Urinary Catheters Market by Product (Indwelling, Intermittent, External), Type (Coated, Uncoated), Application (Urinary Incontinence, Benign Prostate Hyperplasia, General Surgery), Usage (Male, Female), End User (Hospitals) & Region - Global Forecast to 2025

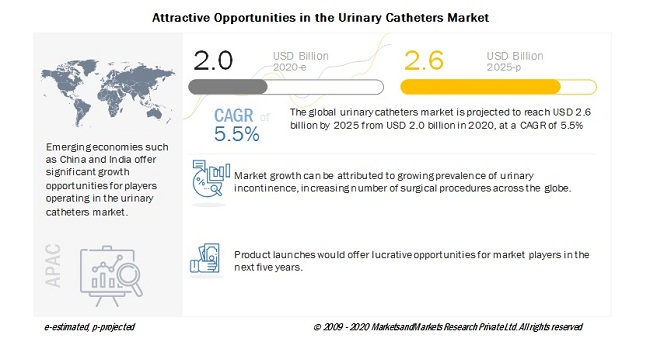

The global urinary catheters market in terms of revenue was estimated to be worth $2.0 billion in 2020 and is poised to reach $2.6 billion by 2025, growing at a CAGR of 5.5% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.The growing prevalence of urinary incontinence, an increasing number of surgical procedures across the globe, high incidence of prostate cancer, and the favorable reimbursement scenario are the major factors driving the growth of the global market. However, the availability of alternative treatment options for urinary incontinence may restrict market growth to a certain extent.

To know about the assumptions considered for the study, Request for Free Sample Report

Urinary Catheters Market Dynamics

Driver: Growing prevalence of urinary incontinence

The high prevalence of urinary incontinence is a major factor leading to the increased demand for urinary catheters, globally. Prevalence rates are higher in the elderly population and among nursing home patients. Urinary catheters are used to manage incontinence, which cannot be treated or managed with medicines or surgery. The prevalence of urinary incontinence is expected to grow due to the growing aging population and the increasing incidence of obesity, as these are the two major risk factors for urinary incontinence further.

Restraint: Complications associated catheterization and availability of alternatives

Catheterization is a painful process. The insertion and removal of poorly lubricated catheters can cause friction between the urethral walls and the surface of the device, which is not only painful for the patient but can also, upon regular use, lead to the narrowing of the urethra, bleeding, and infection. Special care is required during catheterization to prevent urinary tract infections (UTIs) or catheter-associated urinary tract infections (CAUTIs). As a result, there are various alternative invasive and non-invasive treatment options in place for the treatment of temporary incontinence. Their availability, given the disadvantages of catheterization, is expected to limit the market for urinary catheters.

Opportunity: Emerging economies

Emerging economies (such as China, India, South Korea, Brazil, and Mexico) offer significant growth opportunities to major market players. This can be attributed to their low regulatory barriers, improvements in healthcare infrastructure, growing patient population, and rising healthcare expenditure. The regulatory policies in the Asia Pacific are more adaptive and business-friendly than those in developed countries. This, along with the increasing competition in mature markets, has drawn key players in the global market to focus on emerging countries. For instance, in April 2018, B. Braun opened five new medical production facilities in Penang, Malaysia, and in 2017, it established a subsidiary in Zambia.

The coated catheters segment of the urinary catheters industry will witness the highest growth during the forecast period.

Based on catheter type, the global urinary catheters market is segmented into coated and uncoated catheters. Coated catheters accounted for the largest share of the global market. This segment is also expected to register the highest CAGR during the forecast period. The growth in this market is primarily attributed to the various advantages associated with coated catheters, such as easier, more comfortable insertion, low risk of catheter-associated urinary tract infection, reduced risk of urethral damage, and improved patient satisfaction.

The urinary continence segment dominated the urinary catheters industry.

Based on application, the global market is segmented into urinary incontinence, general surgery, benign prostatic hyperplasia, and other applications. The urinary incontinence segment accounted for the largest share of the global market. This segment is also expected to witness the highest CAGR during the forecast period. The large share and high growth of this segment can primarily be attributed to the increasing incidence of urinary incontinence, the growing geriatric population, and the increasing incidence of obesity.

