Hygienic Pumps and Valves Market Size, Share, Trends, Statistics and Industry Growth Analysis Report by Valve Type (Single-seat, Double-seat, Butterfly, Diaphragm, Control, Ball, Globe, Plug, Pinch), Operation Mode (Manual, Air-actuated), Material Type, Function, Hygiene Class, End-user Industry - Global Growth Driver and Industry Forecast to 2028

Hygienic Pumps and Valves Market

Hygienic Pumps and Valves Market and Top Companies

ALFA LAVAL

ALFA LAVAL is one of the leading global providers of products in the areas of fluid handling, heat transfers, and separation. The company operates through three business divisions, namely Energy Division, Food & Water Division, and Marine Division. The Food & Water Division comprises five technology-based business units, which include high-speed separators, food systems, hygienic fluid handling, food heat transfer, and decanters for the customers in dairy, pharmaceuticals, vegetable oils, food, brewery, and body care products. The division also focuses on industrial and public water treatment as well as waste and wastewater treatment. The hygienic fluid handling products under the Food & Water Division are pumps, valves, tank equipment, and installation material for hygienic applications. The pumps provided by the company are centrifugal pumps, three screw pumps, twin screw pumps, rotary lobe pumps, and circumferential piston pumps. The company also offers ball valves, butterfly valves, control/check valves, diaphragm valves, double-seat valves, single-seat valves, etc. Services offered by the company for hygienic valves include start-up services such as commissioning and installation; improvement services such as redesign and upgrade, replacement, or configuration of older equipment; and troubleshooting, technical documentation, training, and remote support.

GEA Group Aktiengesellschaft

GEA Group Aktiengesellschaft is one of the world’s largest suppliers of components and systems for the food, beverages, and other critical industrial sectors. The company aims to provide sustainable solutions for sophisticated production processes and specializes in machinery and plants as well as advanced process technology, components, and comprehensive services. GEA’s business activities are broadly divided into five business divisions, namely Separation & Flow Technologies, Liquid & Powder Technologies, Food & Healthcare Technologies, Farm Technologies, and Refrigeration Technologies. Under the Separation & Flow Technologies business division, GEA encompasses process engineering components and machines such as separators, decanters, homogenizers, valves, and pumps that play critical roles in every production process. These solutions ensure the efficient separation and homogenization of liquids when used in diverse, high-quality products. Under this segment, GEA offers a versatile range of butterfly, double-seat, and single-seat valves, as well as centrifugal and positive displacement pumps for a wide variety of sensitive applications in industries such as beverages, food, and pharmaceuticals.

SPX FLOW, Inc.

SPX FLOW, Inc. is one of the leading developers, manufacturers, and service providers of highly engineered products and processed solutions. The company operates through two business segments: Food & Beverage and Industrial. The Food & Beverage segment operates with in-demand process solutions. The products offered by the company under Food & Beverage business division include pumps, homogenizers, valves, heat exchangers, and separators. It provides a wide range of pumps, including centrifugal pumps, positive displacement pumps, diaphragm pumps, internal gear pumps, flexible impeller pumps, and flow control pumps. Valves provided by the company include ball valves, butterfly valves, double seat valves, single seat valves, diaphragm valves, check valves, mix proof valves, among others. These products are provided under key brands such as APV, Seital, Gerstenberg Schroeder, and Waukesha Cherry-Burrell. The company serves industries such as beverages, chemicals, brewery, dairy, food, pharmaceuticals, personal care, marine, oil & gas, and water and wastewater treatment. Services provided by the company are maintenance, training, spare parts, upgrades, and installation and commissioning.

Hygienic Pumps and Valves Market and Top end-user industry

Processed Food

Cleanliness is one of the highest priorities in the processed foods industry. The Food and Drug Administration (FDA) and the US Department of Agriculture (USDA) are the major regulatory bodies for this industry. These regulatory bodies define standards to ensure the safety and nutritional values of food products and protect them from misbranding and contamination. According to the Food and Drug Administration of the US, 600 million cases of foodborne illnesses are reported every year due to the consumption of unsafe food. Hence, it is essential to maintain hygiene and provide safe and healthy processed foods to customers. Quality control systems and effective food safety are key to safeguard the health as well as well-being of people, and enhancing livelihood and fostering economic development. The need to maintain the highest hygiene levels and desired product quality leads to the demand for hygienic valves and pumps in the processed foods industry.

Pharmaceuticals

A robust healthcare system is an important pillar of a country’s socioeconomic development process. The pharmaceuticals industry makes major contributions to the prosperity of the national economy. Due to this, it is being increasingly recognized as an important industry in the developing world. The pharmaceuticals industry has made some of the greatest innovations and achievements in modern medicine, with many new technologies using cellular and biomolecular processes to help improve the lives of people and the health of the Earth. Therefore, it is necessary to ensure that the products being manufactured in this industry are safe and of high quality.

Hygienic Pumps and Valves by Top Valve Type

Control Valves

Control valves are power-operated devices used to regulate the flow of fluids or gases by opening, closing, or partially obstructing various passageways in a process system. Hygienic control valves have the same working principle and structure as ordinary control valves. A control valves consists of a valve body, a positioner, a plug, and an actuator. The valve body offers fluid connections, and a movable restrictor consists of a valve stem. The plug is in contact with the fluid and controls its flow.

