Smart Shelves Market by Components (Hardware, Software and solutions, Professional services), Organization Size, Application (Planogram management, Inventory management, Pricing management, Content management) and Region - Global Forecast to 2027

Smart Shelves Market Size and Forecast - Worldwide

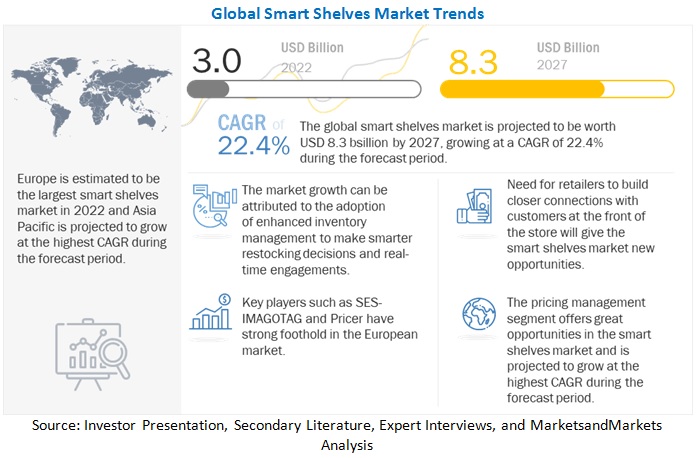

[224 Pages Report] The Smart Shelves Market was valued $3.0 billion in 2022. On the course of projection period, the Smart Shelves Industry is anticipated is anticipated to increase at a CAGR of 22.4% in between 2022-2027 to rise over $8.3 billion in 2027. Adoption of advanced inventory management to make smarter restocking decisions and real-time engagements is driving the market growth but Shifting of customers to the online retail store can slow down the smart shelves market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Smart Shelves Market Growth Dynamics

Driver: Increased use of technologies like IoT and RFID in retail

Smart shelves adoption is driven by smart technologies like IoT and RFID. RFID technology plays an increasingly important role in improving the competitiveness of modern retail enterprises causing the rise of smart retail and high competition among companies. demands for the rapid use of RFID in modern retail has been increased due to the rise in labor costs and demand to reduce logistics’ operational costs. Retail market has always pioneered in RFID use, and many of have already benefited from RFID implementation. When it comes to increasing revenue, cutting costs, improving efficiency, and giving customers a better experience, businesses become more apt to use IoT technology. IoT has helped businesses to make decisions, collect and analyze data, automate workflows, and more. Due to changing lifestyles and constantly evolving corporate environments the adoption of IoT has become even more vital. These technologies are driving the smart experience provided by retailers.

Restrain: Privacy concerns related to inbuild data tags

One restraint in the adoption of smart-shelf technology has been concern about consumer privacy. Privacy has become a important factor for customer and this also reflects in the shopping behavior of the customer. There are incidents where large retailers like Walmart failed with an app that let customers scan items as they removed them from shelves. Consumers doubted that the product tagging tags can be abused and hacked and can provide information to follow people from stores to their homes. This show that organizations fail to increase awareness about the privacy measures they are taking of. As customers are becoming more aware about their privacy due to increased exposure to internet, organization should address this concern.

Opportunity: Need for retailers to build closer connections with customers at the front of the store

Industries are using more automation, increasing efficiency, reducing costs, and helping to collect data in a continuously evolving market, to be competitive, According to an article by Modern Retail, a technological survey provided insights where this use of technology is widely supported, with 75% of decision-makers implemented more technology and have developed smart warehouse systems in 2020. Warehouse challenges and tracking products throughout the supply chain will overcome with help of IoT and AI in the implementation of smart shelves. Smart shelving is one of the leading technologies that capture people’s attention in the world of retail and fulfillment. New opportunities for the smart shelves market are driving the growth of the RFID technology market. Along with RFID, the smart label market will also have a positive impact on the smart shelves market.

Challenge: Shifting of customers to the online retail store can slow down the smart shelves market

Consumers have spent a lot of time on e-commerce platforms. In the US, consumers spent more than USD 860 billion in 2020, a 44% hike compared to 2019. Apart from the developed countries, countries such as Nigeria, with a growing youth population and internet penetration, have embraced the technological changes in daily life. According to the International Telecommunication Union (ITU), there is an increase in internet penetration in sub-Saharan Africa. With the increase in the usage of cell phones, 51% of the individuals shop online in South Africa. A major shift toward online retail stores is now a major challenge for the smart shelves market, especially in the retail sector during the COVID era..

By component, the software and solutions segment to grow at highest CAGR during the forecast period

To build connectivity between shelf components and the cloud servers and gateway, Software and solutions are essential tools and platforms. Some of the prime instances of smart shelf software and solutions are In-store execution, category analysis and planning, inventory optimization, price, promotion compliance, store monitoring and intelligence, and planogram monitoring. . Analytics in the retail industry is essential to optimize operations by responding rapidly to customer needs and market trends. Decision-making and predicting customer behavior is helped by the raw data (historical data) gathered. Currently, AI technology is widely used for analytics.

