Sanitary Pumps and Valves Market by Pump Type (Centrifugal, Positive Displacement (Diaphragm, Twin Screw, Peristaltic, Rotary Lobe, Eccentric Disc, Progressive Cavity)), Power Source (Electric, Air), Priming Type, End-user - Global Forecast to 2028

Sanitary Pumps and Valves Market

Sanitary Pumps and Valves Market and Top Companies

ALFA LAVAL

ALFA LAVAL is one of the leading global providers of products in the areas of fluid handling, heat transfers, and separation. The company operates through three business divisions, namely Energy Division, Food & Water Division, and Marine Division. The Food & Water Division comprises five technology-based business units, which include high-speed separators, food systems, hygienic fluid handling, food heat transfer, and decanters for the customers in dairy, pharmaceuticals, vegetable oils, food, brewery, and body care products. The division also focuses on industrial and public water treatment as well as waste and wastewater treatment. The hygienic fluid handling products under the Food & Water Division are pumps, valves, tank equipment, and installation materials for hygienic applications. The pumps provided by the company are centrifugal pumps, three screw pumps, twin screw pumps, rotary lobe pumps, and circumferential piston pumps. The company also offers ball valves, butterfly valves, control/check valves, diaphragm valves, double-seat valves, single-seat valves, etc. The company caters to various industries, including energy, HVAC, steel, marine and transportation, semiconductor and electronics; mining, minerals and pigment; pulp and paper; home and personal care; and water and waste treatment.

Fristam Pumpen KG

Fristam Pumpen KG (GmbH & Company) is one of the leading manufacturers of stainless-steel pumps and pumping equipment across the world. The company is well known for manufacturing the highest quality, solid design pumps with a minimum wall thickness of 6 mm and with the best quality material that promises to offer optimal hygiene across its applications. The major types of pumps offered by Fristam Pumpen KG (GmbH & Company) include rotary lobe pumps, centrifugal pumps, double screw pumps, and shear pumps. These pumps manufactured by the company have proven to be dimensionally stable, reliable, exceptionally quiet, and insusceptible to sudden pressure changes irrespective of the high discharge pressures at working environments. The company mainly serves food and biotechnology applications, which primarily include industries such as food & beverages, pharmaceuticals, chemicals, and cosmetics.

SPX Flow Inc.

SPX FLOW, Inc. is one of the leading developers, manufacturers, and service providers of highly engineered products and processed solutions. The company operates through two business segments: Food & Beverages and Industrial. The Food & Beverages segment operates with in-demand process solutions. The products offered by the company under the Food & Beverages business division include pumps, homogenizers, valves, heat exchangers, and separators. It provides a wide range of pumps, including centrifugal pumps, positive displacement pumps, diaphragm pumps, internal gear pumps, flexible impeller pumps, and flow control pumps. Valves provided by the company include ball valves, butterfly valves, double-seat valves, single-seat valves, diaphragm valves, check valves, mix proof valves, among others. These products are provided under key brands such as APV, Seital, Gerstenberg Schroeder, and Waukesha Cherry-Burrell. The company serves industries such as beverages, chemicals, brewery, dairy, food, pharmaceuticals, personal care, marine, oil & gas, and water and wastewater treatment.

Sanitary Pumps and Valves market and Top TYPE OF PUMP

Centrifugal Pump

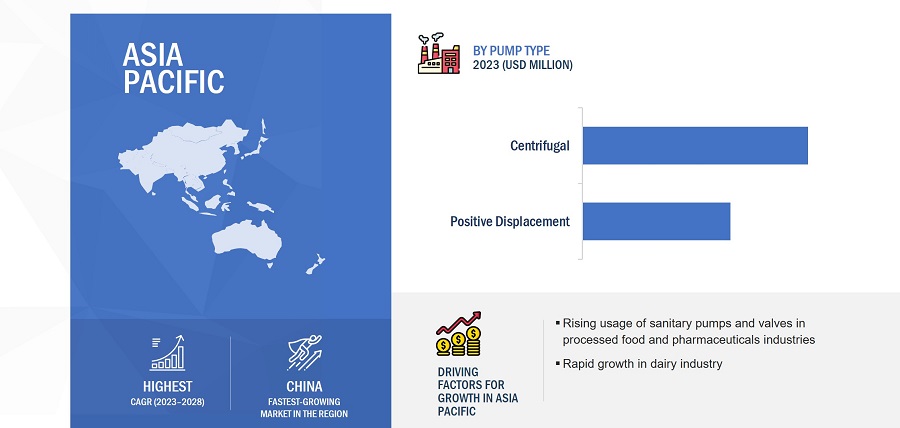

The centrifugal pumps dominated the sanitary pumps and valves market in 2020 and is expected to continue dominating the market during the forecast period. Centrifugal pumps are well known for their simple working principle, hygienic design, dependability, and relatively inexpensive manufacturing cost, which make them the most used type of pumps in the sanitary industry. Centrifugal pumps are the best choice and most efficient for transferring fluids having a lower viscosity. These pumps are also well suited for applications involving variable flow rates. They are capable of very high flow rates with the consistent, non-pulsing flow. Their flow capacity can be regulated by throttling and by varying impeller speed. These pumps are also available in multi-stage versions for applications that require extremely high output pressures.

Positive Displacement Pump

Positive displacement pumps are growing and are expected to grow at the highest growth rate in the market during the forecast period. Several different designs of positive displacement pumps are available in sanitary end-use industries suitable for high-purity and hygienic applications. The positive displacement pumps in these categories are known for transferring the fluid by capturing and moving specific volumes of fluid from the pump inlet to the pump outlet using either rotational or reciprocating mechanical force. One of the common characteristics of all types of positive displacement pumps is that they all are very effective at pumping high viscous fluids. A few other advantages of positive displacement pumps include that they are energy-efficient, gentle at product handling, easier to clean than multistage centrifugal pumps as they are less complex in design and open in their construction, and can maintain consistent flow rates despite fluctuating head pressures.

Sanitary Pumps and Valves market and Top END-USER INDUSTRY

Processed Foods

Cleanliness is one of the highest priorities in the processed foods industry. The Food and Drug Administration (FDA) and the US Department of Agriculture (USDA) are the major regulatory bodies for this industry. These regulatory bodies define standards to ensure the safety and nutritional values of food products and protect them from misbranding and contamination. Hence, it is essential to maintain hygiene and provide safe and healthy processed foods to customers. The processed foods industry is driven by the increasing population, changing consumer consumption patterns, growing urbanization, and improving living standards in developing countries. The manufacturers of processed foods have to meet the safety mandates implemented by the governments of various countries to ensure the quality and safety of food products.

