Seaweed Protein Market by Source (Red Seaweed, Green Seaweed & Brown Seaweed), Mode of Application (Food, Animal Feed & Additives, Personal Care & Cosmetics), Extraction Process (Conventional Method & Current Method), & Region - Global Forecast to 2027

With a 14.1% CAGR, the seaweed protein market is projected to grow at US$ 1131 million by 2027. In 2022, its valuation was US$ 585 million. The seaweed protein is a rising star in the world of food and nutrition, poised for substantial growth in the near future. Sourced from various types of seaweed such as kelp, dulse, nori, and wakame, it offers a sustainable and eco-friendly solution to traditional animal-based proteins. The market's expansion is driven by factors such as growing health consciousness among consumers, the surging demand for plant-based proteins, and the heightened popularity of vegan and vegetarian lifestyles. Seaweed protein is not only environmentally friendly but also a nutritious source of minerals and vitamins, making it a highly sought-after ingredient for health-conscious consumers.

To know about the assumptions considered for the study, Request for Free Sample Report

Seaweed Protein Market Dynamics

Driver: Growth in customer awareness regarding health benefits of seaweed based protein

‘Self-care has evolved into an important component of the modern consumer's lifestyle. Consumers have made some substantial dietary modifications as a result of the rising emphasis on holistic health and immunity. Vitamins, minerals, immunity-boosting meals, organic products, supplements, and other nutritional supplements are all becoming more popular. Though the current epidemic has heightened awareness of the importance of immunity, it is well understood that having a robust immune system can help minimise the likelihood and severity of diseases and infections. Seaweed protien-based food ingredients are in high demand in convenience foods and health drinks due to rising customer desire for alternate protein sources. Seaweeds are considered a complete protein sources, because they contain all nine essential amino acids (EAAs) histidine, isoleucine, leucine, lysine, methionine, phenylalanine, threonine, tryptophan and valine, which are all vital for protein synthesis, tissue repair and nutrient absorption Seaweeds account for up to 50% of total amino acid content, regardless of total protein level, with tryptophan, methionine, and leucine being the most common limiting amino acids in algal protein. As a result, not only because of their overall protein content, but also because of their amino acid makeup, seaweeds are a valuable source of protein. One of the primary aspects attracting customer attention is consumer understanding of the health advantages of seaweed protein-based goods. Teagasc researchers have discovered that some of these seaweed proteins may have health benefits beyond those of basic human nutrition for use in functional foods. Seaweeds are a source of bioactive peptides, which can lower blood pressure and prevent cardiovascular diseases.

Opportunity: Increase in demand for natural ingredient based products by consumers.

Consumers are shifting away from animal proteins and moving toward plant-based proteins, and the market for plant protein components is rapidly expanding. This is anticipated to lead to a shift in customer preference for plant-based supplements, thus expanding the seaweed protein market. Seaweeds are high in macronutrients such as proteins and lipids, as well as micronutrients such as vitamins and minerals, dietary fibre, and other minor elements such as polyphenols. Macroalgae are a useful resource for extracting natural components for use in nutraceuticals, functional foods, cosmetics, medicines, and animal feed, among other applications, due to their diverse biomolecules. In this way, seaweed could be a good source of protein nd rich in antioxidants, polyphenols, minerals, and vitamins, as well as antibacterial, antiviral, anticancer, and antioxidant effects The desire for natural substances in cosmetics has exploded in recent years. Natural substances are environmentally friendly, have fewer adverse effects, and are completely safe to use. As a result, the cosmetics business is always on the lookout for natural active ingredients. With the current consumer trend for organically grown foods and "natural" foods from clean environments, seaweeds should receive an increasing acceptance

Restraint: Low concentration of some Amino Acids (EAAs) in seaweed

Various factors influence the amino acid makeup of seaweeds, including species, preservation method, extraction procedure, seasonal change, and the environment in which they grow. Except for sulphur-containing amino acids, seaweeds are low in most important amino acids. Protein quality can vary substantially based on digestibility and critical amino acid availability. Animal protein sources are often regarded as complete proteins because they contain a high concentration of essential amino acids (EAAs), which the human body cannot produce. Plant proteins, on the other hand, are frequently regarded as inadequate protein sources since they lack one or more important amino acids, such as histidine, isoleucine, leucine, lysine, methionine, phenylalanine, threonine, tryptophan, and valine. Seaweed has a far lower concentration of EAAs in its total biomass base than typical sources like corn and soy, making it unsuitable as a protein source in compound meals for monogastric animals. In most seaweed species, amino acids like tryptophan and lysine are often the limiting amino acids. In red seaweed species, leucine and isoleucine are typically present in low proportions, whereas methionine, cysteine, and lysine are frequently limiting in brown seaweed species. However, this does not detract from its positive health benefits for humans and livestock, where its few calories and high mineral content may be desirable.

Challenge: Toxicity associated with consumption of seaweed protein based products

Commercially available seaweed protein-based products are mostly in the form of partially dried seaweeds packaged as tablets or powder. The presence of heavy metal contaminants such as arsenic and iodine in seaweed taken from wild raises safety issues. Under normal circumstances, metal uptake improves the nutritional quality of algal meals, while excessive uptake can induce toxicity. Higher levels of these heavy metals found in seaweeds can cause medical concerns like cancer, brain damage, gastrointestinal issues, and kidney illness. Seaweed consumption has been regulated as a result of the health concerns raised by the consumption of seaweed protein-based products, limiting the industry's expansion. Engineering solutions like exposure monitoring and possible intervention to decrease additional heavy metal exposure in the environment and in humans could be a big step toward prevention.

The Red Seaweed by source segment is projected to account for the biggest market share in the Seaweed protein market.

High level of proteins in red seaweed and diverse application is driving the market growth for red seaweed. The presence of phycobiliproteins such as phycoerythrin, phycocyanin, and allophycocyanin pigments gives red seaweeds, also known as Rhodophyta, their red hue. Due to their fibrous composition, they assist regulate blood circulation and blood flow in the body, manage blood sugar, and lower excessive cholesterol. Because of their large diversity and composition, red seaweeds have piqued interest in the food and pharmaceutical industries as a source of new natural nutrients and bioactive substances. In comparison to other seaweeds, red algae have higher levels of carbohydrates, proteins, and minerals. Rhodophyta proteins/peptides and polysaccharides have been assigned special functional qualities due to their unique makeup. Red seaweed is high in protein and has a unique umami flavour. Red seaweeds contain around 47 percent dry matter, according to NCBI. Porphyra (47 percent dry mass) and Palmaria palmata are the most important red seaweed species with greater protein levels (35 percent of dry mass). Polysaccharides, such as agar and carrageenan, which are hydrocolloids with texturizing and stabilising qualities and are extracted commercially for a range of food and pharmaceutical purposes, are abundant in red seaweeds.

