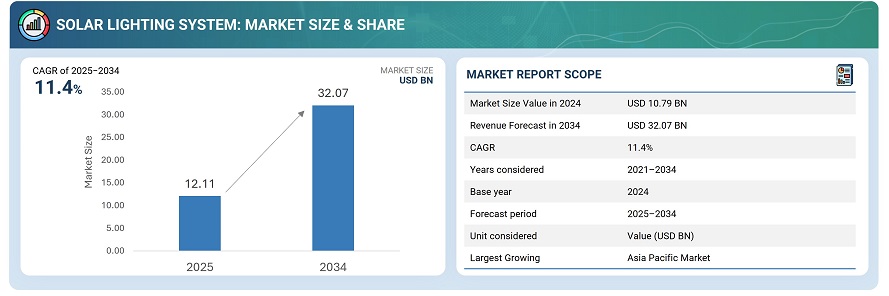

Solar Lighting System Market by Offering (Hardware and Software & Services), Light Source (LED and Others), Grid Type (On Grid and Off Grid), Application (Highways & Roadways, Industrial, and Commercial), and Geography - Global Forecast to 2025-2034

The global solar lighting system market was valued at USD 10.79 billion in 2024 and is projected to reach approximately USD 32.07 billion by 2034, registering a CAGR of 11.6% between 2025 and 2034.

The market’s growth is primarily driven by increasing adoption of sustainable and energy-efficient lighting technologies across urban and rural infrastructure. Governments and municipalities are heavily investing in solar-powered street and area lighting as part of smart city and carbon-neutral initiatives. Technological advancements—such as high-efficiency LEDs, LiFePO4 batteries, and MPPT charge controllers—are improving reliability and reducing lifecycle costs. Furthermore, the integration of IoT-enabled control systems, adaptive dimming, and remote monitoring capabilities is expanding use cases in highways, industrial zones, residential communities, and off-grid rural areas. As energy costs rise and grid dependency declines, solar lighting systems are expected to become an essential component of modern public and private infrastructure worldwide.

A solar lighting system is a self-sustained lighting solution that operates using energy generated from solar panels. It typically comprises a photovoltaic (PV) module, LED luminaire, battery (commonly LiFePO4), charge controller, and supporting hardware. The system converts sunlight into electrical energy stored in the battery, which powers the LED during nighttime. Advanced systems may include sensors, MPPT controllers, and IoT connectivity for optimized performance and energy efficiency.

Market by Application

Highways & Roadways

The highways and roadways segment continues to gain momentum due to rising investments in smart city infrastructure and sustainable public lighting. Governments are increasingly replacing conventional grid-powered lights with solar systems to cut energy costs and emissions. Improved battery life, MPPT controllers, and motion-sensing LEDs are driving large-scale installations for expressways and rural roads, making this one of the most stable and steadily expanding segments.

Industrial

Industrial facilities are adopting solar lighting systems to reduce operational energy costs and comply with environmental regulations. The shift toward renewable power sources and the need for reliable, maintenance-free lighting for remote plants, warehouses, and oil & gas sites are fueling demand. Increasing awareness of long-term cost savings and declining solar component costs are further boosting adoption across heavy manufacturing and logistics zones.

Commercial

The commercial segment holds the largest share of the solar lighting system market. Commercial buildings, campuses, and parking facilities increasingly prefer solar solutions for sustainable illumination and green certifications. The integration of smart controls, high-lumen LEDs, and energy storage systems enhances operational efficiency. Growth is fueled by rapid urbanization, expansion of commercial complexes, and corporate commitments toward net-zero energy consumption goals worldwide.

Residential

The residential segment is the fastest-growing application area, supported by rising consumer awareness and the affordability of compact solar lighting systems. Demand for pathway, garden, and security lights is rising sharply in both developed and emerging economies. Government rebates, falling PV module costs, and increasing preference for off-grid lighting in rural regions further drive this trend, positioning the segment as a major growth catalyst through the next decade.

Market by Offering

Hardware

The hardware segment dominates the solar lighting system market, accounting for the largest revenue share. This dominance is attributed to the widespread deployment of solar panels, LED fixtures, batteries, and controllers in large-scale street lighting and infrastructure projects. Technological advancements—such as higher PV efficiency, LiFePO4 batteries, and MPPT controllers—are further boosting adoption. While growth is steady, the segment’s expansion rate is gradually moderating as hardware prices decline and markets mature.