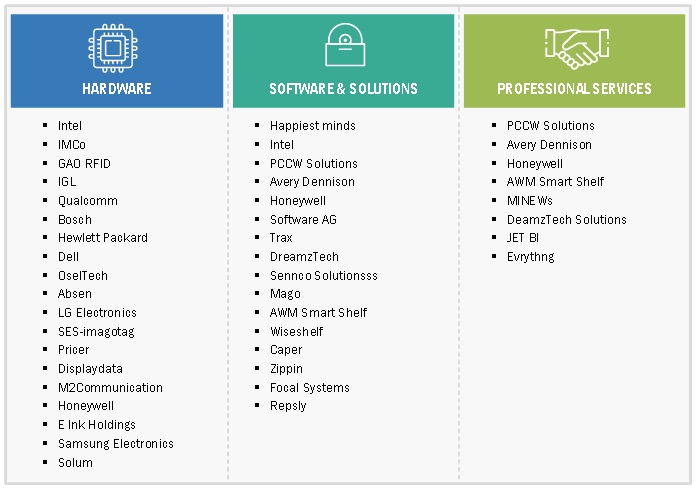

Smart Shelves market Eco-System

To know about the assumptions considered for the study, download the pdf brochure

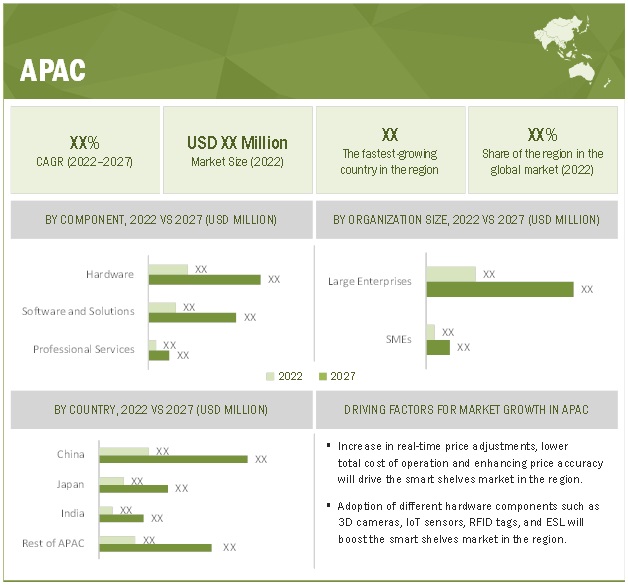

Attacks in the major developed countries in Asia Pacific such as China, Japan, Australia, Singapore, and South Korea, are expected to be potential markets for the smart shelves market. The economic reform programs of various countries in Asia Pacific are creating growth opportunities for the manufacturers of the smart shelves market. In addition, the expansion of large-scale retailers in this region is also responsible for the expected high growth rate of the smart shelves market in Asia Pacific. Another factor driving the growth of smart shelves in Asia Pacific is the presence of giant vendors in the region. Vendors like E Ink Holdings, Huawei, Happiest minds are headquartered in Asia.

The introduction of IoT to counter online retail and retailer’s problems and change in consumer preferences is expected to boost the smart shelves market. According to IDC, retailers that leverage emerging technologies such as AI and IoT will have a 20% improvement in customer satisfaction scores and a 25% improvement in inventory turnovers.

Key Market Players:

The key players in the global Smart Shelves market include SES-Imagotag (France), Pricer (Sweden), Trax (Singapore), Avery Dennison (US), Samsung (South Korea), E Ink (Taiwan), Intel (US), Huawei (China), Honeywell (US), Solum (south Korea), NEXCOM (Taiwan), DreamzTech Solutions (US), Sennco (US), Tronitag (Germany), Mago S.A. (Poland), Happiest Minds (India), PCCW Solutions (Hong Kong), NXP semiconductor (Netherlands), Diebold Nixdorf (US), Software AG (Germany), Minew (China), AWM Smart Shelves (US), Wiseshelf (Israel), Trigo (Israel), Caper (US), Zippin (US), Focal Systems (UK).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

Component, Organization Size, Application |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa (MEA), and Latin America |

|

Major companies covered |

SES-Imagotag (France), Pricer (Sweden), Trax (Singapore), Avery Dennison (US), Samsung (South Korea), E Ink (Taiwan), Intel (US), Huawei (China), Honeywell (US), Solum (south Korea), NEXCOM (Taiwan), DreamzTech Solutions (US), Sennco (US), Tronitag (Germany), Mago S.A. (Poland), Happiest Minds (India), PCCW Solutions (Hong Kong), NXP semiconductor (Netherlands), Diebold Nixdorf (US), Software AG (Germany), Minew (China), AWM Smart Shelves (US), Wiseshelf (Israel), Trigo (Israel), Caper (US), Zippin (US), Focal Systems (UK). |

Recent Development in Smart Shelves Market

- In March 2022, SES-imagotag launched VUSION Operating System and IoT sustainability program. It will help retailers to digitize their locations to be more automated and connected leveraging insights and data in real-time.

- In July 2021, Trax partnered with Storecheck to offer enhanced visibility of SKU performance in traditional mom-and-pop retailers.

