Refrigeration Oil Market by Type (Synthetic Oil (POE, PAG), Mineral Oil), Application (Refrigerators & Freezers, Air conditioner, Automotive AC System, Aftermarket), & Region (APAC, North America, South America, Europe, & MEA) - Global Forecasts to 2026

Updated on : September 03, 2025

Refrigeration Oil Market

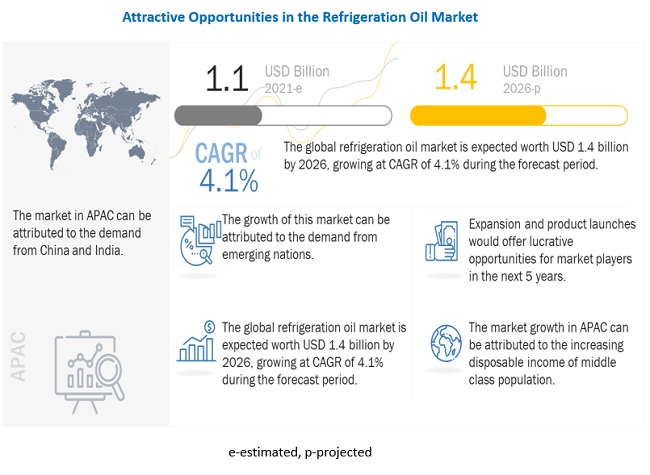

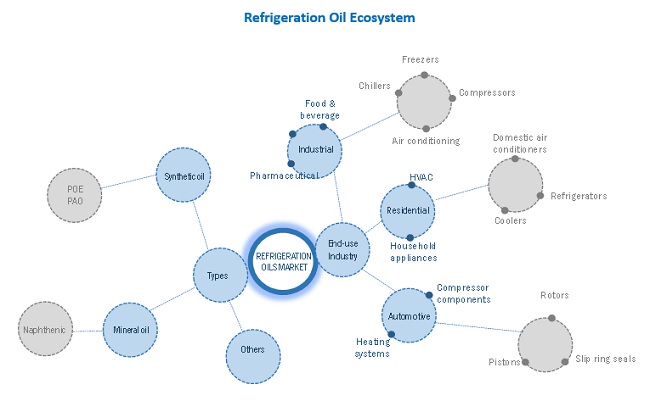

The global refrigeration oil market was valued at USD 1.1 billion in 2021 and is projected to reach USD 1.4 billion by 2026, growing at 4.1% cagr from 2021 to 2026. Refrigeration oil is a high-temperature formulation composed of additives and oil, specially formulated to perform in extreme environments.

These oils are designed for use in cooling systems. The major use of refrigeration oil is to lubricate the compressor bearings and other moving parts. It is also used to reduce friction on metal parts, reduce wear on the compressor, and extend the life of the system. The different types of refrigeration oils used are mineral oil and synthetic oil. These are used in applications such as refrigerator & freezer, air conditioner, automotive AC system, and aftermarket for refilling.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on refrigeration oil market

The refrigeration oil industry got affected negatively by the pandemic. Owning to the pandemic situation, several countries around the world went into lockdown, to curb the spread of the virus. Due to this the supply and demand chain got disrupted affecting the market. The industries, manufacturing units and mining operations got on hold for the past two years due to the pandemic situation leading to the reduced sales in electronics and automotive.

The fluctuating price of raw materials used to make refrigeration oil and COVID-19 pandemic have hindered the growth of the refrigeration oil market. The companies on a brighter side are expecting the situations to get back to normal and the market to improve in the near future. The countries such as China, US, among the others are back on their feet continuing their regular work.

Increased demand for frozen food and pharmaceutical industries

One of the major drivers for the refrigeration oil market is increase in the use of frozen food and pharmaceutical industries. These are the major users of refrigeration oils in the refrigerator & freezer application. Rising population and changing food habits drive the growth of packaged and ready-to-eat food products which are perishable and needs to be stored at low temperature. Also, the pharmaceutical industry also requires low-temperature conditions for the transportation and storage of drugs. The pharmaceutical industry is witnessing significant growth, especially in major emerging economies of APAC such as China and India. Therefore, the growth in the pharmaceutical industry is expected to drive the refrigeration oil market.

Stringent regulations to limit the use of fluorocarbon refrigerants

Governments of various countries are imposing regulations to limit the use of refrigerants, as fluorocarbon has an adverse effect on the atmosphere’s ozone layer. Currently, over 147 countries hold Article 5 Parties. These include developing countries such as China, India, Kuwait, Malaysia, Singapore, South Africa, Thailand, and Turkey. As per the Montreal Protocol, HCFC must be phased out by 97.5% by 2030–2040 and completely by 2040 for the Article 5 Parties

Technological & product innovation

The current market demand is concentrated on refrigeration oil that are cost-effective and meet the minimum standards or regulations mandated in the region. With changing nature of applications, customers demand more functions apart from cooling. Customers are becoming more focused on multi-functional refrigerators & freezers, air conditioners and also for automotive. So the increasing demand for new and innovative electronics leads to technological and product innovation.

