Panel Filters Market by Material (Fiberglass, Synthetic), Type (Disposable, Reusable), Application (Residential, Non-Residential), Region (North America, Europe, Asia Pacific, Middle East & Africa and South America) - Global Forecast to 2027

Panel Filters Market

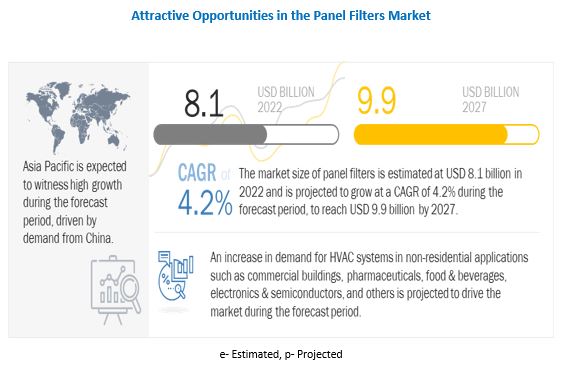

The global panel filters market was valued at USD 8.1 billion in 2022 and is projected to reach USD 9.9 billion by 2027, growing at 4.2% cagr from 2022 to 2027. Panel filters are specifically designed to eliminate solid pollutants and the molecular contaminants from the air. Large particles get carried out through the filter and stick to the threads of the panel filter through inertial mass effect, whilst lighter particles float through the filter through turbulent flow and get caught by fibres that make up the filter. When air enters into contact with the panel filter, the panel filter is being able to filter out solid air particles, dust, pollen, and even toxic fumes that are traveling through said air. The smaller particles at random hit each other, which lowers their speed and raises the chances of their capture by the panel filter. Any small particles are removed through diffusion and move through Brownian motion as it approaches the fibrous.

Panel filter is a versatile, sustainable, and durable, owing to which it is gaining traction across several industrial applications. Due to its superior properties and the changing government policies due to poor air quality index, the global market for panel filter is expected to grow.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Pandemic Impact

Due to COVID-19 pandemic, the suspension of manufacturing operation, disruption of supply chain, and declining demand for industrial goods had significant impact on the market. However, due to COVID-19 pandemic, the demand from pharmaceutical and healthcare industry increased, which, in turn, support for the growth of Panel Filters market. Also, due to changing lifestyle, global warming, and awareness regarding the Air quality index the installation of HVAC systems and AHU has risen. However, the application industries like manufacturing plants (other than healthcare), food and beverages industry, construction, and others were affected by the pandemic.

Panel Filters Market Dynamics

Driver: Rising awareness about air quality levels.

Indoor air quality refers to the quality of air within and around a building. Indoor air contains contaminants such as dust, pollen, fibers, metal or wood particles, hair & animal fur, bacteria, and microorganisms. These contaminants affect health by irritating eyes, nose, and throat, causing headaches, dizziness, and fatigue. These health problems can further lead to asthma and lung diseases. According to the US Environmental Protection Agency (EPA), inadequate ventilation can also pose health and comfort problems. Hence, there is an increasing awareness about indoor air quality to prevent such health problems. This awareness, in turn, is increasing the demand for filters in cooling and ventilation systems to prevent dust particles and contaminants from entering the interiors of buildings.

Industrialization and urbanization have increased environmental health risks and pollution, especially in emerging countries. The rise in pollution levels has triggered a rise in health issues among people in these countries. According to the 2021 world air quality report, only 222 of 6,475 global cities met the updated Particulate Matter (PM) 2.5 parameters provided by WHO and 93 cities have annual PM2.5 concentration levels exceeding ten times those of the WHO norms. Polluted air is considered to be one of the world’s largest health threats. It can cause various health diseases, ranging from asthma to cancer, lung illnesses, and heart disease. It is estimated that PM2.5 air pollution has caused deaths of 40,000 children under the age of five in 2021. The daily economic cost associated with air pollution has been figured at USD 8 billion, or between 3 to 4% of the Gross World Product (GWP).

The panel filter system is used to remove harmful gases and other air pollutants from air. The average efficiency of a panel air filter in air purification ranges between 25% and 30%. Therefore, for the protection of health from diseases and to provide clean air quality, governments in various countries have suggested the use of panel filters in various commercial well as industrial establishments such as corporates, shopping malls, data centers, food & beverages, and pharma manufacturing facilities to maintain appropriate air quality levels. The rising awareness regarding air quality levels are expected to drive the demand for panel filters in future.

Restraint: Rising environmental concerns.

According to the International Energy Agency, sales of air conditioners (ACs) witnessed an increase of approximately 15% during 2017–2018. Increase in the sales of ACs is also expected to lead to an increase in the air pollutants that are released during the functioning of the systems. ACs release hydrofluorocarbons (HFCs) which trap heat in the atmosphere, thus contributing to global warming. HVACs also consume approximately 32% of the total energy in the sector. The increased demand for and sales of ACs is therefore expected to increase the amount of energy and power consumed for their operation. This is expected to lead to demands on the depleting fossil fuel reserves, as the majority of the power is generated through fossil fuels such as coal. The use of highly efficient pre-filters such as panel filters in HVAC systems also increases energy consumption to prevent drop in pressure. To avoid the above situations, manufacturers of HVAC systems and panel filters require to develop energy-efficient and low carbon-emitting systems, which is expected to increase the costs of HVAC systems and panel filters. Hence, rising environmental concerns due to the increasing use of HVAC systems are hampering the growth of the panel filters market.

