Stand-up Pouches Market by Type (Aseptic, Standard, Retort, Hot-filled), Form (Round Bottom, Rollstock, K-Style, Plow/Folded Bottom, Flat Bottom), Closure Type (Top Notch, Zipper, Spout), Material, Application and Region - Global Forecast to 2027

Updated on : August 28, 2025

Stand-Up Pouches Market

The global stand-up pouches market was valued at USD 24.8 billion in 2022 and is projected to reach USD 36.7 billion by 2027, growing at 8.1% cagr from 2022 to 2027. The increase in health awareness and rising per capita income is driving the growth of the market.

Global Stand-up Pouches Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Stand-up Pouches Market Dynamics

DRIVERS: Rise in demand for packaged food & beverages

Increasing health awareness and rising per capita income have resulted in the rise in demand for packaged food & beverages, which, in turn, drives the demand for stand-up pouches. According to The Associated Chambers of Commerce & Industry of India (ASSOCHAM), an annual increase of 22.5% has been witnessed from 2010 to 2015 in annual spending in India on packaged food. Increase in Westernization, rise in the standard of living, and increase in preference for convenience food products contribute to the increase in demand for packaged food products. The major categories of packaged food include dried processed food, ready-to-eat meals, diet snacks, bakery products, frozen processed food, dairy products, health food & drink products, and processed meat.

The on-the-go lifestyle significantly contributes to the demand for packaged food & beverages. Long commuting time and working hours, coupled with consumer preference for convenience food drives the demand for ready-to-eat foods and snacks. According to the Produce for Better Health (PBH) Foundation, the percentage contribution of frozen foods increased to 16% in 2014 from 9% in 1985 in the US. The rise in demand for packaged food subsequently drives the demand for stand-up pouches.

RESTRAINT : Stringent government regulations

Stand-up pouches are one of the fastest-growing segments of the flexible packaging industry. However, stringent regulations imposed on flexible plastic packaging may pose a restraint to the market. Compliance with regulations is necessary as the smallest defect in packaging may contaminate the product; it may also affect the manufacturers’ profits. Packaging for food & beverages, personal care, and healthcare products requires properties such as moisture resistance, barrier against light, and ease of transport. Regulatory bodies regulating flexible plastic packaging include the Food and Drug Administration (FDA), the European Commission, and the US Environmental Protection Agency (EPA).

Packaging waste harms the ecosystem as it requires decades to decompose. Governments worldwide are addressing this issue by imposing stringent laws, which results in the flexible plastic packaging industry being subjected to governance. For instance, governments in Europe implemented various steps to deal with packaging waste and recycling issues. In emerging nations, governments have started focusing on protecting the environment by taking steps to promote sustainable packaging.

OPPORTUNITIES: Sustainable and new flexible plastics packaging solutions

Dynamic industry changes such as the introduction of new regulatory initiatives have encouraged manufacturers in developing new packaging options. Rising concerns regarding the use of plastics for flexible packaging and their impact on the environment have also driven manufacturers to develop biodegradable and sustainable packaging options that are safe and secure. In order to reduce the cost pressure and maintain the integrity of product packages, manufacturers are considering sustainable packaging solutions that require fewer materials and energy to manufacture a package, reduce transportation expenses, and offer extended shelf-life to products.

Due to stringent government regulations, changing consumer preferences, and environmental pressures, manufacturers are steering their strategies towards circularity and have leveraged new plastic technologies to develop recyclable and sustainable solutions which include specific properties such as oxygen, moisture, light, puncture, and chemical resistance, and easy-tear propagation. The key areas of focus for manufacturers include the development of alternative bioplastic solutions such as polybutylene succinate and biopolyproplyene, along with the prices and disposal of bioplastics, which are expected to need to be examined to ensure successful usage.

Governments all over the world are encouraging the use of sustainable packaging in order to minimize waste. In 2018, the UK strode forward to become the world leader in sustainable packaging. With an investment of USD 80 million, the government called on innovators to develop packaging which is expected to reduce the impact that harmful plastics are having on the environment. The Packaging and Packaging Waste Directive has been established in Europe which has two main objectives: to help prevent obstacles to trade and reduce the impact of packaging waste on the environment. According to this directive, EU States shall ensure that the recovery and recycling of packaging are undertaken effectively and that the use of hazardous constituents in packaging are kept to minimal levels.

In May 2021, the sustainable flexible packaging firm Glenroy collaborated with the environmental odor control company Walex Products to introduce a new recyclable stand-up pouch for the household products market. The new recyclable stand-up pouch, which is claimed to be the first of its kind in the industry, is designed for the residential septic tank treatment market. Mondi focuses on providing solutions that reduce plastic waste and is taking steps to close the gaps in the circular economy such as minimizing material and energy usage.

CHALLENGES: Challenges in recycling multi-layer structures

Recycling multi-layer structures of plastics acts as a challenge in the growth of the stand-up pouches market. Generally, multi-layer packaging is not recyclable. The presence of many compositions in the plastic laminates contributes to complications in recycling flexible pouches. Coating, mixed materials, and adhesives, each create complications that result in difficulties in separation, classification, and recycling the flexible materials.

Multi-layered laminates comprise multiple plastic resins and foils and are currently not accepted by municipalities. However, consumers are dropping these materials into their curbside recycling bins. Due to their flat shapes and lightweight properties, these packaging materials are similar to paper and are sent through material recovery facilities (MRF) along with the paper streams. These plastic materials can pollute the recycled paper stream in the recovery unit, and thus, require manual sorting to remove laminated plastics.

However, companies are making constant efforts to develop 100% recyclable pouches. For instance, Dow Chemical, in collaboration with Sustainable Packaging Coalition and Accredo Packaging, produced Seventh Generation’s 100% recyclable stand-up pouch for dishwasher pods. Sprout Organic partnered with TerraCycle with the aim to collect used pouches to recycle them into other consumer products such as tote bags. Few ongoing technological developments: Enval technology in the UK can recover aluminum from laminated packaging and new a plastic sorting technology—are being examined to decide whether they may help create a value stream. This challenge is expected to be overcome in the coming years with the development of advanced recycling technologies and the introduction of recyclable pouches.

