Semi-Autonomous & Autonomous Truck Market By Level of Automation (Level 1, Level 2 & 3, Level 4, and Level 5), Propulsion (Diesel, Electric, and Hybrid), Application, Truck Class, ADAS Features, Sensor, and Region - Global Forecast to 2030

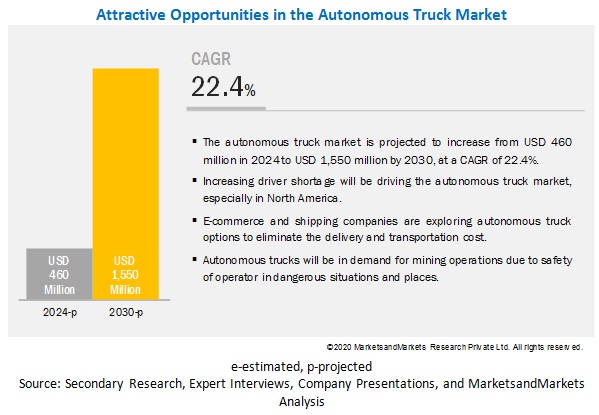

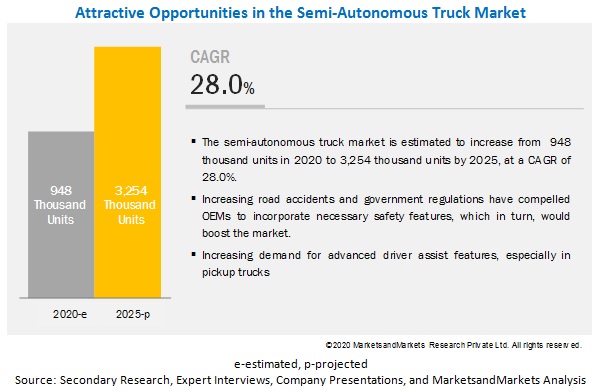

[225 Pages Report] The global autonomous truck market was valued at USD 460 million in 2024 and is expected to reach USD 1,550 million by 2030, at a CAGR of 22.4%. The global semi-autonomous truck market size is projected to reach 3,254 thousand units by 2025, from an estimated 948 thousand units in 2020, growing at a CAGR of 28.0%. Factors such as a rise in road accidents, shortage of drivers, government regulations regarding safety features, companies eyeing a reduction in delivery & transportation cost, and the increasing need for efficient yet feature-rich modern trucks are expected to drive the market for semi-autonomous and autonomous trucks.

The ultrasonic segment is estimated to lead the market during the forecast period

The ultrasonic segment is projected to have the largest market share in the semi-autonomous truck market by volume. Ultrasonic has a short-range and small Field of View (FoV). Hence, many ultrasonic sensors are used in semi-autonomous and autonomous trucks. Ultrasonic sensors are typically used for short-range object detection, which is applicable for parking ADAS features such as intelligent park assist. The cost of the ultrasonic sensors is less than other sensors. Currently, the cost of LIDARs is high, and generally, they are not installed in level 1 and level 2 semi-autonomous trucks.

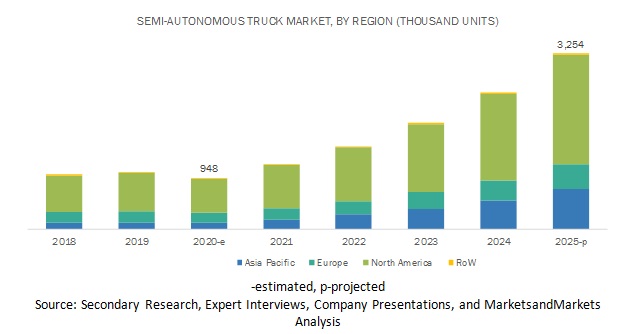

Asia Pacific semi-autonomous truck market is expected to register the fastest growth during the forecast period

The Asia Pacific is expected to be the fastest-growing region in the semi-autonomous truck market as well as in the autonomous truck market during the forecast period, owing to China and Japan's rapid progress toward vehicle automation, especially mining and delivery trucks, and increasing safety regulations by various countries. For instance, South Korea's Transport Ministry has made Autonomous Emergency Braking and Lane Departure Warning systems mandatory in passenger cars from January 2019 and in trucks and other vehicles from July 2021. Currently, both these systems are mandatory in more than 11-meter commercial vehicles and trucks and special vehicles weighing more than 20 tons.

The Asia Pacific is expected to be a technology follower. Once a robust technology is created, the region will speedily adopt the technology. Also, Asia is the largest manufacturer of trucks and contributes more than 65% of the total number of trucks manufactured globally. Road safety concerns will further propel the growth of the semi-autonomous market and the autonomous truck market in the region. Also, the introduction of autonomous technologies in mining trucks would drive the Asia Pacific autonomous truck market, as China is the biggest mining country in the world.

North America is expected to be the largest market during the forecast period

North America is the technology leader in autonomous technology. The region is home to some of the leading technology developers, such as Waymo, Uber, Intel, and Embark. These companies are focusing on the development of autonomous technology. Also, in the US, the testing of autonomous vehicles has started in some states. This will create an opportunity for further development of autonomous trucks. For instance, Daimler tested its level 4 autonomous truck on the streets of Virginia, US. Also, the region is dominated by pickup trucks having advanced semi-autonomous driving features. Ford and GMC are some of the leading players offering pickup trucks in the country. Tesla will enter the market soon with its 'Cybertruck' having all the semi-autonomous features and an optional autonomous driving feature as well.

