Pouches Market by Type (Stand-Up, Flat, Rollstock), Material (Plastic Films, Aluminum Foil, Paper, Bioplastics), Treatment Type (Standard, Aseptic, Retort, Hot-Filled), Pouch Weight, Sealer, Application, and Region - Global Forecast to 2024

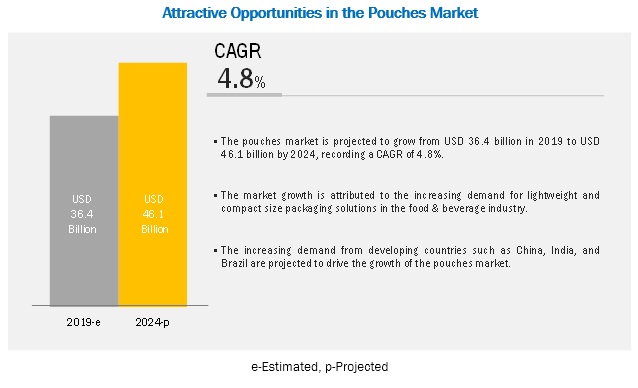

The pouches market is projected to reach USD 46.1 billion by 2024, at a CAGR of 4.8%. The rise in demand for packaged food and cost-effectiveness of pouches are projected to drive the growth of the pouches market, globally. In addition, factors such as the aesthetic appeal and the rise in demand from end-user industries are projected to contribute to the growth of the pouches market during the forecast period.

In terms of value, the stand-up pouches segment is projected to dominate the pouches market during the forecast period.

On the basis of type, the stand-up pouches segment is projected to dominate the pouches market, in terms of value, from 2019 to 2024. These pouches are commonly used in the food & beverages industry, as they are durable and render enhanced stability to the product. They are widely used in food and beverages packaging, due to the increasing demand for compact and lightweight packaging solutions. In addition, they are generally used for lightweight products such as coffee, tea, sauces, and candies.

In terms of value, the beverages segment in the pouches market is projected to grow at the highest CAGR during the forecast period.

Based on application, the beverages segment in the pouches market is projected to grow at the highest CAGR, in terms of value and volume, during the forecast period. The growing use of pouches for alcohol packaging further drives its market growth in the beverage segment. However, the food segment accounted for the largest market share in 2018 in terms of value. Pouches remain preferred and ideal packaging solutions for beverages, due to their malleability and low weight. In addition, they protect the products from contaminants. Due to these factors, the beverage segment is projected to account for a large market share. Protection from risks of contamination and the attractive display of pouches have also led to an increase in the popularity of pouches in applications such as personal care & home care and healthcare packaging.

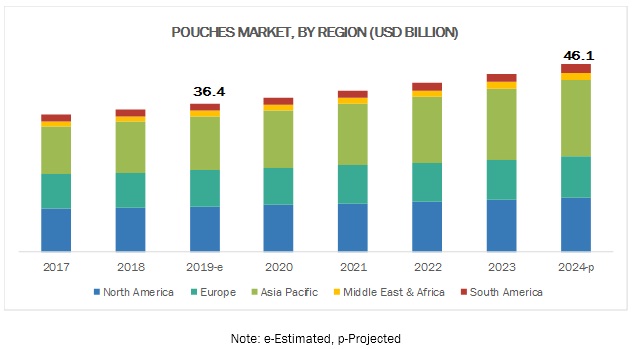

The Asia Pacific pouches market is projected to witness significant growth during the forecast period.

The Asia Pacific pouches market is projected to grow at the highest CAGR from 2018 to 2023, in terms of value. The growth of the market in the Asia Pacific region is attributed to the increased demand for pouches from densely populated countries such as India and China, as this packaging ensures cost savings and offers an aesthetic appeal to the product. Moreover, the increasing application of pouches in the food, beverages, healthcare, personal care & home care, oil & lubricants, and agricultural products is projected to drive the growth of the pouches market in the Asia Pacific region.

Key Players in Pouches Market

Amcor (Australia), Smurfit Kappa (Ireland), Mondi (Austria), Berry Global Inc. (US), Sonoco (US), Sealed Air (US), Huhtamaki (Finland), Constantia Flexibles (Austria), Coveris (Austria), Clondalkin Group (Netherlands), Goglio SpA (Italy), KOROZO (Turkey), ProAmpac (US), Gualapack S.p.A. (Italy), DaklaPack (Netherlands), Wipf Holding AG (Switzerland), A. Hatzopoulos S.A. (Greece), and Formika (Poland) are the key players operating in the pouches market.

