Satellite Launch Vehicle Market by Vehicle (Small (<350,000 Kg), Medium to Heavy (>350,000 Kg)), Payload (<500 Kg, 500-2,500 Kg, >2,500 Kg), Orbit, Launch, Stage, Subsystem, Service and Region - Global Forecast to 2027

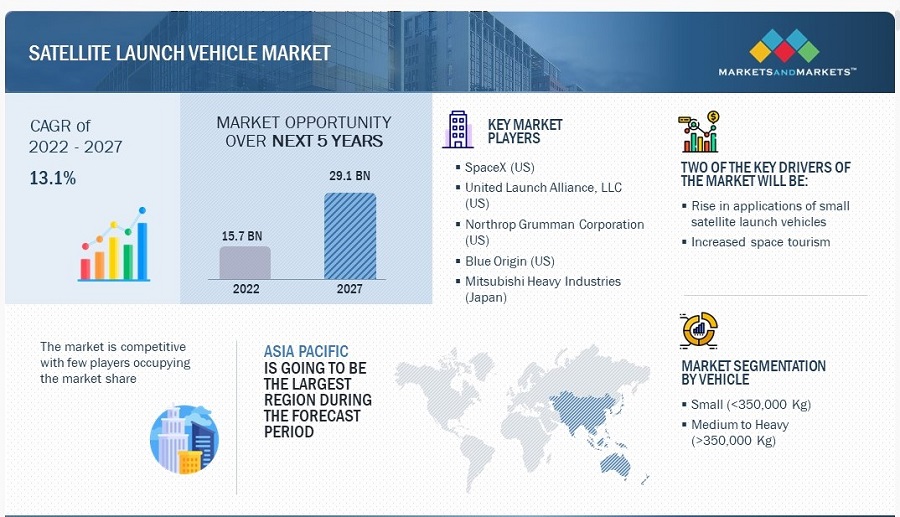

The Satellite Launch Vehicle Market is estimated to be USD 15.7 billion in 2022 and is projected to reach USD 29.1 billion by 2027, at a CAGR of 13.1% from 2022 to 2027. The market is driven by factors such as different value chain levels for vendors, increased use of dedicated small satellite launch vehicles, reusable launch vehicles among others. Artificial intelligence is set to revolutionize the satellite launch vehicle (SLV) industry, driving major advancements in vehicle design, mission optimization, cost efficiency, and operational capabilities.

Satellite Launch Vehicle Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Satellite Launch Vehicle Market Dynamics:

Drivers: Rise in applications of small satellite launch vehicles.

Small satellite launch vehicles are designed to carry payloads weighing up to several hundred kilograms, typically for low Earth orbit (LEO) missions. These launch vehicles are becoming increasingly popular due to the rise in the number of small satellite constellations, which are being used for a variety of applications such as Earth observation, communications, and scientific research.

The importance of small satellites has grown significantly in recent years. Previously, only larger satellite payloads were launched into space, but as the industry has expanded, a wide range of players such as businesses, government agencies, universities, and laboratories have started sending satellites, most of which are smaller in size. The demand for launching small satellites has risen rapidly in the last decade, driven by the increasing need for space-based services such as data, communication, surveillance, and commerce. Satellite manufacturers and operators cannot afford to wait for months to launch their satellites or pay high transportation costs. As a result, organizations are now focusing on developing satellite constellations

Restraints: Oversaturation in launch vehicle market.

Access to space at a low cost is a critical enabler of the commercial space economy. With the help of competition, launch vehicle manufacturers are lowering their costs through improved manufacturing techniques and advanced technology. This has led to an expected increase in the amount of payload sent to orbit in the coming decade. Several companies aim to provide a ride for these payloads. Nevertheless, the small launch vehicle market is already oversaturated with over 75 companies with vehicles in various stages of development or operation. Hence, launch providers that can establish a market presence early and prove their ability to deliver customer payloads reliably have the best chance of long-term sustainability. New entrants later in the decade will need to make use of disruptive technology and/or offer significantly lower prices to capture market share.

Opportunities: Increased outsourcing of manufacturing activities.

In recent years, there has been an increased trend toward outsourcing manufacturing in the launch vehicle industry, due to several factors, including reduced manufacturing cost, increased efficiency, and access to specialized expertise.

One of the primary reasons for outsourcing manufacturing in the launch vehicle industry is cost savings. By outsourcing manufacturing, companies can take advantage of lower labor and material costs in other countries. This can lead to significant cost savings, particularly for large-scale projects.

Outsourcing can also increase efficiency in the manufacturing process. By working with specialized manufacturers, launch vehicle companies can benefit from the latest manufacturing technologies and processes, which can help to reduce production time and improve quality.

Another advantage of outsourcing manufacturing in the space industry is access to specialized expertise. Space companies may not have the in-house expertise or resources needed to manufacture certain components or systems, and outsourcing can help to fill these gaps.

However, outsourcing also comes with certain challenges and risks. For example, there may be concerns around intellectual property protection when it comes to launching vehicles, quality control, and communication barriers when working with manufacturers in other countries. It is important for launch vehicle companies to carefully consider these factors when deciding whether to outsource manufacturing and to work closely with their manufacturing partners to mitigate any potential risks.

Challenges: Reliability and safety of launch vehicles.

Ensuring the reliable and safe operation of satellite launch vehicles is a major challenge for the industry. The reliability and safety of launch vehicles are crucial, as a failure during launch can result in loss of the payload, as well as potential harm to people and property on the ground.

The Falcon 9 by SpaceX (US) has had several successful launches but has also suffered several high-profile failures. In 2015, a Falcon 9 rocket exploded during a routine test flight, resulting in the loss of the payload. More recently, in 2019, another Falcon 9 rocket suffered a first-stage failure during launch, resulting in the loss of the payload.

In order to address these challenges, companies are investing heavily in research and development to improve the reliability and safety of their launch vehicles. This includes the use of advanced materials and propulsion systems, as well as the development of robust and redundant safety systems. The company is also using data analytics and machine learning to improve the performance and safety of its launches.

Ensuring the reliable and safe operation of satellite launch vehicles remains a major challenge for the industry, and companies are constantly working to improve the technology and safety systems used in their launch vehicles.

