Law Enforcement And Public Safety Drone Market Size by Type (Rotary Wing, Fixed Wing, Hybrid), Platform (Micro, Small), Application (Police Operations & Investigations, Firefighting & Disaster Management, Border Management, Others), Mode of operation, and Region - Global Forecast to 2028

Law Enforcement And Public Safety Drone Market Summary

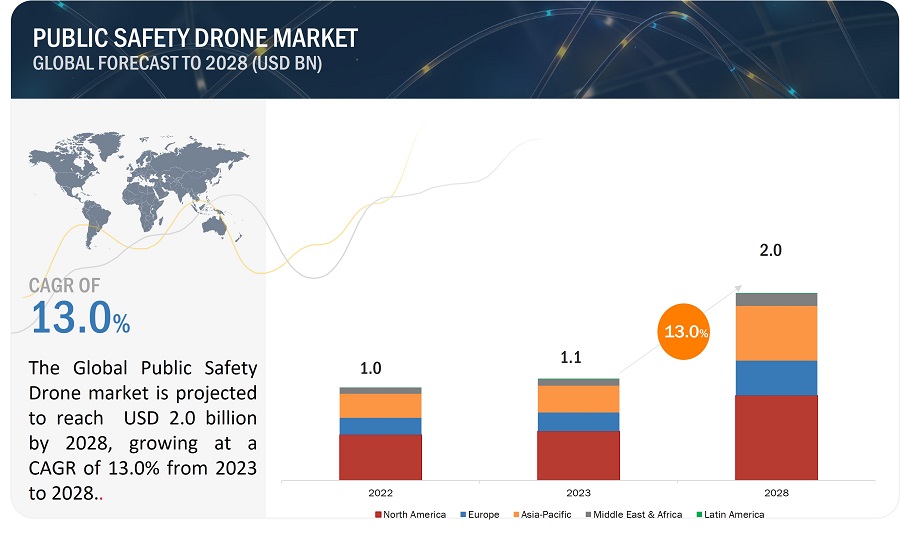

The Global Law Enforcement And Public Safety Drone Market Size was valued at USD 1.1 Billion in 2023 and is estimated to reach USD 2.0 Billion by 2028, growing at a CAGR of 13% during the forecast period. As technology advances and regulations continue to evolve, the demand for public safety drones is expected to grow further, enabling more efficient and effective responses to critical incidents. The flexibility and maneuverability of drones enable them to access hard-to-reach areas, providing critical support to first responders. As a result, public safety agencies are increasingly adopting AI in drones as essential tools for improving their operations and ensuring the safety of communities. Equipped with advanced sensors and cameras, they can detect hazards, locate missing persons, and assist in the management of critical incidents.

The Public Safety Drone Industry has experienced remarkable technological advancements, revolutionizing the way emergency response and public safety operations are conducted. These advancements have propelled drones to the forefront of critical missions, equipping public safety personnel with powerful tools to enhance situational awareness, response capabilities, and overall operational efficiency. With improved flight performance, extended flight times, and increased payload capacities, drones can navigate challenging environments, remain airborne for longer durations, and carry sophisticated equipment and sensors. Advanced imaging technologies, real-time video streaming, and data transmission capabilities enable real-time situational assessment, while intelligent flight modes and autonomy features streamline operations. Furthermore, the integration of data analytics and seamless data integration empowers public safety agencies to leverage valuable insights for incident management and post-incident analysis. The continuous evolution of technology in the public safety drone market promises to unlock new possibilities and revolutionize emergency response efforts, ensuring safer communities and more effective crisis management.

Public Safety Drone Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Law Enforcement and Public Safety Drone Market Dynamics

Driver: Increasing use of drones for border management.

Protecting the United States' borders from risks posed by unauthorized drones is perhaps one of the most difficult technological and operational difficulties for those involved in Counter Unmanned Aerial System Activities. Thus, drones are becoming key tools in border management because they improve the operating capacity and performance of border surveillance systems while charging wirelessly and on a cheap budget. In October 2022, The US Border Patrol paid Red Cat subsidiary Teal Drones more than $1 million for surveillance and tracking drones. The contract is part of a Blanket Purchase Agreement (BPA) announced in December 2021 between US Customs and Border Protection and five drone companies, valued up to $90 million over a five-year period.

Restraints: Lack of skilled & trained personnel to operate drones.

Drones can fly at different altitudes and require pilots to control and operate them and require skilled personnel for remote piloting. The number of pilots available for high-precision operations is comparatively low. Public safety drones flying at low altitudes require pilots to control and operate them. This requires skilled personnel for remote piloting of public safety drones. Several public safety drone accidents occur due to poor control of operators. According to Calhoun: The NPS Institutional Archive, nearly 32% of accidents involving UAVs are due to human error, while 45% occur due to material failure, along with another factor.

In January 2023, according to the Civil Aviation Agency, which governs the use of drones in the country in accordance with larger European laws, only around half of the registered pilots have a qualification in operating an unmanned aircraft.G4S teamed with the Latvian State Police to install a mobile drone detection system for large events and to train officers on how to use the equipment.

Opportunity: Technological advancement in the field of drone payloads

Drones have made remarkable advances in terms of drone payload, or the weighted cargo that a drone can carry. When first responder access is limited due to road conditions, drones can provide blood, medication, food, and water to persons in need. In such cases, saving time and enhancing delivery efficiency might be lifesaving. Drones provide firms with the potential to distribute things without human interaction in the current socially disconnected atmosphere. During COVID-19, Drones were utilized to spray disinfectant to improve the efficiency and speed of sterilization operations in public places.

Challenge: Delivery authentication and cybersecurity concerns

Because they have insufficient security procedures, the increasing frequency of hacking events is cause for concern. Companies in the drone industry offer analytics software-as-a-service to their customers, which necessitates the use of cloud-based servers to handle data. Because the data is sent and stored in an external cloud network, it is vulnerable to hackers. For data protection, industries also require highly secured cloud servers. As a result, issues about data security and data encryption pose a hurdle to the public safety drone market. In March 2023, The US government created a drone cybersecurity evaluation program. The program will provide a standardized cybersecurity analysis for commercial off-the-shelf drones in order to assure the security of the supply chain, which includes their components, software, and other technology.