Amcor is one of the key manufacturers of pouches. Its wide range of pouches caters to a variety of applications across the food, beverage, personal care, and healthcare industries. The company has a strong global presence and has adopted growth strategies such as acquisitions and product launches, to strengthen its leading position in the market. In recent years, the company launched metal-free packaging solutions and ultra-high barrier packaging solutions for spouted pouches, pouches, flow packs, sachets packaging, and bags. In addition, it has acquired Nampak Flexibles, Zhongshan Tiancai Packaging Company, Packaging India Private Limited, Deluxe Packages, and Hebei Qite Packing Co. Ltd), which has further strengthened its market presence and expanded the product portfolio.

Pouches Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2019 |

USD 36.4 billion |

|

Revenue Forecast in 2024 |

USD 46.1 billion |

|

CAGR |

4.8% |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD Billion) and Volume (Million Units) |

|

Segments covered |

Material, Type, Treatment Type, Application, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and the Middle East & Africa |

|

Companies covered |

Amcor (Australia), Bemis Company (US), Berry Global Group (US), Mondi (Austria), Sonoco (US), Sealed Air (US), Coveris (Luxembourg), ProAmpac (US), Smurfit Kappa (Ireland), and Huhtamaki (Finland) Total of 25 market players covered in this report |

This research report categorizes the stand-up pouches market based on material, type, treatment type, application, pouch weight, sealer, and region.

On the basis of type, the pouches market has been categorized as follows:

-

Stand-up Pouches

- Block Bottom

- Bottom Gusset

- Side Gusset

-

Flat Pouches

- Pillow

- Four-Side Sealed

- Three-Side Sealed

- Roll Stock

On the basis of material, the pouches market has been categorized as follows:

- Plastic

- Metal

- Paper

- Bioplastics

On the basis of treatment type, the pouches market has been categorized as follows:

- Aseptic

- Standard

- Retort

- Hot-Filled

On the basis of application, the pouches market has been categorized as follows:

- Food

- Beverage

- Medical & Pharmaceuticals

- Cosmetic & Personal care

- Others

On the basis of pouches weight, the pouches market has been categorized as follows:

- <10 gms

- 10-20 gms

- 20-50 gms

- 50-70 gms

- >70 gms

On the basis of sealer, the pouches market has been categorized as follows:

- Direct Heat Sealer

- Vacuum Pouch Sealer

- Others

On the basis of region, the stand-up pouches market has been categorized as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In June 2019, Amcor acquired Bemis Company Inc. (US), to strengthen the company’s capabilities. Bemis Company Inc. (US) is a global player in the flexible packaging market and provides a range of pouches to the customers. This strategic initiative is projected to expand Amcor’s product portfolio and geographic presence across the globe.

- In June 2019, Smurfit Kappa launched a new stand-up pouch for olive oil, which weighs 17 times less than glass packaging products and is offered in 1.5 L in pouches in the market. This new pouch is cost-efficient and helps in reducing the use of plastic and CO2 emissions during transportation.

- In April 2018, ProAmpac acquired Pactech Packaging (US), to diversify its flexible packaging pouch production capabilities and provide a range of packaging pouches to its customers. In addition, it also focuses on expanding its product portfolio.

Key Questions Addressed by the Report:

- What are the global trends that are increasing the demand for pouches? Would the market witness an increase or decrease in demand in the coming years?

- What is the estimated demand for different types of pouches?

- Where will the strategic developments take the industry in the mid- to long-term?

- What are the upcoming industry applications and trends for pouches?

- Who are the major players in the pouches market, globally?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 21)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Regional Scope

1.3.2 Years Considered for the Study

1.4 Currency Considered

1.5 Units Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 25)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities in the Pouches Market

4.2 Asia Pacific: Pouches Market, By Type and Country

4.3 Pouches Market, By Type

4.4 Pouches Market, By Flat Pouches

4.5 Pouches Market, By Stand-Up Pouches

4.6 Pouches Market, By Material

4.7 Pouches Market, By Treatment Type

4.8 Pouches Market, By Application

4.9 Pouches Market, By Country

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Demand for Packaged Food & Beverages

