Point of Care Molecular Diagnostics Market by Product (Assays, Kits, Instruments, Software), Application (Respiratory Diseases, HAIs, Cancer, STDs, Hepatitis), Technology (RT-PCR, INAAT), End User (Clinics, Hospitals, ICUs) & Region - Global Forecast to 2028

Overview

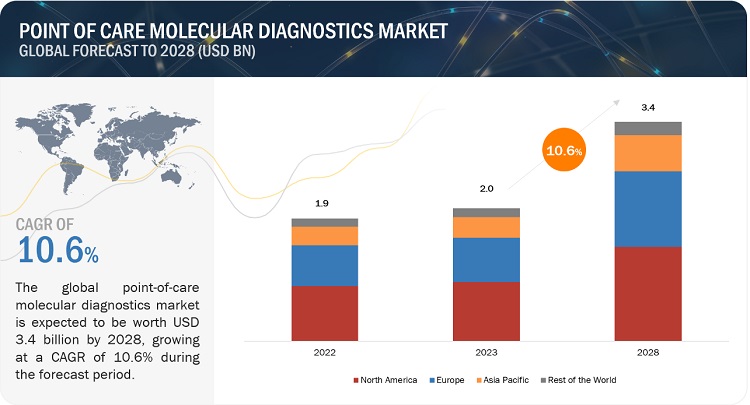

The global point of care molecular diagnostics market, valued at US$1.9 billion in 2022, is forecasted to grow at a robust CAGR of 10.6%, reaching US$2.0 billion by 2023 and an impressive US$3.4 billion by 2028. Market growth is mainly driven by rising incidence of infectious diseases and acute and chronic conditions and increased focus on improving the state of healthcare facilities and infrastructure. However, the market entry of several firms has been resisted by uncertain reimbursement circumstances. The market's expansion is further constrained by a shortage of high-complexity testing facilities that can perform POC molecular diagnostics testing.

Point Of Care Molecular Diagnostics Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Point of Care Molecular Diagnostics Market Dynamics

Driver: Growing incidence of infectious diseases and cancer

The rising occurrence of infectious diseases and cancer in both developed and developing regions is set to have a favourable impact on the expansion of the market. The diagnosis and treatment of these diseases necessitate an increasing number of molecular diagnostic tests, leading to a surge in the demand for such tests. Moreover, the growing inclination towards preventive medicine further contributes to the anticipated rise in demand for point-of-care molecular diagnostics throughout the forecast period.

Restraint: Unfavorable reimbursement settings

The growth of the market is hindered by inadequate reimbursements. One of the significant challenges faced by diagnostic companies is obtaining payment from Medicare and private health insurers for their tests. In the United States, Medicare revised its reimbursement mechanism for certain in vitro diagnostic (IVD) tests, including point-of-care molecular tests, in 2018. Some of these tests lack specific Healthcare Common Procedure Coding System (HCPCS) codes and are billed using unlisted codes instead. In such cases, payment amounts are established by Medicare Administrative Contractors (MACs) for their respective jurisdictions. Additionally, Medicare currently does not provide coverage for genetic testing in individuals without a personal history of cancer, as indicated by the American Society of Clinical Oncology. These factors are anticipated to have an adverse impact on the point-of-care molecular testing market.

Opportunity: Growth prospects in emerging countries

Players in the market have substantial growth prospects in emerging economies like India, South Korea, Brazil, and Mexico. These opportunities stem from several factors, including relatively low regulatory barriers, advancements in healthcare infrastructure, expanding patient populations, increasing incidence of infectious diseases, and a rise in healthcare expenditure. Additionally, the regulatory policies in some of these countries are more flexible and conducive to business compared to those in developed nations.

Challenge: Establishment of alternative technologies

The emergence of alternative technologies, including those employed in COVID-19 testing, presents a potential obstacle to the growth of the market . Most diagnostic tests can be divided into serological and antigen tests and these tests result is usually available in 15 minutes, and thus they are commonly referred to as rapid tests. Antigen tests are also cheaper to manufacture than molecular tests owing to their simpler design. Thus, the introduction of alternative technologies might be challenging to the growth of the market.