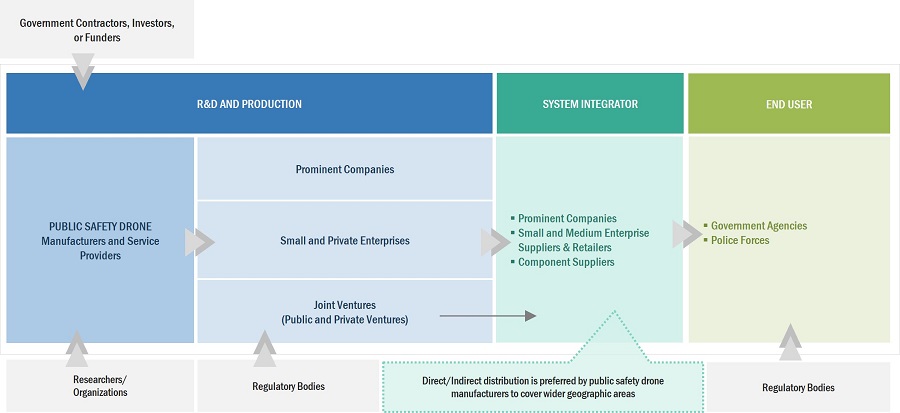

Law Enforcement and Public Safety Drone Market Ecosystem

The key stakeholders in the public safety drone market ecosystem are platform manufacturers, subsystem manufacturers, service providers, software providers, and miscellaneous (insurance companies). The following figure lists some global platform manufacturers, subsystem providers, service providers, and software providers.

The market for Hybrid in the type segment is projected to grow with higher CAGR.

Based on type, the Hybrid segment is projected to record high growth during the forecast period. Hybrid drones offer one significant advantage with their extended flight time and endurance. The increased flight time enables public safety agencies to cover larger areas. Hybrid unmanned aerial vehicles (UAVs) possess the capability to seamlessly transition between vertical takeoff and landing (VTOL) and horizontal flight, effectively amalgamating the agility of rotary-wing UAVs with the efficiency of fixed-wing UAVs. This inherent adaptability empowers them to flexibly accommodate evolving operational demands and adeptly navigate heterogeneous environments. The incorporation of fixed-wing characteristics in hybrid drones confers upon them the capacity to efficiently cover extensive geographical areas. These drones are proficient in performing aerial surveys, conducting border or coastline monitoring operations, and providing comprehensive surveillance capabilities for law enforcement agencies. The extended flight range inherent in hybrid drones enables them to effectively carry out patrol and monitoring activities across vast regions.

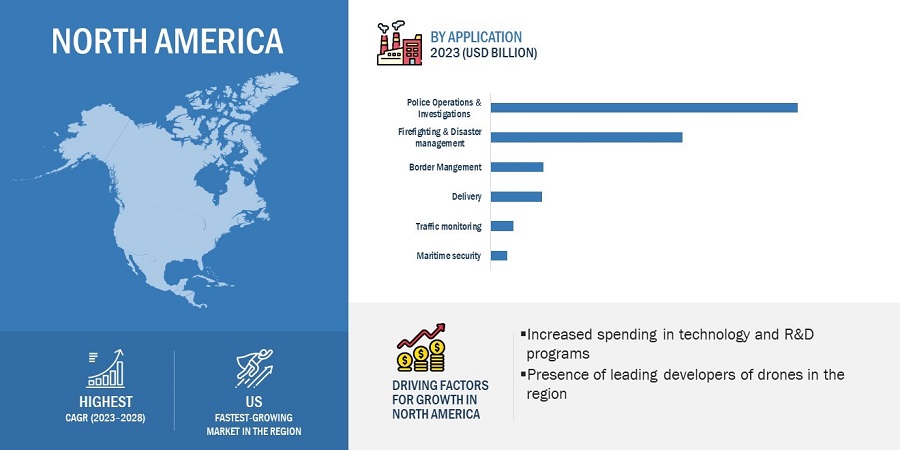

Based on Application, Police Operations & Investigation segment is expected to lead the public safety drone market during the forecast period.

Based on the application, public safety drone is segmented into Police Operations & Investigations, Firefighting & Disaster Management, Border Management, Traffic Monitoring, Maritime security, and Delivery. The Police Operations & Investigation segment is expected to lead the public safety drone market during the forecast period. Increasing usage of public safety drones for crime-scene photography, crowd monitoring, and surveillance is boosting the police operations & investigations segment. Drones are becoming popular for use in police operations and investigations for several reasons. Instead of reimbursing USD 500–600 every hour for a helicopter to map the whole city, the police department of a city can buy a few drones to carry out the same task cost-effectively. These maps can then be used to monitor activities taking place in the city. Drones also provide before-and-after images of natural catastrophes. Hundreds of police departments globally purchase drones each year to help them in tracking down suspects. Having an eye in the sky offers critical intelligence to them and directs the ground police units to position themselves optimally. They also lessen the uncertainty, resulting in lowered stress levels for special weapons and tactics teams. Suspects often are not aware of drones since they are smaller and calmer than helicopters.