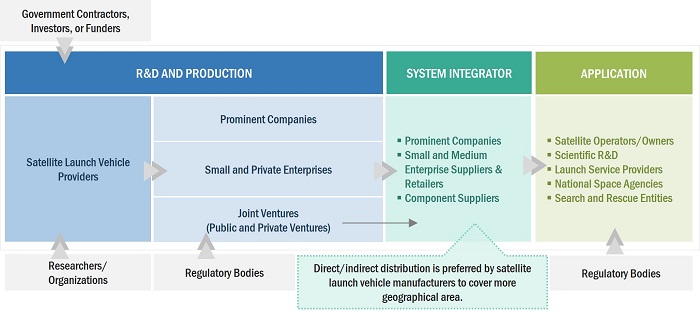

Satellite Launch Vehicle Market Ecosystem

Raw material suppliers, component manufacturers, simulator manufacturers, distributors, and end users such as satellite manufacturers and government space agencies are key stakeholders in the satellite launch vehicle market ecosystem. Investors, funders, academic researchers, integrators, service providers, and licensing authorities serve as major influencers in the market. The strategy of securing contracts was widely adopted by leading players, such as SpaceX (US), United Launch Alliance, LLC (US), Northrop Grumman Corporation (US), Blue Origin (US), and Mitsubishi Heavy Industries (Japan) to enhance their presence in the market.

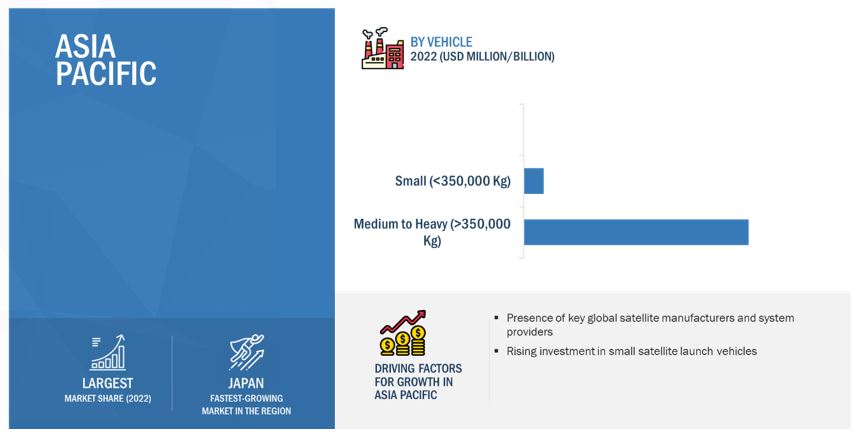

Based on vehicle, the medium to heavy (>350,000 Kg) segment is projected to lead the satellite launch vehicle market during the forecast period.

A medium to heavy launch vehicle is a rocket orbital launch vehicle capable of lifting above 20,000 kg (44092.4 lb.) of payload into Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Orbit (GEO). Ariane 5, Proton-M, Delta IV Heavy, and others are some medium to heavy vehicles. The following are the advantages of medium to heavy launch vehicles. Increased Payload Capacity: Medium to heavy launch vehicles can carry much larger payloads than smaller rockets, allowing for larger and more complex satellites, telescopes, and other scientific instruments to be placed in orbit. Reduced Launch Costs: While medium to heavy launch vehicles are more expensive to build and operate than smaller rockets, their increased payload capacity can reduce the cost per unit of payload delivered to space. This is because fewer launches are required to deliver the same amount of payload, which can result in significant cost savings. Flexibility: Heavy launch vehicles can be used for a wide range of missions, including delivering payloads to low Earth orbit, the geostationary orbit, and beyond. This makes them a versatile tool for space exploration and commercial applications. Access to More Challenging Orbits: A launch vehicle needs significant energy to reach geostationary orbit. Heavy launch vehicles have the power and capability to reach these more challenging orbits, enabling greater access to space for a wider range of missions.

For instance, in December 2022, Arianespace SA (France) launched Europe’s most advanced weather-tracking spacecraft along with a pair of satellites. The triple payload totaling nearly 11,000 kilograms lifted off on a heavy-lift Ariane 5 rocket and was designated for the geostationary transfer orbit.

Based on launch, the reusable segment is projected to grow at the highest CAGR in the satellite launch vehicle market during the forecast period.

Reusable launch vehicles (RLVs) are satellite launch vehicles designed to be recovered and reused after launching a payload into space. Unlike single-use launch vehicles, which are discarded after a single-use, reusable launch vehicles can be flown multiple times, potentially reducing the cost of spaceflight by a significant margin.

Reusable launch vehicles typically consist of two main components: the rocket booster and the spacecraft or payload. The rocket booster is part of the vehicle that provides the initial thrust to launch the spacecraft into space, while the spacecraft or payload is the object being launched.

There are several types of reusable launch vehicles, including the Space Shuttle, the Falcon 9 rocket manufactured by SpaceX (US), and the New Shepard rocket manufactured by Blue Origin (US). These vehicles have been used for a variety of missions, such as launching satellites and sending astronauts to the International Space Station (ISS).

The advantages of reusable launch vehicles include reduced launch costs, increased efficiency, and reduced waste. Companies and space agencies can save on the costs of manufacturing and launching a new rocket for each mission by reusing the rocket booster. Additionally, reusable launch vehicles can be designed to be more efficient and reliable than single-use launch vehicles, which can increase the success rate of space missions.

Asia Pacific is expected to account for the largest share in the forecasted period.

Asia Pacific is estimated to account for the largest share in the forecasted period. Asia Pacific is the second-largest market for satellite capacity usage. There will be many more satellites built and launched in the coming years. The presence of various satellite providers in this region, such as Speedcast International (Hong Kong) and ITC Global (Australia), cater to the increasing demand for digital TV and Direct-to-Home (DTH) entertainment services. An increase in digital broadcasting services and a rise in demand for mobile broadband are key factors contributing to the growth of the satellite launch vehicle industry in Asia Pacific. Technological advancements in the field of launch vehicles have led to the development of reusable launch vehicles in terms of design, function, and integration. India and Japan have advanced their space knowledge and are moving toward military space programs, despite maintaining their commitment to using space for peaceful purposes. South Korea has also been constructing launch vehicles and Earth observation satellites as part of its space program.