Updated on : October 22, 2024

Hygienic Pumps and Valves Market Size

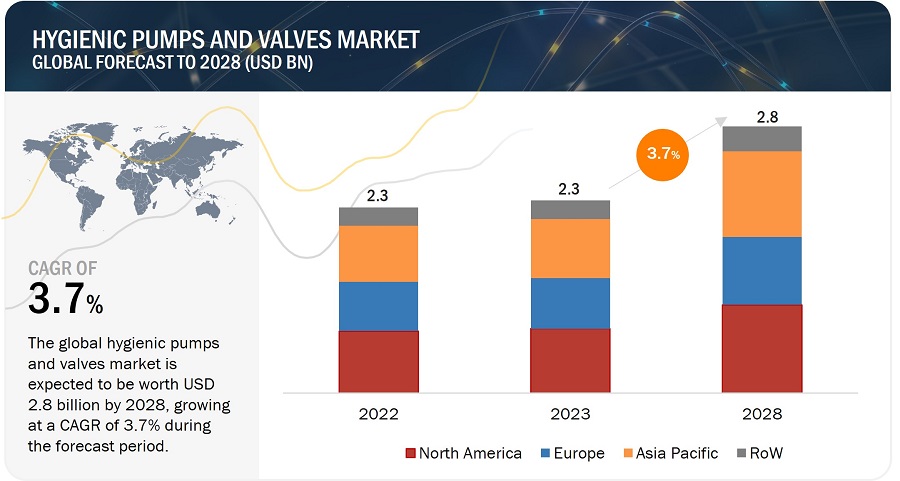

The global hygienic pumps and valves market size is predicted to grow from USD 2.3 billion in 2023 to USD 2.8 billion by 2028, Growing at a CAGR of 3.7% from 2023 to 2028.

Hygienic pumps and valves are used in different industries, such as food and beverages. Manufacturers across these industries must follow several hygiene standards defined by various associations. These standards help in the adoption of hygienic equipment, as they provide control over processes, enhance production, and avoid the contamination of products. In the pharmaceutical industry, manufacturing pharmaceutical products requires maintaining high hygiene standards at each phase of the manufacturing process, such as materials, equipment, containers, premises, and cleaning and disinfecting products, to ensure the purity and quality of final products and the strength of active ingredients. These standards provide adequate and safe products for patients.

Hygienic Pumps and Valves Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Hygienic Pumps and Valves Market Trends & Growth Analysis

DRIVERS: Rising demand for processed food & beverages globally

In recent years, a tremendous rise can be seen in the consumption of processed food globally. Several facts contribute to the overall increased processed food industry. Changing lifestyles, growing globalization, and rising population are major driving factors supporting the adoption of processed foods and beverages. The growing population and increasing economy have pushed the trend for packaged foods and drinks as they are more conveniently available and can be stored longer than fresh foods. The cost of living has improved, so the population is leading a busier lifestyle, hence opting to cut down the efforts and time needed to cook the food. These factors have significantly risen the refrigerated and ready-to-eat packaged food markets.

Moreover, as urbanization rises, the access to fresh foods and vegetables gets saturated, so the people living in urban areas rely more on processed food and drinks. In addition, the population is becoming more aware of healthy lifestyles and choosing foods with lower sugar, salt, and fats. These newer trends are supporting the packaged and processed food market.

RESTRAINTS: Fluctuations in raw material prices

Manufacturing hygienic pumps and valves requires non-corrosive, odorless, and nontoxic materials, mainly 304L or 316L stainless steel. Stainless steel contains nickel and chromium raw materials. The production price of stainless steel depends on the prices of these raw materials, which fluctuate due to the factors such as geopolitical events, trade policies, global supply and demand gap, transportation costs, and others. Hence, this affects the pricing of stainless steel production and supply globally. The highly varying raw material costs also lead to ineffective price management and fluctuations in profit margins. This variation in the end-product prices also affects the sales of hygienic pumps and valves industry . These factors result in changes in the adoption of sanitary pumps and valves across various industries, thus restraining the market.

OPPORTUNITIES: Growing adoption of IIoT in process industries

Hygienic/sanitary pumps and valves are critical components of various industrial equipment in process industries such as food & beverage and pharmaceutical. The failure of these pumps and valves could lead to disruptions in plant processes. Traditional, schedule-based maintenance methods fail to alert manufacturing companies about impending valve failures. Due to this, technicians often inform about faults while inspecting pumps and valves, resulting in unplanned downtime. However, recent developments in data science, communications, and computing power have enabled companies to leverage the IIoT technology to reduce unplanned downtime due to valve failure. IIoT enables hygienic pump and valve experts to monitor their health in a plant remotely and track the efficiency, lifecycle, and potential chances of failure of these valves.

CHALLENGES: Rising competition from gray market players and unorganized sector

With the increasing number of local players across regions and the growing existence of gray market players, the competition for industrial players is increasing enormously. With the growing competition, the well-established players in this market face challenges, especially in developing regions such as Asia Pacific and South America. These players must be cautious and sensitive about their product quality, service offerings, and commitments to their industrial customers. The gray market players are known for buying products from low-price countries or regions and selling them to high-price countries or regions through distribution channels not authorized by the original manufacturer or trademark proprietor. All these factors act as a challenge for existing market players.

Hygienic Pumps and Valves Market Segmentation

Air-actuated operation mode is expected to grow with the highest CAGR during the forecast period.

Manual operation of valves is time-consuming and requires more effort. Deploying thousands of manually operated valves of different types in the factories is also a slow process. Hence, the focus of manufacturers is now being diverted towards automation and the transformation of factories. Air-actuated hygienic valves involve air pressure against a diaphragm or piston to produce circular or linear movement. The air is a control media passed in an air-actuated actuator to open, close, or control fluid flow. These valves reduce the pressure in a controlled manner with the help of positioners and actuators. Air-actuated valves are being used in many industries because they offer several advantages over manually operated pumps.

Hygienic Pumps and Valves End-Use Industry Insights

The processed food industry is projected to hold the largest market share during the forecast period

The processed food industry is driven by the increasing population, changing consumer consumption patterns, growing urbanization, and improving living standards in developing countries. The manufacturers of processed food have to meet the safety mandates implemented by the governments of various countries to ensure the quality and safety of food products. Adopting hygienic pumps and valves in the processed food industry helps meet hygiene requirements with maximum performance. Besides, the need for leakproof and clean containers in this industry creates the need to integrate hygienic valves in pipelines. In food processing plants, hygienic pumps and valves are used for cleaning/rinsing, mixing, CIP process, filling, machine control, factory solution, and food safety and compliance applications.