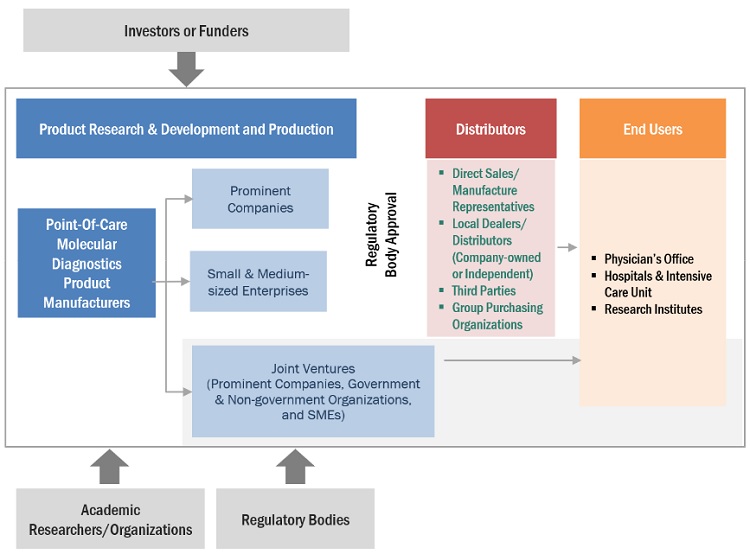

Point of Care Molecular Diagnostics Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of point of care molecular assay and kits. These companies have been operating in the market for several years and possess state-of-the-art technologies, diversified product portfolio, strong global sales, and marketing networks. Prominent companies in this market include Abbott Laboratories (US), F. Hoffmann-La Roche Ltd. (Switzerland), bioMérieux SA (France), Danaher Corporation (US), and QIAGEN N.V. (Netherlands).

In 2022, assays & kits segment accounted for the largest share of the point of care molecular diagnostics industry, by product & service

Based on product, the point of care molecular diagnostics market is segmented into instruments & analyzers, and software & services. In 2022, the assays & kits segment accounted for the largest share of this market. The frequent purchase of these products due to their recurrent usage drives the market growth of this segment.

In 2022, RT-PCR segment accounted for the largest share in the point of care molecular diagnostics industry, by technology

The point of care molecular diagnostics market is segmented into RT-PCR, INAAT and other technologies based on technology. In 2022, the RT-PCR segment accounted for the largest share. RT-PCR is one of the most widely used technologies in diagnostics due to its ease of use, cost-effectiveness, and prompt turnaround time (4 to 6 hours).

In 2022, Physicians’ offices segment accounted for the largest share in the point of care molecular diagnostics industry, by end user

Based on end users, the point of care molecular diagnostics market is segmented into physicians’ offices, hospitals & ICUs, research institutes, and other end users. In 2022, the physicians’ offices segment accounted for the largest share of the market. Point-of-care molecular assay & kits and systems are extensively used in physicians’ offices as they provide quick results within 30 minutes. This helps in instant diagnosis which allows to diagnose or monitor a patient’s condition immediately.

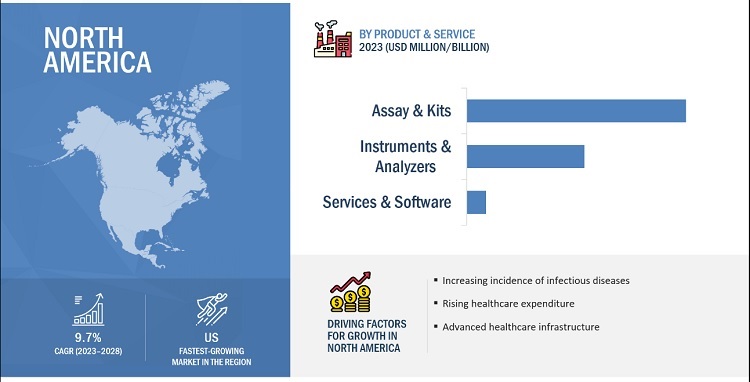

North America is the largest region of the point of care molecular diagnostics industry

The global point of care molecular diagnostics market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. In 2022, North America accounted for the largest share of the global market. The high burden of infectious diseases and cancers on regional healthcare systems is one of the major drivers for market growth. Furthermore, the presence of a well-developed healthcare infrastructure and the growing adoption of advanced technologies infectious disease testing are other factors anticipated to support the growth of the market in the region.