Satellite Launch Vehicle Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Satellite Launch Vehicle Companies - Key Market Players

The satellite launch vehicle companies are dominated by globally established players such as SpaceX (US), United Launch Alliance, LLC (US), Northrop Grumman Corporation (US), Blue Origin (US), and Mitsubishi Heavy Industries (Japan). The report covers various industry trends and new technological innovations in the satellite launch vehicle’ market for the period, 2018-2027.

Scope of the Satellite Launch Vehicle Market Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 15.7 billion by 2022 |

|

Projected Market Size |

USD 29.1 billion by 2027 |

|

CAGR |

13.1% |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD billion) |

|

Segments Covered |

Vehicle, Payload, Orbit, Launch, Stage, Subsystem, Service and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Rest of the World |

|

Companies Covered |

SpaceX (US), United Launch Alliance, LLC (US), Northrop Grumman Corporation (US), Blue Origin (US), and Mitsubishi Heavy Industries (Japan) among 25 others. |

Satellite Launch Vehicle Market Highlights

This research report categorizes the satellite launch vehicle market based on Vehicle, Payload, Orbit, Launch, Stage, Subsystem, Service and Region.

|

Segment |

Subsegment |

|

By Vehicle |

|

|

By Payload |

|

|

By Orbit |

|

|

By Launch |

|

|

By Stage |

|

|

By Subsystem |

|

|

Satellite Launch Vehicle Services Market |

|

|

Region |

|

Recent Developments

- In January 2023, SpaceX’s Falcon 9 launched 49 Starlink satellites and D-Orbit’s ION SCV009 Eclectic Elena to low-Earth orbit.

- In January 2023, SpaceX’s Falcon 9 launched 56 Starlink satellites to low-Earth orbit from Space Launch Complex 40 at Cape Canaveral Space Force Station, Florida. This was the ninth launch and landing for this Falcon 9 first-stage booster.

- In November 2022, Rocket Lab has been awarded two contracts worth a total of USD14 million to provide satellite separation systems for Space Development Agency’s (SDA) Tranche 1 Transport Layer (T1TL) satellites.

- In October 2022, United Launch Alliance (US) successfully launches two key SES commercial c-band satellites. Atlas V launched SES-20 and SES-21 to deliver TV, radio, and critical data transmission services in support of the FCC’s 5G national transition.

- In February 2022, Northrop Grumman Corporation Corporation’s Space Logistics announced a launch agreement for its Mission Robotic Vehicle (MRV) spacecraft, and the sale of its first Mission Extension Pod (MEP).

Frequently Asked Questions (FAQ):

What is the current size of the satellite launch vehicle market?

The satellite launch vehicle market is projected to grow from an estimated USD 15.7 billion in 2022 to USD 29.1 billion by 2027, at a CAGR of 13.1% .

Who are the winners in the satellite launch vehicle market?

SpaceX (US), United Launch Alliance, LLC (US), Northrop Grumman Corporation (US), Blue Origin (US), and Mitsubishi Heavy Industries (Japan) are some of the winners in the market.

What are some of the opportunities of the satellite launch vehicle market?

Advancements in designing satellite launch vehicles, Increased outsourcing of manufacturing activities are few of the opportunities of the satellite launch vehicle market.

What are some of the technological advancements in the market?

Air-launched rockets, electric propulsion, 3D printing , Autonomous systems among others.

What are the factors driving the growth of the market?

Rise in applications of small satellite launch vehicles, Increased space tourism are some of the key factors driving the growth in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rise in demand for small satellites across various applications- Increased space tourismRESTRAINTS- Oversaturation in launch vehicle marketOPPORTUNITIES- Advancements in satellite launch vehicle designs- Increased outsourcing of manufacturing activitiesCHALLENGES- Reliability and safety of launch vehicles- Increased carbon footprint due to space launches

-

5.3 VALUE CHAIN ANALYSISUPSTREAM PLAYERSLAUNCH VEHICLE MANUFACTURERSLAUNCH SERVICE PROVIDERSDOWNSTREAM PLAYERSGOVERNMENT AGENCIESSATELLITE OPERATORS

-

5.4 SATELLITE LAUNCH VEHICLE MARKET ECOSYSTEM

-

5.5 DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS IN SATELLITE LAUNCH VEHICLE MARKET

- 5.6 RECESSION IMPACT ANALYSIS OF SATELLITE LAUNCH VEHICLE MARKET

-

5.7 TECHNOLOGY ANALYSISSYNERGETIC AIR-BREATHING ROCKET ENGINE

-

5.8 PRICING ANALYSISAVERAGE SELLING PRICES

- 5.9 VOLUME DATA

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.11 TRADE DATA ANALYSIS

-

5.12 TARIFF AND REGULATORY LANDSCAPENORTH AMERICAEUROPEASIA PACIFICMIDDLE EAST

- 5.13 KEY CONFERENCES AND EVENTS IN 2023

-

5.14 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSAIR-LAUNCHED ROCKETSELECTRIC PROPULSION3D PRINTINGAUTONOMOUS SYSTEMSSEMI CRYOGENIC ENGINESORBITAL ACCELERATOR

-

6.3 USE CASES: SATELLITE LAUNCH VEHICLE MARKETAUTONOMOUS SPACEPORT DRONE SHIPSMALL SATELLITE LAUNCH VEHICLEELECTRIC PROPULSION

-

6.4 PATENT ANALYSIS

-

6.5 IMPACT OF MEGATRENDSREUSABLE ROCKETS SIGNIFICANTLY REDUCE LAUNCH COSTSINCREASED NUMBER OF SMALL SATELLITE LAUNCHES TO LEAD TO CREATION OF SATELLITE CONSTELLATIONSSPACE TOURISM SUPPORTS GROWTH OF SPACE LAUNCH SERVICES