Pharmaceuticals

The market for the pharmaceuticals end-user industry is expected to grow at the highest CAGR during the forecast period. The pharmaceuticals industry has made some of the greatest innovations to help improve the lives of people and the health of the Earth. Therefore, it is necessary to ensure that the products being manufactured in this industry are safe and of high quality. Maintaining a safe, consistent, and efficient manufacturing process is the basic requirement to ensure the highest quality of products. The growing cost pressures, regulatory and safety guidelines, and increasingly diverse product portfolios are some of the challenges faced by this industry. Hence, prompt control and monitoring over processes are necessary. Sanitary pumps and valves help in better controlling and positioning the transfer of fluids according to the input signals and obtaining control over processes. Therefore, the use of sanitary pumps and valves has helped pharmaceuticals companies in eliminating process constraints.

Sanitary Pumps and Valves market by top PRIMING TYPE

Self-priming

Self-priming sanitary pumps are engineered to be primed automatically. These types of pumps are designed to always have the requisite start-up liquid inside the cavity or the pump body. This presence of the liquid enables the pump to start its pumping process. Self-priming pumps are designed to handle a variety of fluids and can as well transfer heavier materials such as slurries, corrosive fluids, and suspended solids. Solid handling is one of the most important advantages of a self-priming pump, while another advantage includes its ability to continue pumping fluid while the pump is not submerged in a liquid tank or vessel, unlike the submersible pumps. Owing to the numerous benefits that self-priming pumps offer such as handling a variety of fluids as well as solids with high efficiency without any damage to the pump system, the demand for self-priming pumps is increasing across the market, and their market share is expected to grow with the highest growth rate during the forecast period.

Non-self-priming

Non-self-priming pumps being the oldest and compact due to no additional priming components added to the system, still make the largest shareholder in the market. Non-self-priming type of pumps need to be primed externally for which they require the start-up liquid to be added to the pump before initiating operation every time. A few of these methods include natural priming, manual priming, priming a pump with a vacuum pump, priming a pump with a jet pump, priming a pump using a separator, priming a pump by installing a foot valve, and priming a pump with an ejector. Whereas there are a few major disadvantages of these non-self-priming pumps. These pumps need to be externally primed every time before initiating their operations. For this external priming, they need additional components and arrangements to carry out the priming process. This increases the unnecessary expenses as well as the time incurred in the pump operations.

Updated on : October 22, 2024

Sanitary Pumps and Valves Market Size & Growth

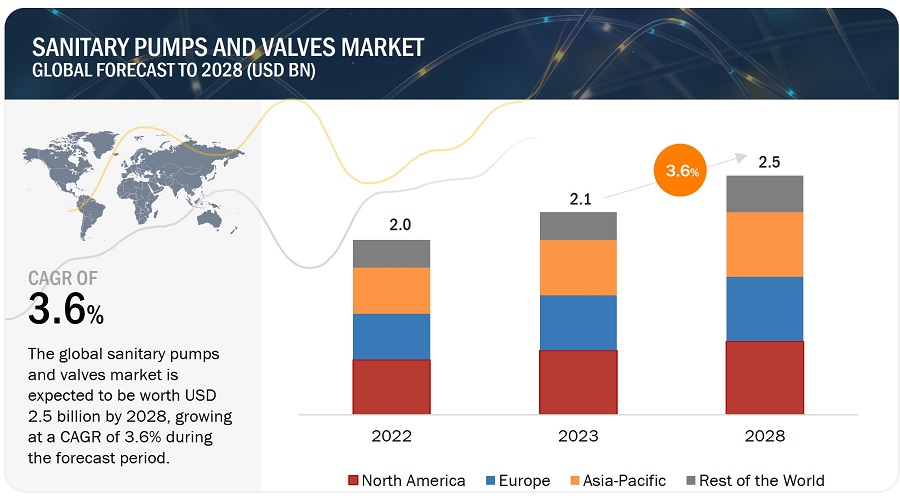

[237 Pages Report] The global sanitary pumps and valves market size is expected to grow from USD 2.1 billion in 2023 to USD 2.5 billion by 2028, at a CAGR of 3.6% from 2023 to 2028. Sanitary pumps and valves equipped with IIoT offer benefits such as massive cost savings, faster process recovery after maintenance breaks, increased safety, reduced occurrences of errors and quality deviations, valuable analytics, and prevention of unplanned downtime to plant owners.

Sanitary Pumps and Valves Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Sanitary Pumps and Valves Market Trends

DRIVERS: Increasing focus on automation for higher efficiency and safety to drive the market growth

Automation has been playing a critical role in industries. Manufacturers are shifting their focus toward automation to maintain plant safety, increase operational efficiency, standardize production processes, and achieve lean manufacturing. Automation helps enterprises reduce work, waste, labor, and production costs; minimize downtime and inaccuracies; increase the process quality; and reduce the processing time. Implementing fluid handling systems like pumps and valves is a game-changer for process industries. Industries such as food, beverages, pharmaceuticals, and chemicals implement fluid handling systems in their plants for the smooth transportation of raw materials and the transport of various fluids or gases as a part of the production processes. Sanitary valves and pumps are among the major components used in fluid handling systems to ensure automation. Thus, the increased focus on plant automation drives the demand for sanitary pumps and valves.

RESTRAINTS: High price fluctuations in raw materials

For their manufacturing, the sanitary pumps and valves need odorless, noncorrosive, and nontoxic materials, such as 304L or 316L stainless steel. The price of these stainless-steel variants depends on the alloying element's price and the alloy's amount. The raw material cost fluctuates, affecting the production cost of sanitary pumps and valves. The highly varying raw material costs also lead to ineffective price management and fluctuations in profit margins. This variation in end-product prices also affects the sales of sanitary valves and pumps.

OPPORTUNITIES: Increasing IIoT adoption across process industries

Hygienic pumps and valves equipped with sensors and connected through IIoT could help industry players reduce maintenance and shutdown costs. Traditional retrofitting monitoring solutions are costly, and manually monitoring thousands of different types of hygienic pumps and valves is time-consuming. Remote pump and valve monitoring include several components, and it detects valve position with a retrofit sensor device mounted on the equipment. With a remote monitoring solution integrated into a manufacturing plant, all valves in a factory can be monitored in real-time. Hygienic pumps and valves equipped with IIoT offer benefits such as massive cost savings, faster process recovery after maintenance breaks, increased safety, reduced occurrences of errors and quality deviations, valuable analytics, and prevention of unplanned downtime to plant owners.