Key Market Players

The global semi-autonomous truck market is dominated by major players such as Continental (Germany) Bosch (Germany), Aptiv (UK), AB Volvo (Sweden), and Denso (Japan). All the companies have strong distribution networks at a global level. In addition, these companies offer an extensive product range in this market. These companies have adopted strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position. On the other hand, Embark (US), Tesla (US), TuSimple (US), Caterpillar (US), and Waymo (US) are some of the companies that are focusing on developing autonomous trucks.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2030 |

|

Base year considered |

2018 |

|

Forecast period |

2020-2030 |

|

Forecast units |

Volume (Units) and Value (USD Billion) |

|

Segments covered |

Propulsion Type, Application, Truck Class, Sensor, ADAS Feature, Level of Automation, and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, and RoW |

|

Companies Covered |

Continental (Germany) Bosch (Germany), Aptiv (UK), AB Volvo (Sweden), and Denso (Japan). |

This research report categorizes the given market based on Propulsion Type, Application, Truck Class, Sensor, ADAS Feature, Level of Automation, and Region.

Based on Propulsion Type:

- Diesel

- Electric

- Hybrid

Based on the Level of Automation:

- Level 1

- Level 2 & Level 3

- Level 4

- Level 5

Based on the Application:

- Last-mile delivery truck

- Mining Truck

Based on the ADAS Feature:

- ACC

- AEB

- BSD

- LKA

- IPA

- TJA

- HP

Based on the Sensor:

- Ultrasonic

- Camera

- LiDAR

- Radar

Based on Truck Class:

- Class 1- Class 3

- Class 4- Class 6

- Class 7- Class 8

Based on the Region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

-

Rest of the World

- Russia

- Brazil

Critical Aspects:

- Governments are focusing on regulations related to safety standards in commercial vehicles. How will this transform the overall semi-autonomous truck market?

- How will fast-paced developments in self-driving technologies change the dynamics of this market?

- The industry is focusing on different sensors and software systems. Which are the leading companies working on it, and what organic and inorganic strategies have been adopted by them?

- The last mile delivery truck segment is expected to have a significant market during the forecast. How will this transform the overall autonomous truck market?

- Analysis of competitors, including major players in this market and ecosystem. The major players are Continental (Germany) Bosch (Germany), Aptiv (UK), AB Volvo (Sweden), and Denso (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 PACKAGE SIZE

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES FOR THE SEMI-AUTONOMOUS & AUTONOMOUS TRUCK MARKET

2.2.2 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH: MARKET

2.4.2 TOP-DOWN APPROACH: MARKET

2.4.3 BOTTOM-UP APPROACH: MARKET

2.4.4 TOP-DOWN APPROACH: MARKET

2.5 SEMI-AUTONOMOUS TRUCK MARKET: RESEARCH DESIGN & METHODOLOGY

2.6 SEMI-AUTONOMOUS TRUCK MARKET: RESEARCH METHODOLOGY ILLUSTRATION OF COMPANY-BASED REVENUE ESTIMATION

2.7 MARKET BREAKDOWN AND DATA TRIANGULATION

2.8 ASSUMPTIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 40)

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES IN THE SEMI-AUTONOMOUS TRUCK MARKET

4.2 ATTRACTIVE OPPORTUNITIES IN THE AUTONOMOUS TRUCK MARKET

4.3 MARKET GROWTH RATE, BY REGION

4.4 MARKET, BY PROPULSION

4.5 MARKET, BY PROPULSION

4.6 MARKET, BY APPLICATION

4.7 MARKET, BY ADAS FEATURE

4.8 SEMI-AUTONOMOUS MARKET, BY TRUCK CLASS

4.9 SEMI-AUTONOMOUS MARKET, BY LEVEL OF AUTOMATION

4.10 AUTONOMOUS MARKET, BY LEVEL OF AUTOMATION

4.11 MARKET, BY SENSOR (THOUSAND UNITS)

4.12 MARKET, BY SENSOR (USD MILLION)

4.13 MARKET, BY SENSOR (THOUSAND UNITS)

4.14 MARKET, BY SENSOR (USD THOUSAND)

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing emphasis on better road safety and traffic control

5.2.1.2 Ability of autonomous and semi-autonomous trucks to alleviate truck driver shortage

5.2.1.3 Economic effect of semi-autonomous and autonomous trucks on the trucking industry

5.2.2 RESTRAINTS

5.2.2.1 Concerns over cybersecurity and data privacy

5.2.2.2 Lack of information technology and communication infrastructure in developing nations

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for 5G technology for vehicle connectivity

