Stoma Care Market / Ostomy Care Market Size by Product (Bags (Surgery Type (Ileostomy, Colostomy, Urostomy), System (One, Two-Piece), Usability (Drainable, Closed), Shape (Flat, Convex)), Accessories (Powder, Deodorant)), End User and Region - Global Forecast to 2026

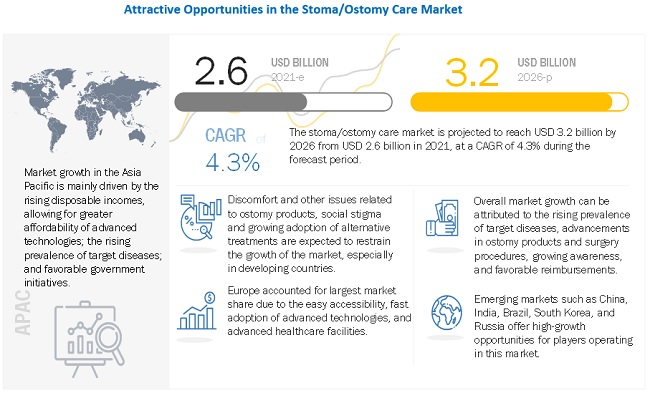

The size of global stoma care market in terms of revenue was estimated to be worth $2.6 billion in 2021 and is poised to reach $3.2 billion by 2026, growing at a CAGR of 4.3% from 2021 to 2026. The research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The increasing target patient population, growing prevalence of inflammatory bowel diseases, rising geriatric population, growing awareness, technological advancements, and the favorable reimbursement system in developed countries are the major factors driving the growth of this market. However, discomfort and other issues associated with the use of ostomy bags and the growing adoption of alternative treatments are limiting the growth of stoma market.

To know about the assumptions considered for the study, Request for Free Sample Report

Stoma Care Market Growth Dynamics

Driver: Growing target patient population and prevalence of inflammatory bowel diseases

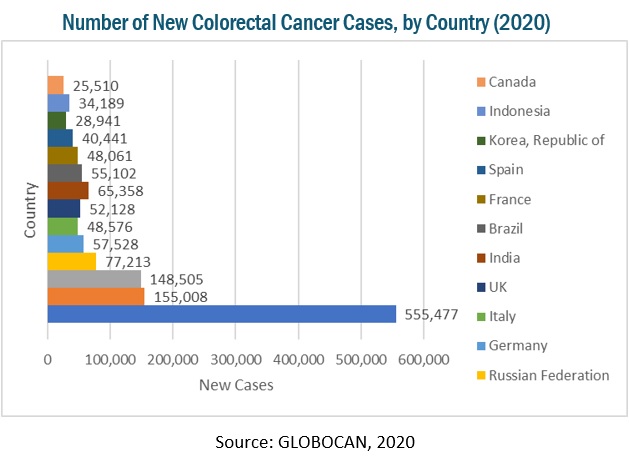

Colorectal cancer, bladder cancer, and inflammatory bowel disease are the major conditions necessitating ostomy surgeries. The treatment of colorectal cancer and inflammatory bowel disease (IBD) involves the surgical removal of the malignant tumor/part of the intestine. In some cases, the surgical opening is made through the abdomen to provide a new pathway for waste elimination, commonly referred to as an ostomy. A surge in the incidence of these conditions, coupled with the growing exposure to risk factors (such as changing food habits and growing use of antibiotics in childhood), has increased the number of ostomy surgeries globally. Some of the major statistics related to the incidence of target indications are mentioned below:

- According to GLOBOCAN 2020, colon and rectal cancers are the fifth and eighth most common cancers globally.

- Approximately 550,000 new urinary bladder cancer cases were diagnosed worldwide in 2018 (Source: World Cancer Research Fund International).

- Around 6.8 million cases of inflammatory bowel disease were diagnosed in 2017 globally. The prevalence rate of IBD increased from 79·5 per 100,000 population in 1990 to 84·3 per 100,000 population in 2017. The highest prevalence of IBD was observed in the US (464·5 per 100,000 population), followed by the UK (449·6 per 100,000 population) (Source: Global Burden of Disease Study 2017).

To know about the assumptions considered for the study, download the pdf brochure

According to the Centers for Disease Control and Prevention, in 2015, an estimated 1.3% of US adults (3 million) reported being diagnosed with IBD (either Crohn’s disease or ulcerative colitis). This was a large increase from 1999 (0.9% or 2 million adults). A recent study found that the prevalence of IBD increased from 2001 to 2018 among Medicare beneficiaries of all race and ethnicity groups, with a higher increase rate among non-Hispanic Black adults.

Restraint: Complications associated with ostomy

Although stomas are a relatively common and safe surgery, there are some possible complications. These include:

- Skin irritation: This is a common problem caused by the adhesive on the ostomy appliance. Using a different appliance or changing the adhesive one uses can decrease the risk of any further complications.

- Dehydration: This is caused by waste exiting the stoma. One can rehydrate by drinking fluids, but severe cases might require hospitalization. Avoiding foods high in sugar, salt, and fat can decrease the risk of dehydration.

- Leakage: If the stoma appliance does not fit properly, it can leak; consequently, a better-fitting appliance is required.

- Bowel obstruction: If food is not properly chewed or digested, it can cause a blockage in the intestines. Symptoms of a blockage include cramps, stomach pain, and a sudden decrease in waste. While it may clear up on its own, some blockages require additional treatment.