To know about the assumptions considered for the study, download the pdf brochure

The major players in this market are Abbott Laboratories (US), F. Hoffmann-La Roche Ltd. (Switzerland), bioMérieux SA (France), Danaher Corporation (US), and QIAGEN N.V. (Netherlands). These players lead the market because of their extensive product portfolios and wide geographic presence. These dominant market players also have numerous advantages, such as more robust marketing and distribution networks, larger budgets for R&D, and better brand recognition.

Point of Care Molecular Diagnostics Market Report Scope

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$2.0 billion |

|

Projected Revenue Size by 2028 |

$3.4 billion |

|

Industry Growth Rate |

poised to grow at a CAGR of 10.6% |

|

Growth Driver |

Growing incidence of infectious diseases and cancer |

|

Growth Opportunity |

Growth prospects in emerging countries |

This report categorizes the point of care molecular diagnostics market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

- Assays & kits

- Instruments & Analyzers

- Software & Services

By Technology

- RT-PCR

- INAAT

- Other technologies

By Application

- Respiratory Diseases

- Sexually Transmitted Diseases

- Hospital-acquired Infections

- Cancer

- Hepatitis

- Gastrointestinal Disorders

- Other Applications

By End User

- Physicians’ Offices

- Hospitals & ICUs

- Research Institutes

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe (RoE)

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Rest of the World (RoW)

Recent Developments of Point of Care Molecular Diagnostics Market

- In April 2023, QIAGEN N.V. (Netherlands) launched QIAstat-Dx in Japan with a respiratory panel for syndromic testing.

- In June 2022, Biocartis NV (Belgium) launched the Rapid CE-marked IVD Idylla GeneFusion Panel for fast treatment decisions in lung cancer.

- In May 2022, bioMérieux SA (France) received De Novo FDA Authorization for its BIOFIRE Joint Infection (JI) Panel.

- In September 2021, F. Hoffmann-La Roche Ltd. (Switzerland) acquired TIB Molbiol (Germany) to expand its PCR test portfolio with a wide range of assays for infectious diseases.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the global point of care molecular diagnostics market from 2023 to 2028?

The global point of care molecular diagnostics market is projected to grow from USD 2.0 billion in 2023 to USD 3.4 billion by 2028, at a CAGR of 10.6%, driven by the rising incidence of infectious diseases and the increasing focus on healthcare infrastructure improvement.

What factors are driving the growth of the point of care molecular diagnostics market?

The major drivers of the point of care molecular diagnostics market include the growing incidence of infectious diseases and cancer, advancements in healthcare infrastructure, and the increasing preference for preventive medicine.

What challenges are faced by the point of care molecular diagnostics market?

One of the main challenges for the point of care molecular diagnostics market is unfavorable reimbursement settings, along with the availability of alternative diagnostic technologies such as antigen tests, which can be cheaper and faster.

What opportunities exist in emerging markets for the point of care molecular diagnostics industry?

Emerging economies such as India, South Korea, Brazil, and Mexico offer significant growth opportunities due to their expanding patient populations, improving healthcare infrastructure, and increasing prevalence of infectious diseases.

Which product segment holds the largest market share in the point of care molecular diagnostics market?

The assays and kits segment held the largest share of the point of care molecular diagnostics market in 2022, driven by the frequent and recurrent usage of these products for diagnostic purposes.

What role does RT-PCR technology play in the point of care molecular diagnostics market?

RT-PCR technology accounts for the largest share in the point of care molecular diagnostics market due to its widespread use, cost-effectiveness, and rapid turnaround time in diagnosing various diseases.

Which region dominates the point of care molecular diagnostics market?

North America holds the largest share of the point of care molecular diagnostics market, driven by a high incidence of infectious diseases, advanced healthcare infrastructure, and the growing adoption of molecular diagnostic technologies.

What is the impact of the increasing incidence of infectious diseases on the point of care molecular diagnostics market?

