Smart Warehousing Market

Smart Warehousing Market by Offering (AGVs, AMRs, AS/RS, AIDC, Palletizing & Depalletizing Systems, Conveyors & Sorters, TMS, WMS, Order Management), Technology (AI, IoT, Blockchain, Big Data & Analytics, Robotics & Automation) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

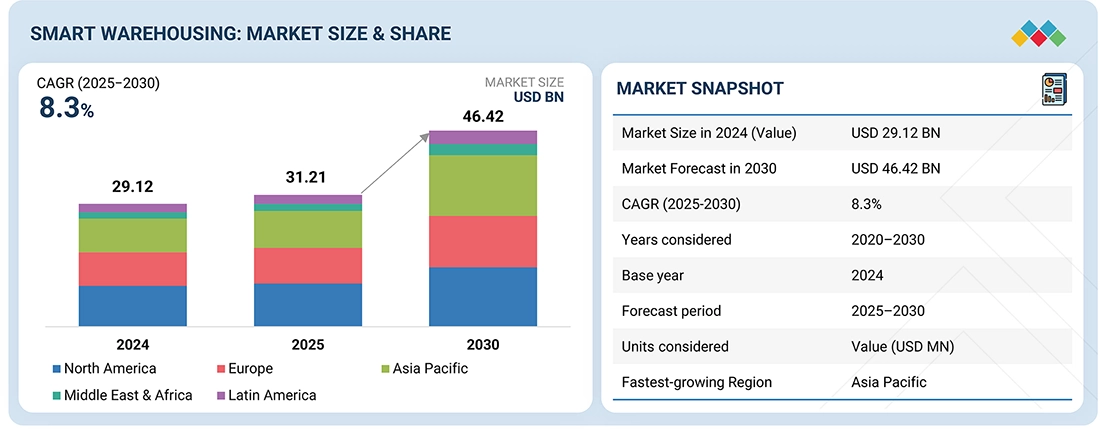

The smart warehousing market is expanding rapidly, with a projected market size anticipated to rise from about USD 31.21 billion in 2025 to USD 46.42 billion by 2030, featuring a CAGR of 8.3%. The market is experiencing robust growth as enterprises across industries accelerate digital transformation within their supply chains. Increasing e-commerce volumes, demand for same-day delivery, and labor shortages are pushing organizations to adopt automated, data-driven warehouse solutions. Technologies such as robotics, IoT, AI, and digital twins are revolutionizing warehouse operations by enabling real-time inventory tracking, intelligent storage management, and autonomous material handling. The market is further driven by the need to improve operational efficiency, reduce human error, and enhance visibility across global logistics networks. As organizations shift toward connected, scalable, and sustainable supply chains, smart warehouses are evolving into the cornerstone of modern warehouse operations.

KEY TAKEAWAYS

- By region, North America accounted for the largest market share of 32.77% in 2025.

- By offering, the ESG Reporting Tools segment is expected to hold largest market share during forecast period.

- The carbon neutrality & climate strategy segment is projected to grow at the highest CAGR of 26.7% during the forecast period.

- The blockchain segment is projected to grow at the highest CAGR of 26.3% during the forecast period.

- By end user, Manufacturing segment is expected to dominate the market.

- Key players, including Dematic, Honeywell, Tecsys, and Körber, focus on cloud and on-premises WMS, autonomous material handling, digital twins, and predictive analytics. These companies deliver scalable, data-driven smart warehousing solutions that enhance throughput, improve inventory accuracy, and optimize labor efficiency.

- Companies like Attabotics, Cin7, Covariant among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Adoption of smart warehousing solutions is accelerating as enterprises prioritize agility, scalability, and automation to manage complex distribution networks. Integrating robotics, AI-based analytics, and IoT sensors, these systems enable predictive inventory management, faster order fulfillment, and data-driven decision-making. Growing demand from e-commerce, manufacturing, and retail sectors is fueling investment in cloud-based platforms that allow seamless coordination between suppliers, distributors, and transportation partners. The convergence of automation, digital twins, and edge computing is transforming traditional warehouses into intelligent, autonomous hubs capable of optimizing throughput while minimizing costs and carbon footprint.

