Service Robotics Market Size, Share & Industry Growth Analysis Report by Environment (Aerial, Ground, Marine), Type (Professional, Personal & Domestic), Component, Application (Logistics, Inspection & Maintenance, Public Relations, Education) and Region - Global Forecast to 2028

The global service robotics market size is projected to reach USD 84.8 billion by 2028 from USD 41.5 billion in 2023; it is expected to grow at a CAGR of 15.4% from 2023 to 2028.

Growing adoption of robots for new applications, surging use of IoT in robots for cost-effective predictive maintenance, and increasing use of disinfection robots due to rising cases of hospital-acquired infections (HAIs) are driving the growth of the service robotics industry. Robots are increasingly being adopted for new applications due to advantages such as increased productivity, streamlined processes, and greater workplace safety.

Service Robotics Market Statistics Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Global Service Robotics Market Dynamics

Driver: Increasing funding for research on robots

The funding for research on service robotics has increased significantly in the past few years, with various governments taking initiatives. According to the National Artificial Intelligence Research and Development Strategic Plan, by 2028, AI researchers in G20 countries are expected to contribute ~USD 11.5 trillion to intelligent technologies.

Various countries are investing heavily in robotics mostly on a government level. For instance, the Government of China provided funding of USD 43.5 million for ‘the Key Special Program on Intelligent Robots in 2022’. In Japan, a budget of USD 440 million was assigned to robotics-related projects in the Moonshot Research and Development Program over 5 years from 2020 to 2025.

Restraint: Concerns over data privacy and regulations

With the rise of software services for robotics, there are ethical issues with data ownership. In the case of delivery robots, public traffic areas designated for pedestrians are used, which binds them to operate under a legal, regulatory framework.

Most western legal authorities hold the manufacturer responsible for the tort of negligence if a delivery robot causes damage or injury to a user or people passing by the robot. In February 2020, Nuro’s (US) R2 became the first autonomous delivery vehicle in the US to get a permit from the Department of Transportation for testing on public roads. Therefore, stringent regulations are delaying the penetration of delivery robots.

Opportunity: Focus on improving endurance and capability of robots

Despite huge advancements in robotics, robots developed until now do not match the capabilities of human beings. There is an opportunity to improve natural language processing and user interfaces to improve the ability of humanoid robots for more interactive communication.

Drones are limited to areas that have access to Wi-Fi. A few companies offer Wi-Fi or communication network-related products or services. For instance, Whizpace (Singapore) offers Super Wi-Fi, which utilizes white space communication and provides services in rural and remote areas. Partnerships with such companies would increase the operating range of drones.

Challenge: Inaccurate results impeding use in critical operations

If robots manufactured by all companies are considered, the average distance covered by a robot is 10 km on a single charge, with its service limited to short distances from the hub or warehouse. Robots are designed to walk or travel on sidewalks, but they are not functional enough to climb stairs.

The navigation of completely autonomous delivery robots is also a key challenge faced by manufacturers. It requires tasks such as building a map of the environment, localizing the robot in that map, and making a motion plan according to the map to be performed simultaneously so that the robots can travel or operate easily in uncontrolled environments or without any human intervention.

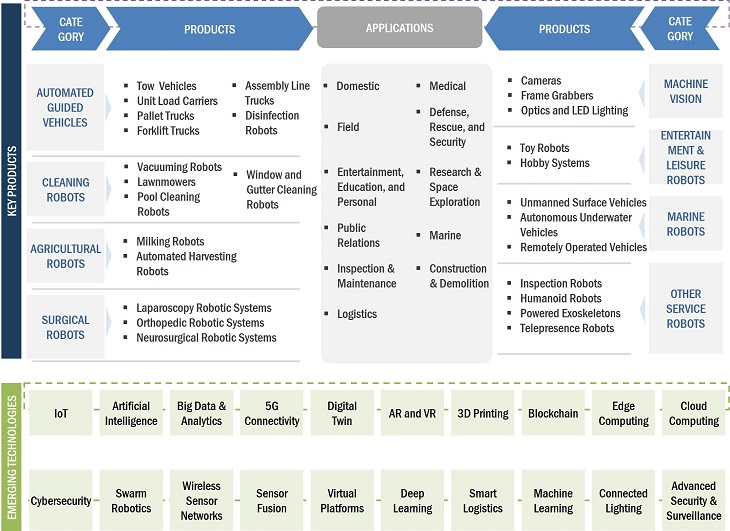

Service Robotics Ecosystem

Service Robotics Industry Segment Overview

Service robotics market for aerial robots expected to grow at highest CAGR during the forecast period

The service robotics market for aerial drones is expected to grow at the highest CAGR during the forecast period. UAVs are garnering high demand from the agriculture industry due to the need for improved and efficient farming, driven by the growing demand for food to fulfill the requirements of the growing global population.