5.2.3.2 Latent demand for semi-autonomous and autonomous truck platooning

5.2.4 CHALLENGES

5.2.4.1 Tapping the untapped market

5.2.4.2 Legal and regulatory framework issues

5.3 AUTONOMOUS TRUCK MARKET, SCENARIOS (2024–2030)

5.3.1 MARKET, MOST LIKELY SCENARIO

5.3.2 MARKET, OPTIMISTIC SCENARIO

5.3.3 MARKET, PESSIMISTIC SCENARIO

6 INTRODUCTION (COVID-19) (Page No. - 63)

6.1 COVID-19 HEALTH ASSESSMENT

6.2 COVID-19 ECONOMIC ASSESSMENT

6.2.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

7 INDUSTRY TRENDS (Page No. - 69)

7.1 TECHNOLOGICAL OVERVIEW

7.1.1 IOT AND 5G IN THE SEMI-AUTONOMOUS AND AUTONOMOUS TRUCK MARKET

7.1.2 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING IN THE SEMI-AUTONOMOUS AND AUTONOMOUS TRUCK MARKET

7.1.3 CYBERSECURITY AND DATA PRIVACY

7.2 REGULATORY OVERVIEW

7.3 VALUE CHAIN ANALYSIS

7.3.1 PLANNING AND REVISING FUNDS

7.3.2 AUTOMOTIVE COMPONENT SUPPLIERS

7.3.3 AV SOFTWARE AND SENSOR SUPPLIERS

7.3.4 OEMS

7.4 PATENT ANALYSIS

7.4.1 PATENT ANALYSIS

7.4.2 METHODOLOGY

7.4.3 DOCUMENT TYPE

7.4.3.1 Insight

7.5 CASE STUDY

7.5.1 A CASE STUDY ON TESLA’S MUCH-AWAITED CYBERTRUCK

7.5.2 A CASE STUDY ON THE FUTURE OF AUTONOMOUS TRUCKS AND ITS IMPACT ON THE US TRUCKING INDUSTRY

8 GOVERNMENT REGULATION & GUIDELINES FOR TESTING (Page No. - 80)

8.1 REGIONAL AND COUNTRY-LEVEL REGULATIONS/GUIDELINES

8.2 REGULATIONS RELATED TO LAST-MILE DELIVERY AUTONOMOUS TRUCKS

8.3 IMPACT OF CURRENT AND FUTURE REGULATIONS ON THE SEMI-AUTONOMOUS TRUCK MARKET

8.4 TESTING AND TRIALS OF AUTONOMOUS TRUCKS

9 AUTONOMOUS TRUCK MARKET, BY APPLICATION (Page No. - 83)

9.1 INTRODUCTION

9.2 OPERATIONAL DATA

9.2.1 ASSUMPTIONS

9.2.2 RESEARCH METHODOLOGY

9.3 LAST MILE DELIVERY TRUCK

9.3.1 INCREASING E-COMMERCE BOOM IS EXPECTED TO BOOST THE AUTONOMOUS TRUCK MARKET

9.4 MINING TRUCK

9.4.1 DEMAND FOR COLLISION AVOIDANCE IN MINING SITES WOULD DRIVE THE MARKET FOR AUTONOMOUS TRUCK MARKET

9.5 KEY INDUSTRY INSIGHTS

10 SEMI-AUTONOMOUS TRUCK MARKET, BY ADAS FEATURE (Page No. - 89)

10.1 INTRODUCTION

10.2 OPERATIONAL DATA

10.2.1 ASSUMPTIONS

10.2.2 RESEARCH METHODOLOGY

10.3 ADAPTIVE CRUISE CONTROL (ACC)

10.3.1 REDUCTION IN FUEL CONSUMPTION DUE TO ACC WILL DRIVE ITS DEMAND

10.4 AUTOMATIC EMERGENCY BRAKING (AEB)

10.4.1 DEMAND FOR SAFETY IN COMMERCIAL VEHICLES WOULD BOOST THE AEB SEGMENT

10.5 BLIND SPOT DETECTION (BSD)

10.5.1 GOVERNMENT MANDATES TO EQUIP SAFETY FEATURES WILL MAKE EUROPEAN MARKET TO GROW AT THE FASTEST RATE

10.6 INTELLIGENT PARK ASSIST (IPA)

10.6.1 EASE OF PARKING OF HEAVY COMMERCIAL VEHICLES WITH MINIMAL DRIVER ASSISTANCE WILL FUEL DEMAND FOR IPA IN SEMI-AUTONOMOUS TRUCK MARKET

10.7 LANE KEEP ASSIST (LKA)

10.7.1 HIGH DEMAND FOR SAFETY FEATURES TO MINIMIZE THE RATE OF ACCIDENTS WILL DRIVE THE NORTH AMERICAN MARKET

10.8 TRAFFIC JAM ASSIST (TJA)

10.8.1 RISING FOCUS ON BETTER ROAD SAFETY AND ADVANCED AUTONOMOUS DRIVING TECHNOLOGY TO DRIVE THE NORTH AMERICAN MARKET

10.9 HIGHWAY PILOT (HP)

10.9.1 DEMAND FOR SAFETY AND COMFORT FOR DRIVERS IN UPCOMING VEHICLES WILL FUEL THE MARKET

10.1 KEY INDUSTRY INSIGHTS

11 SEMI-AUTONOMOUS AND AUTONOMOUS TRUCK MARKET, LEVEL OF AUTOMATION TYPE (Page No. - 101)

11.1 INTRODUCTION

11.2 SEMI-AUTONOMOUS TRUCK MARKET, BY LEVEL OF AUTOMATION

11.3 OPERATIONAL DATA

11.3.1 ASSUMPTIONS

11.3.2 RESEARCH METHODOLOGY

11.4 LEVEL 1

11.4.1 GOVERNMENT MANDATES FOR LEVEL 1 AUTOMATION WILL FUEL THE MARKET

11.5 LEVEL 2 & 3

11.5.1 UPGRADE OF MORE SAFETY FEATURES IN LEVEL 2 & 3 AUTOMATION WILL BOOST THE SEMI-AUTONOMOUS TRUCK MARKET

11.6 AUTONOMOUS TRUCK MARKET, BY LEVEL OF AUTOMATION

11.7 LEVEL 4

11.7.1 ADVANTAGE OF HAVING MANUAL DRIVING AS WELL AS SELF-DRIVING OPTION WOULD MAKE THE SEGMENT MORE FEASIBLE IN PRACTICAL WORLD

11.8 LEVEL 5

11.8.1 DRIVER SHORTAGE AND SAVING IN DELIVERY OR LOGISTICS COST TO DRIVE THE NORTH AMERICAN MARKET

11.9 KEY INDUSTRY INSIGHTS

12 SEMI-AUTONOMOUS AND AUTONOMOUS TRUCK MARKET, BY PROPULSION TYPE (Page No. - 111)

12.1 INTRODUCTION

12.2 OPERATIONAL DATA

12.2.1 ASSUMPTIONS

12.2.2 RESEARCH METHODOLOGY

12.3 DIESEL

12.3.1 HIGH POWER OUTPUT AND TORQUE GENERATED BY DIESEL ENGINES VEHICLES WILL DRIVE THE MARKET

12.3.2 INTRODUCTION TO AUTONOMOUS DRIVING TECH IN MILITARY AND MINING TRUCKS TO BOOST THE DIESEL-ELECTRIC SEGMENT

12.4 ELECTRIC

12.4.1 STRINGENT REGULATIONS FOR ZERO EMISSIONS WILL DRIVE DEMAND FOR ELECTRIC SEMI-AUTONOMOUS TRUCKS SIGNIFICANTLY

12.4.2 PRESENCE OF OEMS AND AUTONOMOUS DRIVING TECHNOLOGY PROVIDERS TO HELP THE NORTH AMERICAN AUTONOMOUS TRUCK MARKET FOR ELECTRIC PROPULSION