- Retraction: The stoma might move inward, usually due to weight gain, scar tissue, or improper placement. Retraction makes it hard to attach the appliance and can also cause irritation and leakage. Accessory products for the appliance can help, but a new stoma might be needed in severe cases.

- Parastomal hernia: This is a frequent complication when the intestine starts to press outward through the opening. These are very common and often go away on their own. However, in some cases, surgery might be needed to repair it.

- Necrosis. Necrosis refers to tissue death when blood flow to the stoma is reduced or cut off. This may happen within the first few days after surgery.

Most stoma complications are minor, but some, especially necrosis and dehydration, can turn into medical emergencies. These complications limit the adoption of these products to a certain extent.

Opportunity: Growth opportunities offered by emerging markets

The penetration rate of ostomy bags in populous countries such as China, India, Indonesia, and Brazil is low. As a result, these markets can potentially offer significant growth opportunities to market players during the forecast period.

Major players in the ostomy care market have significantly lesser revenue from emerging markets. For instance, in 2019, only 16.6% of Coloplast’s revenue came from emerging markets, including Brazil, China, and India; whereas, only 7.8% of ConvaTec’s revenue came from the APAC.

Taking this into consideration, there is a significant growth space for manufacturers to penetrate developing countries. Moreover, over the past decade, sustained economic growth has been witnessed in emerging countries, which has resulted in greater public-private expenditure on healthcare infrastructure. Furthermore, governments across these countries are focused on providing modern and advanced healthcare services to larger proportions of their population and improving reimbursement coverage. Rapid growth in per-capita healthcare expenditure and the growing public demand for affordable healthcare services drive the adoption of healthcare products (including ostomy supplies) in these countries.

To cater to the unmet medical needs and increase their presence in emerging markets, major manufacturers operating in the stoma market have launched various programs in Asia Pacific, Middle Eastern, and South American countries (focusing on increasing the acceptance of their products in these countries).

Challenge: Disparities in reimbursement for ostomy supplies in emerging countries

Developing and low-income countries are increasingly faced with consistent pressure to reduce the cost burden on their healthcare systems. For instance, no reimbursement for ostomy surgery patients is provided in India (data as of 2019). In China, some provinces are reported to offer reimbursement coverage of up to 15% of the total cost for ostomy products.

Also, in most countries, reimbursement systems are not well developed; this is a major factor impacting overall healthcare investments, insurance coverage, reimbursement decision processes, and patient care programs. In emerging economies such as BRIC, operations of reimbursement systems are complex with tedious documentation. Also, the regulatory process and public-private insurance systems in these countries are not well-developed. Hence, manufacturers face challenges targeting countries with a single approach, and customized approaches must be followed for market penetration.

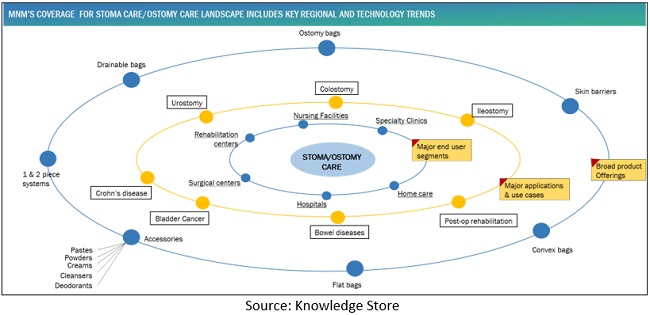

Stoma Care Market Ecosystem

The Colostomy segment accounted for the largest share of the stoma care industry, by surgery type, in 2020

Based on surgery, the stoma care market is segmented into ileostomy, colostomy, and urostomy. The Colostomy segment is expected to dominate this market during the forecast period. Colostomy is the most common type of surgical procedure performed globally. The rising incidence of colon cancer, stomach cancer, and IBD in developed and developing countries, coupled with the favorable reimbursement scenario in developed countries, is supporting the growth of this segment.

The ostomy bags segment, by product type, accounted for the largest share of the global stoma care industry in 2020

Based on product, the stoma care market is segmented into two broad categories—ostomy bags and accessories. The ostomy bags segment accounted for the largest share of the stoma/ostomy care market in 2020. The large share of this segment is attributed to their high usage and low cost. The ostomy bags segment dominated the global stoma/ostomy care market with a share of 88.49% in 2020.

Ostomy bags hold the largest share of the products market due to the growing number of patients suffering from target diseases (such as colorectal cancer and bladder cancer). Moreover, the efficient reimbursement system in developed countries and rising awareness aid market growth.

On the basis of End Users, hospitals & specialty clinics segment accounted for the largest share of the global stoma care industry, in 2020.

Based on end users, the stoma care market is segmented into hospitals & specialty clinics, home care settings, and ambulatory surgical centers. The hospitals & specialty clinics segment accounted for the largest share of the stoma/ostomy care market in 2020. The hospitals & specialty clinics segment accounted for 79.0% of the stoma care market in 2020. The rising target patient population and the favorable reimbursement scenario in most developed countries are the major factors supporting the growth of this segment.

Hospitals and key players operating in this market are collaborating to provide training to healthcare professionals and nurses about stoma care to increase the success rate associated with the procedure and reduce postoperative complications. This factor is expected to increase the number of patients undergoing colostomy, ileostomy, and urostomy procedures, further supporting the growth of this segment. For instance, the Wound, Ostomy and Continence Nurses Society (US) has designed a program on ‘Access to Wound, Ostomy, and Continence (WOC) Supplies.’ The program is aimed to protect and enhance patients’ access to WOC supplies.