Hygienic Pumps and Valves Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Hygienic Pumps and Valves Market Regional Analysis

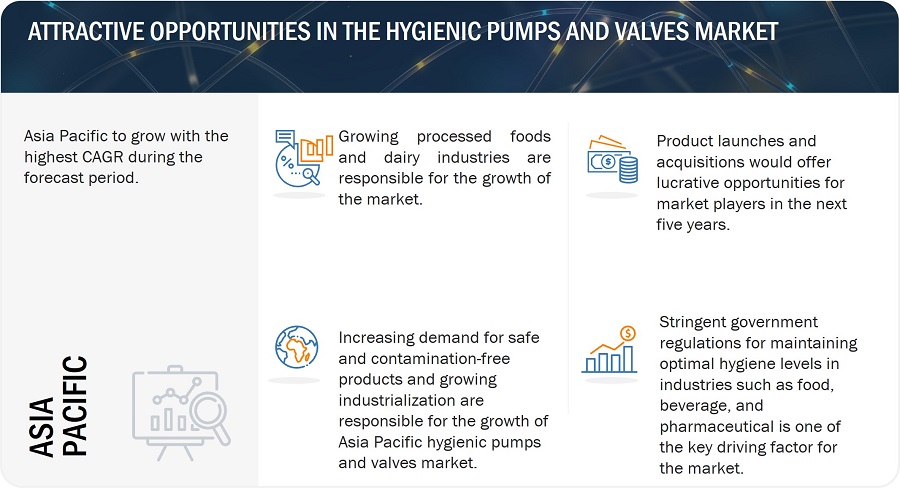

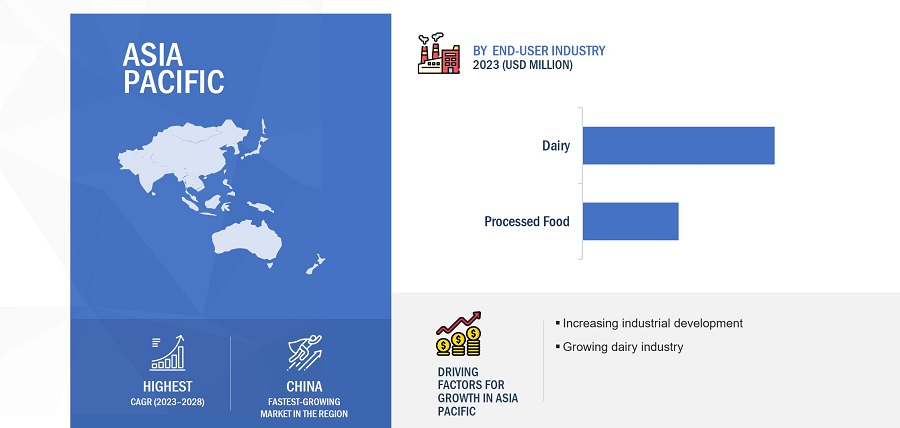

The Hygienic Pumps and Valves market in Asia Pacific is projected to grow at the highest CAGR from 2023 to 2028.

China is one of the largest and fastest-growing economies in the Asia Pacific. The country is among the leading manufacturers and exporters of hygienic pumps and valves, with several medium-sized manufacturers based in the country. Thus, the presence of local manufacturers of hygienic pumps and valves makes it the largest producer and supplier of hygienic pump and valve components. The country has a robust industrial base, where process industries such as processed food and chemicals are the leading industries. Other industries, such as dairy, alcoholic beverages, and pharmaceuticals, contribute a considerable share to the country's economy. These industries require comprehensive control and monitoring actions for controlling the flow, pressure, and level and transporting the fluids in pipelines, which requires hygienic pumps and valves. The demand for hygienic pumps and valves is driven by the rapid growth of the processed food and dairy industries, owing to the rapid growth in the population.

Top Hygienic Pumps and Valves Companies - Key Market Players Insights

- Alfa Laval (Sweden),

- GEA Group Aktiengesellschaft (Germany),

- SPX FLOW, Inc. (US),

- Emerson Electric Co. (US),

- Spirax-Sarco Engineering plc (UK),

- Flowserve Corporation (US),

- ITT Inc. (US), KSB SE & Co.

- KGaA (Germany), Christian Bürkert GmbH & Co. KG (Germany),

- GEMÜ Group (Germany), and SAMSON AG (Germany) are among a few top players in the Hygienic Pumps and Valves Companies.

Hygienic Pumps and Valves Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 2.3 billion in 2023 |

| Projected Market Size | USD 2.8 billion by 2028 |

| Growth Rate | Growing At CAGR of 3.7% |

|

Hygienic pumps and valves market size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Valve Type, Operation Mode, End-user Industry |

|

Geographic Regions Covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies Covered |

Major Players: Alfa Laval (Sweden), GEA Group Aktiengesellschaft (Germany), SPX FLOW, Inc. (US), Emerson Electric Co. (US), Spirax-Sarco Engineering plc (UK), Flowserve Corporation (US), ITT Inc. (US), KSB SE & Co. KGaA (Germany), Christian Bürkert GmbH & Co. KG (Germany), GEMÜ Group (Germany), and SAMSON AG (Germany) and Others- (Total 26 players have been covered) |

Hygienic Pumps and Valves Market Highlights

This research report categorizes the hygienic pumps and valves market Size by pump type, components of hygienic valves, material type, valve type, hygiene class, function, operation mode, end-user industry, and region.

|

Segment |

Subsegment |

|

Hygienic pumps and valves market size, By Pump Type: |

|

|

Components of hygienic valves: |

|

|

Hygienic pumps and valves market size, By Valve Type: |

|

|

Hygienic pumps and valves market Size, By Function : |

|

|

By Hygiene Class: |

|

|

By Operation Mode: |

|

|

By Material Type: |

|

|

Hygienic pumps and valves market size, By End-user Industry: |

|

|

Hygienic pumps and valves market size, By Region |

|

Recent Developments in Hygienic Pumps and Valves Industry

- In March 2023, Alfa Laval launched its new ThinkTop V20, the next generation of hygienic valve indication unit, which will help drive the digital transformation in process industries. The ThinkTop V20 will help in process control and save time and money on installation, commissioning, operation, and maintenance.