5.2.1.2 Cost-Effectiveness

5.2.1.3 Rise in Demand From End-Use Industries

5.2.1.4 Aesthetic Appeal

5.2.2 Restraints

5.2.2.1 Stringent Government Regulations

5.2.3 Opportunities

5.2.3.1 Rise in Demand From Emerging Economies

5.2.3.2 Growing Popularity of Pouches in Alcohol Packaging

5.2.4 Challenges

5.2.4.1 Availability of Substitutes

5.2.4.2 Recycling of Multi-Layer Structure

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.1.1 Presence of Large-Scale Players

6.3.1.2 High Investments

6.3.2 Threat of Substitutes

6.3.2.1 Abundance of Substitutes

6.3.2.2 Low Switching Costs

6.3.3 Bargaining Power of Suppliers

6.3.3.1 Easy Availability of Raw Materials

6.3.4 Bargaining Power of Buyers

6.3.4.1 High-Volume Buyers Hold A High Degree of Bargaining Power

6.3.4.2 Availability of Numerous Substitutes

6.3.5 Intensity of Competitive Rivalry

6.3.5.1 High Degree of Market Fragmentation

6.3.5.2 Low Customer Loyalty

7 Pouches Market, By Type (Page No. - 51)

7.1 Introduction

7.2 Stand-Up Pouches

7.2.1 Bottom Gusset Bags are the Most Preferred Type of Pouches

7.3 Flat Pouches

7.3.1 Increasing Demand for Four-Side-Seal Pouches to Drive the Demand for Flat Pouches

7.4 Rollstock

7.4.1 Rise in Demand for Ready-To-Eat Food is Expected to Drive the Growth of the Rollstock Segment

8 Pouches Market, By Material (Page No. - 57)

8.1 Introduction

8.2 Plastic Films

8.2.1 The Plastic Films Segment to Lead the Pouches Market

8.2.2 Polyethylene (PE)

8.2.2.1 High-Density Polyethylene (HDPE)

8.2.2.2 Low-Density Polyethylene (LDPE)

8.2.2.3 Linear Low-Density Polyethylene (Lldpe)

8.2.3 Polypropylene (PP)

8.2.3.1 Biaxially Oriented Polypropylene (BOPP)

8.2.3.2 Cast Polypropylene (CPP)

8.2.4 Poly Vinyl Chloride (PVC)

8.2.5 Ethylene Vinyl Alcohol (EVOH)

8.2.6 Polyamide

8.3 Aluminum Foil

8.3.1 Rising Demand for High Ductility and Barrier Protection Packaging Products to Drive the Demand for Aluminum Foil

8.4 Paper

8.4.1 Cost-Effectiveness and Low Weight to Drive the Growth of the Paper Segment

8.5 Bioplastics

8.5.1 Growing Trend Towards Sustainable Packaging to Drive the Bioplastics Segment

9 Pouches Market, By Application (Page No. - 64)

9.1 Introduction

9.2 Food

9.2.1 Growth in Demand for Compact & Lightweight Packaging to Drive the Pouches Demand in the Food Industry

9.3 Beverages

9.3.1 Beverages Application is Projected to Grow at the Fastest Rate During the Forecast Period

9.4 Personal Care & Homecare

9.4.1 Increasing Demand for Pouches in Personal Care to Drive the Market

9.5 Healthcare

9.5.1 Aesthetic Appeal and Product Protection Characteristics of Pouches to Drive Its Demand in Healthcare

9.6 Others

10 Pouches Market, By Treatment Type (Page No. - 69)

10.1 Introduction

10.2 Standard

10.2.1 Standard Pouches to Be the Largest Segment of the Pouches Market

10.3 Aseptic

10.3.1 Increasing Need for A Longer Shelf Life of Products to Boost the Usage of Aseptic Pouches

10.4 Retort

10.4.1 Rise in Demand for Ready-To-Eat Food is Expected to Drive the Demand for Retort Pouches

10.5 Hot-Filled

10.5.1 High Demand From the Beverages Industry to Drive the Demand for Hot-Filled Pouches

11 Pouches Market, By Pouch Weight (Page No. - 73)

11.1 Introduction

11.2 Below 10 Grams

11.3 10–20 Grams

11.4 50–70 Grams

11.5 More Than 70 Grams

12 Stand-Up Pouches Market, By Sealer (Page No. - 74)

12.1 Stand-Up Pouches Market, By Sealer

12.2 Direct Heat Sealer

12.3 Vacuum Pouch Sealer

13 Pouches Market, By Region (Page No. - 75)

13.1 Introduction

13.1.1 Pouches Market Size, By Region

13.2 Europe

13.2.1 Germany

13.2.1.1 Germany to Lead the Stand-Up Pouches Market in Europe