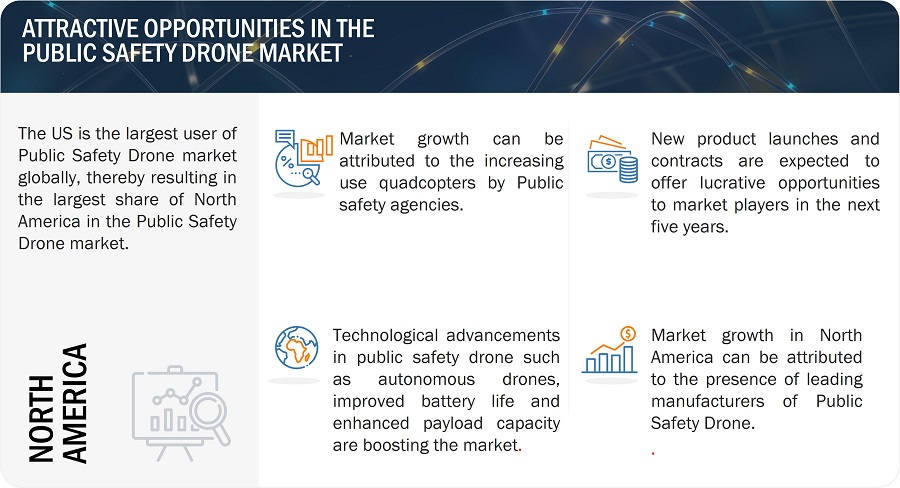

North America is expected to lead the market during the forecast period.

North America is projected to lead the Public Safety Drone market during the forecast period. The US is the largest market for Public Safety drones in North America. Collaboration between public safety agencies and private drone service providers has accelerated the adoption of public safety drones in North America. Public-private partnerships have facilitated access to advanced drone technologies, expertise, and operational support for public safety agencies. The combination of a strong focus on public safety, supportive regulatory frameworks, technological innovation, diverse landscapes, and collaboration between sectors has contributed to the significant demand for public safety drones in North America.

Public Safety Drone Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Law Enforcement and Public Safety Drone Companies are dominated by a few globally established players such as DJI (China), Autel Robotics (China), Skydio Inc (US), Parrot Drone SAS (France), and Teledyne FLIR LLC (US). They have an established portfolio of reputable products and services, a robust market presence, strong business strategies, a significant market share, products with wider applications, broader geographical use cases, and a larger product footprint.

Scope of the Report

|

Report Metric |

Details |

|

Growth Rate |

13.0% |

|

Estimated Market Size in 2023 |

USD 1.1 Billion |

|

Projected Market Size in 2028 |

USD 2.0 Billion |

|

Market size available for years |

2020-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

By type, by platform, by application, and by mode of operation |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

DJI (China), Autel Robotics (China), Skydio Inc (US), Parrot Drone SAS (France), Teledyne FLIR LLC (US), and few others. (Total 25 Players) |

Public Safety Drone Market Highlights

This research report categorizes the Public Safety Drone market based on platform, application, solution, payload weight, and range.

|

Segment |

Subsegment |

|

By Platform |

|

|

By Type |

|

|

By Application |

|

|

By Mode or Operation |

|

|

By Region |

|

Recent Developments

- In May 2023, Skydio released the Skydio X2D Multiband, which includes new multiband technology and features. The X2D can overcome limitations like interference, attenuation, or bandwidth constraints in a single frequency band by utilizing various frequency bands.

- In May 2023, Skydio Inc and the Alaska Department of Transportation & Public Facilities collaborated to launch a new drone program (ARROW), The Alaska Rural Remote Operations Work Plan, that would benefit 10 remote communities during emergencies.

- In April 2023, DJI teamed up with MRSDE to supply drones for search and rescue missions in the United Kingdom. The collaboration includes the deployment of DJI drones to identify missing people in remote places and to acquire real-time situational information during emergency situations.

- In April 2023, DraganFly Inc. announced a collaboration with AgileMesh Inc. AgileMesh, Inc. will add Draganfly's UAV Platform to its wireless surveillance product line as a result of this collaboration, leading to significant improvements to emergency personnel communication capabilities.

- In March 2023, Ondas Holding’s Airobotics Ltd acquired Iron Drone Ltd. And launched a new counter-drone. The Iron Drone system is a completely automated interceptor capable of eliminating small drones without the need for GPS or RF jamming.

- In February 2023, Autel Robotics' Drone assisted a scientific team of foreign academics in documenting activities on Costa Rica's Iraz Volcano. The scientists chose the Autel EVO Lite+ drone for its high-quality sensor and durability. The EVO Lite+ flew safely through 17-knot winds and can be utilized in situations up to 37 knots, making it ideal for high-altitude projects.

- In January 2023, DraganFly Inc. entered into a partnership with Lufthansa Industry Solutions, providing the maritime industry with the greatest level of information technology and performance monitoring. Draganfly's reconnaissance drones are capable of inspecting cargo and potential risks on the sea

Frequently Asked Questions (FAQ):

What is the current size of the Public Safety Drone market?

The Public Safety Drone market is valued at USD 1.1 billion in 2023 and is projected to reach USD 2.0 billion by 2028, at a CAGR of 13.0%. North America is estimated to account for the largest share of the Public Safety Drone market in 2023.

Who are the winners in the Public Safety Drone market?

Some of the key players in the Public Safety Drone market are DJI (China), Autel Robotics (China), Skydio Inc (US), Parrot Drone SAS (France), and Teledyne FLIR LLC (US).

What are some of the technological advancements in the market?

Synthetic Aperture Radar (SAR), Drone swarm technologies, Network functions virtualization (NFV), Software Defined Networking (SDN) are some of the technological advancements in the market. The drone industry has witnessed significant growth during the past decade due to increasing use in the commercial and military sectors. Major applications include the use of drones in law enforcement and SWAT, agriculture & conservation, product delivery, construction, mining, news gathering, search & rescue, combat, surveillance, and reconnaissance. Due to their unique ability to hover and access areas considered unsafe and hazardous for humans, they are used in a wide range of applications. Accidents due to power failure or losing control of drones could result in injury or damage to private or public property. This could result in high costs, medical expenses, or personal injury. Hence, ensuring drones is one of the best ways to promote the growth of the public safety drone market.

What are the factors driving the growth of the market?

The Increasing use of public safety drones for marine border patrolling, Increasing use of drones for border management, Enhanced situational awareness, Increasing demand for hybrid drones, and reduction in the price of drone components like ICs (controllers, GPS). The costs of drones are falling as the costs of various ICs (controllers, GPS), IoT sensors, MEMS sensors, and batteries are going down, whereas their performance is rising, like the GPS accuracy. The drone’s hardware is mostly made of fiber composites, whose cost is decreasing due to advancements in technology and investment in drone hardware worldwide. New drone technology will improve drone manufacturing efficiency, which should make manufacturing drones cheaper, and as new competitors will enter the market, drone companies will have to reduce prices in order to capture a larger market share.

