Product Engineering Services Market Share, Forecast | Growth Analysis

Product Engineering Services Market by Service Type (Product Design & Prototyping, Product Development, Process Engineering, Product Sustenance & Support Services, Product Modernization & Integration, Reverse Engineering ) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global Product Engineering Services (PES) market, valued at USD 1,297.71 billion in 2025 and projected to reach USD 1,800.45 billion by 2030 at a CAGR of 6.8%, is being propelled by connected mobility, electrification, and intelligent systems. OEMs and enterprises are increasingly shifting to software-defined products, driving demand for PES capabilities such as embedded systems development, digital twin modeling, AI-powered design, cloud-native platforms, and end-to-end prototyping. Government incentives across automotive, healthcare, and industrial automation further accelerate engineering-led digital transformation, positioning vendors that align with autonomous systems, IoT integration, and edge computing to capture the most value.

KEY TAKEAWAYS

- The North America product engineering services market accounted for a 41.1% revenue share in 2024.

- By services type, the product modernization & integration segment is expected to register the highest CAGR of 7.8%.

- By organization size, large enterprises segment will hold the largest market share.

- By delivery mode, the hybrid segment is expected to dominate the product engineering services market.

- By vertical, the industrial manufacturing segment is projected to grow the at the fastest rate of 7.7% during the forecast period.

- Company IBM, HCL Technologies, and Capgemini were identified as some of the star players in the product engineering services market (global), given their strong market share and product footprint.

- Companies EPAM Systems, GlobalLogic, and Globant, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The Product Engineering Services (PES) market is shifting toward innovation-driven models as enterprises embrace electrification, autonomous systems, and connected products across automotive, industrial automation, medical devices, and aerospace. To address rising complexity, PES providers are moving beyond traditional services to deliver MBSE, embedded software, RISC-V prototyping, AI-enabled validation, cross-domain toolchains, and IP-led platforms, enabling faster prototyping, OTA upgrades, and seamless hardware–software integration. At the same time, regulatory-compliant frameworks for functional safety, cybersecurity, and interoperability are becoming integral, particularly in high-risk sectors.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on businesses emerges from customer trends and disruptions, with industrial manufacturing, automotive & transportation, semiconductor & electronics, and healthcare & life sciences representing key clients of product engineering service providers, while their customers are the ultimate beneficiaries. Shifts in digital twins, AI-driven automation, and connected solutions will influence end-user revenues, further driving revenues for PES providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid transformation toward electric vehicles and connected mobility platforms

-

Need for continuous innovation and iteration

Level

-

DevOps Sprawl and Toolchain complexity threatening efficiency

Level

-

Development of semiconductor and embedded systems

-

Growing number of smart city projects

Level

-

Fragmented technology ecosystems

-

Lack of robust feedback loops and continuous management

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid transformation toward electric vehicles and connected mobility platforms

The automotive sector is driving demand for product engineering services as OEMs and Tier 1 suppliers advance toward electric vehicles (EVs), ADAS, and connected mobility platforms. To accelerate innovation and control costs, they are increasingly outsourcing engineering for battery systems, software-defined vehicle architectures, sensor fusion, and real-time connectivity. According to the German Association of the Automotive Industry (VDA) report, automakers and Tier 1 suppliers are expected to invest over USD 270 billion globally in R&D and digital development between 2023 and 2027. This creates strong opportunities for service providers to deliver IP-led portfolios and form technology-driven partnerships in EV platforms, ADAS, and autonomous mobility.

Restraint: DevOps Sprawl and Toolchain complexity threatening efficiency

The product engineering services market is restrained by growing DevOps complexity and fragmented toolchains that undermine efficiency and elevate costs. According to GitLab’s 2024 DevSecOps report, more than 50% of DevOps teams manage six or more tools, creating duplicated efforts, inconsistent workflows, and significant time lost on integration and maintenance. This fragmentation results in delayed project timelines, higher engineering costs, and reduced quality, while making team onboarding and scaling more difficult. To overcome these challenges, service providers must focus on harmonizing toolchains, enabling end-to-end automation, and building tool-agnostic environments that improve interoperability, productivity, and delivery velocity.