To know about the assumptions considered for the study, download the pdf brochure

North America was the largest region for urinary catheters industry.

The urinary catheters market is segmented into North America, Europe, the Asia Pacific, and the Rest of the World. In 2019, North America was the largest regional segment of the overall market, followed by Europe. Factors such as the high prevalence of diseases, growing geriatric population, the availability of advanced interventional products (including urinary catheters), and increasing surgical procedures performed in the region are driving market growth in North America.

The prominent players operating in this market include B. Braun Melsungen AG (Germany), Boston Scientific Corporation (US), Coloplast Ltd. (Denmark), ConvaTec Inc. (UK), Becton, Dickinson and Company (US), and Cardinal Health (US).

Scope of the Urinary Catheters Industry:

|

Report Metric |

Details |

|

Market Revenue in 2020 |

$2.0 billion |

|

Estimated Value by 2025 |

$2.6 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 5.5% |

|

Market Driver |

Growing prevalence of urinary incontinence |

|

Market Opportunity |

Emerging economies |

This report categorizes the urinary catheters market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Indwelling Catheters

- Intermittent Catheters

- External Catheters

By Type

- Coated Catheters

- Uncoated Catheters

By Usage

- Male Urinary Catheters

- Female Urinary Catheters

By Application

- Urinary Incontinence

- General Surgery

- Benign Prostatic Hyperplasia

- Other Applications (spinal cord injuries, spina bifida, multiple sclerosis, and Parkinson’s disease)

By End User

- Hospitals

- Long-Term Care Facilities

- Other End Users (emergency clinics and physicians’ offices)

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Rest of the World

Recent Developments of Urinary Catheters Industry

- In 2019, Bactiguard launched BIP Foley TempSensor. This enhanced the urinary catheters product portfolio of Bactiguard.

- In 2019, ConvaTec Group acquired Southlake Medical Supplies, Inc. (US). This acquisition helped to strengthen ConvaTec’s distribution of catheter-related supplies in the US.

- In 2018, Coloplast acquired IncoCare Gunhild Vieler GmbH (Germany). This acquisition helped strengthen the company’s position in Germany, primarily in home care continence supplies.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global urinary catheters market?

The global urinary catheters market boasts a total revenue value of $2.6 billion by 2025.

What is the estimated growth rate (CAGR) of the global urinary catheters market?

The global urinary catheters market has an estimated compound annual growth rate (CAGR) of 5.5% and a revenue size in the region of $2.0 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 URINARY CATHETERS MARKET

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.2 SECONDARY DATA

2.2.1 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

2.3.1 KEY DATA FROM PRIMARY SOURCES

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.4.2 GROWTH FORECAST

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.6 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 32)

FIGURE 6 GLOBAL MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 7 GLOBAL MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 8 GLOBAL MARKET, BY USAGE, 2020-2025 (USD MILLION)

FIGURE 9 GLOBAL MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 10 GLOBAL MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 11 GEOGRAPHIC SNAPSHOT OF THE GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 URINARY CATHETERS MARKET OVERVIEW

FIGURE 12 GROWING TARGET PATIENT POPULATION TO DRIVE MARKET GROWTH DURING THE FORECAST PERIOD

4.2 ASIA PACIFIC: MARKET, BY APPLICATION & COUNTRY (2019)

FIGURE 13 URINARY INCONTINENCE APPLICATIONS DOMINATED THE GLOBAL MARKET IN ASIA PACIFIC IN 2019

4.3 GLOBAL MARKET, BY END USER, 2019

FIGURE 14 HOSPITALS TO BE THE LARGEST END USERS OF URINARY CATHETERS DURING THE FORECAST PERIOD

4.4 GLOBAL MARKET: GEOGRAPHIC SNAPSHOT

FIGURE 15 CHINA TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 URINARY CATHETERS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND TRENDS