The growing demand for home healthcare services is an important trend in the end-user market. Moreover, patients who have undergone colostomy, ileostomy, and urostomy surgeries often require ostomy care till the reversal of the surgery or during their lifetime. This has increased the demand for home care services. In recent times, ambulatory surgical centers have emerged as important end users in the stoma care market.

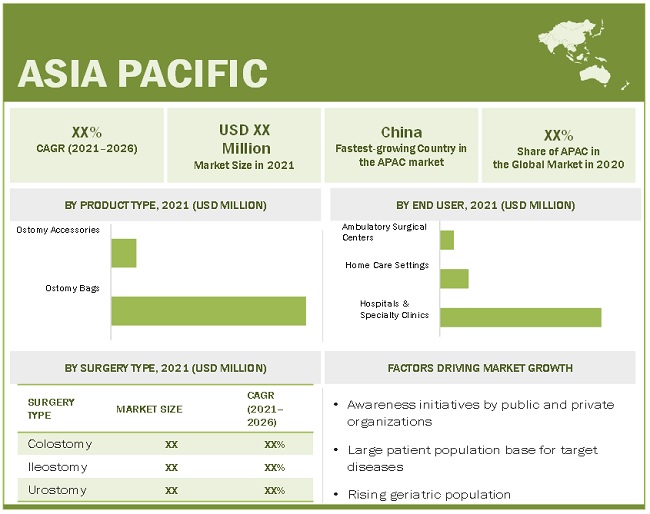

The Asia Pacific region of the stoma care industry is expected to grow at the highest CAGR during the forecast period

The global stoma care market is segmented into five major regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe accounted for the largest share of 37.85% of the ostomy care market in 2020. The large share of this region can be attributed to the growing patient population, rising geriatric population (as this population segment is more prone to developing gastrointestinal diseases which require ostomy procedures), and favorable reimbursement scenario.

The Asia Pacific region is expected to register the highest growth during the forecast period. The Asia Pacific market is segmented into Japan, China, India, South Korea, Australia, and the Rest of Asia Pacific. In 2020, the APAC accounted for 23.84% of the ostomy care market.

Awareness initiatives by public and private organizations, a large patient population base for target diseases, and the rising geriatric population are the key factors driving the growth of stoma care market. In addition, many market players are focusing on strengthening their distribution networks in APAC markets to capitalize on the growth opportunities in this region.

Prominent players in the ostomy care market include Coloplast Corp (Denmark), Hollister Incorporated (US), B. Braun Melsungen AG (Germany), ConvaTec Inc. (England), Salts Healthcare (UK), Welland Medical Limited (UK), Flexicare Group Limited (UK), Alcare Co. Ltd. (Japan), Cymed Micro Skin (US), Marlen Manufacturing & Development Company (US), Nu-Hope Labs (US), Torbot Group Inc. (US), Smith & Nephew (UK), Perma-Type Company Inc. (US), and 3M (US).

Coloplast is a prominent player in the stoma care market. The company’s leading position in this market can be attributed to its strong pipeline of new products, sustained cost discipline, and adoption of new strategies to enhance its product portfolio based on new technologies available in the market. The ostomy care business of the company has witnessed organic sales growth of 6% in 2020 FY. This growth was mainly supported by its SenSura Mio product line in various important markets.

The company maintains a database of around 1.5 million users and offers direct support to end users in more than 30 countries. Its key subsidiaries are Coloplast de Argentina S.A. (Argentina), Coloplast Pty. Ltd. (Australia), Coloplast do Brasil Ltda. (Brazil), Lilial S.A.S. (France), Coloplast Turkey AS (Turkey), Coloplast Corp. (USA), Coloplast Korea Limited (Korea), and Coloplast K.K. (Japan).

The company also focuses on expanding its market presence through M&A, product launches, and contracts activities. For instance, in 2021, Coloplast opened its first factory in Central America in Costa Rica.

Scope of the Stoma Care Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$2.6 billion |

|

Projected Revenue Size by 2026 |

$3.2 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 4.3% |

|

Market Driver |

Growing target patient population and prevalence of inflammatory bowel diseases |

|

Market Opportunity |

Growth opportunities offered by emerging markets |

In this report, the stoma care market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Ostomy bags

- Ostomy accessories

By Surgery type

- Colostomy

- Ileostomy

- Urostomy

By End Users

- Hospitals and Specialty clinics

- Home care settings

- Ambulatory Surgical Centers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLA

- Middle East & Africa

Recent Developments

- In June 2021, Welland Medical Limited launched a new innovative ostomy bag under the brand name Aurum Plus. It is available in both closed and drainable types.

- May 2021, Welland Medical Limited started its new distribution center in Costa Rica with Panamedical de Costa Rica.

- In March 2021, ConvaTec and Vizient signed a three-year contract for ostomy care products. The deal will help ConvaTec grow its market presence.

- In July 2019, Coloplast launched SenSura Mio Baby and SenSura Mio Kids.

Frequently Asked Questions (FAQ):

What is the expected addressable market value of global stoma care market over a 5-year period?

The global ostomy care market is expected to reach USD 3.2 billion by 2026 from an estimated USD 2.6 billion in 2021, at a CAGR of 4.3% from 2021 to 2026.

Which segment based on product type is expected to garner the highest traction within the stoma care market?

Based on product, the ostomy care market is segmented into two broad categories—ostomy bags and accessories. The ostomy bags segment accounted for the largest share of the stoma care market in 2020. The large share of this segment is attributed to their high usage and low cost. However, the accessories segment is expected to grow at the highest CAGR during the forecast period.