- 7.1 INTRODUCTION

-

7.2 SINGLE-USE/EXPENDABLEEXTENSIVE USE TO LAUNCH LIGHTER PAYLOADS TO DRIVE SEGMENT

-

7.3 REUSABLEINCREASED PREFERENCE DUE TO LOWER LAUNCH COSTS TO PROPEL SEGMENT

- 8.1 INTRODUCTION

-

8.2 LOW EARTH ORBIT (LEO)EXTENSIVE DEPLOYMENT OF COMMUNICATION SATELLITES TO PROPEL SEGMENT

-

8.3 MEDIUM EARTH ORBIT (MEO)RISE IN NUMBER OF SATELLITE NAVIGATION SYSTEMS TO DRIVE SEGMENT

-

8.4 GEOSTATIONARY EARTH ORBIT (GEO)RISE IN NUMBER OF WEATHER MONITORING SATELLITES TO DRIVE SEGMENT

- 9.1 INTRODUCTION

-

9.2 <500 KGRISE IN NUMBER OF SMALL SATELLITE CONSTELLATIONS TO FUEL SEGMENT

-

9.3 500 KG–2,500 KGINCREASED APPLICATIONS IN CLIMATE & ENVIRONMENTAL MONITORING, EARTH OBSERVATION & METEOROLOGY TO DRIVE SEGMENT

-

9.4 >2,500 KGRISE IN DEMAND FOR COMMUNICATION SUBSYSTEMS TO PROPEL SEGMENT

- 10.1 INTRODUCTION

-

10.2 SINGLE STAGESIMPLE AND LESS EXPENSIVE DESIGN TO DRIVE SEGMENT

-

10.3 TWO STAGEABILITY TO ACHIEVE HIGHER SPEEDS AND ALTITUDES TO BOOST SEGMENT

-

10.4 THREE STAGEINCREASED USE IN DEEP SPACE MISSIONS TO PROPEL SEGMENT

- 11.1 INTRODUCTION

-

11.2 STRUCTUREUSE OF ADVANCED MATERIALS TO SPUR SEGMENT GROWTH

-

11.3 GUIDANCE, NAVIGATION & CONTROL SYSTEMS (GN&C)INCREASED USE OF AUTOMATED GUIDANCE, NAVIGATION, AND CONTROL (GN&C) SYSTEMS TO PROPEL SEGMENT

-

11.4 PROPULSION SYSTEMSRISE IN DEMAND FOR ELECTRIC PROPULSION SYSTEMS TO DRIVE SEGMENT

-

11.5 TELEMETRY, TRACKING & COMMAND SYSTEMSIMPROVED AND FULLY REDUNDANT TELEMETRY SYSTEMS TO BOOST SEGMENT

-

11.6 ELECTRICAL POWER SYSTEMSINTRODUCTION OF EFFICIENT POWER GENERATION SYSTEMS TO DRIVE SEGMENT

-

11.7 SEPARATION SYSTEMSUSE OF PYROTECHNIC DEVICES AND ACTIVE SEPARATION SYSTEMS TO DRIVE SEGMENT

- 12.1 INTRODUCTION

-

12.2 SMALL (<350,000 KG)RAPID DEPLOYMENT AND TARGETED PAYLOAD DELIVERY TO DRIVE SEGMENT

-

12.3 MEDIUM TO HEAVY (>350,000 KG)INCREASED PAYLOAD CAPACITY AT REDUCED LAUNCH COSTS TO DRIVE SEGMENT

- 13.1 ENGINEERING AND DESIGN SERVICES

- 13.2 TESTING AND CERTIFICATION SERVICES

- 13.3 MANUFACTURING AND ASSEMBLY SERVICES

- 13.4 LOGISTICS AND SUPPLY CHAIN MANAGEMENT SERVICES

- 14.1 INTRODUCTION

- 14.2 REGIONAL RECESSION IMPACT ANALYSIS

-

14.3 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Presence of major companies manufacturing launch vehicles to boost marketCANADA- New regulations pertaining to satellite launches to drive market

-

14.4 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Ambitious space programs to drive marketINDIA- Increased demand for satellite launches for both commercial and government applications to propel marketJAPAN- Well-planned space launch programs to drive marketSOUTH KOREA- Significant investments by government to boost marketNEW ZEALAND- Increased small satellite launches to drive marketAUSTRALIA- Efforts by government and private sectors to propel market

-

14.5 EUROPEPESTLE ANALYSIS: EUROPERUSSIA- Dominance in space industry to drive marketFRANCE- Increased investments in space programs to propel marketGERMANY- Major contributions to European Space Agency’s R&D budget to propel marketUK- Space Innovation and Growth Strategy by government to drive marketITALY- Rise in demand for communication and remote sensing small satellites to propel market

-

14.6 REST OF WORLDPESTLE ANALYSIS: REST OF THE WORLDMIDDLE EAST & AFRICALATIN AMERICA

- 15.1 INTRODUCTION

-

15.2 COMPETITIVE OVERVIEWKEY DEVELOPMENTS OF LEADING PLAYERS IN SATELLITE LAUNCH VEHICLE MARKET, 2018–2022

- 15.3 RANKING ANALYSIS OF KEY PLAYERS, 2021

- 15.4 REVENUE ANALYSIS OF KEY PLAYERS, 2021

- 15.5 MARKET SHARE ANALYSIS, 2021

-

15.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE BENCHMARKING

-

15.7 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

15.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

- 16.1 INTRODUCTION

-

16.2 KEY PLAYERSSPACE EXPLORATION TECHNOLOGIES CORP.- Business overview- Products offered- Recent developments- MnM viewUNITED LAUNCH ALLIANCE, LLC- Business overview- Products offered- Recent developments- MnM viewNORTHROP GRUMMAN CORPORATION- Business overview- Products offered- Recent developments- MnM viewMITSUBISHI HEAVY INDUSTRIES- Business overview- Products offered- Recent developments- MnM viewBLUE ORIGIN- Business overview- Products offered- Recent developments- MnM viewABL SPACE SYSTEMS- Business overview- Products offered- Recent developmentsINDIAN SPACE RESEARCH ORGANIZATION- Business overview- Products offered- Recent developmentsTHE BOEING COMPANY- Business overview- Products offered- Recent developmentsFIREFLY AEROSPACE- Business overview- Products offered- Recent developmentsROCKET LAB- Business overview- Products offered- Recent developmentsRELATIVITY SPACE- Business overview- Products offered- Recent developmentsISRAEL AEROSPACE INDUSTRY LTD.- Business overview- Products offered- Recent developmentsARIANESPACE SA- Business overview- Products offered- Recent developmentsONE SPACE TECHNOLOGY INC.- Business overview- Products offered- Recent developmentsVIRGIN ORBIT- Business overview- Products offered- Recent developments