5.2.1 DRIVERS

5.2.1.1 Growing prevalence of urinary incontinence

TABLE 1 GLOBAL PREVALENCE OF URINARY INCONTINENCE

5.2.1.1.1 Increasing rates of obesity

TABLE 2 PROJECTED GROWTH RATE OF OBESITY IN VARIOUS COUNTRIES

5.2.1.1.2 Rapidly increasing geriatric population

TABLE 3 GLOBAL OVERVIEW OF THE RISE IN THE AGING POPULATION (MILLION)

5.2.1.2 High incidence of prostate cancer

TABLE 4 GLOBAL INCIDENCE AND PREVALENCE OF PROSTATE CANCER

5.2.1.3 Increasing number of surgical procedures

TABLE 5 NUMBER OF SURGICAL PROCEDURES, BY COUNTRY, 2014 VS. 2018

5.2.1.4 Favorable reimbursement scenario

5.2.2 RESTRAINTS

5.2.2.1 Complications associated with catheterization and the availability of alternatives

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging economies

5.2.4 TRENDS

5.2.4.1 Growing preference for single-use catheters and self-catheterization

5.2.5 COVID IMPACT

5.3 PRICING ANALYSIS

TABLE 6 PRICE OF URINARY CATHETERS (USD)

5.4 VALUE CHAIN ANALYSIS

FIGURE 17 MAJOR VALUE IS ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASE

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 18 DISTRIBUTION-A STRATEGY PREFERRED BY PROMINENT COMPANIES

5.6 ECOSYSTEM ANALYSIS OF THE UROLOGY DEVICES MARKET

FIGURE 19 ECOSYSTEM ANALYSIS OF THE UROLOGY DEVICES MARKET

6 URINARY CATHETERS MARKET, BY PRODUCT (Page No. - 51)

6.1 INTRODUCTION

TABLE 7 GLOBAL MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 8 GLOBAL MARKET, BY PRODUCT, 2018-2025 (MILLION UNITS)

6.2 INDWELLING CATHETERS

6.2.1 INDWELLING CATHETERS TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

TABLE 9 INDICATIONS FOR SUPRAPUBIC AND URETHRAL CATHETERIZATION

TABLE 10 INDWELLING GLOBAL MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 11 INDWELLING GLOBAL MARKET, BY REGION, 2018-2025 (MILLION UNITS)

6.3 INTERMITTENT CATHETERS

6.3.1 INTERMITTENT CATHETERS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 12 INTERMITTENT GLOBAL MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 13 INTERMITTENT GLOBAL MARKET, BY REGION, 2018-2025 (MILLION UNITS)

6.4 EXTERNAL CATHETERS

6.4.1 ADVANTAGES SUCH AS MINIMIZED RISK OF DAMAGE TO THE URETHRA TO DRIVE THE MARKET FOR EXTERNAL CATHETERS

TABLE 14 EXTERNAL GLOBAL MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 15 EXTERNAL GLOBAL MARKET, BY REGION, 2018-2025 (MILLION UNITS)

7 URINARY CATHETERS MARKET, BY TYPE (Page No. - 57)

7.1 INTRODUCTION

TABLE 16 GLOBAL MARKET, BY TYPE, 2018-2025 (USD MILLION)

7.2 COATED CATHETERS

7.2.1 COATED CATHETERS ARE THE LARGEST AND FASTEST-GROWING SEGMENT IN THE GLOBAL MARKET

TABLE 17 COATED GLOBAL MARKET, BY REGION, 2018-2025 (USD MILLION)

7.3 UNCOATED CATHETERS

7.3.1 AFFORDABLE PRICE AND EASY AVAILABILITY TO DRIVE THE MARKET FOR UNCOATED CATHETERS

TABLE 18 ADVANTAGES AND DISADVANTAGES OF COMMONLY USED URINARY CATHETER MATERIALS

TABLE 19 UNCOATED GLOBAL MARKET, BY REGION, 2018-2025 (USD MILLION)

8 URINARY CATHETERS MARKET, BY USAGE (Page No. - 62)

8.1 INTRODUCTION

TABLE 20 GLOBAL MARKET, BY USAGE, 2018-2025 (USD MILLION)