What are the strategies adopted by the top market players to penetrate emerging regions?

The key growth strategies adopted by the top players in stoma care market include product launches; agreements and partnerships; acquisitions and expansion.

What are the major factors expected to limit the growth of the stoma care market?

Discomfort and other issues associated with the use of ostomy bags, social stigma, complications, and the growing adoption of alternative treatments are limiting the growth of stoma care market.

What is the adoption pattern for stoma care across major healthcare markets?

Europe dominated the stoma care market with the largest market share in 2020. The large share of this region in the global market can be attributed to the high incidence of colorectal and bladder cancers and favorable reimbursement in the region. The population structure of European countries represents low birth rates and higher life expectancy. The rising aging population indicates future increases in the incidence of colon and bladder cancers, IBD, and incontinence. In addition, changes in lifestyle, industrialization, changing food habits, and the growing prevalence of smoking have increased the number of ostomy surgeries conducted in Europe. The rapid expansion of healthcare infrastructure across emerging European countries (such as Russia and Poland) will also contribute to the demand for ostomy management products in Europe. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 STOMA CARE MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

FIGURE 1 MARKETS COVERED

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY USED FOR THE STUDY

TABLE 1 EXCHANGE RATES UTILIZED FOR THE CONVERSION TO USD

1.5 STOMA CARE MARKET - KEY STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Indicative list of secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

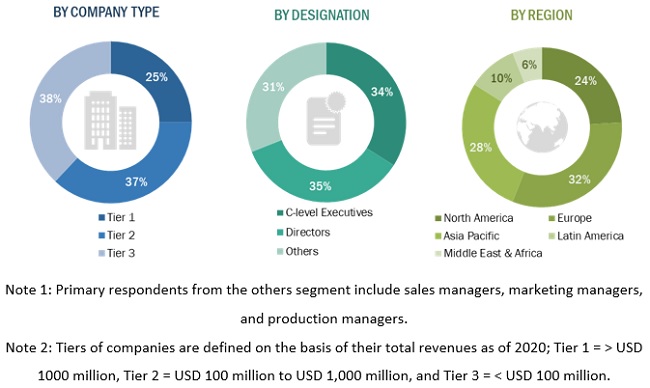

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

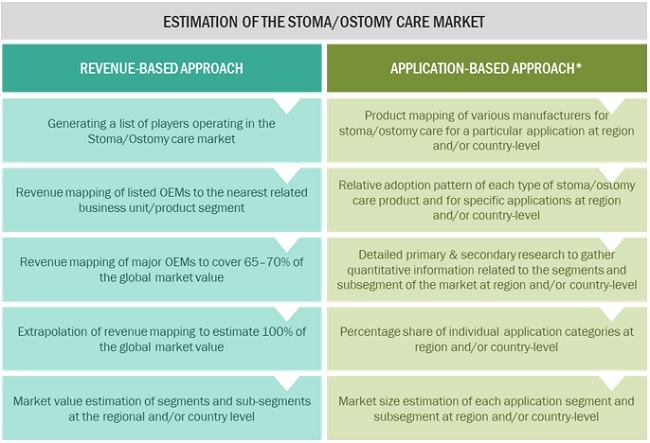

2.2 STOMA CARE MARKET SIZE ESTIMATION METHODOLOGY

FIGURE 4 REVENUE MAPPING-BASED MARKET ESTIMATION

2.3 MARKET SIZE ESTIMATION

2.3.1 PRODUCT-BASED MARKET ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: REVENUE-BASED APPROACH

2.3.2 EPIDEMIOLOGY-BASED MARKET SIZE ESTIMATION

2.3.3 PRIMARY RESEARCH VALIDATION

2.4 STOMA CARE MARKET - BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.5 RESEARCH LIMITATIONS AND ASSUMPTIONS

2.5.1 ASSUMPTIONS FOR THE STUDY

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 7 OSTOMY CARE MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 8 MARKET, BY SURGERY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 9 STOMA CARE MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 10 OSTOMY ACCESSORIES MARKET SHARE, BY TYPE, 2020 VS. 2025

FIGURE 11 GEOGRAPHICAL SNAPSHOT OF THE STOMA CARE MARKET

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 OSTOMY CARE MARKET OVERVIEW

FIGURE 12 GROWING TARGET PATIENT POPULATION IS DRIVING THE GROWTH OF THE OSTOMY CARE MARKET

4.2 STOMA CARE MARKET SEGMENTAL OVERVIEW, 2020 (USD MILLION)

FIGURE 13 HOSPITALS & SPECIALITY CLINICS TO DOMINATE THE MARKET, BY END USER, IN 2020

4.3 EUROPE: MARKET, BY SURGERY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 14 COLOSTOMY SEGMENT DOMINATES THE EUROPEAN STOMA CARE MARKET

4.4 GEOGRAPHIC SNAPSHOT OF THE GLOBAL MARKET

FIGURE 15 ASIA PACIFIC IS THE FASTEST-GROWING MARKET FOR OSTOMY PRODUCTS

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 STOMA CARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing target patient population and prevalence of inflammatory bowel diseases

FIGURE 17 NUMBER OF NEW COLORECTAL CANCER CASES, BY COUNTRY (2020)

5.2.1.2 Rising geriatric population

FIGURE 18 NUMBER OF COLORECTAL CANCER CASES, BY AGE (2020)

FIGURE 19 NUMBER OF BLADDER CANCER CASES, BY AGE (2020)