The conventional extraction segment is estimated to account for the largest market share in the Seaweed protein market during the forecast period.

Physical techniques such as aqueous treatment and Patter homogenization, osmotic stress, and high shear force are used in the conventional extraction method. This method is commonly used to extract proteins from seaweeds such as Palmana palmata, Ula fasciata, Sargassum vulgare, and Porphyra sp. The enzymatic hydrolysis sector led the market among all the conventional methods of seaweed protein extraction.

The food segment, by mode of application is projected to account for the fastest growth during the forecast period.

Because of its adaptability, the food segment is expected to hold the largest market share and increase at the fastest rate due to ongoing innovation in the use of seaweed into food products. Proteins, minerals, trace elements, and vitamins determine the nutritional value of seaweeds. Protein-rich algae such as Acanthophora, Caulerpa, Codium, Enteromorpha, Eucheuma, Gracilaria, Laminaria, Laurencia, Macrocystis, Monostroma, Porphyra, Ulva, and Undaria were used in salads, soups, and curries in China, Indonesia, Japan, Korea, Malaysia, Philippines, and Thailand. Two food-grade extracts from seaweed are agar and alginate. Agar is used to make tomato sauce, ice cream, jelly, lime jelly, and marmalade, among other things. Desserts and drinks often contain alginate. ice cream, jelly, syrups, flavour sauces, fruit juices, bread items, and milkshakes are just a few of the things available.

To know about the assumptions considered for the study, download the pdf brochure

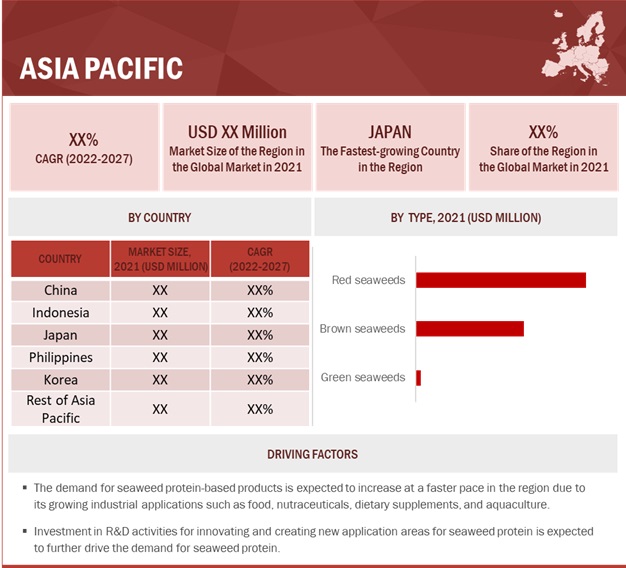

Asia Pacific is projected to account for the largest share in the market during the forecast period.

In 2022, the Asia Pacific region held the highest share of the seaweed protein market. According to the FAO, seaweed has been used as food in Japan since the fourth century and in China since the sixth century. China and Japan, along with the Republic of Korea, are the largest consumers of seaweed as food, and their needs support an industry that harvests 6 000 000 tonnes of wet seaweed per year, valued at $5 billion. They are utilised in Chinese and Japanese cuisine preparations. Alternatives to animal-based protein include seaweed proteins. The demand for fortified nutritional food and personal care products is increasing in response to busy lifestyles and a growth in interest in healthy food items. Because of its rising industrial applications in food, nutraceuticals, nutritional supplements, and aquaculture, demand for seaweed protein-based products is predicted to grow at a quicker rate in the region. An investment in R&D efforts for inventing and creating new application areas for seaweed protein is another aspect contributing to the industry's growth. Pharmaceuticals, cosmetics, and animal feed additives are among the various industrial uses of seaweeds in the region. These reasons are propelling the Asia Pacific seaweed protein market forward.

Key Companies

The key players in this market include CP Kelco U.S.,Inc. (US), Algaia (France), Algea (Norway), Qingdao Gather Great Ocean Algae Industry Group Co, Ltd (China), Qingdao Brightmoon Seaweed Co Group Co. Ltd (China), Cargill Incorporated (US) Gelymar SA (Chile), Ceamsa (Spain), BASF (Germany), Irish Seaweed (Ireland), Dupont Nutrition and Biosciences (US), Compo Expert Group (Germany), Beijing Leili Agricultural Co, Ltd (China), Groupe Roullier (France), Acadian Seaplants (Canada). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Seaweed Protein Market Report Scope

|

Report Metric |

Details |

|

Market size value in 2022 |

USD $585 million |

|

Revenue forecast in 2027 |

USD $1131 million |

|

Growth rate |

CAGR of 14.1% by 2027 |

|

Historical data |

2020-2027 |

|

Base year for estimation |

2021 |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report Coverage |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Segments covered |

Sources, Region, Extraction Process, Mode of Application |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Key companies profiled |

CP Kelco U.S., Inc. (US), Algaia (France), Algea (Norway), Qingdao Gather Great Ocean Algae Industry Group Co, Ltd (China), Qingdao Brightmoon Seaweed Co Group Co. Ltd (China), Cargill Incorporated (US) Gelymar SA (Chile), Ceamsa (Spain), BASF (Germany), Irish Seaweed (Ireland), Dupont Nutrition and Biosciences (US), Compo Expert Group (Germany), Beijing Leili Agricultural Co, Ltd (China), Groupe Roullier (France), Acadian Seaplants (Canada) |

|

Market Challenges |

|

This research report categorizes the Seaweed protein market based on type, application, form, source, and region.

Based on source, the market has been segmented as follows:

- Red Seaweed

- Brown Seaweed

- Green Seaweed

Based on extraction process, the market has been segmented as follows:

- Coventional Method

- Current Method

Based on mode of application, the market has been segmented as follows:

- Food

- Animal Feed and additive

- Personal Care and Cosmetics

- Others

Based on the region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW (South America, the Middle East & Africa)

Recent Developments (Revenue, USD million, 2022 - 2027)

- In Mar 2022, Shiru, Inc., a food ingredient entrepreneur, and CP Kelco have launched a new relationship to help the transition to a more sustainable food system. Shiru's "Hourish" platform will use precision fermentation technology to find plant-based proteins, while CP Kelco will scale up these proteins using its fermentation capabilities and further confirm Shiru proteins in food prototypes.

