Smart Lighting Market

Smart Lighting Market Size, Share , Growth & Trends by Lights and Luminaire, Lighting Controls, LED Drivers and Ballasts, Sensors, Switches, Gateways, Dimmers, Relay Units, DALI, Power over Ethernet (PoE), Power Line Communications (PLC) and Zigbee - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global smart lighting market is anticipated to grow from USD 9.86 billion in 2025 to USD 17.38 billion by 2030, expanding at a compound annual growth rate (CAGR) of 12.0% during the forecast period. There are multiple factors driving the growth of the smart lighting market. Establishment of digital and standard protocols by regulatory bodies, increasing smart city initiatives globally, advancements in AI and edge computing, growing adoption of LEDs and luminaires in outdoor applications, rising demand for IoT- integrated smart lighting solutions, and increasing penetration of data analytics in smart lighting are some of the major factors influencing the market growth.

The smart lighting market has emerged as one of the most dynamic segments within the broader smart home and commercial automation industry, driven by rapid adoption of energy-efficient and connected lighting solutions. According to recent industry reports, the global smart lighting market size is projected to grow significantly over the next decade, propelled by increasing investments in IoT infrastructure, rising consumer demand for automated lighting controls, and strong regulatory support for energy savings. Market analysis shows that devices such as smart bulbs, adaptive luminaires, and networked control systems collectively account for the largest industry share, as both residential and commercial sectors seek solutions that offer real-time control, mesh connectivity, and integration with AI assistants. Key statistics indicate a forecasted annual growth rate that outpaces traditional lighting, underscoring the transition toward intelligent lighting ecosystems.

Growth trends in the smart led lighting market reveal that technological advancements and consumer preferences are reshaping industry dynamics. Smart lighting devices now incorporate features such as occupancy sensing, adaptive brightness, daylight harvesting, and remote programming boosting demand across end-use verticals. Detailed market forecasts highlight that the Asia-Pacific region is expected to register robust growth, while North America and Europe continue to hold substantial market share due to higher penetration of connected devices. Industry analysis further points to the expanding role of wireless protocols and standardized interoperability frameworks, enabling seamless integration with broader building management systems. With sustainability goals driving investments and a growing array of product innovations, smart lighting is set to experience sustained growth in both consumer and enterprise applications worldwide.

KEY TAKEAWAYS

-

BY OFFERINGOffering includes Hardware, Software, and Services. Services in the smart lighting market are expected to exhibit the highest CAGR due to growing demand for installation, maintenance, and managed lighting solutions that ensure optimal performance and energy efficiency.

-

BY INSTALLATION TYPEInstallation type segment includes New Installations and Retrofit Installations. Retrofit installations are expected to exhibit the highest CAGR due to increasing demand for upgrading existing lighting infrastructure to energy-efficient, IoT-enabled systems without major capital expenditure.

-

BY COMMUNICATION TECHNOLOGYThe communication technology segment includes Wired and Wireless. Wired communication technology is expected to lead the smart lighting market in 2024 due to its reliable data transmission, low latency, and secure connectivity, which are critical for large-scale urban and industrial lighting networks.

-

BY DISTRIBUTION CHANNELDistribution channel includes online sales and offline sales. Offline sales are expected to lead in 2024 because traditional retail channels and direct distributor networks remain the primary choice for commercial and municipal lighting purchases, where buyers prefer in-person evaluation and installation support.

-

BY END-USE APPLICATIONThe end-use application segment includes indoor and outdoor applications. Outdoor lighting is expected to exhibit the highest CAGR due to increasing smart city projects, rising demand for energy-efficient streetlights, and the need for adaptive, IoT-enabled public and roadway illumination.

-

BY REGIONAsia Pacific is expected to exhibit the highest CAGR due to rapid urbanization, strong smart city initiatives, and increasing adoption of energy-efficient, IoT-enabled lighting solutions across commercial and public infrastructure.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships, expansions, and product launches. For instance, in November 2024, the lighting brands Thorn and Zumtobel of Zumtobel Group joined forces with Sunderland Association Football Club (Sunderland AFC) to execute an extensive Stadium of Light illumination upgrade.