Opportunities: Rapid transformation through IoT in panel filters

The Internet of Things (IoT) represents a scenario wherein panel filters are connected to the Internet to enable data sharing. It collects data, stores it in the cloud, improves operations for better efficiency, and runs a predictive maintenance schedule. For instance, Automatic Panel Filters (APF) is a cleaning robot that provides variable cleaning for individual applications. IoT enables access to the real-time performance data of panel filters and interprets it correctly. For instance, IoT-enabled buildings can alert facility managers by providing early warnings of any operational abnormalities and enabling remote diagnosis and adjustments, which, in turn, is expected to save costs by minimizing system failures. Panel filters in commercial or residential buildings consume maximum energy. Implementing IoT in these applications is expected to help in saving costs, predictive maintenance, comfort control, and healthy building performance. This amalgamation of IoT with panel filters provides opportunities for companies operating in this industry.

Challenges: Shortage of skilled labor

The panel filters industry is poised to experience exponential growth. Panel filters require fine-tuning and the custom fabrication of parts during installation for their efficient working and preventing failure. Thus, professionals are needed for the proper installation of panel filters. If the installation is not done by professionals, the end user may need to pay more in the long run for repairs, or the panel filters may not work efficiently. The requirement of skilled labor is expected to incur additional costs for the user. Thus, lack of skilled labor may hinder the growth of the panel filters market.

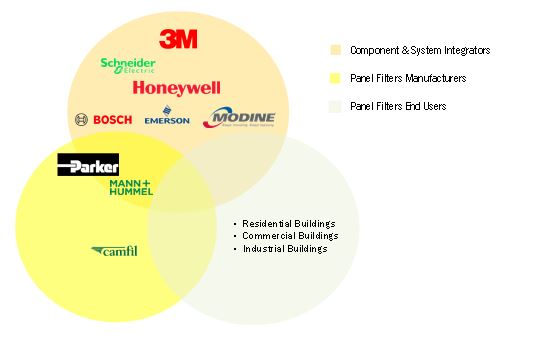

Panel Filters Market Ecosystem Diagram

Synthetic accounted for the largest share in 2021

Synthetic are estimated to be the largest material in Panel Filters. The filtration of air in a synthetic polymer material occurs on its surface, whereas in fiberglass, the filtration happens within the filters. This property makes synthetic materials suitable for application in industries such as pharmaceutical, food & beverage, automotive, and electronics & semiconductor. Synthetic filter materials are available in the form of pleats or stretched films, which are either made from spun-bond or melt-blown manufacturing processes. The pleats increase the surface area and make the filters more efficient at capturing airborne particles in the HVAC systems.

By application, Non Residential accounted for the largest share in 2021

Non-residential is estimated to be the largest market for panel filters due to its rising demand from building & construction, pharmaceutical, food & beverage, automotive, and other industries. For non-residential applications, panel filters are used as pre-filters to reduce the number of airborne particles from reaching the main filters ultimately increasing the life span of main filters reducing the maintenance cost. Increase in industrialization, government regulations, and a rising air quality index are expected to propel the demand for panel filters in non-residential applications.

By Type, Reusable Panel Filters accounted for the largest share in 2021

Reusable filters are estimated the largest market for Panel Filter as this filter offer more convenience as compared to disposable panel filters. Reusable panel filters are washed and cleaned after every few months and reused in HVAC systems. However, reusable panel filters are costlier compared to disposable panel filters, but these are ecologically beneficial and expected to be cost-effective in the longer run.

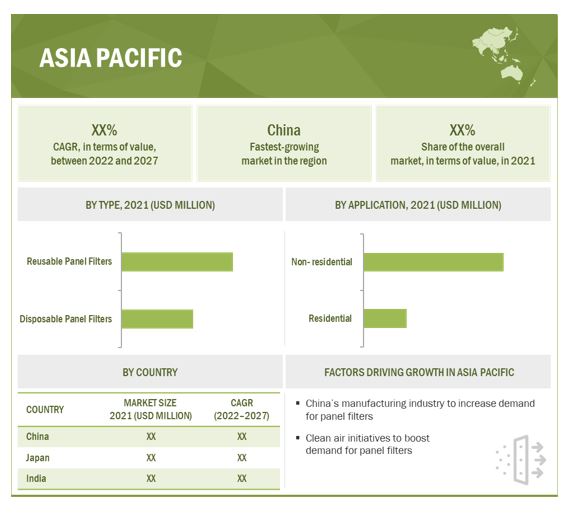

APAC account for the largest share of the Panel Filters market during the forecast period

APAC is estimated to be the largest market for Panel Filters and is projected to reach USD 4,183.3 Million by 2027. The market in the region is primarily driven by the rising demand due to continuously increasing population in the emerging economies, such as China and India, is amongst the factors expected to drive the Asia Pacific Panel filters market during the forecasted period. Increasing investment in building & construction and other end-use industries in the region promotes growth of the market. Moreover, increasing manufacturing capacities in the region further boost the market growth.