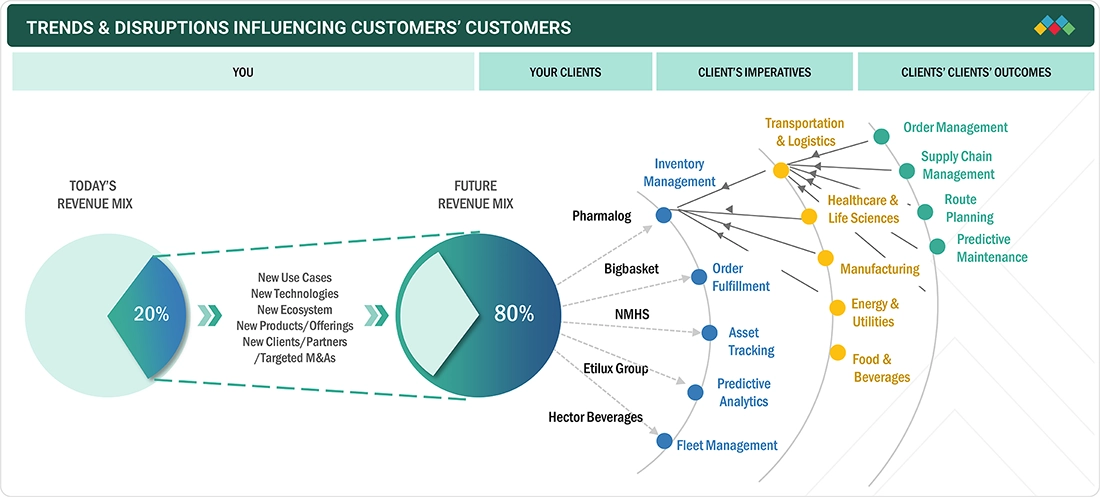

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

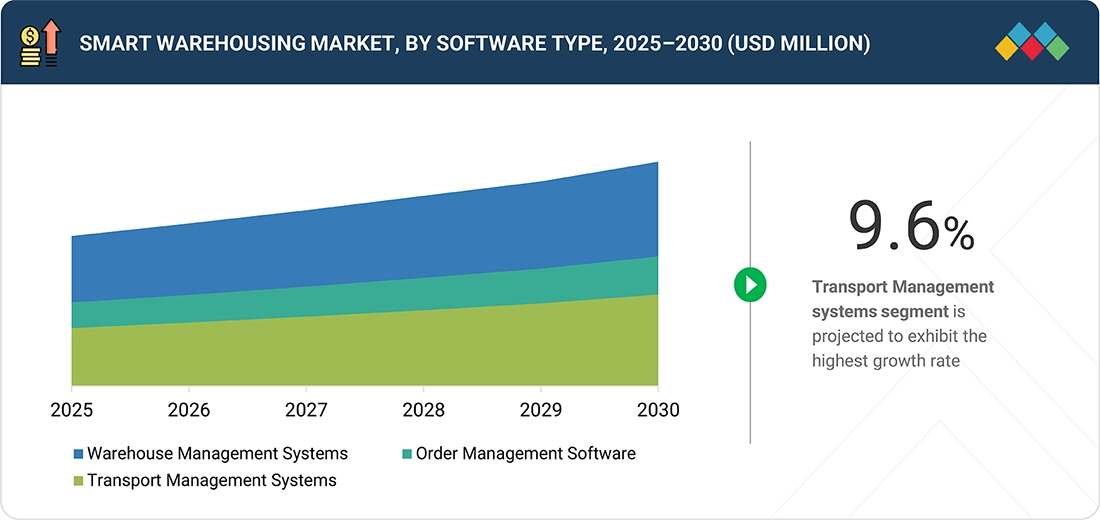

The Smart Warehousing market is rapidly evolving, driven by advances in AI-powered warehouse management systems (WMS), autonomous mobile robots (AMRs), and predictive analytics for inventory and labor optimization. Vendors traditionally relied on on-premises WMS and standalone automation equipment, but growing demand for real-time visibility, multi-channel order fulfillment, and scalable logistics solutions is reshaping business models. Companies now focus on cloud-based WMS, IoT-enabled asset tracking, AI-driven labor and task optimization, and digital twin simulations. Real-time inventory monitoring, automated workflows, and AI-powered predictive analytics optimize throughput, accuracy, and operational efficiency, positioning vendors as strategic partners in driving cost-effective, scalable, and intelligent warehouse operations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Emergence of multi-channel distribution networks

-

Convergence of IoT and 5G to accelerate warehouse intelligence

Level

-

Lack of uniform governance standards in fragmented logistics industry

Level

-

Adoption of AR and VR technologies to streamline warehouse operations

-

Advancements in self-driving vehicles and robotics

Level

-

High implementation and maintenance costs for SMEs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Emergence of multi-channel distribution networks in Smart Warehousing

The Smart Warehousing market is driven by multi-channel distribution networks enabling seamless order fulfillment across direct sales, e-commerce platforms, franchise stores, and third-party marketplaces. Smart warehouses leverage AI-powered warehouse management systems (WMS), IoT-enabled inventory tracking, and automated order processing to manage high volumes of multi-channel orders efficiently. Real-time visibility into inventory, labor, and transport allows warehouse managers to optimize packing, shipping, and invoice management, reducing operational costs and improving throughput. Enterprises increasingly adopt these solutions to enhance supply chain efficiency, minimize errors, and meet rising customer expectations in omnichannel environments.