- In January 2021, E Ink partnered with Atmosic to offer a power-optimized eBadge reference design, which will feature one of E Ink’s 2.9” or 3.7” black and white displays.

- In August 2020, Avery Dennison partnered with VeChain. The partnership helped both VeChain and Avery Dennison Intelligent Labels showcase their various advanced technology solutions such as blockchain and IoT in front of enterprise attendees around the globe.

- In July 2020, Pricer announced that the Canadian Tire Dealer Association (CTDA), a dealer network of approximately 500 stores across Canada, signed a Master Framework Agreement with Pricer as its exclusive supplier for Electronic Shelves Label (ESL) systems.

Frequently Asked Questions (FAQ):

What is Smart Shelves?

According to SciTech Patent Art Services (P) Ltd, “Smart shelves, which are also known as ‘intelligent shelves,’ are electronically connected shelves which are designed to automatically keep track of inventory in any retail establishment. Manufactures can collect real-time data about their products usage and get sales data. Smart shelves use a combination of sensors, digital displays, and RFID tags to provide detailed product information, marketing, and cross-selling suggestions, while providing retailers invaluable insights into customer preferences and shopping patterns.”.

What is the projected market value of the global Smart Shelves market?

The global Smart Shelves market size is expected to grow from an estimated value of USD 3.0 billion in 2022 to USD 8.3 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 22.4% from 2022 to 2027.

Who are the key companies influencing the market growth of Smart Shelves?

SES-Imagotag (France), Pricer (Sweden), Trax (Singapore), Avery Dennison (US), Samsung (South Korea) are the leaders in the Smart Shelves market and are recognized as the star players. These companies account for a major share of the Smart Shelves market. These vendors offer solutions per user requirements and adopting growth strategies to consistently achieve the desired growth and make their presence in the market.

Who are the emerging start-ups/SMEs that are supporting significantly in the market growth?

Wiseshelf (Israel), Trigo (Israel), Caper (US), Zippin (US), Focal Systems (UK) are few of the emerging SMEs that are nurturing the market growth with their technical skills and expertise. These startups focus on developing product/service portfolios and bringing innovations to the market compared to their competitors. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 1 SMART SHELVES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 2 MARKET: DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1 (SUPPLY SIDE): REVENUE OF HARDWARE, SOFTWARE, AND SERVICES IN MARKET

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1—BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF HARDWARE, SOFTWARE, AND SERVICES IN SMART SHELVES MARKET

FIGURE 5 MARKET: MARKET ESTIMATION APPROACH-2—SUPPLY-SIDE ANALYSIS [COMPANY REVENUE ESTIMATION (ILLUSTRATION OF REVENUE ESTIMATION FOR PRICE)]

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2—BOTTOM-UP (DEMAND SIDE): APPLICATIONS (USE CASES)

2.4 MARKET FORECAST

FIGURE 7 FACTOR ANALYSIS

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

TABLE 2 SMART SHELVES MARKET SIZE AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y)

TABLE 3 MARKET SIZE AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y)

FIGURE 8 EUROPE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE OPPORTUNITIES IN SMART SHELVES MARKET

FIGURE 9 USE OF AUTOMATION AND INTELLIGENCE FOR BETTER SMART SHOPPING TO BOOST DEMAND FOR SMART SHELF SOLUTIONS

4.2 MARKET, BY COMPONENT

FIGURE 10 SMART SHELF HARDWARE TO ACCOUNT FOR LARGEST SHARE IN 2022

4.3 MARKET, BY ORGANIZATION SIZE

FIGURE 11 LARGE ENTERPRISES TO DOMINATE DURING FORECAST PERIOD

4.4 MARKET, BY APPLICATION

FIGURE 12 MARKET: TOP THREE APPLICATIONS, 2022–2027

4.5 MARKET INVESTMENT SCENARIO

FIGURE 13 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 SMART SHELVES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increased use of technologies like IoT and RFID in retail

5.2.1.2 Adoption of enhanced inventory management

5.2.1.3 Use of automation and intelligence for smart shopping

5.2.2 RESTRAINTS

5.2.2.1 Privacy concerns related to in-built data tags

5.2.3 OPPORTUNITIES

5.2.3.1 Need for retailers to build closer connections with customers

5.2.4 CHALLENGES

5.2.4.1 Shifting customers to the online retail store can slow down the smart shelves market

5.3 USE CASES

5.3.1 ZERYNTH HELPED IVIEW WITH ITS REQUIREMENTS

5.3.2 PRICER OFFERED ESL TO MATVARLDEN TO INCREASE PROFITABILITY AND REDUCE ADMINISTRATIVE WORK

5.3.3 SOLUM HELPED ALIEXPRESS TO DIGITALIZE ITS PHYSICAL STORE

5.4 VALUE CHAIN ANALYSIS

FIGURE 15 SMART SHELVES MARKET: VALUE CHAIN

5.5 ECOSYSTEM

FIGURE 16 MARKET: ECOSYSTEM

TABLE 4 MARKET: KEY PLAYERS’ ROLE IN ECOSYSTEM

5.6 PORTER’S FIVE FORCES MODEL ANALYSIS

FIGURE 17 SMART SHELVES: PORTER’S FIVE FORCES ANALYSIS

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 AVERAGE PRICING MODEL ANALYSIS