To know about the assumptions considered for the study, download the pdf brochure

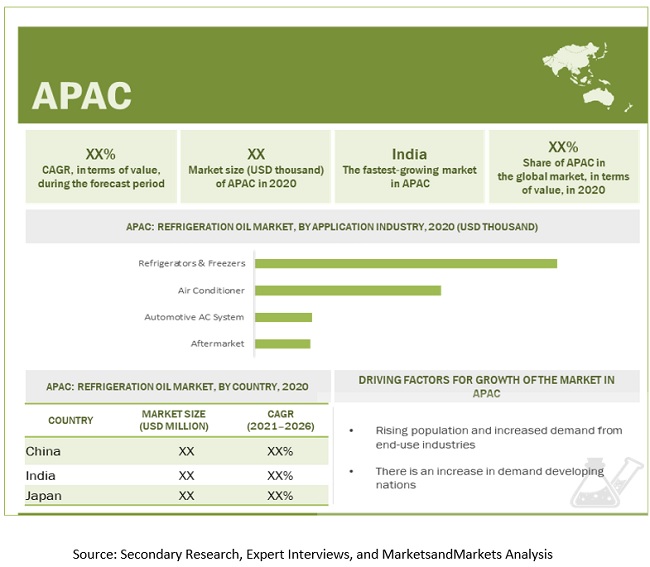

APAC to account for the largest share of the global refrigeration oil market during the forecast period

APAC is an emerging market for the refrigeration oil market, and it is mainly attributed to high economic growth rate, followed by heavy investment across industries such as oil & gas, automotive, infrastructure, chemical, and electronics among others. With economic contraction and saturation in the European and North American markets, the demand is shifting to the APAC region.

Refrigeration oil manufacturers are targeting this region as it is the strongest regional market for various applications, such as automotive, electronics and home appliances among others. The advantage of shifting production to the Asian region is that the cost of production is low here. Also, it is easier to serve the local emerging market.

Refrigeration Oil Market Ecosystem

Refrigeration Oil Market Players

The key market players profiled in the report include as Eneos Holdings Inc. (Japan), BASF SE (Germany), Idemitsu Kosan Co. Ltd (Japan), ExxonMobil Corporation (U.S.), Royal Dutch Shell Plc. (Netherlands), Total Energies SE(France), China Petrochemical Corporation (Sinopec Corp), Petroliam Nasional Berhad(Petronas), FUCHS Petrolub SE (Germany), Johnson Controls(Ireland).

Eneos Holdings Inc. is one of the world’s leading manufacturers and innovators of petroleum, natural gas, and metals. . The company operates through four business segments, namely, Energy, Metals, Oil, Natural gas E&P, and Others. . The company operates through four business segments, namely, Energy, Metals, Oil, Natural gas E&P, and Others. The company operates its refrigeration oil business in Japan, China, and other among other countries

BASF SE is one of the largest chemical producers in the world. It engages in manufacturing and selling a wide range of chemicals and intermediate solutions. The BASF Group comprises subsidiaries and joint ventures in more than 80 countries and operates six integrated production sites and 390 other production sites in Europe, Asia, Australia, America, and Africa. BASF has customers in over 200 countries and supplies products to a wide variety of industries. The company has a presence in more than 60 countries of Europe, North America, APAC, South America, and the Middle East & Africa

Refrigeration Oil Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 1.1 billion |

|

Revenue Forecast in 2026 |

USD 1.4 billion |

|

CAGR |

4.1% |

|

Years considered for the study |

2016-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments covered |

Type, Application, and Region |

|

Regions covered |

APAC, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

Eneos Holdings Inc. (Japan), BASF SE (Germany), Idemitsu Kosan Co. Ltd (Japan), ExxonMobil Corporation (U.S.), Royal Dutch Shell Plc. (Netherlands), Total Energies SE(France), China Petrochemical Corporation (Sinopec Corp), Petroliam Nasional Berhad(Petronas), FUCHS Petrolub SE (Germany), Johnson Controls(Ireland) among others. Top 25 major players covered |

This report categorizes the global refrigeration oil market based on type, application, and region.

On the basis of oil type, the refrigeration oil market has been segmented as follows:

- Synthetic oil

- Mineral oil

On the basis of application, the refrigeration oil market has been segmented as follows:

- Refrigerators & Freezers

- Air Conditioner

- Automotive AC System

- Aftermarket

On the basis of region, the refrigeration oil market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments:

- In 2020, BASF SE is collaborating with FUCHS for more sustainable refrigerant lubricants and oil products, also to produce more ester based and mineral oil-based fluids.

Frequently Asked Questions (FAQ):

What are the high growth applications of refrigeration oil?

Refrigeration oil in the refrigerators & freezers application holds the largest share. The major reason is due to increasing disposable income and changing lifestyle which leads to higher demand for frozen food, new electronic appliances and advanced vehicles.

What are the major factors impacting market growth during the forecast period?