- In June 2021 In Atlanta, Georgia, CP Kelco opened a new global innovation centre that will serve as an open environment for scientists and customers to collaborate on ingredient research, problem solving, development, and pilot plant scale-up for food, beverage, home care, personal care, and other goods.

- In August 2021, The applications team worked with Enil-Besancon Mamirolle to test alginates in processed cheese. Enil-Besancon Mamirolle provided the team with their pilot production capacity, allowing the team to conduct these successful experiments.

Frequently Asked Questions (FAQ):

What is seaweed protein?

Seaweed protein is a plant-based protein derived from various types of seaweed, such as kelp, dulse, nori, and wakame. It is considered to be a sustainable and environmentally-friendly alternative to traditional animal-based proteins.

How big is the seaweed protein market?

Seaweed protein market is expected to generate US$ 1131 million in revenue by 2027, growing at a 14.1% compound annual growth rate. In 2022, its valuation was US$585 million.

What are the potential challenges to the Seaweed protein market?

Seaweeds growing in polluted environments, which are commonly caused by industry or inadequate sewage systems, absorb heavy metals from the surrounding water and rocks, but at amounts that are not harmful to humans. However, perennial seaweeds have higher levels of pollution exposure, putting humans at danger of heavy metal toxicity if consumed consistently. At excessively high levels, most heavy metals can cause health concerns. Effective legislation, guidelines, and the detection of locations with increased heavy metal levels are all needed. Engineering solutions, on the other hand, can limit occupational exposure to heavy metals and could be a big step toward prevention.

What are the key market trends in the food Seaweed protein market?

Seaweed protein-based food additives are in high demand in convenience foods and health drinks due to rising customer demand for alternative protein sources. Furthermore, the expanding vegetal and vegan population in North America and Europe are likely to stimulate demand for seaweed protein-based food products, resulting in their expansion. Manufacturers have been motivated to introduce new beverages to the market as a result of the increased understanding that seaweed protein is sourced naturally, leading to continued expansion of the seaweed protein-based goods industry.

What are the key development strategies undertaken by companies in the Seaweed protein market?

Strategies such as new product launches, investments into expansion and development, research initiatives are the key strategies being used by large players in order to achieve differential positioning in the global market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS & EXCLUSIONS

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2021

1.7 VOLUME UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 50)

TABLE 2 SEAWEED PROTEIN MARKET SNAPSHOT (VALUE), 2022 VS. 2027

FIGURE 6 MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 7 MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 8 MARKET SHARE (VOLUME), BY EXTRACTION PROCESS, 2022 VS. 2027

FIGURE 9 MARKET SHARE (VALUE), BY REGION, 2022

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 OPPORTUNITIES IN THE MARKET

FIGURE 10 INCREASE IN DEMAND FOR VEGAN PROTEIN ALTERNATIVES TO MEAT AND DAIRY EXPECTED TO DRIVE THE MARKET

4.2 SEAWEED PROTEIN MARKET: KEY COUNTRIES

FIGURE 11 FRANCE PROJECTED TO GROW AT THE HIGHEST RATE IN THE SEAWEED PROTEIN MARKET IN 2022 TO 2027

4.3 MARKET FOR SEAWEED PROTEIN, BY SOURCE & REGION

FIGURE 12 ASIA PACIFIC DOMINATED THE MARKET IN 2021

4.4 MARKET FOR SEAWEED PROTEIN, BY APPLICATION

FIGURE 13 FOOD SEGMENT TO DOMINATE THE MARKET, 2022 VS. 2027

4.5 ASIA PACIFIC: MARKET FOR SEAWEED PROTEIN, BY APPLICATION & COUNTRY

FIGURE 14 CHINA ESTIMATED ACCOUNTED FOR THE LARGEST SHARE IN 2021

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 MARKET DYNAMICS: MARKET FOR SEAWEED PROTEIN

5.2.1 DRIVERS

5.2.1.1 Growth in consumer awareness regarding the health benefits of seaweed protein-based products

TABLE 3 CHEMICAL COMPOSITION OF DIFFERENT SEAWEEDS

TABLE 4 AMINO ACIDS COMPOSITION OF SOME SEAWEEDS AND LEGUMINOUS PLANTS (IN GRAM AMINO ACID/100 GRAM PROTEIN)

5.2.1.2 Alternate protein source

5.2.1.3 Increase in applications of seaweed protein

TABLE 5 EFFECT OF SEAWEED ADDITION ON FOOD PROPERTIES

5.2.2 RESTRAINTS

5.2.2.1 Low concentration of some essential amino acids (EAAs) in seaweeds

5.2.3 OPPORTUNITIES

5.2.3.1 Growth in consumer demand for natural ingredients

TABLE 6 THE BIOACTIVITIES OF SEVERAL MACROALGAL PROTEINS

TABLE 7 THE BIOACTIVITIES OF SEVERAL MACROALGAL PEPTIDES

5.2.3.2 Seaweed protein-based products emerging as a snack

5.2.4 CHALLENGES

5.2.4.1 Toxicity associated with the consumption of seaweed protein-based products

5.2.4.2 Variability, scalability, and digestibility associated with seaweed proteins

6 INDUSTRY TRENDS (Page No. - 70)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 16 MARKET FOR SEAWEED PROTEIN: VALUE CHAIN ANALYSIS

6.2.1 RESEARCH & TESTING

6.2.2 PROCESSING/EXTRACTION

6.2.3 PACKAGING

6.2.4 DISTRIBUTION

6.2.5 MARKETING & SALES

6.2.6 POST-SALE SERVICES

6.3 TECHNOLOGY ANALYSIS

6.3.1 MEMBRANE TECHNOLOGIES

6.4 AVERAGE SELLING PRICE TREND

FIGURE 17 PRICING ANALYSIS, 2018–2026 (USD MILLION/KT)