To know about the assumptions considered for the study, download the pdf brochure

Panel Filters Market Players

The Panel Filters market comprises major manufacturers such as Camfil AB (Sweden), AAF International (US), AFPRO Filtration Group (Netherlands), Mann+Hummel(Germany), Parker Hannifin (US), Donaldson Company (US), Freudenberg Filtration Technologies (Germany) are the key players operating in the Panel Filters market. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the Panel Filters market.

Panel Filters Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 8.1 billion |

|

Revenue Forecast in 2027 |

USD 9.9 billion |

|

CAGR |

4.2% |

|

Years Considered |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Unit considered |

Value (USD Billion) |

|

Segments |

Type, Material, Application, and Region |

|

Regions |

North America, Europe, Asia-Pacific, Middle East & Africa and South America |

|

Companies |

The major players are as Camfil AB (Sweden), AAF International (US), AFPRO Filtration Group (Netherlands), Mann+Hummel(Germany), Parker Hannifin (US), Donaldson Company (US), Freudenberg Filtration Technologies (Germany) and others are covered in the panel filters market. |

This research report categorizes the global panel filters market on the basis of Type, Material, Application, and Region.

Panel Filters Market, By Type

- Disposable Panel Filters

- Reusable Panel Filters

Panel Filters Market, By Material

- Fiberglass

- Synthetic

- Others

Panel Filters Market, By Application

- Residential

- Non-residential

Panel Filters Market, By Region

- North America

- Europe

- Asia Pacific (APAC)

- South America

- Middle East & Africa (MEA)

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In October 2021 Camfil launched a new-generation panel filter called CamClose. Adding pre-filter in front of a final filter further improves the overall filtration efficiency.

- In Jan 2017 AAF International acquired AFP (Aire filter Products). AFP operates in the commercial, government, and education sectors. This acquisition will allow AAF to expand its air filtration services across the western United States.

- In May 2021 AFPRO Filtration acquired Filtration Group. This acquisition will allow Filtration Group to expand its global presence and further enhance its portfolio of world-class filtration solutions for its customers.

- In March 2021 Camfil expanded its Malaysia plant. The total land size of the plant will increase to 759,000 square feet.

Frequently Asked Questions (FAQ):

What are the major drivers influencing the growth of the Panel Filters Market?

The major drivers influencing the growth of PANEL FILTERS are increasing demand due to degradation of air quality levels & stringent government laws and legislation.

What are the major challenges in the Panel Filters Market?

The major challenges in Panel Filters Market are its skilled labour shortage.

What are the different applications of specialty Panel Filters Market?

Panel Filters find their applications in various end-use industries such as Chemicals industry, Manufacturing Plants, construction, automobile, and others. The applications of these have been constantly increasing owing to constant innovation.

What is the impact of COVID-19 pandemic on the Panel Filters Market?

Owing to the COVID-19 pandemic, there has been a mixed impact on the Panel Filters Market across the globe. The demand from the Healthcare industry has increased due to COVID-19 and other related Biomedical devices has increased whereas in construction, Manufacturing plants (other than healthcare) and in others the demand for Panel filters was declined.

What are the industry trends in Panel Filters Market?

In the recent past, several manufacturers have expanded their production facilities to cater to the rising demand for panel filters and enhance their presence in the target market. Along with this, to alleviate the competitive scenario, these key players are focusing on expanding their regional presence particularly in the Asia Pacific.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

TABLE 1 MARKET SEGMENT DEFINITION, BY MATERIAL

TABLE 2 MARKET SEGMENT DEFINITION, BY TYPE

TABLE 3 MARKET SEGMENT DEFINITION, BY APPLICATION

1.2.1 INCLUSIONS AND EXCLUSIONS

TABLE 4 TYPES CONSIDERED IN REPORT

TABLE 5 APPLICATIONS CONSIDERED IN REPORT

1.3 MARKET SCOPE

FIGURE 1 PANEL FILTERS MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 PANEL FILTERS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

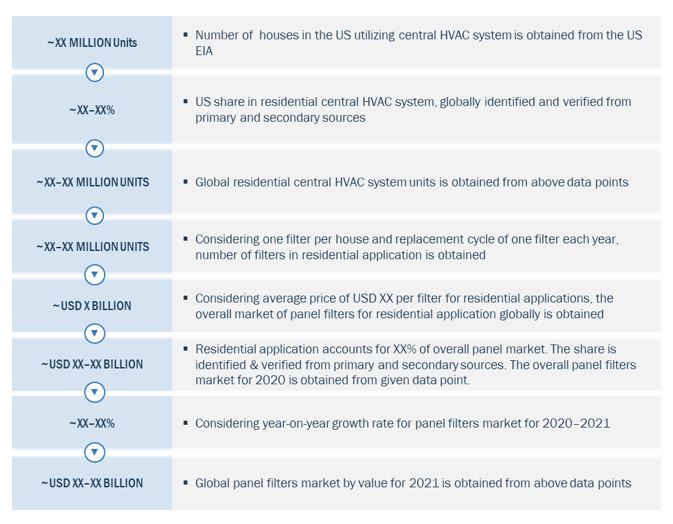

FIGURE 3 BOTTOM-UP APPROACH: BASED ON DEMAND FOR RESIDENTIAL APPLICATION

2.2.2 TOP-DOWN APPROACH: BASED ON HVAC SYSTEMS MARKET

FIGURE 4 TOP-DOWN APPROACH: BASED ON HVAC SYSTEMS MARKET

2.3 DATA TRIANGULATION

FIGURE 5 PANEL FILTERS MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

2.4.3 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 6 SYNTHETIC SEGMENT ACCOUNTED FOR LARGER SHARE BY MATERIAL IN 2021