The smart lighting market is being driven by rapid urbanization and the global push for smart city initiatives, which are fueling demand for connected and energy-efficient lighting solutions. Rising adoption of IoT-enabled and human-centric lighting systems in commercial, residential, and public spaces is further accelerating market growth. Technological advancements such as AI-based adaptive lighting, Li-Fi integration, and sensor-driven automation are enabling smarter, more responsive lighting networks. Additionally, supportive government policies promoting energy efficiency, sustainability, and reduced carbon emissions are creating new opportunities, while increasing investments and partnerships between lighting vendors and IoT platform providers are shaping the competitive landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Smart lighting companies are increasingly shifting from traditional lamps, bulbs, and non-integrated controls toward connected, integrated, and human-centric lighting solutions to capture new revenue streams. Innovations such as PoE lighting, wireless systems, smart solar-powered lighting, and IoT-enabled smart workplaces are redefining the market, enabling enhanced energy efficiency, automation, and user-centric experiences. This transition reflects a broader disruption as companies pivot from conventional revenue sources to smart, technology-driven lighting offerings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing smart city initiatives

-

Rising demand for IoT-integrated smart lighting solutions

Level

-

Difficulties associated with retrofitting of traditional lighting infrastructure

-

Cybersecurity concerns associated with internet-connected lighting systems

Level

-

Emerging smart office and smart retail trends

-

Rising adoption of human-centric lighting solutions

Level

-

Interoperability and compatibility issues

-

High upfront costs of equipment & accessories

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing Smart City Initiatives

The growing implementation of smart city projects is driving the deployment of connected and energy-efficient lighting systems. Governments and municipalities are increasingly adopting smart lighting to enhance urban infrastructure, reduce energy consumption, and enable adaptive illumination for public safety and sustainability.

Restraint: Cybersecurity Concerns Associated with Internet-Connected Lighting Systems

As lighting systems become part of larger IoT networks, they are exposed to cybersecurity vulnerabilities. Unauthorized access or hacking can compromise data privacy or disrupt operations, making robust encryption, secure communication protocols, and continuous monitoring essential for system integrity.

Opportunity: Emerging Smart Office and Smart Retail Trends

The increasing adoption of intelligent lighting in offices and retail spaces presents significant growth opportunities. Smart lighting enhances employee productivity, improves customer experience, and supports energy optimization through automation and personalized control, aligning with modern workplace and retail transformation trends.

Challenge: High Upfront Costs of Equipment & Accessories

The adoption of smart lighting systems is often limited by the high initial investment required for sensors, controllers, communication modules, and installation. These costs can be challenging for small-scale projects or developing regions, despite long-term savings through reduced energy and maintenance expenses.

Smart Lighting Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Comprehensive smart lighting systems for residential, commercial, and outdoor environments, integrating sensors, wireless control, and cloud-based management. | Industry leadership, high energy efficiency, advanced IoT connectivity, and strong interoperability with smart home ecosystems. |

|

Intelligent lighting solutions featuring wireless controls, occupancy sensing, and daylight harvesting for smart buildings and industrial spaces. | Enhanced energy savings, automation-driven lighting optimization, and improved operational efficiency in connected environments. |

|

Smart switches, lighting control systems, and integrated building management solutions for commercial and residential infrastructure. | Seamless integration with building automation systems, user-friendly interfaces, and improved lighting flexibility and comfort. |

|

Networked lighting systems integrated with building management platforms for industrial, commercial, and institutional facilities. | Real-time lighting control, improved energy management, enhanced occupant comfort, and reduced operational costs. |

|

IoT-enabled smart lighting solutions for homes, offices, and public infrastructure, incorporating motion sensors and wireless connectivity. | Improved energy efficiency, flexible installation, enhanced user experience, and alignment with sustainable smart city initiatives. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The smart lighting ecosystem comprises R&D engineers driving innovation, hardware, software, and services providers developing integrated solutions, distributors facilitating market reach, and end users adopting connected lighting for energy efficiency, automation, and enhanced user experience. This interconnected network ensures continuous product improvement, seamless deployment, and scalable adoption across residential, commercial, and industrial segments.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Smart Lighting Market, Offering

Hardware is expected to lead in 2024 as it forms the foundation of smart lighting systems. The growing adoption of connected lighting across residential, commercial, and industrial segments drives strong demand for physical components that enable automation, energy management, and integration with smart networks.