Rollstock is the fastest growing segment by form in the stand-up pouches market.

Based on form, solution Rollstock is estimated to be the largest and fastest growing segment of Stand-up pouches during the forecast period. Rollstock can be defined as a laminated film wrapped on a roll. It is used with FFS (form, fill, and seal) machines that automatically form the film into a pouch shape, fill it with the product, and seal the pouch. It is used across numerous industries to produce flat pouches, stand-up pouches, side gusseted bags, and other package formats.

Standard stand-up pouches is the fastest growing segment by application in the stand-up pouches market.

Standard stand-up pouches is estimated to be the largest end-use industry segment in the stand-up pouches market during the forecast period. Standard stand-up pouches are available with numerous additional features and benefits, including zipper re-closure, pour spouts, slider closures, release valves, and strong shelf presence. They also provide high clarity and superior barrier properties to the product enclosed within. Such pouches are widely employed by several industries for satisfying their product packaging needs. In the current scenario, they are widely used in the packaging of food, beverages, fertilizers, and cosmetics.

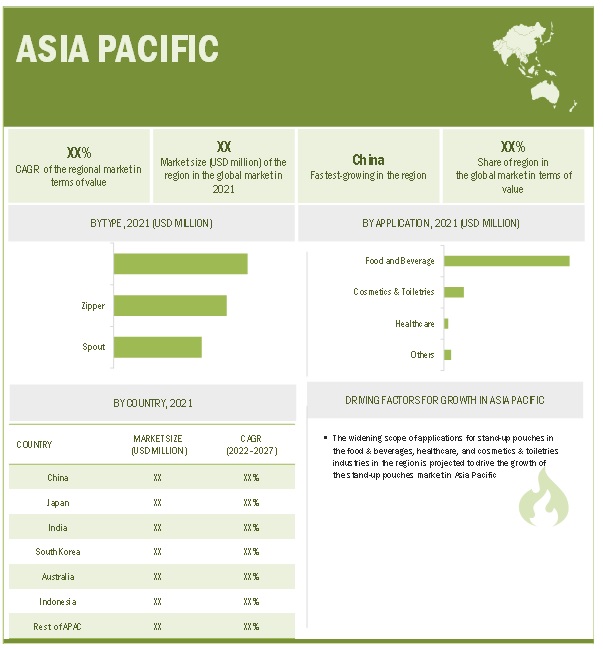

Asia Pacific is estimated to be the largest market for stand-up pouches

Asia Pacific is the largest and fastest growing market for stand-up pouches, followed by North America and Europe. China is the largest country-wise market in the region, and this trend is projected to continue over the next five years. The use of stand-up pouches in the region has increased due to various features such as cost-effectiveness, easy availability of raw materials, and the increasing demand for compact packaging solutions from highly populated countries such as India and China.

To know about the assumptions considered for the study, download the pdf brochure

Stand-up Pouches Market Players

The leading players in the stand-up pouches market are Amcor Plc (Switzerland), Berry Global Inc (US), Mondi (US), Sealed Air (US), Smurfit Kappa (Ireland), Coveris (Austria), ProAmpac (US), Huhtamaki (Finland), Sonoco (US), Constantia Flexibles (Austria), and others.

These companies have adopted various organic as well as inorganic growth strategies between 2018 and 2022 to strengthen their position in the market. New product development, joint venture, acquisition, and expansion were among the key growth strategies adopted by these leading players to enhance their product offering and regional presence and meet the growing demand for stand-up pouches in the emerging economies.

Stand-up Pouches Market Report Scope

|

Report Metric |

Details |

|

Years Considered |

2020-2027 |

|

Base year |

2021 |

|

Forecast period |

2022-2027 |

|

Unit considered |

Value (USD Billion), Volume (Million Units) |

|

Segments |

Application, Type, Closure Type, Form, Material and Region |

|

Regions |

North America, Europe, Asia-Pacific, Middle East & Africa and South America |

|

Companies |

The major players are Amcor Plc (Switzerland), Berry Global Inc (US), Mondi (US), Sealed Air (US), Smurfit Kappa (Ireland), Coveris (Austria), ProAmpac (US), Huhtamaki (Finland), Sonoco (US), Constantia Flexibles (Austria), and others. |

This research report categorizes the global Stand-up pouches market on the basis of Application, Type, Closure Type, Form, Material and Region.

Stand-up pouches market, By Form

- Round Bottom

- Rollstock

- K-style

- Plow/Folded Bottom

- Flat Bottom

- Others

Stand-up pouches market, By Type

- Aseptic Stand-up Pouches

- Standard Stand-up Pouches

- Retort Stand-up Pouches

- Hot-filled Stand-up Pouches

Stand-up pouches market, By Closure Type

- Top Notch

- Zipper

- Spout

Stand-up pouches market, By Material

- Plastic

- Metal/Foil

- Paper

- Bioplastic

Stand-up pouches market, By Application

- Food & Beverage

- Cosmetics & Toiletries

- Healthcare

- Others

Stand-up pouches market, By Region

- North America

- Europe

- Asia Pacific (APAC)

- South America

- Middle East & Africa (MEA)

The market has been further analyzed for the key countries in each of these regions.

Recent Developments in Stand-up Pouches Market

- In June 2021, Amcor launched a specialty multi-chamber pouch for drug-device combination products. The Dual Chamber Pouch has already won a 2021 Award from the Flexible Packaging Association for its technical innovation and material structure.

- In September 2020, Packaging firm Amcor, in collaboration with Nestlé, has developed what it claims to be the world’s first recyclable flexible retort pouch for consumer products.