CHALLENGES: Growing competition from local players and gray market players

The sanitary pumps and valves industry is highly fragmented. The number of players in this market is very high. These players provide their offerings worldwide with a robust and widespread network of suppliers and distributors. The manufacturers and distributors operating at the international level have to deal with transportation costs, pricing discrimination, tariffs, sales tax, and other additional prices such as customs duty and shipping charges on their commodities and services. Along with these industrial manufacturers and distributors, this industry's ecosystem also consists of many local players and gray market players. The gray market players are known for buying products from low-price countries or regions and selling them to high-price countries or regions through distribution channels not authorized by the original manufacturer or trademark proprietor. With the increasing competition, the well-established players in this market face challenges, especially in developing regions such as Asia Pacific and South America.

Sanitary Pumps and Valves Market Segmentation

Non-self-priming segment is expected to hold the largest share during the forecast period.

Non-self-priming pumps need to be primed externally, requiring the start-up liquid to be added to the pump before initiating operation. They can be primed by considering layout arrangements or using some external arrangements. A few of the priming methods include natural priming, manual priming, priming a pump with a vacuum pump, priming a pump with a jet pump, priming a pump using a separator, priming a pump by installing a foot valve and priming a pump with an ejector. They need additional components and arrangements to carry out the priming process for this external priming. This process increases the unnecessary expenses and the time incurred in the pump operations. However, non-self-priming pumps being the oldest and most compact due to no additional priming components added to the system, still make them the largest shareholders in the market.

The nonalcoholic beverage industry is projected to grow at an impressive CAGR during the forecast period

Globally, the demand for nonalcoholic beverages, such as soft drinks, tea, coffee, cider, juices, etc., continues to increase in developed and developing countries. Consumers are moving toward a healthier lifestyle and thus prefer soft and energy drinks to keep themselves hydrated throughout the day. Besides, the increased consumer attention to health and sustainability leads to the development of high-quality beverages. These beverages demand high safety and hygiene during production to eliminate contamination. The output of nonalcoholic drinks requires maintaining desired end-product characteristics through safe, cost-effective, and sustainable multi-stage processing. Thus, sanitary pumps and valves are designed to effectively and safely control or regulate the flow and transport of fluids in a pipeline. Using hygienic equipment ensures reliable production and efficient clean-in-place of the production lines. The producers of nonalcoholic beverages need to comply with stringent regulatory standards. Thus, the nonalcoholic beverages industry's adoption of sanitary pumps and valves is increasing.

Sanitary Pumps and Valves Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Sanitary Pumps and Valves Market Regional Analysis

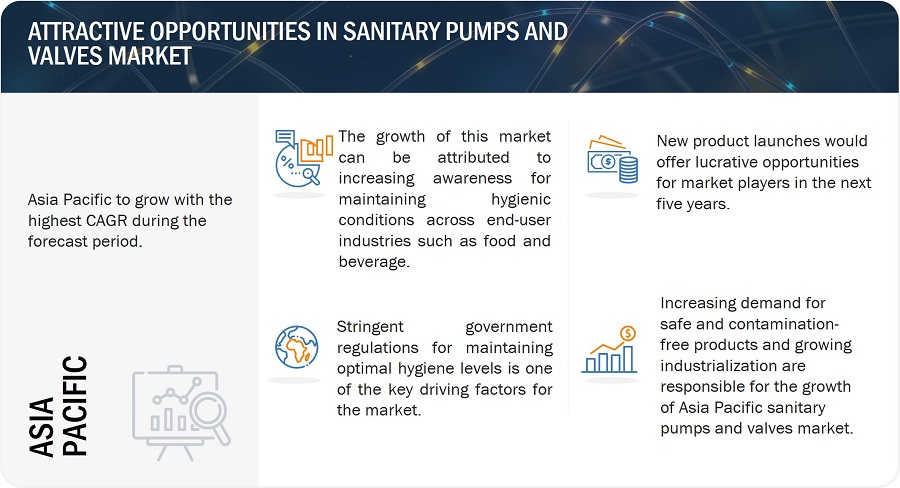

The market in Asia Pacific is projected to grow at the highest CAGR from 2023 to 2028.

The sanitary pumps and valves market in the Asia Pacific has been further classified into China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific. Japan is one of the world's most advanced economies and witnesses a high demand for sanitary pumps and valves from various process industries. The growing processed food, chemicals, and pharmaceutical industries, which are the major contributors to the economy of Japan, are expected to boost the growth of the sanitary pumps and valves market during the forecast period. The country largely depends on imports for its food-related needs. The US is a reliable supplier of high-quality and safe processed food to Japan. The popularity and consumption of health-oriented products and frozen foods have increased during the past two decades. The growing demand for ready-to-eat and convenient food options is also responsible for the growth of the processed food industry in the country. These factors have increased the adoption of sanitary pumps and valves in the processed food industry.

Top Sanitary Pumps and Valves Companies : Key players

Alfa Laval (Sweden), Fristam Pumpen KG (GmbH & Co.) (Germany), GEA Group Aktiengesellschaft (Germany), SPX FLOW, Inc. (US), Dover Corporation (US), Evoguard GmbH (Germany), Verder International B.V. (Netherlands), and IDEX Corporation (US), are among a few top players in the sanitary pumps and valves Companies.

Sanitary Pumps and Valves Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 2.1 billion in 2023 |

| Projected Market Size | USD 2.5 billion by 2028 |

| Growth Rate | CAGR of 3.6% |

|

Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

|

|

Geographic Regions Covered |

|

|

Companies Covered |

Major Players: Alfa Laval (Sweden), Fristam Pumpen KG (GmbH & Co.) (Germany), GEA Group Aktiengesellschaft (Germany), SPX FLOW, Inc. (US), Dover Corporation (US), Evoguard GmbH (Germany), Verder International B.V. (Netherlands), IDEX Corporation (US), Xylem (US), Graco Inc. (US), ITT INC. (US), Inoxpa S.A.U. (Spain), Flowserve Corporation (US), KSB SE & Co. KGaA (Germany), Spirax-Sarco Engineering plc (UK), and Others- (Total of 25 players have been covered) |

Sanitary Pumps and Valves Market Highlights

This research report categorizes the sanitary pumps and valves market by valve type, pump priming type, pump power source, material type, hygiene class, pump type, end-user industry, and region.

|

Segment |

Subsegment |

|

By Pump Type: |

|

|

By Valve Type: |

|

|

By Priming Type: |

|

|

By Hygiene Class: |

|

|

By Pump Power Source: |

|

|

By Material Type: |

|

|

By End-user Industry: |

|

|

By Region |

|

Recent Developments in sanitary pumps and valves Industry:

- In December 2022, Graco Inc. announced the release of the electric-operated double diaphragm pump, QUANTM. The QUANTM pump of the company is suitable for nearly any fluid transfer application. It offers a variety of materials of construction to support multiple industrial and hygienic applications such as chemical processing, food and beverage, pharmaceutical, and more.