12.5 HYBRID

12.5.1 INCREASING DEMAND FOR EFFICIENT AND LESS-EMITTING TRUCKS TO DRIVE THE MARKET FOR HYBRID SEMI-AUTONOMOUS TRUCKS

12.5.2 FOCUS ON DEVELOPING HYBRID PROPULSION TRUCKS BY LEADING OEMS TO DRIVE THE MARKET

12.6 KEY INDUSTRY INSIGHTS

13 SEMI-AUTONOMOUS AND AUTONOMOUS TRUCK MARKET, BY SENSOR TYPE (Page No. - 121)

13.1 INTRODUCTION

13.2 OPERATIONAL DATA

13.2.1 ASSUMPTIONS

13.2.2 RESEARCH METHODOLOGY

13.3 CAMERA

13.3.1 OEMS OFFERING ADVANCED PICKUP TRUCKS IN THE REGION TO BOOST THE NORTH AMERICAN REGION

13.3.2 3600 VIEW PROVIDED BY CAMERA SENSORS WILL FUEL THE MARKET

13.4 RADAR

13.4.1 HIGH DEMAND FOR ACCURATE DATA WITH A PRECISE ANGULAR RESOLUTION WILL DRIVE THE RADAR SENSORS IN SEMI-AUTONOMOUS AND AUTONOMOUS MARKET

13.5 LIDAR

13.5.1 ADAS APPLICATIONS SUPPORTED BY LIDAR WILL FUEL THE MARKET

13.6 ULTRASONIC

13.6.1 SHORT RANGE OBJECT DETECTION BY ULTRASONIC SENSORS WILL BOOST THE MARKET

13.7 KEY INDUSTRY INSIGHTS

14 SEMI-AUTONOMOUS TRUCK MARKET, BY TRUCK CLASS (Page No. - 135)

14.1 INTRODUCTION

14.2 OPERATIONAL DATA

14.2.1 ASSUMPTIONS

14.2.2 RESEARCH METHODOLOGY

14.3 CLASS 1–CLASS 3 (LIGHT-DUTY TRUCK)

14.3.1 INCREASING DEMAND FOR LIGHT-DUTY TRUCKS WILL FUEL THE SEMI-AUTONOMOUS TRUCK MARKET

14.4 CLASS 4–CLASS 6 (MEDIUM-DUTY TRUCK)

14.4.1 FOCUS ON SAFETY AND COMFORT FEATURES TO MAKE WAY FOR SEMI-AUTONOMOUS TRUCKS

14.5 CLASS 7 & CLASS 8

14.5.1 OEMS AND TECHNOLOGY COMPANIES FOCUSING ON TESTING CLASS 8 TRUCKS WITH ADVANCED TECHNOLOGIES TO DRIVE THE NORTH AMERICAN MARKET

14.6 KEY INDUSTRY INSIGHTS

15 SEMI-AUTONOMOUS AND AUTONOMOUS TRUCK MARKET, BY REGION (Page No. - 142)

15.1 INTRODUCTION

15.1.1 INCREASING DEMAND FOR SAFE COMMERCIAL VEHICLES IS EXPECTED TO DRIVE THE MARKET

15.1.2 COMPANIES FOCUSING ON REDUCING DELIVERY/TRANSPORTATION COST ARE EXPECTED TO DRIVE THE MARKET

15.2 EUROPE

15.2.1 PRESENCE OF LEADING TECHNOLOGY PROVIDERS IN THE REGION TO DRIVE THE EUROPEAN MARKET

15.2.2 GERMANY

15.2.2.1 Presence of key players to drive the German market

15.2.3 ITALY

15.2.3.1 Increasing vehicle safety concerns will fuel the Italian market

15.2.4 UK

15.2.4.1 Increasing initiatives from various institutions for installation of ADAS features will drive the UK market

15.2.5 SPAIN

15.2.5.1 Upcoming safety features mandate in the European region would boost the Spanish market as well

15.2.6 FRANCE

15.2.6.1 Increasing trend of adoption of safe vehicles will fuel the French market

15.3 NORTH AMERICA

15.3.1 US

15.3.1.1 Increasing efforts from the government for adoption of ADAS and large sales of advanced pickup trucks to drive the US market