8.2 MALE URINARY CATHETERS

8.2.1 HIGH INCIDENCE OF PROSTATE CANCER TO DRIVE THE MARKET FOR MALE URINARY CATHETERS

TABLE 21 MALE GLOBAL MARKET, BY REGION, 2018-2025 (USD MILLION)

8.3 FEMALE URINARY CATHETERS

8.3.1 HIGH PREVALENCE OF URINARY INCONTINENCE TO DRIVE THE MARKET FOR FEMALE URINARY CATHETERS

TABLE 22 FEMALE GLOBAL MARKET, BY REGION, 2018-2025 (USD MILLION)

9 URINARY CATHETERS MARKET, BY APPLICATION (Page No. - 65)

9.1 INTRODUCTION

TABLE 23 GLOBAL MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

9.2 URINARY INCONTINENCE

9.2.1 URINARY INCONTINENCE APPLICATION SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 24 GLOBAL MARKET FOR URINARY INCONTINENCE APPLICATIONS, BY REGION, 2018-2025 (USD MILLION)

9.3 GENERAL SURGERY

9.3.1 INCREASING NUMBER OF SURGERIES TO DRIVE MARKET GROWTH

TABLE 25 GLOBAL MARKET FOR GENERAL SURGERY APPLICATIONS, BY REGION, 2018-2025 (USD MILLION)

9.4 BENIGN PROSTATIC HYPERPLASIA

9.4.1 GROWING GLOBAL PREVALENCE OF BENIGN PROSTATIC HYPERPLASIA TO DRIVE THE DEMAND FOR URINARY CATHETERS

TABLE 26 GLOBAL MARKET FOR BENIGN PROSTATIC HYPERPLASIA APPLICATIONS, BY REGION, 2018-2025 (USD MILLION)

9.5 OTHER APPLICATIONS

TABLE 27 GLOBAL MARKET FOR OTHER APPLICATIONS, BY REGION, 2018-2025 (USD MILLION)

10 URINARY CATHETERS MARKET, BY END USER (Page No. - 70)

10.1 INTRODUCTION

TABLE 28 GLOBAL MARKET, BY END USER, 2018-2025 (USD MILLION)

10.2 HOSPITALS

10.2.1 HIGH PATIENT INFLUX AND PROCEDURAL VOLUMES MAKE HOSPITALS THE LARGEST END USERS OF URINARY CATHETERS

TABLE 29 GLOBAL MARKET FOR HOSPITALS, BY REGION, 2018-2025 (USD MILLION)

10.3 LONG-TERM CARE FACILITIES

10.3.1 GROWING DEMAND FOR LONG-TERM CARE SUPPORTS THE GROWTH OF THIS END-USER SEGMENT

TABLE 30 GLOBAL MARKET FOR LONG-TERM CARE FACILITIES, BY REGION, 2018-2025 (USD MILLION)

10.4 OTHER END USERS

TABLE 31 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2018-2025 (USD MILLION)

11 URINARY CATHETERS MARKET, BY REGION (Page No. - 74)

11.1 INTRODUCTION

TABLE 32 GLOBAL MARKET, BY REGION, 2018-2025 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 20 NORTH AMERICA: URINARY CATHETERS MARKET SNAPSHOT

TABLE 33 NORTH AMERICA: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.2.1 US

11.2.1.1 The US dominates the North American market

TABLE 39 US: KEY MACROINDICATORS

TABLE 40 US: MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 41 US: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 42 US: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 43 US: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 44 US: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Rising prevalence of target diseases to positively impact the market in Canada

TABLE 45 CANADA: KEY MACROINDICATORS

TABLE 46 CANADA: URINARY CATHETERS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 47 CANADA: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 48 CANADA: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 49 CANADA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 50 CANADA: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3 EUROPE

TABLE 51 EUROPE: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 52 EUROPE: MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 53 EUROPE: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 54 EUROPE: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 55 EUROPE: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 56 EUROPE: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Germany holds the largest share of the urinary catheters market in Europe