- In June 2021, GEA Group Aktiengesellschaft launched GEA Hilge CONTRA III, which will meet the general requirements of the dairy, beverage, and food industries. With this range, GEA expanded the performance spectrum of its centrifugal pumps to a flow rate of 100 cubic meters per hour.

- In July 2020, SPX FLOW, Inc. launched a new range of ball valves provided under APV, the BLV1 Series. The new ball valves offer economical and durable options for various non-hygienic and hygienic applications.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded by the hygienic pumps and valves market during 2023-2028?

The global hygienic pumps and valves market is expected to record a CAGR of 3.7% from 2023–2028.

What are the driving factors for the hygienic pumps and valves market?

Growing global demand for processed food & beverages is the key driving factor for the hygienic pumps and valves market.

Which end-user industry will grow at a fast rate in the future?

The pharmaceutical end-user industry is expected to grow at the highest CAGR during the forecast period. Maintaining a safe, consistent, and efficient manufacturing process is one of the critical reasons for this sector's growth.

Which are the significant players operating in the hygienic pumps and valves market?

Alfa Laval (Sweden), GEA Group Aktiengesellschaft (Germany), SPX FLOW, Inc. (US), Emerson Electric Co. (US), Spirax-Sarco Engineering plc (UK), and Flowserve Corporation (US) are among a few top players in the hygienic pumps and valves market.

Which region will grow at a fast rate in the future?

The Asia Pacific's hygienic pumps and valves market is expected to grow at the highest CAGR during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Stringent government regulations to maintain optimal hygiene standards- Rising demand for processed food & beverages- Expanding pharmaceutical industryRESTRAINTS- Fluctuations in raw material pricesOPPORTUNITIES- Increasing focus of manufacturers on R&D activities to develop new and advanced pumps and valves- Growing adoption of IIoT in process industriesCHALLENGES- Rising competition from gray market players and unorganized sector

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE TRENDAVERAGE SELLING PRICE TREND, BY KEY PLAYER

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 TECHNOLOGY ANALYSISPREDICTIVE MAINTENANCEIIOTSMART VALVE POSITIONERS

- 5.8 PORTER’S FIVE FORCE ANALYSIS

-

5.9 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS ON BUYING PROCESSBUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

-

5.11 TRADE ANALYSISTRADE ANALYSIS FOR VALVESTRADE ANALYSIS FOR PUMPS

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES & EVENTS, 2023–2024

-

5.14 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY STANDARDS

- 6.1 INTRODUCTION

-

6.2 CENTRIFUGAL PUMPSWIDELY USED FOR TRANSFERRING LOW VISCOUS FLUIDS

-

6.3 POSITIVE DISPLACEMENT PUMPSHIGHLY EFFICIENT AND EASY TO OPERATEDIAPHRAGM PUMPS- Air-powered operation, safe design, and high efficiencyTWIN SCREW PUMPS- High versatility and flexibilityPERISTALTIC PUMPS- Growing need for gentle transfer of sterile and shear-sensitive fluidsROTARY LOBE PUMPS- Ideal for fluids with high viscosityPROGRESSIVE CAVITY PUMPS- High accuracy in dosing applicationsECCENTRIC DISC PUMPS- Handles low and high viscous fluidsOTHERS