13.2.2 UK

13.2.2.1 Increase in Expenditure on Food and Beverages to Drive the Demand for Pouches in the UK

13.2.3 France

13.2.3.1 Stand-Up Pouches Segment to Lead the Pouches Market in France

13.2.4 Spain

13.2.4.1 Rise in Demand for Convenient Packaging to Support the Growth of the Pouches Market in Spain

13.2.5 Russia

13.2.5.1 Growing Demand for Ready-To-Eat and Packaged Food to Drive the Pouches Market in Russia

13.2.6 Italy

13.2.6.1 Flat Pouches to Lead the Pouches Market in Italy

13.2.7 Rest of Europe

13.2.7.1 Growing Consumption of Packaged Food to Drive the Demand for Pouches in Rest of Europe

13.3 North America

13.3.1 US

13.3.1.1 The US to Lead the North American Pouches Market

13.3.2 Canada

13.3.2.1 Increase in Exports of Packaged Food to Drive the Canadian Pouches Market

13.3.3 Mexico

13.3.3.1 Increase in the Demand for Frozen, Ready-To-Eat, and Processed Food to Drive the Pouches Market in Mexico

13.4 Asia Pacific

13.4.1 China

13.4.1.1 China to Lead the Asia Pacific Pouches Market

13.4.2 Japan

13.4.2.1 High Demand From the Food & Beverages Segment to Drive the Pouches Market in Japan

13.4.3 India

13.4.3.1 India to Be the Second-Fastest-Growing Market for Pouches in Asia Pacific

13.4.4 Australia

13.4.4.1 High Disposable Income, Rise in the Consumption of Packaged Food, and Changes in Lifestyle to Drive the Pouches Market in Australia

13.4.5 South Korea

13.4.5.1 Demand for Convenience Packaging is Expected to Impact the South Korean Pouches Market

13.4.6 Rest of Asia Pacific

13.4.6.1 Rise in Consumption of Packed Food to Drive the Pouches Market in the Rest of Asia Pacific

13.5 Middle East & Africa

13.5.1 Turkey

13.5.1.1 Turkey to Lead the Pouches Market in the Middle East & Africa

13.5.2 South Africa

13.5.2.1 Bottom Gusset Bags to Be the Largest Consumed Type of Pouch in South Africa

13.5.3 Saudi Arabia

13.5.3.1 Increasing Need for Convenience Packaging in Various Applications is Driving the Pouches Market in Saudi Arabia

13.5.4 Nigeria

13.5.4.1 Rapid Urbanization to Drive the Pouches Market in Nigeria

13.5.5 Rest of the Middle East & Africa

13.5.5.1 The Market in Rest of the Middle East & Africa to Grow at A Stagnant Rate

13.6 South America

13.6.1 Brazil

13.6.1.1 Growth in Disposable Income to Drive the Pouches Market in Brazil

13.6.2 Argentina

13.6.2.1 Rise in Demand for Innovative Packaging to Drive the Pouches Market in Argentina

13.6.3 Rest of South America

13.6.3.1 Growth in the Packaged Food Industry to Drive the Pouches Market in Rest of South America

14 Competitive Landscape (Page No. - 141)

14.1 Overview

14.2 Market Ranking

14.3 Competitive Scenario

14.3.1 Mergers & Acquisitions

14.3.2 Expansions, Investments, and Divestitures

14.3.3 Partnerships, Agreements, and Joint Ventures

14.3.4 New Product Launches

15 Company Profiles (Page No. - 147)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

15.1 Smurfit Kappa

15.2 Amcor

15.3 Mondi

15.4 Berry Global Inc.

15.5 Sonoco

15.6 Sealed Air

15.7 Huhtamaki

15.8 Constantia Flexibles

15.9 Coveris

15.10 Clondalkin Group

15.11 Goglio Spa

15.12 KOROZO

15.13 Wipf Holding AG

15.14 A. Hatzopoulos S.A.

15.15 Proampac

15.16 Gualapack S.p.A.

15.17 Formika

15.18 Daklapack Group

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15.19 Other Players

15.19.1 American Packaging Corporation

15.19.2 Bryce Corporation

15.19.3 Glenroy, Inc.

15.19.4 C-P Flexible Packaging

15.19.5 St. Johns Packaging

15.19.6 Scholle Ipn

15.19.7 Interflex Group

16 Appendix (Page No. - 201)

16.1 Discussion Guide

16.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.3 Available Customizations