The market growth is primarily due to the growing demand from food & beverage industry and pharmaceuticals, also the increasing population. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 REFRIGERATION OIL MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 REFRIGERATION OIL: MARKET DEFINITION AND INCLUSIONS, BY TYPE

1.2.3 REFRIGERATION OIL: MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

1.3 MARKET DEFINITION

1.3.1 REFRIGERATION OIL MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNITS CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 1 REFRIGERATION OIL MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews - Demand and supply-side

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF PRODUCTS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - BOTTOM-UP (DEMAND-SIDE): PRODUCTS SOLD AND THEIR AVERAGE SELLING PRICE

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - TOP-DOWN

2.3 DATA TRIANGULATION

FIGURE 6 REFRIGERATION OIL MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.4.1 SUPPLY-SIDE

FIGURE 7 MARKET CAGR PROJECTIONS FROM SUPPLY-SIDE

2.4.2 DEMAND-SIDE

FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE DRIVERS AND OPPORTUNITIES

2.5 FACTORS ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 1 REFRIGERATION OIL MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 9 REFRIGERATOR & FREEZER TO BE LARGEST APPLICATION OF REFRIGERATION OIL MARKET IN 2020

FIGURE 10 SYNTHETIC OIL TO LEAD OVERALL MARKET BETWEEN 2021 AND 2026

FIGURE 11 POE TO LEAD SYNTHETIC OIL MARKET BETWEEN 2021 AND 2026

FIGURE 12 REFRIGERATOR & FREEZER TO BE FASTEST-GROWING APPLICATION OF REFRIGERATION OIL

FIGURE 13 APAC ACCOUNTED FOR LARGEST SHARE OF REFRIGERATION OIL MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES IN REFRIGERATION OIL MARKET

FIGURE 14 GROWING REFRIGERATOR & FREEZER APPLICATION TO DRIVE REFRIGERATION OIL MARKET DURING THE FORECAST PERIOD

4.2 REFRIGERATION OIL MARKET SIZE, BY REGION

FIGURE 15 APAC TO BE LARGEST MARKET FOR REFRIGERATION OIL DURING THE FORECAST PERIOD

4.3 APAC: REFRIGERATION OIL MARKET, BY APPLICATION AND COUNTRY, 2020

FIGURE 16 CHINA ACCOUNTED FOR THE LARGEST MARKET SHARE

4.4 REFRIGERATION OIL MARKET SIZE, BY APPLICATION

FIGURE 17 REFRIGERATOR & FREEZER TO BE LARGEST APPLICATION OF REFRIGERATION OIL MARKET

4.5 REFRIGERATION OIL MARKET SIZE, BY APPLICATION VS REGION

FIGURE 18 REFRIGERATOR & FREEZER TO BE DOMINANT APPLICATION OF REFRIGERATION OIL MARKET ACROSS REGIONS

4.6 REFRIGERATION OIL MARKET, BY KEY COUNTRIES

FIGURE 19 INDIA TO REGISTER THE HIGHEST CAGR BETWEEN 2021 AND 2026

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 REFRIGERATION OIL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing demand for consumer appliances

TABLE 2 GROSS ADJUSTED HOUSEHOLD DISPOSABLE PER CAPITA INCOME, 2019 (USD)

5.2.1.2 Growing demand for chilled & frozen food and growth of pharmaceutical industry

TABLE 3 SIZE OF FROZEN FOODS MARKET WORLDWIDE FROM 2018 TO 2026 (USD BILLION)

5.2.1.3 Rising demand for low GWP refrigerants

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulations to limit use of fluorocarbon refrigerants

5.2.3 OPPORTUNITIES

5.2.3.1 Development of low viscosity and high-quality refrigeration oil

5.2.4 CHALLENGES

5.2.4.1 Compatibility of refrigeration oil with refrigerants

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 PORTER’S FIVE FORCES ANALYSIS OF REFRIGERATION OIL MARKET

TABLE 4 REFRIGERATION OIL MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 TECHNOLOGY ANALYSIS

5.5 MACROECONOMIC INDICATORS

5.5.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

TABLE 5 TRENDS AND FORECAST OF GDP, 2019–2026 (GROWTH RATE)

5.6 COVID-19 IMPACT

5.6.1 INTRODUCTION

5.6.2 COVID-19 HEALTH ASSESSMENT

FIGURE 22 COUNTRY-WISE SPREAD OF COVID-19

5.6.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 23 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2021

5.6.3.1 COVID-19 Impact on the Economy—Scenario Assessment

FIGURE 24 FACTORS IMPACTING THE GLOBAL ECONOMY

FIGURE 25 SCENARIOS OF COVID-19 IMPACT

5.7 IMPACT OF COVID-19: CUSTOMER ANALYSIS

6 INDUSTRY TRENDS (Page No. - 70)

6.1 SUPPLY CHAIN ANALYSIS

FIGURE 26 REFRIGERATION OIL MARKET: SUPPLY CHAIN

TABLE 6 REFRIGERATION OIL MARKET: SUPPLY CHAIN

6.1.1 RAW MATERIAL

6.1.2 MANUFACTURING OF REFRIGERATION OILS

6.1.3 DISTRIBUTION TO END USERS

6.2 REFRIGERATION OIL MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

FIGURE 27 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

TABLE 7 REFRIGERATION OIL MARKET: MARKET FORECAST SCENARIO, 2019–2026 (USD MILLION)

6.2.1 NON-COVID-19 SCENARIO

6.2.2 OPTIMISTIC SCENARIO

6.2.3 PESSIMISTIC SCENARIO

6.2.4 REALISTIC SCENARIO

6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

6.3.1 REVENUE SHIFTS & REVENUE POCKETS FOR REFRIGERATION OILS MARKET

FIGURE 28 REVENUE SHIFT FOR REFRIGERATION OILS MARKET

6.4 CONNECTED MARKETS: ECOSYSTEM

FIGURE 29 REFRIGERATION OILS MARKET: ECOSYSTEM

6.5 CASE STUDY ANALYSIS

6.5.1 A CASE STUDY ON UNILEVER-HYDROCARBON ICE CREAM FREEZERS

6.5.2 A CASE STUDY ON OIL RETURN CHARACTERISTICS IN A DISPLAY CASE REFRIGERATION SYSTEM

6.6 TARIFF AND REGULATORY LANDSCAPE

6.6.1 US

6.6.2 JAPAN

6.6.3 CHINA

6.7 TRADE ANALYSIS

6.7.1 IMPORT SCENARIO OF REFRIGERATION OIL

FIGURE 30 REFRIGERATION OIL IMPORTS, BY KEY COUNTRY, 2016–2020

TABLE 8 IMPORTS OF REFRIGERATION OILS, BY REGION, 2016–2020 (USD BILLION)