15.3.2 CANADA

15.3.2.1 Increasing number of tests conducted by the government will drive the Canadian market

15.3.3 MEXICO

15.3.3.1 Trade agreements like NAFTA will drive the Mexican market

15.4 ASIA PACIFIC

15.4.1 CHINA

15.4.1.1 Increasing demand for driver safety in mining applications to drive the market for semi-autonomous trucks

15.4.2 JAPAN

15.4.2.1 Upcoming safety regulations will drive the Japanese semi-autonomous market

15.4.3 INDIA

15.4.3.1 Increasing government initiatives toward improving road safety to drive the Indian market

15.4.4 SOUTH KOREA

15.4.4.1 Mandating of FCW and LDW will fuel the South Korean market

15.5 REST OF THE WORLD (ROW)

15.5.1 BRAZIL

15.5.1.1 Need to reduce traffic accidents will drive the market in Brazil

15.5.2 RUSSIA

15.5.2.1 Presence of companies investing and developing self-driving vehicles in Russia will trigger the market

16 COMPETITIVE LANDSCAPE (Page No. - 165)

16.1 OVERVIEW

16.2 MARKET RANKING ANALYSIS FOR SEMI-AUTONOMOUS TRUCK MARKET

16.3 MARKET RANKING ANALYSIS FOR AUTONOMOUS TRUCK MARKET

16.4 COMPETITIVE SCENARIO

16.4.1 COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/ PARTNERSHIPS/AGREEMENTS

16.4.2 NEW PRODUCT DEVELOPMENTS

16.4.3 MERGERS & ACQUISITIONS

16.4.4 EXPANSIONS

16.5 COMPETITIVE LEADERSHIP MAPPING FOR SEMI-AUTONOMOUS AND AUTONOMOUS TRUCK MARKET

16.5.1 STARS

16.5.2 EMERGING LEADERS

16.5.3 PERVASIVE

16.5.4 EMERGING COMPANIES

16.6 STRENGTH OF PRODUCT PORTFOLIO

16.7 BUSINESS STRATEGY EXCELLENCE

16.8 WINNERS VS. TAIL-ENDERS

17 COMPANY PROFILES (Page No. - 177)

17.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

17.1.1 AB VOLVO

17.1.2 BOSCH

17.1.3 CONTINENTAL

17.1.4 DENSO

17.1.5 APTIV

17.1.6 EMBARK

17.1.7 DAIMLER

17.1.8 WAYMO

17.1.9 TESLA

17.1.10 PACCAR

17.1.11 NVIDIA

17.1.12 TUSIMPLE

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

17.2 OTHER MAJOR PLAYERS

17.2.1 NORTH AMERICA

17.2.1.1 Qualcomm

17.2.1.2 Intel

17.2.1.3 Uber

17.2.1.4 Nvidia

17.2.1.5 Ford Motor Co.

17.2.1.6 Caterpillar

17.2.2 EUROPE

17.2.2.1 Scania

17.2.2.2 NXP

17.2.2.3 IVECO

17.2.2.4 ZF

17.2.2.5 MAN SE

17.2.2.6 BMW

17.2.2.7 2getthere

17.2.3 ASIA PACIFIC

17.2.3.1 Hino Motors, Ltd.

17.2.3.2 Isuzu Motors Ltd.

18 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 217)

18.1 NORTH AMERICA WILL BE A MAJOR SEMI-AUTONOMOUS AND AUTONOMOUS TRUCK MARKET

18.2 LAST MILE DELIVERY TRUCKS CAN BE A KEY FOCUS FOR AUTONOMOUS DRIVING TECHNOLOGY COMPANIES

18.3 CONCLUSION

19 APPENDIX (Page No. - 218)

19.1 KEY INSIGHTS OF INDUSTRY EXPERTS

19.2 DISCUSSION GUIDE

19.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

19.4 AVAILABLE CUSTOMIZATIONS

19.5 RELATED REPORTS

19.6 AUTHOR DETAILS

LIST OF TABLES (124 Tables)

TABLE 1 INCLUSIONS & EXCLUSIONS FOR THE SEMI-AUTONOMOUS TRUCK MARKET

TABLE 2 US HOURS OF SERVICE REGULATIONS

TABLE 3 KEY PLAYERS IN THE GLOBAL TRUCK PLATOONING MARKET

TABLE 4 MARKET SIZE (MOST LIKELY), BY REGION, 2024–2030 (UNITS)

TABLE 5 MARKET SIZE (OPTIMISTIC), BY REGION, 2024–2030 (UNITS)

TABLE 6 MARKET SIZE (PESSIMISTIC), BY REGION, 2024–2030 (UNITS)

TABLE 7 PATENTS FILED

TABLE 8 SOME NOTEWORTHY TESTING AND TRIALS OF AUTONOMOUS TRUCKS

TABLE 9 MARKET SIZE, BY APPLICATION, 2024-2030 (UNITS)

TABLE 10 PLAYERS OPERATING IN AUTONOMOUS MINING TRUCKS AND THEIR FLEET SIZE

TABLE 11 LAST MILE DELIVERY TRUCK: MARKET SIZE, BY REGION, 2024–2030 (UNITS)

TABLE 12 MINING TRUCK: MARKET SIZE, BY REGION, 2024–2030 (UNITS)

TABLE 13 SEMI-AUTONOMOUS TRUCK MARKET SIZE, BY ADAS FEATURE, 2018–2025 (THOUSAND UNITS)

TABLE 14 CRASH REDUCTION THROUGH APPLICATION OF ADAS SYSTEMS

TABLE 15 ADAPTIVE CRUISE CONTROL (ACC): MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 16 AUTOMATIC EMERGENCY BRAKING (AEB): MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 17 BLIND SPOT DETECTION (BSD): MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 18 INTELLIGENT PARKING ASSISTANCE (IPA): MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 19 LANE KEEP ASSIST (LKA): MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 20 TRAFFIC JAM ASSIST (TJA): MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 21 HIGHWAY PILOT (HP): MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 22 SEMI-AUTONOMOUS TRUCK MARKET SIZE, BY LEVEL OF AUTOMATION, 2018–2025 (THOUSAND UNITS)

TABLE 23 TOP FIVE BEST-SELLING PICKUP TRUCKS WITH LEVEL 1 AUTONOMY FEATURES IN THE US

TABLE 24 LEVEL 1: MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 25 LEVEL 2 & 3: MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 26 MARKET SIZE, BY LEVEL OF AUTOMATION, 2024–2030 (UNITS)

TABLE 27 LEVEL 4: MARKET SIZE, BY REGION, 2024–2030 (UNITS)

TABLE 28 LEVEL 5: MARKET SIZE, BY REGION, 2024–2030 (UNITS)

TABLE 29 MARKET SIZE, BY PROPULSION TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 30 MARKET SIZE, BY PROPULSION TYPE, 2024–2030 (UNITS)

TABLE 31 LARGE TRUCK CRASHES IN THE USE, BY ROAD TYPE (2018)

TABLE 32 DIESEL: MARKET SIZE, BY REGION, 2018-2025 (THOUSAND UNITS)

TABLE 33 DIESEL: MARKET SIZE, BY REGION, 2024–2030 (UNITS)

TABLE 34 ELECTRIC: MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 35 ELECTRIC: MARKET SIZE, BY REGION, 2024–2030 (UNITS)

TABLE 36 HYBRID: MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 37 HYBRID: MARKET SIZE, BY REGION, 2024–2030 (UNITS)

TABLE 38 MARKET SIZE, BY SENSOR TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 39 MARKET SIZE, BY SENSOR TYPE, 2018–2025 (USD MILLION)