- In March 2022, US-based plastic packaging product manufacturer Berry Global is planning to launch a new food closure that is lightweight and more recyclable. The new closure is said to save weight and reduce material consumption without impacting the overall performance or user convenience.

- In February 2022, Mondi & Henkel partner to launch fully recyclable mono-material refill pouch for Pril. The two companies worked together on a packaging solution for Henkel’s hand dishwashing products that enables refilling plastic bottles from flexible pouches. This supports Henkel’s sustainability targets of making 100% packaging recyclable or reusable and reducing 50% fossil-based virgin plastic by 2025.

- In June 2019, US-based flexible packaging solutions provider ProAmpac introduced new ProActive PCR Retort pouches designed for pet and human food packaging.

Frequently Asked Questions (FAQ):

What is the major driver influencing the growth of the stand-up pouches market?

Increasing health awareness and rising per capita income have resulted in the rise in demand for packaged food & beverages, which, in turn, drives the demand for stand-up pouches.

How is the stand-up pouches market segmented in terms of applications?

The stand-up pouches market is segmented into food and beverages, cosmetics, toiletries, healthcare and others.

What are the major challenges in stand-up pouches market?

Availability of substitutes

What are the major opportunities in stand-up pouches market?

Sustainable and new flexible plastics packaging solutions

Which region has the largest demand?

APAC has the largest demand for stand-up pouches owing to food and beverage sector present in China, India, Japan, South Korea and other Southeast Asian countries.

Who are the major manufacturers of stand-up pouches?

The major manufacturers of stand-up pouches are Amcor Plc (Switzerland), Berry Global Inc (US), Mondi (US), Sealed Air (US), Smurfit Kappa (Ireland), Coveris (Austria), ProAmpac (US), Huhtamaki (Finland), Sonoco (US), Constantia Flexibles (Austria), and others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 STAND-UP POUCHES MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 2 STAND-UP POUCHES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

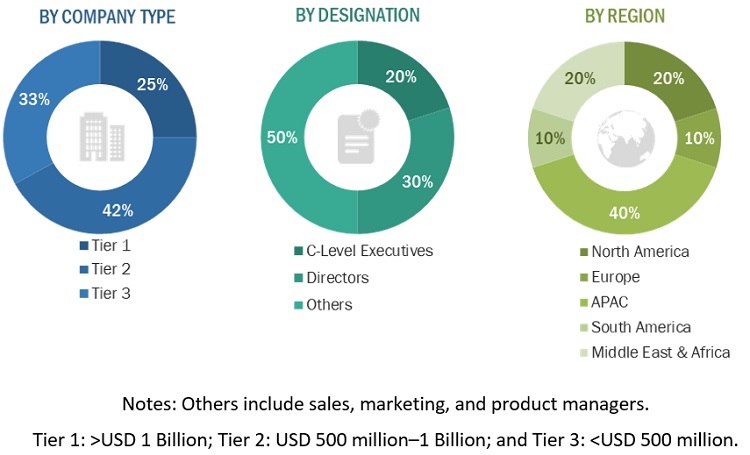

FIGURE 3 LIST OF STAKEHOLDERS AND BREAKDOWN OF PRIMARY INTERVIEWS

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE

2.3 DATA TRIANGULATION

FIGURE 7 STAND-UP POUCHES MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 8 ASEPTIC STAND-UP POUCHES SEGMENT TO LEAD MARKET

FIGURE 9 FOOD & BEVERAGES SEGMENT TO LEAD IN TERMS OF APPLICATION

FIGURE 10 ROUND BOTTOM TO BE FASTEST-GROWING FORM

FIGURE 11 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 SIGNIFICANT OPPORTUNITIES IN STAND-UP POUCHES MARKET

FIGURE 12 FOOD & BEVERAGES SECTOR TO OFFER GROWTH OPPORTUNITIES

4.2 ASIA PACIFIC STAND-UP POUCHES MARKET, BY TYPE AND COUNTRY, 2021

FIGURE 13 CHINA ACCOUNTED FOR LARGEST SHARE IN ASIA PACIFIC

4.3 STAND-UP POUCHES MARKET, BY APPLICATION

FIGURE 14 FOOD & BEVERAGES SEGMENT TO DOMINATE MARKET, 2022–2027

4.4 STAND-UP POUCHES MARKET, BY FORM

FIGURE 15 ROLLSTOCK SEGMENT AND ASIA PACIFIC ACCOUNTED FOR LARGEST SHARES, 2021

4.5 STAND-UP POUCHES MARKET, BY COUNTRY

FIGURE 16 CHINA TO BE FASTEST-GROWING MARKET IN TERMS OF VOLUME

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 STAND-UP POUCHES MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rise in demand for packaged food & beverages

5.2.1.2 Cost-effectiveness

5.2.1.3 Increase in demand from end-use industries

5.2.1.4 Esthetic appeal

TABLE 1 CUSTOMIZABLE FEATURES OF STAND-UP POUCHES

5.2.2 RESTRAINTS

5.2.2.1 Stringent government regulations

5.2.3 OPPORTUNITIES

5.2.3.1 Sustainable and new flexible plastic packaging solutions

5.2.3.2 Rise in demand from emerging economies

5.2.3.3 Demand for alcohol packaging

5.2.4 CHALLENGES

5.2.4.1 Availability of substitutes

5.2.4.2 Challenges in recycling multi-layer structures

5.2.4.3 Volatile raw material prices

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 STAND-UP POUCHES MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 2 STAND-UP POUCHES MARKET: PORTER'S FIVE FORCE ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.1.1 Presence of large-scale players

5.3.1.2 High investments

5.3.2 THREAT OF SUBSTITUTES

5.3.2.1 Abundant substitutes

5.3.2.2 Low cost of switching

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.3.1 Easy availability of raw materials

5.3.4 BARGAINING POWER OF BUYERS

5.3.4.1 Large number of buyers hold high bargaining power

5.3.4.2 Availability of numerous substitutes

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.3.5.1 High market fragmentation