Opportunity: Development of semiconductor and embedded systems

The growth of semiconductor and embedded systems development presents a significant opportunity for PES providers. According to United Nations data, the global semiconductor market is expected to surpass USD 4.8 trillion by 2033. Enterprises increasingly seek external expertise in embedded design, firmware development, and board-level prototyping to address rising complexity from AI, edge computing, and high-performance workloads. Providers that build specialization in RISC-V chip architecture, AI-integrated hardware testing, and hybrid interconnects can capture demand across industrial IoT, automotive, smart devices, and healthcare. Hardware-software co-design and rapid prototyping further position PES vendors as strategic partners for chipmakers and OEMs.

Challenge: Fragmented technology ecosystems

Fragmented technology ecosystems hinder integration, collaboration, and delivery efficiency in the product engineering services market. Enterprises face siloed systems, legacy infrastructure, and incompatible platforms, causing delays, higher costs, and rework from data inconsistencies. In manufacturing, varied protocols such as PROFINET, Modbus, and EtherCAT complicate interoperability. The absence of standardized frameworks further reduces productivity. To overcome this, PES providers must build modular integration architectures, reusable interface libraries, and middleware, while enabling hybrid cloud collaboration. Vendors that deliver flexible, interoperable frameworks will be best positioned to support scalable and consistent solutions across multi-platform environments.

Product Engineering Services Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Infosys: Silicon and Platform Engineering for V2X SoC – Automotive Semiconductor Provider | Enabled next-generation V2X communication systems with full ISO 26262 functional safety compliance, supporting software-defined vehicle architectures and real-time connectivity. Leveraged early-stage prototyping and IP-led engineering to reduce development risk and accelerate innovation. |

|

Infosys: SoC Physical Design Implementation in TSMC 5nm – American Fabless Semiconductor Firm | Delivered high-frequency SoC performance with integrated analog IP blocks, optimized power delivery through EM/IR analysis, and accelerated design closure using advanced planning and simulation. |

|

Tata Technologies: High-Performance Data Architecture for Global Engineering Operations | Migrated over 53 TB of engineering data from legacy systems, enabling real-time access for 2,500+ users. Established a low-latency, disaster-resilient digital backbone to support global collaboration, engineering continuity, and data-driven decision-making. |

|

IBM: Driving Digital Transformation for Snack Empire | Enabled real-time supply chain visibility and faster product delivery through data integration and automation. Enhanced customer engagement via unified CRM insights on Salesforce, and accelerated innovation using IBM Garage’s agile co-creation framework. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The global product engineering services (PES) ecosystem spans solution areas such as product design and prototyping, development, testing and QA, modernization and integration, process and reverse engineering, and sustenance and support. Demand comes from diverse sectors including automotive, industrial, medical devices, electronics, and aerospace and defense. To compete effectively, service providers must align engineering talent, IP assets, and tooling infrastructure with vertical-specific regulations and safety standards, enabling compliance, faster time-to-market, and sustained innovation in highly regulated industries.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Product Engineering Services Market, By Service Type

The product development segment is poised to lead the product engineering services market, driven by rising demand for end-to-end lifecycle management powered by digital engineering, AI-native development, and software-defined architectures. Enterprises are shifting from siloed platforms to integrated models using simulation, digital twins, and automated testing, while EVs, IoT devices, and smart industrial systems fuel demand for embedded software, real-time control, and AI-driven validation. Vendors leveraging IP-led accelerators, generative AI, and model-based design are enabling faster time-to-market and reduced risk, with product development evolving into an innovation enabler through continuous engineering, OTA updates, and modular product design.