6.7.2 EXPORT SCENARIO OF REFRIGERATION OIL

FIGURE 31 REFRIGERATION OIL EXPORTS, BY KEY COUNTRY, 2016– 2020

TABLE 9 EXPORTS OF REFRIGERATION OILS, BY REGION, 2016–2020 (USD BILLION)

6.8 AVERAGE SELLING PRICE

TABLE 10 AVERAGE SELLING PRICE OF REFRIGERATION OIL, BY REGION (USD/KG)

6.9 PATENT ANALYSIS

6.9.1 APPROACH

6.9.2 DOCUMENT TYPE

TABLE 11 GRANTED PATENTS ACCOUNT FOR 21 % OF THE TOTAL COUNT IN THE LAST 11 YEARS.

FIGURE 32 PATENTS REGISTERED FOR REFRIGERATION OIL, 2010–2020

FIGURE 33 PATENTS PUBLICATION TRENDS FOR REFRIGERATION OIL, 2010–2020

6.9.3 JURISDICTION ANALYSIS

FIGURE 34 MAXIMUM PATENTS FILED BY COMPANIES IN CHINA

6.9.4 TOP APPLICANTS

FIGURE 35 LG CHEMICAL LTD. TECHNOLOGIES LLC REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2010 AND 2020

TABLE 12 TOP 10 PATENT OWNERS IN US, 2010–2020

7 REFRIGERATION OIL MARKET, BY OIL TYPE (Page No. - 86)

7.1 INTRODUCTION

FIGURE 36 SYNTHETIC OIL TO DOMINATE REFRIGERATION OIL MARKET BETWEEN 2021 AND 2026

TABLE 13 REFRIGERATION OIL MARKET SIZE, BY OIL TYPE, 2016–2019 (KILOTON)

TABLE 14 REFRIGERATION OIL MARKET SIZE, BY OIL TYPE, 2020–2026 (KILOTON)

TABLE 15 REFRIGERATION OIL MARKET SIZE, BY OIL TYPE, 2016–2019 (USD MILLION)

TABLE 16 REFRIGERATION OIL MARKET SIZE, BY OIL TYPE, 2020–2026 (USD MILLION)

7.2 SYNTHETIC OIL

7.2.1 INCREASE IN DEMAND DUE TO ITS HIGH PERFORMANCE IN EXTREME CONDITIONS

TABLE 17 SYNTHETIC REFRIGERATION OIL MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 18 SYNTHETIC REFRIGERATION OIL MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

TABLE 19 SYNTHETIC REFRIGERATION OIL MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 20 SYNTHETIC REFRIGERATION OIL MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

7.2.2 POE

7.2.2.1 High thermal stability and excellent wear performance are expected to drive the demand for POE

7.2.3 PAG

7.2.3.1 Excellent lubricity of PAG synthetic oil driving its demand

7.2.4 OTHERS

7.2.4.1 PAO

7.2.4.2 PVE

7.2.4.3 AB

7.2.4.4 Blends

7.3 MINERAL OIL

7.3.1 EXCELLENT FLUIDITY IS EXPECTED TO DRIVE THE DEMAND FOR MINERAL REFRIGERATION OIL

8 REFRIGERATION OIL MARKET, BY APPLICATION (Page No. - 92)

8.1 INTRODUCTION

FIGURE 37 REFRIGERATOR & FREEZER TO BE LEADING APPLICATION SEGMENT IN REFRIGERATION OIL MARKET

TABLE 21 REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 22 REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 23 REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 24 REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

8.2 REFRIGERATOR & FREEZER

8.2.1 DOMESTIC REFRIGERATOR & FREEZER

8.2.1.1 Rise in demand for frozen food products to drive the segment

8.2.2 COMMERCIAL REFRIGERATOR & FREEZER

8.2.2.1 Increasing use of POE-based synthetic oil to drive the market in the segment

8.2.3 INDUSTRIAL REFRIGERATOR & FREEZER

8.2.3.1 Rising popularity of CO2 in industrial refrigerator & freezer to drive the market

TABLE 25 REFRIGERATION OIL MARKET SIZE IN REFRIGERATOR & FREEZER, BY REGION, 2016–2019 (KILOTON)

TABLE 26 REFRIGERATION OIL MARKET SIZE IN REFRIGERATOR & FREEZER, BY REGION, 2020–2026 (KILOTON)

TABLE 27 REFRIGERATION OIL MARKET SIZE IN REFRIGERATOR & FREEZER, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 REFRIGERATION OIL MARKET SIZE IN REFRIGERATOR & FREEZER, BY REGION, 2020–2026 (USD MILLION)