5.3.5.2 Low customer loyalty

5.4 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS

5.5 REGULATORY LANDSCAPE

5.6 REGULATORY LANDSCAPE

5.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.7 KEY CONFERENCES AND EVENTS IN 2022

TABLE 6 STAND-UP POUCHES MARKET: LIST OF CONFERENCES & EVENTS

5.8 CASE STUDY

5.8.1 HELLA NUTS’ SUCCESS DUE TO STAND-UP POUCHES

5.8.2 BOTTLES TO SPOUTED STAND-UP POUCHES

5.9 TECHNOLOGY ANALYSIS

5.9.1 NANOCELLULOSE BASE OF VTT’S NEW STAND-UP POUCH

5.10 AVERAGE SELLING PRICE ANALYSIS

TABLE 7 AVERAGE PRICES OF STAND-UP POUCHES, (USD/GRAM)

5.11 STAND-UP POUCHES TRADE ANALYSIS

TABLE 8 ARTICLES FOR CONVEYANCE OR PACKAGING GOODS OF PLASTICS, IMPORT BY COUNTRY (2020–2021) IN US DOLLAR THOUSAND

TABLE 9 ARTICLES FOR CONVEYANCE OR PACKAGING GOODS OF PLASTICS, EXPORT BY COUNTRY (2020–2021) IN US DOLLAR THOUSAND

5.12 STAND-UP POUCHES ECOSYSTEM

5.13 YC, YCC SHIFT

FIGURE 20 SUSTAINABLE AND ENVIRONMENT-FRIENDLY PACKAGING PRODUCTS TO ENHANCE FUTURE REVENUE MIX

5.14 STAND-UP POUCHES PATENT ANALYSIS

5.14.1 INTRODUCTION

5.14.2 METHODOLOGY

5.14.3 DOCUMENT TYPE

TABLE 10 TOTAL NUMBER OF PATENTS

FIGURE 21 TOTAL NUMBER OF PATENTS

FIGURE 22 PUBLICATION TRENDS - LAST FIVE YEARS

5.14.4 INSIGHTS

5.14.5 LEGAL STATUS OF PATENTS

FIGURE 23 LEGAL STATUS OF PATENTS

FIGURE 24 JURISDICTION ANALYSIS

5.14.6 TOP COMPANIES/APPLICANTS

FIGURE 25 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 11 LIST OF PATENTS BY DOW GLOBAL TECHNOLOGIES LLC.

TABLE 12 LIST OF PATENTS BY FRITO LAY NORTH AMERICA INC.

TABLE 13 TOP 10 PATENT OWNERS (US) DURING LAST 10 YEARS

6 STAND-UP POUCHES MARKET, BY FORM (Page No. - 76)

6.1 INTRODUCTION

FIGURE 26 ROUND BOTTOM STAND-UP POUCHES SEGMENT TO LEAD MARKET

TABLE 14 STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 15 STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

6.2 ROLLSTOCK

6.2.1 ROLLSTOCK SEGMENT LARGEST IN TERMS OF VOLUME

6.3 ROUND BOTTOM

6.3.1 ROUND BOTTOM TO BE FASTEST-GROWING SEGMENT

6.4 K-STYLE

6.4.1 DEMAND FOR HIGH-CAPACITY DRIVES K-STYLE STAND-UP POUCHES

6.5 PLOW BOTTOM/FOLDED BOTTOM

6.5.1 RISING DEMAND FOR PLOW BOTTOM POUCHES IN FOOD & BEVERAGES INDUSTRY

6.6 FLAT BOTTOM

6.6.1 ESTHETIC APPEAL OF FLAT BOTTOM STAND-UP POUCHES

6.7 OTHERS

6.7.1 OTHERS SEGMENT TO RECORD MODERATE GROWTH DURING FORECAST PERIOD

7 STAND-UP POUCHES MARKET, BY TYPE (Page No. - 80)

7.1 INTRODUCTION

FIGURE 27 ASEPTIC SEGMENT TO LEAD STAND-UP POUCHES MARKET

TABLE 16 STAND-UP POUCHE MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 17 STAND-UP POUCHES MARKET SIZE, BY TYPE, 2020–2027 (MILLION UNITS)

7.2 STANDARD STAND-UP POUCHES

7.2.1 STANDARD STAND-UP POUCHES TO BE LARGEST SEGMENT

7.3 ASEPTIC STAND-UP POUCHES

7.3.1 ASEPTIC STAND-UP POUCHES SEGMENT TO BE FASTEST-GROWING

7.4 RETORT STAND-UP POUCHES

7.4.1 INCREASING DEMAND FOR READY-TO-EAT FOOD TO DRIVE MARKET

7.5 HOT-FILLED STAND-UP POUCHES

7.5.1 GROWING NEED FOR LONGER SHELF-LIFE TO BOOST MARKET

8 STAND-UP POUCHES MARKET, BY CLOSURE TYPE (Page No. - 84)

8.1 INTRODUCTION

FIGURE 28 STAND-UP POUCHES MARKET, BY CLOSURE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 18 STAND-UP POUCHE MARKET SIZE, BY CLOSURE TYPE, 2020–2027 (USD MILLION)

TABLE 19 STAND-UP POUCHES MARKET SIZE, BY CLOSURE TYPE, 2020–2027 (MILLION UNITS)

8.2 TOP NOTCH

8.2.1 TOP NOTCH SEGMENT TO LEAD MARKET

8.3 ZIPPER

8.3.1 RE-SEALABLE POUCHES TO DRIVE DEMAND FOR ZIPPER CLOSURES

8.3.2 PRESS-TO-CLOSE ZIPPER

8.3.3 SLIDING ZIPPER

8.3.4 VELCRO

8.4 SPOUT

8.4.1 SPOUT TO BE FASTEST-GROWING CLOSURE TYPE

9 STAND-UP POUCHES MARKET, BY MATERIAL (Page No. - 88)

9.1 INTRODUCTION

FIGURE 29 STAND-UP POUCHES MARKET, BY MATERIAL, 2022 VS. 2027 (USD MILLION)