Smart Lighting Market, Installation Type

Retrofit installation is projected to show the highest CAGR due to the preference for upgrading existing lighting systems rather than installing entirely new setups. This approach offers cost efficiency, convenience, and faster deployment, allowing buildings to modernize and achieve energy savings without major structural changes.

Smart Lighting Market, Communication Technology

Wireless communication technology is expected to grow fastest due to its flexibility, scalability, and ease of deployment. It simplifies installation, support integration with smart systems, and enable seamless connectivity in both new and existing environments, aligning with the increasing demand for automated and connected lighting.

Smart Lighting Market, By Distribution Channel

Offline sales are anticipated to lead as customers rely on hands-on evaluation, personalized guidance, and immediate access to solutions. Distributors, retail outlets, and installers remain key in educating end users, ensuring proper setup, and fostering trust, which is critical for widespread adoption.

Smart Lighting Market, By End-use Application

Indoor commercial applications are expected to dominate due to growing adoption in offices, retail, and institutional facilities. The focus on improving productivity, user comfort, operational efficiency, and sustainability drives strong demand for smart lighting solutions in these environments.

REGION

Asia Pacific to exhibit the fastest CAGR in the global smart lighting market during the forecast period

Asia Pacific is expected to register the highest CAGR due to rapid urbanization, increasing smart city initiatives, and strong government support for energy-efficient infrastructure. Growing awareness of sustainability, rising commercial and residential construction, and increasing adoption of connected technologies in countries like China, India, and South Korea further drive the demand for smart lighting solutions in the region.

The European smart lighting market is projected to reach USD 3.06 billion by 2030 from USD 2.02 billion in 2025, at a CAGR of 8.6% from 2025 to 2030. The regional market is driven by stringent energy-efficiency regulations and sustainability mandates set by European regulatory bodies, promoting the widespread adoption of smart lighting solutions across commercial, industrial, and municipal sectors.

The Asia Pacific smart lighting market is projected to reach USD 8.45 billion by 2030, up from USD 3.94 billion in 2025, at a CAGR of 16.5% from 2025 to 2030. This growth is driven by large-scale urban development, expanding smart-city programs, and the acceleration of LED-to-IoT lighting transitions across the region. The rising adoption of intelligent lighting solutions in commercial buildings, industrial facilities, residential complexes, and municipal infrastructure is strengthening overall market demand. Government-backed energy-efficiency policies, carbon-reduction targets, and nationwide LED modernization initiatives are further supporting expansion.

The North American smart lighting market is projected to reach USD 3.67 billion by 2030, up from USD 2.63 billion in 2025, at a CAGR of 6.9% from 2025 to 2030. This growth is driven by the increasing adoption of intelligent lighting solutions across commercial, industrial, and municipal sectors. Market expansion is supported by stringent energy-efficiency regulations, carbon-reduction targets, and rebate programs introduced by US and Canadian authorities. Rising smart-building investments and the modernization of public infrastructure, including street lighting, campuses, and transportation hubs, are accelerating the transition from conventional lighting to IoT-enabled connected systems across the region.

Smart Lighting Market: COMPANY EVALUATION MATRIX

Signify is a star player with high market share and a broad product portfolio, maintaining a strong global presence. Honeywell is an emerging leader with growth opportunities, leveraging its building management expertise to expand in commercial and industrial smart lighting.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Signify Holding (Netherlands)

- Acuity Brands, Inc. (US)

- Legrand (France)

- Honeywell International Inc. (US)

- Panasonic Holdings Corporation (Japan)

- Elbit System Limited (Israel)

- Boeing (US)

- Aselsan A.S. (Turkey)

- Kongsberg (Norway)

- Northrop Grumman (US)

- GMV Innovating Solutions S.L. (Spain)

- Kratos Defense & Security Solutions (US)

- Mitsubishi Electric Corporation (Japan)