5.2.1.3 Technological advancements

5.2.1.4 Favorable reimbursement system in developed countries

5.2.1.5 Awareness programs

5.2.2 RESTRAINTS

5.2.2.1 Complications associated with ostomy

5.2.2.2 Growing adoption of alternative treatments

5.2.2.3 Discomfort and other issues associated with ostomy bags

5.2.3 OPPORTUNITIES

5.2.3.1 Growth opportunities offered by emerging markets

5.2.3.2 Growing internet usage for online sales

5.2.3.3 Growing medical tourism in Asian countries

5.2.4 CHALLENGES

5.2.4.1 Disparities in reimbursement for ostomy supplies in emerging countries

5.3 REGULATORY LANDSCAPE

TABLE 2 INDICATIVE LIST OF REGULATORY AUTHORITIES GOVERNING THE OSTOMY CARE MARKET

5.3.1 NORTH AMERICA

5.3.1.1 US

TABLE 3 CLASSIFICATION OF MEDICAL DEVICES BY US FDA

5.3.1.2 Canada

5.3.2 EUROPE

5.3.3 ASIA PACIFIC

5.3.3.1 India

5.3.3.2 China

TABLE 4 NMPA MEDICAL DEVICE CLASSIFICATION

5.3.3.3 Japan

TABLE 5 CLASSIFICATION OF MEDICAL DEVICES BY PMDA

5.4 COVID-19 IMPACT ON THE STOMA/OSTOMY CARE MARKET

5.5 REIMBURSEMENT SCENARIO

TABLE 6 NUMBER OF SUPPLIES COVERED BY MEDICARE 2021

5.6 PATENT ANALYSIS

5.6.1 PATENTS GRANTED FOR OSTOMY CARE

FIGURE 20 PATENTS GRANTED FOR OSTOMY CARE (JANUARY 2011 TO NOVEMBER 2021)

5.6.2 JURISDICTION AND TOP APPLICANT ANALYSIS

TABLE 7 TOP 20 PATENT OWNERS FOR OSTOMY CARE (JANUARY 2011 TO NOVEMBER 2021)

FIGURE 21 TOP 10 PATENT APPLICANTS FOR OSTOMY CARE(JANURAY 2011 TO NOVEMBER 2021)

FIGURE 22 PATENTS FOR OSTOMY CARE, BY JURISDICTION (JANUARY 2011 TO NOVEMBER 2021)

5.7 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN OF THE OSTOMY CARE MARKET

5.8 PRICING TREND ANALYSIS

TABLE 8 AVERAGE PRICE OF STOMA CARE PRODUCTS, BY DEVICE NAME, 2020 (USD)

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 OSTOMY CARE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.1 ECOSYSTEM LANDSCAPE

FIGURE 24 STOMA/OSTOMY CARE MARKET: ECOSYSTEM LANDSCAPE

6 STOMA CARE MARKET, BY SURGERY TYPE (Page No. - 68)

6.1 INTRODUCTION

TABLE 10 STOMA CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

6.2 COLOSTOMY

6.2.1 A LARGE NUMBER OF COLOSTOMIES PERFORMED TO DRIVE MARKET GROWTH

TABLE 11 TYPES OF COLOSTOMY BASED ON STOMA LOCATION

TABLE 12 STOMA/OSTOMY CARE MARKET FOR COLOSTOMY, BY COUNTRY/REGION, 2019–2026 (USD MILLION)

6.3 ILEOSTOMY

6.3.1 INCREASING INCIDENCE OF ULCERATIVE COLITIS AND CROHN’S DISEASE TO SUPPORT MARKET GROWTH

TABLE 13 TYPES OF ILEOSTOMY PROCEDURES

TABLE 14 STOMA CARE MARKET FOR ILEOSTOMY, BY COUNTRY/REGION, 2019–2026 (USD MILLION)

6.4 UROSTOMY

6.4.1 UROSTOMIES ARE COMMONLY PERFORMED FOR THE TREATMENT OF BLADDER CANCER

TABLE 15 STOMA CARE MARKET FOR UROSTOMY, BY COUNTRY/REGION, 2019–2026 (USD MILLION)

7 STOMA CARE MARKET, BY PRODUCT (Page No. - 74)

7.1 INTRODUCTION

TABLE 16 STOMA/OSTOMY CARE MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

7.2 OSTOMY BAGS

7.2.1 EUROPE IS THE LARGEST MARKET FOR OSTOMY BAGS

TABLE 17 OSTOMY BAGS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3 OSTOMY ACCESSORIES

TABLE 18 OSTOMY ACCESSORIES MARKET, BY TYPE, 2019–2026 (USD MILLION)

7.3.1 PASTES & POWDERS

7.3.1.1 These products protect the skin and increase the wear time of ostomy products

TABLE 19 PASTES & POWDERS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3.2 CREAMS

7.3.2.1 Creams help in adding moisture to dry skin caused due to the application and removal of skin barriers

TABLE 20 CREAMS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3.3 CLEANSERS

7.3.3.1 Cleansers are designed to clean the skin around the stoma

TABLE 21 CLEANSERS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3.4 DEODORANTS

7.3.4.1 Deodorants help in reducing odor emanation

TABLE 22 DEODORANTS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3.5 STOMA CAPS

7.3.5.1 Stoma caps help in living a normal life

TABLE 23 STOMA CAPS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3.6 BELTS

7.3.6.1 Belts enhance pouching system adhesion

TABLE 24 BELTS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3.7 POUCH COVERS