6.5 PATENT ANALYSIS

FIGURE 18 PATENTS GRANTED FOR SEAWEED PROTEIN MARKET, 2011–2021

FIGURE 19 REGIONAL ANALYSIS OF PATENT GRANTED FOR SEAWEED PROTEIN MARKET, 2011–2021

TABLE 8 KEY PATENTS PERTAINING TO SEAWEED PROTEIN MARKET, 2020

6.6 MARKET MAP

6.6.1 MARKET MAP

FIGURE 20 SEAWEED PROTEIN MARKET: MARKET MAP

6.6.2 MANUFACTURERS

6.6.3 REGULATORY BODIES

6.6.4 END-USER COMPANIES

6.6.5 START-UPS/EMERGING COMPANIES

TABLE 9 MARKET FOR SEAWEED PROTEIN: ECOSYSTEM

6.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 MARKET FOR SEAWEED PROTEIN: PORTER’S FIVE FORCES ANALYSIS

6.7.1 DEGREE OF COMPETITION

6.7.2 BARGAINING POWER OF SUPPLIERS

6.7.3 BARGAINING POWER OF BUYERS

6.7.4 THREAT OF SUBSTITUTES

6.7.5 THREAT OF NEW ENTRANTS

6.8 KEY EXPORT-IMPORT MARKETS

FIGURE 21 SEAWEEDS FIT HOR HUMAN CONSUMPTION: IMPORT VALUE, BY KEY COUNTRY, 2016–2020 (USD THOUSAND)

FIGURE 22 SEAWEEDS FIT FOR HUMAN CONSUMPTION: EXPORT VALUE, BY KEY COUNTRY, 2016–2020 (USD THOUSAND)

FIGURE 23 SEAWEEDS UNFIT HOR HUMAN CONSUMPTION: IMPORT VALUE, BY KEY COUNTRY, 2016–2020 (USD THOUSAND)

FIGURE 24 SEAWEEDS UNFIT FOR HUMAN CONSUMPTION: EXPORT VALUE, BY KEY COUNTRY, 2016–2020 (USD THOUSAND)

6.9 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 11 SEAWEED PROTEIN MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

6.10 TARIFF AND REGULATORY LANDSCAPE

6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.10.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

FIGURE 25 REVENUE SHIFT FOR MARKET

6.11 CASE STUDY ANALYSIS

6.11.1 ALGAIA STARTED OFFERING IMPROVED PLANT-BASED MEAT PRODUCTS

6.11.2 SAFETY ASSESSMENT AND CERTIFICATION DEMAND BY INDUSTRY PLAYERS TO ENSURE TRANSPARENCY

7 SEAWEED PROTEIN MARKET, BY SOURCE (Page No. - 88)

7.1 INTRODUCTION

FIGURE 26 SEAWEED PROTEIN MARKET SIZE, BY SOURCE, 2022 VS. 2027 (USD MILLION)

TABLE 16 MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 17 MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 18 MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 19 MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

TABLE 20 MARKET SIZE FOR SEAWEED PROTEIN, BY SPECIES, 2018–2021 (USD MILLION)

TABLE 21 MARKET SIZE FOR SEAWEED PROTEIN, BY SPECIES, 2022–2027 (USD MILLION)

TABLE 22 MARKET SIZE FOR SEAWEED PROTEIN, BY SPECIES, 2018–2021 (KT)

TABLE 23 MARKET SIZE FOR SEAWEED PROTEIN, BY SPECIES, 2022–2027 (KT)

7.2 RED SEAWEEDS

7.2.1 RED SEAWEED-DERIVED PROTEINS ARE LARGELY USED IN SALADS, SNACKS, AND SUSHI

7.2.2 PORPHYRA SPP.

7.2.3 PALMARIA PALMATA

TABLE 24 RED SEAWEEDS: SEAWEED PROTEIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 RED SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (USD MILLION)

TABLE 26 RED SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2018–2021 (KT)

TABLE 27 RED SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (KT)

TABLE 28 RED SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY SPECIES, 2018–2021 (USD MILLION)

TABLE 29 RED SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY SPECIES, 2022–2027 (USD MILLION)

TABLE 30 RED SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY SPECIES, 2018–2021 (KT)

TABLE 31 RED SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY SPECIES, 2022–2027 (KT)

7.3 BROWN SEAWEEDS

7.3.1 RICH IN ASPARTIC AND GLUTAMIC AMINO ACIDS

7.3.2 LAMINARIA SPP.

7.3.3 UNDARIA PINNATIFIDA

7.3.4 FUCUS VESICULOSUS

TABLE 32 BROWN SEAWEEDS: SEAWEED PROTEIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 BROWN SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (USD MILLION)

TABLE 34 BROWN SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2018–2021 (KT)

TABLE 35 BROWN SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (KT)

TABLE 36 BROWN SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY SPECIES, 2018–2021 (USD MILLION)

TABLE 37 BROWN SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY SPECIES, 2022–2027 (USD MILLION)

TABLE 38 BROWN SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY SPECIES, 2018–2021 (KT)

TABLE 39 BROWN SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY SPECIES, 2022–2027 (KT)

7.4 GREEN SEAWEEDS

7.4.1 EMERGING USE OF GREEN SEAWEEDS IN THE PROCESSED FOOD INDUSTRY

7.4.2 ULVA SPP.

7.4.3 ENTEROMORPHA SPP.

TABLE 40 GREEN SEAWEEDS: SEAWEED PROTEIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 GREEN SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (USD MILLION)

TABLE 42 GREEN SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2018–2021 (KT)

TABLE 43 GREEN SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (KT)

TABLE 44 GREEN SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY SPECIES, 2018–2021 (USD MILLION)

TABLE 45 GREEN SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY SPECIES, 2022–2027 (USD MILLION)

TABLE 46 GREEN SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY SPECIES, 2018–2021 (KT)

TABLE 47 GREEN SEAWEEDS: MARKET SIZE FOR SEAWEED PROTEIN, BY SPECIES, 2022–2027 (KT)

8 SEAWEED PROTEIN MARKET, BY APPLICATION (Page No. - 107)

8.1 INTRODUCTION

FIGURE 27 SEAWEED PROTEIN MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 48 MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 49 MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 50 MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2018–2021 (KT)

TABLE 51 MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2022–2027 (KT)

8.2 FOOD

8.2.1 INCREASE IN APPLICATION OF SEAWEED PROTEIN AS A FUNCTIONAL INGREDIENT IN PROCESSED FOOD

TABLE 52 FOOD: SEAWEED PROTEIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 FOOD: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (USD MILLION)