- Thales (France)

- SpaceX (US)

- Terma Group (Denmark)

- BAE Systems plc (UK)

- Leonardo S.p.A. (Italy)

- Indra Sistemas, S.A. (Spain)

- Amazon (US)

- Honeywell International Inc. (US)

- Exail (France)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 9.86 Billion |

| Market Forecast in 2030 (Value) | USD 17.38 Billion |

| Growth Rate | CAGR of 12.0% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Americas, Europe, Asia Pacific, and RoW |

WHAT IS IN IT FOR YOU: Smart Lighting Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| European Smart City Authority | Evaluation of connected lighting infrastructure across public areas, transportation corridors, and residential clusters with focus on interoperability and adaptive illumination. |

|

| North American Building Automation Company | Assessment of IoT-integrated lighting controls aligned with Building Management Systems (BMS) for commercial complexes. |

|

| Asia Pacific Real Estate Developer | Comparative evaluation of human-centric and circadian lighting technologies for smart homes and commercial properties. |

|

| Middle East Infrastructure Operator | Cost–performance analysis of adaptive street lighting systems incorporating motion sensors and dynamic dimming capabilities. |

|

| South American Utility Provider | Feasibility study for deployment of solar-powered and IoT-connected smart streetlights within urban grids. |

|

RECENT DEVELOPMENTS

- January 2025 : Signify Holding added new innovative features along with Philips Hue accessories that enhanced home illumination functions and entertainment features as well as home security solutions. The first generative Al assistant from Philips Hue became commercially available to customers. Through the Hue app users can access an assistant that creates customized lighting scenes based on their preferences for moods along with celebrations and various design styles. Users can generate perfect ambient settings through input commands either by verbal or written instructions using this assistance tool. Users can also utilize type or voice commands while receiving feedback to achieve ongoing system upgrades.

- November 2024 : The lighting brands Thorn and Zumtobel of Zumtobel Group joined forces with Sunderland Association Football Club (Sunderland AFC) to execute an extensive Stadium of Light illumination upgrade. The initiative belongs to Sunderland AFC's biggest stadium investment program of the past two decades while advancing the club's long-term sustainability framework to achieve complete energy independence by 2028.

- October 2024 : Acuity Brands established Nightingale as its patient-focused brand which combines lighting solutions to provide a splendid experience for patients while supporting both caregiver performance needs. Nightingale utilizes its extensive lighting experience to combine design elements with advanced illumination technology which establishes a healing environment that cares for patients.

- February 2024 : Panasonic Life Solutions India (PEWIN) established a new manufacturing plant in Daman, Gujrat, India. The dedicated manufacturing unit will extend the existing product capabilities and boost the overall production capability for lighting at their Indian facilities. PEWIN allocated INR 15 million (approximately USD 0.18 million) to build the facility which will enable the manufacturing of lighting products under its own roof as part of the company's strategic growth plan.

- January 2024 : Legrand introduced its newest advanced LED dimmer in the radiant Collection. This dimmer controls lighting precisely through its advanced circuitry which delivers wide-ranging dimmer functions to eliminate standard dimming difficulties.