Product Engineering Services Market, By Delivery Mode

The offshore delivery mode is expected to hold the largest market share, driven by the need for cost optimization, engineering scalability, and 24/7 development cycles. Offshore hubs provide access to specialized STEM talent in AI/ML, embedded systems, and digital twin engineering, while addressing the rising complexity of workloads in automotive, semiconductors, and industrial automation. In February 2025, Accenture expanded its offshore engineering hub in Pune, India, integrating AI-driven simulation and automated testing to streamline global programs. Equipped with advanced test benches and cloud-native environments, offshore centers now deliver more than cost efficiency, they enable engineering agility, global program orchestration, and standardized excellence, solidifying their position as the backbone of the PES market.

Product Engineering Services Market, By Organization Size

Large enterprises will hold the largest market share in the product engineering services market, driven by large-scale digital transformation requiring integrated hardware, software, and cloud-based engineering. Operating in complex domains such as EV platforms, semiconductor design, and smart manufacturing, they demand deep specialization, global delivery, and multi-year strategic partnerships. In June 2025, Volvo Cars engaged Tata Technologies for embedded software and system development to advance its electric and software-defined vehicle programs, underscoring this demand. With strong R&D budgets and a focus on IP co-creation, AI-enabled workflows, and digital twin innovation, large enterprises act as ecosystem orchestrators, setting the benchmark for scalability, domain accelerators, and innovation in the PES landscape.

Product Engineering Services Market, By Vertical

The industrial manufacturing sector is set to capture a major share of the product engineering services market, driven by the adoption of Industry 4.0, smart factories, and predictive maintenance. Manufacturers are embedding robotics, AI-powered diagnostics, and control systems into production, while demanding real-time data integration, digital twin modeling, and cyber-physical systems. In March 2025, ABB partnered with HCLTech to co-develop digital engineering solutions for next-gen plants, reflecting this shift. As manufacturing evolves into a software-defined, data-driven ecosystem, PES providers delivering full-stack engineering, AI-native platforms, and smart automation are positioned to lead innovation, efficiency, and sustainable connected production.

REGION

Asia Pacific to be the fastest-growing region in the global product engineering services market during the forecast period

Asia Pacific, led by India, Vietnam, and Malaysia, is becoming the fastest-growing hub for product engineering services, driven by a deep STEM talent pool in embedded systems, AI/ML, and digital twin expertise, along with cost-efficient, high-quality delivery. Offshore hubs equipped with AI-enabled simulation, automated testing, and cloud-native development environments enable large-scale, complex engineering. Government investments in digital infrastructure, semiconductor ecosystems, and innovation hubs are boosting outsourcing, R&D partnerships, and IP co-creation. Developments such as Google’s Cybersecurity Engineering Center in Tokyo and Honeywell India’s USD 1 Billion engineering milestone highlight the region’s strategic role in semiconductor design, EV platforms, and industrial automation, positioning APAC as central to next-generation product engineering for global OEMs and Tier-1 suppliers.

Product Engineering Services Market: COMPANY EVALUATION MATRIX

In the Product Engineering Services market matrix, Accenture (Star) leads with a commanding market share and a broad service portfolio, strengthened by its digital engineering depth, cloud-native development, and AI-led innovation. Its strong presence across industries such as automotive & transportation, healthcare & life sciences, and industrials reinforces its position, enabling enterprises to accelerate transformation and product delivery. Persistent Systems (Emerging Leader) is steadily advancing with its focus on software product engineering, embedded systems, and next-generation areas such as IoT and cloud. While Accenture dominates with global scale and comprehensive offerings, Persistent Systems is moving closer to the Star quadrant by driving agility, innovation, and industry-focused engineering services.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1,213.90 Billion |

| Market Forecast in 2030 (value) | USD 1,800.50 Billion |

| Growth Rate | CAGR of 6.8% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Product Engineering Services Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Software Product Company (US) | Evaluation of PES vendors’ capabilities in cloud-native development, microservices architecture, and DevOps enablement to support product modernization. | A Technology Capability Matrix mapping vendor strengths across scalable software delivery, CI/CD pipelines, and cloud-native engineering frameworks. Enabled strategic partner selection for accelerated modernization, reduced technical debt, and improved engineering agility. |

