ASEAN Point of Care Diagnostics Market: Growth, Size, Share, and Trends

ASEAN Point of Care Diagnostics Market by Product (Infectious Disease (TB, Hepatitis, STDs, HAIs), Glucose, Cardiometabolic, Pregnancy, Coagulation), Technology (Lateral Flow Assays, Biochemistry, MDx), End User (Home Care, Hospitals) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The ASEAN point of care diagnostics market is expected to grow from around USD 1.08 billion in 2025 to USD 1.36 billion by 2030, reflecting a CAGR of 4.7%. Rising rates of chronic diseases, particularly diabetes, are driving the need for frequent monitoring and early detection, increasing the demand for rapid and accurate POC testing solutions. Devices like glucose meters are gaining popularity for their ability to deliver immediate results, helping patients manage their health and enabling timely clinical interventions. Market growth is further supported by government initiatives aimed at expanding healthcare access and fostering innovation in diagnostic technologies. In addition, the expansion of public-private partnerships across the region is strengthening the development, availability, and adoption of point of care diagnostics throughout ASEAN.

KEY TAKEAWAYS

-

BY TECHNOLOGYThe ASEAN point of care diagnostics market is categorized into lateral flow assays (immunoassays), rapid tests (molecular diagnostics), and biochemistry. Among these, biochemistry-based solutions are the most widely used, owing to their broad applicability in routine and essential diagnostic tests such as blood glucose monitoring, electrolyte analysis, liver function, and kidney function tests. The rising prevalence of chronic and lifestyle-related conditions, including diabetes, cardiovascular diseases, and kidney disorders, has further fueled the demand for biochemistry-based POC testing in the region. Their ease of use, cost-effectiveness, and quick turnaround times make these solutions particularly suitable for decentralized healthcare settings such as community clinics, primary health centers, and emergency departments.

-

BY PRODUCTThe ASEAN point of care diagnostics market is divided into multiple product categories, including infectious disease testing, glucose monitoring, cardiometabolic testing, coagulation monitoring, pregnancy and fertility testing, urinalysis, cancer marker testing, cholesterol testing, hematology, fecal occult testing, drugs-of-abuse testing, and other POC products. Among these, glucose monitoring products are the most widely used across the region. This is largely driven by the rising prevalence of diabetes in ASEAN countries and the growing emphasis on routine blood glucose management in both clinical and home care settings. Glucose monitoring devices are valued for their convenience, accuracy, and ability to provide real-time results, making them essential for early detection and ongoing diabetes management. In addition, increasing patient awareness, government initiatives to combat diabetes, and the adoption of user-friendly monitoring solutions are further reinforcing the strong position of glucose monitoring in the regional point of care diagnostics market.

-

BY END USERThe ASEAN point of care diagnostics market is segmented by end users into clinical laboratories, hospitals and critical care centers, outpatient and ambulatory care settings, home care settings, and other users. Among these, home care settings have emerged as a key segment. The growing preference for convenience and patient-centered care is driving the adoption of home-based testing solutions, allowing individuals to monitor their health without frequent visits to healthcare facilities. Rapid results, particularly for chronic disease management such as diabetes, further enhance the appeal of home testing devices. With the increasing prevalence of chronic conditions across ASEAN and rising interest in preventive care and self-monitoring, home care settings are expected to maintain a leading role in the regional point of care diagnostics market.

The ASEAN point of care diagnostics market is poised for significant growth in the coming years, driven by the rising incidence of infectious diseases, increasing prevalence of target health conditions, and supportive government initiatives promoting POC testing. The growing number of public-private partnerships (PPPs) in the region is further facilitating the development, distribution, and adoption of rapid and accurate diagnostic solutions. Point of care tests are increasingly being utilized in hospitals, clinics, and decentralized healthcare settings to enable timely detection and management of diseases, improve patient outcomes, and enhance overall healthcare efficiency. Continuous innovation, coupled with efforts to expand accessibility across the region, is further accelerating the uptake of POC diagnostics and strengthening their impact on healthcare delivery.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The ASEAN point of care diagnostics market is experiencing steady growth, driven by rising incidence of infectious and chronic diseases, supportive government initiatives, and increasing public-private partnerships. Key end users include clinical laboratories, hospitals and critical care centers, outpatient and ambulatory care settings, home care settings, and other healthcare providers. The growing adoption of convenient, rapid, and easy-to-use POC testing solutions is reshaping patient management and clinical workflows across these settings. This rising demand is fueling the procurement of diagnostic devices, consumables, and associated services, supporting broader implementation of point of care diagnostics throughout the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising incidence of infectious diseases