TABLE 54 FOOD: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2018–2021 (KT)

TABLE 55 FOOD: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (KT)

TABLE 56 FOOD: MARKET SIZE FOR SEAWEED PROTEIN, BY SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 57 FOOD: MARKET SIZE FOR SEAWEED PROTEIN, BY SUB-APPLICATION, 2022–2027 (USD MILLION)

TABLE 58 DAIRY: SEAWEED PROTEIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 DAIRY: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (USD MILLION)

TABLE 60 MEAT & POULTRY: SEAWEED PROTEIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 MEAT & POULTRY: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (USD MILLION)

TABLE 62 BAKERY PRODUCTS: SEAWEED PROTEIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 BAKERY PRODUCTS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (USD MILLION)

TABLE 64 CONFECTIONERY PRODUCTS: SEAWEED PROTEIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 CONFECTIONERY PRODUCTS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (USD MILLION)

TABLE 66 OTHERS: SEAWEED PROTEIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 OTHERS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (USD MILLION)

8.3 ANIMAL FEED & ADDITIVES

8.3.1 PROTEIN EXTRACTED FROM RED AND GREEN SEAWEEDS IS A SOURCE OF FEED FOR RUMINANTS

TABLE 68 ANIMAL FEED & ADDITIVES: SEAWEED PROTEIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 ANIMAL FEED & ADDITIVES: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (USD MILLION)

TABLE 70 ANIMAL FEED & ADDITIVES: SEAWEED PROTEIN MARKET SIZE, BY REGION, 2018–2021 (KT)

TABLE 71 ANIMAL FEED & ADDITIVES: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (KT)

8.4 PERSONAL CARE & COSMETICS

8.4.1 SEAWEED PROTEIN IS USED AS A SOURCE FOR PRODUCING SKIN CARE PRODUCTS

TABLE 72 PERSONAL CARE & COSMETICS: SEAWEED PROTEIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 PERSONAL CARE & COSMETICS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (USD MILLION)

TABLE 74 PERSONAL CARE & COSMETICS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2018–2021 (KT)

TABLE 75 PERSONAL CARE & COSMETICS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (KT)

8.5 OTHER APPLICATIONS

TABLE 76 OTHER APPLICATIONS: SEAWEED PROTEIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 OTHER APPLICATIONS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (USD MILLION)

TABLE 78 OTHER APPLICATIONS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2018–2021 (KT)

TABLE 79 OTHER APPLICATIONS: MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (KT)

9 SEAWEED PROTEIN MARKET, BY EXTRACTION PROCESS (Page No. - 124)

9.1 INTRODUCTION

FIGURE 28 MARKET SHARE (VOLUME), BY EXTRACTION PROCESS, 2022 VS. 2027

TABLE 80 MARKET SIZE FOR SEAWEED PROTEIN, BY EXTRACTION PROCESS, 2018–2021 (KT)

TABLE 81 MARKET SIZE FOR SEAWEED PROTEIN, BY EXTRACTION PROCESS, 2022–2027 (KT)

9.2 CONVENTIONAL METHOD

9.2.1 PHYSICAL PROCESSES

9.2.2 ENZYMATIC HYDROLYSIS

9.2.3 CHEMICAL EXTRACTION

TABLE 82 SEAWEED PROTEIN MARKET SIZE, BY CONVENTIONAL METHOD, 2018–2021 (KT)

TABLE 83 MARKET SIZE FOR SEAWEED PROTEIN, BY CONVENTIONAL METHOD, 2022–2027 (KT)

9.3 CURRENT METHOD

9.3.1 ULTRASOUND-ASSISTED EXTRACTION (UAE)

9.3.2 PULSED ELECTRIC FIELD (PEF)

9.3.3 MICROWAVE-ASSISTED EXTRACTION (MAE)

TABLE 84 SEAWEED PROTEIN MARKET SIZE, BY CURRENT METHOD, 2018–2021 (KT)

TABLE 85 MARKET SIZE FOR SEAWEED PROTEIN, BY CURRENT METHOD, 2022–2027 (KT)

TABLE 86 COMPARISON OF THE RELEVANT ASPECTS OF PROTEIN EXTRACTION METHODS

10 SEAWEED PROTEIN MARKET, BY REGION (Page No. - 132)

10.1 INTRODUCTION

FIGURE 29 SEAWEED PROTEIN MARKET SHARE (VALUE), BY KEY COUNTRY, 2021

TABLE 87 MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2018–2021 (USD MILLION)

TABLE 88 MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (USD MILLION)

TABLE 89 MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2018–2021 (KT)

TABLE 90 MARKET SIZE FOR SEAWEED PROTEIN, BY REGION, 2022–2027 (KT)

10.2 NORTH AMERICA

TABLE 91 NORTH AMERICA: SEAWEED PROTEIN MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE FOR SEAWEED PROTEIN, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE FOR SEAWEED PROTEIN, BY COUNTRY, 2018–2021 (KT)

TABLE 94 NORTH AMERICA: MARKET SIZE FOR SEAWEED PROTEIN, BY COUNTRY, 2022–2027 (KT)

TABLE 95 NORTH AMERICA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 98 NORTH AMERICA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

TABLE 99 NORTH AMERICA: MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2018–2021 (KT)

TABLE 102 NORTH AMERICA: MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2022–2027 (KT)

TABLE 103 NORTH AMERICA: MARKET SIZE FOR SEAWEED PROTEIN, BY FOOD SUB APPLICATION, 2018–2021 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE FOR SEAWEED PROTEIN, BY FOOD SUB APPLICATION, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Greater shift to healthier food options in the US

TABLE 105 US: SEAWEED PROTEIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 106 US: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 107 US: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 108 US: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

10.2.2 CANADA

10.2.2.1 Canadian seaweed industry shifts from being an animal feed to an alternative protein source for human food

TABLE 109 CANADA: MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 110 CANADA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 111 CANADA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 112 CANADA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

10.2.3 MEXICO

10.2.3.1 Mexican researchers explore the use of seaweeds as a nutrition alternative

TABLE 113 MEXICO: SEAWEED PROTEIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 114 MEXICO: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 115 MEXICO: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 116 MEXICO: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