The growing incidence of infectious diseases is a key driver of demand for point of care molecular diagnostics, particularly in respiratory and sexually transmitted diseases, contributing to market expansion.

Which end-user segment accounted for the largest share of the point of care molecular diagnostics market in 2022?

In 2022, physicians’ offices held the largest share of the market due to the widespread use of point of care molecular diagnostics for quick and efficient patient diagnosis in a clinical setting.

What are the recent developments in the point of care molecular diagnostics market?

Recent developments include QIAGEN’s launch of QIAstat-Dx in Japan for syndromic testing and bioMérieux’s FDA authorization for its BIOFIRE Joint Infection Panel.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing prevalence of infectious diseases and cancer- Rising focus on decentralized diagnostics and increasing R&D funding- Growing awareness of the early detection of infectious diseases- Increasing use of POC diagnostic testsRESTRAINTS- Unfavorable reimbursement scenario- High capital investments and low cost-benefit ratioOPPORTUNITIES- Growing R&D activities in point-of-care molecular diagnostics testing- Growth opportunities in emerging economiesCHALLENGES- Stringent and time-consuming regulatory policies that significantly increase product launch cycle- Introduction of alternative technologies

- 5.3 PRICING ANALYSIS

-

5.4 PATENT ANALYSISLIST OF KEY PATENTS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 ECOSYSTEM ANALYSISPOINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: ROLE IN ECOSYSTEM

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.9 PESTLE ANALYSIS

-

5.10 REGULATORY ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific- Latin America- Middle East- Africa

- 5.11 TRADE ANALYSIS

- 5.12 TECHNOLOGY ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 ASSAYS & KITSRECURRENT PURCHASES OF ASSAYS & KITS TO DRIVE GROWTH

-

6.3 INSTRUMENTS & ANALYZERSINCREASING ADOPTION OF POC TECHNOLOGIES TO DRIVE GROWTH IN MARKET

-

6.4 SOFTWARE & SERVICESGROWING UPTAKE OF ADVANCED INSTRUMENTS TO DRIVE DEMAND

- 7.1 INTRODUCTION

-

7.2 RT-PCRGROWING PREVALENCE OF INFECTIOUS DISEASES TO DRIVE MARKET GROWTH

-

7.3 INAATCOST BENEFITS OF INAAT TO BOOST DEMAND

- 7.4 OTHER TECHNOLOGIES

- 8.1 INTRODUCTION

-

8.2 RESPIRATORY DISEASESRISING DEMAND FOR EARLY DIAGNOSIS AND DETECTION OF RESPIRATORY DISEASES TO DRIVE GROWTH

-

8.3 SEXUALLY TRANSMITTED DISEASESTECHNOLOGICAL ADVANCEMENTS FOR DETECTION OF STDS TO FAVOR MARKET GROWTH

-

8.4 HOSPITAL-ACQUIRED INFECTIONSRISING BURDEN OF MRSA TO SUPPORT GROWTH

-

8.5 CANCERRISING PREVALENCE OF CANCER AND GROWING FUNDING FOR CANCER RESEARCH TO DRIVE MARKET

-

8.6 HEPATITISINCREASING CASES OF HEPATITIS AMONG HIGH-RISK SUBGROUP POPULATIONS TO BOOST GROWTH

-

8.7 GASTROINTESTINAL DISORDERSGROWING INCIDENCE OF GASTROINTESTINAL DISORDERS TO PROPEL MARKET

- 8.8 OTHER APPLICATIONS

-

8.9 COVID-19DECLINING CASES OF COVID-19 TO HINDER MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 PHYSICIANS’ OFFICESFASTER RESULTS ASSOCIATED WITH POINT-OF-CARE MOLECULAR ASSAYS TO DRIVE GROWTH

-

9.3 HOSPITALS & ICUSSEPSIS- Growing need for quick diagnosis and treatment to favor market growthGASTROENTERITIS- Growing incidence of gastroenteritis cases in emergency departments to propel growthMENINGOENCEPHALITIS- Severity of disease and need for early detection to drive demandOTHER DISEASES