- In May 2022, IDEX Corporation announced the acquisition of KZValve, LLC. The acquisition will help the company to expand precision farming components such as waterproof motorized valves, manifolds, controllers, and other accessories.

- In December 2020, Dover Corporation announced the launch of Blackmer System One High-Temperature Series Centrifugal Pumps. These pumps are mainly designed to increase the temperature limits for Blackmer Frame A and Frame M centrifugal pumps.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded by the sanitary pumps and valves market during 2023-2028?

The global sanitary pumps and valves market is expected to record a CAGR of 3.6% from 2023–2028.

What are the driving factors for the sanitary pumps and valves market?

The growing need for industrial automation is the key driving factor for the sanitary pumps and valves market.

Which end-user industry will grow at a fast rate in the future?

The pharmaceutical end-user industry is expected to grow at the highest CAGR during the forecast period. The growing need to eliminate process constraints, such as contamination, dead space, leakages, and crystallization in pharmaceutical companies, is one of the key reasons for this sector's growth.

Which are the significant players operating in the sanitary pumps and valves market?

Alfa Laval (Sweden), Fristam Pumpen KG (GmbH & Co.) (Germany), GEA Group Aktiengesellschaft (Germany), SPX FLOW, Inc. (US), and Dover Corporation (US) are among a few top players in the sanitary pumps and valves market.

Which region will grow at a fast rate in the future?

The sanitary pumps and valves market in the Asia Pacific is expected to grow at the highest CAGR during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Government mandates and regulations regarding maintaining hygiene in process industries- Growing demand for processed food and beveragesRESTRAINTS- Fluctuations in raw material pricesOPPORTUNITIES- Rising focus of pump and valve manufacturers on research and development activities- Increasing IIoT adoption across process industriesCHALLENGES- Increasing competition from players in unorganized sector

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE OF SANITARY PUMPS AND VALVES, BY TYPEAVERAGE SELLING PRICE OF SANITARY PUMPS OFFERED BY KEY PLAYERS

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 TECHNOLOGY ANALYSISPREDICTIVE MAINTENANCEINDUSTRIAL INTERNET OF THINGS (IIOT)

-

5.8 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

-

5.11 TRADE ANALYSISTRADE ANALYSIS FOR PUMPSTRADE ANALYSIS FOR VALVES

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES & EVENTS, 2023–2024

-

5.14 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY STANDARDS

- 6.1 INTRODUCTION

-

6.2 SINGLE-SEAT VALVESIDEAL FOR SMALL FLOW RATE APPLICATIONS

-

6.3 DOUBLE-SEAT VALVESHANDLE SIMULTANEOUS FLOW OF TWO DIFFERENT FLUIDS WITHOUT RISK OF CROSS-CONTAMINATION

-

6.4 BUTTERFLY VALVESUSED FOR LOW- AND MEDIUM-VISCOSITY LIQUIDS

-

6.5 DIAPHRAGM VALVESDESIGNED TO CONTROL FLOW OF CORROSIVE, RADIOACTIVE, AND FIBROUS FLUIDS THAT MUST BE FREE FROM CONTAMINATION

-

6.6 CONTROL VALVESWIDELY USED IN CRITICAL OPERATIONS AND SAFETY APPLICATIONS

- 6.7 OTHER VALVES

- 7.1 INTRODUCTION

-

7.2 CENTRIFUGALLOW COST, STEADY OUTPUT, AND AVAILABILITY IN NUMEROUS DESIGNS TO INDUCE DEMAND FOR CENTRIFUGAL PUMPS

-

7.3 POSITIVE DISPLACEMENTDIAPHRAGM PUMPS- High efficiency and suitability for metering applications to boost demand for diaphragm pumpsTWIN SCREW PUMPS- Ability to handle fluids of varied viscosities to propel adoption of twin screw pumpsPERISTALTIC PUMPS- Capability to gently transfer sterile and shear-sensitive fluids to augment demand for peristaltic pumpsROTARY LOBE PUMPS- High accuracy and consistent output to generate demand for rotary lobe pumpsPROGRESSIVE CAVITY PUMPS- High suitability for dosing applications to fuel demand for progressive cavity pumpsECCENTRIC DISC PUMPS- Ability to handle low- and high-viscosity fluids to drive demand for eccentric disc pumpsOTHER TYPES

- 8.1 INTRODUCTION

-

8.2 STAINLESS STEELSTRENGTH AND FLEXIBILITY OF STAINLESS STEEL PUMPS TO DRIVE THEIR ADOPTION

-

8.3 BRONZECORROSION-RESISTANT NATURE TO FUEL DEMAND FOR BRONZE PUMPS

-

8.4 COPPERANTIMICROBIAL PROPERTIES TO BOOST DEMAND FOR COPPER PUMPS

- 9.1 INTRODUCTION

-

9.2 STANDARDADHERES TO HYGIENE STANDARDS AND PROVIDES HIGH LEVEL OF SANITATION ACROSS INDUSTRIES

-

9.3 ASEPTICFOCUSES ON PREVENTING CONTAMINATION AND ENSURING PRODUCT STERILIZATION

-

9.4 ULTRACLEANSUITABLE FOR PRODUCTION PROCESSES THAT NEED HIGHER PROTECTION AGAINST CONTAMINATION

- 10.1 INTRODUCTION

-

10.2 ELECTRICRELIANT ON ELECTRICITY FOR OPERATIONS

-

10.3 AIRUSED WHERE ELECTRICITY IS NOT AVAILABLE OR IN EXPLOSIVE OR FLAMMABLE AREAS

- 11.1 INTRODUCTION

-

11.2 SELF-PRIMINGCAPABILITY TO HANDLE VARIETY OF FLUIDS TO FUEL NEED FOR SELF-PRIMING PUMPS

-

11.3 NON-SELF-PRIMINGCOMPACT DESIGN TO BOOST ADOPTION OF NON-SELF-PRIMING PUMPS IN PROCESS INDUSTRIES

- 12.1 INTRODUCTION

-

12.2 PROCESSED FOODNEED TO MEET HYGIENE REQUIREMENTS TO DRIVE ADOPTION OF SANITARY PUMPS AND VALVES IN PROCESSED FOOD INDUSTRY