10.3 EUROPE

FIGURE 30 EUROPE: MARKET SNAPSHOT

TABLE 117 EUROPE: SEAWEED PROTEIN MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE FOR SEAWEED PROTEIN, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE FOR SEAWEED PROTEIN, BY COUNTRY, 2018–2021 (KT)

TABLE 120 EUROPE: MARKET SIZE FOR SEAWEED PROTEIN, BY COUNTRY, 2022–2027 (KT)

TABLE 121 EUROPE: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 124 EUROPE: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

TABLE 125 EUROPE: MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2018–2021 (KT)

TABLE 128 EUROPE: MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2022–2027 (KT)

TABLE 129 EUROPE: MARKET SIZE FOR SEAWEED PROTEIN, BY FOOD SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 130 EUROPE: MARKET SIZE FOR SEAWEED PROTEIN, BY FOOD SUB-APPLICATION, 2022–2027 (USD MILLION)

10.3.1 FRANCE

10.3.1.1 Use of seaweed protein-based products in the processed food industry

TABLE 131 FRANCE: SEAWEED PROTEIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 132 FRANCE: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 133 FRANCE: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 134 FRANCE: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

10.3.2 IRELAND

10.3.2.1 Demand for seaweed protein for application in feed

TABLE 135 IRELAND: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 136 IRELAND: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 137 IRELAND: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 138 IRELAND: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

10.3.3 NORWAY

10.3.3.1 Growing industrial & human food application of seaweeds driving the growth of the market

TABLE 139 NORWAY: SEAWEED PROTEIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 140 NORWAY: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 141 NORWAY: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 142 NORWAY: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

10.3.4 SPAIN

10.3.4.1 Rapid growth in the consumption of seaweed as sea vegetables

TABLE 143 SPAIN: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 144 SPAIN: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 145 SPAIN: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 146 SPAIN: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

10.3.5 REST OF EUROPE

TABLE 147 REST OF EUROPE: SEAWEED PROTEIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 148 REST OF EUROPE:MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 149 REST OF EUROPE: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 150 REST OF EUROPE: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

10.4 ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 151 ASIA PACIFIC: SEAWEED PROTEIN MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE FOR SEAWEED PROTEIN, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE FOR SEAWEED PROTEIN, BY COUNTRY, 2018–2021 (KT)

TABLE 154 ASIA PACIFIC: MARKET SIZE FOR SEAWEED PROTEIN, BY COUNTRY, 2022–2027 (KT)

TABLE 155 ASIA PACIFIC: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 158 ASIA PACIFIC: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

TABLE 159 ASIA PACIFIC: MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2018–2021 (KT)

TABLE 162 ASIA PACIFIC: MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2022–2027 (KT)

TABLE 163 ASIA PACIFIC: MARKET SIZE FOR SEAWEED PROTEIN, BY FOOD SUB APPLICATION, 2018–2021 (USD MILLION)

TABLE 164 ASIA PACIFIC: SEAWEED PROTEIN MARKET SIZE, BY FOOD SUB APPLICATION, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Easy availability of raw materials and growth in the aquaculture industry propelling the market for seaweed protein

TABLE 165 CHINA: SEAWEED PROTEIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 166 CHINA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 167 CHINA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 168 CHINA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

10.4.2 INDONESIA

10.4.2.1 Increase in usage of seaweed proteins as direct food products in Indonesia

TABLE 169 INDONESIA: SEAWEED PROTEIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 170 INDONESIA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 171 INDONESIA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 172 INDONESIA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

10.4.3 PHILIPPINES

10.4.3.1 Multiple usages of seaweeds expected to drive the growth

TABLE 173 PHILIPPINES: SEAWEED PROTEIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 174 PHILIPPINES: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 175 PHILIPPINES: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 176 PHILIPPINES: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

10.4.4 SOUTH KOREA

10.4.4.1 Rise in the market for seaweed protein as a snack product in the country

TABLE 177 SOUTH KOREA: SEAWEED PROTEIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 178 SOUTH KOREA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 179 SOUTH KOREA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 180 SOUTH KOREA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

10.4.5 JAPAN

10.4.5.1 Easy availability of raw materials, increase in the use of organic products and rise in health-conscious consumers propelling the market growth

TABLE 181 JAPAN: SEAWEED PROTEIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 182 JAPAN: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 183 JAPAN: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 184 JAPAN: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

10.4.6 REST OF ASIA PACIFIC

TABLE 185 REST OF ASIA PACIFIC: SEAWEED PROTEIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 186 REST OF ASIA PACIFIC: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 187 REST OF ASIA PACIFIC: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 188 REST OF ASIA PACIFIC: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027(KT)

10.5 REST OF THE WORLD (ROW)

TABLE 189 ROW: SEAWEED PROTEIN MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 190 ROW: MARKET SIZE FOR SEAWEED PROTEIN, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 191 ROW: MARKET SIZE FOR SEAWEED PROTEIN, BY COUNTRY, 2018–2021 (KT)

TABLE 192 ROW: MARKET SIZE FOR SEAWEED PROTEIN, BY COUNTRY, 2022–2027 (KT)

TABLE 193 ROW: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 194 ROW: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 195 ROW: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 196 ROW: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

TABLE 197 ROW: MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 198 ROW: MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 199 ROW: MARKET SIZE FOR SEAWEED PROTEIN, BY FOOD SUBAPPLICATION, 2018–2021 (USD MILLION)

TABLE 200 ROW: MARKET SIZE FOR SEAWEED PROTEIN, BY FOOD SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 201 ROW: MARKET SIZE FOR SEAWEED PROTEIN, BY APPLICATION, 2018–2021 (KT)

TABLE 202 ROW: SEAWEED PROTEIN MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

10.5.1 BRAZIL

10.5.1.1 The country majorly imports seaweeds to meet the demand for the food processing industry

TABLE 203 BRAZIL: SEAWEED PROTEIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 204 BRAZIL: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 205 BRAZIL: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 206 BRAZIL: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

10.5.2 CHILE

10.5.2.1 Seaweed production helps in improving food security in Chile

TABLE 207 CHILE: SEAWEED PROTEIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 208 CHILE: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 209 CHILE: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 210 CHILE: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

10.5.3 SOUTH ARICA

10.5.3.1 Seaweed is a potential superfood in South Africa

TABLE 211 SOUTH AFRICA: SEAWEED PROTEIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 212 SOUTH AFRICA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 213 SOUTH AFRICA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 214 SOUTH AFRICA: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