Restraint: Lack of uniform governance standards in the fragmented logistics industry

Adoption is restrained by fragmented governance across the logistics and warehouse sector. The absence of standardized IoT protocols, interoperability frameworks, and data exchange standards such as MTConnect, EtherCAT, and MCS-DCS Interface Standardization, hinders integration of AI, robotics, and WMS platforms. Regulatory disparities across regions, particularly in China and South Korea, complicate compliance and slow the deployment of fully automated smart warehousing solutions. Without unified governance, warehouse operators face integration inefficiencies, limiting scalability, operational visibility, and the full potential of smart warehousing adoption.

Opportunity: Adoption of AR and VR technologies to optimize warehouse operations

AR and VR technologies present a significant opportunity to enhance inventory management, order picking, material handling, and employee training. AR headsets and mobile devices overlay digital instructions onto the physical warehouse environment, improving accuracy and operational speed. VR simulations enable immersive training for equipment operation, emergency procedures, and workflow optimization. Companies like DHL and BMW have successfully implemented AR-enabled vision picking and VR-assisted production monitoring, reducing errors, lowering labor costs, and enhancing supply chain agility. Widespread adoption of AR/VR can improve warehouse efficiency, safety, and responsiveness in increasingly automated logistics networks.

Challenge: High implementation and maintenance costs for SMEs

Smart Warehousing adoption is challenged by the high upfront investment required for on-premises WMS, robotics, automated material handling, and IoT infrastructure. SMEs face significant costs for hardware, software setup, employee training, and ongoing technology support, which constrain adoption despite potential efficiency gains. Labor-intensive environments further elevate operating expenses, as labor accounts for approximately 65% of warehouse budgets. Limited financial resources prevent SMEs from leveraging advanced automation, AI analytics, and cloud-based optimization tools, slowing market penetration and creating a barrier to achieving scalable, intelligent warehouse operations.