-

16.3 OTHER PLAYERSSKYROOT AEROSPACEAGNIKUL COSMOS PRIVATE LIMITEDGALACTIC ENERGY AEROSPACE TECHNOLOGY CO. LTD.I-SPACESKYRORA LIMITEDGILMOUR SPACE TECHNOLOGIESC6 LAUNCH SYSTEMSROCKET FACTORY AUGSBURGHYIMPULSE TECHNOLOGIES GMBHISAR AEROSPACE

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 INCLUSIONS AND EXCLUSIONS

- TABLE 3 OUTSOURCING COMPANIES FOR NASA

- TABLE 4 PROPELLANTS USED AND EMISSIONS FROM LAUNCH VEHICLES

- TABLE 5 SATELLITE LAUNCH VEHICLE MARKET ECOSYSTEM

- TABLE 6 AVERAGE SELLING PRICES OF LAUNCH VEHICLES (USD MILLION)

- TABLE 7 MARKET: VOLUME DATA (UNITS)

- TABLE 8 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 9 COUNTRY-WISE IMPORTS, 2020-2021 (USD THOUSAND)

- TABLE 10 COUNTRY-WISE EXPORTS, 2020-2021 (USD THOUSAND)

- TABLE 11 MARKET CONFERENCES AND EVENTS, 2023

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 13 KEY BUYING CRITERIA FOR END USERS

- TABLE 14 AUTONOMOUS SPACEPORT DRONE SHIP

- TABLE 15 SMALL SATELLITE LAUNCH VEHICLE

- TABLE 16 ELECTRIC PROPULSION

- TABLE 17 PATENTS RELATED TO SATELLITE LAUNCH VEHICLES, 2019–2022

- TABLE 18 SATELLITE LAUNCH VEHICLE MARKET, BY LAUNCH, 2018–2021 (USD MILLION)

- TABLE 19 MARKET, BY LAUNCH, 2022–2027 (USD MILLION)

- TABLE 20 MARKET, BY ORBIT, 2018–2021 (USD MILLION)

- TABLE 21 MARKET, BY ORBIT, 2022–2027 (USD MILLION)

- TABLE 22 MARKET, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 23 MARKET, BY PAYLOAD, 2022–2027 (USD MILLION)

- TABLE 24 MARKET, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 25 MARKET, BY STAGE, 2022–2027 (USD MILLION)

- TABLE 26 MARKET, BY SUBSYSTEM, 2018–2021 (USD MILLION)

- TABLE 27 MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

- TABLE 28 MARKET, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 29 SATELLITE LAUNCH VEHICLE MARKET, BY VEHICLE, 2022–2027 (USD MILLION)

- TABLE 30 MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

- TABLE 31 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

- TABLE 32 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 33 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 34 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027(USD MILLION)

- TABLE 35 NORTH AMERICA: MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 36 NORTH AMERICA: MARKET SIZE, BY VEHICLE, 2022–2027(USD MILLION)

- TABLE 37 NORTH AMERICA: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 38 NORTH AMERICA: MARKET SIZE, BY PAYLOAD, 2022–2027(USD MILLION)

- TABLE 39 NORTH AMERICA: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 40 NORTH AMERICA: MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 41 US: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 42 US: MARKET SIZE, BY VEHICLE, 2022–2027 (USD MILLION)

- TABLE 43 US: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 44 US: MARKET SIZE, BY PAYLOAD, 2022–2027 (USD MILLION)

- TABLE 45 US: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 46 US: MARKET SIZE, BY STAGE, 2022–2027 (USD MILLION)

- TABLE 47 CANADA: MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 48 CANADA: MARKET SIZE, BY VEHICLE, 2022–2027 (USD MILLION)

- TABLE 49 CANADA: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 50 CANADA: MARKET SIZE, BY PAYLOAD, 2022–2027 (USD MILLION)

- TABLE 51 CANADA: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 52 CANADA: MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 53 ASIA PACIFIC: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 54 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027(USD MILLION)

- TABLE 55 ASIA PACIFIC: MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 56 ASIA PACIFIC: MARKET SIZE, BY VEHICLE, 2022–2027(USD MILLION)

- TABLE 57 ASIA PACIFIC: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 58 ASIA PACIFIC: MARKET SIZE, BY PAYLOAD, 2022–2027(USD MILLION)

- TABLE 59 ASIA PACIFIC: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 60 ASIA PACIFIC: MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 61 CHINA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 62 CHINA: MARKET SIZE, BY VEHICLE, 2022–2027(USD MILLION)

- TABLE 63 CHINA: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 64 CHINA: MARKET SIZE, BY PAYLOAD, 2022–2027(USD MILLION)

- TABLE 65 CHINA: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 66 CHINA: MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 67 INDIA: MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 68 INDIA: MARKET SIZE, BY VEHICLE, 2022–2027(USD MILLION)

- TABLE 69 INDIA: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 70 INDIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022–2027(USD MILLION)

- TABLE 71 INDIA: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 72 INDIA: MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 73 JAPAN: MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 74 JAPAN: MARKET SIZE, BY VEHICLE, 2022–2027(USD MILLION)

- TABLE 75 JAPAN: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 76 JAPAN: MARKET SIZE, BY PAYLOAD, 2022–2027(USD MILLION)

- TABLE 77 JAPAN: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 78 JAPAN: MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 79 SOUTH KOREA: MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 80 SOUTH KOREA: MARKET SIZE, BY VEHICLE, 2022–2027(USD MILLION)

- TABLE 81 SOUTH KOREA: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 82 SOUTH KOREA: MARKET SIZE, BY PAYLOAD, 2022–2027(USD MILLION)

- TABLE 83 SOUTH KOREA: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 84 SOUTH KOREA: MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 85 NEW ZEALAND: MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 86 NEW ZEALAND: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022–2027(USD MILLION)