TABLE 20 STAND-UP POUCHE MARKET SIZE, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 21 STAND-UP POUCHES MARKET SIZE, BY MATERIAL, 2020–2027 (MILLION UNITS)

9.2 PLASTIC

9.2.1 PLASTIC SEGMENT TO LEAD MARKET

9.2.1.1 POLYETHYLENE (PE)

9.3 POLYPROPYLENE (PP)

9.4 POLYVINYL CHLORIDE (PVC)

9.5 ETHYLENE VINYL ALCOHOL (EVOH)

9.6 POLYAMIDE

9.7 METAL/FOIL

9.7.1 RISING DEMAND FOR HIGH DUCTILITY AND BARRIER PROTECTION TO DRIVE DEMAND

9.8 PAPER

9.8.1 COST-EFFECTIVENESS AND LOW WEIGHT TO DRIVE GROWTH

9.9 BIOPLASTIC

9.9.1 RISING TREND IN SUSTAINABLE PACKAGING TO DRIVE BIOPLASTIC SEGMENT

10 STAND-UP POUCHES MARKET, BY APPLICATION (Page No. - 94)

10.1 INTRODUCTION

FIGURE 30 FOOD & BEVERAGES SEGMENT TO LEAD STAND-UP POUCHES MARKET

TABLE 22 STAND-UP POUCHE MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 23 STAND-UP POUCHES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

10.2 FOOD & BEVERAGES

10.2.1 RISE IN DEMAND FOR COMPACT & LIGHTWEIGHT PACKAGING TO DRIVE MARKET

10.3 COSMETICS & TOILETRIES

10.3.1 COSMETICS & TOILETRIES SECOND-FASTEST-GROWING APPLICATION

10.4 HEALTHCARE

10.4.1 ESTHETIC APPEAL AND PRODUCT PROTECTION CHARACTERISTICS TO DRIVE DEMAND

10.5 OTHERS

11 STAND-UP POUCHES MARKET, BY REGION (Page No. - 98)

11.1 INTRODUCTION

FIGURE 31 REGIONAL SNAPSHOT: RAPIDLY GROWING MARKETS EMERGING NEW HOTSPOTS

TABLE 24 STAND-UP POUCHES MARKET SIZE, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 25 STAND-UP POUCHE MARKET SIZE, BY REGION, 2020–2027 (MILLION UNITS)

TABLE 26 STAND-UP POUCHES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 STAND-UP POUCHE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 28 STAND-UP POUCHES MARKET SIZE, BY FORM, 2016–2019 (MILLION UNITS)

TABLE 29 STAND-UP POUCHE MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 30 STAND-UP POUCHES MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 31 STAND-UP POUCHE MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 32 STAND-UP POUCHES MARKET SIZE, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 33 STAND-UP POUCHE MARKET SIZE, BY TYPE, 2020–2027 (MILLION UNITS)

TABLE 34 STAND-UP POUCHES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 35 STAND-UP POUCHE MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 36 STAND-UP POUCHES MARKET SIZE, BY CLOSURE TYPE, 2016–2019 (MILLION UNITS)

TABLE 37 STAND-UP POUCHE MARKET SIZE, BY CLOSURE TYPE, 2020–2027 (MILLION UNITS)

TABLE 38 STAND-UP POUCHES MARKET SIZE, BY CLOSURE TYPE, 2016–2019 (USD MILLION)

TABLE 39 STAND-UP POUCHE MARKET SIZE, BY CLOSURE TYPE, 2020–2027 (USD MILLION)

TABLE 40 STAND-UP POUCHES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 41 STAND-UP POUCHE MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 42 STAND-UP POUCHES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 43 STAND-UP POUCHE MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 44 STAND-UP POUCHES MARKET SIZE, BY MATERIAL, 2016–2019 (MILLION UNITS)

TABLE 45 STAND-UP POUCHE MARKET SIZE, BY MATERIAL, 2020–2027 (MILLION UNITS)

TABLE 46 STAND-UP POUCHES MARKET SIZE, BY MATERIAL, 2016–2019 (USD MILLION)

TABLE 47 STAND-UP POUCHE MARKET SIZE, BY MATERIAL, 2020–2027 (USD MILLION)

11.2 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: STAND-UP POUCHES MARKET SNAPSHOT

TABLE 48 ASIA PACIFIC: STAND-UP POUCHE MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION UNITS)

TABLE 49 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 50 ASIA PACIFIC: MARKET SIZE, BY FORM, 2016–2019 (MILLION UNITS)

TABLE 51 ASIA PACIFIC: MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 52 ASIA PACIFIC: MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 53 ASIA PACIFIC: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 54 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 55 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2027 (MILLION UNITS)

TABLE 56 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 57 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 ASIA PACIFIC: MARKET SIZE, BY CLOSURE TYPE, 2016–2019 (MILLION UNITS)

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY CLOSURE TYPE, 2020–2027 (MILLION UNITS)

TABLE 60 ASIA PACIFIC: MARKET SIZE, BY CLOSURE TYPE, 2016–2019 (USD MILLION)

TABLE 61 ASIA PACIFIC: MARKET SIZE, BY CLOSURE TYPE, 2020–2027 (USD MILLION)

TABLE 62 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 63 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 64 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 65 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET SIZE, BY MATERIAL, 2016–2019 (MILLION UNITS)

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY MATERIAL, 2020–2027 (MILLION UNITS)

TABLE 68 ASIA PACIFIC: MARKET SIZE, BY MATERIAL, 2016–2019 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET SIZE, BY MATERIAL, 2020–2027 (USD MILLION)

11.2.1 CHINA

11.2.1.1 China projected to be largest market in Asia Pacific

TABLE 70 CHINA: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 71 CHINA: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 72 CHINA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 73 CHINA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.2.2 INDIA