Smart Warehousing Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Costa Logistics implemented Manhattan Associates’ WMS to digitize cold chain operations, integrate warehouse and transport systems, and improve efficiency, visibility, and scalability across its nationwide fresh produce distribution centers. | Improved pick accuracy and throughput, enhanced visibility across the cold chain, faster response to peak-season demand without additional labor, and scalable integration with future automation technologies. |

|

Nagel Group adopted PSIwms from PSI Group, using AI-driven logistics software to optimize storage, picking, and route planning across temperature-controlled warehouses, ensuring real-time adaptability to fluctuating demand. | Increased operational efficiency and transparency, reduced picking times, enabled dynamic capacity management for demand fluctuations, and lowered operational costs while improving customer service levels. |

|

Endries International deployed Infor WMS on AWS to automate warehouse workflows, integrate ERP systems, and enhance visibility, accuracy, and scalability for global vendor-managed inventory and order fulfillment. | Achieved a 40% boost in warehouse productivity, improved inventory accuracy and fulfillment speed, enhanced scalability to meet customer demand, and strengthened service reliability across global OEM supply chains. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

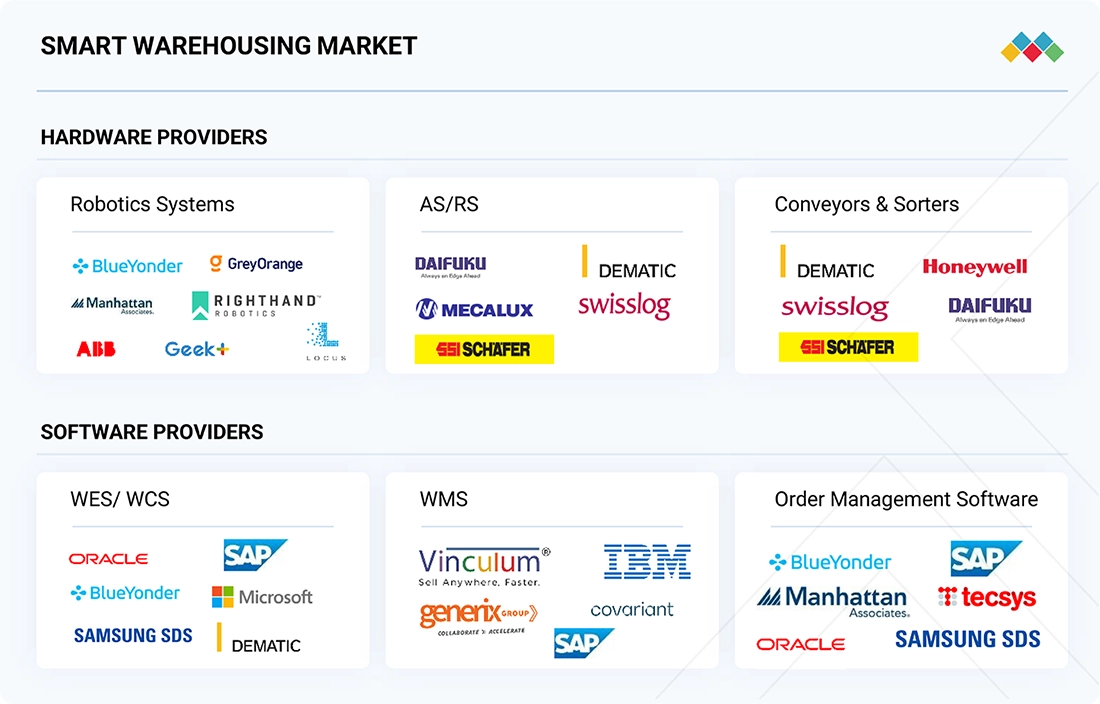

MARKET ECOSYSTEM

The smart warehousing market ecosystem encompasses a diverse range of stakeholders, including automated system vendors, software developers, and service providers. Automated system vendors supply robotic systems, automated storage and retrieval systems (AS/RS), conveyors, and sortation solutions that enable high-speed, error-free operations. Software providers deliver integrated warehouse management systems (WMS), transport management systems (TMS), and order management platforms that ensure real-time inventory visibility and seamless data flow across the supply chain. Service providers, including professional and managed service firms, play a crucial role in system integration, predictive maintenance, and optimization of warehouse performance. Together, these ecosystem participants enable end-to-end automation, data intelligence, and operational resilience across modern warehouse environments.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Smart Warehousing Market, By Offering

The Automatic Identification & Data Collection (AIDC) segment is experiencing rapid adoption, driven by the need for real-time inventory visibility, accurate asset tracking, and operational efficiency. Technologies such as RFID, barcode scanning, and IoT-enabled sensors are enabling warehouses to reduce errors, optimize storage utilization, and accelerate order fulfillment. For market readers, this segment demonstrates how intelligent data capture is central to modern warehouse automation, offering vendors opportunities in integration, predictive analytics, and scalable warehouse management solutions.