- TABLE 87 NEW ZEALAND: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 88 NEW ZEALAND: MARKET SIZE, BY PAYLOAD, 2022–2027(USD MILLION)

- TABLE 89 NEW ZEALAND: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 90 NEW ZEALAND: MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 91 AUSTRALIA: MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 92 AUSTRALIA: MARKET SIZE, BY VEHICLE, 2022–2027(USD MILLION)

- TABLE 93 AUSTRALIA: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 94 AUSTRALIA: MARKET SIZE, BY PAYLOAD, 2022–2027(USD MILLION)

- TABLE 95 AUSTRALIA: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 96 AUSTRALIA: MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 97 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 98 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027(USD MILLION)

- TABLE 99 EUROPE: MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 100 EUROPE: MARKET SIZE, BY VEHICLE, 2022–2027(USD MILLION)

- TABLE 101 EUROPE: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 102 EUROPE: MARKET SIZE, BY PAYLOAD, 2022–2027(USD MILLION)

- TABLE 103 EUROPE: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 104 EUROPE: MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 105 RUSSIA: MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 106 RUSSIA: MARKET SIZE, BY VEHICLE, 2022–2027(USD MILLION)

- TABLE 107 RUSSIA: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 108 RUSSIA: MARKET SIZE, BY PAYLOAD, 2022–2027(USD MILLION)

- TABLE 109 RUSSIA: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 110 RUSSIA: MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 111 FRANCE: MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 112 FRANCE: MARKET SIZE, BY VEHICLE, 2022–2027(USD MILLION)

- TABLE 113 FRANCE: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 114 FRANCE: MARKET SIZE, BY PAYLOAD, 2022–2027(USD MILLION)

- TABLE 115 FRANCE: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 116 FRANCE: MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 117 GERMANY: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 118 GERMANY: MARKET SIZE, BY VEHICLE, 2022–2027(USD MILLION)

- TABLE 119 GERMANY: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 120 GERMANY: MARKET SIZE, BY PAYLOAD, 2022–2027(USD MILLION)

- TABLE 121 GERMANY: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 122 GERMANY: MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 123 UK: MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 124 UK: MARKET SIZE, BY VEHICLE, 2022–2027(USD MILLION)

- TABLE 125 UK: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 126 UK: MARKET SIZE, BY PAYLOAD, 2022–2027(USD MILLION)

- TABLE 127 UK: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 128 UK: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 129 ITALY: MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 130 ITALY: MARKET SIZE, BY VEHICLE, 2022–2027(USD MILLION)

- TABLE 131 ITALY: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 132 ITALY: MARKET SIZE, BY PAYLOAD, 2022–2027(USD MILLION)

- TABLE 133 ITALY: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 134 ITALY: MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 135 REST OF THE WORLD: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 136 REST OF THE WORLD: MARKET SIZE, BY COUNTRY, 2022–2027(USD MILLION)

- TABLE 137 REST OF THE WORLD: MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 138 REST OF THE WORLD: MARKET SIZE, BY VEHICLE, 2022–2027(USD MILLION)

- TABLE 139 REST OF THE WORLD: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 140 REST OF THE WORLD: MARKET SIZE, BY PAYLOAD, 2022–2027(USD MILLION)

- TABLE 141 REST OF THE WORLD: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 142 REST OF THE WORLD: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: MARKET SIZE, BY VEHICLE, 2022–2027(USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: MARKET SIZE, BY PAYLOAD, 2022–2027(USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 149 LATIN AMERICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018–2021 (USD MILLION)

- TABLE 150 LATIN AMERICA: MARKET SIZE, BY VEHICLE, 2022–2027(USD MILLION)

- TABLE 151 LATIN AMERICA: MARKET SIZE, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 152 LATIN AMERICA: MARKET SIZE, BY PAYLOAD, 2022–2027(USD MILLION)

- TABLE 153 LATIN AMERICA: MARKET SIZE, BY STAGE, 2018–2021 (USD MILLION)

- TABLE 154 LATIN AMERICA: MARKET SIZE, BY STAGE, 2022–2027(USD MILLION)

- TABLE 155 KEY DEVELOPMENTS OF LEADING PLAYERS: SATELLITE LAUNCH VEHICLE MARKET

- TABLE 156 MARKET: DEGREE OF COMPETITION

- TABLE 157 MARKET: COMPETITIVE BENCHMARKING

- TABLE 158 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 159 MARKET: PRODUCT LAUNCHES, JANUARY 2023

- TABLE 160 MARKET: DEALS, FEBRUARY 2022–JANUARY 2023

- TABLE 161 SPACE EXPLORATION TECHNOLOGIES CORP.: BUSINESS OVERVIEW

- TABLE 162 SPACE EXPLORATION TECHNOLOGIES CORP.: PRODUCTS OFFERED

- TABLE 163 SPACE EXPLORATION TECHNOLOGIES CORP.: DEALS

- TABLE 164 UNITED LAUNCH ALLIANCE, LLC: BUSINESS OVERVIEW

- TABLE 165 UNITED LAUNCH ALLIANCE, LLC.: PRODUCTS OFFERED

- TABLE 166 UNITED LAUNCH ALLIANCE, LLC: DEALS

- TABLE 167 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- TABLE 168 NORTHROP GRUMMAN CORPORATION: PRODUCTS OFFERED

- TABLE 169 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 170 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 171 MITSUBISHI HEAVY INDUSTRIES: BUSINESS OVERVIEW