TABLE 6 AVERAGE SELLING PRICE ANALYSIS OF SMART SHELVES, 2022

5.8 TECHNOLOGY ANALYSIS

5.8.1 IOT

5.8.2 GROWTH IN DEMAND FOR AI-POWERED DYNAMIC PRICING SOLUTIONS

5.8.2.1 Optimizing functions of retail stores using AI-driven shelf monitoring software

5.8.3 DEPLOYING SELF-SCANNING SOLUTIONS TO ENRICH CUSTOMER EXPERIENCE

5.8.3.1 Visual recognition and cashierless stores

5.8.4 MOBILE APPS

5.8.5 AR, VR, AND VOICE COMMERCE

5.8.5.1 Personalized experience

5.9 PATENT ANALYSIS

FIGURE 18 PATENT ANALYSIS: SMART SHELVES MARKET

5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 19 TRENDS AND DISRUPTIONS IN MARKET IMPACTING CUSTOMER’S BUSINESS

5.11 TARIFF AND REGULATORY LANDSCAPE

5.11.1 EPC GLOBAL ARCHITECTURE FRAMEWORK

5.11.2 ISO 15693

5.11.3 RFID AUTHENTICATION PROTOCOL

5.11.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS (%)

5.13 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 9 MARKET: LIST OF CONFERENCES AND EVENTS

6 SMART SHELVES MARKET, BY COMPONENT (Page No. - 63)

6.1 INTRODUCTION

FIGURE 21 HARDWARE SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 10 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 11 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 HARDWARE

6.2.1 HARDWARE: MARKET DRIVERS

TABLE 12 HARDWARE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 13 HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 HARDWARE

TABLE 14 HARDWARE: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 15 HARDWARE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.2.3 CAMERAS

TABLE 16 CAMERAS: SMART SHELVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 17 CAMERAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.4 IOT SENSORS

TABLE 18 IOT SENSORS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 19 IOT SENSORS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.5 RADIO FREQUENCY IDENTIFICATION (RFID) TAGS AND READERS

TABLE 20 RADIO FREQUENCY IDENTIFICATION (RFID) TAGS AND READERS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 21 RADIO FREQUENCY IDENTIFICATION (RFID) TAGS AND READERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.6 DIGITAL DISPLAYS

TABLE 22 DIGITAL DISPLAYS: SMART SHELVES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 23 DIGITAL DISPLAYS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.7 ELECTRONIC SHELF LABELS

TABLE 24 ELECTRONIC SHELF LABELS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 25 ELECTRONIC SHELF LABELS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.8 OTHER HARDWARE

TABLE 26 OTHER HARDWARE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 27 OTHER HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SOFTWARE AND SOLUTIONS

6.3.1 SOFTWARE AND SOLUTIONS: MARKET DRIVERS

TABLE 28 SOFTWARE AND SOLUTIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 SOFTWARE AND SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 PROFESSIONAL SERVICES

6.4.1 PROFESSIONAL SERVICES: MARKET DRIVERS

TABLE 30 PROFESSIONAL SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 31 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 SMART SHELVES MARKET, BY ORGANIZATION SIZE (Page No. - 75)

7.1 INTRODUCTION

FIGURE 22 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE

TABLE 32 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 33 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

7.2 LARGE ENTERPRISES

7.2.1 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 34 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 35 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

7.3.1 SMES: MARKET DRIVERS

TABLE 36 SMES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 37 SMES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 SMART SHELVES MARKET, BY APPLICATION (Page No. - 79)

8.1 INTRODUCTION

FIGURE 23 INVENTORY MANAGEMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

TABLE 38 MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 39 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 PLANOGRAM MANAGEMENT

8.2.1 PLANOGRAM MANAGEMENT: MARKET DRIVERS

TABLE 40 PLANOGRAM MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 41 PLANOGRAM MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

(Page No. - )

8.3 INVENTORY MANAGEMENT

8.3.1 INVENTORY MANAGEMENT: MARKET DRIVERS

TABLE 42 INVENTORY MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 43 INVENTORY MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 PRICING MANAGEMENT

8.4.1 PRICING MANAGEMENT: SMART SHELVES MARKET DRIVERS

TABLE 44 PRICING MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 45 PRICING MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 CONTENT MANAGEMENT

8.5.1 CONTENT MANAGEMENT: MARKET DRIVERS

TABLE 46 CONTENT MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 47 CONTENT MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 OTHER APPLICATIONS

8.6.1 OTHER APPLICATIONS: MARKET DRIVERS

TABLE 48 OTHER APPLICATIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 49 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 SMART SHELVES MARKET, BY REGION (Page No. - 88)

9.1 INTRODUCTION

FIGURE 24 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 50 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 51 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: MARKET DRIVERS

9.2.2 NORTH AMERICA: REGULATORY LANDSCAPE

TABLE 52 NORTH AMERICA: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.3 UNITED STATES

