Pre-Insulated Pipes Market by Installation (Below Ground & Above Ground), End-use Industry (District Heating & Cooling, Oil & Gas, Infrastructure & Utility), and Region (Europe, North America, APAC, MEA, South America) - Global Forecast to 2024

[166 Pages Report] Pre-insulated pipes are layered pipes, which consist of a carrier pipe, insulation layer, and outer casing/jacketing. These layers are made using different raw materials, which depend on the end-use industry for which these are required. Traditionally, pre-insulated pipes are used to enable energy conservation by preventing energy loss to the environment, which boosts cost savings. Energy loss is prevented by using effective insulation materials and providing appropriate jacketing to the carrier pipe. The most common end-use industries of pre-insulated pipes are district heating & cooling, oil & gas, infrastructure & utility, food processing, pharmaceutical, and chemical, water treatment, and wineries.

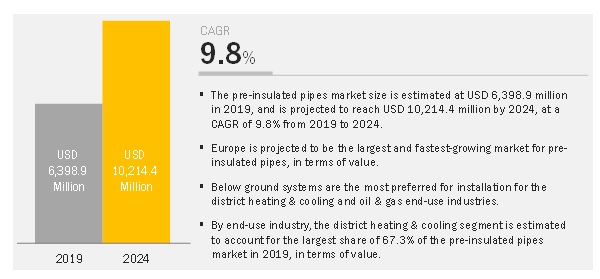

The pre-insulated pipes market is projected to grow from USD 6.39 billion in 2019 to USD 10.21 billion by 2024 at a Compound Annual Growth Rate (CAGR) of 9.8% during the forecast period. Stringent regulations and initiatives in the European region, such as EPBD and NZEB, to reduce the carbon footprint and construct energy-efficient buildings are infusing growth in the pre-insulated pipes market.

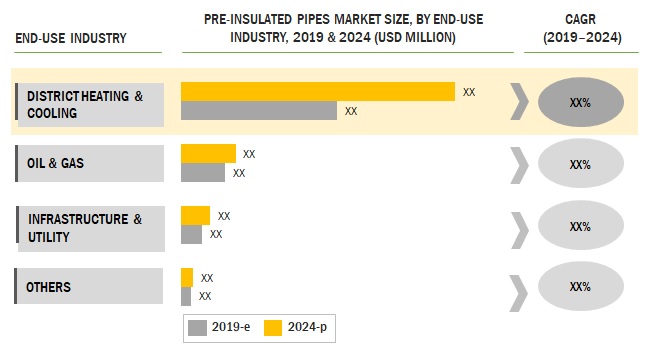

By installation, below ground segment projected to lead the market during the forecast period

Pre-insulated pipes are widely used in energy-related applications to enable transportation of media while maintaining the temperature. The pre-insulated pipe manufacturing industry is highly regulated with several regulatory standards defined for carrier pipes, insulation, and jacketing. These pipes are manufactured under controlled factory conditions to ensure high-quality levels and excellent durability. Increasing adoption of district heating & cooling systems is driving the below-ground segment. For long straight installations, below ground pre-insulated piping systems are preferred as these reduce the required number of fittings, joints, and welding costs.

District heating and cooling segment projected to lead pre-insulated pipes market during the forecast period

District heating and cooling is the interconnection of various heat sources or chillers employing hot water/steam/chilled water networks to provide room space heating or cooling to customers. District heating & cooling systems are ideal where the thermal load density and annual load factor are high. The district heating & cooling segment is projected to be the largest segment of the pre-insulated pipes market, by end-use industry. Some of the key advantages provided by pre-insulated pipes are excellent thermal efficiency, lower maintenance, reduced on-site labor, and improved safety, as these are better protected against leakages, and offer superior quality insulation, which minimizes energy loss.