Table of Contents

Methodology

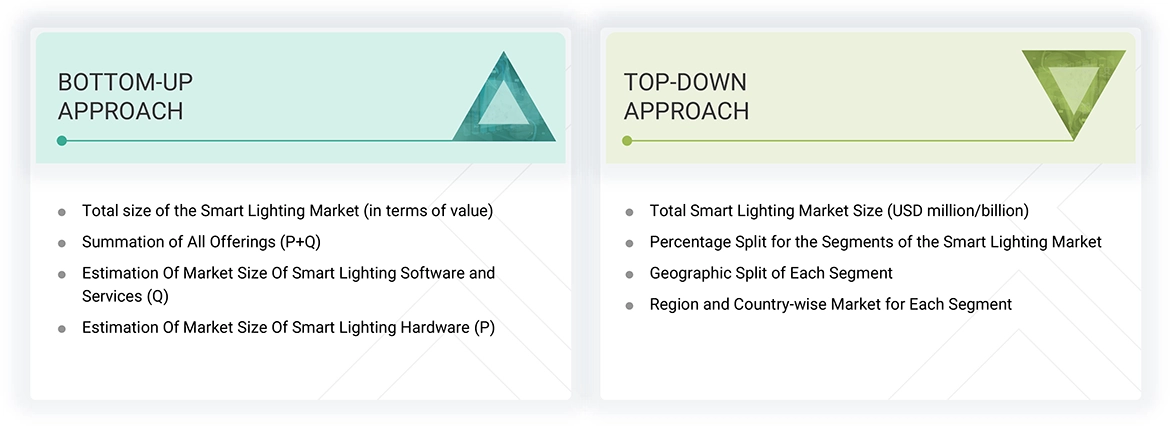

The research study involved 4 major activities in estimating the size of the smart lighting market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the supply chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

Primary Research

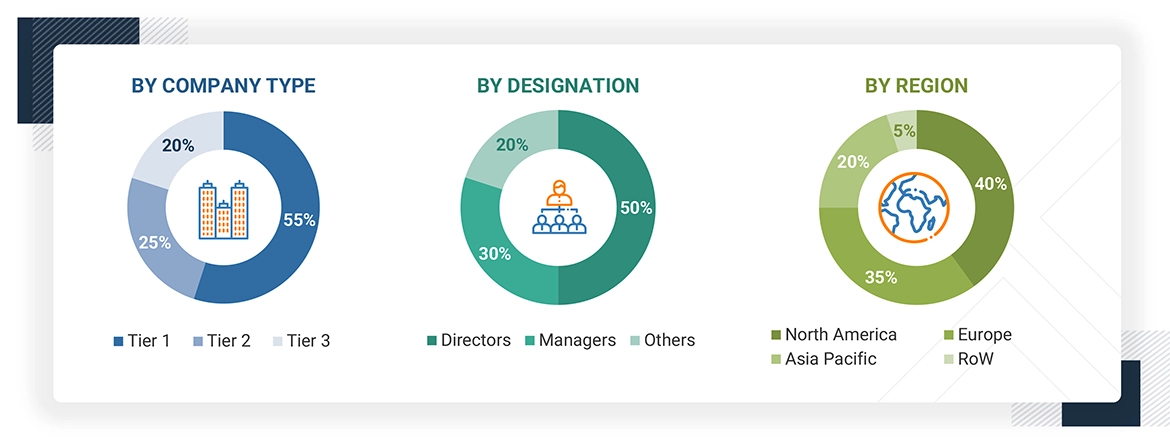

In primary research, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the smart lighting market ecosystem. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the smart lighting market.

- Identification of major companies providing smart lighting hardware, software, and services

- Identification of key segments within the smart lighting market across different geographical regions

- Estimation of the market size in various regions by analyzing the adoption of smart lighting solutions across different industries

- Determination of market share estimates for deployments in different end-use application segments by assessing the demand for smart lighting products and solutions

- Tracking ongoing and upcoming developments in smart lighting products

- Compilation of regional market size data for each segment to derive regional market estimates

- Conducting interviews with multiple key leaders to comprehend the smart lighting market scope, product demand, future market growth, and potential impact of economic downturns

- Verification and validation of estimates through cross-checking with primary sources, discussions with leaders, and consultation with domain experts at MarketsandMarkets

- Analysis of various paid and unpaid information sources, including annual reports, press releases, white papers, and databases

The top-down approach has been used to estimate and validate the total size of the smart lighting market.

- Focusing, initially, on the top-line investments and spending in the ecosystems of various industries. Tracking further splits based on product launches, advancements in smart lighting technologies, smart lighting solutions and software used for various industrial applications, and developments in the key market areas

- Representing and developing the information related to market revenue offered by key hardware, software, and service providers

- Carrying out multiple on-field discussions with key opinion leaders across each major company involved in the development of hardware and software components and services pertaining to smart lighting

- Estimating the geographic split using secondary sources based on factors such as the number of players in a specific country and region, types of products, levels of services offered, and types of software implemented.

Smart Lighting Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides of the smart lighting market.