- TABLE 172 MITSUBISHI HEAVY INDUSTRIES: PRODUCTS OFFERED

- TABLE 173 MITSUBISHI HEAVY INDUSTRIES: DEALS

- TABLE 174 BLUE ORIGIN: BUSINESS OVERVIEW

- TABLE 175 BLUE ORIGIN: PRODUCTS OFFERED

- TABLE 176 BLUE ORIGIN: DEALS

- TABLE 177 ABL SPACE SYSTEMS: BUSINESS OVERVIEW

- TABLE 178 ABL SPACE SYSTEMS: PRODUCTS OFFERED

- TABLE 179 ABL SPACE SYSTEMS: DEALS

- TABLE 180 INDIAN SPACE RESEARCH ORGANIZATION: BUSINESS OVERVIEW

- TABLE 181 INDIAN SPACE RESEARCH ORGANIZATION: PRODUCTS OFFERED

- TABLE 182 INDIAN SPACE RESEARCH ORGANIZATION: PRODUCT LAUNCHES

- TABLE 183 INDIAN SPACE RESEARCH ORGANIZATION: DEALS

- TABLE 184 THE BOEING COMPANY: BUSINESS OVERVIEW

- TABLE 185 THE BOEING COMPANY: PRODUCTS OFFERED

- TABLE 186 THE BOEING COMPANY: DEALS

- TABLE 187 FIREFLY AEROSPACE INC.: BUSINESS OVERVIEW

- TABLE 188 FIREFLY AEROSPACE INC.: PRODUCTS OFFERED

- TABLE 189 FIREFLY AEROSPACE INC.: DEALS

- TABLE 190 ROCKET LAB: BUSINESS OVERVIEW

- TABLE 191 ROCKET LAB: PRODUCTS OFFERED

- TABLE 192 ROCKET LAB: DEALS

- TABLE 193 RELATIVITY SPACE: BUSINESS OVERVIEW

- TABLE 194 RELATIVITY SPACE: PRODUCTS OFFERED

- TABLE 195 RELATIVITY SPACE: DEALS

- TABLE 196 ISRAEL AEROSPACE INDUSTRY LTD.: BUSINESS OVERVIEW

- TABLE 197 ISRAEL AEROSPACE INDUSTRY LTD.: PRODUCTS OFFERED

- TABLE 198 ISRAEL AEROSPACE INDUSTRY: DEALS

- TABLE 199 ARIANESPACE SA: BUSINESS OVERVIEW

- TABLE 200 ARIANESPACE SA: PRODUCTS OFFERED

- TABLE 201 ARIANESPACE SA: DEALS

- TABLE 202 ONE SPACE TECHNOLOGY INC.: BUSINESS OVERVIEW

- TABLE 203 ONE SPACE TECHNOLOGY INC.: PRODUCTS OFFERED

- TABLE 204 VIRGIN ORBIT: BUSINESS OVERVIEW

- TABLE 205 VIRGIN ORBIT: PRODUCTS OFFERED

- TABLE 206 VIRGIN ORBIT: DEALS

- TABLE 207 SKYROOT AEROSPACE: COMPANY OVERVIEW

- TABLE 208 AGNIKUL COSMOS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 209 GALACTIC ENERGY AEROSPACE TECHNOLOGY CO. LTD.: COMPANY OVERVIEW

- TABLE 210 I-SPACE: COMPANY OVERVIEW

- TABLE 211 SKYRORA LIMITED: COMPANY OVERVIEW

- TABLE 212 GILMOUR SPACE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 213 C6 LAUNCH SYSTEMS: COMPANY OVERVIEW

- TABLE 214 ROCKET FACTORY AUGSBURG: COMPANY OVERVIEW

- TABLE 215 HYIMPULSE TECHNOLOGIES GMBH: COMPANY OVERVIEW

- TABLE 216 ISAR AEROSPACE: COMPANY OVERVIEW

- FIGURE 1 SATELLITE LAUNCH VEHICLE MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 SINGLE-USE/EXPENDABLE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 MEDIUM AND HEAVY (>350,000 KG) SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 9 THREE STAGE TO BE LARGEST SEGMENT OF MARKET DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO LEAD SATELLITE LAUNCH VEHICLE MARKET IN 2022

- FIGURE 11 RISING DEPLOYMENT OF SMALL SATELLITES TO DRIVE MARKET

- FIGURE 12 PROPULSION SYSTEMS SEGMENT TO LEAD MARKET FROM 2022 TO 2027

- FIGURE 13 GEOSTATIONARY ORBIT SEGMENT TO DOMINATE MARKET FROM 2022 TO 2027

- FIGURE 14 >2,500 KG SEGMENT TO DOMINATE MARKET FROM 2022 TO 2027

- FIGURE 15 UK TO BE FASTEST-GROWING MARKET FROM 2022 TO 2027

- FIGURE 16 MARKET DYNAMICS OF SATELLITE LAUNCH VEHICLE MARKET

- FIGURE 17 GLOBAL REVENUE OF SPACE TRAVEL AND TOURISM, 2021 -2030

- FIGURE 18 VALUE CHAIN ANALYSIS: MARKET

- FIGURE 19 MARKET ECOSYSTEM MAP

- FIGURE 20 REVENUE SHIFT IN THIS MARKET

- FIGURE 21 RECESSION IMPACT ANALYSIS OF MARKET

- FIGURE 22 SATELLITE LAUNCH VEHICLE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 24 KEY BUYING CRITERIA FOR END USERS

- FIGURE 25 REUSABLE SEGMENT TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 26 LOW EARTH ORBIT (LEO) SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 27 <500 KG SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 28 THREE STAGE SATELLITE LAUNCH VEHICLE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 29 PROPULSION SYSTEMS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 30 SMALL (<350,000 KG) SEGMENT TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 31 NORTH AMERICA PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 32 GLOBAL PESSIMISTIC AND REALISTIC VIEW ON RECESSION IMPACT

- FIGURE 33 NORTH AMERICA: SATELLITE LAUNCH VEHICLE MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 35 EUROPE: MARKET SNAPSHOT

- FIGURE 36 RANKING ANALYSIS OF TOP FIVE PLAYERS IN SATELLITE LAUNCH VEHICLE MARKET, 2021

- FIGURE 37 MARKET: REVENUE ANALYSIS OF KEY COMPANIES (2019–2021)

- FIGURE 38 MARKET SHARE ANALYSIS OF KEY COMPANIES, 2021

- FIGURE 39 MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 40 SATELLITE LAUNCH VEHICLE MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 41 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 42 MITSUBISHI HEAVY INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 43 THE BOEING COMPANY: COMPANY SNAPSHOT