8.3 AIR CONDITIONER

8.3.1 DOMESTIC AIR CONDITIONERS

8.3.1.1 Increase in disposable income to drive the market in the segment

8.3.2 COMMERCIAL AIR CONDITIONERS

8.3.2.1 Growth in demand in commercial spaces such as office buildings and retail stores to increase demand for air conditioners

TABLE 29 REFRIGERATION OIL MARKET SIZE IN AIR CONDITIONER, BY REGION, 2016–2019 (KILOTON)

TABLE 30 REFRIGERATION OIL MARKET SIZE IN AIR CONDITIONER, BY REGION, 2020–2026 (KILOTON)

TABLE 31 REFRIGERATION OIL MARKET SIZE IN AIR CONDITIONER, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 REFRIGERATION OIL MARKET SIZE IN AIR CONDITIONER, BY REGION, 2020–2026 (USD MILLION)

8.4 AUTOMOTIVE AC SYSTEM

8.4.1 RISING DEMAND FOR AUTOMOBILES DRIVING THE MARKET IN THE SEGMENT

TABLE 33 REFRIGERATION OIL MARKET SIZE IN AUTOMOTIVE AC SYSTEM, BY REGION, 2016–2019 (KILOTON)

TABLE 34 REFRIGERATION OIL MARKET SIZE IN AUTOMOTIVE AC SYSTEM, BY REGION, 2020–2026 (KILOTON)

TABLE 35 REFRIGERATION OIL MARKET SIZE IN AUTOMOTIVE AC SYSTEM, BY REGION, 2016–2019 (USD MILLION)

TABLE 36 REFRIGERATION OIL MARKET SIZE IN AUTOMOTIVE AC SYSTEM, BY REGION, 2020–2026 (USD MILLION)

8.5 AFTERMARKET

8.5.1 INCREASING DEMAND FOR REFRIGERATORS, FREEZER, AIR CONDITIONER, AND AUTOMOTIVE AC SYSTEM TO BOOST THE MARKET

TABLE 37 REFRIGERATION OIL MARKET SIZE IN AFTERMARKET, BY REGION, 2016–2019 (KILOTON)

TABLE 38 REFRIGERATION OIL MARKET SIZE IN AFTERMARKET, BY REGION, 2020–2026 (KILOTON)

TABLE 39 REFRIGERATION OIL MARKET SIZE IN AFTERMARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 REFRIGERATION OIL MARKET SIZE IN AFTERMARKET, BY REGION, 2020–2026 (USD MILLION)

9 REFRIGERATION OIL MARKET, BY REGION (Page No. - 104)

9.1 INTRODUCTION

FIGURE 38 APAC TO REGISTER HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 41 REFRIGERATION OIL MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 42 REFRIGERATION OIL MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

TABLE 43 REFRIGERATION OIL MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 44 REFRIGERATION OIL MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.2 APAC

FIGURE 39 APAC: REFRIGERATION OIL MARKET SNAPSHOT

9.2.1 APAC REFRIGERATION OIL MARKET, BY APPLICATION

TABLE 45 APAC: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 46 APAC: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 47 APAC: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 48 APAC: REFRIGERATION OIL MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.2.2 APAC REFRIGERATION OIL MARKET, BY COUNTRY

TABLE 49 APAC: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 50 APAC: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 51 APAC: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 52 APAC: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.2.2.1 China

9.2.2.1.1 Increasing demand for consumer appliances drives the market

TABLE 53 CHINA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 54 CHINA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 55 CHINA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 56 CHINA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.2.2.2 Japan

9.2.2.2.1 Presence of various refrigerator & freezer manufacturers likely to drive the market

TABLE 57 JAPAN: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 58 JAPAN: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 59 JAPAN: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 60 JAPAN: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.2.2.3 India

9.2.2.3.1 Rising income level of middle-class population propels growth of the market

TABLE 61 INDIA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 62 INDIA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 63 INDIA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 64 INDIA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.2.2.4 South Korea

9.2.2.4.1 Increasing demand for processed food to drive demand for refrigerator & freezer

TABLE 65 SOUTH KOREA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 66 SOUTH KOREA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 67 SOUTH KOREA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 68 SOUTH KOREA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.2.2.5 Thailand

9.2.2.5.1 Rise in demand from refrigerator & freezer application expected to drive the market

TABLE 69 THAILAND: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 70 THAILAND: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 71 THAILAND: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 72 THAILAND: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.2.2.6 Indonesia

9.2.2.6.1 Hot climatic conditions drive the demand for air conditioners in the country

TABLE 73 INDONESIA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 74 INDONESIA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 75 INDONESIA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 76 INDONESIA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.2.2.7 Vietnam

9.2.2.7.1 Growth in automotive industry expected to drive the market

TABLE 77 VIETNAM: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 78 VIETNAM: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 79 VIETNAM: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 80 VIETNAM: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.2.2.8 Taiwan

9.2.2.8.1 Increasing production of automobiles in the country driving the market

TABLE 81 TAIWAN: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 82 TAIWAN: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 83 TAIWAN: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 84 TAIWAN: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.3 NORTH AMERICA

FIGURE 40 NORTH AMERICAN: REFRIGERATION OIL MARKET SNAPSHOT

9.3.1 NORTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION

TABLE 85 NORTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 86 NORTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 87 NORTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 88 NORTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

9.3.2 NORTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY COUNTRY

TABLE 89 NORTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 90 NORTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 91 NORTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 92 NORTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.3.2.1 US