-

Increasing prevalence of target conditions

Level

-

Pricing pressure on manufacturers

-

Stringent regulatory approval process for product commercialization

Level

-

Gradual shift toward decentralized healthcare systems

-

Availability of POC tests with multiplexing capabilities

Level

-

Shortage of skilled healthcare providers

-

Premium pricing of novel platforms

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising incidence of infectious diseases

The growing prevalence of infectious diseases is a major driver of the ASEAN point of care diagnostics market. The region faces a wide spectrum of health challenges, including respiratory infections, sexually transmitted diseases, tropical illnesses, and emerging viral outbreaks. The increasing need for timely diagnosis and prompt medical intervention has elevated the importance of POC diagnostics, which deliver rapid and reliable results close to the patient, reducing delays associated with centralized laboratory testing. In many ASEAN countries, where healthcare infrastructure is still developing and access to diagnostic facilities can be limited, point of care testing plays a critical role in strengthening infectious disease management. High-sensitivity and high-specificity tests enable early detection and treatment while helping to curb disease transmission, ultimately improving public health outcomes across the region.

Restraint: Stringent regulatory approval process for product commercialization

Navigating regulatory approval pathways for point of care diagnostics in ASEAN countries can be a significant challenge for manufacturers, often slowing product commercialization. While the ASEAN Medical Device Directive (AMDD) was established to harmonize medical device regulations across member states, its implementation varies by country. Before POC diagnostic products can enter the market, they must undergo rigorous conformity assessments and receive clearance from the respective national regulatory authorities. Differences in local regulatory interpretations, documentation requirements, clinical performance expectations, and approval timelines can create inconsistencies across the region. These variations complicate market entry strategies for manufacturers, leading to delays, increased administrative workload, and higher compliance costs.

Opportunity: Availability of POC tests with multiplexing capabilities

The increasing availability of multiplex point of care diagnostic tests is creating significant growth opportunities in the ASEAN market. These advanced tests allow simultaneous detection of multiple pathogens or biomarkers from a single sample, improving diagnostic speed and accuracy, particularly for conditions such as respiratory infections. Multiplex POC tests help healthcare professionals reduce the need for repeat testing, lower costs, and enhance overall diagnostic efficiency. As demand for high-performance, time-saving solutions grows across the region, collaborations and initiatives are expanding access to multiplex testing in both urban and rural areas. Continued investment in the development of multiplex platforms to meet rising clinical demand further supports a positive outlook for the adoption of these tests in ASEAN.

Challenge: Shortage of skilled healthcare providers

A persistent challenge for the adoption and effective use of point of care diagnostics in ASEAN countries is the shortage of skilled healthcare professionals. Many healthcare facilities, particularly in rural and remote areas, lack trained personnel capable of operating POC devices accurately and interpreting results correctly. Inadequate expertise can lead to errors or delays, negatively impacting patient care and treatment outcomes. Addressing this skills shortage through targeted training and workforce development will be crucial for maximizing the benefits of POC diagnostics in early detection and overall healthcare delivery across the ASEAN region.