-

9.4 RESEARCH INSTITUTESINCREASING USE OF POC MOLECULAR DIAGNOSTIC TESTS IN GENOMICS RESEARCH TO CONTRIBUTE TO MARKET GROWTH

- 9.5 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACT: NORTH AMERICAUS- Growing prevalence of infectious diseases to drive marketCANADA- Rising government initiatives to propel market growth in coming years

-

10.3 EUROPERECESSION IMPACT: EUROPEGERMANY- Increasing healthcare expenditure to drive market growth in GermanyUK- Increasing prevalence of infectious diseases to fuel growthFRANCE- Rising R&D expenditure in France to boost marketITALY- Adoption of advanced diagnostic technologies to favor growthSPAIN- Growing demand for genetic testing in Spain to create major growth opportunities for market playersREST OF EUROPE

-

10.4 ASIA PACIFICRECESSION IMPACT: ASIA PACIFICCHINA- Growing public access to modern healthcare to drive market growthJAPAN- Universal healthcare reimbursement policy to drive market growth in JapanINDIA- Increasing private & public investments in healthcare system to support market growthREST OF ASIA PACIFIC (ROAPAC)

-

10.5 LATIN AMERICALOW PER CAPITA HEALTH SPENDING TO RESTRAIN MARKET GROWTHRECESSION IMPACT: LATIN AMERICA

-

10.6 MIDDLE EAST & AFRICALACK OF SKILLED RESOURCES TO RESTRICT MARKET GROWTHRECESSION IMPACT: MIDDLE EAST & AFRICA

- 11.1 OVERVIEW

-

11.2 STRATEGIES OF KEY PLAYERSOVERVIEW OF STRATEGIES DEPLOYED BY PLAYERS IN POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET

- 11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANTLIST OF EVALUATED VENDORSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2022)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

11.7 COMPETITIVE BENCHMARKINGPRODUCT AND REGIONAL FOOTPRINT ANALYSIS

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHES & APPROVALSDEALS

-

12.1 KEY PLAYERSABBOTT LABORATORIES- Business overview- Products offered- Recent developments- MnM viewF. HOFFMANN-LA ROCHE LTD.- Business overview- Products offered- Recent developments- MnM viewBIOMÉRIEUX SA- Business overview- Products offered- Recent developments- MnM viewDANAHER CORPORATION- Business overview- Products offered- Recent developments- MnM viewQIAGEN N.V.- Business overview- Products offered- Recent developments- MnM viewQUIDELORTHO CORPORATION- Business overview- Products offered- Recent developmentsCO-DIAGNOSTICS, INC.- Business overview- Products offered- Recent developmentsBIOCARTIS NV- Business overview- Products offered- Recent developmentsMERIDIAN BIOSCIENCE, INC.- Business overview- Products offered- Recent developmentsTHERMO FISHER SCIENTIFIC INC.- Business overview- Products offered- Recent developments

-

12.2 OTHER PLAYERSLUCIRA HEALTH, INC.CUE HEALTHOPGEN, INC.BINX HEALTH, INC.MOLBIO DIAGNOSTICS PVT. LTD.GENOMADIXVISBY MEDICAL, INC.QUIKPATH PTE. LTD.MD-BIOQUANTUMDX GROUP LTD.AIDIAN OYGENESTAT MOLECULAR DIAGNOSTICS, LLC.LABSYSTEMS DIAGNOSTICS OYAKONNI BIOSYSTEMSCURETIS N.V.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 AVAILABLE CUSTOMIZATIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT

- TABLE 2 PORTER’S FIVE FORCES ANALYSIS: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET

- TABLE 3 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 IMPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 9 EXPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 10 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF POINT-OF-CARE MOLECULAR DIAGNOSTICS PRODUCTS

- TABLE 12 KEY BUYING CRITERIA FOR POINT-OF-CARE MOLECULAR DIAGNOSTIC PRODUCTS

- TABLE 13 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 14 KEY ASSAYS & KITS AVAILABLE IN MARKET

- TABLE 15 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR ASSAYS & KITS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 16 KEY INSTRUMENTS & ANALYZERS AVAILABLE IN MARKET