16.4 Related Reports

16.5 Author Details

List of Tables (177 Tables)

Table 1 USD Conversion Rates, 2016–2018

Table 2 Customizable Features of Pouches

Table 3 Pouches Market Size, By Type, 2017–2024 (USD Million)

Table 4 Pouche Market Size, By Type, 2017–2024 (Million Unit)

Table 5 Pouch Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 6 Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 7 Pouche Market Size, By Flat Pouches, 2017–2024 (USD Million)

Table 8 Market Size, By Flat Pouches, 2017–2024 (Million Unit)

Table 9 Pouch Market Size, By Material, 2017–2024 (USD Million)

Table 10 Market Size, By Material, 2017–2024 (Million Unit)

Table 11 Pouche Market Size, By Application, 2017–2024 (USD Million)

Table 12 Pouch Market Size, By Application, 2017–2024 (Million Unit)

Table 13 Market Size, By Treatment Type, 2017–2024 (USD Million)

Table 14 Pouche Market Size, By Treatment Type, 2017–2024 (Million Unit)

Table 15 Pouch Market Size, By Region, 2017–2024 (USD Million)

Table 16 Market Size, By Region, 2017–2024 (Million Unit)

Table 17 Pouche Market Size, By Type, 2017–2024 (USD Million)

Table 18 Pouch Market Size, By Type, 2017–2024 (Million Unit)

Table 19 Pouches Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 20 Pouche Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 21 Pouch Market Size, By Flat Pouches, 2017–2024 (USD Million)

Table 22 Market Size, By Flat Pouches, 2017–2024 (Million Unit)

Table 23 Pouche Market Size, By Material, 2017–2024 (USD Million)

Table 24 Pouch Market Size, By Material, 2017–2024 (Million Unit)

Table 25 Pouches Market Size, By Treatment Type, 2017–2024 (USD Million)

Table 26 Pouche Market Size, By Treatment Type, 2017–2024 (Million Unit)

Table 27 Pouch Market Size, By Application, 2017–2024 (USD Million)

Table 28 Pouche Market Size, By Application, 2017–2024 (Million Unit)

Table 29 Europe: Pouches Market Size, By Country, 2017–2024 (USD Million)

Table 30 Europe: Pouche Market Size, By Country, 2017–2024 (Million Unit)

Table 31 Europe: Pouch Market Size, By Type, 2017–2024 (USD Million)

Table 32 Europe: Market Size, By Type, 2017–2024 (Million Unit)

Table 33 Europe: Pouche Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 34 Europe: Pouch Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 35 Europe: Market Size, By Treatment Type, 2017–2024 (USD Million)

Table 36 Europe: Pouche Market Size, By Treatment Type, 2017–2024 (Million Unit)

Table 37 Europe: Pouch Market Size, By Application, 2017–2024 (USD Million)

Table 38 Europe: Market Size, By Application, 2017–2024 (Million Unit)

Table 39 Germany: Pouche Market Size, By Type, 2017–2024 (USD Million)

Table 40 Germany: Pouch Market Size, By Type, 2017–2024 (Million Unit)

Table 41 Germany: Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 42 Germany: Pouche Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 43 UK: Pouch Market Size, By Type, 2017–2024 (USD Million)

Table 44 UK: Market Size, By Type, 2017–2024 (Million Unit)

Table 45 UK: Pouche Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 46 UK: Pouch Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 47 France: Market Size, By Type, 2017–2024 (USD Million)

Table 48 France: Pouche Market Size, By Type, 2017–2024 (Million Unit)

Table 49 France: Pouch Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 50 France: Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 51 Spain: Pouche Market Size, By Type, 2017–2024 (USD Million)

Table 52 Spain: Pouch Market Size, By Type, 2017–2024 (Million Unit)

Table 53 Spain: Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 54 Spain: Pouche Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 55 Russia: Pouch Market Size, By Type, 2017–2024 (USD Million)

Table 56 Russia: Market Size, By Type, 2017–2024 (Million Unit)

Table 57 Russia: Pouche Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 58 Russia: Pouch Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 59 Italy: Market Size, By Type, 2017–2024 (USD Million)

Table 60 Italy: Pouche Market Size, By Type, 2017–2024 (Million Unit)

Table 61 Italy: Pouch Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 62 Italy: Pouches Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 63 Rest of Europe: Pouche Market Size, By Type, 2017–2024 (USD Million)