FIGURE 7 REUSABLE PANEL FILTERS ACCOUNTED FOR LARGER SHARE IN 2021

FIGURE 8 NON-RESIDENTIAL SEGMENT ACCOUNTED FOR LARGER SHARE IN 2021

FIGURE 9 ASIA PACIFIC TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 ATTRACTIVE OPPORTUNITIES IN PANEL FILTERS MARKET

FIGURE 10 INCREASING USE IN NON-RESIDENTIAL APPLICATIONS IN EMERGING ECONOMIES TO DRIVE DEMAND

4.2 PANEL FILTERS MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

FIGURE 11 NON-RESIDENTIAL SEGMENT TO LEAD PANEL FILTERS MARKET IN ASIA PACIFIC

4.3 PANEL FILTERS MARKET, BY MATERIAL

FIGURE 12 SYNTHETIC SEGMENT TO LEAD PANEL FILTERS MARKET DURING FORECAST PERIOD

4.4 PANEL FILTERS MARKET, BY TYPE

FIGURE 13 REUSABLE PANEL FILTERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.5 PANEL FILTERS MARKET, BY APPLICATION

FIGURE 14 NON-RESIDENTIAL SEGMENT TO DOMINATE PANEL FILTERS MARKET DURING FORECAST PERIOD

4.6 PANEL FILTERS MARKET, BY COUNTRY

FIGURE 15 MARKET IN CHINA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

FIGURE 16 MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Rising awareness about air quality levels

FIGURE 17 TOP NINE CAPITAL CITY RANKINGS (AVERAGE ANNUAL PM2.5 CONCENTRATION IN 2021)

5.1.1.2 Government regulations for efficient filtration

5.1.1.3 Rising demand from non-residential sector

FIGURE 18 GROWTH OF GLOBAL PHARMACEUTICAL INDUSTRY FROM 2015 TO 2023

FIGURE 19 GROWTH TRENDS IN CHEMICAL PRODUCTION (2021-2023)

5.1.2 RESTRAINTS

5.1.2.1 Rising environmental concerns

5.1.3 OPPORTUNITIES

5.1.3.1 Rapid transformation through IoT in panel filters

5.1.3.2 Innovations and developments of new products for residential and commercial applications

5.1.4 CHALLENGES

5.1.4.1 Shortage of skilled labor

5.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 PORTER’S FIVE FORCES ANALYSIS OF PANEL FILTERS MARKET

TABLE 6 PORTER’S FIVE FORCES ANALYSIS: PANEL FILTERS MARKET

5.2.1 BARGAINING POWER OF SUPPLIERS

5.2.2 BARGAINING POWER OF BUYERS

5.2.3 INTENSITY OF COMPETITIVE RIVALRY

5.2.4 THREAT OF NEW ENTRANTS

5.2.5 THREAT OF SUBSTITUTES

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 21 SUPPLY CHAIN OF PANEL FILTERS MARKET

TABLE 7 COMPANIES IN SUPPLY CHAIN OF PANEL FILTERS MARKET

5.4 REGULATORY LANDSCAPE

TABLE 8 REGULATIONS ON PANEL FILTERS MARKET- EUROPE

TABLE 9 REGULATIONS ON PANEL FILTERS MARKET– CE REGULATIONS

TABLE 10 REGULATIONS ON PANEL FILTERS MARKET – HARMONIZED STANDARDS

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 22 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PANEL FILTERS MARKET