| Industrial Equipment Provider (MEA) | Identification of niche PES vendors with expertise in digital twins, IoT integration, and AI-powered product lifecycle services. | A curated Emerging Vendor Profiling framework highlighting firms with domain-specific accelerators, predictive maintenance capabilities, and smart industrial engineering. Provided exposure to cutting-edge engineering capabilities, fostering co-innovation partnerships for next-gen industrial automation. |

| European Automotive OEM (Europe) | Scan of PES providers working on EV platforms, autonomous driving systems, and connected car ecosystems. | A Next-Gen Mobility Solutions Scan assessing vendor capabilities in embedded software, vehicle-to-cloud integration, and SDV enablement. Helped identify engineering partners driving mobility innovation, reducing R&D risks, and accelerating time-to-market for software-defined vehicles. |

RECENT DEVELOPMENTS

- May 2025 : AVL partnered with Penske Autosport to deploy its VSM RACE simulation software, enhancing engineering precision in Formula E vehicle development. This collaboration focuses on optimizing energy management strategies, improving lap performance, and enabling system-level integration for electric race cars. By leveraging simulation-driven engineering, AVL strengthens its position in high-performance EV platforms, showcasing its capabilities in motorsport innovation, digital prototyping, and real-time system validation.

- April 2025 : Cognizant became the strategic engineering partner for OMRON’s Industrial Automation Business, integrating its expertise in cloud, AI, IoT, and digital twins with OMRON’s operational technology (OT) stack, sensors, controllers, robots, and safety systems. This IT-OT convergence delivers smart factory transformation, streamlines manufacturing operations, and supports sustainable automation. The partnership exemplifies how PES providers are enabling intelligent industrial systems, cyber-physical integration, and next-gen productivity platforms.

- February 2025 : ChargePoint collaborated with HCLTech to accelerate innovation in EV charging software, establishing an advanced R&D center in Bengaluru. This hub serves as a nucleus for developing scalable, customizable, and cloud-native EV charging platforms, leveraging HCLTech’s deep engineering expertise. The initiative positions HCLTech as a key enabler in mobility electrification, supporting the evolution of connected charging ecosystems, personalized user experiences, and software-defined infrastructure for the EV market.

- December 2024 : LTIMindtree partnered with GitHub to integrate GitHub Copilot into enterprise software engineering workflows, enhancing AI-powered development across the lifecycle. This collaboration improves code quality, boosts developer productivity, and accelerates DevSecOps transformation at scale. By embedding AI into the software delivery pipeline, LTIMindtree is driving automated coding, intelligent refactoring, and enterprise-grade software agility, reinforcing its role in AI-native engineering services.

Table of Contents

Methodology

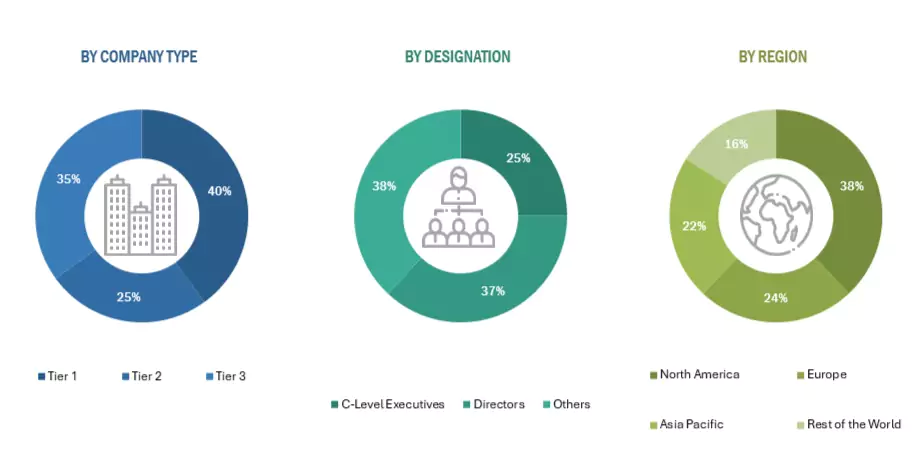

This research study on the product engineering services market involved extensive secondary sources, directories, IEEE Communication-Efficient: Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred product engineering service providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. These included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, spending on various countries’ product engineering services was extracted from the respective sources.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The supply side sources included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors specializing in business development, marketing, and product engineering service providers. It also included key executives from product engineering services vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