- 7.1 INTRODUCTION

-

7.2 VALVE BODYPROVIDES FRAMEWORK TO HOLD ALL INTEGRAL COMPONENTS

-

7.3 ACTUATORSPREFERRED FOR HIGH-PRECISION APPLICATIONS

-

7.4 CONTROL TOPSMONITORS PERFORMANCE OF DIFFERENT VALVE TYPES

-

7.5 POSITIONERSDETERMINES CORRECT VALVE POSITIONING

- 7.6 OTHER COMPONENTS

- 8.1 INTRODUCTION

-

8.2 STAINLESS STEELSTRONG AND FLEXIBLE PROPERTIES OF STEEL

-

8.3 BRONZEHIGH CORROSION RESISTANCE AND INEXPENSIVE NATURE OF BRONZE

-

8.4 COPPERHIGH DUCTILITY AND ELECTRICAL CONDUCTIVITY OF COPPER

- 9.1 INTRODUCTION

-

9.2 SINGLE-SEAT VALVESINCREASING DEMAND FOR SMALL FLOW RATE APPLICATIONS

-

9.3 DOUBLE-SEAT VALVESRISING ADOPTION OF SUPERIOR HYGIENE AND CLEANLINESS STANDARDS

-

9.4 BUTTERFLY VALVESINCREASING DEMAND FOR COST-EFFECTIVE VALVES

-

9.5 DIAPHRAGM VALVESHIGH ADOPTION IN PHARMACEUTICAL INDUSTRY

-

9.6 CONTROL VALVESGROWING ADOPTION FOR CRITICAL OPERATIONS AND ENHANCED SAFETY

- 9.7 OTHER VALVES

- 10.1 INTRODUCTION

-

10.2 STANDARDGROWING NEED TO MAINTAIN HIGH LEVEL OF HYGIENE ACROSS INDUSTRIES

-

10.3 ASEPTICINCREASING FOCUS ON PREVENTING CONTAMINATION AND ENSURING PRODUCT STERILIZATION

-

10.4 ULTRACLEANHIGHER SAFETY AND QUALITY PROTECTION OFFERED BY ULTRACLEAN HYGIENE CLASS

- 11.1 INTRODUCTION

-

11.2 SHUT-OFF/ISOLATIONFACILITATES START AND STOP FLOW OF FLUIDS

-

11.3 DIVERTOFFERS EASE OF OPERATION AND HIGH FLEXIBILITY

-

11.4 SAMPLINGALLOWS SAMPLE EXTRACTION FOR QUALITY TESTING AND ANALYSIS

- 11.5 OTHERS

- 12.1 INTRODUCTION

-

12.2 MANUALRISING DEMAND FOR RELIABLE AND COST-EFFECTIVE VALVES

-

12.3 AIR-ACTUATEDRISING FOCUS ON PROCESS AUTOMATION

- 13.1 INTRODUCTION

-

13.2 PROCESSED FOODINCREASING INVESTMENTS TO BOOST PROCESSED FOOD INDUSTRY

-

13.3 DAIRYRISING GOVERNMENT INITIATIVES AND INVESTMENTS

-

13.4 ALCOHOLIC BEVERAGEINCREASING HYGIENE AWARENESS IN ALCOHOLIC BEVERAGE INDUSTRY

-

13.5 NONALCOHOLIC BEVERAGEGROWING INVESTMENTS BY COUNTRIES TO STRENGTHEN NONALCOHOLIC BEVERAGE INDUSTRY

-

13.6 PHARMACEUTICALSTRINGENT QUALITY AND SAFETY STANDARDS IN PHARMACEUTICAL INDUSTRY

- 13.7 OTHER END-USER INDUSTRIES

- 14.1 INTRODUCTION

-

14.2 NORTH AMERICAIMPACT OF RECESSIONUS- Expansion of pharmaceutical manufacturing industryCANADA- Growth in food & beverage industryMEXICO- Attractive opportunities in manufacturing sector

-

14.3 EUROPEIMPACT OF RECESSIONGERMANY- Increasing pharmaceutical manufacturing sitesUK- Rapid growth in processed food and nonalcoholic beverage industryFRANCE- Thriving cosmetics industryITALY- Fast-growing processed food industryBENELUX- Strong presence of key chemical and pharmaceutical companiesREST OF EUROPE

-

14.4 ASIA PACIFICIMPACT OF RECESSIONCHINA- Strong manufacturing sectorJAPAN- Rising investments in pharmaceutical industryINDIA- Strong dairy and pharmaceutical industriesSOUTH KOREA- Increased use of hygienic pumps and valves in chemical industryAUSTRALIA- Rising demand for processed food productsREST OF ASIA PACIFIC

-

14.5 ROWIMPACT OF RECESSIONMIDDLE EAST & AFRICA- High demand from pharmaceutical and chemical industriesSOUTH AMERICA- Growing processed food industry

- 15.1 INTRODUCTION

- 15.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 15.3 TOP FIVE COMPANY REVENUE ANALYSIS

- 15.4 MARKET SHARE ANALYSIS, 2022

-

15.5 COMPANY EVALUATION QUADRANT, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

15.6 COMPANY EVALUATION QUADRANT FOR SMES, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 15.7 HYGIENIC PUMPS AND VALVES MARKET: COMPANY FOOTPRINT

- 15.8 COMPETITIVE BENCHMARKING

-

15.9 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHESDEALS

-

16.1 KEY PLAYERSALFA LAVAL- Business overview- Products offered- Recent developments- MnM viewGEA GROUP AKTIENGESELLSCHAFT- Business overview- Products offered- Recent developments- MnM viewSPX FLOW, INC.- Business overview- Products offered- Recent developments- MnM viewCHRISTIAN BÜRKERT GMBH & CO. KG- Business overview- Products offeredEMERSON ELECTRIC CO.- Business overview- Products offered- Recent developmentsEVOGUARD GMBH- Business overview- Products offeredFLOWSERVE CORPORATION- Business overview- Products offered- Recent developmentsGEMÜ GROUP- Business overview- Products offered- Recent developmentsINOXPA S.A.U.- Business overview- Products offered- Recent developmentsITT INC.- Business overview- Products offered- Recent developmentsKIESELMANN GMBH- Business overview- Products offeredKSB SE & CO. KGAA- Business overview- Products offered- Recent developmentsNEUMO EHRENBERG GROUP- Business overview- Products offeredSAMSON AG- Business overview- Products offeredSPIRAX-SARCO ENGINEERING PLC- Business overview- Products offered- Recent developments

-

16.2 OTHER PLAYERSADAMANT VALVESBARDIANI VALVOLE S.P.A.CIPRIANI HARRISON VALVESDFT INC.DIXON VALVE & COUPLING COMPANY, LLCDONJOY TECHNOLOGY CO., LTD.HAITIMA CORPORATIONHANNINGFIELDJONENG VALVES CO., LTD.STERIFLOW VALVETAPFLO GROUP

- 17.1 INTRODUCTION

-

17.2 INDUSTRIAL VALVES MARKET: BY REGIONINTRODUCTION

-

17.3 NORTH AMERICAUS- Aging water & wastewater infrastructure in US to accelerate market growthCANADA- Rising adoption of valves in oil & gas sector to contribute to market growthMEXICO- Thriving semiconductor industry to boost growth

- 18.1 INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS

- TABLE 1 RISK ASSESSMENT

- TABLE 2 HYGIENIC PUMPS AND VALVES MARKET: ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE OF HYGIENIC PUMPS AND VALVES

- TABLE 4 AVERAGE SELLING PRICE OF HYGIENIC VALVES OFFERED BY KEY PLAYERS (USD)

- TABLE 5 AVERAGE SELLING PRICE OF HYGIENIC VALVES, BY REGION (USD)

- TABLE 6 HYGIENIC PUMPS AND VALVES MARKET: PORTER’S FIVE FORCES ANALYSIS, 2022

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 9 GEA GROUP AKTIENGESELLSCHAFT PROVIDES VALVES TO G. SCHNEIDER & SOHN

- TABLE 10 INOXPA S.A.U. PROVIDES NEW PROCESSING EQUIPMENT AND VALVE MANIFOLDS TO CALIDAD PASCUAL S.A.