5.6 ECOSYSTEM MAP

FIGURE 23 ECOSYSTEM OF PANEL FILTERS MARKET

5.7 MACROECONOMIC INDICATORS

5.7.1 GLOBAL GDP OUTLOOK

TABLE 11 WORLD GDP GROWTH PROJECTION (USD BILLION), 2019-2026

5.8 AVERAGE PRICING ANALYSIS

FIGURE 24 WEIGHTED AVERAGE PRICING ANALYSIS (PER UNIT) PANEL FILTER, BY REGION, 2020

TABLE 12 AVERAGE SELLING PRICES OF PANEL FILTERS, BY REGION, USD PER UNIT

5.9 PATENT ANALYSIS

5.9.1 INTRODUCTION

5.9.2 METHODOLOGY

5.9.3 DOCUMENT TYPE

TABLE 13 GRANTED PATENTS ARE 18% OF TOTAL COUNT DURING LAST 10 YEARS

FIGURE 25 NUMBER OF PATENTS FILED DURING LAST 10 YEARS

5.9.4 PUBLICATION TRENDS OVER LAST 10 YEARS

FIGURE 26 YEAR-WISE DATA FOR NUMBER OF PATENTS PUBLISHED, 2011–2021

5.9.5 INSIGHTS

5.9.6 LEGAL STATUS OF PATENTS

FIGURE 27 LEGAL STATUS

5.9.7 JURISDICTION ANALYSIS

FIGURE 28 PATENT ANALYSIS FOR TOP 10 JURISDICTIONS BY DOCUMENT

5.9.8 TOP COMPANIES/APPLICANTS

FIGURE 29 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS, 2010–2020

TABLE 14 LIST OF PATENTS, 2017–2021

TABLE 15 TOP PATENT OWNERS (US) DURING LAST TEN YEARS

5.10 RANGE SCENARIOS FOR PANEL FILTERS MARKET

FIGURE 30 RANGE SCENARIO, 2020–2027

5.11 COVID-19 IMPACT ANALYSIS

FIGURE 31 IMPACT OF COVID-19 ON VARIOUS INDUSTRIES

5.12 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 16 PANEL FILTERS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.13 CASE STUDY

5.13.1 IMPROVED AIR QUALITY IN CONVENTIONAL CENTER

5.14 TECHNOLOGY ANALYSIS

5.14.1 PLEATED FILTERS

5.14.2 HEPA

5.14.3 ELECTROSTATIC PRECIPITATOR

5.14.4 ACTIVATED CARBON

5.15 KEY STAKEHOLDERS & BUYING CRITERIA

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 32 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

TABLE 17 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

5.15.2 BUYING CRITERIA

FIGURE 33 KEY BUYING CRITERIA FOR DIFFERENT PANEL FILTERS

TABLE 18 KEY BUYING CRITERIA FOR DIFFERENT GRADES

5.16 ADJACENT AND RELATED MARKETS

5.16.1 INTRODUCTION

5.16.2 LIMITATIONS

5.16.3 AIR HANDLING UNITS MARKET

5.16.3.1 Market definition

5.16.3.2 Air handling units market, by application

TABLE 19 AIR HANDLING UNITS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 20 AIR HANDLING UNITS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

5.16.3.3 Air handling units market, by capacity

TABLE 21 AIR HANDLING UNITS MARKET, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 22 AIR HANDLING UNITS MARKET BY CAPACITY, 2020–2026 (USD MILLION)

5.16.3.4 Air handling units market, by type

TABLE 23 AIR HANDLING UNITS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 24 AIR HANDLING UNITS MARKET, BY TYPE, 2020–2026 (USD MILLION)

5.16.3.5 Air handling units market, by region

TABLE 25 AIR HANDLING UNITS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 AIR HANDLING UNITS MARKET, BY REGION, 2020–2026 (USD MILLION)

5.16.4 HVAC SYSTEM MARKET

5.16.4.1 Market definition

5.16.4.2 HVAC system market, by cooling equipment

TABLE 27 HVAC SYSTEM MARKET, BY COOLING EQUIPMENT, 2017–2020 (USD BILLION)

TABLE 28 HVAC SYSTEM MARKET, BY COOLING EQUIPMENT, 2021–2026 (USD BILLION)

5.16.4.3 HVAC system market, by heating equipment

TABLE 29 HVAC SYSTEM MARKET, BY HEATING EQUIPMENT, 2017–2020 (USD BILLION)

TABLE 30 HVAC SYSTEM MARKET, BY HEATING EQUIPMENT, 2021–2026 (USD BILLION)

5.16.4.4 HVAC system market, by ventilation equipment

TABLE 31 HVAC SYSTEM MARKET, BY VENTILATION EQUIPMENT, 2017–2020 (USD BILLION)

TABLE 32 HVAC SYSTEM MARKET, BY VENTILATION EQUIPMENT, 2021–2026 (USD BILLION)

5.16.4.5 HVAC system market, by implementation type

TABLE 33 HVAC SYSTEM MARKET, BY IMPLEMENTATION TYPE, 2017–2020 (USD BILLION)

TABLE 34 HVAC SYSTEM MARKET, BY IMPLEMENTATION TYPE, 2021–2026 (USD BILLION)

5.16.4.6 HVAC system market, by application

TABLE 35 HVAC SYSTEM MARKET, BY APPLICATION, 2017–2020 (USD BILLION)

TABLE 36 HVAC SYSTEM MARKET, BY APPLICATION, 2021–2026 (USD BILLION)

5.16.4.7 HVAC system market, by region

TABLE 37 HVAC SYSTEM MARKET, BY REGION, 2017–2020 (USD BILLION)

TABLE 38 HVAC SYSTEM MARKET, BY REGION, 2021–2026 (USD BILLION)

6 PANEL FILTERS MARKET, BY MATERIAL TYPE (Page No. - 82)

6.1 INTRODUCTION

FIGURE 34 SYNTHETIC MATERIAL TO LEAD MARKET DURING FORECAST PERIOD

TABLE 39 PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

6.2 FIBERGLASS

6.2.1 LOWER COST AND DESIGN FLEXIBILITY TO INCREASE DEMAND

TABLE 40 FIBERGLASS PANEL FILTERS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 SYNTHETIC

6.3.1 HIGHER FILTERING EFFICIENCY AND DUST HOLDING CAPACITY TO INCREASE DEMAND

TABLE 41 SYNTHETIC PANEL FILTERS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 OTHERS