7.3.7.1 Pouch cover increases stoma pouch system aesthetics

TABLE 25 POUCH COVERS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3.8 TAPES

7.3.8.1 Tapes help in increasing the adhesion of the skin barrier

TABLE 26 TAPES MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3.9 SEALS/BARRIER RINGS

7.3.9.1 Barrier rings help protect peristomal skin

TABLE 27 SEALS/BARRIER RINGS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3.10 POUCH CLOSERS

7.3.10.1 Pouch closers form a small segment of the market

TABLE 28 POUCH CLOSERS MARKET, BY REGION, 2019–2026 (USD MILLION)

8 STOMA CARE MARKET, BY END USER (Page No. - 83)

8.1 INTRODUCTION

TABLE 29 STOMA/OSTOMY CARE MARKET, BY END USER, 2019–2026 (USD MILLION)

8.2 HOSPITALS & SPECIALTY CLINICS

8.2.1 A LARGE NUMBER OF OSTOMY PROCEDURES PERFORMED IN HOSPITALS IS SUPPORTING THE GROWTH OF THIS SEGMENT

TABLE 30 STOMA CARE MARKET FOR HOSPITALS & SPECIALTY CLINICS, BY REGION, 2019–2026 (USD MILLION)

8.3 HOME CARE SETTINGS

8.3.1 HOME CARE SETTINGS ARE THE SECOND-LARGEST END USERS OF OSTOMY PRODUCTS

TABLE 31 STOMA CARE MARKET FOR HOME CARE SETTINGS, BY REGION, 2019–2026 (USD MILLION)

8.4 AMBULATORY SURGICAL CENTERS

8.4.1 AMBULATORY CENTERS PROVIDE SAME-DAY CARE AND ARE FINDING INCREASING PREFERENCE

TABLE 32 OSTOMY CARE MARKET FOR AMBULATORY SURGICAL CENTERS, BY REGION, 2019–2026 (USD MILLION)

9 STOMA/OSTOMY CARE MARKET, BY REGION (Page No. - 88)

9.1 INTRODUCTION

FIGURE 25 GEOGRAPHIC SNAPSHOT OF THE STOMA CARE MARKET

TABLE 33 OSTOMY CARE MARKET, BY REGION, 2019–2026 (USD MILLION)

9.2 EUROPE

FIGURE 26 EUROPE: STOMA CARE MARKET SNAPSHOT

TABLE 34 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 35 EUROPE: STOMA CARE MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 36 EUROPE: MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

TABLE 37 EUROPE: OSTOMY CARE ACCESSORIES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 38 EUROPE: STOMA CARE MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2.1 GERMANY

9.2.1.1 Favorable reimbursement scenario to support market growth

TABLE 39 GERMANY: OSTOMY CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

9.2.2 UK

9.2.2.1 Rising patient population to support the adoption of ostomy products in the country

TABLE 40 UK: OSTOMY CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

9.2.3 FRANCE

9.2.3.1 Growing initiatives by the government to propel market growth

TABLE 41 FRANCE: OSTOMY CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

9.2.4 ITALY

9.2.4.1 Initiatives by private and government organizations to raise awareness about ostomy care are driving market growth in Italy

TABLE 42 ITALY: STOMA CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

9.2.5 SPAIN

9.2.5.1 The growing geriatric population has driven demand for ostomy procedures in Spain

TABLE 43 SPAIN: STOMA CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

9.2.6 REST OF EUROPE

TABLE 44 ROE: MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

9.3 NORTH AMERICA

TABLE 45 NORTH AMERICA: OSTOMY CARE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 47 NORTH AMERICA: STOMA CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

TABLE 48 NORTH AMERICA: OSTOMY CARE ACCESSORIES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 49 NORTH AMERICA: STOMA CARE MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.1 US

9.3.1.1 Favorable reimbursement scenario for ostomy supplies to support market growth in the US

TABLE 50 US: STOMA/OSTOMY CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

9.3.2 CANADA

9.3.2.1 A surge in the incidence of target diseases and favorable government guidelines to support market growth

TABLE 51 CANADA: STOMA/OSTOMY CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 27 ASIA PACIFIC: STOMA CARE MARKET SNAPSHOT

TABLE 52 ASIA PACIFIC: OSTOMY CARE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 53 ASIA PACIFIC: STOMA CARE MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 54 ASIA PACIFIC: MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

TABLE 55 ASIA PACIFIC: OSTOMY CARE ACCESSORIES MARKET, BY TYPE, –2026 (USD MILLION)

TABLE 56 ASIA PACIFIC: STOMA CARE MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Rising number of cancer cases to propel market growth

TABLE 57 JAPAN: OSTOMY CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Increasing patient pool and government initiatives for healthcare development are fueling the market growth

TABLE 58 CHINA: STOMA CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Rising patient population is propelling the market growth

TABLE 59 INDIA: STOMA CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

9.4.4 AUSTRALIA

9.4.4.1 Government initiatives to support market growth

TABLE 60 AUSTRALIA: STOMA CARE MARKET, BY SURGERY TYPE 2019–2026 (USD MILLION)

9.4.5 SOUTH KOREA

9.4.5.1 Increasing R&D activities in the country to drive market growth

TABLE 61 SOUTH KOREA: MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

9.4.6 REST OF APAC

TABLE 62 ROAPAC: STOMA CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

9.5 LATIN AMERICA

TABLE 63 LATIN AMERICA: STOMA MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 64 LATIN AMERICA: OSTOMY CARE MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 65 LATIN AMERICA: STOMA CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