Smart Warehousing Market, By Deployment Mode

The Cloud deployment mode is emerging as the preferred choice for enterprises seeking scalable, flexible, and cost-efficient warehouse management. Cloud-based WMS platforms, integrated with real-time analytics, remote monitoring, and AI-driven optimization, allow organizations to manage multiple facilities, track inventory globally, and respond dynamically to demand fluctuations. For market intelligence subscribers, cloud deployment highlights a shift toward subscription-based, remotely accessible, and continuously upgradable smart warehousing solutions.

Smart Warehousing Market, By Technology

The AI segment is accelerating adoption across smart warehousing operations, with applications in predictive demand planning, autonomous mobile robot (AMR) coordination, labor optimization, and real-time decision-making. By leveraging machine learning algorithms and data-driven insights, warehouses are improving throughput, minimizing errors, and enhancing operational efficiency. For report readers, AI represents a key driver for innovation, enabling predictive, automated, and scalable warehouse processes.

Smart Warehousing Market, By Vertical

The Healthcare & Life Sciences segment is witnessing strong growth as organizations adopt smart warehousing solutions for temperature-sensitive storage, inventory traceability, and compliance with regulatory standards such as FDA and WHO guidelines. AI-powered inventory optimization, automated picking, and real-time monitoring enhance supply chain reliability and patient safety. For market subscribers, this vertical emphasizes the importance of precision, compliance, and operational visibility in high-value and regulated warehouse operations.

REGION

Asia Pacific to be the fastest-growing region in the Smart Warehousing market during the forecast period

The Asia Pacific Smart Warehousing market is experiencing rapid growth, driven by increasing adoption of AI-powered warehouse management systems (WMS), autonomous mobile robots (AMRs), IoT-enabled inventory tracking, and predictive analytics. China is leading the expansion by deploying large-scale robotics automation and cloud-based WMS across e-commerce and retail distribution centers, enhancing operational efficiency and throughput. India is emerging as a key player, leveraging tech-enabled logistics startups, real-time warehouse visibility solutions, and AI-driven labor optimization to modernize supply chains. Rising investments in last-mile delivery automation and sustainable logistics solutions, combined with growing e-commerce demand, are accelerating adoption of scalable, intelligent Smart Warehousing solutions across the region.

Smart Warehousing Market: COMPANY EVALUATION MATRIX

In the smart warehousing market, Dematic (Star) leads with a comprehensive automation portfolio, including AI-driven warehouse management systems (WMS), autonomous mobile robots (AMRs), automated storage and retrieval systems (AS/RS), IoT-enabled inventory tracking, and real-time operational analytics, enabling seamless end-to-end supply chain optimization. Leveraging digital twins, predictive analytics, and labor optimization, Dematic enhances throughput, accuracy, and scalability across manufacturing, e-commerce, retail, and cold chain logistics. Tecsys (Emerging Leader) is gaining traction with cloud-based WMS, AI-powered inventory optimization, transportation management integration, and logistics visibility dashboards, demonstrating strong growth potential while expanding its presence across North American and global smart warehousing networks.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 29.12 Billion |

| Market Forecast in 2030 | USD 46.42 Billion |

| Growth Rate | CAGR of 8.3% during 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