- TABLE 17 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR INSTRUMENTS & ANALYZERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 KEY SOFTWARE & SERVICES AVAILABLE IN MARKET

- TABLE 19 POINT-OF-CARE DIAGNOSTICS MARKET FOR SOFTWARE & SERVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 21 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR RT-PCR, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR INAAT, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 25 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR RESPIRATORY DISEASES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITAL-ACQUIRED INFECTIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR CANCER, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR HEPATITIS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR GASTROINTESTINAL DISORDERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR COVID-19, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 34 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR PHYSICIANS’ OFFICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITALS & ICUS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITALS & ICUS, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 37 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR RESEARCH INSTITUTES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 38 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 45 US: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 46 US: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 47 US: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 48 US: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 49 CANADA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 50 CANADA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 51 CANADA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 52 CANADA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 53 EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 55 EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 56 EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 57 EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 58 GERMANY: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 59 GERMANY: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 60 GERMANY: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 61 GERMANY: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 62 UK: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 63 UK: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 64 UK: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 65 UK: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 66 FRANCE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 67 FRANCE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 68 FRANCE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 69 FRANCE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 70 ITALY: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 71 ITALY: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 72 ITALY: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 73 ITALY: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 74 SPAIN: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 75 SPAIN: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 76 SPAIN: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 77 SPAIN: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 78 REST OF EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 79 REST OF EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 80 REST OF EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 81 REST OF EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 87 CHINA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 88 CHINA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 89 CHINA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 90 CHINA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 91 JAPAN: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 92 JAPAN: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 93 JAPAN: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 94 JAPAN: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 95 INDIA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 96 INDIA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 97 INDIA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 98 INDIA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 99 REST OF ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 100 REST OF ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 101 REST OF ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 103 LATIN AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 104 LATIN AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 105 LATIN AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 106 LATIN AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 111 OVERVIEW OF STRATEGIES DEPLOYED BY KEY POINT-OF-CARE MOLECULAR DIAGNOSTICS MANUFACTURING COMPANIES

- TABLE 112 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET SHARE: DEGREE OF COMPETITION

- TABLE 113 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: COMPANY REGIONAL FOOTPRINT

- TABLE 114 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: COMPANY PRODUCT & SERVICE FOOTPRINT

- TABLE 115 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 116 KEY PRODUCT LAUNCHES & APPROVALS

- TABLE 117 KEY DEALS

- TABLE 118 ABBOTT LABORATORIES: BUSINESS OVERVIEW

- TABLE 119 F. HOFFMANN-LA ROCHE LTD.: BUSINESS OVERVIEW

- TABLE 120 BIOMÉRIEUX SA: BUSINESS OVERVIEW

- TABLE 121 DANAHER CORPORATION: BUSINESS OVERVIEW

- TABLE 122 QIAGEN N.V.: BUSINESS OVERVIEW

- TABLE 123 QUIDELORTHO CORPORATION: BUSINESS OVERVIEW

- TABLE 124 CO-DIAGNOSTICS INC.: BUSINESS OVERVIEW

- TABLE 125 BIOCARTIS NV: BUSINESS OVERVIEW

- TABLE 126 MERIDIAN BIOSCIENCE, INC.: BUSINESS OVERVIEW

- TABLE 127 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

- FIGURE 1 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

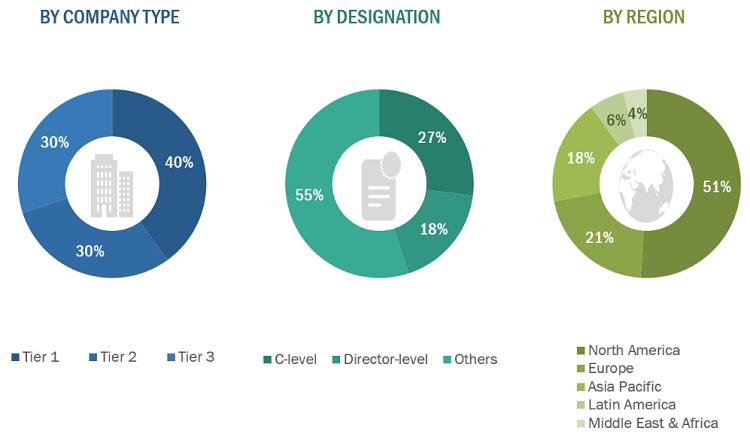

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 6 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 RISING ADOPTION OF POC DIAGNOSTICS TO SUPPORT MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 14 ASSAYS & KITS SEGMENT TO CONTINUE TO DOMINATE MARKET IN 2028