11.2.2.1 India to be second fastest-growing Asia Pacific market

TABLE 74 INDIA: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 75 INDIA: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 76 INDIA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 77 INDIA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.2.3 JAPAN

11.2.3.1 Round bottom to be largest segment

TABLE 78 JAPAN: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 79 JAPAN: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 80 JAPAN: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 81 JAPAN: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.2.4 SOUTH KOREA

11.2.4.1 Food & beverages segment to be fastest-growing

TABLE 82 SOUTH KOREA: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 83 SOUTH KOREA: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 84 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 85 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.2.5 AUSTRALIA

11.2.5.1 Rise in consumption of packaged food

TABLE 86 AUSTRALIA: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 87 AUSTRALIA: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 88 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 89 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.2.6 INDONESIA

11.2.6.1 Round bottom segment to lead market

TABLE 90 INDONESIA: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 91 INDONESIA: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 92 INDONESIA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 93 INDONESIA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.2.7 REST OF ASIA PACIFIC

TABLE 94 REST OF ASIA PACIFIC: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 95 REST OF ASIA PACIFIC: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 96 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 97 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.3 EUROPE

TABLE 98 EUROPE: STAND-UP POUCHES MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION UNITS)

TABLE 99 EUROPE: STAND-UP POUCHE MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 101 EUROPE: MARKET SIZE, BY TYPE, 2020–2027 (MILLION UNITS)

TABLE 102 EUROPE: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY FORM, 2016–2019 (MILLION UNITS)

TABLE 105 EUROPE: MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 106 EUROPE: MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY CLOSURE TYPE, 2016–2019 (MILLION UNITS)

TABLE 109 EUROPE: MARKET SIZE, BY CLOSURE TYPE, 2020–2027 (MILLION UNITS)

TABLE 110 EUROPE: MARKET SIZE, BY CLOSURE TYPE, 2016–2019 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY CLOSURE TYPE, 2020–2027 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 113 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 114 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY MATERIAL, 2016–2019 (MILLION UNITS)

TABLE 117 EUROPE: MARKET SIZE, BY MATERIAL, 2020–2027 (MILLION UNITS)

TABLE 118 EUROPE: MARKET SIZE, BY MATERIAL, 2016–2019 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY MATERIAL, 2020–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Largest market for food & beverages

TABLE 120 GERMANY: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 121 GERMANY: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 122 GERMANY: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 123 GERMANY: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.3.2 UK

11.3.2.1 Increase in expenditure on food & beverages

TABLE 124 UK: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 125 UK: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 126 UK: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 127 UK: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Rollstock segment to lead market in France

TABLE 128 FRANCE: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 129 FRANCE: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 130 FRANCE: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 131 FRANCE: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.3.4 SPAIN

11.3.4.1 Rise in demand for convenient packaging

TABLE 132 SPAIN: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 133 SPAIN: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 134 SPAIN: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 135 SPAIN: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.3.5 ITALY

11.3.5.1 Food & beverages industry to lead market

TABLE 136 ITALY: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 137 ITALY: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 138 ITALY: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 139 ITALY: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.3.6 RUSSIA

11.3.6.1 Rise in demand for ready-to-eat and packaged food

TABLE 140 RUSSIA: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 141 RUSSIA: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 142 RUSSIA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 143 RUSSIA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.3.7 REST OF EUROPE

TABLE 144 REST OF EUROPE: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 145 REST OF EUROPE: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 146 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 147 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.4 NORTH AMERICA

TABLE 148 NORTH AMERICA: STAND-UP POUCHES MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION UNITS)

TABLE 149 NORTH AMERICA: STAND-UP POUCHE MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 150 NORTH AMERICA: MARKET SIZE, BY FORM, 2016–2019 (MILLION UNITS)

TABLE 151 NORTH AMERICA: MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 152 NORTH AMERICA: MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 153 NORTH AMERICA: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 154 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 155 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020–2027 (MILLION UNITS)

TABLE 156 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 157 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 158 NORTH AMERICA: MARKET SIZE, BY CLOSURE TYPE, 2016–2019 (MILLION UNITS)

TABLE 159 NORTH AMERICA: MARKET SIZE, BY CLOSURE TYPE, 2020–2027 (MILLION UNITS)

TABLE 160 NORTH AMERICA: HISTORICAL STAND-UP POUCHES MARKET SIZE, BY CLOSURE TYPE, 2016–2019 (USD MILLION)

TABLE 161 NORTH AMERICA: MARKET SIZE, BY CLOSURE TYPE, 2020–2027 (USD MILLION)

TABLE 162 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 163 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 164 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 165 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 166 NORTH AMERICA: MARKET SIZE, BY MATERIAL, 2016–2019 (MILLION UNITS)

TABLE 167 NORTH AMERICA: MARKET SIZE, BY MATERIAL, 2020–2027 (MILLION UNITS)

TABLE 168 NORTH AMERICA: MARKET SIZE, BY MATERIAL, 2016–2019 (USD MILLION)

TABLE 169 NORTH AMERICA: MARKET SIZE, BY MATERIAL, 2020–2027 (USD MILLION)

11.4.1 US

11.4.1.1 Product differentiation through attractive packaging

TABLE 170 US: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 171 US: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 172 US: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 173 US: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.4.2 CANADA

11.4.2.1 Increase in exports of packaged food

TABLE 174 CANADA: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 175 CANADA: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 176 CANADA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 177 CANADA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.4.3 MEXICO

11.4.3.1 Rising popularity of ready-to-eat food

TABLE 178 MEXICO: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 179 MEXICO: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 180 MEXICO: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 181 MEXICO: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.5 MIDDLE EAST & AFRICA

TABLE 182 MIDDLE EAST & AFRICA: STAND-UP POUCHES MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION UNITS)