Which region is expected to grow most in the Forecast years?

The market in Asia Pacific is projected to grow at the highest CAGR from 2023 to 2030, showcasing strong demand for public safety drones in the region. The growth of the public safety drone market in the Asia Pacific can be attributed to the rise in internal conflicts within the countries in the region. Moreover, political tensions in countries of Asia Pacific have led to the deployment of drones to ensure the security of their borders. This serves to be one of the most significant factors driving the growth of the public safety drone market in the region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for hybrid drones- Need for enhanced situational awareness- Growing use of drones for border management- Increasing use of public safety drones for marine border patrolling- Decreasing price of drone componentsRESTRAINTS- Lack of skilled personnel to operate drones- Weather conditions and environmental factorsOPPORTUNITIES- Technological advancement in drone payloads- Simultaneous localization and mapping- Integration with other technologies- Partnerships and collaborationsCHALLENGES- Delivery authentication and cybersecurity concerns- Beyond visual line of sight operations

-

5.3 PUBLIC SAFETY DRONE MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESSTARTUPSEND USERS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR PUBLIC SAFETY DRONE MARKET

-

5.5 TECHNOLOGY ANALYSISAI IN PUBLIC SAFETY DRONESDRONES WITH LIDAR SYSTEMS

- 5.6 VALUE CHAIN ANALYSIS OF PUBLIC SAFETY DRONE MARKET

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.8 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.9 KEY CONFERENCES AND EVENTS IN 2023

- 5.10 TRADE DATA ANALYSIS

-

5.11 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSNORTH AMERICA- US- CanadaEUROPE- UK- Germany- France

- 5.12 VOLUME DATA

-

5.13 PRICING ANALYSISAVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPE

- 6.1 INTRODUCTION

-

6.2 EMERGING TECHNOLOGY TRENDSSYNTHETIC APERTURE RADARSWARMING TECHNOLOGYNETWORK FUNCTIONS VIRTUALIZATIONNEW SCOPE FOR DRONE REST AND RECHARGESOFTWARE-DEFINED NETWORKINGDRONE INSURANCE

-

6.3 USE CASE ANALYSISZIPLINE DRONES USED TO DELIVER COVID-19 VACCINESTRANSFER OF MEDICAL PRESCRIPTIONS USING DRONES FROM MANNA AERODRONE FIELD TESTS IN AMAZON FOREST IN PERUTEAR GAS BY DRONES

-

6.4 CONNECTED USE CASESDRONE TECHNOLOGY FOR RADIOLOGICAL MONITORINGDRONE TECHNOLOGY FOR CONSERVATIONTRAFFIC AND CROWD MONITORING

- 6.5 IMPACT OF MEGATRENDS

-

6.6 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 ROTARY-WINGINCREASING USE OF ROTARY-WING DRONES IN CLOSE-PROXIMITY OPERATIONS- Single rotors- Bi-copters- Tri-copters- Quadcopters- Hexacopters- Octocopters

-

7.3 FIXED-WINGEXTENDED FLIGHT ENDURANCE, LONG-DISTANCE OPERATION, AND WIDE AREA COVERAGE CAPABILITIES TO DRIVE DEMAND FOR FIXED-WING DRONES

-

7.4 HYBRIDGROWING DEMAND FOR EXTENDED FLIGHT RANGE TO BOOST DEMAND FOR HYBRID DRONES

- 8.1 INTRODUCTION

-

8.2 MICRO (250 GM–2 KG)INCREASING DEMAND FOR EASILY MANEUVERABLE COMPACT DRONES

-

8.3 SMALL (2 KG–25 KG)QUICK DEPLOYMENT FOR IMMEDIATE SURVEILLANCE NEEDS

- 9.1 INTRODUCTION

-

9.2 SEMI-AUTONOMOUSINCREASED ADOPTION OF PUBLIC SAFETY DRONES TO DRIVE DEMAND

-

9.3 FULLY AUTONOMOUSINCREASED DEMAND FOR MISSION EFFICIENCY AND PRECISION TO DRIVE SEGMENT

- 10.1 INTRODUCTION

-

10.2 POLICE OPERATIONS & INVESTIGATIONSEMERGENCE OF PUBLIC SAFETY DRONES AS COST-EFFECTIVE SOLUTIONS TO IDENTIFY SUSPECTS- Crime scene-photography- Investigating armed and dangerous suspects- Bombs and materials observation- Fugitive apprehension- Crowd monitoring- Surveillance- Search and rescue

-

10.3 FIREFIGHTING & DISASTER MANAGEMENTEMPOWERING FIREFIGHTING AND DISASTER MANAGEMENT EFFORTS THROUGH PUBLIC SAFETY DRONES

-

10.4 BORDER MANAGEMENTENHANCING BORDER SECURITY AND PUBLIC SAFETY THROUGH DRONE TECHNOLOGY

-

10.5 TRAFFIC MONITORINGIMPROVING TRAFFIC MONITORING AND SAFETY THROUGH PUBLIC SAFETY DRONES

-

10.6 MARITIME SECURITYSTRENGTHENING MARITIME SECURITY THROUGH PUBLIC SAFETY DRONES

-

10.7 DELIVERYINCREASED USAGE OF DRONES FOR MEDICAL AND EMERGENCY RESPONSE

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAINTRODUCTIONRECESSION IMPACT ANALYSIS: NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Focus on development of UAVs for US Army to drive marketCANADA- Increasing use of drones for public safety to drive market

-

11.3 EUROPEINTRODUCTIONRECESSION IMPACT ANALYSIS: EUROPEPESTLE ANALYSIS: EUROPEUK- Presence of key players to drive marketGERMANY- Increased adoption of drones for safety to drive marketFRANCE- Government initiatives supporting UAVs to boost marketITALY- Growing demand for drones for public safety to drive marketRUSSIA- Investments in research & development to elevate public safety and securityREST OF EUROPE