- TABLE 11 BEAR REPUBLIC BREWERY USES GEA HILGE HYGIA PUMPS TO FOCUS ON EFFICIENCY

- TABLE 12 LARGE SWEETS MANUFACTURER USES SLH TWIN SCREW PUMP BY ITT BORNEMANN TO SOLVE ITS WEAR ISSUE

- TABLE 13 SYMRISE PVT. LTD. BUILDS NEW PRODUCTION PLANT

- TABLE 14 US: TOP 20 PATENT OWNERS IN LAST 10 YEARS

- TABLE 15 HYGIENIC PUMPS AND VALVES MARKET: LIST OF PATENTS, 2019–2022

- TABLE 16 HYGIENIC PUMPS AND VALVES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 STANDARDS FOR HYGIENIC PUMPS AND VALVES MARKET

- TABLE 22 HYGIENIC VALVES AND PUMPS MARKET, BY VALVE TYPE, 2019–2022 (USD MILLION)

- TABLE 23 HYGIENIC VALVES AND PUMPS MARKET, BY VALVE TYPE, 2023–2028 (USD MILLION)

- TABLE 24 SINGLE-SEAT VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2019–2022 (USD MILLION)

- TABLE 25 SINGLE-SEAT VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2023–2028 (USD MILLION)

- TABLE 26 SINGLE-SEAT VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 27 SINGLE-SEAT VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 DOUBLE-SEAT VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2019–2022 (USD MILLION)

- TABLE 29 DOUBLE-SEAT VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2023–2028 (USD MILLION)

- TABLE 30 DOUBLE-SEAT VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 DOUBLE-SEAT VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 BUTTERFLY VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2019–2022 (USD MILLION)

- TABLE 33 BUTTERFLY VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2023–2028 (USD MILLION)

- TABLE 34 BUTTERFLY VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 BUTTERFLY VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 DIAPHRAGM VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2019–2022 (USD MILLION)

- TABLE 37 DIAPHRAGM VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2023–2028 (USD MILLION)

- TABLE 38 DIAPHRAGM VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 DIAPHRAGM VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 CONTROL VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2019–2022 (USD MILLION)

- TABLE 41 CONTROL VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2023–2028 (USD MILLION)

- TABLE 42 CONTROL VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 CONTROL VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 OTHER VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2019–2022 (USD MILLION)

- TABLE 45 OTHER VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2023–2028 (USD MILLION)

- TABLE 46 OTHER VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 47 OTHER VALVES: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2019–2022 (USD MILLION)

- TABLE 49 HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2023–2028 (USD MILLION)

- TABLE 50 MANUAL: HYGIENIC PUMPS AND VALVES MARKET, BY VALVE TYPE, 2019–2022 (USD MILLION)

- TABLE 51 MANUAL: HYGIENIC PUMPS AND VALVES MARKET, BY VALVE TYPE, 2023–2028 (USD MILLION)

- TABLE 52 MANUAL: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 MANUAL: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 AIR-ACTUATED: HYGIENIC PUMPS AND VALVES MARKET, BY VALVE TYPE, 2019–2022 (USD MILLION)

- TABLE 55 AIR-ACTUATED: HYGIENIC PUMPS AND VALVES MARKET, BY VALVE TYPE, 2023–2028 (USD MILLION)

- TABLE 56 AIR-ACTUATED: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 57 AIR-ACTUATED: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 HYGIENIC PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 59 HYGIENIC PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 60 PROCESSED FOOD: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 PROCESSED FOOD: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 DAIRY: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 DAIRY: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 ALCOHOLIC BEVERAGE: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 ALCOHOLIC BEVERAGE: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 NONALCOHOLIC BEVERAGE: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 NONALCOHOLIC BEVERAGE: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 PHARMACEUTICAL: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 PHARMACEUTICAL: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 OTHER END-USER INDUSTRIES: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 OTHER END-USER INDUSTRIES: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: HYGIENIC PUMPS AND VALVES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: HYGIENIC PUMPS AND VALVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: HYGIENIC PUMPS AND VALVES MARKET, BY VALVE TYPE, 2019–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: HYGIENIC PUMPS AND VALVES MARKET, BY VALVE TYPE, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2019–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: HYGIENIC PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: HYGIENIC PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 82 EUROPE: HYGIENIC PUMPS AND VALVES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 83 EUROPE: HYGIENIC PUMPS AND VALVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: HYGIENIC PUMPS AND VALVES MARKET, BY VALVE TYPE, 2019–2022 (USD MILLION)

- TABLE 85 EUROPE: HYGIENIC PUMPS AND VALVES MARKET, BY VALVE TYPE, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2019–2022 (USD MILLION)

- TABLE 87 EUROPE: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: HYGIENIC PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 89 EUROPE: HYGIENIC PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: HYGIENIC PUMPS AND VALVES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 91 ASIA PACIFIC: HYGIENIC PUMPS AND VALVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: HYGIENIC PUMPS AND VALVES MARKET, BY VALVE TYPE, 2019–2022 (USD MILLION)

- TABLE 93 ASIA PACIFIC: HYGIENIC PUMPS AND VALVES MARKET, BY VALVE TYPE, 2023–2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2019–2022 (USD MILLION)

- TABLE 95 ASIA PACIFIC: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2023–2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: HYGIENIC PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 97 ASIA PACIFIC: HYGIENIC PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 98 ROW: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 99 ROW: HYGIENIC PUMPS AND VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 100 ROW: HYGIENIC PUMPS AND VALVES MARKET, BY VALVE TYPE, 2019–2022 (USD MILLION)

- TABLE 101 ROW: HYGIENIC PUMPS AND VALVES MARKET, BY VALVE TYPE, 2023–2028 (USD MILLION)

- TABLE 102 ROW: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2019–2022 (USD MILLION)

- TABLE 103 ROW: HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE, 2023–2028 (USD MILLION)