10.5.4 OTHERS IN ROW

TABLE 215 ROW: SEAWEED PROTEIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 216 ROW: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 217 ROW: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2018–2021 (KT)

TABLE 218 ROW: MARKET SIZE FOR SEAWEED PROTEIN, BY SOURCE, 2022–2027 (KT)

11 COMPETITIVE LANDSCAPE (Page No. - 187)

11.1 OVERVIEW

11.2 MARKET RANKING ANALYSIS

TABLE 219 MARKET SHARE (CONSOLIDATED)

11.3 KEY PLAYER STRATEGIES

FIGURE 32 KEY PLAYER STRATEGIES IN THE MARKET, 2019–2022

11.4 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

11.4.1 STARS

11.4.2 PERVASIVE PLAYERS

11.4.3 EMERGING LEADERS

11.4.4 PARTICIPANTS

FIGURE 33 SEAWEED PROTEIN MARKET, COMPANY EVALUATION QUADRANT, 2021 (OVERALL MARKET)

11.4.5 PRODUCT FOOTPRINT

TABLE 220 COMPANY SOURCE FOOTPRINT

TABLE 221 COMPANY APPLICATION FOOTPRINT

TABLE 222 COMPANY REGIONAL FOOTPRINT

TABLE 223 OVERALL COMPANY FOOTPRINT

11.5 SEAWEED PROTEIN MARKET, STARTUP/SME EVALUATION QUADRANT

11.5.1 PROGRESSIVE COMPANIES

11.5.2 STARTING BLOCKS

11.5.3 RESPONSIVE COMPANIES

11.5.4 DYNAMIC COMPANIES

FIGURE 34 MARKET FOR SEAWEED PROTEIN, COMPANY EVALUATION QUADRANT, 2021 (STARTUP/SME)

11.6 COMPETITIVE BENCHMARKING

TABLE 224 MARKET FOR SEAWEED PROTEIN: DETAILED LIST OF KEY STARTUP/SMES

TABLE 225 MARKET FOR SEAWEED PROTEIN: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