-

11.4 ASIA PACIFICINTRODUCTIONRECESSION IMPACT ANALYSIS: ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Increased innovations in drone technology to contribute to market growthINDIA- Government initiatives to promote use of drones for public safety to lead to market growthJAPAN- Growing need for traffic monitoring to boost marketAUSTRALIA- Increasing use of drones for surveillance to drive marketSOUTH KOREA- Innovations in drone technology to lead to market growth

-

11.5 MIDDLE EAST & AFRICAINTRODUCTIONRECESSION IMPACT ANALYSIS: MIDDLE EAST & AFRICAISRAEL- Government investments in building drone networks to boost marketTURKEY- Garuda Aerospace drones to be used for relief operationsUAESAUDI ARABIA- Public-private partnerships to boost marketSOUTH AFRICA- Increased government focus on drone-based public safety initiatives to fuel market

-

11.6 LATIN AMERICAINTRODUCTIONRECESSION IMPACT ANALYSIS: LATIN AMERICAPESTLE ANALYSIS: LATIN AMERICABRAZIL- Increasing use of drones by government agencies to boost marketMEXICO- Increased use of drones for disaster management and monitoring to drive marketARGENTINA- Increased adoption of drones by government authorities to drive market

- 12.1 INTRODUCTION

- 12.2 COMPANY OVERVIEW

- 12.3 RANKING ANALYSIS OF KEY PLAYERS IN PUBLIC SAFETY DRONE MARKET, 2022

- 12.4 REVENUE ANALYSIS, 2022

- 12.5 MARKET SHARE ANALYSIS, 2022

-

12.6 COMPETITIVE EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.7 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

- 12.8 COMPETITIVE SCENARIO OF MARKET PLAYERS

-

12.9 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSDJI- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPARROT DRONE SAS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTELEDYNE FLIR LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAUTEL ROBOTICS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSKYDIO, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewYUNEEC- Business overview- Products/Solutions/Services offered- Recent developmentsDRAGANFLY INC.- Business overview- Products/Solutions/Services offered- Recent developmentsBRINC DRONES, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsONDAS HOLDINGS INC.- Business overview- Products/Solutions/Services offered- Recent developmentsHARRIS AERIAL, INC.- Business overview- Products/Solutions/Services offeredLOCKHEED MARTIN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsTEAL DRONES- Business overview- Products/Solutions/Services offered- Recent developmentsDELAIR- Business overview- Products/Solutions/Services offeredFLYABILITY- Business overview- Products/Solutions/Services offered- Recent developmentsWINGTRA- Business overview- Products/Solutions/Services offered- Recent developments

-

13.3 OTHER PLAYERSAEE AVIATION TECHNOLOGY INC.KESPRYINSITU, INC.HOVERFLY TECHNOLOGIESMICRODRONESELISTAIRZIPLINEVOLOCOPTER GMBHAGEAGLE AERIAL SYSTEMS INC.AUTERION GS

- 14.1 DISCUSSION GUIDE

- 14.2 MARKET DEFINITION

- 14.3 MARKET DYNAMICS

- 14.4 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.5 CUSTOMIZATION OPTIONS

- 14.6 RELATED REPORTS

- 14.7 AUTHOR DETAILS

- TABLE 1 PUBLIC SAFETY DRONE MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 LAW ENFORCEMENT AND PUBLIC SAFETY DRONE MARKET ECOSYSTEM

- TABLE 3 COMPANIES WORKING TOWARD DEVELOPMENT OF DRONES WITH AI SOFTWARE

- TABLE 4 COMPANIES WORKING TOWARD DEVELOPMENT OF DRONE EQUIPMENT WITH AI

- TABLE 5 PUBLIC SAFETY DRONE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 TYPES (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP 3 TYPES

- TABLE 8 PUBLIC SAFETY DRONE MARKET: CONFERENCES AND EVENTS, 2023

- TABLE 9 COUNTRY-WISE IMPORTS FOR DRONES, 2020–2022 (USD THOUSAND)

- TABLE 10 COUNTRY-WISE EXPORTS FOR DRONES, 2020–2022 (USD THOUSAND)

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 US: RULES AND GUIDELINES BY FAA FOR DRONE OPERATIONS

- TABLE 17 CANADA: RULES AND GUIDELINES FOR DRONE OPERATIONS

- TABLE 18 UK: RULES AND GUIDELINES BY CAA FOR DRONE OPERATIONS

- TABLE 19 GERMANY: RULES AND GUIDELINES FOR DRONE OPERATIONS

- TABLE 20 FRANCE: RULES AND GUIDELINES FOR DRONE OPERATIONS

- TABLE 21 PUBLIC SAFETY DRONE REGULATIONS, BY COUNTRY

- TABLE 22 AVERAGE SELLING PRICES OF KEY PLAYERS (USD)