Table 64 Rest of Europe: Pouch Market Size, By Type, 2017–2024 (Million Unit)

Table 65 Rest of Europe: Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 66 Rest of Europe: Pouche Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 67 North America: Pouch Market Size, By Country, 2017–2024 (USD Million)

Table 68 North America: Pouches Market Size, By Country, 2017–2024 (Million Unit)

Table 69 North America: Pouche Market Size, By Type, 2017–2024 (USD Million)

Table 70 North America: Pouch Market Size, By Type, 2017–2024 (Million Unit)

Table 71 North America: Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 72 North America: Pouche Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 73 North America: Pouch Market Size, By Treatment Type, 2017–2024 (USD Million)

Table 74 North America: Pouches Market Size, By Treatment Type, 2017–2024 (Million Unit)

Table 75 North America: Pouche Market Size, By Application, 2017–2024 (USD Million)

Table 76 North America: Pouch Market Size, By Application, 2017–2024 (Million Unit)

Table 77 US: Pouches Market Size, By Type, 2017–2024 (USD Million)

Table 78 US: Pouche Market Size, By Type, 2017–2024 (Million Unit)

Table 79 US: Pouch Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 80 US: Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 81 Canada: Pouche Market Size, By Type, 2017–2024 (USD Million)

Table 82 Canada: Pouch Market Size, By Type, 2017–2024 (Million Unit)

Table 83 Canada: Pouches Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 84 Canada: Pouche Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 85 Mexico: Pouch Market Size, By Type, 2017–2024 (USD Million)

Table 86 Mexico: Market Size, By Type, 2017–2024 (Million Unit)

Table 87 Mexico: Pouche Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 88 Mexico: Pouch Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 89 Asia Pacific: Pouches Market Size, By Country, 2017–2024 (USD Million)

Table 90 Asia Pacific: Pouche Market Size, By Country, 2017–2024 (Million Unit)

Table 91 Asia Pacific: Pouch Market Size, By Type, 2017–2024 (USD Million)

Table 92 Asia Pacific: Market Size, By Type, 2017–2024 (Million Unit)

Table 93 Asia Pacific: Pouche Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 94 Asia Pacific: Pouch Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 95 Asia Pacific: Pouche Market Size, By Treatment Type, 2017–2024 (USD Million)

Table 96 Asia Pacific: Market Size, By Treatment Type, 2017–2024 (Million Unit)

Table 97 Asia Pacific: Pouche Market Size, By Application, 2017–2024 (USD Million)

Table 98 Asia Pacific: Pouch Market Size, By Application, 2017–2024 (Million Unit)

Table 99 China: Pouches Market Size, By Type, 2017–2024 (USD Million)

Table 100 China: Pouche Market Size, By Type, 2017–2024 (Million Unit)

Table 101 China: Pouch Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 102 China: Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 103 Japan: Pouche Market Size, By Type, 2017–2024 (USD Million)

Table 104 Japan: Pouch Market Size, By Type, 2017–2024 (Million Unit)

Table 105 Japan: Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 106 Japan: Pouche Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 107 India: Pouch Market Size, By Type, 2017–2024 (USD Million)

Table 108 India: Pouches Market Size, By Type, 2017–2024 (Million Unit)

Table 109 India: Pouche Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 110 India: Pouch Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 111 Australia: Market Size, By Type, 2017–2024 (USD Million)

Table 112 Australia: Pouche Market Size, By Type, 2017–2024 (Million Unit)

Table 113 Australia: Pouch Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 114 Australia: Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 115 South Korea: Pouche Market Size, By Type, 2017–2024 (USD Million)

Table 116 South Korea: Pouch Market Size, By Type, 2017–2024 (Million Unit)

Table 117 South Korea: Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 118 South Korea: Pouche Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 119 Rest of Asia Pacific: Pouch Market Size, By Type, 2017–2024 (USD Million)

Table 120 Rest of Asia Pacific: Pouches Market Size, By Type, 2017–2024 (Million Unit)

Table 121 Rest of Asia Pacific: Pouche Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 122 Rest of Asia Pacific: Pouch Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 123 Middle East & Africa: Market Size, By Country, 2017–2024 (USD Million)

Table 124 Middle East & Africa: Pouche Market Size, By Country, 2017–2024 (Million Unit)

Table 125 Middle East & Africa: Pouch Market Size, By Type, 2017–2024 (USD Million)