9.3.2.1.1 Increase in retail and commercial construction driving the market for refrigeration oil

TABLE 93 US: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 94 US: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 95 US: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 96 US: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.3.2.2 Mexico

9.3.2.2.1 Growing residential and non-residential construction projects estimated to drive the market

TABLE 97 MEXICO: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 98 MEXICO: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 99 MEXICO: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 100 MEXICO: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.3.2.3 Canada

9.3.2.3.1 Presence of major refrigeration oil manufacturers to drive the market

TABLE 101 CANADA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 102 CANADA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 103 CANADA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 104 CANADA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.4 EUROPE

9.4.1 EUROPE: REFRIGERATION OIL MARKET SIZE, BY APPLICATION

TABLE 105 EUROPE: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 106 EUROPE: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 107 EUROPE: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 108 EUROPE: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

9.4.2 EUROPE: REFRIGERATION OIL MARKET SIZE, BY COUNTRY

TABLE 109 EUROPE: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 110 EUROPE: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 111 EUROPE: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 112 EUROPE: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.4.2.1 Italy

9.4.2.1.1 Growing demand for refrigerators & freezers expected to drive the market

TABLE 113 ITALY: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 114 ITALY: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 115 ITALY: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 116 ITALY: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.4.2.2 Germany

9.4.2.2.1 Growth in manufacturing of automobiles fueling the demand for refrigeration oil

TABLE 117 GERMANY: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 118 GERMANY: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 119 GERMANY: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 120 GERMANY: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.4.2.3 Russia

9.4.2.3.1 Growing production of consumer appliances for domestic and export to drive the market

TABLE 121 RUSSIA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 122 RUSSIA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 123 RUSSIA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 124 RUSSIA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.4.2.4 France

9.4.2.4.1 Increase in spending power of the population driving the market

TABLE 125 FRANCE: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 126 FRANCE: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 127 FRANCE: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 128 FRANCE: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.4.2.5 UK

9.4.2.5.1 Growth in production of automobiles fuels the market for refrigeration oil

TABLE 129 UK: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 130 UK: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 131 UK: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 132 UK: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.5 MIDDLE EAST & AFRICA

9.5.1 MIDDLE EAST & AFRICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION

TABLE 133 MIDDLE EAST & AFRICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 134 MIDDLE EAST & AFRICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 135 MIDDLE EAST & AFRICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 136 MIDDLE EAST & AFRICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.5.2 MIDDLE EAST & AFRICA A: REFRIGERATION OIL MARKET SIZE, BY COUNTRY

TABLE 137 MIDDLE EAST & AFRICA: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 138 MIDDLE EAST & AFRICA: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 139 MIDDLE EAST & AFRICA: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2016–2019 (USD THOUSAND)

TABLE 140 MIDDLE EAST & AFRICA: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2020–2026 (USD THOUSAND)

9.5.2.1 Turkey

9.5.2.1.1 Presence of major refrigerator & freezer manufacturers increases demand for refrigeration oil

TABLE 141 TURKEY: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 142 TURKEY: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 143 TURKEY: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 144 TURKEY: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.5.2.2 Iran

9.5.2.2.1 Increase in residential housing constructions expected to fuel growth of consumer appliances

TABLE 145 IRAN: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 146 IRAN: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 147 IRAN: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 148 IRAN: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.5.2.3 South Africa

9.5.2.3.1 Growing demand for energy-efficient refrigerators & freezers to drive the market

TABLE 149 SOUTH AFRICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 150 SOUTH AFRICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 151 SOUTH AFRICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 152 SOUTH AFRICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.6 SOUTH AMERICA

9.6.1 SOUTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION

TABLE 153 SOUTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 154 SOUTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 155 SOUTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 156 SOUTH AFRICA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

9.6.2 SOUTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY COUNTRY

TABLE 157 SOUTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 158 SOUTH AFRICA: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 159 SOUTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 160 SOUTH AMERICA: REFRIGERATION OIL MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.6.2.1 Brazil

9.6.2.1.1 Rapid Urbanization driving demand for consumer appliances in the country

TABLE 161 BRAZIL: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 162 BRAZIL: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 163 BRAZIL: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 164 BRAZIL: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

9.6.2.2 Argentina

9.6.2.2.1 Increasing export and domestic sales of consumer appliances driving the market

TABLE 165 ARGENTINA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 166 ARGENTINA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 167 ARGENTINA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 168 ARGENTINA: REFRIGERATION OIL MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

10 COMPETITIVE LANDSCAPE (Page No. - 159)

10.1 INTRODUCTION

10.2 STRATEGIES ADOPTED BY KEY PLAYERS

10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY REFRIGERATION OIL MANUFACTURERS