-

12.3 DAIRY3A SANITARY STANDARDS AND PASTEURIZED MILK ORDINANCE (PMO) REQUIREMENTS TO BOOST ADOPTION OF SANITARY PUMPS AND VALVES IN DAIRY INDUSTRY

-

12.4 ALCOHOLIC BEVERAGERISING HYGIENE AWARENESS IN ALCOHOLIC BEVERAGE INDUSTRY TO DRIVE DEMAND FOR SANITARY PUMPS AND VALVES

-

12.5 NONALCOHOLIC BEVERAGENEED TO ENSURE RELIABLE AND EFFICIENT PRODUCTION OF NONALCOHOLIC BEVERAGES TO GENERATE DEMAND FOR SANITARY PUMPS AND VALVES

-

12.6 PHARMACEUTICALSTRINGENT QUALITY AND SAFETY STANDARDS TO SPUR DEMAND FOR SANITARY PUMPS AND VALVES IN PHARMACEUTICAL INDUSTRY

- 12.7 OTHER END-USER INDUSTRIES

- 13.1 INTRODUCTION

-

13.2 NORTH AMERICANORTH AMERICA: IMPACT OF RECESSIONUS- Presence of top food & beverage industry players to drive demand for sanitary pumps and valvesCANADA- Growing processed food industry to offer growth opportunities for players in sanitary pumps and valves marketMEXICO- Growing industrialization to drive market

-

13.3 EUROPEEUROPE: IMPACT OF RECESSIONGERMANY- Presence of major pharmaceutical manufacturers to favor market growthUK- Growing nonalcoholic beverage industry to provide opportunities for sanitary pumps and valves manufacturersFRANCE- Thriving cosmetics industry to underpin market growthITALY- Established alcoholic beverage industry to support market growthBENELUX- Presence of major chemical and pharmaceutical companies to fuel demand for sanitary pumps and valvesREST OF EUROPE

-

13.4 ASIA PACIFICASIA PACIFIC: IMPACT OF RECESSIONCHINA- Robust industrial base to support market growthJAPAN- Growing pharmaceutical industry to generate demand for sanitary pumps and valvesINDIA- Strong dairy industry to induce demand for sanitary pumps and valvesSOUTH KOREA- Increasing use of sanitary pumps and valves in chemical industry to augment market growthAUSTRALIA- Rising demand for processed food and beverages to accelerate adoption of sanitary pumps and valvesREST OF ASIA PACIFIC

-

13.5 REST OF THE WORLDREST OF THE WORLD: IMPACT OF RECESSIONMIDDLE EAST & AFRICA- Growing cosmetics and personal care industries to favor market growthSOUTH AMERICA- Rising demand for processed foods to fuel market growth

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.3 REVENUE SHARE ANALYSIS

- 14.4 MARKET SHARE ANALYSIS, 2022

-

14.5 COMPANY EVALUATION QUADRANT, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

14.6 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 14.7 SANITARY PUMPS AND VALVES MARKET: COMPANY FOOTPRINT

- 14.8 COMPETITIVE BENCHMARKING

-

14.9 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

-

15.1 KEY PLAYERSALFA LAVAL- Business overview- Products offered- Recent developments- MnM viewSPX FLOW, INC.- Business overview- Products offered- Recent developments- MnM viewGEA GROUP AKTIENGESELLSCHAFT- Business overview- Products offered- Recent developments- MnM viewDOVER CORPORATION- Business overview- Products offered- Recent developments- MnM viewFRISTAM PUMPEN KG (GMBH & CO.)- Business overview- Products offered- MnM viewEVOGUARD GMBH- Business overview- Products offeredFLOWSERVE CORPORATION- Business overview- Products offered- Recent developmentsGRACO INC.- Business overview- Products offered- Recent developmentsIDEX CORPORATION- Business overview- Products offered- Recent developmentsINOXPA S.A.U.- Business overview- Products offered- Recent developmentsITT INC.- Business overview- Products offered- Recent developmentsKSB SE & CO. KGAA- Business overview- Products offered- Recent developmentsSPIRAX-SARCO ENGINEERING PLC- Business overview- Products offered- Recent developmentsVERDER INTERNATIONAL B.V.- Business overview- Products offered- Recent developmentsXYLEM INC.- Business overview- Products offered

-

15.2 OTHER PLAYERSADAMANT VALVESAMPCO PUMPS COMPANY, INC.CSF INOX S.P.A.FLUX-GERÄTE GMBHDONJOY TECHNOLOGY CO., LTD.DIXON VALVE & COUPLING COMPANY, LLCJONENG VALVES CO., LTD.LEWA GMBHQ-PUMPSTAPFLO GROUP

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS

- TABLE 1 ASSUMPTIONS

- TABLE 2 RISK ASSESSMENT

- TABLE 3 SANITARY PUMPS AND VALVES MARKET: ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE OF SANITARY PUMPS AND VALVES, BY TYPE

- TABLE 5 AVERAGE SELLING PRICE OF SANITARY PUMPS OFFERED BY KEY PLAYERS

- TABLE 6 AVERAGE SELLING PRICE OF SANITARY PUMPS, BY REGION

- TABLE 7 SANITARY PUMPS AND VALVES MARKET: PORTER’S FIVE FORCES ANALYSIS, 2022

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USER INDUSTRIES

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

- TABLE 10 INOXPA S.A.U. SUPPLIED VARIOUS CUSTOMIZED PUMPS AND VALVES TO SYMRISE PVT. LTD.

- TABLE 11 INOXPA S.A.U. PROVIDED NEW PROCESSING EQUIPMENT AND VALVE MANIFOLDS TO CALIDAD PASCUAL S.A.