TABLE 57 GERMANY: KEY MACROINDICATORS

TABLE 58 GERMANY: MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 59 GERMANY: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 60 GERMANY: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 61 GERMANY: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 62 GERMANY: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.2 UK

11.3.2.1 Large number of road accidents to drive the market for urinary catheters in the country

TABLE 63 UK: KEY MACROINDICATORS

TABLE 64 UK: MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 65 UK: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 66 UK: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 67 UK: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 68 UK: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Favorable government initiatives have supported market growth in France

TABLE 69 FRANCE: KEY MACROINDICATORS

TABLE 70 FRANCE: URINARY CATHETERS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 71 FRANCE: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 72 FRANCE: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 73 FRANCE: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 74 FRANCE: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Increasing healthcare expenditure and investments are driving the market in Italy

TABLE 75 ITALY: MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 76 ITALY: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 77 ITALY: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 78 ITALY: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 79 ITALY: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Rising geriatric population will aid the market growth

TABLE 80 SPAIN: URINARY CATHETERS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 81 SPAIN: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 82 SPAIN: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 83 SPAIN: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 84 SPAIN: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.3.6 REST OF EUROPE (ROE)

TABLE 85 ROE: CANCER CASES AND PROSTATE CANCER (%), BY COUNTRY, 2018

TABLE 86 ROE: HEALTHCARE EXPENDITURE, BY COUNTRY, 2006 VS. 2016 (% OF GDP)

TABLE 87 ROE: MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 88 ROE: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 89 ROE: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 90 ROE: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 91 ROE: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 21 ASIA PACIFIC: URINARY CATHETERS MARKET SNAPSHOT

TABLE 92 APAC: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 93 APAC: MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 94 APAC: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 95 APAC: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 96 APAC: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 97 APAC: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.4.1 JAPAN

11.4.1.1 Japan dominates the Asia Pacific market

TABLE 98 JAPAN: MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 99 JAPAN: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 100 JAPAN: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 101 JAPAN: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 102 JAPAN: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Improvements in healthcare infrastructure will favor market growth in China

TABLE 103 CHINA: URINARY CATHETERS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 104 CHINA: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 105 CHINA: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 106 CHINA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 107 CHINA: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.4.3 INDIA

11.4.3.1 High incidence of target medical conditions to drive the market for urinary catheters in the country

TABLE 108 INDIA: MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 109 INDIA: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 110 INDIA: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 111 INDIA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 112 INDIA: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.4.4 REST OF ASIA PACIFIC

TABLE 113 ROAPAC: CANCER CASES AND PROSTATE CANCER (%), BY COUNTRY, 2018

TABLE 114 ROAPAC: URINARY CATHETERS MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 115 ROAPAC: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 116 ROAPAC: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 117 ROAPAC: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 118 ROAPAC: MARKET, BY END USER, 2018-2025 (USD MILLION)

11.5 ROW

TABLE 119 ROW: NEW CANCER CASES AND PROSTATE CANCER (%), BY COUNTRY, 2018

TABLE 120 ROW: MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 121 ROW: MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 122 ROW: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 123 ROW: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 124 ROW: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 125 ROW: MARKET, BY END USER, 2018-2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 112)

12.1 OVERVIEW

FIGURE 22 KEY PLAYERS ADOPTED ORGANIC AS WELL AS INORGANIC GROWTH STRATEGIES BETWEEN 2017 AND 2020

FIGURE 23 MARKET EVOLUTION FRAMEWORK

12.2 COMPETITIVE SITUATIONS AND TRENDS

12.2.1 PARTNERSHIPS & AGREEMENTS

12.2.2 PRODUCT LAUNCHES & APPROVALS

12.2.3 EXPANSIONS

12.2.4 ACQUISITIONS

13 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 116)