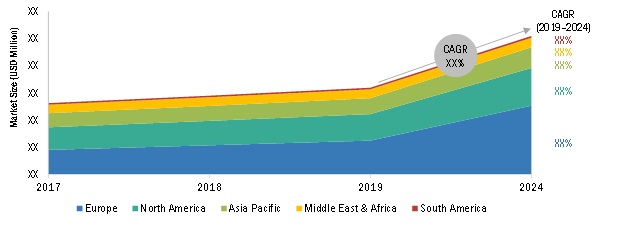

Pre-insulated pipes market in Europe projected to grow at the highest CAGR during the forecast period

Europe is estimated to account for the largest share of the pre-insulated pipes market during the forecast period. Europe is the largest market for district heating as leading players are based in this region. Increasing technological advancements in terms of connectivity, digitalization, and IoT integration, rising demand for energy-efficient solutions, and growing initiatives to reduce greenhouse gas emissions are the crucial factors driving the growth of this market in Europe. District heating is used in commercial, industrial, and residential applications for space heating and domestic hot water supply.

Market Dynamics

Driver: Rising awareness regarding environment and government incentives

Pre-insulated pipes enable higher cost savings due to their superior design. Stringent environmental regulations have led to the rapid adoption of these systems for the reduction of CO2 emissions. In Europe, higher incentives are provided for the adoption of renewable heating & cooling systems. Financial benefits in Europe include direct grants, tax breaks (direct and indirect taxes), loans at privileged rates, and incentives linked to housing subsidies.

Other benefits include economies of scale, pay per usage, and reduced energy losses. Nearly 90% of the heating and almost 100% of the cooling in the EU is produced and used in single buildings, the rest being delivered through district heating & cooling networks, which constitutes an attractive market for renewable heating & cooling systems.

Restraint: Volatility in prices of raw materials

Polyethylene, polybutene, Chlorinated Polyvinyl Chloride (CPVC), Fiber Reinforced Plastic (FRP), Glass Reinforced Plastic (GRP), and stainless steel are the essential raw materials used for the manufacture of pre-insulated pipes. Changes in the demand and supply of these raw materials could have a significant impact on the pre-insulated pipes industry. As some of these materials are derived from crude oil, an increase in the prices of crude oil results in an increase in the prices of raw materials, thus impacting the pre-insulated pipes industry. Fluctuations in prices of raw materials also affect the operating margins of manufacturers, which, in turn, makes it difficult for them to sustain in the market.

Opportunity: Investments in emerging economies

Emerging countries in the Asia Pacific, such as China, India, and South American countries, such as Colombia, are attracting global players in establishing their manufacturing bases in these regions. In countries such as China and India, the increasing customer base is leading manufacturers to fulfill the demand for advanced technologies and quality products. The increased investments across various technological, infrastructural, and R&D sectors have enabled manufacturers of pre-insulated pipes to supply high-quality products to these end-users and capitalize on the increasing demand in the region. These markets are propelled by economic growth and subsequent increase in demand from end-use industries.

Challenge: Stringent regulatory compliances

The manufacture of pre-insulated pipes is highly regulated. Several regulations and compliances have been implemented for the manufacturing processes, such as EN, ASTM, and API, among others. This acts as a strong entry barrier for small and medium-sized manufacturers who do not receive the cost-benefit ratio in the long term as they are not able to undertake the high initial investments to venture into the market. Missing incentives, such as debt provisioning, bond financing, city-level subsidies, and unfair competition, makes it even more challenging for new players.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

USD Million/ Billion (Value) |

|

Segments covered |

Installation, End-use Industry, Region |

|

Geographies covered |

North America, South America, Europe, APAC and Middle East & Africa |

|

Companies covered |

Georg Fischer AG (Switzerland), Logstor (Denmark), Uponor (Finland), Watts Water Technologies (US), Perma-Pipe International Holdings (US), Kabelwerke Brugg (Switzerland), Polypipe Group PLC (UK), and Isoplus Fernwaermetechnik GmbH (Germany) |

This research report categorizes the pre-insulated pipes market based on installation, end-use industry, and region.