TABLE 66 LATIN AMERICA: OSTOMY CARE ACCESSORIES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 67 LATIN AMERICA: STOMA CARE MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Growing adoption of healthcare insurance in the country to support market growth

TABLE 68 BRAZIL: STOMA CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

9.5.2 MEXICO

9.5.2.1 Increasing awareness programs are fueling the market growth

TABLE 69 MEXICO: OSTOMY CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

9.5.3 REST OF LATIN AMERICA

TABLE 70 ROLA: STOMA CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 IMPROVING HEALTHCARE INFRASTRUCTURE AND INCREASING PUBLIC-PRIVATE INVESTMENTS TO DRIVE MARKET GROWTH IN THE MEA

TABLE 71 MEA: STOMA CARE MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 72 MEA: OSTOMY CARE MARKET, BY SURGERY TYPE, 2019–2026 (USD MILLION)

TABLE 73 MEA: OSTOMY CARE ACCESSORIES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 74 MEA: STOMA CARE MARKET, BY END USER, 2019–2026(USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 115)

10.1 INTRODUCTION

FIGURE 28 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE STOMA/OSTOMY CARE MARKET, 2018–2021

10.2 REVENUE SHARE ANALYSIS

FIGURE 29 REVENUE SHARE ANALYSIS OF THE TOP PLAYERS IN THE STOMA/OSTOMY CARE MARKET

10.3 MARKET SHARE ANALYSIS

FIGURE 30 STOMA CARE MARKET SHARE, BY KEY PLAYER, 2020

10.4 COMPETITIVE LEADERSHIP MAPPING: COMPANY EVALUATION QUADRANT (2020)

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 PARTICIPANTS

FIGURE 31 STOMA/OSTOMY CARE MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

10.5 COMPETITIVE LEADERSHIP MAPPING: START-UP/SME EVALUATION QUADRANT (AS OF 2020)

10.5.1 PROGRESSIVE COMPANIES

10.5.2 RESPONSIVE COMPANIES

10.5.3 DYNAMIC COMPANIES

10.5.4 STARTING BLOCKS

FIGURE 32 STOMA/OSTOMY CARE MARKET: COMPETITIVE LEADERSHIP MAPPING (SMES/START-UPS)

10.6 COMPETITIVE BENCHMARKING

TABLE 75 PRODUCT FOOTPRINT ANALYSIS OF THE TOP PLAYERS IN THE STOMA/OSTOMY CARE MARKET

TABLE 76 COMPANY FOOTPRINT ANALYSIS IN THE STOMA/OSTOMY CARE MARKET

10.7 STOMA CARE MARKET COMPETITIVE SCENARIO (2018–2021)

10.7.1 STOMA CARE MARKET - PRODUCT LAUNCHES

10.7.2 DEALS

10.7.3 STOMA CARE MARKET - OTHER DEVELOPMENTS

11 COMPANY PROFILES (Page No. - 126)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1.1 COLOPLAST CORP

TABLE 77 COLOPLAST CORP: BUSINESS OVERVIEW

FIGURE 33 COLOPLAST CORP: COMPANY SNAPSHOT (2020)

11.1.2 CONVATEC

TABLE 78 CONVATEC INC.: BUSINESS OVERVIEW

FIGURE 34 CONVATEC INC.: COMPANY SNAPSHOT (2020)

11.1.3 B. BRAUN MELSUNGEN AG

TABLE 79 B. BRAUN MELSUNGEN AG: BUSINESS OVERVIEW

FIGURE 35 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2020)

11.1.4 HOLLISTER INCORPORATED

TABLE 80 HOLLISTER INCORPORATED: BUSINESS OVERVIEW

11.1.5 ALCARE CO. LTD.

TABLE 81 ALCARE CO. LTD.: BUSINESS OVERVIEW

11.1.6 CYMED MICRO SKIN

TABLE 82 CYMED MICRO SKIN: BUSINESS OVERVIEW

11.1.7 NU-HOPE LABORATORIES, INC.

TABLE 83 NU-HOPE LABORATORIES, INC.: BUSINESS OVERVIEW

11.1.8 FLEXICARE (GROUP) LIMITED

TABLE 84 FLEXICARE (GROUP) LIMITED: BUSINESS OVERVIEW

11.1.9 SALTS HEALTHCARE

TABLE 85 SALTS HEALTHCARE: BUSINESS OVERVIEW

11.1.10 WELLAND MEDICAL LIMITED

TABLE 86 WELLAND MEDICAL LIMITED: BUSINESS OVERVIEW

11.1.11 3M

TABLE 87 3M: BUSINESS OVERVIEW

FIGURE 36 3M: COMPANY SNAPSHOT (2020)

11.1.12 SMITH & NEPHEW

TABLE 88 SMITH & NEPHEW: BUSINESS OVERVIEW

FIGURE 37 SMITH & NEPHEW: COMPANY SNAPSHOT (2020)