Professional UAVs are considered a low-cost alternative to traditional aerial photogrammetry for surveying and mapping. For photography and filmmaking, professional UAVs offer unique advantages over conventional methods, such as extended range, agility, and the ability to film acrobatic shots.

Service robotics market for software component to grow at higher CAGR than that of the hardware component during the forecast period

The market is estimated to be higher for the software component as the deployment of service robots is likely to become more application-specific. Several companies are developing software to map 3D data collected by UAVs.

Software are generally used for semi-automation of UAVs to maintain their stability since the takeoff and landing of UAVs can be a challenge for UAV operators. This feature is easy to program and inexpensive.

Research and space exporation application to grow at higher CAGR during the forecast period

The research and space exploration segment is expected to grow at the highest CAGR during the forecast period, attributed to the rising government funding related to space exploration.

For instance, in 2020, the US government provided USD 22.6 billion to NASA. In 2019, the European Space Agency received funding of USD 15.9 billion from its 22 member states.

Professional robots to hold a larger share than that of personal and domestic robots during the forecast period

The professional service robots are expected to hold a larger market share as compared to domestic service robots during the forecast period. The service robots used for professional applications include drones, agricultural robots, inspection robots, humanoid robots, exoskeletons, construction robots, unmanned surface vehicles (USVs), and autonomous underwater vehicles (AUVs) among others.

Humanoid robots are used in various industries, such as retail, hospitality, education, archeology, rescue applications, and space. For instance, Robotmea Middle East, an outcome of the partnership between Robotron Incorporation (Australia) and Minirobot Corporation (South Korea), is developed to redefine education by adding robotics and AI in the existing curriculums of schools, colleges, and universities. Exoskeletons are used in industries to increase the endurance of workers. For instance, in January 2020, Delta Airlines (US) partnered with exoskeleton company Sarcos Robotics (US) to help employees lift luggage.

Service Robotics Market Share

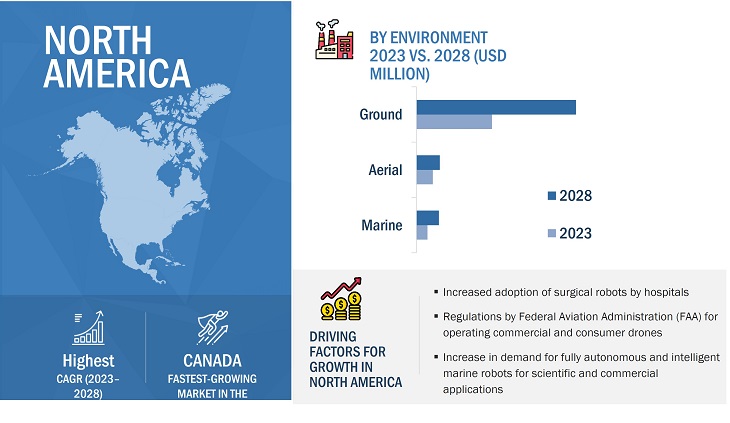

Service robotics market in North America to hold largest market share during the forecast period

The factors driving the market in the North America include the high per capita income, ongoing research programs, increasing aging population, and shortage of labor due to stringent immigration laws.

Mexico is still a developing country, and many service robots have not penetrated Mexico due to their high cost. Mexico can offer a good opportunity for service robots owing to a strong agriculture industry and various free trade agreements signed by the country. The following table lists some of the players operating in this region.

Service Robotics Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

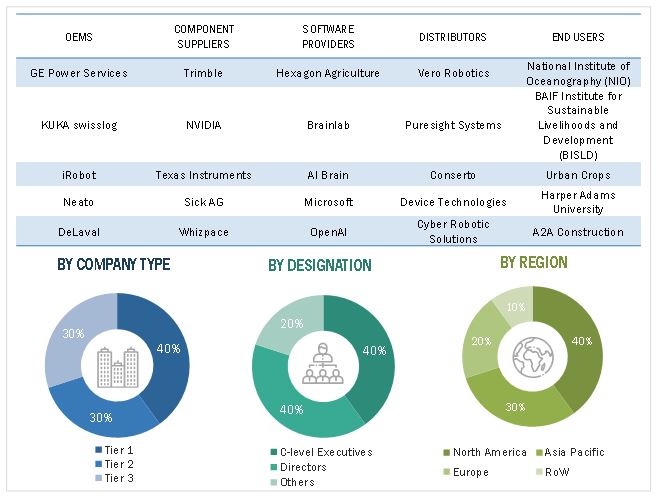

In the process of determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key industry experts in the service robotics market space. The break-up of primary participants for the report has been shown below:

- By Company Type: Tier 1 – 40%, Tier 2 – 30%, and Tier 3 – 30%

- By Designation: C-level Executives – 40%, Directors – 40%, and Others – 20%

- By Region: North America –40%, Asia Pacific– 30%, Europe – 20%, and RoW

Top Service Robotics Companies - Key Market Players

Major service robotics companies are iRobot (US), SoftBank Robotics Group (Japan), Intuitive Surgical (US), JD.com, Inc. (China), Daifuku (Japan), Samsung Electronics Co., Ltd. (South Korea), DJI (China), Kongsberg Maritime (Norway), Northrop Grumman (US), DeLaval (Sweden), Exyn Technologies (US), XAG (China), AMP Robotics (US), UVD Robots (Denmark), Diligent (US), HARVEST CROO (US), and Starship Technologies (US).

Service Robotics Market Report Scope

|

Report Metric |

Details |

| Service Robotics Market Growth Rate | CAGR of 15.4% |

| Market Size Value in 2028 | USD 84.8 billion |

| Market Size Value in 2023 | USD 41.5 billion |

|

Service Robotics Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Units |

Value (USD Million/USD Billion) |

|

Segments covered |

Component, Environment, Type, Application, and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

iRobot (US), Intuitive Surgical (US), Daifuku (Japan), Samsung Electronics Co. Ltd. (South Korea), JD.com Inc. (China), DeLaval (Sweden), DJI (China), Kongsberg Maritime (Norway), Northrop Grumman (US), Neato Robotics (US), KUKA (Germany), Lely (Netherlands), ECA Group (France), 3DR (US), Stryker Corporation (US), HARVEST CROO (US), Starship Technologies (US), PARROT SA (France), General Electric (US), Amazon Robotics (US), Diligent(US), AMP Robotics (US), UVD Robots (Denmark), XAG (China), and Exyn Technologies (US). |

Service Robotics Market Highlights

The study categorizes the service robotics market based on component, environment, type, application, and region.

|

Segment |

Subsegment |

|

By Component: |

|

|

By Environment |

|

|

By Type |

|

|

By Application |

|

|

By Region |

|

Recent Developments in Service Robotics Industry

- In August 2022, Amazon.com, Inc. (US) and iRobot Corporation announced a definitive merger agreement under which Amazon will acquire iRobot Corporation under its expansion plan with a USD 1.7 billion offer.

- In June 2022, Intuitive Surgical and Siemens collaborated to integrate a mobile cone-beam CT (CBCT) imaging technology and the Ion Endoluminal System used for robot-assisted bronchoscopy.

- In March 2022, JD.com, Inc., through its logistics arm, JD Logistics, has introduced autonomous delivery robots in Shanghai to offer contactless last-mile delivery. These robots can load up to 100 kilograms of goods and can drive up to 80 kilometers per charge.

- In September 2021, iRobot Corporation launched the Roomba j7+ robot vacuum and new features powered by iRobot Corporation Genius 3.0 Home Intelligence.

Frequently Asked Questions (FAQ):

Which are the major companies in service robotics market? What are the major strategies to strengthen their market presence?

Some of the key players in the service robotics market include Intuitive Surgical (US), DJI (China), Daifuku (Japan), iRobot (US), JD.com Inc. (China), and Samsung Electronics (South Korea), among others.

What are the drivers and opportunities for the service robotics market?

Growing adoption of robots for new applications is providing high returns on investment. This is due to advantages such as increased productivity, streamlined processes, and enhanced workplace safety. The main benefit of using service robots is the reduction in operations cost and high ROI. Service robots have recently been introduced for delivery applications in e-commerce. The need for high efficiency in automotive, healthcare, e-commerce, and food & beverages industries is increasing the demand for automation.

What are the various technological developments for the service robotics landscape in the future?

Advancement in artificial intelligence (AI) is expected to drastically improve the operational capabilities for service robotics and provide a desired long-term outcome for increased productivity, real-time guidance, and data-driven performance. AI-based robot can perform tasks much faster and with greater precision than humans, which can increase efficiency and productivity in various industries. AI-based robots can use sensors and other technologies to accurately measure and analyze data, pertaining to more accurate results and better decision-making.

Which region is expected to adopt service robotics at a fastest rate during forecasted period?

Asia Pacific region is expected to adopt service robotics at the fastest rate. Developing countries such as China and India are expected to have a high potential for the future growth of the service robotics market.

What is the total CAGR expected to be recorded for the service robotics market during forecasted period?