TABLE 183 MIDDLE EAST & AFRICA: STAND-UP POUCHE MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 185 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2027 (MILLION UNITS)

TABLE 186 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 187 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 188 MIDDLE EAST & AFRICA: MARKET SIZE, BY FORM, 2016–2019 (MILLION UNITS)

TABLE 189 MIDDLE EAST & AFRICA: MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 190 MIDDLE EAST & AFRICA: MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 192 MIDDLE EAST & AFRICA: MARKET SIZE, BY CLOSURE TYPE, 2016–2019 (MILLION UNITS)

TABLE 193 MIDDLE EAST & AFRICA: MARKET SIZE, BY CLOSURE TYPE, 2020–2027 (MILLION UNITS)

TABLE 194 MIDDLE EAST & AFRICA: MARKET SIZE, BY CLOSURE TYPE, 2016–2019 (USD MILLION)

TABLE 195 MIDDLE EAST & AFRICA: MARKET SIZE, BY CLOSURE TYPE, 2020–2027 (USD MILLION)

TABLE 196 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 197 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 198 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 199 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 200 MIDDLE EAST & AFRICA: MARKET SIZE, BY MATERIAL, 2016–2019 (MILLION UNITS)

TABLE 201 MIDDLE EAST & AFRICA: MARKET SIZE, BY MATERIAL, 2020–2027 (MILLION UNITS)

TABLE 202 MIDDLE EAST & AFRICA: MARKET SIZE, BY MATERIAL, 2016–2019 (USD MILLION)

TABLE 203 MIDDLE EAST & AFRICA: MARKET SIZE, BY MATERIAL, 2020–2027 (USD MILLION)

11.5.1 UAE

11.5.1.1 Fastest-growing market in Middle East & Africa

TABLE 204 UAE: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 205 UAE: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 206 UAE: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 207 UAE: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.5.2 TURKEY

11.5.2.1 Round bottom segment to lead market

TABLE 208 TURKEY: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 209 TURKEY: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 210 TURKEY: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 211 TURKEY: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.5.3 SOUTH AFRICA

11.5.3.1 Food & beverages industry to be largest consumer of stand-up pouches

TABLE 212 SOUTH AFRICA: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 213 SOUTH AFRICA: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 214 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 215 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.5.4 SAUDI ARABIA

11.5.4.1 Growth of food & beverages industry

TABLE 216 SAUDI ARABIA: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 217 SAUDI ARABIA: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 218 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 219 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 220 REST OF MIDDLE EAST & AFRICA: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 221 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 222 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 223 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.6 SOUTH AMERICA

TABLE 224 SOUTH AMERICA: STAND-UP POUCHES MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION UNITS)

TABLE 225 SOUTH AMERICA: STAND-UP POUCHE MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 226 SOUTH AMERICA: MARKET SIZE, BY FORM, 2016–2019 (MILLION UNITS)

TABLE 227 SOUTH AMERICA: MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 228 SOUTH AMERICA: MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 229 SOUTH AMERICA: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 230 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 231 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2027 (MILLION UNITS)

TABLE 232 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 233 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 234 SOUTH AMERICA: MARKET SIZE, BY CLOSURE TYPE, 2016–2019 (MILLION UNITS)

TABLE 235 SOUTH AMERICA: MARKET SIZE, BY CLOSURE TYPE, 2020–2027 (MILLION UNITS)

TABLE 236 SOUTH AMERICA: MARKET SIZE, BY CLOSURE TYPE, 2016–2019 (USD MILLION)

TABLE 237 SOUTH AMERICA: MARKET SIZE, BY CLOSURE TYPE, 2020–2027 (USD MILLION)

TABLE 238 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 239 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 240 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 241 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 242 SOUTH AMERICA: MARKET SIZE, BY MATERIAL, 2016–2019 (MILLION UNITS)

TABLE 243 SOUTH AMERICA: MARKET SIZE, BY MATERIAL, 2020–2027 (MILLION UNITS)

TABLE 244 SOUTH AMERICA: HISTORICAL STAND-UP POUCHES MARKET SIZE, BY MATERIAL, 2016–2019 (USD MILLION)

TABLE 245 SOUTH AMERICA: MARKET SIZE, BY MATERIAL, 2020–2027 (USD MILLION)

11.6.1 BRAZIL

11.6.1.1 Brazil to account for largest share of South America market

TABLE 246 BRAZIL: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 247 BRAZIL: MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 248 BRAZIL: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 249 BRAZIL: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.6.2 ARGENTINA

11.6.2.1 Increase in demand for innovative packaging

TABLE 250 ARGENTINA: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 251 ARGENTINA: STAND-UP POUCHE MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 252 ARGENTINA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 253 ARGENTINA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.6.3 REST OF SOUTH AMERICA

TABLE 254 REST OF SOUTH AMERICA: STAND-UP POUCHES MARKET SIZE, BY FORM, 2020–2027 (MILLION UNITS)

TABLE 255 REST OF SOUTH AMERICA: STAND-UP POUCHE MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 256 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION UNITS)

TABLE 257 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 186)

12.1 OVERVIEW

12.2 COMPANIES ADOPTED NEW PRODUCT LAUNCHES AS KEY GROWTH STRATEGY BETWEEN 2019 AND 2022

12.3 MARKET SHARE ANALYSIS

TABLE 258 STAND-UP POUCHES MARKET: SHARE OF KEY PLAYERS

FIGURE 33 STAND-UP POUCHE MARKET: SHARE ANALYSIS

12.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 34 REVENUE ANALYSIS OF KEY COMPANIES