11.1.13 MARLEN MANUFACTURING & DEVELOPMENT COMPANY

TABLE 89 MARLEN MANUFACTURING & DEVELOPMENT COMPANY: BUSINESS OVERVIEW

11.1.14 TORBOT GROUP INC.

TABLE 90 TORBOT GROUP INC: BUSINESS OVERVIEW

11.1.15 PERMA-TYPE COMPANY INC.

TABLE 91 PERMA-TYPE COMPANY INC.: BUSINESS OVERVIEW

11.2 OTHER PLAYERS

11.2.1 SCAPA HEALTHCARE

TABLE 92 SCAPA HEALTHCARE: BUSINESS OVERVIEW

11.2.2 TYTEX A/S

TABLE 93 TYTEX A/S: BUSINESS OVERVIEW

11.2.3 PROWESS CARE

TABLE 94 PROWESS CARE: BUSINESS OVERVIEW

11.2.4 SAFE N SIMPLE

TABLE 95 SAFE N SIMPLE: BUSINESS OVERVIEW

11.2.5 SCHENA OSTOMY TECHNOLOGIES INC.

TABLE 96 SCHENA OSTOMY TECHNOLOGIES INC.: BUSINESS OVERVIEW

11.2.6 AVITR FARMICA

TABLE 97 AVITR FARMICA: BUSINESS OVERVIEW

11.2.7 TRIO HEALTHCARE LTD.

TABLE 98 TRIO HEALTHCARE LTD.: BUSINESS OVERVIEW

11.2.8 CRIMSON HEALTHCARE PVT. LTD.

TABLE 99 CRIMSON HEALTHCARE PVT. LTD.: BUSINESS OVERVIEW

11.2.9 FORTIS MEDICAL PRODUCTS

TABLE 100 FORTIS MEDICAL PRODUCTS: BUSINESS OVERVIEW

11.2.10 ANGIPLAST PVT. LTD.

TABLE 101 ANGIPLAST PVT. LTD.: BUSINESS OVERVIEW

11.2.11 OAKMED HEALTHCARE

TABLE 102 OAKMED HEALTHCARE: BUSINESS OVERVIEW

11.2.12 WUJIANG EVERGREEN EX/IM CO. LTD.

TABLE 103 WUJIANG EVERGREEN EX/IM CO. LTD.: BUSINESS OVERVIEW

11.2.13 ZHEJIANG AILEBAO MEDICAL TECHNOLOGIES CO. LTD.

TABLE 104 ZHEJIANG AILEBAO MEDICAL TECHNOLOGIES CO. LTD.: BUSINESS OVERVIEW

11.2.14 EAKIN HEALTHCARE GROUP

TABLE 105 EAKIN HEALTHCARE GROUP: BUSINESS OVERVIEW

11.2.15 POLARSEAL

TABLE 106 POLARSEAL: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 193)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

This research study involved extensive secondary sources; directories; databases such as D&B Hoovers, Bloomberg Business, and Factiva; white papers; annual reports; company house documents; and SEC filings of companies. Societies and organizations such as the World Health Organization (WHO) and Centers for Disease Control and Prevention (CDC) were also considered while estimating the size of the global stoma/ostomy care market.

Primary Research

In the primary research process, various respondents from the supply and demand side were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the stoma/ostomy care market. Primary sources from the demand side include research institutes, academic institutes, and pharmaceutical & biotechnology companies.

After completing the market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify segmentation types, industry trends, key players, the competitive landscape of stoma/ostomy care products supplied by different market players, and the key market dynamics such as drivers, opportunities, industry trends, and key player strategies.

- A robust primary research methodology has been adopted to validate the contents of the report and fill in the gaps. Telephonic and e-mail communication was adopted to conduct interviews (questionnaires were designed and sent to primary participants). Some of the major objectives of primary research were:

- To validate the segmentation defined through the assessment of the product portfolios of the leading players in the market

- To understand the key industry trends and issues defining the growth objectives of market players

- To gather demand and supply-side validation of the key factors affecting market growth, including market drivers, restraints, opportunities, and challenges

- To validate assumptions for the market sizing and forecasting model used for this market study

- To understand the market position of leading players in the stoma/ostomy care market and their market shares/rankings

- To understand the ongoing pricing trends in the market and future expectations

- To understand and validate the impact of COVID-19 on the global and regional stoma/ostomy care markets

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

The top-down and bottom-up approaches were used to estimate and validate the sizes of the global market and various other dependent submarkets of the stoma/ostomy care market. The research methodology used to estimate the market size includes the following details:

- The key players in the market were identified through secondary research, and their market contributions in respective regions were determined through primary and secondary research.

- This entire procedure included the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined by secondary sources and verified through primary sources.

- All the possible parameters affecting the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to reach the final quantitative and qualitative data.

- The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in the report.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation:

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply side. Along with this, the market was validated using the top-down and bottom-up approaches.

Report Objectives:

- To define, describe and forecast the stoma/ostomy care market based on surgery type, ostomy products & accessories, end user, and region.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges).

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the revenues of market segments in five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies in the global stoma/ostomy care market.

- To track and analyze competitive developments such as partnerships, agreements, expansions, and product launches in the global stoma/ostomy care market.

- To study the impact of COVID-19 on the market and specifically analyze the current market trends in terms of the regulatory landscape, reimbursement scenario, and pricing.

- To study the advancements in ostomy care by identifying new patents and mergers & acquisitions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global defibrillator market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe stoma/ostomy care market into Belgium, Austria, the Czech Republic, Denmark, Greece, Poland, and Russia, among other

- Further breakdown of the Rest of Asia Pacific stoma/ostomy care market into New Zealand, Vietnam, the Philippines, Singapore, Malaysia, Thailand, and Indonesia among other

- Further breakdown of the Latin American stoma/ostomy care market into Argentina, Chile, Peru, and Colombia, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Stoma Care Market

What are the growth opportunities for the key players in the Global Stoma Care Market?

What challenges are faced during the global growth of the Global Stoma Care Market?

Can you please elaborate more on the emerging trends in the Global Stoma Care Market? Thank You