TABLE 42 OTHER MATERIALS PANEL FILTERS MARKET, BY REGION, 2020–2027 (USD MILLION)

7 PANEL FILTERS MARKET, BY TYPE (Page No. - 86)

7.1 INTRODUCTION

FIGURE 35 REUSABLE PANEL FILTERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 43 PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

7.2 DISPOSABLE PANEL FILTERS

7.2.1 HIGHER AIR FILTRATION EFFICIENCY AND LOWER COST TO INCREASE DEMAND

TABLE 44 DISPOSABLE PANEL FILTERS MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 REUSABLE PANEL FILTERS

7.3.1 MORE CONVENIENT AND COST-EFFECTIVE IN LONG RUN

TABLE 45 REUSABLE PANEL FILTERS MARKET, BY REGION, 2020–2027 (USD MILLION)

8 PANEL FILTERS MARKET, BY APPLICATION (Page No. - 89)

8.1 INTRODUCTION

FIGURE 36 NON-RESIDENTIAL APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

TABLE 46 PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 RESIDENTIAL

8.2.1 INCREASE IN URBANIZATION AND IMPROVEMENT IN STANDARDS OF LIVING TO INCREASE DEMAND

TABLE 47 PANEL FILTERS MARKET SIZE IN RESIDENTIAL APPLICATION, BY REGION, 2020–2027 (USD MILLION)

8.3 NON-RESIDENTIAL

8.3.1 INCREASED INDUSTRIALIZATION TO PROPEL DEMAND

TABLE 48 PANEL FILTERS MARKET SIZE IN NON-RESIDENTIAL APPLICATION, BY REGION, 2020–2027 (USD MILLION)

9 PANEL FILTERS MARKET, BY REGION (Page No. - 93)

9.1 INTRODUCTION

FIGURE 37 CHINA TO BE FASTEST-GROWING PANEL FILTERS MARKET

TABLE 49 PANEL FILTERS MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 ASIA PACIFIC

TABLE 50 ASIA PACIFIC: PANEL FILTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

FIGURE 38 ASIA PACIFIC: PANEL FILTERS MARKET SNAPSHOT

TABLE 51 ASIA PACIFIC: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 52 ASIA PACIFIC: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 53 ASIA PACIFIC: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.1 CHINA

9.2.1.1 Healthy growth of manufacturing industry to increase demand for panel filters

TABLE 54 CHINA: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 55 CHINA: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 56 CHINA: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.2 INDIA

9.2.2.1 India to register highest growth in Asia Pacific

TABLE 57 INDIA: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 58 INDIA: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 59 INDIA: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.3 JAPAN

9.2.3.1 Clean air initiatives to boost demand

TABLE 60 JAPAN: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 61 JAPAN: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 62 JAPAN: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.4 SOUTH KOREA

9.2.4.1 Electronics & semiconductors industry to boost demand

TABLE 63 SOUTH KOREA: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 64 SOUTH KOREA: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 65 SOUTH KOREA: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.5 REST OF ASIA PACIFIC

TABLE 66 REST OF ASIA PACIFIC: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 67 REST OF ASIA PACIFIC: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 68 REST OF ASIA PACIFIC: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3 NORTH AMERICA

TABLE 69 NORTH AMERICA: PANEL FILTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

FIGURE 39 NORTH AMERICA: PANEL FILTERS MARKET SNAPSHOT

TABLE 70 NORTH AMERICA: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 71 NORTH AMERICA: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.1 US

9.3.1.1 Growing construction activities to boost market

TABLE 73 US: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 74 US: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 75 US: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Food & beverage processing industry to increase demand

TABLE 76 CANADA: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 77 CANADA: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 78 CANADA: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.3 MEXICO

9.3.3.1 Increase in construction activities and production of pharmaceuticals to drive growth

TABLE 79 MEXICO: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 80 MEXICO: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 81 MEXICO: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4 EUROPE

TABLE 82 EUROPE: PANEL FILTERS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 83 EUROPE: PANEL FILTERS MARKET SIZE, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 84 EUROPE: PANEL FILTERS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 85 EUROPE: PANEL FILTERS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 Increasing investments in building & construction industry to drive panel filters market

TABLE 86 GERMANY: PANEL FILTERS MARKET SIZE, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 87 GERMANY: PANEL FILTERS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 GERMANY: PANEL FILTERS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.2 FRANCE

9.4.2.1 Increasing demand for non-residential application to drive market

TABLE 89 FRANCE: PANEL FILTERS MARKET SIZE, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 90 FRANCE: PANEL FILTERS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 91 FRANCE: PANEL FILTERS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.3 UK

9.4.3.1 Increasing industrialization to propel demand for panel filters

TABLE 92 UK: PANEL FILTERS MARKET SIZE, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 93 UK: PANEL FILTERS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 94 UK: PANEL FILTERS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.4 RUSSIA

9.4.4.1 Negative impact on market due to Russia-Ukraine crisis

TABLE 95 RUSSIA: PANEL FILTERS MARKET SIZE, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 96 RUSSIA: PANEL FILTERS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 RUSSIA: PANEL FILTERS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.5 SPAIN