TABLE 40 MARKET SIZE, BY SENSOR TYPE, 2024–2030 (THOUSAND UNITS)

TABLE 41 MARKET SIZE, BY SENSOR TYPE, 2024–2030 (USD THOUSAND)

TABLE 42 COMMERCIAL VEHICLE SALES DATA, 2016–2019, UNITS

TABLE 43 CAMERA: SEMI-AUTONOMOUS TRUCK MARKET SIZE, BY REGION,2018–2025 (THOUSAND UNITS)

TABLE 44 CAMERA: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 45 CAMERA: MARKET SIZE, BY REGION, 2024–2030 (THOUSAND UNITS)

TABLE 46 CAMERA: MARKET SIZE, BY REGION, 2024–2030 (USD THOUSAND)

TABLE 47 RADAR: MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 48 RADAR: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 49 RADAR: MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 50 RADAR: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 51 LIDAR: SEMI-AUTONOMOUS TRUCK MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 52 LIDAR: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 53 LIDAR: MARKET SIZE, BY REGION, 2024–2030 (THOUSAND UNITS)

TABLE 54 LIDAR: MARKET SIZE, BY REGION, 2024–2030 (USD THOUSAND)

TABLE 55 ULTRASONIC: SEMI-AUTONOMOUS TRUCK MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 56 ULTRASONIC: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 57 ULTRASONIC: MARKET SIZE, BY REGION, 2024–2030 (THOUSAND UNITS)

TABLE 58 ULTRASONIC: MARKET SIZE, BY REGION, 2024–2030 (USD THOUSAND)

TABLE 59 SEMI-AUTONOMOUS TRUCK MARKET SIZE, BY TRUCK CLASS, 2020–2025 (THOUSAND UNITS)

TABLE 60 CLASS 7 & 8 TRUCKS LEADING THE DEVELOPMENT OF SEMI-AUTONOMOUS AND AUTONOMOUS DRIVING SOLUTIONS

TABLE 61 CLASS 1–CLASS 3: MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 62 CLASS 4–CLASS 6: MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 63 CLASS 7 & CLASS 8: MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 64 MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 65 MARKET SIZE, BY REGION, 2024–2030 (UNITS)

TABLE 66 MARKET SIZE, BY REGION, 2024–2030 (USD MILLION)

TABLE 67 AUTOMOBILE ASSEMBLY AND PRODUCTION PLANTS IN EUROPE, BY COUNTRY

TABLE 68 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 69 GERMANY: MARKET SIZE, BY LEVEL OF AUTOMATION, 2018–2025 (THOUSAND UNITS)

TABLE 70 ITALY: MARKET SIZE, BY LEVEL OF AUTOMATION, 2018–2025 (THOUSAND UNITS)

TABLE 71 UK: MARKET SIZE, BY LEVEL OF AUTOMATION, 2018–2025 (THOUSAND UNITS)

TABLE 72 SPAIN: MARKET SIZE, BY LEVEL OF AUTOMATION, 2018–2025 (THOUSAND UNITS)

TABLE 73 FRANCE: MARKET SIZE, BY LEVEL OF AUTOMATION, 2018–2025 (THOUSAND UNITS)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 75 US: MARKET SIZE, BY LEVEL OF AUTOMATION, 2018–2025 (THOUSAND UNITS)

TABLE 76 CANADA: MARKET SIZE, BY LEVEL OF AUTOMATION, 2018–2025 (THOUSAND UNITS)

TABLE 77 MEXICO: MARKET SIZE, BY LEVEL OF AUTOMATION, 2018–2025 (THOUSAND UNITS)

TABLE 78 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 79 CHINA: MARKET SIZE, BY LEVEL OF AUTOMATION, 2018–2025 (THOUSAND UNITS)

TABLE 80 JAPAN: MARKET SIZE, BY LEVEL OF AUTOMATION, 2018–2025 (THOUSAND UNITS)

TABLE 81 INDIA: MARKET SIZE, BY LEVEL OF AUTOMATION, 2018–2025 (THOUSAND UNITS)

TABLE 82 SOUTH KOREA: MARKET SIZE, BY LEVEL OF AUTOMATION, 2018–2025 (THOUSAND UNITS)

TABLE 83 ROW: MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 84 BRAZIL: MARKET SIZE, BY LEVEL OF AUTOMATION, 2018–2025 (THOUSAND UNITS)

TABLE 85 RUSSIA: MARKET SIZE, BY LEVEL OF AUTOMATION, 2018–2025 (THOUSAND UNITS)

TABLE 86 COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/PARTNERSHIPS/ AGREEMENTS, 2017–2019

TABLE 87 NEW PRODUCT DEVELOPMENTS, 2017–2018

TABLE 88 MERGERS & ACQUISITIONS, 2016–2017

TABLE 89 EXPANSIONS, 2017-2019

TABLE 90 WINNERS VS. TAIL-ENDERS

TABLE 91 AB VOLVO: THE COMPANY OFFERS THE FOLLOWING PRODUCTS:

TABLE 92 AB VOLVO: NEW PRODUCT LAUNCHES

TABLE 93 AB VOLVO: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/ AGREEMENTS/MERGERS & ACQUISITIONS

TABLE 94 BOSCH: THE COMPANY OFFERS THE FOLLOWING PRODUCTS:

TABLE 95 BOSCH: NEW PRODUCT LAUNCHES

TABLE 96 BOSCH: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/ AGREEMENTS/MERGERS & ACQUISITIONS

TABLE 97 CONTINENTAL: THE COMPANY OFFERS THE FOLLOWING PRODUCTS:

TABLE 98 CONTINENTAL: NEW PRODUCT LAUNCHES/EXPANSIONS

TABLE 99 CONTINENTAL: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/ AGREEMENTS/MERGERS & ACQUISITIONS

TABLE 100 DENSO: THE COMPANY OFFERS THE FOLLOWING PRODUCTS:

TABLE 101 DENSO: NEW PRODUCT LAUNCHES/EXPANSIONS

TABLE 102 DENSO: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/AGREEMENTS/ MERGERS & ACQUISITIONS

TABLE 103 APTIV: THE COMPANY OFFERS THE FOLLOWING PRODUCTS:

TABLE 104 APTIV: NEW PRODUCT LAUNCHES/EXPANSIONS

TABLE 105 APTIV: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/AGREEMENTS/ MERGERS & ACQUISITIONS

TABLE 106 EMBARK: THE COMPANY OFFERS THE FOLLOWING PRODUCTS/TECHNOLOGIES:

TABLE 107 EMBARK: NEW PRODUCT LAUNCHES/EXPANSIONS

TABLE 108 EMBARK: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/ AGREEMENTS/MERGERS & ACQUISITIONS

TABLE 109 DAIMLER: THE COMPANY OFFERS THE FOLLOWING PRODUCTS:

TABLE 110 DAIMLER: NEW PRODUCT LAUNCHES

TABLE 111 DAIMLER: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/ AGREEMENTS/MERGERS & ACQUISITIONS

TABLE 112 WAYMO: THE COMPANY OFFERS THE FOLLOWING PRODUCTS:

TABLE 113 WAYMO: NEW PRODUCT LAUNCHES

TABLE 114 WAYMO: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/AGREEMENTS/ MERGERS & ACQUISITIONS

TABLE 115 TESLA: NEW PRODUCT DEVELOPMENTS

TABLE 116 TESLA: EXPANSIONS

TABLE 117 TESLA: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/ AGREEMENTS/MERGERS & ACQUISITIONS

TABLE 118 PACCAR: THE COMPANY OFFERS THE FOLLOWING PRODUCTS:

TABLE 119 PACCAR: NEW PRODUCT LAUNCHES

TABLE 120 PACCAR: PARTNERSHIP/COLLABORATION/JOINT VENTURES/AGREEMENTS/ MERGERS & ACQUISITIONS

TABLE 121 NVIDIA: THE COMPANY OFFERS THE FOLLOWING PRODUCTS:

TABLE 122 NVIDIA: NEW PRODUCT LAUNCHES

TABLE 123 NVIDIA: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/AGREEMENTS/ MERGERS & ACQUISITIONS

TABLE 124 TUSIMPLE: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/ AGREEMENTS/MERGERS & ACQUISITIONS

LIST OF FIGURES (75 Figures)

FIGURE 1 RESEARCH METHODOLOGY

FIGURE 2 DIESEL

FIGURE 3 HIGH POWER OUTPUT AND TORQUE GENERATED BY DIESEL ENGINES VEHICLES WILL DRIVE THE MARKET

FIGURE 4 INTRODUCTION TO AUTONOMOUS DRIVING TECH IN MILITARY AND MINING TRUCKS TO BOOST THE DIESEL-ELECTRIC SEGMENT

FIGURE 5 ELECTRIC

FIGURE 6 STRINGENT REGULATIONS FOR ZERO EMISSIONS WILL DRIVE DEMAND FOR ELECTRIC SEMI-AUTONOMOUS TRUCKS SIGNIFICANTLY

FIGURE 7 PRESENCE OF OEMS AND AUTONOMOUS DRIVING TECHNOLOGY PROVIDERS TO HELP THE NORTH AMERICAN AUTONOMOUS TRUCK MARKET FOR ELECTRIC PROPULSION

FIGURE 8 HYBRID

FIGURE 9 INCREASING DEMAND FOR EFFICIENT AND LESS-EMITTING TRUCKS TO DRIVE THE MARKET FOR HYBRID SEMI-AUTONOMOUS TRUCKS

FIGURE 10 FOCUS ON DEVELOPING HYBRID PROPULSION TRUCKS BY LEADING OEMS TO DRIVE THE MARKET

FIGURE 11 KEY INDUSTRY INSIGHTS

FIGURE 12 SEMI-AUTONOMOUS AND AUTONOMOUS TRUCK MARKET, BY SENSOR TYPE

FIGURE 13 INTRODUCTION

FIGURE 14 OPERATIONAL DATA

FIGURE 15 ASSUMPTIONS

FIGURE 16 RESEARCH METHODOLOGY

FIGURE 17 CAMERA

FIGURE 18 OEMS OFFERING ADVANCED PICKUP TRUCKS IN THE REGION TO BOOST THE NORTH AMERICAN REGION

FIGURE 19 3600 VIEW PROVIDED BY CAMERA SENSORS WILL FUEL THE MARKET

FIGURE 20 RADAR

FIGURE 21 HIGH DEMAND FOR ACCURATE DATA WITH A PRECISE ANGULAR RESOLUTION WILL DRIVE THE RADAR SENSORS IN SEMI-AUTONOMOUS AND AUTONOMOUS MARKET

FIGURE 22 LIDAR

FIGURE 23 ADAS APPLICATIONS SUPPORTED BY LIDAR WILL FUEL THE MARKET

FIGURE 24 ULTRASONIC

FIGURE 25 SHORT RANGE OBJECT DETECTION BY ULTRASONIC SENSORS WILL BOOST THE MARKET

FIGURE 26 KEY INDUSTRY INSIGHTS

FIGURE 27 SEMI-AUTONOMOUS TRUCK MARKET, BY TRUCK CLASS

FIGURE 28 INTRODUCTION

FIGURE 29 OPERATIONAL DATA

FIGURE 30 ASSUMPTIONS

FIGURE 31 RESEARCH METHODOLOGY

FIGURE 32 CLASS 1–CLASS 3 (LIGHT-DUTY TRUCK)

FIGURE 33 INCREASING DEMAND FOR LIGHT-DUTY TRUCKS WILL FUEL THE SEMI-AUTONOMOUS TRUCK MARKET

FIGURE 34 CLASS 4–CLASS 6 (MEDIUM-DUTY TRUCK)