- TABLE 23 INSURANCE COVERAGE OFFERED

- TABLE 24 COMPANIES PROVIDING DRONE INSURANCE

- TABLE 25 COVID-19 VACCINES DELIVERED TO GHANA BY ZIPLINE

- TABLE 26 ESSENTIAL SUPPLIES DELIVERED BY MANNA AERO IN RURAL AREAS

- TABLE 27 FIELD TESTS USING CARGO DRONES TO DELIVER VACCINES AND BLOOD SAMPLES

- TABLE 28 EXPERIMENTING WITH DRONES FOR TEAR GAS DROP

- TABLE 29 UAV-RELATED USE CASES IN DIFFERENT GEOGRAPHIES

- TABLE 30 PATENTS RELATED TO MILITARY DRONES GRANTED BETWEEN FEBRUARY 2020 AND DECEMBER 2022

- TABLE 31 LAW ENFORCEMENT AND PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 32 PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 33 ROTARY-WING PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 34 ROTARY-WING PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 35 PUBLIC SAFETY DRONE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 36 PUBLIC SAFETY DRONE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 37 PUBLIC SAFETY DRONE MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 38 PUBLIC SAFETY DRONE MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 39 PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 40 PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 41 PUBLIC SAFETY DRONE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 42 LAW ENFORCEMENT AND PUBLIC SAFETY DRONE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 49 US: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 50 US: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 51 US: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 52 US: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 53 CANADA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 54 CANADA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 55 CANADA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 56 CANADA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 57 EUROPE: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 58 EUROPE: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 59 EUROPE: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 60 EUROPE: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 61 EUROPE: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 62 EUROPE: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 63 UK: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 64 UK: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 65 UK: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 66 UK: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 67 GERMANY: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 68 GERMANY: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 69 GERMANY: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 70 GERMANY: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 71 FRANCE: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 72 FRANCE: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 73 FRANCE: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 74 FRANCE: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 75 ITALY: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 76 ITALY LAW ENFORCEMENT AND PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 77 ITALY: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 78 ITALY: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 79 RUSSIA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 80 RUSSIA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 81 RUSSIA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 82 RUSSIA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 83 REST OF EUROPE: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 84 REST OF EUROPE: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 85 REST OF EUROPE: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 86 REST OF EUROPE: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 88 ASIA PACIFIC: LAW ENFORCEMENT AND PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 89 ASIA PACIFIC: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 90 ASIA PACIFIC: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 93 CHINA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 94 CHINA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 95 CHINA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 96 CHINA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 97 INDIA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 98 INDIA: LAW ENFORCEMENT AND PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 99 INDIA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 100 INDIA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 101 JAPAN: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 102 JAPAN: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 103 JAPAN: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 104 JAPAN: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 105 AUSTRALIA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 106 AUSTRALIA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 107 AUSTRALIA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 108 AUSTRALIA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 109 SOUTH KOREA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 110 SOUTH KOREA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 111 SOUTH KOREA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 112 SOUTH KOREA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 ISRAEL: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 120 ISRAEL: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 121 ISRAEL: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 122 ISRAEL: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 123 TURKEY: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 124 TURKEY: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 125 TURKEY: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 126 TURKEY: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 127 UAE: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 128 UAE: LAW ENFORCEMENT AND PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 129 UAE: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 130 UAE: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 131 SAUDI ARABIA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 132 SAUDI ARABIA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 133 SAUDI ARABIA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 134 SAUDI ARABIA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 135 SOUTH ARICA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 136 SOUTH ARICA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 137 SOUTH ARICA: LAW ENFORCEMENT AND PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 138 SOUTH ARICA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 LATIN AMERICA: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 140 LATIN AMERICA: PUBLIC SAFETY DRONE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 141 LATIN AMERICA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 142 LATIN AMERICA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 143 LATIN AMERICA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 144 LATIN AMERICA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 145 BRAZIL: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 146 BRAZIL: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 147 BRAZIL: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 148 BRAZIL: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 149 MEXICO: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 150 MEXICO: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 151 MEXICO: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 152 MEXICO: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 153 ARGENTINA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 154 ARGENTINA: PUBLIC SAFETY DRONE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 155 ARGENTINA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 156 ARGENTINA: PUBLIC SAFETY DRONE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 157 KEY DEVELOPMENTS OF LEADING PLAYERS IN PUBLIC SAFETY DRONE MARKET (2022–2023)

- TABLE 158 PUBLIC SAFETY DRONE MARKET: DEGREE OF COMPETITION

- TABLE 159 PUBLIC SAFETY DRONE MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 160 PUBLIC SAFETY DRONE MARKET: COMPETITIVE SCENARIO OF KEY PLAYERS [MAJOR PLAYERS]

- TABLE 161 PUBLIC SAFETY DRONE MARKET: COMPETITIVE SCENARIO OF KEY PLAYERS [STARTUPS/SMES]

- TABLE 162 PUBLIC SAFETY DRONE MARKET: PRODUCT LAUNCHES, JUNE 2020–MAY 2023

- TABLE 163 PUBLIC SAFETY DRONE MARKET: DEALS, FEBRUARY 2020–MAY 2023

- TABLE 164 PUBLIC SAFETY DRONE MARKET: OTHER DEVELOPMENTS, OCTOBER 2021– OCTOBER 2022

- TABLE 165 DJI: BUSINESS OVERVIEW

- TABLE 166 DJI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 DJI: NEW PRODUCT LAUNCHES

- TABLE 168 DJI: DEALS

- TABLE 169 PARROT DRONE SAS: BUSINESS OVERVIEW

- TABLE 170 PARROT DRONE SAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 PARROT DRONE SAS: NEW PRODUCT LAUNCHES

- TABLE 172 PARROT DRONE SAS: DEALS

- TABLE 173 PARROT DRONE SAS: OTHERS

- TABLE 174 TELEDYNE FLIR LLC: BUSINESS OVERVIEW

- TABLE 175 TELEDYNE FLIR LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 TELEDYNE FLIR LLC: NEW PRODUCT LAUNCHES

- TABLE 177 TELEDYNE FLIR LLC: DEALS

- TABLE 178 AUTEL ROBOTICS: BUSINESS OVERVIEW

- TABLE 179 AUTEL ROBOTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 AUTEL ROBOTICS: NEW PRODUCT LAUNCHES

- TABLE 181 AUTEL ROBOTICS: DEALS

- TABLE 182 AUTEL ROBOTICS: OTHERS

- TABLE 183 SKYDIO, INC.: COMPANY OVERVIEW

- TABLE 184 SKYDIO, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 SKYDIO, INC.: NEW PRODUCT LAUNCHES

- TABLE 186 SKYDIO, INC.: DEALS

- TABLE 187 YUNEEC: BUSINESS OVERVIEW

- TABLE 188 YUNEEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 YUNEEC HOLDING LTD.: DEALS

- TABLE 190 DRAGANFLY INC.: BUSINESS OVERVIEW

- TABLE 191 DRAGANFLY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 DRAGANFLY INC.: DEALS