TABLE 62 UNITED STATES: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 63 UNITED STATES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 64 UNITED STATES: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 65 UNITED STATES: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 66 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 67 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 68 UNITED STATES: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 69 UNITED STATES: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2.4 CANADA

TABLE 70 CANADA: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 71 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 72 CANADA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 73 CANADA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 74 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 75 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 76 CANADA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 77 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3 EUROPE

9.3.1 EUROPE: MARKET DRIVERS

9.3.2 EUROPE: REGULATORY LANDSCAPE

FIGURE 25 EUROPE: MARKET SNAPSHOT

TABLE 78 EUROPE: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 80 EUROPE: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 81 EUROPE: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.3 UNITED KINGDOM

TABLE 88 UNITED KINGDOM: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 89 UNITED KINGDOM: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 90 UNITED KINGDOM: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 91 UNITED KINGDOM: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 92 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 93 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 94 UNITED KINGDOM: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 95 UNITED KINGDOM: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.4 GERMANY

TABLE 96 GERMANY: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 97 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 98 GERMANY: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 99 GERMANY: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 100 GERMANY: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 101 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 102 GERMANY: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 103 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.5 FRANCE

TABLE 104 FRANCE: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 105 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 106 FRANCE: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 107 FRANCE: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 108 FRANCE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 109 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 110 FRANCE: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 111 FRANCE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 112 REST OF EUROPE: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 113 REST OF EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 114 REST OF EUROPE: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 115 REST OF EUROPE: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 116 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 117 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 118 REST OF EUROPE: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 119 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: MARKET DRIVERS

9.4.2 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 26 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 120 ASIA PACIFIC: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 122 ASIA PACIFIC: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 123 ASIA PACIFIC: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.4.3 CHINA

TABLE 130 CHINA: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 131 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 132 CHINA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 133 CHINA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 134 CHINA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 135 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 136 CHINA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 137 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.4.4 JAPAN

TABLE 138 JAPAN: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 139 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 140 JAPAN: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 141 JAPAN: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 142 JAPAN: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 143 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 144 JAPAN: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 145 JAPAN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.4.5 INDIA

TABLE 146 INDIA: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 147 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 148 INDIA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 149 INDIA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 150 INDIA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 151 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 152 INDIA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 153 INDIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.4.6 REST OF ASIA PACIFIC

TABLE 154 REST OF ASIA PACIFIC: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 155 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 156 REST OF ASIA PACIFIC: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 157 REST OF ASIA PACIFIC: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 158 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 159 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 160 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 161 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.5 MIDDLE EAST AND AFRICA

9.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

9.5.2 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 162 MIDDLE EAST AND AFRICA: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 165 MIDDLE EAST AND AFRICA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 170 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.5.3 UNITED ARAB EMIRATES

TABLE 172 UNITED ARAB EMIRATES: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 173 UNITED ARAB EMIRATES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 174 UNITED ARAB EMIRATES: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 175 UNITED ARAB EMIRATES: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 176 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 177 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 178 UNITED ARAB EMIRATES: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 179 UNITED ARAB EMIRATES: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.5.4 SOUTH AFRICA

TABLE 180 SOUTH AFRICA: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 181 SOUTH AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 182 SOUTH AFRICA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 183 SOUTH AFRICA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 184 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 185 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 186 SOUTH AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 187 SOUTH AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.5.5 REST OF MIDDLE EAST AND AFRICA

TABLE 188 REST OF MIDDLE EAST AND AFRICA: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 189 REST OF MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 190 REST OF MIDDLE EAST AND AFRICA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 191 REST OF MIDDLE EAST AND AFRICA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 192 REST OF MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 193 REST OF MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 194 REST OF MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 195 REST OF MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.6 LATIN AMERICA

9.6.1 LATIN AMERICA: MARKET DRIVERS

9.6.2 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 196 LATIN AMERICA: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 198 LATIN AMERICA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 199 LATIN AMERICA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.6.3 BRAZIL

TABLE 206 BRAZIL: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 207 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 208 BRAZIL: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 209 BRAZIL: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 210 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 211 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 212 BRAZIL: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 213 BRAZIL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.6.4 MEXICO

TABLE 214 MEXICO: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 215 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 216 MEXICO: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 217 MEXICO: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 218 MEXICO: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 219 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 220 MEXICO: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 221 MEXICO: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.6.5 REST OF LATIN AMERICA

TABLE 222 REST OF LATIN AMERICA: SMART SHELVES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 223 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 224 REST OF LATIN AMERICA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 225 REST OF LATIN AMERICA: SMART SHELVES HARDWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 226 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 227 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 228 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 229 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 159)

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 27 SMART SHELVES: MARKET EVALUATION FRAMEWORK

10.3 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 28 SMART SHELVES MARKET: REVENUE ANALYSIS