- TABLE 104 ROW: HYGIENIC PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 105 ROW: HYGIENIC PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 106 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 107 HYGIENIC PUMPS AND VALVES MARKET SHARE ANALYSIS (2022)

- TABLE 108 COMPANY FOOTPRINT

- TABLE 109 PRODUCT: COMPANY FOOTPRINT

- TABLE 110 END-USER INDUSTRY: COMPANY FOOTPRINT

- TABLE 111 REGION: COMPANY FOOTPRINT

- TABLE 112 HYGIENIC PUMPS AND VALVES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 113 HYGIENIC PUMPS AND VALVES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 114 HYGIENIC PUMPS AND VALVES MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 115 HYGIENIC PUMPS AND VALVES MARKET: DEALS, 2019–2023

- TABLE 116 ALFA LAVAL: BUSINESS OVERVIEW

- TABLE 117 ALFA LAVAL: PRODUCTS OFFERED

- TABLE 118 ALFA LAVAL: PRODUCT LAUNCHES

- TABLE 119 GEA GROUP AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

- TABLE 120 GEA GROUP AKTIENGESELLSCHAFT: PRODUCTS OFFERED

- TABLE 121 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT LAUNCHES

- TABLE 122 SPX FLOW, INC.: BUSINESS OVERVIEW

- TABLE 123 SPX FLOW, INC.: PRODUCTS OFFERED

- TABLE 124 SPX FLOW, INC.: PRODUCT LAUNCHES

- TABLE 125 SPX FLOW, INC.: DEALS

- TABLE 126 CHRISTIAN BÜRKERT GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 127 CHRISTIAN BÜRKERT GMBH & CO. KG: PRODUCTS OFFERED

- TABLE 128 EMERSON ELECTRIC CO.: BUSINESS OVERVIEW

- TABLE 129 EMERSON ELECTRIC CO.: PRODUCTS OFFERED

- TABLE 130 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 131 EVOGUARD GMBH: BUSINESS OVERVIEW

- TABLE 132 EVOGUARD GMBH: PRODUCTS OFFERED

- TABLE 133 FLOWSERVE CORPORATION: BUSINESS OVERVIEW

- TABLE 134 FLOWSERVE CORPORATION: PRODUCTS OFFERED

- TABLE 135 FLOWSERVE CORPORATION: PRODUCT LAUNCHES

- TABLE 136 FLOWSERVE CORPORATION: DEALS

- TABLE 137 GEMÜ GROUP: BUSINESS OVERVIEW

- TABLE 138 GEMÜ GROUP: PRODUCTS OFFERED

- TABLE 139 GEMÜ GROUP: PRODUCT LAUNCHES

- TABLE 140 INOXPA S.A.U.: BUSINESS OVERVIEW

- TABLE 141 INOXPA S.A.U.: PRODUCTS OFFERED

- TABLE 142 INOXPA S.A.U.: PRODUCT LAUNCHES

- TABLE 143 ITT INC.: BUSINESS OVERVIEW

- TABLE 144 ITT INC.: PRODUCTS OFFERED

- TABLE 145 ITT INC.: PRODUCT LAUNCHES

- TABLE 146 ITT INC.: DEALS

- TABLE 147 KIESELMANN GMBH: BUSINESS OVERVIEW

- TABLE 148 KIESELMANN GMBH: PRODUCTS OFFERED

- TABLE 149 KSB SE & CO. KGAA: BUSINESS OVERVIEW

- TABLE 150 KSB SE & CO. KGAA: PRODUCTS OFFERED

- TABLE 151 KSB SE & CO. KGAA: PRODUCT LAUNCHES

- TABLE 152 KSB SE & CO. KGAA: OTHERS

- TABLE 153 NEUMO EHRENBERG GROUP: BUSINESS OVERVIEW

- TABLE 154 NEUMO EHRENBERG GROUP: PRODUCTS OFFERED

- TABLE 155 SAMSON AG: BUSINESS OVERVIEW

- TABLE 156 SAMSON AG: PRODUCTS OFFERED

- TABLE 157 SPIRAX-SARCO ENGINEERING PLC: BUSINESS OVERVIEW

- TABLE 158 SPIRAX-SARCO ENGINEERING PLC: PRODUCTS OFFERED

- TABLE 159 SPIRAX-SARCO ENGINEERING PLC: PRODUCT LAUNCHES

- TABLE 160 INDUSTRIAL VALVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 161 INDUSTRIAL VALVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 162 NORTH AMERICA: INDUSTRIAL VALVES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 163 NORTH AMERICA: INDUSTRIAL VALVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 164 NORTH AMERICA: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 165 NORTH AMERICA: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- FIGURE 1 HYGIENIC PUMPS AND VALVES MARKET: SEGMENTATION

- FIGURE 2 HYGIENIC PUMPS AND VALVES MARKET: REGIONS COVERED

- FIGURE 3 HYGIENIC PUMPS AND VALVES MARKET: RESEARCH DESIGN

- FIGURE 4 HYGIENIC PUMPS AND VALVES MARKET: RESEARCH APPROACH

- FIGURE 5 HYGIENIC PUMPS AND VALVES MARKET: BOTTOM-UP APPROACH

- FIGURE 6 HYGIENIC PUMPS AND VALVES MARKET: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY FOR HYGIENIC PUMPS AND VALVES MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 ASSUMPTIONS

- FIGURE 10 HYGIENIC PUMPS AND VALVES MARKET, 2019–2028 (USD MILLION)

- FIGURE 11 SINGLE-SEAT VALVES TO HOLD LARGEST MARKET SHARE FROM 2023 TO 2028

- FIGURE 12 AIR-ACTUATED HYGIENIC VALVES EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 PROCESSED FOOD INDUSTRY TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO RECORD HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 15 GROWING PROCESSED FOOD INDUSTRY AND STRINGENT GOVERNMENT REGULATIONS TO DRIVE MARKET GROWTH