By Installation

- Below Ground

- Above Ground

By End-use Industry

- District Heating & Cooling

- Oil & Gas

- Infrastructure & Utility

- Others

- Food Processing

- Pharmaceuticals

- Wineries

- Chemicals

- Water Treatment

By Region

- Asia Pacific (China, India, Japan, South Korea, Rest of APAC)

- North America (US, Canada, Mexico)

- Europe (Germany, France, Italy, Russia, UK, Rest of Europe)

- Middle East & Africa (Saudi Arabia, UAE, Qatar, Rest of Middle East and Africa)

- South America (Brazil, Argentina, Rest of South America)

Key Market Players

Georg Fischer AG (Switzerland), Logstor (Denmark), Uponor (Finland), Watts Water Technologies (US), Perma-Pipe International Holdings (US)

Recent Developments

- In February 2019, Isoplus Fernwaermetechnik GmbH undertook the pioneering district heating project of the housing association JAB (Denmark). The project aimed at having heating distributed to a new 33-house development in the Juelsminde peninsula (Denmark). The purpose of this development was to meet the national vision of Denmark having a future fossil-free heat supply.

- In December 2018, Uponor Oyj divested 100% of its operations in the Asian region, which forms a part of its business segment, Building Solutions Europe. Under this divestment, the company would cease operations in China, and close sales offices in South Korea, Malaysia, and Hong Kong by the end of 2019. The divestment is estimated to impact about USD 7.1 million business of Uponor Oyj.

- In October 2018, Polypipe Group PLC acquired Manthorpe Building Products Holdings Limited (UK) for USD 69.4 million. Manthorpe Building Products Holdings Limited was integrated into the Residential Systems segment of Polypipe Group PLC. The purpose of the acquisition was the expansion of its product portfolio. Also, with this acquisition, Polypipe Group PLC enhanced its market reach in the UK, Ireland, and RMI markets.

- In January 2018, Logstor A/S initiated the construction of Odense Data Center (Denmark). The Odense Data Center is estimated to have an area of 1, 84,000 meters square, and offers solutions to optimize overall energy efficiency. With this facility, the company supplied heat distribution to 6,900 homes in Odense (Denmark). Also, this development aided Logstor A/S in offering energy solutions to the local areas in Odense.

- In July 2017, GF Piping Systems, a division of Georg Fischer AG, acquired a 49% shareholding in Urecon Ltd. (Canada), a major player in pre-insulated piping systems. With this acquisition, GF Piping Systems enhanced its footprint in North America. The purpose of the development was to accelerate the introduction of the pre-insulated piping system package for cooling and air-conditioning in North America.

Critical questions the report answers:

- How is the use of pre-insulated pipes in the district heating & cooling segment affecting the market?

- How is the increased penetration of energy-efficient systems in emerging countries impacting the pre-insulated pipes market?

- How are expansions helping the growth of the pre-insulated pipes market?

- Who are the leading players in the pre-insulated pipes market?

- How is volatility in the prices of raw materials expected to affect the pre-insulated pipes market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Market Scope

1.2.2 Years Considered for the Study

1.3 Currency

1.4 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Pre-Insulated Pipes Market