10.4 MARKET SHARE ANALYSIS OF THE TOP MARKET PLAYERS

TABLE 230 MARKET: DEGREE OF COMPETITION

10.5 HISTORICAL REVENUE ANALYSIS

FIGURE 29 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF KEY PUBLIC SECTOR SMART SHELVES PROVIDERS

10.6 RANKING OF KEY PLAYERS IN MARKET

FIGURE 30 KEY PLAYERS RANKING

10.7 EVALUATION QUADRANT OF KEY COMPANIES

FIGURE 31 SMART SHELVES MARKET: KEY COMPANY EVALUATION QUADRANT 2022

10.7.1 STARS

10.7.2 EMERGING LEADERS

10.7.3 PERVASIVE PLAYERS

10.7.4 PARTICIPANTS

10.8 COMPETITIVE BENCHMARKING

10.8.1 EVALUATION CRITERIA OF KEY COMPANIES

TABLE 231 EVALUATION CRITERIA

10.8.2 EVALUATION CRITERIA OF SMES/STARTUP COMPANIES

TABLE 232 DETAILED LIST OF SMES/STARTUPS

10.9 SME/STARTUPS COMPANY EVALUATION QUADRANT

FIGURE 32 SMART SHELVES MARKET: SME/STARTUP EVALUATION QUADRANT 2022

10.9.1 PROGRESSIVE COMPANIES

10.9.2 RESPONSIVE COMPANIES

10.9.3 DYNAMIC COMPANIES

10.9.4 STARTING BLOCKS

10.10 COMPETITIVE SCENARIO AND TRENDS

10.10.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 233 MARKET: NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2019–2022

10.10.2 DEALS

TABLE 234 SMART SHELVES MARKET: DEALS, 2019–2022

11 COMPANY PROFILES (Page No. - 174)

11.1 INTRODUCTION

11.2 KEY PLAYERS

(Business Overview, Solutions, Products & Services, Recent Developments, MnM View)*

11.2.1 SES-IMAGOTAG

TABLE 235 SES-IMAGOTAG: BUSINESS OVERVIEW

FIGURE 33 SES-IMAGOTAG: COMPANY SNAPSHOT

TABLE 236 SES-IMAGOTAG: SOLUTIONS OFFERED

TABLE 237 SES-IMAGOTAG: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 238 SES-IMAGOTAG: DEALS

11.2.2 PRICER

TABLE 239 PRICER: BUSINESS OVERVIEW

FIGURE 34 PRICER: COMPANY SNAPSHOT

TABLE 240 PRICER: SOLUTIONS OFFERED

TABLE 241 PRICER: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 242 PRICER: DEALS

11.2.3 TRAX

TABLE 243 TRAX: BUSINESS OVERVIEW

TABLE 244 TRAX: SOLUTIONS OFFERED

TABLE 245 TRAX: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 246 TRAX: DEALS

11.2.4 AVERY DENNISON

TABLE 247 AVERY DENNISON: BUSINESS OVERVIEW

FIGURE 35 AVERY DENNISON: COMPANY SNAPSHOT

TABLE 248 AVERY DENNISON: SOLUTIONS OFFERED

TABLE 249 AVERY DENNISON: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 250 AVERY DENNISON: DEALS

11.2.5 SAMSUNG

TABLE 251 SAMSUNG: BUSINESS OVERVIEW

FIGURE 36 SAMSUNG: COMPANY SNAPSHOT

TABLE 252 SAMSUNG: SOLUTIONS OFFERED

TABLE 253 SAMSUNG: DEALS

11.2.6 E INK

TABLE 254 E INK: BUSINESS OVERVIEW

FIGURE 37 E INK: COMPANY SNAPSHOT

TABLE 255 E INK: SOLUTIONS OFFERED

TABLE 256 E INK: PRODUCT LAUNCHES

TABLE 257 E INK: DEALS

11.2.7 INTEL

TABLE 258 INTEL: BUSINESS OVERVIEW

FIGURE 38 INTEL: COMPANY SNAPSHOT

TABLE 259 INTEL: SOLUTIONS OFFERED

TABLE 260 INTEL: PRODUCT LAUNCHES

TABLE 261 INTEL: DEALS

11.2.8 HUAWEI

TABLE 262 HUAWEI: BUSINESS OVERVIEW

TABLE 263 HUAWEI: SOLUTIONS OFFERED

TABLE 264 HUAWEI: DEALS

11.2.9 HONEYWELL

TABLE 265 HONEYWELL: BUSINESS OVERVIEW

FIGURE 39 HONEYWELL: COMPANY SNAPSHOT

TABLE 266 HONEYWELL: SOLUTIONS OFFERED

11.2.10 SOLUM

TABLE 267 SOLUM: BUSINESS OVERVIEW

TABLE 268 SOLUM: SOLUTIONS OFFERED

TABLE 269 SOLUM: PRODUCT LAUNCHES

TABLE 270 SOLUM: DEALS

*Details on Business Overview, Solutions, Products & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

