primary and secondary research. This entire research methodology involved studying the annual and financial reports of the top players, as well as conducting interviews with experts (including CEOs, VPs, directors, and marketing executives) to gather key insights (both quantitative and qualitative). All percentage share, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Optical Sorter Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size through the estimation process, as explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and obtain precise statistics for all segments and subsegments, market breakdown and data triangulation procedures were employed, as applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market has been validated using both top-down and bottom-up approaches.

Market Definition

An optical sorter is a device that automatically sorts objects based on visual criteria. It is used for sorting products using cameras or lasers. An optical sorter machine compares objects according to user-defined criteria, recognizes and eliminates flawed and foreign objects from production lines, and separates products of different grades. It sorts objects automatically based on visual criteria.

Optical sorters are commonly used in food processing facilities, material recycling, and mining applications. They are used to detect flaws and distinguish between different types of items. Several types of sorters are available in the market. Some of these sorters use a camera with a pulsed LED, hyperspectral cameras, and sensors. Others utilize near-infrared (NIR) spectrum, multispectral, X-ray, laser, and UV lights, as well as various other technologies for sorting different subjects.

Key Stakeholders

- Government Bodies and Policymakers

- Industry Organizations, Forums, Alliances, and Associations

- Market Research and Consulting Firms

- Raw Material Suppliers and Distributors

- Research Institutes and Organizations

- Analysts and Strategic Business Planners

- End Users

Report Objectives

- To describe and forecast the size of the optical sorter market, by offering, type, platform, and application, in terms of value

- To describe and forecast the market size for four major regions, namely North America, Europe, Asia Pacific, and RoW, in terms of value

- To describe and forecast the market size, by application, in terms of volume

- To provide a detailed overview of the optical sorter technologies and throughputs

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges, influencing the market growth

- To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, value chain analysis, trends/disruptions impacting customer business, impact of AI/Gen AI, key conferences and events, pricing analysis, Porter’s five forces analysis, 2025 US tariff impact, and regulations pertaining to the market under study

- To strategically analyze micromarkets with regard to individual market trends, growth prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with a detailed competitive landscape for the market leaders

- To analyze major growth strategies, such as product launches, expansions, joint ventures, and acquisitions, adopted by key market players to enhance their market position

- To describe macroeconomic factors impacting market growth in each region

- To analyze the AI/Gen AI impact on the optical sorter market

- To analyze the 2025 US tariff impact on the optical sorter market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Optical Sorter Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Optical Sorter Market

Brittany

May, 2019

Doing a research project on high tech products in the market and current advancements being made in industry. Please help me by sending a sample brochure of the study..