4.2 Pre-Insulated Pipes Market, By Installation

4.3 Pre-Insulated Pipes Market, By End-Use Industry

4.4 Pre-Insulated Pipes Market, By Region

5 Regulations Governing Pre-Insulated Pipes (Page No. - 34)

5.1 Introduction

5.2 International Codes and Standards for District Heating Systems

5.3 International Codes and Standards Related to Equipment, Material, and Construction

5.4 Additional Standards for Pipeline Systems

5.5 Codes and Standards Requirements for Carrier Pipes

5.6 Standard Materials for Hot and Cold Insulation

6 Pre-Insulated Pipes Market, Comparative Study (Page No. - 38)

6.1 Introduction

6.2 Component Cost

6.3 Labor Cost

6.4 Execution Cost

6.5 External Support

7 Market Overview (Page No. - 41)

7.1 Introduction

7.2 Market Dynamics

7.2.1 Drivers

7.2.1.1 Growth in District Heating & Cooling End-Use Industry Segment

7.2.1.2 Rising Awareness Regarding Environment and Government Incentives

7.2.1.3 Penetration of Pre-Insulated Pipes in Niche Applications

7.2.2 Restraints

7.2.2.1 Volatility in Prices of Raw Materials

7.2.2.2 High Cost of Pre-Insulated Pipes

7.2.3 Opportunities

7.2.3.1 Investments in Emerging Economies

7.2.3.2 Controlling the Cost of Labor

7.2.4 Challenges

7.2.4.1 Stringent Regulatory Compliances

7.2.4.2 Logistics and Certification

7.3 Porters Five Forces Analysis

7.3.1 Bargaining Power of Suppliers

7.3.2 Bargaining Power of Buyers

7.3.3 Threat of Substitutes

7.3.4 Threat of New Entrants

7.3.5 Intensity of Competitive Rivalry

7.4 Economic Indicators

7.4.1 Industry Outlook

7.4.1.1 Oil & Gas

7.4.1.2 Construction

8 Pre-Insulated Pipes Market, By Type of Pipe (Page No. - 51)

8.1 Introduction

8.2 Flexible Pre-Insulated Pipes

8.3 Rigid Pre-Insulated Pipes

9 Pre-Insulated Pipes Market, By Layer (Page No. - 55)

9.1 Introduction

9.2 Carrier Pipes

9.3 Foaming/Insulation Layers

9.4 Jacketing

10 Pre-Insulated Pipes Market, By Materials Used (Page No. - 58)

10.1 Introduction

10.2 Metals & Alloys

10.3 Others

11 Pre-Insulated Pipes Market, By Medium (Page No. - 60)

11.1 Introduction

11.2 Steam

11.3 Water

11.4 Others

12 Pre-Insulated Pipes Market, By Installation (Page No. - 63)

12.1 Introduction

12.2 Below Ground Pre-Insulated Pipes

12.2.1 Europe Dominates the Below Ground Segment for Pre-Insulated Pipes

12.3 Above Ground Pre-Insulated Pipes

12.3.1 Europe is the Fastest Growing Market for Above Ground Installations in the Pre-Insulated Pipes Market

13 Pre-Insulated Pipes Market, By End-Use Industry (Page No. - 67)

13.1 Introduction

13.2 District Heating & Cooling

13.2.1 Europe Dominates the District Heating & Cooling Segment of Pre-Insulated Pipes Market

13.3 Oil & Gas

13.3.1 North America Dominates the Oil & Gas Segment of Pre-Insulated Pipes Market

13.4 Infrastructure & Utility

13.4.1 Europe is Witnessing the Fastest Growth in the Infrastructure & Utility Segment

13.5 Others

14 Regional Analysis (Page No. - 75)

14.1 Introduction

14.2 Asia Pacific

14.2.1 China

14.2.1.1 District Heating & Cooling is the Fastest Growing End-Use Industry for Pre-Insulated Pipes in China

14.2.2 India

14.2.2.1 District Heating & Cooling is the Fastest Growing End-Use Industry for Pre-Insulated Pipes in India

14.2.3 Japan

14.2.3.1 Below Ground are the Most Preferred Installation and Dominate the Pre-Insulated Pipes Industry in Japan

14.2.4 South Korea

14.2.4.1 District Heating & Cooling Segment is the Fastest Growing End-Use Industry for Pre-Insulated Pipes

14.2.5 Rest of Asia Pacific

14.3 Europe

14.3.1 Germany

14.3.1.1 Below Ground is the Most Preferred Installation in Germany and is Growing at the Fastest CAGR

14.3.2 France

14.3.2.1 District Heating & Cooling is the Fastest Growing End-Use Industry in France

14.3.3 Italy

14.3.3.1 Below Ground Installations are the Most Preferred Installation in Italy

14.3.4 UK

14.3.4.1 District Heating & Cooling End-Use Industry is Expected to Grow at the Fastest Growth Rate During the Forecast Period

14.3.5 Russia

14.3.5.1 District Heating & Cooling End-Use Segment is Witnessing Good Growth in Russia Due to Replacement of Old Systems

14.3.6 Rest of Europe

14.4 North America

14.4.1 US

14.4.1.1 US is Witnessing Good Growth Due to Replacement of Old District Heating Systems

14.4.2 Canada

14.4.2.1 District Heating & Cooling End-Use Industry is Expected to Grow at the Fastest Growth Rate During the Forecast Period