The CAGR is expected to record a of 15.4% from 2023-2028 for service robotics market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

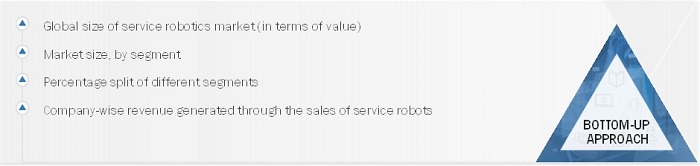

The study involved four major activities in estimating the current size for service robotics market. Exhaustive secondary research was done to collect information on the market, related market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. Both top-down and bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary research process referred for this study include various secondary sources were referred to for identifying and collecting information related to this study. Secondary sources include annual reports; press releases; investor presentations; white papers; journals and certified publications; and articles from recognized authors, directories, and databases. Secondary research was conducted to obtain key information about the industry’s supply chain, value chain, total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from the market- and technology-oriented perspectives.

After the complete market engineering (which includes calculations for market statistics, market breakdown, data triangulation, market size estimations, and market forecasting), extensive primary research was conducted to gather information and verify and validate the numbers obtained.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering service robotics market and information from various trade, business, and professional associations (Association for the Advancement of Artificial Intelligence (AAAI), International Federation of Robotics (IFR), IEEE Robotics And Automation Society). The secondary data was collected and analyzed to arrive at the overall size of the service robotics market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after gaining knowledge about the service robotics market scenario through various secondary sources. Exhaustive primary interviews were conducted with market experts from both demand-side (commercial application-specific peripheral providers) and supply-side (equipment manufacturers and distributors) across 4 major regions includes North America, Europe, Asia Pacific, and Rest of the World. The aaproximate segmentation of primaries were 20% and 80% for demand side and suppy side, respectively. Primary data was collected through questionnaires, e-mails, meetings, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market sizing used to estimate and validate the size of the service robotics market and other dependent submarkets include the complete engineering process, such as top-down and bottom-up approaches and several data triangulation methods. Key players in the market have been determined through primary and secondary resources. This complete research methodology involved the study of the annual and financial reports of top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) about the service robotics market. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Service Robotics Market Size: Bottom-Up Approach

Service Robotics Market Size: Top- Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand and supply sides. The market size was also validated using top-down and bottom-up approaches.

Market Definition

A service robot operates with partial assistance or full autonomy to perform services useful for the well-being of humans or equipment, excluding manufacturing operations. A service robot used for noncommercial tasks is called a personal/domestic robot, e.g., robotic vacuum cleaners and elderly assistance robots. A service robot used for commercial tasks and usually operated by a properly trained operator is called a professional robot, e.g., surgical robots and automated guided vehicles (AGVs). The scope of the report also includes drones (commercial and consumer) and marine robots (remotely operated vehicles (ROVs), autonomous underwater vehicles (AUVs), and unmanned surface vehicles (USVs)).

Key Stakeholders

- Original equipment manufacturers (OEMs)

- OEM technology solution providers

- Research institutes

- Market research and consulting firms

- Forums, alliances, and associations

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- Existing and prospective end users

Report Objectives

- To describe and forecast the service robotics market by environment, type, component, and application in terms of value

- To describe and forecast the market for four main regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the service robotics market

- To provide a detailed overview of the value chain and ecosystem of the service robotics market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To benchmark market players using the proprietary Company Evaluation Quadrant framework, which analyzes the players under various parameters within the broad categories of business strategy excellence and strength of product portfolio

- To strategically profile key players and comprehensively analyze their market position in terms of rankings and core competencies2, and provide the competitive landscape of the market

- To analyze competitive developments such as acquisitions, product launches, and research and development in the service robotics market

Available Customizations

MarketsandMarkets offers customizations according to the company’s specific needs and with the given market data. The following customization options are available for the report:

- Additional country-level analysis of the service robotics market

- Profiling additional market players (upto 5)

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company in service robotics market

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Service Robotics Market

Interested in market size of defense service robots and also home service robots with information related to competitors and market projections.

Interested in office and enterprise robotic applications, telepresence robots, trend toward robot vendors having SDKs.

Hi, Is it possible to purchase only market for logistics? Do you have market reports on software, integration services, and operational services for logistics robots with, e.g., warehouse execution systems?

Please send me some sample info that I can use to get a client to buy the full report OR come back with a custom request.

In extrapolating the market growth, was the assumption that the market will be composed of unique robot hardware plus software applications? Or, did you consider a paradigm shift that would occur with a cloud-connected standard robot platform plus a robust 3rd party developer program based on an SDK and API by which software entrepreneurs can enter the market?

Interested on finding out how much semiconductor content, market potential per technology is present in the consumer or service robotics market.

I am specifically interested in the breakdown of the service robotics market by component and application.

we want to understand the competitive landscape of the service robot market, and who are the leading players. Moreover, whether their products and techniques can be effectively used under the scenario of living community or workplace in china.

Hi, we are interested in the report and require additional information for existing report. We will communicate our requirements to you via email.