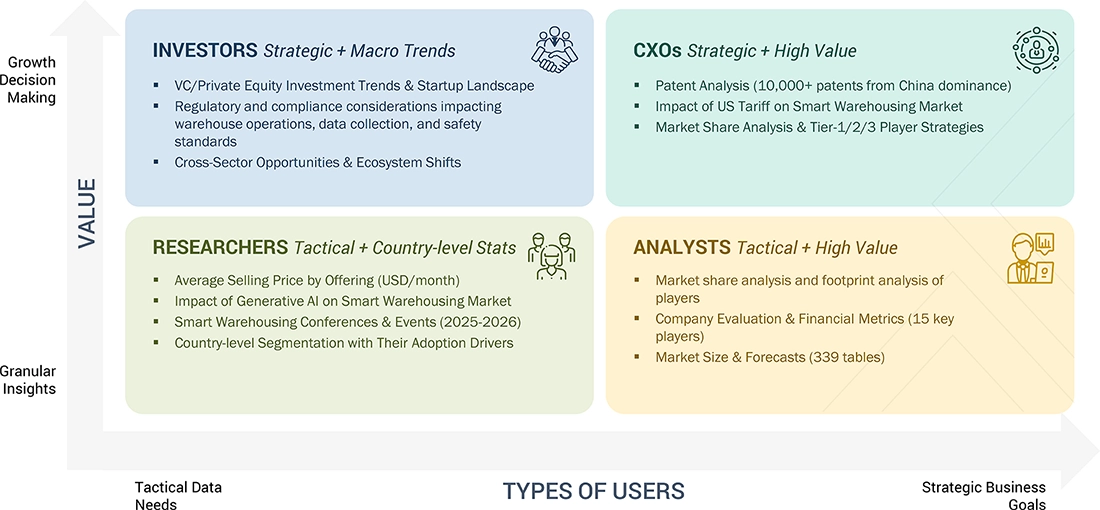

WHAT IS IN IT FOR YOU: Smart Warehousing Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Smart Warehousing Provider (US) |

|

|

RECENT DEVELOPMENTS

- May 2025 : Blue Yonder acquired Pledge Earth Technologies Ltd. to expand its end-to-end supply chain platform with accredited carbon emissions reporting. Pledge’s software solutions enable businesses to monitor and manage their carbon footprint across logistics operations, aligning with global sustainability standards and enhancing supply chain transparency.

- May 2025 : Samsung SDS and SAP strengthened their collaboration to expand cloud ERP services, focusing on regulated industries such as finance, public, and defense sectors. The partnership aims to support cloud ERP migration and integrate AI and hyper-automation technologies, enhancing operational efficiency and warehouse and supply chain management compliance.

- April 2025 : Uniserve partnered with Logistics Reply to implement LEA Reply, a cloud-native, microservices-based warehouse management system (WMS). This partnership enhances scalability, operational efficiency, and real-time inventory visibility across Uniserve’s supply chain operations. Future plans include integrating AI, inventory drones, yard management, and dock scheduling technologies.

- January 2025 : Blue Yonder and Rhenus Warehousing Solutions formed a strategic partnership to standardize warehouse operations globally. This collaboration focuses on implementing Blue Yonder’s Warehouse Management System (WMS) across Rhenus’s facilities to enhance efficiency, scalability, and consistency in warehouse processes.

- December 2024 : Körber and KKR acquired MercuryGate, a transportation management system (TMS) provider, to enhance their supply chain execution suite. This strategic move aims to offer integrated solutions across order, warehouse, and transportation management, improving efficiency and visibility from procurement to delivery.