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE COMPANIES

12.5.4 PARTICIPANTS

FIGURE 35 COMPETITIVE LEADERSHIP MAPPING: STAND-UP POUCHES MARKET, 2021

12.6 SME MATRIX, 2021

12.6.1 PROGRESSIVE COMPANIES

12.6.2 RESPONSIVE COMPANIES

12.6.3 DYNAMIC COMPANIES

12.6.4 STARTING BLOCKS

FIGURE 36 SME MATRIX: STAND-UP POUCHES MARKET, 2021

12.7 COMPETITIVE SCENARIO

12.7.1 PARTNERSHIPS

TABLE 259 PARTNERSHIPS, 2019–2022

12.7.2 PRODUCT LAUNCHES

TABLE 260 PRODUCT LAUNCHES, 2019–2022

13 COMPANY PROFILES (Page No. - 194)

13.1 KEY PLAYERS

(Business overview, Products/Solutions/Services offered, Recent developments, Deals, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats)*

13.1.1 AMCOR PLC

TABLE 261 AMCOR PLC: COMPANY OVERVIEW

FIGURE 37 AMCOR PLC: COMPANY SNAPSHOT

TABLE 262 AMCOR PLC: PRODUCT LAUNCHES

TABLE 263 AMCOR PLC: DEALS

13.1.2 BERRY GLOBAL INC

TABLE 264 BERRY GLOBAL INC: COMPANY OVERVIEW

FIGURE 38 BERRY GLOBAL INC: COMPANY SNAPSHOT

TABLE 265 BERRY GLOBAL INC: PRODUCT LAUNCHES

TABLE 266 BERRY GLOBAL INC: DEALS

13.1.3 MONDI

TABLE 267 MONDI: COMPANY OVERVIEW

FIGURE 39 MONDI: COMPANY SNAPSHOT

TABLE 268 MONDI: PRODUCT LAUNCHES

TABLE 269 MONDI: DEALS

13.1.4 SEALED AIR

TABLE 270 SEALED AIR: COMPANY OVERVIEW

FIGURE 40 SEALED AIR: COMPANY SNAPSHOT

13.1.5 SMURFIT KAPPA

TABLE 271 SMURFIT KAPPA: COMPANY OVERVIEW

FIGURE 41 SMURFIT KAPPA: COMPANY SNAPSHOT

TABLE 272 SMURFIT KAPPA: PRODUCT LAUNCHES

13.1.6 COVERIS

TABLE 273 COVERIS: COMPANY OVERVIEW

TABLE 274 COVERIS: DEALS

13.1.7 PROAMPAC

TABLE 275 PROAMPAC: COMPANY OVERVIEW

TABLE 276 PROAMPAC: PRODUCT LAUNCHES

13.1.8 HUHTAMAKI

TABLE 277 HUHTAMAKI: COMPANY OVERVIEW

FIGURE 42 HUHTAMAKI: COMPANY SNAPSHOT

TABLE 278 HUHTAMAKI: DEALS

13.1.9 SONOCO

TABLE 279 SONOCO: COMPANY OVERVIEW

FIGURE 43 SONOCO: COMPANY SNAPSHOT

13.1.10 CONSTANTIA FLEXIBLES

TABLE 280 CONSTANTIA FLEXIBLES: COMPANY OVERVIEW

13.2 OTHER PLAYERS

13.2.1 WINPAK

TABLE 281 WINPAK: COMPANY OVERVIEW

13.2.2 GUALAPACK S.P.A.

TABLE 282 GUALAPACK S.P.A.: COMPANY OVERVIEW

13.2.3 PRINTPACK

TABLE 283 PRINTPACK: COMPANY OVERVIEW

13.2.4 AMERICAN PACKAGING CORPORATION

TABLE 284 AMERICAN PACKAGING CORPORATION: COMPANY OVERVIEW

13.2.5 BRYCE CORPORATION

TABLE 285 BRYCE CORPORATION: COMPANY OVERVIEW

13.2.6 BISCHOF + KLEIN SE & CO. KG

TABLE 286 BISCHOF + KLEIN SE & CO. KG: COMPANY OVERVIEW

13.2.7 TOPPAN INC

TABLE 287 TOPPAN INC: COMPANY OVERVIEW

13.2.8 SWISS PACK

TABLE 288 SWISS PACK: COMPANY OVERVIEW

13.2.9 GLENROY, INC.

TABLE 289 GLENROY, INC.: COMPANY OVERVIEW

13.2.10 C-P FLEXIBLE PACKAGING

TABLE 290 C-P FLEXIBLE PACKAGING: COMPANY OVERVIEW

13.2.11 ST. JOHNS PACKAGING

TABLE 291 ST. JOHNS PACKAGING: COMPANY OVERVIEW

13.2.12 SCHOLLE IPN

TABLE 292 SCHOLLE IPN: COMPANY OVERVIEW

13.2.13 SHAKO FLEXIPACK PRIVATE LIMITED

TABLE 293 SHAKO FLEXIPACK PRIVATE LIMITED: COMPANY OVERVIEW

13.2.14 SKY FLEXI PACK

TABLE 294 SKY FLEXI PACK: COMPANY OVERVIEW

*Details on Business overview, Products/Solutions/Services offered, Recent developments, Deals, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 227)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This research involves the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the Stand-up pouches market. Primary sources include industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Stand-up Pouches Market Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Stand-up Pouches Market Primary Research

The Stand-up pouches market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the Stand-up pouches market. Primary sources from the supply side include associations and institutions involved in the Stand-up pouches industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Stand-up Pouches Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global Stand-up pouches market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Stand-up Pouches Market Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Stand-up Pouches Market Report Objectives

- To define, describe, and forecast the global Stand-up pouches market in terms of both volume and value

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on application

- To forecast the market size, in terms of volume and value, with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launch, capacity expansion, and merger & acquisition

- To strategically profile the leading players and comprehensively analyze their key developments, such as expansions and mergers & acquisitions, in the Stand-up pouches market

Stand-up Pouches Market Report Available Customizations

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Stand-up Pouches Market Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Stand-up Pouches Market Regional Analysis

- Further breakdown of the Rest of APAC Stand-up pouches market

- Further breakdown of Rest of Europe Stand-up pouches market

Stand-up Pouches Market Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Stand-up Pouches Market