ASEAN Point of Care Diagnostics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides a comprehensive range of POC diagnostics including glucose monitoring devices, cardiometabolic testing, and rapid infectious disease tests for hospitals, clinics, and home care settings. Emphasis on portable and easy-to-use solutions for chronic disease management. | Quick and reliable results for clinical and home use, supports continuous monitoring of chronic conditions, enhances patient self-management, scalable for high patient volumes, improves early intervention and treatment adherence. |

|

Offers multiplex POC platforms for infectious diseases, cardiometabolic testing, and molecular diagnostics in hospitals, outpatient centers, and emergency care units. Focuses on integrated systems that combine sample-to-result automation. | High diagnostic accuracy, rapid turnaround times, simultaneous detection of multiple biomarkers, supports early disease detection and timely treatment decisions, reduces repeat testing and workflow burden, facilitates point-of-care decision-making in critical care. |

|

Specializes in biochemistry-based POC testing for blood chemistry, electrolyte panels, liver and kidney function tests, and organ monitoring. Deploys compact and automated solutions in primary care centers, hospitals, and decentralized healthcare settings. | Automated, reliable, and reproducible results, reduces operator error, cost-effective, enables high-throughput testing, supports decentralized healthcare with minimal infrastructure, improves patient monitoring and disease management. |

|

Provides a diverse portfolio of POC diagnostic instruments and assay kits for infectious disease detection, hematology, glucose monitoring, and cardiovascular markers in hospitals and clinics. Offers solutions designed for high-volume, decentralized testing environments. | Rapid and accurate results, supports multiple diagnostic applications from a single platform, improves operational efficiency and workflow integration, enhances clinical decision-making, scalable for large patient populations, facilitates timely monitoring and intervention. |

|

Focuses on hematology and coagulation POC testing, with additional offerings for infectious diseases and chronic condition monitoring. Products are targeted at clinical laboratories, hospitals, and outpatient facilities for high-precision testing. | Accurate and reproducible results, easy-to-use compact platforms, supports timely patient management, enhances lab workflow efficiency, enables continuous monitoring of blood and coagulation parameters, facilitates early detection of abnormalities in critical care and routine testing. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ASEAN point of care (POC) diagnostics market serves hospitals, critical care centers, clinical laboratories, outpatient and ambulatory care facilities, home care settings, and other healthcare providers. The market is primarily driven by the need for quick, reliable testing for infectious diseases, chronic conditions such as diabetes and cardiovascular disorders, and routine health monitoring. Growing adoption of user-friendly, portable POC devices with multiplexing and automated features is enhancing testing efficiency, accuracy, and turnaround times. In addition, increasing government support, awareness campaigns for early detection, and the shift toward decentralized healthcare are fueling the broader utilization of POC diagnostics across the region.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

ASEAN Point of Care Diagnostics Market, By Technology

The ASEAN point of care diagnostics market is categorized into lateral flow assays (immunoassays), rapid tests (molecular diagnostics), and biochemistry. Among these, biochemistry-based solutions are the most widely used, owing to their broad applicability in routine and essential diagnostic tests such as blood glucose monitoring, electrolyte analysis, liver function, and kidney function tests. The rising prevalence of chronic and lifestyle-related conditions, including diabetes, cardiovascular diseases, and kidney disorders, has further fueled the demand for biochemistry-based POC testing in the region. Their ease of use, cost-effectiveness, and quick turnaround times make these solutions particularly suitable for decentralized healthcare settings such as community clinics, primary health centers, and emergency departments.

ASEAN Point of Care Diagnostics Market, By Product

The ASEAN point of care diagnostics market is divided into multiple product categories, including infectious disease testing, glucose monitoring, cardiometabolic testing, coagulation monitoring, pregnancy and fertility testing, urinalysis, cancer marker testing, cholesterol testing, hematology, fecal occult testing, drugs-of-abuse testing, and other POC products. Among these, glucose monitoring products are the most widely used across the region. This is largely driven by the rising prevalence of diabetes in ASEAN countries and the growing emphasis on routine blood glucose management in both clinical and home care settings. Glucose monitoring devices are valued for their convenience, accuracy, and ability to provide real-time results, making them essential for early detection and ongoing diabetes management. In addition, increasing patient awareness, government initiatives to combat diabetes, and the adoption of user-friendly monitoring solutions are further reinforcing the strong position of glucose monitoring in the regional point of care diagnostics market.