Table of Contents

Methodology

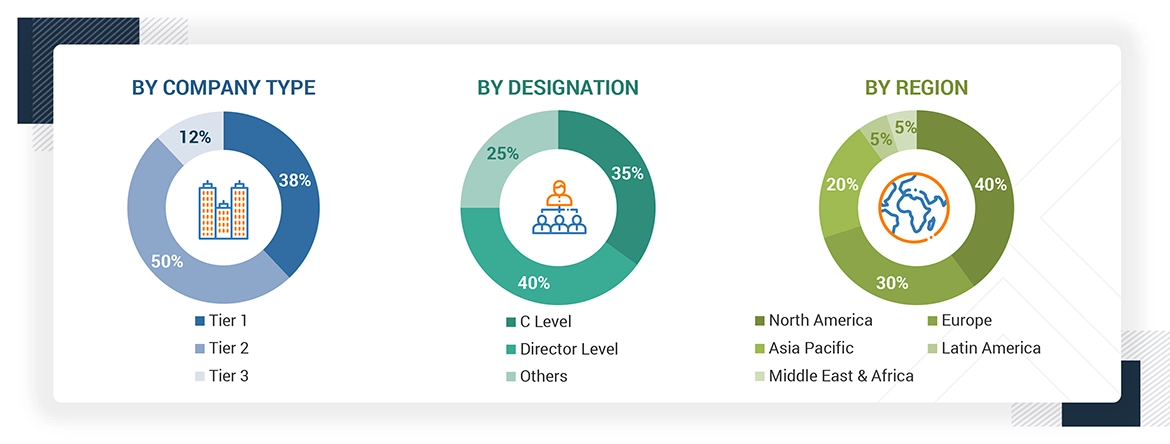

This research study on the smart warehousing market involved extensive secondary sources, directories, IEEE Communication-Efficient: Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred smart warehousing solution providers, third-party service providers, consulting service providers, hardware providers, end users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, the smart warehousing spending of various countries was extracted from the respective sources.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors specializing in business development, marketing, and smart warehousing providers. It also included key executives from smart warehousing solution vendors, system integrators (SIs), professional service providers, hardware providers, industry associations, and other key opinion leaders.

Note: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between

USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion. Other designations include

sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

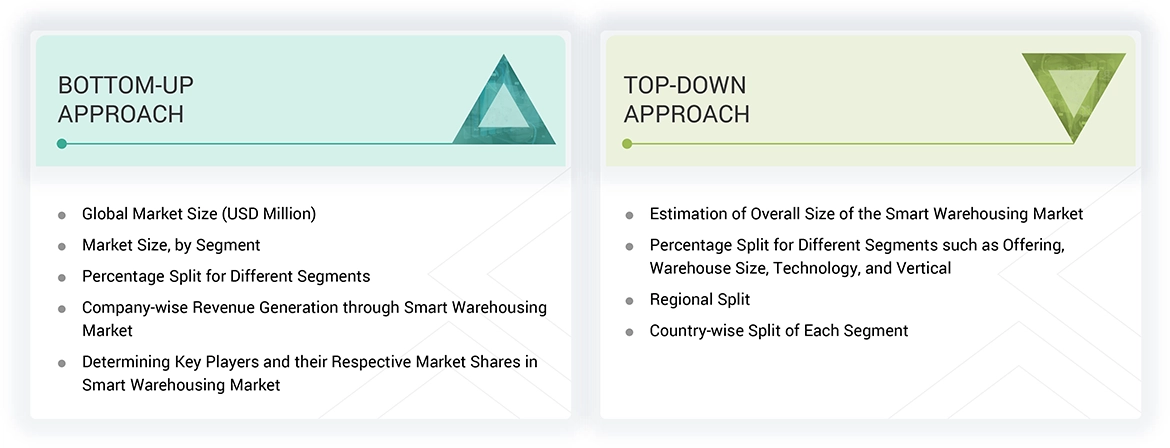

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the smart warehousing market. The first approach involved estimating the market size by companies’ revenue generated through the sale of smart warehousing products.

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering products in the smart warehousing market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on software, services, hardware, warehouse size offered, technology, vertical, and region. The markets were triangulated through primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of smart warehousing products among different verticals in key countries, concerning their regions contributing the most to the market share, was identified. For cross-validation, the adoption of smart warehousing products among enterprises, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the smart warehousing market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major smart warehousing providers, and organic and inorganic business development activities of regional and global players were estimated.