- FIGURE 44 ROCKET LAB: COMPANY SNAPSHOT

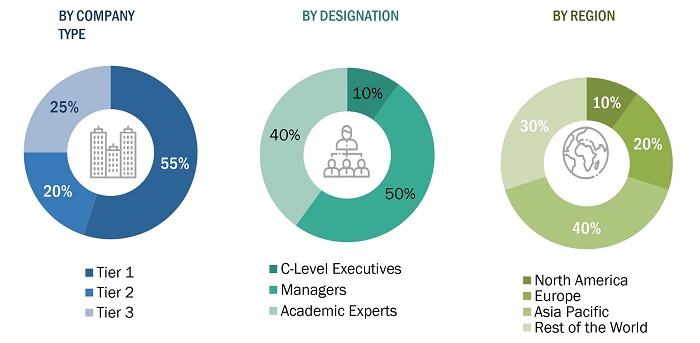

The research study conducted on the satellite launch vehicle market involved extensive use of secondary sources, including directories, databases of articles, journals on satellite launch vehicle, company newsletters, and information portals such as Hoover’s, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the satellite launch vehicle market. Primary sources are several industry experts from the core and related industries, alliances, organizations, Original Equipment Manufacturers (OEMs), vendors, suppliers, and technology developers. These sources relate to all segments of the value chain of the satellite launch vehicle industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and to assess future prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for this study on the satellite launch vehicle market. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers and certified publications; articles from recognized authors; manufacturer's associations; directories; and databases. Secondary research was mainly used to obtain key information about the supply chain of the satellite launch vehicle industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted to obtain qualitative and quantitative information for this report on the satellite launch vehicle market. Several primary interviews were conducted with the market experts from both demand- and supply-side across major regions, namely, North America, Europe, Asia Pacific, Rest of the World. The Rest of the World consists of the Middle East & Africa, and Latin America. Primary sources from the supply-side included industry experts such as business development managers, sales heads, technology and innovation directors, and related key executives from various key companies and organizations operating in the Satellite launch vehicle market.

To know about the assumptions considered for the study, download the pdf brochure

Key Primary Sources

|

Company Name |

Designation |

|

Indian Space Research Organisation |

Senior Scientist |

|

Australasian Youth CubeSat |

Project Advisory |

|

Sapeinza Universita di Roma |

Researcher |

|

Space Generation Advisory Council |

Project Lead |

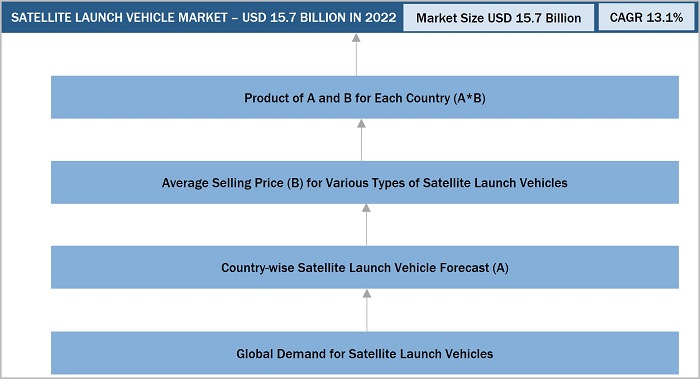

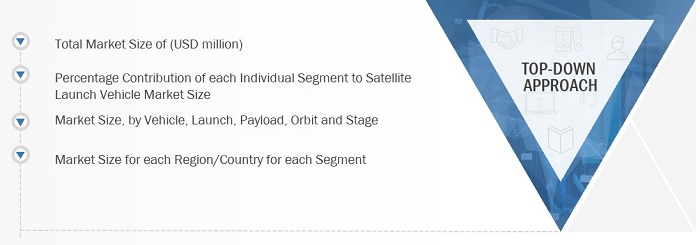

Market Size Estimation

The Satellite launch vehicle market is an emerging one due to the growing demand for satellite launches. Both top-down and bottom-up approaches were used to estimate and validate the size of the Satellite launch vehicle market. The research methodology used to estimate the market size also included the following details:

Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-Up Approach

Market size estimation methodology: Top Down Approach

Data Triangulation

After arriving at the overall size of the Satellite launch vehicle market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated sizes of different market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

A satellite launch vehicle (SLV) is a rocket that is designed to carry satellites into orbit around the Earth or other celestial bodies. These vehicles are typically multi-stage rockets, which means that they have several rockets stacked on top of each other that fire in sequence to propel the payload into space. There are several types of SLVs, including expendable launch vehicles (ELVs) and reusable launch vehicles (RLVs). ELVs are designed to be used once and then discarded, while RLVs are designed to be recovered and reused multiple times. SLVs can be launched from a variety of locations, including launchpads on land and sea, as well as from aircraft and balloons. They are typically used by space agencies and private companies to launch communication satellites, weather satellites, scientific research satellites, and other payloads.

Key Stakeholders

- Launch Service Providers

- Launch Vehicle Manufacturers

- Subsystem Manufacturers

- Payload Suppliers

- Meteorological Organizations

- Propellent and Engine Providers

- Technology Support Providers

- Government Space Agencies

- Ministry of Defense

- Scientific Research Centers

- Software/Hardware/Service and Solution Providers

Report Objectives

- To analyze the satellite launch vehicle market and provide forecasts from 2022 to 2027

- To define, describe, and forecast the size of the market based on vehicle, payload, orbit, launch, stage, subsystem, and satellite launch vehicle services market and region

- To understand the market structure by identifying its various subsegments

- To provide in-depth market intelligence regarding the major factors, such as drivers, restraints, opportunities, and challenges, that influence the growth of the market

- To analyze opportunities in the market for stakeholders by identifying key trends

- To forecast the size of various segments of the market with respect to major regions, such as North America, Europe, Asia Pacific, and the Rest of the World. The rest of the World includes the Middle East & Africa and Latin America

- To strategically analyze micro markets with respect to individual growth trends, prospects, and their contribution to the satellite launch vehicle market

- To provide a detailed competitive landscape of the market, along with an analysis of the business and corporate strategies adopted by key market players

- To analyze competitive developments of key players in the market, such as contracts, agreements, and new product developments

- To strategically profile key market players and comprehensively analyze their core competencies

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Satellite Launch Vehicle Market