9.4.5.1 EU standards and regulations regarding air filtration to drive market

TABLE 98 SPAIN: PANEL FILTERS MARKET SIZE, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 99 SPAIN: PANEL FILTERS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 SPAIN: PANEL FILTERS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.6 ITALY

9.4.6.1 Growth in food & beverage industry to propel demand

TABLE 101 ITALY: PANEL FILTERS MARKET SIZE, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 102 ITALY: PANEL FILTERS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 ITALY: PANEL FILTERS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.7 REST OF EUROPE

TABLE 104 REST OF EUROPE: PANEL FILTERS MARKET SIZE, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 105 REST OF EUROPE: PANEL FILTERS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 106 REST OF EUROPE: PANEL FILTERS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

TABLE 107 MIDDLE EAST & AFRICA: PANEL FILTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 108 MIDDLE EAST & AFRICA: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 110 MIDDLE EAST & AFRICA: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.5.1 SAUDI ARABIA

9.5.1.1 Rising demand for panel filters from oil & gas industry to drive market

TABLE 111 SAUDI ARABIA: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 112 SAUDI ARABIA: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 113 SAUDI ARABIA: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.5.2 UAE

9.5.2.1 Use of panel filters in non-residential industry expected to boost market

TABLE 114 UAE: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 115 UAE: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 116 UAE: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 117 REST OF MIDDLE EAST & AFRICA: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 118 REST OF MIDDLE EAST & AFRICA: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 119 REST OF MIDDLE EAST & AFRICA: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.6 SOUTH AMERICA

TABLE 120 SOUTH AMERICA: PANEL FILTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 121 SOUTH AMERICA: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 122 SOUTH AMERICA: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 123 SOUTH AMERICA: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.6.1 BRAZIL

9.6.1.1 Pharmaceuticals industry to boost demand for panel filters in Brazil

TABLE 124 BRAZIL: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 125 BRAZIL: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 126 BRAZIL: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.6.2 ARGENTINA

9.6.2.1 Food & beverage processing industry to increase demand for panel filters

TABLE 127 ARGENTINA: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 128 ARGENTINA: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 129 ARGENTINA: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.6.3 REST OF SOUTH AMERICA

TABLE 130 REST OF SOUTH AMERICA: PANEL FILTERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 131 REST OF SOUTH AMERICA: PANEL FILTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 132 REST OF SOUTH AMERICA: PANEL FILTERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 127)