Smart Warehousing Market : Top-Down and Bottom-Up Approach

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes as explained above. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

The smart warehousing market refers to the software, hardware, and services ecosystem that enables automated, data-driven warehouse operations. It leverages AI, IoT, robotics, and cloud computing technologies to optimize inventory management, improve operational efficiency, and enhance real-time visibility across supply chain functions.

Stakeholders

- Smart warehousing vendors

- Smart warehousing service vendors

- Managed service providers

- Support and maintenance service providers

- System integrators (SIs)/migration service providers

- Value-added resellers (VARs) and distributors

- Distributors and value-added resellers (VARs)

- Independent software vendors (ISV)

- Third-party providers

- Technology providers

Report Objectives

- To define, describe, and forecast the smart warehousing market by offering, warehouse size, technology, and vertical

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the smart warehousing market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for the five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments, such as partnerships, product launches, and mergers and acquisitions, in the smart warehousing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's product portfolio.

Geographic Analysis as per Feasibility

- Further breakup of the North American smart warehousing market

- Further breakup of the European smart warehousing market

- Further breakup of the Asia Pacific smart warehousing market

- Further breakup of the Middle East & Africa smart warehousing market

- Further breakup of the Latin American smart warehousing market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is smart warehousing?

Smart warehousing is the integration of Artificial Intelligence (AI), Internet of Things (IoT), robotics, cloud computing, and data analytics to automate and streamline warehouse operations. It enables real-time tracking of goods, efficient inventory management, and automated picking and sorting. This results in faster order fulfillment, reduced human error, and increased overall efficiency. Smart warehouses adapt quickly to changing demands and help businesses stay competitive in fast-paced markets.

What are the key applications of smart warehousing across industries?

Smart warehousing is widely applied across retail, manufacturing, logistics, healthcare, and food & beverage sectors. In retail and e-commerce, it enables faster order processing and personalized delivery services. In manufacturing, it supports just-in-time inventory and supply chain transparency. Pharmaceutical companies use it for cold chain monitoring and compliance. Across industries, it facilitates predictive maintenance, space optimization, and better labor allocation through automation and analytics.

What are the major factors driving market growth?

The primary growth drivers include the surge in online shopping, the need for faster and more accurate order fulfillment, and labor shortages pushing the demand for automation. Technological advancements in robotics, AI, and machine learning are making smart warehousing more accessible and scalable. Businesses also seek to reduce operational costs and carbon footprints, which smart systems help achieve through energy-efficient operations and optimized logistics. Increasing customer expectations for real-time delivery updates further fuel demand.

What are the key challenges faced by companies in the market?

Despite its benefits, smart warehousing faces several challenges. High capital investment for automation and technology integration can be a barrier for small and medium-sized enterprises (SMEs). Legacy systems in older warehouses are often incompatible with new technologies, complicating upgrades. There are also concerns about data privacy, cybersecurity, and system reliability. Additionally, the shortage of skilled workers who can manage and interpret smart systems hinders smooth implementation and long-term maintenance.

Who are the key vendors in the market?

Some major players in the smart warehousing market include Manhattan Associates (US), Körber (Germany), Oracle (US), SAP (Germany), Tecsys (Canada), PSI Logistics (Germany), Samsung SDS (South Korea), Reply (Italy), Infor (US), IBM (US), Blue Yonder (US), Generix Group (France), Microlistics (Australia), ABB (Switzerland), Microsoft (US), Epicor (US), Made4net (US), Mantis (US), Softeon (US), Synergy Logistics (US), E2open (US), Vinculum (India), Mecalux (Spain), SSI Schaefer (US), Demantic (US), Honeywell (US), Swisslog (Switzerland), Daifuku (Japan), WareIQ (India), Foysonis (India), Increff (India), Locus Robotics (US), ShipHero (US), Cin7 (US), EasyEcom (India), Unicommerce (India), Logiwa (US), IAM Robotics (US), Greyorange (India), Righthand Robotics (US), Magazino (Germany), Covariant (US), Attabotics (Canada), Geek+ (China), Nomagic (US), and Plus One Robotics (US).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Smart Warehousing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Smart Warehousing Market