ASEAN Point of Care Diagnostics Market, By End User

The ASEAN point of care diagnostics market is segmented by end users into clinical laboratories, hospitals and critical care centers, outpatient and ambulatory care settings, home care settings, and other users. Among these, home care settings have emerged as a key segment. The growing preference for convenience and patient-centered care is driving the adoption of home-based testing solutions, allowing individuals to monitor their health without frequent visits to healthcare facilities. Rapid results, particularly for chronic disease management such as diabetes, further enhance the appeal of home testing devices. With the increasing prevalence of chronic conditions across ASEAN and rising interest in preventive care and self-monitoring, home care settings are expected to maintain a leading role in the regional point of care diagnostics market.

REGION

Indonesia accounted for the largest share of the global ASEAN point of care diagnostics market during the forecast period.

The ASEAN point of care diagnostics market includes Vietnam, Laos, Cambodia, Malaysia, Myanmar, Philippines, Singapore, Thailand, Indonesia, and Brunei. Indonesia has emerged as a key market due to its large and growing population and the rising prevalence of infectious and chronic diseases, which drive demand for affordable and effective diagnostic solutions. Expansion of healthcare services has promoted faster adoption of point of care testing, especially in areas with limited laboratory infrastructure. Government initiatives to enhance early disease detection and strengthen primary healthcare, along with increasing healthcare expenditure, improved insurance coverage, and better access to cost-effective POC diagnostic devices, are further supporting market growth in the country.

ASEAN Point of Care Diagnostics Market: COMPANY EVALUATION MATRIX

Abbott is a leading player in the ASEAN point of care diagnostics market, offering a wide range of rapid and reliable testing solutions for infectious diseases, chronic conditions, and other critical health parameters. With a strong presence across hospitals, clinics, home care settings, and laboratories in the region, Abbott addresses diverse diagnostic needs for both clinical and decentralized healthcare environments. Its partnerships with healthcare providers, public health organizations, and research institutions enhance its ability to deliver accurate, user-friendly, and accessible point of care solutions, supporting broader adoption and improved patient care throughout ASEAN countries.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 1.05 Billion |

| Revenue Forecast in 2030 | USD 1.36 Billion |

| Growth Rate | CAGR of 4.7% from 2025-2030 |

| Actual data | 2023-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (Million) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By product (infectious disease testing products, glucose monitoring products, cardiometabolic testing products, coagulation monitoring products, pregnancy & fertility testing products, urinalysis testing products, cancer marker testing products, cholesterol testing products, hematology testing products, fecal occult testing products, drugs-of-abuse testing products, and other POC products), by technology (lateral flow assays [immunoassays], rapid tests [molecular diagnostics], and biochemistry), by end user (clinical laboratories, hospitals and critical care centers, outpatient settings and ambulatory care centers, home care settings, and other end users) |

| Regional Scope | Vietnam, Laos, Cambodia, Malaysia, Myanmar, Philippines, Singapore, Thailand, Indonesia, and Brunei |

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | ? Product matrix, which provides a detailed comparison of the product portfolio of each company in the ASEAN point of care diagnostics market | Enables easy comparison of competitors’ offerings, helping identify gaps, overlaps, and differentiation opportunities. |

| Company Information | ? Additional five company profiles of players operating in the ASEAN point of care diagnostics market. | Provides insights into competitors’ strategies, innovation focus, and partnerships, supporting strategic planning. |

| Geographic Analysis | ? Additional country-level analysis of the ASEAN point of care diagnostics market | Guides market entry, localization, and targeted launch strategies by highlighting regional demand and opportunities. |

RECENT DEVELOPMENTS

- January 2025 : bioMérieux (France) entered into an agreement to acquire SpinChip (Norway)that has developed an immunoassay diagnostics platform. The small benchtop analyzer is well-adapted for near-patient testing. It can deliver a result from a whole blood sample within 10 minutes with the same high-sensitivity performance as the laboratory instruments.

- January 2025 : The US FDA granted F. Hoffmann-La Roche Ltd. (Switzerland) 510(k) clearance and Clinical Laboratory Improvement Amendments of 1988 (CLIA) for its cobas liat sexually transmitted infection (STI) multiplex assay panels. These panels diagnose sexually transmitted infections at the point of care.