Table 126 Middle East & Africa: Market Size, By Type, 2017–2024 (Million Unit)

Table 127 Middle East & Africa: Pouche Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 128 Middle East & Africa: Pouch Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 129 Middle East & Africa: Market Size, By Treatment Type, 2017–2024 (USD Million)

Table 130 Middle East & Africa: Pouche Market Size, By Treatment Type, 2017–2024 (Million Unit)

Table 131 Middle East & Africa: Pouch Market Size, By Application,2017–2024 (USD Million)

Table 132 Middle East & Africa: Market Size, By Application, 2017–2024 (Million Unit)

Table 133 Turkey: Pouche Market Size, By Type, 2017–2024 (USD Million)

Table 134 Turkey: Pouch Market Size, By Type, 2017–2024 (Million Unit)

Table 135 Turkey: Pouch Market Size, By Stand-Up Pouches,2017–2024 (USD Million)

Table 136 Turkey: Pouche Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 137 South Africa: Pouch Market Size, By Type, 2017–2024 (USD Million)

Table 138 South Africa: Pouches Market Size, By Type, 2017–2024 (Million Unit)

Table 139 South Africa: Pouche Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 140 South Africa: Pouch Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 141 Saudi Arabia: Market Size, By Type, 2017–2024 (USD Million)

Table 142 Saudi Arabia: Pouche Market Size, By Type, 2017–2024 (Million Unit)

Table 143 Saudi Arabia: Pouch Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 144 Saudi Arabia: Pouches Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 145 Nigeria: Pouche Market Size, By Type, 2017–2024 (USD Million)

Table 146 Nigeria: Pouch Market Size, By Type, 2017–2024 (Million Unit)

Table 147 Nigeria: Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 148 Nigeria: Pouche Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 149 Rest of Middle East & Africa: Pouch Market Size, By Type, 2017–2024 (USD Million)

Table 150 Rest of Middle East & Africa: Market Size, By Type, 2017–2024 (Million Unit)

Table 151 Rest of Middle East & Africa: Pouche Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 152 Rest of Middle East & Africa: Pouch Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 153 South America: Market Size, By Country, 2017–2024 (USD Million)

Table 154 South America: Pouche Market Size, By Country, 2017–2024 (Million Unit)

Table 155 South America: Pouch Market Size, By Type, 2017–2024 (USD Million)

Table 156 South America: Market Size, By Type, 2017–2024 (Million Unit)

Table 157 South America: Pouche Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 158 South America: Pouch Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 159 South America: Market Size, By Treatment Type, 2017–2024 (USD Million)

Table 160 South America: Pouche Market Size, By Treatment Type, 2017–2024 (Million Unit)

Table 161 South America: Pouch Market Size, By Application, 2017–2024 (USD Million)

Table 162 South America: Market Size, By Application, 2017–2024 (Million Unit)

Table 163 Brazil: Pouche Market Size, By Type, 2017–2024 (USD Million)

Table 164 Brazil: Pouch Market Size, By Type, 2017–2024 (Million Unit)

Table 165 Brazil: Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 166 Brazil: Pouche Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 167 Argentina: Pouch Market Size, By Type, 2017–2024 (USD Million)

Table 168 Argentina: Market Size, By Type, 2017–2024 (Million Unit)

Table 169 Argentina: Pouche Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 170 Argentina: Pouch Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 171 Rest of South America: Market Size, By Type, 2017–2024 (USD Million)

Table 172 Rest of South America: Market Size, By Type, 2017–2024 (Million Unit)

Table 173 Rest of South America: Pouche Market Size, Stand-Up Pouches, 2017–2024 (USD Million)

Table 174 Rest of South America: Pouch Market Size, Stand-Up Pouches, 2017–2024 (Million Unit)

Table 175 Mergers & Acquisitions

Table 176 Expansions, Investments, and Divestitures

Table 177 Partnerships, Agreements, and Joint Ventures

List of Figures (49 Figures)

Figure 1 Pouches Market Segmentation

Figure 2 Pouche Market, By Region

Figure 3 Pouch Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Pouches: Data Triangulation

Figure 7 Standard Pouches to Lead the Pouches Market During the Forecast Period

Figure 8 Food Application to Lead the Pouches Market During the Forecast Period

Figure 9 Bioplastics to Be the Fastest-Growing Material in the Pouches Market During the Forecast Period