- FIGURE 15 RT-PCR SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 RESPIRATORY DISEASES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 PHYSICIANS’ OFFICES SEGMENT TO CONTINUE TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE IN POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET DURING FORECAST PERIOD

- FIGURE 19 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 PATENT ANALYSIS FOR POINT-OF-CARE MOLECULAR DIAGNOSTICS (JANUARY 2013–DECEMBER 2022)

- FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING & ASSEMBLY PHASE

- FIGURE 22 POINT-OF-CARE MOLECULAR DIAGNOSTICS: SUPPLY CHAIN ANALYSIS

- FIGURE 23 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 REVENUE SHIFT IN POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF POINT-OF-CARE MOLECULAR DIAGNOSTICS PRODUCTS

- FIGURE 26 KEY BUYING CRITERIA FOR POINT-OF-CARE MOLECULAR DIAGNOSTICS PRODUCTS

- FIGURE 27 NORTH AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET SNAPSHOT

- FIGURE 28 ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET SNAPSHOT

- FIGURE 29 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET (2018–2022)

- FIGURE 30 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET SHARE, BY KEY PLAYER (2022)

- FIGURE 31 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 32 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2022

- FIGURE 33 PRODUCT & SERVICE AND REGIONAL FOOTPRINT ANALYSIS OF TOP PLAYERS IN POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET

- FIGURE 34 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2022)

- FIGURE 35 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 36 BIOMÉRIEUX SA: COMPANY SNAPSHOT (2022)

- FIGURE 37 DANAHER CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 38 QIAGEN N.V.: COMPANY SNAPSHOT (2022)

- FIGURE 39 QUIDELORTHO CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 40 CO-DIAGNOSTICS, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 41 BIOCARTIS NV: COMPANY SNAPSHOT (2022)

- FIGURE 42 MERIDIAN BIOSCIENCE, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 43 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

The objective of the study is to analyze the key market dynamics, such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships of the leading players, the competitive landscape of the point-of-care molecular diagnostics market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, market breakdown and data triangulation were used.

The four steps involved in estimating the market size are:

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), annual reports, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the point-of-care molecular diagnostics market. A database of the key industry leaders was also prepared using secondary research.

Collecting Primary Data

The primary research data was conducted after acquiring knowledge about the point-of-care molecular diagnostics market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such as hospitals & ICUs, diagnostic laboratories, research institutes, research laboratories and home care settings) and supply side (such as included various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers, wholesalers, channel partners, and distributors) across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Approximately 40% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 60%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

Note 1: *Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue as of 2022: Tier 1=> USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3=< USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

All major product manufacturers offering various point-of-care molecular diagnostics products were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value point-of-care molecular diagnostics market was also split into various segments and subsegments at the region and country level based on:

- Product mapping of various manufacturers for each type of point-of-care molecular diagnostics market at the regional and country-level

- Relative adoption pattern of each point-of-care molecular diagnostics market among key application segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country-level.

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country-level

Global Point-of-Care Molecular Diagnostics Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the point-of-care molecular diagnostics industry.

Market Definition

Point-of-care molecular diagnostics includes various portable point-of-care devices used by healthcare professionals to detect and diagnose various diseases in humans by using techniques to identify and analyze nucleic acids or proteins at the molecular level.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the global point-of-care molecular diagnostics market by product & service, technology, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as acquisitions, product launches and approvals, expansions, and other developments in the point-of-care molecular diagnostics market.

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

- Point-of-Care Molecular Diagnostics market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific and Rest of the World

Company profiles

- Additional ten company profiles of players operating in the point-of-care molecular diagnostics market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Point of Care Molecular Diagnostics Market