- FIGURE 16 SINGLE-SEAT VALVES TO SECURE LARGEST MARKET SHARE FROM 2023 TO 2028

- FIGURE 17 PROCESSED FOOD INDUSTRY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 SINGLE-SEAT VALVES AND US TO BE LARGEST MARKET SHAREHOLDERS IN NORTH AMERICA BY 2028

- FIGURE 19 CHINA TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 20 GLOBAL HYGIENIC PUMPS AND VALVES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 HYGIENIC PUMPS AND VALVES MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 22 HYGIENIC PUMPS AND VALVES MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 23 HYGIENIC PUMPS AND VALVES MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 24 HYGIENIC PUMPS AND VALVES MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 25 HYGIENIC PUMPS AND VALVES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 HYGIENIC PUMPS AND VALVES MARKET: ECOSYSTEM

- FIGURE 27 AVERAGE SELLING PRICE TREND OF HYGIENIC VALVES, 2022–2028

- FIGURE 28 AVERAGE SELLING PRICE OF HYGIENIC VALVES OFFERED BY KEY PLAYER

- FIGURE 29 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN HYGIENIC PUMPS AND VALVES MARKET

- FIGURE 30 HYGIENIC PUMPS AND VALVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 33 IMPORT VALUE OF VALVES, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 34 EXPORT VALUE OF VALVES, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 35 IMPORT VALUE OF PUMPS, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 36 EXPORT VALUE OF PUMPS, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 37 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 38 NUMBER OF PATENTS GRANTED PER YEAR, 2013–2022

- FIGURE 39 HYGIENIC PUMPS AND VALVES MARKET, BY PUMP TYPE

- FIGURE 40 KEY COMPONENTS OF HYGIENIC VALVES

- FIGURE 41 HYGIENIC PUMPS AND VALVES MARKET, BY MATERIAL TYPE

- FIGURE 42 HYGIENIC PUMPS AND VALVES MARKET, BY VALVE TYPE

- FIGURE 43 SINGLE-SEAT VALVES TO HOLD LARGEST MARKET SHARE FROM 2023 TO 2028

- FIGURE 44 HYGIENIC PUMPS AND VALVES MARKET, BY HYGIENE CLASS

- FIGURE 45 HYGIENIC PUMPS AND VALVES MARKET, BY FUNCTION

- FIGURE 46 HYGIENIC PUMPS AND VALVES MARKET, BY OPERATION MODE

- FIGURE 47 AIR-ACTUATED HYGIENIC VALVES TO DOMINATE THROUGHOUT FORECAST PERIOD

- FIGURE 48 HYGIENIC PUMPS AND VALVES MARKET, BY END-USER INDUSTRY

- FIGURE 49 PROCESSED FOOD INDUSTRY TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 50 HYGIENIC PUMPS AND VALVES MARKET, BY REGION

- FIGURE 51 CHINA TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 52 NORTH AMERICA: HYGIENIC PUMPS AND VALVES MARKET SNAPSHOT

- FIGURE 53 US TO ACCOUNT FOR LARGEST SHARE IN NORTH AMERICA THROUGHOUT FORECAST PERIOD

- FIGURE 54 EUROPE: HYGIENIC PUMPS AND VALVES MARKET SNAPSHOT

- FIGURE 55 GERMANY TO SECURE LARGEST MARKET SHARE IN EUROPE THROUGHOUT FORECAST PERIOD

- FIGURE 56 ASIA PACIFIC: HYGIENIC PUMPS AND VALVES MARKET SNAPSHOT

- FIGURE 57 CHINA TO RECORD HIGHEST CAGR IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 58 MIDDLE EAST & AFRICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 59 HYGIENIC PUMPS AND VALVES MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2017–2021

- FIGURE 60 SHARE OF KEY PLAYERS IN HYGIENIC PUMPS AND VALVES MARKET, 2022

- FIGURE 61 HYGIENIC PUMPS AND VALVES MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 62 HYGIENIC PUMPS AND VALVES MARKET: COMPANY EVALUATION QUADRANT FOR SMES, 2022

- FIGURE 63 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 64 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 65 SPX FLOW, INC.: COMPANY SNAPSHOT

- FIGURE 66 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 67 FLOWSERVE CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 ITT INC.: COMPANY SNAPSHOT

- FIGURE 69 KSB SE & CO. KGAA.: COMPANY SNAPSHOT

- FIGURE 70 SPIRAX-SARCO ENGINEERING PLC: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the hygienic pumps and valves market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. The next step has been to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the hygienic pumps and valves market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred hygienic pumps and valves providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from hygienic pumps and valves providers, such as Alfa Laval (Sweden), GEA Group Aktiengesellschaft (Germany), SPX FLOW, Inc. (US), Emerson Electric Co. (US), Spirax-Sarco Engineering plc (UK), and Flowserve Corporation (US); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the hygienic pumps and valves market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

A hygienic valve is a mechanical device used in industrial process equipment for controlling, regulating, and diverting the flow of liquids or gas. The valves use an actuator to provide power for flow control. These are the most common elements used in process industries to automatically regulate and control the flow, pressure, and level of media. The main components of hygienic valves are the valve body, actuators, control tops, and positioners. A hygienic pump is a device used for transporting fluids in pipelines in process industries.

Key Stakeholders

- Government bodies, such as regulatory authorities and policymakers

- Organizations, forums, alliances, and associations

- Market research and consulting firms

- Raw material suppliers and distributors

- Research institutes and organizations

- Hygienic pumps and valves original equipment manufacturers (OEMs)

- Traders and suppliers

Report Objectives

- To define and forecast the hygienic pumps and valves market in terms of valve type, operation mode, and end-user industry.

- To describe and forecast the hygienic pumps and valves market and its value segments for four regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain and allied industry segments of the hygienic pumps and valves market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with a detailed market competitive landscape.

- To analyze strategic approaches such as agreements, collaborations, and partnerships in the hygienic pumps and valves market

- To provide an analysis of the recession impact on the growth of the market and its segments

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hygienic Pumps and Valves Market