10.3 MARKET SHARE ANALYSIS

10.3.1 RANKING OF KEY MARKET PLAYERS, 2020

FIGURE 41 RANKING OF TOP FIVE PLAYERS IN THE REFRIGERATION OIL MARKET, 2020

10.3.2 MARKET SHARE OF KEY PLAYERS

TABLE 169 REFRIGERATION OIL MARKET: DEGREE OF COMPETITION

FIGURE 42 ENEOS HOLDINGS INC. IS LEADING PLAYER IN THE REFRIGERATION OIL MARKET

10.3.2.1 Eneos Holdings Inc.

10.3.2.2 ExxonMobil Corporation

10.3.2.3 Royal Dutch Shell Plc.

10.3.2.4 BASF SE

10.3.2.5 Idemitsu Kosan Co. Ltd.

10.3.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS

FIGURE 43 REVENUE ANALYSIS OF KEY COMPANIES IN THE PAST 5 YEARS

10.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

FIGURE 44 REFRIGERATION OIL MARKET: COMPANY FOOTPRINT

TABLE 170 REFRIGERATION OIL MARKET: OIL TYPE FOOTPRINT

TABLE 171 REFRIGERATION OIL MARKET: APPLICATION FOOTPRINT

TABLE 172 REFRIGERATION OIL MARKET: COMPANY REGION FOOTPRINT

10.5 COMPANY EVALUATION MATRIX (TIER 1)

10.5.1 STARS

10.5.2 EMERGING LEADERS

FIGURE 45 COMPANY EVALUATION MATRIX FOR REFRIGERATION OIL MARKET (TIER 1)

10.6 START-UP/SMES EVALUATION MATRIX

10.6.1 PROGRESSIVE COMPANIES

10.6.2 RESPONSIVE COMPANIES

10.6.3 DYNAMIC COMPANIES

10.6.4 STARTING BLOCKS

FIGURE 46 START-UP/SMES EVALUATION MATRIX FOR REFRIGERATION OIL MARKET

10.7 COMPETITIVE SITUATION AND TRENDS

10.7.1 NEW PRODUCT LAUNCHES

TABLE 173 REFRIGERATION OIL MARKET: NEW PRODUCT LAUNCHES (2018–2021)

10.7.2 DEALS

TABLE 174 REFRIGERATION OIL MARKET: DEALS (2018–2021)

10.7.3 OTHER DEVELOPMENTS

TABLE 175 REFRIGERATION OIL MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS (2016–2021)

11 COMPANY PROFILES (Page No. - 173)

11.1 MAJOR PLAYERS

(Business Overview, Products Offered, MnM view, Key Strengths/Right to win, Strategic choice made, Weaknesses and competitive threats, Deals, Other developments)*