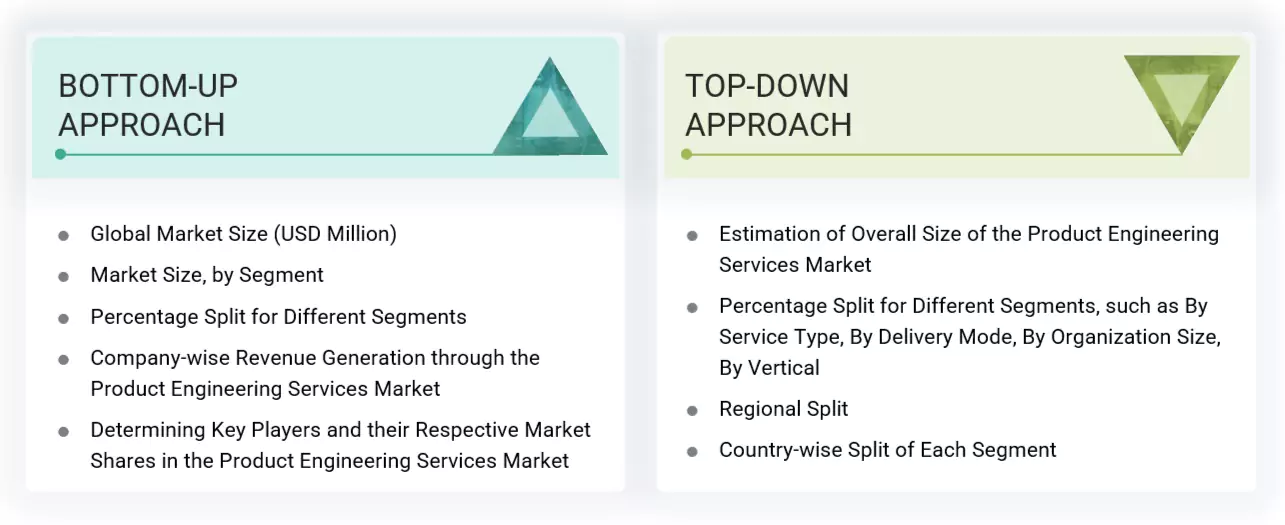

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the product engineering services market. The first approach involved estimating the market size by companies’ revenue generated through the sale of product engineering services.

The top-down approach prepared an exhaustive list of all the vendors offering products in the product engineering services market. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on platform, degree of customization, type, application, end user, and region. The markets were triangulated through primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Market Size Estimation Methodology-Bottom-up approach

The bottom-up approach identified the adoption rate of product engineering services among different verticals in key countries, focusing on the regions contributing the largest market share. The adoption of product engineering services among enterprises and other regional use cases was identified and extrapolated for cross-validation. Use cases identified in different areas were weighted for the market size calculation.

The regional split was determined by primary and secondary sources based on the market numbers. The procedure included an analysis of the product engineering services market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of major product engineering service providers, and organic and inorganic business development activities of regional and global players were estimated.

Product Engineering Services Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. Where applicable, data triangulation and market breakup procedures were employed to complete the overall market engineering process and determine each market segment’s and subsegment’s exact statistics. The overall market size was used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

The product engineering services (PES) market encompasses outsourced services provided by third-party vendors to support software or hardware product design, development, testing, and deployment. These services span the entire product lifecycle, from ideation and prototyping to product maintenance and modernization. PES providers help organizations accelerate innovation, reduce time-to-market, optimize costs, and ensure high product quality. This market caters to automotive, healthcare, telecom, and consumer electronics industries, driven by the growing need for digital transformation, innovative product development, and emerging technologies such as AI, IoT, and cloud. PES typically includes embedded systems, software engineering, and mechanical design.