10.1 INTRODUCTION

FIGURE 40 ACQUISITIONS & EXPANSIONS WERE KEY STRATEGIES ADOPTED BY PLAYERS BETWEEN 2018 AND 2022

10.2 MARKET SHARE ANALYSIS

FIGURE 41 MARKET SHARE OF KEY PLAYERS, 2021

TABLE 133 PANEL FILTERS MARKET: DEGREE OF COMPETITION

TABLE 134 STRATEGIC POSITIONING OF KEY PLAYERS

10.3 COMPANY EVALUATION MATRIX

10.3.1 STARS

10.3.2 PERVASIVE PLAYERS

10.3.3 EMERGING LEADERS

10.3.4 PARTICIPANTS

FIGURE 42 PANEL FILTERS MARKET: COMPANY EVALUATION MATRIX, 2021

10.4 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

10.4.1 RESPONSIVE COMPANIES

10.4.2 DYNAMIC COMPANIES

10.4.3 STARTING BLOCKS

FIGURE 43 PANEL FILTERS MARKET: STARTUP AND SMES MATRIX, 2021

10.5 REVENUE ANALYSIS OF TOP PLAYERS

10.5.1 COMPETITIVE BENCHMARKING

TABLE 135 PANEL FILTERS MARKET: DETAILED LIST OF KEY PLAYERS

10.6 BUSINESS STRATEGY EXCELLENCE

10.7 COMPETITIVE SITUATIONS & TRENDS

10.7.1 NEW PRODUCT LAUNCHES

10.7.2 DEALS

10.7.3 OTHERS

11 COMPANY PROFILES (Page No. - 137)

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

11.1 CAMFIL AB

TABLE 136 CAMFIL AB: COMPANY OVERVIEW

TABLE 137 CAMFIL: NEW PRODUCT LAUNCHES

TABLE 138 CAMFIL AB: OTHERS

FIGURE 44 CAMFIL AB’S CAPABILITY IN PANEL FILTERS MARKET

11.2 AAF INTERNATIONAL

TABLE 139 AAF INTERNATIONAL: COMPANY OVERVIEW

TABLE 140 AAF INTERNATIONAL: DEAL

FIGURE 45 AAF INTERNATIONAL’S CAPABILITY IN PANEL FILTERS MARKET

11.3 AFPRO FILTRATION GROUP

TABLE 141 AFPRO FILTRATION GROUP: COMPANY OVERVIEW

TABLE 142 AFPRO FILTRATION GROUP: DEAL

FIGURE 46 AFPRO FILTRATION GROUP'S CAPABILITY IN PANEL FILTERS MARKET

11.4 MANN+HUMMEL

TABLE 143 MANN+HUMMEL: COMPANY OVERVIEW

FIGURE 47 MANN+HUMMEL: COMPANY SNAPSHOT

FIGURE 48 MANN+HUMMEL’S CAPABILITY IN PANEL FILTERS MARKET

11.5 PARKER HANNIFIN

TABLE 144 PARKER HANNIFIN: COMPANY OVERVIEW

FIGURE 49 PARKER HANNIFIN: COMPANY SNAPSHOT

TABLE 145 PARKER HANNIFIN GROUP: OTHERS

FIGURE 50 PARKER HANNIFIN CORPORATION ‘S CAPABILITY IN PANEL FILTERS MARKET

11.6 DONALDSON COMPANY, INC.

TABLE 146 DONALDSON COMPANY, INC.: COMPANY OVERVIEW

FIGURE 51 DONALDSON: COMPANY SNAPSHOT

TABLE 147 DONALDSON COMPANY, INC.: OTHERS

FIGURE 52 DONALDSON COMPANY'S CAPABILITY IN PANEL FILTERS MARKET

11.7 FREUDENBERG FILTRATION TECHNOLOGIES

TABLE 148 FREUDENBERG FILTRATION TECHNOLOGIES: COMPANY OVERVIEW

11.8 KOCH FILTERS CORPORATION

TABLE 149 KOCH FILTERS CORPORATION: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

11.9 OTHER PLAYERS

11.9.1 PLACON FILTERS PVT. LTD.

TABLE 150 PLACON FILTERS PVT. LTD.: COMPANY OVERVIEW

11.9.2 EMIRATES INDUSTRIAL FILTERS L.L.C

TABLE 151 EMIRATES INDUSTRIAL FILTERS L.L.C: COMPANY OVERVIEW

11.9.3 B&H INDUSTRIAL L.L.C

TABLE 152 B&H INDUSTRIAL L.L.C: COMPANY OVERVIEW

11.9.4 TFI FILTRATION (INDIA) PVT. LTD.

TABLE 153 TFI FILTRATION (INDIA) PVT. LTD.: COMPANY OVERVIEW

11.9.5 PURAFIL INC.

TABLE 154 PURAFIL INC.: COMPANY OVERVIEW

11.9.6 GENERAL FILTER HAVAK

TABLE 155 GENERAL FILTER HAVAK: COMPANY OVERVIEW

11.9.7 AHLSTROM-MUNKSJÖ

TABLE 156 AHLSTROM-MUNKSJO: COMPANY OVERVIEW

11.9.8 FILSON FILTRATION EQUIPMENTS CO., LTD

TABLE 157 FILSON FILTRATION EQUIPMENTS CO., LTD: COMPANY OVERVIEW

11.9.9 XIAMEN R&J FILTRATION CO., LTD

TABLE 158 XIAMEN R&J FILTRATION CO., LTD: COMPANY OVERVIEW

11.9.10 NANJING BLUE SKY FILTER CO., LTD

TABLE 159 NANJING BLUE SKY FILTER CO., LTD: COMPANY OVERVIEW

11.9.11 GUANGZHOU KLC CLEANTECH CO., LTD.

TABLE 160 GUANGZHOU KLC CLEANTECH CO., LTD.: COMPANY OVERVIEW

11.9.12 HENAN TOP ENVIRONMENT PROTECTION EQUIPMENT CO., LTD

TABLE 161 HENAN TOP ENVIRONMENT PROTECTION EQUIPMENT CO., LTD.: COMPANY OVERVIEW

11.9.13 TEX-AIR FILTERS

TABLE 162 TEX-AIR FILTERS: COMPANY OVERVIEW

11.9.14 UNITED FILTER INDUSTRIES PVT. LTD.

TABLE 163 UNITED FILTER INDUSTRIES PVT. LTD.: COMPANY OVERVIEW

11.9.15 OMEGA FILTERS (INDIA)

TABLE 164 OMEGA FILTERS (INDIA): COMPANY OVERVIEW

11.9.16 AIRVENTFIL PTY (LTD)

TABLE 165 AIRVENTFIL PTY (LTD): COMPANY OVERVIEW

12 APPENDIX (Page No. - 165)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

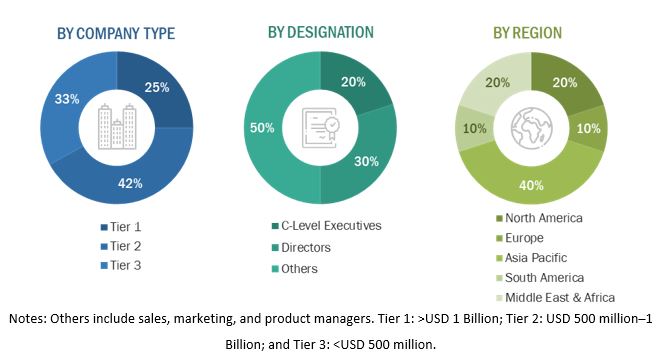

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the panel filters market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The panel filters market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the panel filters market. Primary sources from the supply side include associations and institutions involved in the panel filters industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global panel filters market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global panel filters market in terms of value

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on material, type, and application

- To forecast the market size, in terms of value, with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions

- To strategically profile the leading players and comprehensively analyze their key developments in the market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC panel filters market

- Further breakdown of Rest of Europe panel filters market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Panel Filters Market