- TABLE 12 SWEETS MANUFACTURER USED SLH TWIN SCREW PUMP BY ITT BORNEMANN TO SOLVE ISSUES RELATED TO PUMPS

- TABLE 13 BEAR REPUBLIC BREWERY USED GEA HILGE HYGIA PUMPS TO FOCUS ON EFFICIENCY

- TABLE 14 US: TOP 20 PATENT OWNERS IN LAST 10 YEARS

- TABLE 15 SANITARY PUMPS AND VALVES MARKET: LIST OF PATENTS, 2019–2022

- TABLE 16 SANITARY PUMPS AND VALVES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 STANDARDS FOR SANITARY PUMPS AND VALVES MARKET

- TABLE 22 SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2019–2022 (USD MILLION)

- TABLE 23 SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2023–2028 (USD MILLION)

- TABLE 24 CENTRIFUGAL: SANITARY PUMPS AND VALVES MARKET, BY PUMP POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 25 CENTRIFUGAL: SANITARY PUMPS AND VALVES MARKET, BY PUMP POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 26 CENTRIFUGAL: SANITARY PUMPS AND VALVES MARKET, BY PUMP PRIMING TYPE, 2019–2022 (USD MILLION)

- TABLE 27 CENTRIFUGAL: SANITARY PUMPS AND VALVES MARKET, BY PUMP PRIMING TYPE, 2023–2028 (USD MILLION)

- TABLE 28 CENTRIFUGAL: SANITARY PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 29 CENTRIFUGAL: SANITARY PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 30 CENTRIFUGAL: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 CENTRIFUGAL: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 POSITIVE DISPLACEMENT: SANITARY PUMPS AND VALVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 33 POSITIVE DISPLACEMENT: SANITARY PUMPS AND VALVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 34 POSITIVE DISPLACEMENT: SANITARY PUMPS AND VALVES MARKET, BY PUMP POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 35 POSITIVE DISPLACEMENT: SANITARY PUMPS AND VALVES MARKET, BY PUMP POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 36 POSITIVE DISPLACEMENT: SANITARY PUMPS AND VALVES MARKET, BY PUMP PRIMING TYPE, 2019–2022 (USD MILLION)

- TABLE 37 POSITIVE DISPLACEMENT: SANITARY PUMPS AND VALVES MARKET, BY PUMP PRIMING TYPE, 2023–2028 (USD MILLION)

- TABLE 38 POSITIVE DISPLACEMENT: SANITARY PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 39 POSITIVE DISPLACEMENT: SANITARY PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 40 POSITIVE DISPLACEMENT: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 POSITIVE DISPLACEMENT: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 SANITARY PUMPS AND VALVES MARKET, BY PUMP POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 43 SANITARY PUMPS AND VALVES MARKET, BY PUMP POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 44 ELECTRIC: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2019–2022 (USD MILLION)

- TABLE 45 ELECTRIC: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2023–2028 (USD MILLION)

- TABLE 46 AIR: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2019–2022 (USD MILLION)

- TABLE 47 AIR: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2023–2028 (USD MILLION)

- TABLE 48 SANITARY PUMPS AND VALVES MARKET, BY PUMP PRIMING TYPE, 2019–2022 (USD MILLION)

- TABLE 49 SANITARY PUMPS AND VALVES MARKET, BY PUMP PRIMING TYPE, 2023–2028 (USD MILLION)

- TABLE 50 SELF-PRIMING: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2019–2022 (USD MILLION)

- TABLE 51 SELF-PRIMING: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2023–2028 (USD MILLION)

- TABLE 52 NON-SELF-PRIMING: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2019–2022 (USD MILLION)

- TABLE 53 NON-SELF-PRIMING: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2023–2028 (USD MILLION)

- TABLE 54 SANITARY PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 55 SANITARY PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 56 PROCESSED FOOD: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2019–2022 (USD MILLION)

- TABLE 57 PROCESSED FOOD: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2023–2028 (USD MILLION)

- TABLE 58 PROCESSED FOOD: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 PROCESSED FOOD: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 DAIRY: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2019–2022 (USD MILLION)

- TABLE 61 DAIRY: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2023–2028 (USD MILLION)

- TABLE 62 DAIRY: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 DAIRY: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 ALCOHOLIC BEVERAGE: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2019–2022 (USD MILLION)

- TABLE 65 ALCOHOLIC BEVERAGE: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2023–2028 (USD MILLION)

- TABLE 66 ALCOHOLIC BEVERAGE: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 ALCOHOLIC BEVERAGE: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 NONALCOHOLIC BEVERAGE: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2019–2022 (USD MILLION)

- TABLE 69 NONALCOHOLIC BEVERAGE: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2023–2028 (USD MILLION)

- TABLE 70 NONALCOHOLIC BEVERAGE: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 NONALCOHOLIC BEVERAGE: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 PHARMACEUTICAL: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2019–2022 (USD MILLION)

- TABLE 73 PHARMACEUTICAL: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2023–2028 (USD MILLION)

- TABLE 74 PHARMACEUTICAL: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 PHARMACEUTICAL: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 OTHER END-USER INDUSTRIES: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2019–2022 (USD MILLION)

- TABLE 77 OTHER END-USER INDUSTRIES: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2023–2028 (USD MILLION)

- TABLE 78 OTHER END-USER INDUSTRIES: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 79 OTHER END-USER INDUSTRIES: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 SANITARY PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 81 SANITARY PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: SANITARY PUMPS AND VALVES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: SANITARY PUMPS AND VALVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2019–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: SANITARY PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: SANITARY PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: SANITARY PUMPS AND VALVES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 89 EUROPE: SANITARY PUMPS AND VALVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2019–2022 (USD MILLION)

- TABLE 91 EUROPE: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: SANITARY PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 93 EUROPE: SANITARY PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: SANITARY PUMPS AND VALVES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 95 ASIA PACIFIC: SANITARY PUMPS AND VALVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2019–2022 (USD MILLION)

- TABLE 97 ASIA PACIFIC: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2023–2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: SANITARY PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: SANITARY PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 100 REST OF THE WORLD: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 101 REST OF THE WORLD: SANITARY PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 102 REST OF THE WORLD: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2019–2022 (USD MILLION)

- TABLE 103 REST OF THE WORLD: SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE, 2023–2028 (USD MILLION)

- TABLE 104 REST OF THE WORLD: SANITARY PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 105 REST OF THE WORLD: SANITARY PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 106 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 107 SANITARY PUMPS AND VALVES MARKET SHARE ANALYSIS (2022)