Figure 10 Flat Pouches to Lead the Pouches Market During the Forecast Period

Figure 11 Asia Pacific Led the Pouches Market in 2018

Figure 12 Food Industry Led the Asia Pacific Market in 2018

Figure 13 Emerging Economies Offer Attractive Opportunities in the Pouches Market During the Forecast Period

Figure 14 China Was the Largest Market for Pouches Market in Asia Pacific in 2018

Figure 15 Flat Pouches Segment to Lead the Pouches Market During the Forecast Period

Figure 16 Pillow Pouch Type of Flat Pouches Segment to Lead the Pouches Market During the Forecast Period

Figure 17 Bottom Gusset Bags Segment to Lead the Pouches Market During the Forecast Period

Figure 18 Paper Segment to Lead the Pouches Market During the Forecast Period

Figure 19 Standard Segment to Lead the Pouches Market Duringthe Forecast Period

Figure 20 Food Segment to Lead the Pouches Market During the Forecast Period

Figure 21 The Pouches Market in China is Projected to Grow at the Highest CAGR Between 2019 and 2024

Figure 22 Drivers, Restraints, Opportunities, and Challenges in the Pouches Market

Figure 23 Value Chain Analysis

Figure 24 Porter’s Five Forces Analysis

Figure 25 Pouches Market Size, By Type, 2019 vs. 2024 (USD Million)

Figure 26 Pouche Market, By Material, 2019 vs. 2024 (USD Million)

Figure 27 Pouch Market, By Application, 2019 vs. 2024 (USD Million)

Figure 28 Pouches Market Size, By Treatment Type, 2019 vs. 2024 (USD Million)

Figure 29 Regional Snapshot: China to Be the Fastest-Growing Pouches Market, 2019–2024

Figure 30 Asia Pacific: Pouches Market Snapshot

Figure 31 Companies Adopted Mergers & Acquisitions as the Key Growth Strategy Between 2015 and 2019

Figure 32 Market Ranking of Key Players, 2018

Figure 33 Smurfit Kappa: Company Snapshot

Figure 34 Smurfit Kappa: SWOT Analysis

Figure 35 Amcor: Company Snapshot

Figure 36 Amcor: SWOT Analysis

Figure 37 Mondi: Company Snapshot

Figure 38 Mondi: SWOT Analysis

Figure 39 Berry Global Inc.: Company Snapshot

Figure 40 Berry Global Inc.: SWOT Analysis

Figure 41 Sonoco: Company Snapshot

Figure 42 Sonoco: SWOT Analysis

Figure 43 Sealed Air: Company Snapshot

Figure 44 Huhtamaki: Company Snapshot

Figure 45 Constantia Flexibles: Company Snapshot

Figure 46 Coveris: Company Snapshot

Figure 47 Goglio Spa: Company Snapshot

Figure 48 KOROZO : Company Snapshot

Figure 49 Wipf Holding AG: Company Snapshot

The study involved four major activities for estimating the current global size of the pouches market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of the pouches market through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the pouches market. Thereafter, market breakdown and data triangulation procedures were conducted to estimate the size of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for the study on the pouches market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

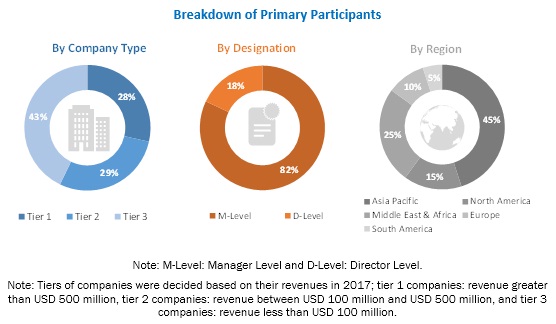

Primary Research

Various primary sources from both supply- and demand-side of the market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts such as chief executive officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various key companies and organizations operating in the pouches market. The primary sources from the demand-side included key executives from the food, beverages, healthcare, personal care & home care, and oil & lubricant companies. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the global size of the pouches market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the pouches market. The data was triangulated by studying various factors and trends from both demand- and supply-side.

Research Objectives

- To define, analyze, and project the size of the pouches market, in terms of value and volume, based on type, material, treatment type, application, and region

- To project the size of the market and its segments, in terms of value and volume, with respect to the five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the key factors such as drivers, opportunities, restraints, and challenges influencing the growth of the market

- To strategically analyze the micromarkets, with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments such as acquisitions, expansions, investments, new product launches, partnerships, and agreements in the pouches market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the pouches report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the pouches market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Pouches Market