- December 2024 : bioMérieux (France) revealed that the BIOFIRE FILMARRAY Gastrointestinal (GI) Panel Mid has obtained clearance from the US FDA. This midplex molecular panel tests 11 of the most common bacteria, viruses, and parasites associated with gastroenteritis—all from one sample, with results available in approximately one hour.

- April 2024 : Abbott’s (US) i-STAT TBI cartridge received clearance from the US FDA to be used with whole blood, allowing doctors to help assess patients with suspected concussion at the patient's bedside and obtain lab-quality results in 15 minutes.

Table of Contents

Methodology

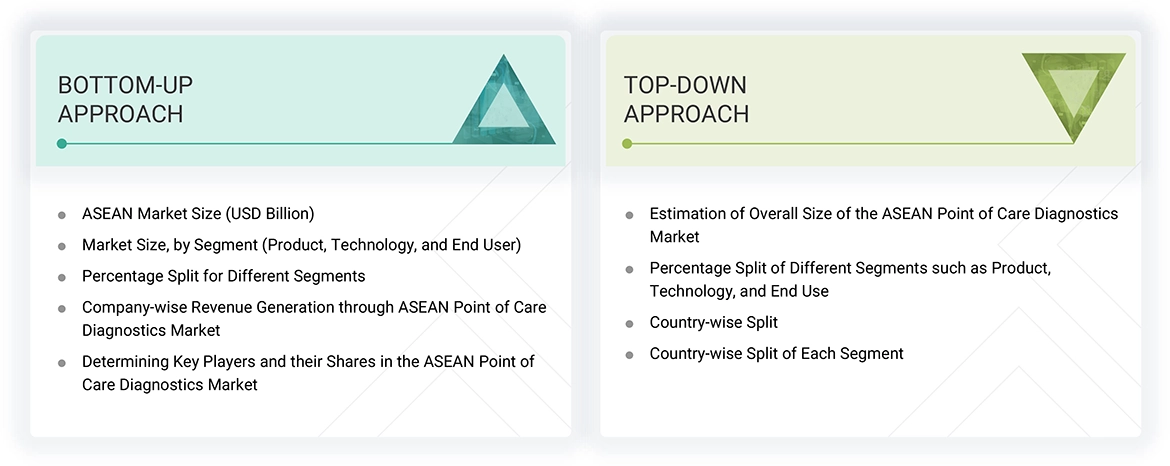

The study involved major activities in estimating the current market size for the ASEAN point of care diagnostics market. Exhaustive secondary research was done to collect information on the ASEAN point of care diagnostics industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the ASEAN point of care diagnostics market.

The four steps involved in estimating the market size are:

Secondary Research

In the secondary research process, various secondary sources, such as company annual reports, press releases, and investor presentations, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva), were referred to identify and collect information for this study.