11.7 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

11.7.1 PRODUCT LAUNCHES

TABLE 226 SEAWEED PROTEIN MARKET: PRODUCT LAUNCHES, JANUARY 2019–MARCH 2022

11.7.2 DEALS

TABLE 227 MARKET FOR SEAWEED PROTEIN: DEALS, MAY 2020–MARCH 2022

12 COMPANY PROFILES (Page No. - 203)

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

12.1 KEY PLAYERS

12.1.1 CP KELCO U.S., INC.

TABLE 228 CP KELCO U.S., INC.: BUSINESS OVERVIEW

TABLE 229 CP KELCO U.S., INC.: PRODUCTS OFFERED

TABLE 230 CP KELCO U.S., INC.: NEW PRODUCT LAUNCHES

TABLE 231 CP KELCO U.S., INC.: DEALS

12.1.2 ALGAIA

TABLE 232 ALGAIA: BUSINESS OVERVIEW

TABLE 233 ALGAIA: PRODUCTS OFFERED

TABLE 234 ALGAIA: DEALS

12.1.3 ALGEA

TABLE 235 ALGEA: BUSINESS OVERVIEW

TABLE 236 ALGEA: PRODUCTS OFFERED

12.1.4 QINGDAO GATHER GREAT OCEAN ALGAE INDUSTRY GROUP CO., LTD

TABLE 237 QINGDAO GATHER GREAT OCEAN ALGAE INDUSTRY GROUP CO., LTD.: BUSINESS OVERVIEW

TABLE 238 QINGDAO GATHER GREAT OCEAN ALGAE INDUSTRY GROUP CO., LTD.: PRODUCTS OFFERED

TABLE 239 QINGDAO GATHERS GREAT OCEAN ALGAE INDUSTRY GROUP CO. LTD.: NEW PRODUCT LAUNCHES

TABLE 240 QINGDAO GATHER GREAT OCEAN ALGAE INDUSTRY GROUP CO., LTD.: DEALS

12.1.5 CARGILL, INCORPORATED

TABLE 241 CARGILL, INCORPORATED: BUSINESS OVERVIEW

FIGURE 35 CARGILL, INCORPORATED: COMPANY SNAPSHOT

TABLE 242 CARGILL, INCORPORATED: PRODUCTS OFFERED

TABLE 243 CARGILL, INCORPORATED: NEW PRODUCT LAUNCHES

TABLE 244 CARGILL, INCORPORATED: DEALS

12.1.6 QINGDAO BRIGHT MOON SEAWEED GROUP CO. LTD

TABLE 245 QINGDAO BRIGHT MOON SEAWEED GROUP CO. LTD: BUSINESS OVERVIEW

12.1.7 GELYMAR S.A

TABLE 246 GELYMAR S.A: BUSINESS OVERVIEW

TABLE 247 GELYMAR S.A: PRODUCTS OFFERED

TABLE 248 GELYMAR S.A: PRODUCTS LAUNCHES

12.1.8 CEAMSA

TABLE 249 CEAMSA: BUSINESS OVERVIEW

TABLE 250 CEAMSA: PRODUCTS OFFERED

12.1.9 BASF

TABLE 251 BASF: BUSINESS OVERVIEW

FIGURE 36 BASF: COMPANY SNAPSHOT

TABLE 252 BASF: PRODUCTS OFFERED

12.1.10 IRISH SEAWEEDS

TABLE 253 IRISH SEAWEEDS: BUSINESS OVERVIEW

TABLE 254 IRISH SEAWEEDS: PRODUCTS OFFERED

12.1.11 DUPONT

TABLE 255 DUPONT: BUSINESS OVERVIEW

FIGURE 37 DUPONT: COMPANY SNAPSHOT

TABLE 256 DUPONT: PRODUCTS OFFERED

12.1.12 COMPO EXPERT GROUP

TABLE 257 COMPO EXPERT GROUP: BUSINESS OVERVIEW

TABLE 258 COMPO EXPERT GROUP: PRODUCTS OFFERED

12.1.13 BEIJING LEILI AGRICULTURAL CO. LTD.

TABLE 259 BEIJING LEILI AGRICULTURAL CO. LTD: BUSINESS OVERVIEW

TABLE 260 BEIJING LEILI AGRICULTURAL CO. LTD: PRODUCTS OFFERED

12.1.14 GROUPE ROULLIER

TABLE 261 GROUP ROULLIER: BUSINESS OVERVIEW

TABLE 262 GROUPE ROULLIER: PRODUCTS OFFERED

12.1.15 ACADIAN SEAPLANTS

TABLE 263 ACADIAN SEAPLANTS.: BUSINESS OVERVIEW

TABLE 264 ACADIAN SEAPLANTS: PRODUCTS OFFERED

12.2 STARTUPS/SMES/OTHER PLAYERS

12.2.1 BIOATLANTIS

TABLE 265 BIOATLANTIS: BUSINESS OVERVIEW

12.2.2 THE SEAWEED COMPANY

TABLE 266 THE SEAWEED COMPANY: BUSINESS OVERVIEW

TABLE 267 THE SEAWEED COMPANY: PRODUCTS OFFERED

12.2.3 AQUARI PROCESSING PRIVATE LIMITED

TABLE 268 AQUARI PROCESSING PRIVATE LIMITED: BUSINESS OVERVIEW

TABLE 269 AQUAGRI PROCESSING PRIVATE LIMITED: PRODUCTS OFFERED

12.2.4 MARA SEAWEED

TABLE 270 MARA SEAWEED: BUSINESS OVERVIEW

TABLE 271 MARA SEAWEED: PRODUCTS OFFERED

12.2.5 ALGAPLUS

TABLE 272 ALGAPLUS: BUSINESS OVERVIEW

12.3 OTHER PLAYERS

12.3.1 SYMBROSIA

TABLE 273 SYMBROSIA: COMPANY OVERVIEW

12.3.2 SEAWEED AND CO

TABLE 274 SEAWEED AND CO: COMPANY OVERVIEW

12.3.3 OCEANIUM

TABLE 275 OCEANIUM: COMPANY OVERVIEW

12.3.4 UMARO

TABLE 276 UMARO: COMPANY OVERVIEW

12.3.5 TECHNAFLORA

TABLE 277 TECHNAFLORA: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 257)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

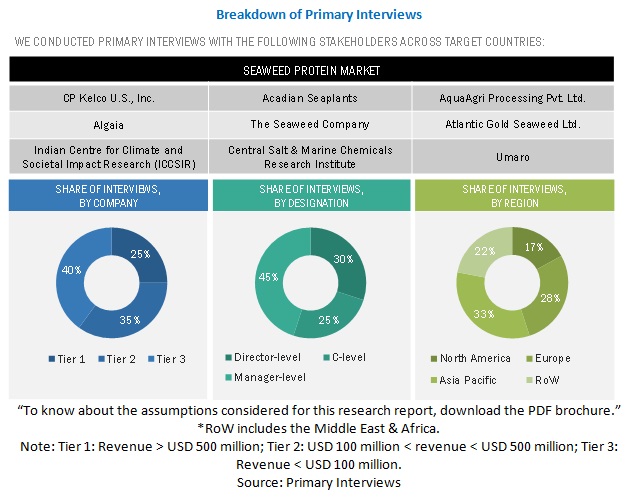

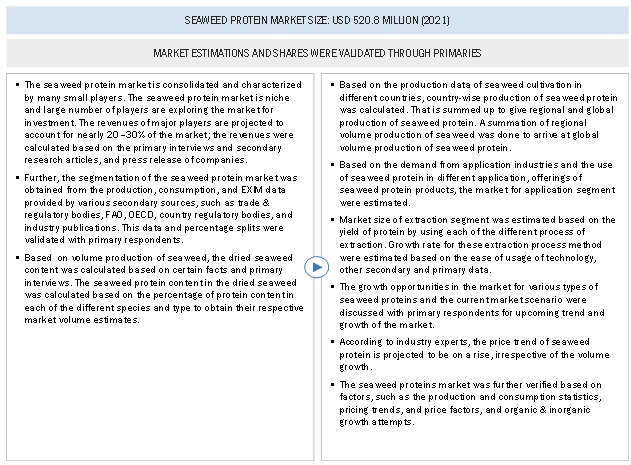

The study involved four major steps in estimating the size of the Seaweed protein market. Exhaustive secondary research was done to collect information on the market, as well as the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources, such as Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Food Safety Agency (EFSA), Food and Agriculture Organization (FAO), The Organization for Economic Co-operation and Development (OECD), The World Bank, The European Fisheries Control Agency (EFCA), The Seaweed Industry Association of Philippines (SIAP), and Southeast Asian Fisheries Development Centre/Aquaculture Department (SEAFDEC/AQD) were referred to identify and collect information for this study. The secondary sources also include clinical studies and medical journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, which include raw material suppliers, technology suppliers, and seaweed protein ingredient manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include seaweed protein manufacturers. The primary sources from the demand side include distributors, importers, exporters, and end consumers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the seaweed protein market. These approaches were also used extensively to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

-

Approach 1:

- The key players in the industry and the market were identified through extensive secondary research.

- The revenues of major seaweed protein players were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- Based on the market share analysis of key industry players from all regions, we arrived at the final market size of the seaweed protein market.

- Approach 2:

- Based on the demand for types and functions, offerings of key players, and the region-wise market share of major players, the global market, by type, was estimated.

- The other factors considered include the demand for health and wellness products, growth in immunity concerts, consumer awareness, function trends, pricing trends, adoption rate & price factors, patents registered, and organic & inorganic growth attempts.

- The demand analysis was conducted for each type, mode of application, and regional segment.

- The pricing analysis was conducted based on supplement types in regions.

- From this, we derived the market sizes for each region.

- Summing up the above, we arrived at the size of the global seaweed protein market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the seaweed protein market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global Seaweed protein Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into various segments and subsegments. To estimate the overall seaweed protein market and arrive at the exact statistics for all subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- Determining and projecting the size of the seaweed protein market with respect to type, mode of application, function, target consumer, and regional markets over a five year period ranging from 2022 to 2027

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across various regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- Providing the regulatory framework for major countries related to the seaweed protein market

- Analyzing the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

Competitive Intelligence

- Identifying and profiling the key players in the seaweed protein market

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- Analyzing the value chain and products across the key regions and their impact on the prominent market players.

- Providing insights on key product innovations and investments in the global seaweed protein market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Geographical Analysis

- Further breakdown of the Rest of Europe Seaweed protein market, by key country

- Further breakdown of the Rest of Asia Pacific Seaweed protein market, by key country

Company Information

- Analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Seaweed Protein Market