14.4.3 Mexico

14.4.3.1 Oil & Gas End-Use Industry Dominated the Market for Pre-Insulated Pipes in Mexico

14.5 Middle East & Africa

14.5.1 Saudi Arabia

14.5.1.1 District Heating & Cooling End-Use Industry is Expected to Grow at the Fastest Growth Rate During the Forecast Period

14.5.2 UAE

14.5.2.1 District Heating & Cooling End-Use Industry is Expected to Grow at the Fastest Growth Rate During the Forecast Period

14.5.3 Qatar

14.5.3.1 Below Ground Installations are Expected to Grow at the Fastest Growth Rate During the Forecast Period

14.5.4 Rest of Middle East & Africa

14.6 South America

14.6.1 Brazil

14.6.1.1 District Heating & Cooling End-Use Industry is Expected to Grow at the Fastest Growth Rate During the Forecast Period

14.6.2 Argentina

14.6.2.1 Below Ground Installations are Expected to Grow at the Fastest Growth Rate During the Forecast Period

14.6.3 Rest of South America

15 Competitive Landscape (Page No. - 109)

15.1 Overview

15.2 Competitive Leadership Mapping, 2019

15.2.1 Specialists

15.2.2 Innovators

15.2.3 Leaders

15.2.4 Challengers

15.3 Competitive Benchmarking

15.3.1 Strength of Product Portfolio

15.3.2 Business Strategy Excellence

15.4 Market Ranking of Key Players

15.5 Competitive Scenario

15.5.1 Acquisitions

15.5.2 Contracts

15.5.3 Expansions

15.5.4 Divestments

15.5.5 Partnerships

15.5.6 Joint Ventures

15.5.7 New Product Launches

15.5.8 New Product Developments

16 Company Profiles (Page No. - 121)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

16.1 Georg Fischer AG

16.2 Perma-Pipe International Holdings, Inc.

16.3 Watts Water Technologies, Inc.

16.4 Uponor Oyj

16.5 Polypipe Group PLC

16.6 Kabelwerke Brugg AG Holding

16.7 Interplast S.A.

16.8 Isoplus Fernwaermetechnik GmbH

16.9 Pem Korea Co., Ltd.

16.10 Thermaflex International

16.11 Zeco Aircon Ltd.

16.12 Logstor A/S

16.13 Aquatherm GmbH

16.14 Other Companies

16.14.1 Ke KELIT Kunststoffwerk Gesellschaft M.B.H.

16.14.2 KC Polymers Pvt. Ltd.

16.14.3 Thermal Pipe Systems, Inc.

16.14.4 Ecoline S.R.L.

16.14.5 Vital Energi Utilities Ltd.

16.14.6 Set Pipes GmbH

16.14.7 Polytherm Heating Systems Ltd.

16.14.8 Maincor Rohrsysteme GmbH & Co. Kg

16.14.9 Durotan Ltd.

16.14.10 Nupi Industrie Italiane S.P.A.

16.14.11 Muovitech International Group

16.14.12 Tece GmbH

16.14.13 Rovanco Piping Systems, Inc.

16.14.14 Rehau Unlimited Polymer Solutions

16.14.15 Brunata Ltd.

16.14.16 Thermacor Process Inc.

16.14.17 Simona AG

16.14.18 Geberit AG

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

17 Appendix (Page No. - 161)

17.1 Discussion Guide

17.2 Knowledge Store: Marketsandmarkets Subscription Portal

17.3 Available Customizations

17.4 Related Reports

17.5 Author Details

List of Tables (83 Tables)

Table 1 Pre-Insulated Pipes Market Snapshot

Table 2 Type of Pipe and Operating Temperature

Table 3 Type of Pipe and Nominal Diameter

Table 4 Type of Pipe and Operating Pressure

Table 5 European Norms

Table 6 Materials Used and Operating Temperature

Table 7 Type of Pipe and Operating Pressure

Table 8 Types of Carrier Pipe and Operating Characteristics

Table 9 Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 10 Below Ground Pre-Insulated Pipes Market, By Region, 20172024 (USD Million)

Table 11 Above Ground Pre-Insulated Pipes Market, By Region, 20172024 (USD Million)

Table 12 Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 13 Pre-Insulated Pipes Market in District Heating & Cooling, By Region, 20172024 (USD Million)