11.1.1 ENEOS HOLDINGS INC.

FIGURE 47 ENEOS HOLDINGS INC.: COMPANY SNAPSHOT

TABLE 176 ENEOS HOLDINGS INC.: BUSINESS OVERVIEW

11.1.2 BASF SE

FIGURE 48 BASF SE: COMPANY SNAPSHOT

TABLE 177 BASF SE: BUSINESS OVERVIEW

11.1.3 IDEMITSU KOSAN CO., LTD.

FIGURE 49 IDEMITSU KOSAN CO. LTD.: COMPANY SNAPSHOT

TABLE 178 IDEMITSU KOSAN CO., LTD.: BUSINESS OVERVIEW

11.1.4 EXXONMOBIL CORPORATION

FIGURE 50 EXXONMOBIL CORPORATION: COMPANY SNAPSHOT

TABLE 179 EXXONMOBIL CORPORATION: BUSINESS OVERVIEW

11.1.5 ROYAL DUTCH SHELL PLC

FIGURE 51 ROYAL DUTCH SHELL PLC: COMPANY SNAPSHOT

TABLE 180 ROYAL DUTCH SHELL PLC: BUSINESS OVERVIEW

11.1.6 TOTALENERGIES SE

FIGURE 52 TOTALENERGIES SE: COMPANY SNAPSHOT

TABLE 181 TOTALENERGIES SE: BUSINESS OVERVIEW

11.1.7 CHINA PETROCHEMICAL CORPORATION (SINOPEC CORP.)

FIGURE 53 CHINA PETROCHEMICAL CORPORATION: COMPANY SNAPSHOT

TABLE 182 CHINA PETROCHEMICAL CORPORATION: BUSINESS OVERVIEW

11.1.8 PETROLIAM NASIONAL BERHAD (PETRONAS)

FIGURE 54 PETROLIAM NASIONAL BERHAD: COMPANY SNAPSHOT

TABLE 183 PETROLIAM NASIONAL BERHAD: BUSINESS OVERVIEW

11.1.9 FUCHS PETROLUB SE

FIGURE 55 FUCHS PETROLUB SE: COMPANY SNAPSHOT

TABLE 184 FUCHS PETROLUB SE: BUSINESS OVERVIEW

11.1.10 JOHNSON CONTROLS

FIGURE 56 JOHNSON CONTROLS: COMPANY SNAPSHOT

TABLE 185 JOHNSON CONTROLS: BUSINESS OVERVIEW

11.1.11 THE LUBRIZOL CORPORATION

TABLE 186 THE LUBRIZOL CORPORATION: BUSINESS OVERVIEW

11.1.12 BP PLC

FIGURE 57 BP PLC: COMPANY SNAPSHOT

TABLE 187 BP PLC: BUSINESS OVERVIEW

11.1.13 CHEVRON CORPORATION

FIGURE 58 CHEVRON CORPORATION: COMPANY SNAPSHOT

TABLE 188 CHEVRON CORPORATION: BUSINESS OVERVIEW

11.2 STARTUP/SME PLAYERS

11.2.1 MAHLE GROUP

TABLE 189 MAHLE GROUP: COMPANY OVERVIEW

11.2.2 BVA, INC.

TABLE 190 BVA, INC.: COMPANY OVERVIEW

11.2.3 CALUMET SPECIALTY PRODUCTS PARTNERS, L.P.

TABLE 191 CALUMET SPECIALTY PRODUCTS PARTNERS, L.P.: COMPANY OVERVIEW

11.2.4 CAMCO LUBRICANTS

TABLE 192 CAMCO LUBRICANTS: COMPANY OVERVIEW

11.2.5 CITGO PETROLEUM CORPORATION

TABLE 193 CITGO PETROLEUM CORPORATION: COMPANY OVERVIEW

11.2.6 COSMO OIL LUBRICANTS CO., LTD.

TABLE 194 COSMO OIL LUBRICANTS: COMPANY OVERVIEW

11.2.7 ENTE NAZIONALE IDROCARBURI ENI

TABLE 195 ENTE NAZIONALE IDROCARBURI ENI: COMPANY OVERVIEW

11.2.8 INDIAN OIL CORPORATION LTD.

TABLE 196 INDIAN OIL CORPORATION LTD.: COMPANY OVERVIEW

11.2.9 ISEL INC.

TABLE 197 ISEL INC.: COMPANY OVERVIEW

11.2.10 NATIONAL REFRIGERANTS, INC.

TABLE 198 NATIONAL REFRIGERANTS, INC.: COMPANY OVERVIEW

11.2.11 KLUBER LUBRICATION

TABLE 199 KLUBER LUBRICATION: COMPANY OVERVIEW

11.2.12 LUBRIPLATE LUBRICANTS COMPANY

TABLE 200 LUBRIPLATE LUBRICANTS COMPANY: COMPANY OVERVIEW

11.2.13 LUKOIL

TABLE 201 LUKOIL: COMPANY OVERVIEW

11.2.14 PETRO-CANADA LUBRICANTS INC.

TABLE 202 PETRO-CANADA LUBRICANTS INC.: COMPANY OVERVIEW

11.2.15 PHILLIPS 66 LUBRICANTS

TABLE 203 PHILLIPS 66 LUBRICANTS: COMPANY OVERVIEW

11.2.16 SUN COMPANY, INC.

TABLE 204 SUN COMPANY, INC.: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, MnM view, Key Strengths/Right to win, Strategic choice made, Weaknesses and competitive threats, Deals, Other developments might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 215)

12.1 INTRODUCTION

12.2 LIMITATION

12.3 INDUSTRIAL REFRIGERATION SYSTEM MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.4 INDUSTRIAL REFRIGERATION SYSTEM, BY REGION

TABLE 205 INDUSTRIAL REFRIGERATION SYSTEM MARKET, BY REGION, 2016–2025 (USD BILLION)

12.4.1 NORTH AMERICA

TABLE 206 INDUSTRIAL REFRIGERATION SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2025 (USD MILLION)

TABLE 207 INDUSTRIAL REFRIGERATION SYSTEM MARKET IN NORTH AMERICA, BY COMPONENT, 2016–2025 (USD MILLION)

12.4.2 EUROPE

TABLE 208 INDUSTRIAL REFRIGERATION SYSTEM MARKET IN EUROPE, BY COUNTRY, 2016–2025 (USD MILLION)

TABLE 209 INDUSTRIAL REFRIGERATION SYSTEM MARKET IN EUROPE, BY COMPONENT, 2016–2025 (USD MILLION)

12.4.3 APAC

TABLE 210 INDUSTRIAL REFRIGERATION SYSTEM MARKET IN APAC, BY COUNTRY, 2016–2025 (USD MILLION)

TABLE 211 INDUSTRIAL REFRIGERATION SYSTEM MARKET IN APAC, BY COMPONENT, 2016–2025 (USD MILLION)

12.4.4 REST OF WORLD

TABLE 212 INDUSTRIAL REFRIGERATION SYSTEM MARKET IN ROW, BY REGION, 2016–2025 (USD MILLION)

TABLE 213 INDUSTRIAL REFRIGERATION SYSTEM MARKET IN ROW, BY COMPONENT, 2016–2025 (USD MILLION)

13 APPENDIX (Page No. - 220)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

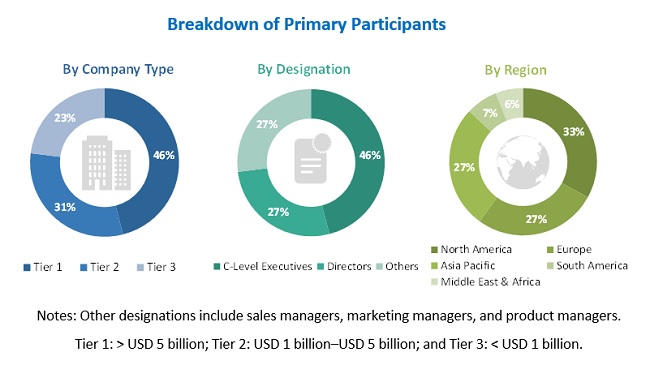

The study involved four major activities in estimating the market size for the refrigeration oil market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The refrigeration oil market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the electronics, food and automotive industry. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the refrigeration oil market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the construction, oil& gas, automotive industry among others.

Report Objectives

- To analyze and forecast the size of the refrigeration oil market in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, challenges and opportunities influencing the growth of the market

- To define, describe, and segment the refrigeration oil market based on oil type, and application

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Refrigeration Oil Market

Automotive segment of refrigeration oil and sub-segments of polyester in refrigeration oil