11.3 OTHER PLAYERS

11.3.1 NEXCOM

11.3.2 DREAMZTECH SOLUTIONS

11.3.3 SENNCO SOLUTIONS

11.3.4 TRONITAG

11.3.5 MAGO S.A

11.3.6 HAPPIEST MINDS

11.3.7 PCCW SOLUTIONS

11.3.8 NXP SEMICONDUCTOR

11.3.9 DIEBOLD NIXDORF

11.3.10 SOFTWARE AG

11.3.11 MINEW

11.4 STARTUPS

11.4.1 AWM SMART SHELVES

11.4.2 WISESHELF

11.4.3 TRIGO

11.4.4 CAPER

11.4.5 ZIPPIN

11.4.6 FOCAL SYSTEMS

12 ADJACENT MARKETS (Page No. - 211)

12.1 INTRODUCTION TO ADJACENT MARKETS

TABLE 271 ADJACENT MARKETS AND FORECASTS

12.2 LIMITATIONS

12.3 SMART SHELVES: ADJACENT MARKETS

12.3.1 ELECTRONIC SHELF LABEL MARKET

TABLE 272 ELECTRONIC SHELF LABEL MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 273 ELECTRONIC SHELF LABEL MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 274 ELECTRONIC SHELF LABEL MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 275 ELECTRONIC SHELF LABEL MARKET, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 276 ELECTRONIC SHELF LABEL MARKET, BY COMMUNICATION TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 277 ELECTRONIC SHELF LABEL MARKET, BY COMMUNICATION TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 278 ELECTRONIC SHELF LABEL MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 279 ELECTRONIC SHELF LABEL MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 280 ELECTRONIC SHELF LABEL MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 281 ELECTRONIC SHELF LABEL MARKET, BY REGION, 2021–2026 (USD MILLION)

12.3.2 SMART RETAIL MARKET

TABLE 282 SMART RETAIL MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 283 SMART RETAIL MARKET, BY RETAIL OFFERING, 2017–2025 (USD MILLION)

TABLE 284 SMART RETAIL MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 285 SMART RETAIL MARKET FOR AI, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 286 SMART RETAIL MARKET FOR ROBOTICS, BY APPLICATION, 2017–2025 (USD MILLION)

13 APPENDIX (Page No. - 217)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

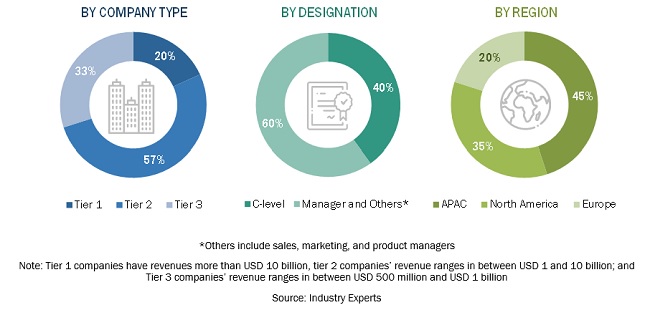

The study involved major activities in estimating the current market size for the Smart Shelves market. Exhaustive secondary research was done to collect information on the Smart Shelves industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches like top-down, bottom up were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the smart Shelves market.

Secondary Research

In the secondary research process, various secondary sources were referred to, for identifying and collecting information regarding the study. The secondary sources included annual reports, press releases, and investor presentations of smart shelf vendors, forums, certified publications, and whitepapers. The secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification, and segmentation from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the smart shelves market.

In the market engineering process, top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and sub-segments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

In used approach for market estimation, the key companies offering the smart shelves and services, such as SES-IMAGOTAG, Intel, Honeywell, Pricer, and AWM, are identified, which contribute a major part of the smart shelves market. After finalizing these companies, validation of the data was done from industry experts through primary interviews related to the leading vendors of the market. Furthermore, we estimated their total revenue through annual reports, US Securities and Exchange Commission (SEC) filings, and paid databases.

Data Triangulation

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information, and verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of smart shelves market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies

Report Objectives

- To define, describe and forecast the global Smart Shelves market by component, organization size, application, and region

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and Latin America

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze opportunities in the market for stakeholders and provide the competitive landscape details of major players

- To profile the key players of the smart shelves market; provide competitive analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research & Development (R&D) activities, in the market

Intelligent Shelves Market & its impact on Smart Shelves Market

When referring to shelves that use technology to enhance inventory management and customer experience, the terms "intelligent shelves" and "smart shelves" are sometimes used interchangeably. As a result, intelligent shelves and smart shelves both refer to the same technology and are associated with one another.

Intelligent shelves and smart shelves use technologies such as RFID (Radio Frequency Identification), sensors, cameras, and data analytics to provide retailers with real-time inventory data, detect theft or misplaced items, and personalize the shopping experience for customers.

Intelligent shelves and smart shelves are closely related, and the growth of the intelligent shelves market has had a significant impact on the smart shelves market. Here are some ways in which the intelligent shelves market is impacting the smart shelves market:

Increased Demand: The use of intelligent shelves has raised awareness of and demand for them. Retailers may look to upgrade to smart shelves, which provide even more cutting-edge capabilities, as they get more familiar with the advantages of intelligent shelves.

Improved Technology: The advancement of intelligent shelves has brought about advancements in the technology behind them. Intelligent and smart shelves today frequently incorporate new technology like RFID and sensors, giving businesses access to more precise and up-to-the-minute inventory data.