13.1 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

13.1.1 MARKET SHARE ANALYSIS, 2019

FIGURE 24 URINARY CATHETERS MARKET, BY KEY PLAYER, 2019

13.2 COMPANY EVALUATION MATRIX

13.2.1 STARS

13.2.2 EMERGING LEADERS

13.2.3 PERVASIVE PLAYERS

13.2.4 PARTICIPANTS

FIGURE 25 MNM VENDOR DIVE COMPARISON MATRIX: GLOBAL MARKET

13.3 COMPETITIVE LEADERSHIP MAPPING (START-UPS)

13.3.1 PROGRESSIVE COMPANIES

13.3.2 STARTING BLOCKS

13.3.3 RESPONSIVE COMPANIES

13.3.4 DYNAMIC COMPANIES

FIGURE 26 MNM VENDOR DIVE COMPARISON MATRIX FOR START-UPS: GLOBAL MARKET

13.4 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, MnM View)*

13.4.1 COLOPLAST A/S

FIGURE 27 COLOPLAST A/S: COMPANY SNAPSHOT

13.4.2 BECTON, DICKINSON AND COMPANY (BD)

FIGURE 28 BECTON, DICKINSON AND COMPANY (BD): COMPANY SNAPSHOT

13.4.3 CONVATEC GROUP PLC

FIGURE 29 CONVATEC GROUP PLC: COMPANY SNAPSHOT

13.4.4 CARDINAL HEALTH

FIGURE 30 CARDINAL HEALTH: COMPANY SNAPSHOT

13.4.5 B. BRAUN MELSUNGEN AG

FIGURE 31 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT

13.4.6 BOSTON SCIENTIFIC CORPORATION

FIGURE 32 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT

13.4.7 ASID BONZ GMBH

13.4.8 BACTIGUARD

FIGURE 33 BACTIGUARD: COMPANY SNAPSHOT

13.4.9 COOK MEDICAL

13.4.10 CURE MEDICAL

13.4.11 GO MEDICAL INDUSTRIES PTY LTD.

13.4.12 HOLLISTER INCORPORATED

13.4.13 TELEFLEX INCORPORATED

FIGURE 34 TELEFLEX INCORPORATED: COMPANY SNAPSHOT

13.4.14 WELLSPECT HEALTHCARE (A SUBSIDIARY OF DENTSPLY SIRONA INC.)

FIGURE 35 DENTSPLY SIRONA: COMPANY SNAPSHOT

13.5 OTHER COMPANIES

13.5.1 AMSINO INTERNATIONAL, INC.

13.5.2 COMPACTCATH

13.5.3 DEGANIA SILICONE LTD. (A PART OF Q LIFE SCIENCES)

13.5.4 HUNTER UROLOGY

13.5.5 J AND M URINARY CATHETERS LLC

13.5.6 MANFRED SAUER GMBH

13.5.7 MEDICAL TECHNOLOGIES OF GEORGIA

13.5.8 RIBBEL INTERNATIONAL LIMITED

13.5.9 ROCAMED

13.5.10 UROCARE PRODUCTS, INC.

13.5.11 WELL LEAD MEDICAL CO., LTD.

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 158)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

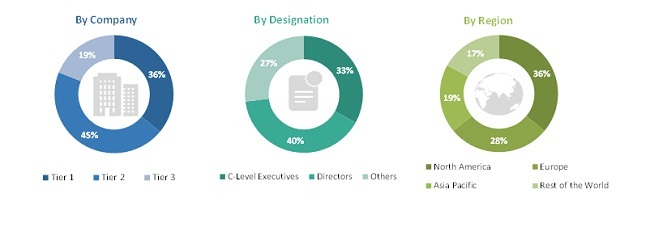

This study involved four major activities in estimating the current size of the urinary catheters market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the urinary catheters market. The secondary sources used for this study include World Health Organization (WHO), Organisation for Economic Co-operation and Development (OECD), National Center for Biotechnology Information (NCBI), Centers for Disease Control and Prevention (CDC), US Food and Drug Administration (US FDA), National Institutes of Health (NIH), National Cancer Institute (NCI), National Association for Continence (NAFC), Urology Care Foundation, Annual Reports, SEC Filings, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the urinary catheters market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the urinary catheters business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global urinary catheters market based on the product, type, usage, application, end user and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall urinary catheters market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and R&D activities in the urinary catheters market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- An additional five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Urinary Catheters Market