- TABLE 108 COMPANY FOOTPRINT

- TABLE 109 PRODUCT: COMPANY FOOTPRINT

- TABLE 110 END-USER INDUSTRY: COMPANY FOOTPRINT

- TABLE 111 REGION: COMPANY FOOTPRINT

- TABLE 112 SANITARY PUMPS AND VALVES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 113 SANITARY PUMPS AND VALVES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 114 SANITARY PUMPS AND VALVES MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 115 SANITARY PUMPS AND VALVES MARKET: DEALS, 2019–2023

- TABLE 116 ALFA LAVAL: BUSINESS OVERVIEW

- TABLE 117 ALFA LAVAL: PRODUCT OFFERINGS

- TABLE 118 ALFA LAVAL: PRODUCT LAUNCHES

- TABLE 119 SPX FLOW, INC.: BUSINESS OVERVIEW

- TABLE 120 SPX FLOW, INC.: PRODUCT OFFERINGS

- TABLE 121 SPX FLOW, INC.: PRODUCT LAUNCHES

- TABLE 122 SPX FLOW, INC.: DEALS

- TABLE 123 GEA GROUP AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

- TABLE 124 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT OFFERINGS

- TABLE 125 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT LAUNCHES

- TABLE 126 DOVER CORPORATION: BUSINESS OVERVIEW

- TABLE 127 DOVER CORPORATION: PRODUCT OFFERINGS

- TABLE 128 DOVER CORPORATION: PRODUCT LAUNCHES

- TABLE 129 DOVER CORPORATION: DEALS

- TABLE 130 FRISTAM PUMPEN KG (GMBH & CO.): BUSINESS OVERVIEW

- TABLE 131 FRISTAM PUMPEN KG (GMBH & CO.): PRODUCT OFFERINGS

- TABLE 132 EVOGUARD GMBH: BUSINESS OVERVIEW

- TABLE 133 EVOGUARD GMBH: PRODUCT OFFERINGS

- TABLE 134 FLOWSERVE CORPORATION: BUSINESS OVERVIEW

- TABLE 135 FLOWSERVE CORPORATION: PRODUCT OFFERINGS

- TABLE 136 FLOWSERVE CORPORATION: PRODUCT LAUNCHES

- TABLE 137 FLOWSERVE CORPORATION: DEALS

- TABLE 138 GRACO INC.: BUSINESS OVERVIEW

- TABLE 139 GRACO INC.: PRODUCT OFFERINGS

- TABLE 140 GRACO INC.: PRODUCT LAUNCHES

- TABLE 141 IDEX CORPORATION: BUSINESS OVERVIEW

- TABLE 142 IDEX CORPORATION: PRODUCT OFFERINGS

- TABLE 143 IDEX CORPORATION: DEALS

- TABLE 144 INOXPA S.A.U.: BUSINESS OVERVIEW

- TABLE 145 INOXPA S.A.U.: PRODUCT OFFERINGS

- TABLE 146 INOXPA S.A.U.: PRODUCT LAUNCHES

- TABLE 147 ITT INC.: BUSINESS OVERVIEW

- TABLE 148 ITT INC.: PRODUCT OFFERINGS

- TABLE 149 ITT INC.: PRODUCT LAUNCHES

- TABLE 150 ITT INC.: DEALS

- TABLE 151 KSB SE & CO. KGAA: BUSINESS OVERVIEW

- TABLE 152 KSB SE & CO. KGAA: PRODUCT OFFERINGS

- TABLE 153 KSB SE & CO. KGAA: PRODUCT LAUNCHES

- TABLE 154 KSB SE & CO. KGAA: OTHERS

- TABLE 155 SPIRAX-SARCO ENGINEERING PLC: BUSINESS OVERVIEW

- TABLE 156 SPIRAX-SARCO ENGINEERING PLC: PRODUCT OFFERINGS

- TABLE 157 SPIRAX-SARCO ENGINEERING PLC: PRODUCT LAUNCHES

- TABLE 158 VERDER INTERNATIONAL B.V.: BUSINESS OVERVIEW

- TABLE 159 VERDER INTERNATIONAL B.V.: PRODUCT OFFERINGS

- TABLE 160 VERDER INTERNATIONAL B.V.: PRODUCT LAUNCHES

- TABLE 161 VERDER INTERNATIONAL B.V.: DEALS

- TABLE 162 XYLEM INC.: BUSINESS OVERVIEW

- TABLE 163 XYLEM INC.: PRODUCT OFFERINGS

- FIGURE 1 SANITARY PUMPS AND VALVES MARKET: SEGMENTATION

- FIGURE 2 SANITARY PUMPS AND VALVES MARKET: REGIONS COVERED

- FIGURE 3 SANITARY PUMPS AND VALVES MARKET: RESEARCH DESIGN

- FIGURE 4 SANITARY PUMPS AND VALVES MARKET: RESEARCH APPROACH

- FIGURE 5 SANITARY PUMPS AND VALVES MARKET: BOTTOM-UP APPROACH

- FIGURE 6 SANITARY PUMPS AND VALVES MARKET: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY FOR SANITARY PUMPS AND VALVES MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 SANITARY PUMPS AND VALVES MARKET, 2019–2028 (USD MILLION)

- FIGURE 10 CENTRIFUGAL SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 SELF-PRIMING SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 12 ELECTRIC SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 PROCESSED FOOD SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 STRINGENT GOVERNMENT REGULATIONS TO MAINTAIN HYGIENE ACROSS END-USER INDUSTRIES TO DRIVE MARKET

- FIGURE 16 CENTRIFUGAL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 PROCESSED FOOD SEGMENT TO AMASS LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 PROCESSED FOOD AND US TO BE LARGEST SHAREHOLDERS IN NORTH AMERICAN MARKET BY 2028

- FIGURE 19 CHINA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 SANITARY PUMPS AND VALVES MARKET DYNAMICS

- FIGURE 21 SANITARY PUMPS AND VALVES MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 22 SANITARY PUMPS AND VALVES MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 23 SANITARY PUMPS AND VALVES MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 24 SANITARY PUMPS AND VALVES MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 25 SANITARY PUMPS AND VALVES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 SANITARY PUMPS AND VALVES MARKET: ECOSYSTEM

- FIGURE 27 AVERAGE SELLING PRICE OF SANITARY PUMPS OFFERED BY KEY PLAYERS

- FIGURE 28 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN SANITARY PUMPS AND VALVES MARKET