FIGURE 35 FOCUS ON SAFETY AND COMFORT FEATURES TO MAKE WAY FOR SEMI-AUTONOMOUS TRUCKS

FIGURE 36 CLASS 7 & CLASS 8

FIGURE 37 OEMS AND TECHNOLOGY COMPANIES FOCUSING ON TESTING CLASS 8 TRUCKS WITH ADVANCED TECHNOLOGIES TO DRIVE THE NORTH AMERICAN MARKET

FIGURE 38 KEY INDUSTRY INSIGHTS

FIGURE 39 SEMI-AUTONOMOUS AND AUTONOMOUS TRUCK MARKET, BY REGION

FIGURE 40 INTRODUCTION

FIGURE 41 INCREASING DEMAND FOR SAFE COMMERCIAL VEHICLES IS EXPECTED TO DRIVE THE MARKET

FIGURE 42 COMPANIES FOCUSING ON REDUCING DELIVERY/TRANSPORTATION COST ARE EXPECTED TO DRIVE THE MARKET

FIGURE 43 EUROPE

FIGURE 44 PRESENCE OF LEADING TECHNOLOGY PROVIDERS IN THE REGION TO DRIVE THE EUROPEAN MARKET

FIGURE 45 GERMANY

FIGURE 46 Presence of key players to drive the German market

FIGURE 47 ITALY

FIGURE 48 Increasing vehicle safety concerns will fuel the Italian market

FIGURE 49 UK

FIGURE 50 Increasing initiatives from various institutions for installation of ADAS features will drive the UK market

FIGURE 51 SPAIN

FIGURE 52 Upcoming safety features mandate in the European region would boost the Spanish market as well

FIGURE 53 FRANCE

FIGURE 54 Increasing trend of adoption of safe vehicles will fuel the French market

FIGURE 55 NORTH AMERICA

FIGURE 56 US

FIGURE 57 Increasing efforts from the government for adoption of ADAS and large sales of advanced pickup trucks to drive the US market

FIGURE 58 CANADA

FIGURE 59 Increasing number of tests conducted by the government will drive the Canadian market

FIGURE 60 MEXICO

FIGURE 61 Trade agreements like NAFTA will drive the Mexican market

FIGURE 62 ASIA PACIFIC

FIGURE 63 CHINA

FIGURE 64 Increasing demand for driver safety in mining applications to drive the market for semi-autonomous trucks

FIGURE 65 JAPAN

FIGURE 66 Upcoming safety regulations will drive the Japanese semi-autonomous market

FIGURE 67 INDIA

FIGURE 68 Increasing government initiatives toward improving road safety to drive the Indian market

FIGURE 69 SOUTH KOREA

FIGURE 70 Mandating of FCW and LDW will fuel the South Korean market

FIGURE 71 REST OF THE WORLD (ROW)

FIGURE 72 BRAZIL

FIGURE 73 Need to reduce traffic accidents will drive the market in Brazil

FIGURE 74 RUSSIA

FIGURE 75 Presence of companies investing and developing self-driving vehicles in Russia will trigger the market

The study involved four major activities in estimating the current market size of the semi-autonomous and autonomous truck market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of truck OEMs, Canadian Automobile Association (CAA), International Energy Agency (IEA), Federal Transit Administration (FTA), Regional Transportation Authority (RTA), country-level automotive associations and trade organizations, and the US Department of Transportation (DOT)], truck magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, government organizations websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global semi-autonomous and autonomous truck market.

Primary Research

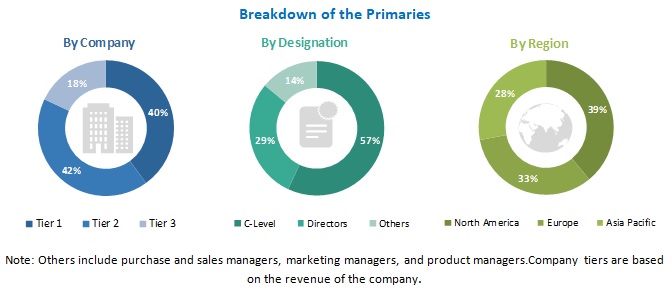

Extensive primary research has been conducted after acquiring an understanding of this market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across three major regions, namely, Asia Pacific, Europe, North America, Latin America, and Middle East & Africa. Approximately 30% and 70% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the total market size. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To analyze the semi-autonomous truck market and forecast its size, in terms of volume (units), from 2018 to 2025

- To analyze the market and forecast its size, in terms of volume (units), from 2024 to 2030

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To segment the market and forecast the market size, by volume (units), based on propulsion type (Diesel, Hybrid, and Electric)

- To segment the market and forecast the market size, by volume (Units) and value (USD thousand), based on sensor type (Radars, LIDAR, Ultrasonic, and Cameras)

- To segment the market and forecast the market size, by volume (units), based on the level of automation (Level 1, Level 2 & Level 3)

- To segment the market and forecast the market size, by volume (units), based on the level of automation (Level 4 and Level 5)

- To segment the market and forecast the market size, by volume (units), based on truck class (Class 1 to Class 3 (Light-duty trucks), Class 4 to Class 6 (Medium-duty trucks), Class 7 & Class 8 (Heavy-duty trucks))

- To segment the market and forecast the market size, by volume (units), based on ADAS features (Adaptive Cruise Control, Traffic Jam Assist, Intelligent Park Assist, Automatic Emergency Braking, Blind Spot Detection, Highway Pilot, and Lane Keep Assist)

- To segment the market and forecast the market size, by volume (units), based on application (Last-Mile Delivery Truck and Mining Truck).

- To segment the market and forecast its size, by volume, based on region (Asia Pacific, Europe, North America, and Rest of the world (RoW))

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with the company’s specific needs.

- Semi-Autonomous and Autonomous Truck Market, By Sensor Type at country level (For countries covered in the report)

- Semi-Autonomous and Autonomous Truck Market, By Propulsion Type at country level (For countries covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 5)

Growth opportunities and latent adjacency in Semi-Autonomous & Autonomous Truck Market