- TABLE 193 BRINC DRONES, INC.: COMPANY OVERVIEW

- TABLE 194 BRINC DRONES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 BRINC DRONES, INC.: NEW PRODUCT LAUNCHES

- TABLE 196 BRINC DRONES, INC.: DEALS

- TABLE 197 ONDAS HOLDINGS INC.: BUSINESS OVERVIEW

- TABLE 198 ONDAS HOLDINGS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 ONDAS HOLDINGS INC.: DEALS

- TABLE 200 HARRIS AERIAL, INC. COMPANY OVERVIEW

- TABLE 201 HARRIS AERIAL, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

- TABLE 203 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 205 TEAL DRONES: BUSINESS OVERVIEW

- TABLE 206 TEAL DRONES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 TEAL DRONES: NEW PRODUCT LAUNCHES

- TABLE 208 TEAL DRONES: OTHERS

- TABLE 209 DELAIR: BUSINESS OVERVIEW

- TABLE 210 DELAIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 FLYABILITY: COMPANY OVERVIEW

- TABLE 212 FLYABILITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 FLYABILITY: NEW PRODUCT LAUNCHES

- TABLE 214 FLYABILITY: DEALS

- TABLE 215 WINGTRA: COMPANY OVERVIEW

- TABLE 216 WINGTRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 WINGTRA: NEW PRODUCT LAUNCHES

- TABLE 218 WINGTRA: DEALS

- TABLE 219 AEE AVIATION TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 220 KESPRY: COMPANY OVERVIEW

- TABLE 221 INSITU, INC.: COMPANY OVERVIEW

- TABLE 222 HOVERFLY TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 223 MICRODRONES: COMPANY OVERVIEW

- TABLE 224 ELISTAIR: COMPANY OVERVIEW

- TABLE 225 ZIPLINE: COMPANY OVERVIEW

- TABLE 226 VOLOCOPTER GMBH: COMPANY OVERVIEW

- TABLE 227 AGEAGLE AERIAL SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 228 AUTERION GS: COMPANY OVERVIEW

- FIGURE 1 PUBLIC SAFETY DRONE MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 ASSUMPTIONS FOR RESEARCH STUDY

- FIGURE 8 HYBRID SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 9 SMALL DRONE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE THAN MICRO DRONE SEGMENT FROM 2023 TO 2028

- FIGURE 10 FULLY AUTONOMOUS SEGMENT TO EXHIBIT HIGHER CAGR THAN SEMI-AUTONOMOUS SEGMENT DURING FORECAST PERIOD

- FIGURE 11 POLICE OPERATIONS & INVESTIGATIONS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 13 INCREASING USE OF DRONES BY PUBLIC SAFETY AGENCIES TO DRIVE MARKET

- FIGURE 14 QUADCOPTERS TO DOMINATE ROTARY-WING TYPE SEGMENT DURING FORECAST PERIOD

- FIGURE 15 SMALL DRONE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 POLICE OPERATIONS & INVESTIGATIONS SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 17 SEMI-AUTONOMOUS SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 18 PUBLIC SAFETY DRONE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 PUBLIC SAFETY DRONE MARKET ECOSYSTEM MAP

- FIGURE 20 REVENUE SHIFT IN PUBLIC SAFETY DRONE MARKET

- FIGURE 21 VALUE CHAIN ANALYSIS

- FIGURE 22 PUBLIC SAFETY DRONE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 TYPES

- FIGURE 24 KEY BUYING CRITERIA FOR TOP 3 TYPES

- FIGURE 25 PUBLIC SAFETY DRONE MARKET, MARKET VOLUME (UNITS), 2020-2028

- FIGURE 26 AVERAGE SELLING PRICES OF KEY PLAYERS

- FIGURE 27 HYBRID SEGMENT TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 28 SMALL SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE THAN MICRO SEGMENT FROM 2023 TO 2028

- FIGURE 29 FULLY AUTONOMOUS SEGMENT TO RECORD HIGHER GROWTH RATE THAN SEMI-AUTONOMOUS SEGMENT DURING FORECAST PERIOD

- FIGURE 30 POLICE OPERATIONS & INVESTIGATIONS SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 31 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 32 NORTH AMERICA: PUBLIC SAFETY DRONE MARKET SNAPSHOT

- FIGURE 33 EUROPE: PUBLIC SAFETY DRONE MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: PUBLIC SAFETY DRONE MARKET SNAPSHOT

- FIGURE 35 MIDDLE EAST & AFRICA: PUBLIC SAFETY DRONE MARKET SNAPSHOT

- FIGURE 36 LATIN AMERICA: PUBLIC SAFETY DRONE MARKET SNAPSHOT

- FIGURE 37 RANKING OF KEY PLAYERS IN PUBLIC SAFETY DRONE MARKET, 2022

- FIGURE 38 REVENUE ANALYSIS FOR KEY COMPANIES IN PUBLIC SAFETY DRONE MARKET, 2022

- FIGURE 39 MARKET SHARE ANALYSIS FOR KEY COMPANIES IN PUBLIC SAFETY DRONE MARKET, 2022

- FIGURE 40 PUBLIC SAFETY DRONE MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 41 PUBLIC SAFETY DRONE MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 42 PARROT DRONE SAS: COMPANY SNAPSHOT