Table 14 Major Oil & Gas Projects Using Pre-Insulated Pipes

Table 15 Pre-Insulated Pipes Market in Oil & Gas, By Region, 20172024 (USD Million)

Table 16 Pre-Insulated Pipes Market in Infrastructure & Utility, By Region, 20172024 (USD Million)

Table 17 Pre-Insulated Pipes Market in Others, By Region, 20172024 (USD Million)

Table 18 Pre-Insulated Pipes Market, By Region, 20172024 (USD Million)

Table 19 Asia Pacific Pre-Insulated Pipes Market, By Country, 20172024 (USD Million)

Table 20 Asia Pacific Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 21 Asia Pacific Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 22 China Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 23 China Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 24 India Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 25 India Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 26 Japan Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 27 Japan Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 28 South Korea Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 29 South Korea Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 30 Rest of Asia Pacific Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 31 Rest of Asia Pacific Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 32 Europe Pre-Insulated Pipes Market, By Country, 20172024 (USD Million)

Table 33 Europe Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 34 Europe Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 35 Germany Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 36 Germany Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 37 France Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 38 France Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 39 Italy Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 40 Italy Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 41 UK Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 42 UK Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 43 Russia Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 44 Russia Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 45 Rest of Europe Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 46 Rest of Europe Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 47 North America Pre-Insulated Pipes Market, By Country, 20172024 (USD Million)

Table 48 North America Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 49 North America Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 50 US Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 51 US Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 52 Canada Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 53 Canada Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 54 Mexico Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 55 Mexico Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 56 Middle East & Africa Pre-Insulated Pipes Market, By Country, 20172024 (USD Million)

Table 57 Middle East & Africa Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 58 Middle East & Africa Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 59 Saudi Arabia Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 60 Saudi Arabia Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 61 UAE Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 62 UAE Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 63 Qatar Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 64 Qatar Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 65 Rest of Middle East & Africa Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 66 Rest of Middle East & Africa Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 67 South America Pre-Insulated Pipes Market, By Country, 20172024 (USD Million)

Table 68 South America Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 69 South America Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 70 Brazil Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 71 Brazil Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 72 Argentina Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 73 Argentina Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 74 Rest of South America Pre-Insulated Pipes Market, By End-Use Industry, 20172024 (USD Million)

Table 75 Rest of South America Pre-Insulated Pipes Market, By Installation, 20172024 (USD Million)

Table 76 Acquisitions, 20132019

Table 77 Contracts, 20132019

Table 78 Expansions, 20132019

Table 79 Divestments, 20132019

Table 80 Partnerships, 20132019

Table 81 Joint Ventures, 20132019

Table 82 New Product Launches, 20132019

Table 83 New Product Developments, 20132019

List of Figures (44 Figures)

Figure 1 Pre-Insulated Pipes Market Segmentation

Figure 2 Pre-Insulated Pipes Market: Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Pre-Insulated Pipes Market: Data Triangulation

Figure 6 Below Ground Segment Projected to Lead Market During Forecast Period

Figure 7 District Heating & Cooling Segment Projected to Lead Pre-Insulated Pipes Market During Forecast Period

Figure 8 Europe Estimated to Account for Highest Share of Pre-Insulated Pipes Market in 2019

Figure 9 Expansion in Emerging Markets Offers Lucrative Opportunities for Market Players

Figure 10 Below Ground Segment Projected to Grow at Higher CAGR During Forecast Period

Figure 11 District Heating & Cooling Segment Projected to Grow at Highest CAGR During Forecast Period

Figure 12 Europe Pre-Insulated Pipes Market Projected to Grow at Highest CAGR During Forecast Period

Figure 13 Cost Reduction and Affordability Pockets

Figure 14 Pre-Insulated Pipe Layers and Materials

Figure 15 Pre-Insulated Pipes Market Dynamics

Figure 16 Pre-Insulated Pipes Market: Porters Five Forces Analysis

Figure 17 Recovering Oil Prices Between December 2015 and March 2019

Figure 18 Average Crude Oil Prices Between 2010 and 2018

Figure 19 Regional Infrastructure Investment Needs: 2016-2040 (USD Trillion)