Market Definition

Smart lighting systems combine automation technologies with connectivity features and intelligent control aspects to deliver enhanced efficiency and improved experience paired with convenience. The system contains LED luminaires, sensors, and wire-based or wireless communication systems to allow remote monitoring and scheduling adjustments based on occupancy status, daylight exposure, and user settings. Users can operate smart lighting systems through mobile applications, voice commands, and centralized automation networks which enable full control of brightness adjustments, color temperature settings, and hue transformation features. These devices play an essential role in residential, commercial, and industrial sectors, helping to reduce energy consumption while aiding sustainability efforts.

Key Stakeholders

- Raw material and component suppliers

- Communication network providers

- Smart lighting device manufacturers

- Original equipment manufacturers

- Semiconductor component suppliers

- Analysts and strategic business planners

- Venture capitalists and start-ups

- Research laboratories and intellectual property (IP) companies

- Technology standards organizations, forums, alliances, and associations

- Hardware vendors

- Software integrators

- Smart lighting solutions-related service providers

- End users

- Government bodies such as regulatory authorities and policymakers

Report Objectives

- To define, estimate, and forecast the smart lighting market based on hardware, software, and services offerings, wired and wireless communication technologies, indoor and outdoor applications, online and offline sales distribution channels, and new and retrofit installation types

- To estimate and project the market size, in terms of value, for various segments with respect to four regions: Americas, Europe, Asia Pacific, and the Rest of the World (ROW)

- To describe and forecast the smart lighting market size, in terms of volume, by hardware offering

- To provide detailed insights regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyse emerging applications and standards in the smart lighting market

- To examine manufacturers of smart lighting products, their strategies, production plans, and the overall supply chain, including material and component suppliers

- To strategically analyse the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyse the market opportunities for stakeholders, and provide a comprehensive competitive landscape analysis

- To provide a detailed overview of the smart lighting value chain and ecosystem

- To provide a detailed overview of impact of AI/Gen AI on smart lighting market

- To provide information about the key technology trends, trade analysis, and patents related to the smart lighting market

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyses them on various parameters within the broad categories of market ranking/share and product portfolio

- To analyse competitive developments, such as partnership, acquisitions, agreements, collaborations, and product launches

- To strategically profile key players and analyse their market share, ranking, and core competencies

This research report categorizes the smart lighting market based on offering, communication technology, installation type, distribution channel, end-use application, and region.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Smart Lighting Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Smart Lighting Market

User

Sep, 2019

I am very much interested in understanding market revenue and forecast in terms of $ and #units for smart lighting broken down by segments (commercial, industrial, outdoor, residential), and by lighting technology (LED, CFL, HID, etc). Is this information available as a part of this report? .

Zhang

Jul, 2022

I am developing a wireless smart lighting switch for home usage and want to sell it around the world out of china. I would like to know where in the world could that kind of products be best sold to, the market size right now, and the possible prospect, especially for Europe. Itís not in a hurry, no strict timeline, Itís a new tech of controlling any light anywhere using any device connected to the lighting device wirelessly. Itís not decided for the exact market budget including information taking. Only after the product had been developed successfully..

User

Sep, 2019

I'm wireless controller manufacturersand hence, looking specifically into wirelessly connected light bulbs. Do you have any information about this? Also, is the report contain market share analysis of varoius lighting controls manufacturers by region? .

User

Sep, 2019

I am currently a student at the University of Texas. I am researching the smart lighting industry. My group and I have to do a presentation on the market and how it will be affected with in the near future. I feel this article would be very helpful and would like to read it for some more specific details. I am specifically looking forward the market projections for US by region/states for smart lighitng space. Could you share such infomration? If yes, at what cost?.

User

Nov, 2019

My company is the distributors of smart lighting product lines. I am researching about smart lighting market. I am specifically looking for market information about Southeast Asia and Africa Markets. Is your study include detailed information for these 2 regions? If it is not readily available how much time will you need for this?.

User

Mar, 2019

Iím a researcher and analysing smart lightning market in Sweden, Russia and Denmark, compare the demands in them. I am also looking for the market drivers and barrieers within these countries. I feel that your report will be the greatest source of information for me to prepare! Does your report has information about these countries? at what price? .