Stakeholders

- Product Engineering Service Providers

- Product Engineering Outsourcing Service Providers

- Consultants/Consultancies/Advisory Firms

- Governments and Standardization Bodies

- Independent Software Vendors

- Information Technology (IT) Infrastructure Providers

- Regional Associations

- Resellers and Distributors

- Support and Maintenance Service Providers

- System Integrators (SIs)

- Third-party Providers

- Value-added Resellers and Distributors

Report Objectives

- To describe and forecast the global product engineering services market based on service type, organization size, vertical, and region

- To forecast the market size of regional segments: North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America

- To strategically analyze the market’s subsegments concerning individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the significant factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze industry trends, patents and innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To analyze the impact of AI/GenAI on the global product engineering service market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product developments, and partnerships & collaborations in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations to meet the company’s needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company’s portfolio.

Geographic Analysis as per Feasibility

- Further breakup of the North American product engineering services market

- Further breakup of the European product engineering services market

- Further breakup of the Asia Pacific product engineering services market

- Further breakup of the Middle East & Africa product engineering services market

- Further breakup of the Latin American product engineering services market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is product engineering?

According to the Institute of Electrical and Electronics Engineers (IEEE), product engineering involves the application of systematic, disciplined, and quantifiable approaches to developing, operating, and maintaining products. It applies engineering principles to designing, developing, testing, and deploying hardware, embedded systems, and software products. It optimizes performance, cost, time-to-market, and user experience.

What services are typically offered in product engineering?

Product engineering services offer a focused suite of capabilities across the product lifecycle. New product development covers complete hardware and software creation. Embedded systems engineering delivers real-time firmware and integration for intelligent devices. Product modernization and integration upgrade legacy systems for compatibility with new technologies. QA and testing ensure product reliability, performance, and compliance. Sustenance and lifecycle management support ongoing maintenance and enhancements post-launch. Reverse engineering and digital twin design enable the analysis of existing products to drive improvements and virtual simulations for faster, smarter innovation.

What are the primary drivers of the growth of the product engineering services market?

The product engineering services market is driven by several key factors that are reshaping global priorities. The growing demand for digital product innovation is compelling enterprises to accelerate software and hardware development cycles. Rapid advancements in electric vehicles (EVs), artificial intelligence of things (AIoT), and autonomous mobility are pushing the need for domain-specific engineering expertise. Meanwhile, the proliferation of semiconductors and Connected smart devices fuel demand for embedded systems and real-time software integration. Generative artificial intelligence further transforms the landscape by enabling faster prototyping, automated quality assurance, and cost-efficient innovation, positioning PES as a strategic imperative for modern enterprises.

What challenges are product engineering service vendors facing?

PES vendors face multiple operational and technical challenges that hinder scalability and efficiency. One of the foremost issues is the growing complexity of DevOps toolchains, which leads to integration delays and inconsistent development workflows. Legacy infrastructure fragmentation further complicates service delivery, making modernization and interoperability difficult across client environments.

The rising demand for cross-domain expertise, particularly in AI, IoT, and cloud-native development, is also straining engineering resources. Standardization gaps across platforms and technologies often result in cost overruns, quality issues, and project delays, requiring PES vendors to invest in unified frameworks and specialized talent to remain competitive.

Who are the key vendors in the product engineering services market?

The key vendors in the global product engineering services market include IBM (US), Cognizant (US), HCL Tech (India), Capgemini (France), Alten Group (France), Accenture (Ireland), Wipro (India), and LTIMindtree (India).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Product Engineering Services Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Product Engineering Services Market

Scott

Feb, 2023

What are the future product engineering services market trends?.