Figure 20 Pre-Insulated Pipe Layers

Figure 21 Pre-Insulated Pipe Components

Figure 22 Pre-Insulated Pipes Market, By Installation, 20192024 (USD Million)

Figure 23 Below Ground Pre-Insulated Pipes Market, 20192024 (USD Million)

Figure 24 Above Ground Pre-Insulated Pipes Market, 20192024 (USD Million)

Figure 25 Pre-Insulated Pipes Market, By End-Use Industry, 20192024 (USD Million)

Figure 26 Pre-Insulated Pipes Market in District Heating & Cooling, 20192024 (USD Million)

Figure 27 Pre-Insulated Pipes Market in Oil & Gas, 20192024 (USD Million)

Figure 28 Pre-Insulated Pipes Market in Infrastructure & Utility, 20192024 (USD Million)

Figure 29 Pre-Insulated Pipes Market in Others, 20192024 (USD Million)

Figure 30 Germany and UK are Potential Markets for Pre-Insulated Pipes

Figure 31 Asia Pacific Pre-Insulated Pipes Market Snapshot

Figure 32 Europe Pre-Insulated Pipes Market Snapshot

Figure 33 North America Pre-Insulated Pipes Market Snapshot

Figure 34 Middle East & Africa Pre-Insulated Pipes Market Snapshot

Figure 35 South America Pre-Insulated Pipes Market Snapshot

Figure 36 Companies Adopted Both, Organic and Inorganic Growth Strategies Between August 2013 and February 2019

Figure 37 Pre-Insulated Pipes Market: Competitive Leadership Mapping, 2019

Figure 38 Georg Fischer AG: Company Snapshot

Figure 39 Perma-Pipe International Holdings, Inc.: Company Snapshot

Figure 40 Watts Water Technologies, Inc.: Company Snapshot

Figure 41 Uponor Oyj: Company Snapshot

Figure 42 Polypipe Group PLC: Company Snapshot

Figure 43 Kabelwerke Brugg AG Holding: Company Snapshot

Figure 44 Interplast S.A.: Company Snapshot

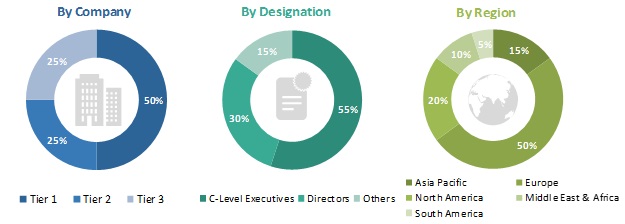

This research study involved 4 major activities in estimating the current market size for pre-insulated pipes. Exhaustive secondary research was undertaken to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The pre-insulated pipes market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the growth of the district heating & cooling, oil & gas, and infrastructure & utility segments. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents interviewed:

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the pre-insulated pipes market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes explained abovethe market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the district heating & cooling, oil & gas, and infrastructure & utility segments.

Report Objectives

- To define, describe, and forecast the global pre-insulated pipes market on the basis of installation, end-use industry, and region in terms of value

- To provide detailed information about key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape

- To forecast the market size in terms of value with respect to 5 main regions, namely, Asia Pacific, North America, Europe, the Middle East & Africa, and South America, along with their key countries

- To analyze competitive developments, such as expansions, acquisitions, contracts, mergers, new product developments, new product launches, and divestment activities in the pre-insulated pipes market

- To strategically profile the key players operating in the pre-insulated pipes market and comprehensively analyze their core competencies2

1. Micromarkets are defined as further segments and subsegments of the pre-insulated pipes market included in the report.

2. Core competencies of companies are captured in terms of their key developments and key strategies adopted by them to sustain their positions in the pre-insulated pipes market.

The following customization options are available for the report

With the given market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

- Further breakdown of the Rest of Asia Pacific, the Rest of Europe, and the Rest of Middle East & Africa by layer in terms of value

- Further breakdown of the Rest of Asia Pacific, the Rest of Europe, and the Rest of Middle East & Africa by material in terms of value

- Further breakdown of the Rest of Asia Pacific, the Rest of Europe, and the Rest of Middle East & Africa in terms of value

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Pre-Insulated Pipes Market