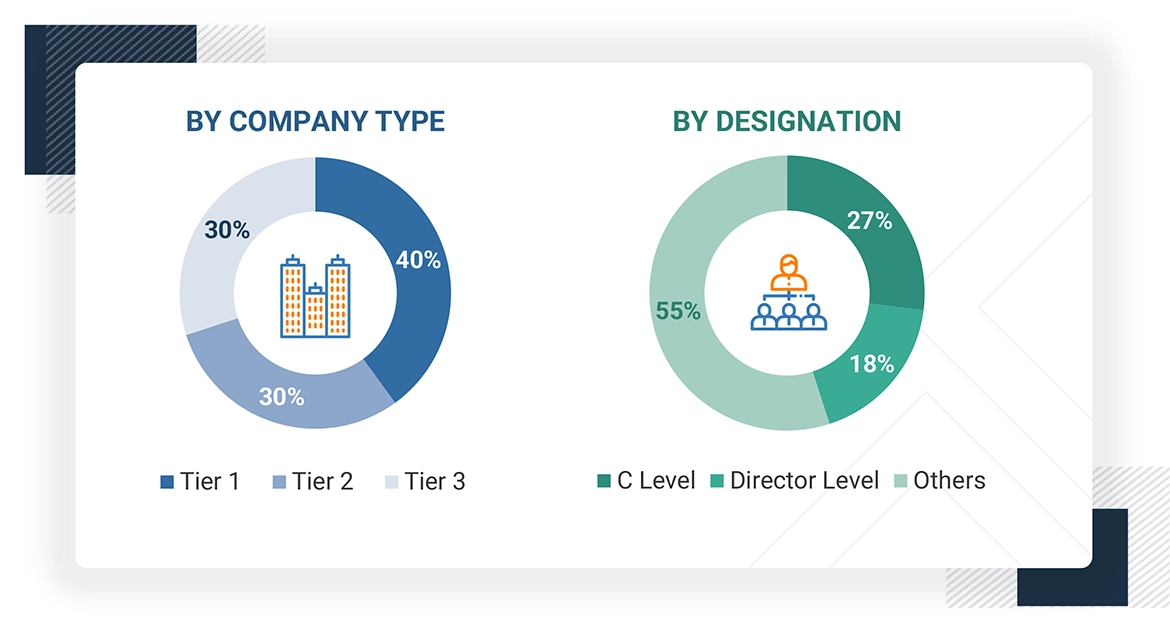

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess prospects.

The following is a breakdown of the primary respondents:

Note 1: Others include sales, marketing, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2024, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = < USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION |

|---|---|

| PTS Diagnostics | Regional Sales Manager |

| EKF Diagnostics Holdings plc | Product Manager |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the ASEAN point of care diagnostics market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- Primary and secondary research has determined the revenues of leading players operating in the ASEAN point of care diagnostics market.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size by applying the abovementioned process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Point of care testing (POCT) includes tests designed to be used at or near the patient's site (such as at home, in an ambulance, at a physician’s office, and other locations). POCT allows rapid & reliable diagnostic testing to obtain outcomes instantly, helping physicians/patients make care decisions remotely and rapidly.

Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the ASEAN point of care diagnostics market based on product, technology, end user, and country

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall ASEAN point of care diagnostics market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to ten countries, namely, Vietnam, Laos, Cambodia, Malaysia, Myanmar, Philippines, Singapore, Thailand, Indonesia, and Brunei

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches & approvals, partnerships, acquisitions, agreements, and other developments

- To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business & product excellence

Frequently Asked Questions (FAQ)

What recent trends affect the ASEAN point of care diagnostics market?

Recent trends affecting the ASEAN point of care diagnostics market involve ongoing technological advancements, the rising need for quick & precise testing, and the growing focus on patient-centric healthcare. Rising government investments in healthcare infrastructure further support the production & uptake of POC tests, enhancing availability and reducing test costs throughout the region.

Who are the key players in the ASEAN point of care diagnostics market?

The key players in this market are Abbott (US), F. Hoffmann-La Roche Ltd. (Switzerland), Siemens Healthineers AG (Germany), Sysmex Corporation (Japan), Danaher Corporation (US), BD (US), QuidelOrtho Corporation (US), Cardinal Health (US), AccuBioTech Co., Ltd. (China), EKF Diagnostics Holdings plc (UK), bioMérieux (France), and Thermo Fisher Scientific Inc. (US).

Who are the primary end users of point of care diagnostic products?

Based on end users, the ASEAN point of care diagnostics market is segmented into clinical laboratories, hospitals and critical care centers, outpatient settings and ambulatory care centers, home care settings, and other end users. Home care settings dominated the market due to the increasing demand for affordable, convenient, and personalized healthcare products.

What are the opportunities for growth in the ASEAN point of care diagnostics market?

The ASEAN point of care diagnostics market provides various growth prospects, such as a steady inclination toward decentralized healthcare systems, which is driving the demand for rapid & portable diagnostic products. Additionally, the growing adoption of multiplex POC tests, which can identify multiple conditions from a single sample, enhances diagnostic effectiveness and facilitates wider usage in clinical and remote environments.

Which country is lucrative for the ASEAN point of care diagnostics market?

Vietnam is one of the most promising countries in the ASEAN point-of-care diagnostics market, primarily due to its expanding healthcare infrastructure, increased healthcare expenditures, government initiatives to improve access to healthcare, and awareness of early diagnosis benefits.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the ASEAN Point of Care Diagnostics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in ASEAN Point of Care Diagnostics Market