- FIGURE 29 SANITARY PUMPS AND VALVES MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USER INDUSTRIES

- FIGURE 31 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

- FIGURE 32 IMPORT VALUE OF PUMPS, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 33 EXPORT VALUE OF PUMPS, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 34 IMPORT VALUE OF VALVES, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 35 EXPORT VALUE OF VALVES, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 36 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 37 NUMBER OF PATENTS GRANTED PER YEAR, 2013–2022

- FIGURE 38 SANITARY PUMPS AND VALVES MARKET, BY VALVE TYPE

- FIGURE 39 SANITARY PUMPS AND VALVES MARKET, BY PUMP TYPE

- FIGURE 40 POSITIVE DISPLACEMENT SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 41 SANITARY PUMPS AND VALVES MARKET, BY MATERIAL TYPE

- FIGURE 42 SANITARY PUMPS AND VALVES MARKET, BY HYGIENE CLASS

- FIGURE 43 SANITARY PUMPS AND VALVES MARKET, BY PUMP POWER SOURCE

- FIGURE 44 ELECTRIC SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 45 SANITARY PUMPS AND VALVES MARKET, BY PUMP PRIMING TYPE

- FIGURE 46 NON-SELF-PRIMING SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 47 SANITARY PUMPS AND VALVES MARKET, BY END-USER INDUSTRY

- FIGURE 48 PHARMACEUTICAL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 SANITARY PUMPS AND VALVES MARKET, BY REGION

- FIGURE 50 CHINA TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 51 NORTH AMERICA: SANITARY PUMPS AND VALVES MARKET SNAPSHOT

- FIGURE 52 US TO ACCOUNT FOR LARGEST SHARE OF SANITARY PUMPS AND VALVES MARKET IN NORTH AMERICA DURING FORECAST PERIOD

- FIGURE 53 EUROPE: SANITARY PUMPS AND VALVES MARKET SNAPSHOT

- FIGURE 54 GERMANY TO ACCOUNT FOR LARGEST SIZE OF SANITARY PUMPS AND VALVES MARKET IN EUROPE DURING FORECAST PERIOD

- FIGURE 55 ASIA PACIFIC: SANITARY PUMPS AND VALVES MARKET SNAPSHOT

- FIGURE 56 CHINA TO DOMINATE SANITARY PUMPS AND VALVES MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 57 MIDDLE EAST & AFRICA TO ACCOUNT FOR LARGER SHARE OF MARKET IN REST OF THE WORLD DURING FORECAST PERIOD

- FIGURE 58 SANITARY PUMPS AND VALVES MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021

- FIGURE 59 SHARE OF KEY PLAYERS IN SANITARY PUMPS AND VALVES MARKET, 2022

- FIGURE 60 SANITARY PUMPS AND VALVES MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 61 SANITARY PUMPS AND VALVES MARKET: COMPANY EVALUATION QUADRANT FOR SMES, 2022

- FIGURE 62 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 63 SPX FLOW, INC.: COMPANY SNAPSHOT

- FIGURE 64 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 65 DOVER CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 FLOWSERVE CORPORATION: COMPANY SNAPSHOT

- FIGURE 67 GRACO INC.: COMPANY SNAPSHOT

- FIGURE 68 IDEX CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 ITT INC.: COMPANY SNAPSHOT

- FIGURE 70 KSB SE & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 71 SPIRAX-SARCO ENGINEERING PLC: COMPANY SNAPSHOT

- FIGURE 72 XYLEM INC.: COMPANY SNAPSHOT

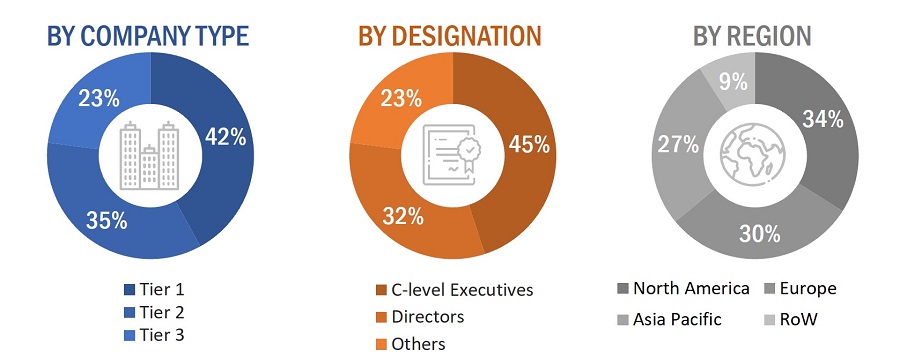

The study involved four major activities in estimating the current size of the sanitary pumps and valves market. Exhaustive secondary research has been done to collect information on the market, peer, and parent markets. The next step has been to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments. Secondary and primary sources have been used to identify and collect information for an extensive technical and commercial study of the sanitary pumps and valves market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred sanitary pumps and valves providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from sanitary pumps and valves providers, such as Alfa Laval (Sweden), Fristam Pumpen KG (GmbH & Co.) (Germany), GEA Group Aktiengesellschaft (Germany), SPX FLOW, Inc. (US), and Dover Corporation (US); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the sanitary pumps and valves market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

A sanitary pump is a mechanical device that transports hygienic products and solutions through industrial processing pipeline systems. Whereas the sanitary valve is a mechanical device used to control, regulate, and divert the flow of hygienic products and solutions. These sanitary pumps and valves play a critical part in transporting products as these products are meant for direct human consumption or contact. The pump or valve, specifically its components that contact the fluid medium while processing, must be made of materials with hygienic properties, corrosion resistant, and remain sterile to prevent the contamination of the liquid products passing through them.

Key Stakeholders

- Sanitary pumps and valves manufacturers

- Government bodies, such as regulating authorities and policymakers

- Organizations, forums, alliances, and associations

- Market research and consulting firms

- Raw material suppliers and distributors

- Research institutes and organizations

- Sanitary pumps and valves traders and suppliers

Report Objectives

- To define and forecast the sanitary pumps and valves market by valve type, pump priming type, pump power source, material type, hygiene class, pump type, and end-user industry.

- To describe and forecast the sanitary pumps and valves market and its value segments for four regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micro-markets concerning individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain and allied industry segments of the sanitary pumps and valves market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To strategically profile key players and comprehensively analyze their market position, ranking, core competencies, and a detailed market competitive landscape.

- To analyze strategic approaches such as agreements, collaborations, and partnerships in the sanitary pumps and valves market

- To provide an analysis of the recession impact on the growth of the market and its segments

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sanitary Pumps and Valves Market