Enhanced Functionality: The potential of intelligent shelves to offer shop features beyond traditional inventory management has been demonstrated. Retailers may find smart shelves more appealing as they grow with features like personalised recommendations, interactive displays, and even automated checkout.

Increased Competition: With the growing adoption of intelligent shelves, more companies are entering the smart shelves market, resulting in increased competition. This is leading to the development of new and innovative smart shelf solutions, driving the overall growth of the market.

Overall, the intelligent shelves market has had a significant impact on the smart shelves market, driving up consumer demand, technological advancements, functional improvements, and competitiveness. As a result, in the upcoming years, it is anticipated that the intelligent shelves market will continue to increase.

Futuristic Growth Use-Cases of Intelligent Shelves Market

Intelligent shelves have the power to completely change how stores handle their inventory and give customers a customized shopping experience. Here are some futuristic growth use-cases of the intelligent shelves market:

Personalized product recommendations: Data analytics and machine learning algorithms can be used by intelligent shelves to study customer preferences and make tailored product recommendations. Sales might be boosted, and customer satisfaction raised as a result.

Inventory management and replenishment: Real-time inventory data provided by intelligent shelves can aid merchants in streamlining their replenishment and inventory management procedures. This can lower the possibility of stockouts and overstocking, increasing efficiency and resulting in cost savings.

In-store navigation and wayfinding: Intelligent shelves can be integrated with digital displays and maps to provide customers with real-time information on product locations and store layout. This can improve the shopping experience for customers and help them find what they need more quickly and easily.

Interactive product information: Intelligent shelves can incorporate interactive displays that provide customers with detailed information about products, such as ingredients, allergens, and sustainability features. This can help customers make more informed purchasing decisions and increase their trust in the retailer.

Automated checkout: Sensors and cameras can be added to intelligent shelves so they can recognize when a consumer has taken something off the shelf. By automating the checkout process, this can shorten lines and enhance the entire shopping experience.

Overall, the intelligent shelves market has the potential to drive significant growth in the retail industry by providing retailers with innovative solutions for inventory management and enhancing the shopping experience for customers.

Some of the Top players in the Intelligent Shelves market are AWM Smart Shelf, Pricer AB, Trax, E Ink, LG Innotek, Caper, RIoT Insight, Avery Dennison, Smart Shelf Solutions and Intel.

New Business Opportunities in Intelligent Shelves Market

The Intelligent Shelves market is rapidly growing and evolving, creating new business opportunities for companies in various industries. Here are some of the new business opportunities in the Intelligent Shelves Market:

- Hardware and software development: Companies can develop and manufacture hardware and software solutions for intelligent shelves, including sensors, RFID readers, cameras, and data analytics software.

- Consulting and system integration: Companies can provide consulting services and system integration solutions to help retailers implement intelligent shelves in their stores. This includes assessing retailers' needs and requirements, designing and implementing intelligent shelf solutions, and providing ongoing maintenance and support.

- Data analytics and machine learning: Companies can develop and provide data analytics and machine learning solutions to help retailers analyze customer behavior and preferences, optimize inventory management and replenishment, and provide personalized product recommendations.

- Digital signage and content creation: Companies can develop and provide digital signage and content creation solutions for intelligent shelves, including interactive displays, videos, and product information.

- Logistics and supply chain management: Companies can provide logistics and supply chain management solutions for retailers using intelligent shelves, including inventory tracking, order fulfillment, and transportation and logistics services.

- Retail analytics and optimization: Companies can develop and provide retail analytics and optimization solutions to help retailers improve their store layout, optimize product placement, and increase sales and profitability.

Overall, the Intelligent Shelves Market presents numerous new business opportunities for companies in various industries, from hardware and software development to consulting, data analytics, and logistics and supply chain management.

Industries Getting Impacted in the Future by Intelligent Shelves Market

Here are some specific examples of industries that could be impacted by intelligent shelves in the future:

- Retail Industry: The retail industry is the primary industry that is being impacted by the intelligent shelves market. Retailers may optimize inventory management, cut expenses, and give their customers a customized shopping experience by deploying intelligent shelves.

- Healthcare Industry: Intelligent shelves can help hospitals and clinics to manage their inventory of medical supplies and equipment. This technology can help to reduce waste and improve the efficiency of healthcare facilities.

- Logistics Industry: The logistics industry can benefit from the use of intelligent shelves in warehouse management. By providing real-time inventory data, intelligent shelves can help to optimize warehouse operations, reduce labor costs, and improve order fulfillment.

- Hospitality Industry: Intelligent shelves can be used in the hospitality industry to improve the guest experience by providing real-time information on hotel amenities, such as room service and spa services.

- Food and Beverage Industry: The implementation of intelligent shelves can improve inventory control and decrease food waste in the food and beverage sector. Real-time data on product performance can be provided by intelligent shelves, which can be used to determine which products are selling well and which ones are not.

- Automotive Industry: To improve inventory control in auto dealerships, the automotive sector can employ intelligent shelves. Intelligent shelves can assist dealerships in determining which automobiles are selling well and which are not by offering real-time data on vehicle performance.

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Shelves Market