- FIGURE 43 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

- FIGURE 44 ONDAS HOLDINGS INC.: COMPANY SNAPSHOT

- FIGURE 45 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

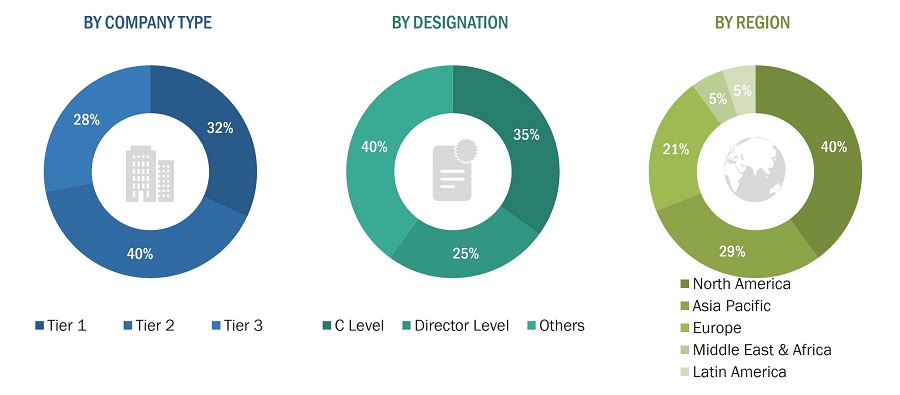

This research study on the public safety drone market involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, and Factiva, to identify and collect information relevant to the market. The primary sources considered experts from the core and related industries and preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, subject-matter experts (SME), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the market, as well as to assess its growth prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information pertinent to this study on the public safety drone market. Secondary sources included annual reports; press releases; investor presentations; white papers; journals and certified publications; articles by recognized authors; directories; and databases. Secondary research was conducted to obtain key information about the supply chain of the industry, the value chain of the market, the total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both, market- and technology-oriented perspectives.

After the complete market engineering (which includes calculations for market statistics, market breakdown, data triangulation, market size estimations, and market forecasting), extensive primary research was carried out to gather information as well as to verify and validate the critical numbers that were obtained.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the public safety drone market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across five regions: North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. This primary data was collected through questionnaires, emails, and telephonic interviews. In the primary research process, various sources were interviewed to obtain qualitative and quantitative information on the market. Sources from the supply side included various industry experts, such as chief X officers (CXOs); vice presidents (VPs); and directors from business development, marketing, and product development/innovation teams; and related key executives from the market participants, such as independent consultants, manufacturers, parts manufacturers of PSD, and key opinion leaders. These interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market size forecasting, and data triangulation. The expert insights also helped analyze the type, platform, application, and mode of operation market segments

Stakeholders from the demand side, such as CXOs, production managers, and maintenance engineers, were interviewed to understand the perspective of buyers on product suppliers and service providers, along with their current usage. The primary interviews also helped in understanding the future outlook of their businesses, which will affect the overall public safety drone market

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

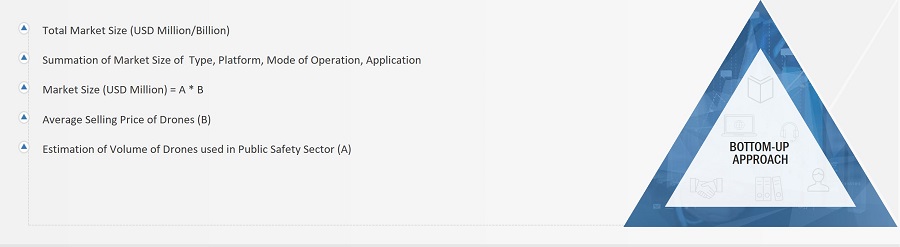

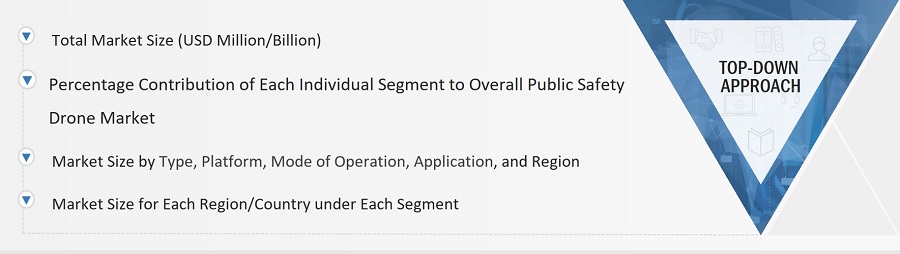

- The top-down and bottom-up approaches were used to estimate and validate the size of the public safety drone market. The research methodology used to estimate the market size also included the following details.

- The public safety drone market is in the initial stage. Hence, information about investments in the sector based on secondary sources, penetration of drones by law enforcement agencies and firefighting units and adoption rate of public safety drone were considered to analyze the market size.

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market Size Estimation Methodology: Bottom-up Approach

Market size estimation methodology: Top-Down Approach

Data triangulation

After arriving at the overall size of the public safety drone market from the market size estimation process explained above, the total market was split into several segments and subsegments. The market breakdown & data triangulation procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both demand- and supply-side. Along with this, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Public safety drones are unmanned aerial vehicles (UAVs) that are particularly built and deployed to improve public safety and security. These drones are outfitted with cutting-edge technology and capabilities to aid emergency services, police enforcement, and other public safety organizations in their operations. The primary goal of public safety drones is to provide responders with a bird's-eye perspective of emergency situations and crucial occurrences, allowing them to make educated judgements and take necessary measures. These drones may be used in a variety of circumstances, such as search and rescue, disaster response, fire suppression, criminal prevention, traffic management, and crowd surveillance.

Market Stakeholders

- Hardware suppliers

- Component manufacturers

- Software providers

- Regulatory bodies

- Public safety drone consultants

- Public safety agency city and state

- Public safety drone research centers

- Public safety drone distributers

Report Objectives

- To define, describe, segment, and forecast the size of the public safety drone market based on type, platform, application, and mode of operation.

- To forecast the size of different segments of the market with respect to five key regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, Latin America, along with their key countries

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To identify technology trends currently prevailing in the public safety drone market

- To provide an overview of the tariff and regulatory landscape with respect to public safety drone market across different regions

- To analyze micro-markets {1} with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for the stakeholders by identifying key market trends

- To analyze the impact of the recession on the public safety drone market and its stakeholders

- To profile the leading market players and comprehensively analyze their market share and core competencies {2}

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, new product launches, contracts, and partnerships, adopted by the leading market players.

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the public safety drone market, along with a ranking analysis, market share analysis, and revenue analysis of key players

1 Micromarkets are referred to as the segments and subsegments of the Public Safety Dronemarket considered in the scope of the report.

2 Core competencies of companies were captured in terms of their key developments and key strategies adopted to sustain their positions in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Law Enforcement And Public Safety Drone Market