Software & Services

The software & services segment, though smaller in size, is witnessing faster growth than hardware. The increasing integration of IoT platforms, remote monitoring software, and predictive maintenance solutions is driving recurring revenue opportunities. Governments and municipalities are adopting centralized control systems for large solar lighting networks, enhancing performance tracking and energy optimization. As a result, this segment is expected to capture a growing share of total market value in the coming years.

Market by Geography

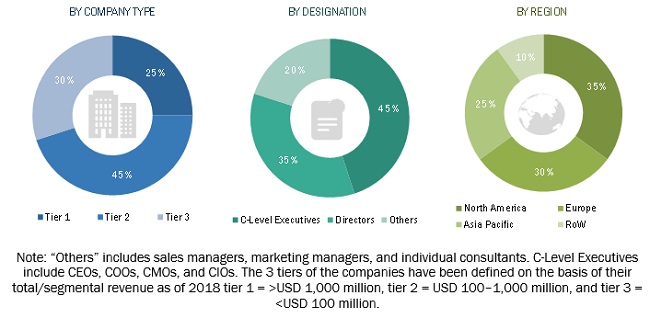

The Asia Pacific region dominates the solar lighting system market, supported by large-scale rural electrification projects, rapid urban expansion, and extensive government-led renewable energy initiatives. High solar irradiation, falling component costs, and smart city programs in China, India, and Southeast Asia have positioned the region as a global manufacturing and deployment hub for solar lighting systems. North America follows, with strong growth driven by sustainable infrastructure investments, modernization of roadway lighting, and growing adoption across residential and commercial applications. Government incentives and net-zero emission policies further accelerate regional expansion. Europe continues to grow steadily, fueled by stringent energy efficiency regulations, sustainability goals, and widespread replacement of conventional grid-connected lighting. Integration of smart control systems and the region’s emphasis on green urban planning are reinforcing market adoption. The RoW region, including the Middle East, Africa, and South America, is emerging as a high-potential market. Off-grid lighting projects, abundant solar resources, and government-backed electrification programs are expanding access to solar lighting solutions, particularly across rural and underdeveloped areas.

Market Dynamics

Driver: Growing Shift Toward Renewable and Energy-Efficient Lighting

The solar lighting system market is driven by the accelerating global shift toward clean and energy-efficient technologies. Governments and municipalities are investing heavily in solar-powered lighting for streets, highways, and public areas to reduce grid dependency and carbon emissions. Declining photovoltaic module and battery costs, along with incentives and rural electrification programs, are fueling large-scale adoption. Additionally, smart city projects and public–private sustainability partnerships are reinforcing long-term market growth.

Restraint: High Initial Installation and Component Costs

Despite long-term cost savings, high upfront investment remains a key restraint for market expansion. The initial costs associated with solar panels, batteries, and smart control systems can be prohibitive for small-scale or residential users. In regions with limited subsidies or low electricity tariffs, payback periods tend to be longer, discouraging adoption. Furthermore, performance variations due to geographical and climatic conditions continue to pose challenges to cost justification.

Opportunity: Integration of Smart Controls and IoT Connectivity

Advancements in digital technology are creating significant opportunities for solar lighting manufacturers. The integration of IoT, wireless communication, and smart sensors enables remote monitoring, adaptive brightness control, and predictive maintenance. Such intelligent systems enhance operational efficiency and lifespan while reducing maintenance costs. Governments are increasingly incorporating these smart features in tender specifications, driving the evolution toward connected solar lighting networks and data-driven infrastructure management.

Challenge: Performance Dependency on Weather and Maintenance Issues

The efficiency of solar lighting systems remains highly dependent on sunlight availability and battery health. In regions with prolonged cloudy conditions or dust accumulation, system performance can decline significantly. Poor maintenance and substandard components further reduce reliability, especially in rural or remote installations. To address these challenges, manufacturers are focusing on improved battery management systems, higher-efficiency panels, and self-cleaning or low-maintenance designs to ensure consistent illumination performance.

Future Outlook

Between 2025 and 2034, the solar lighting system market is poised for substantial growth as global efforts toward clean energy transition and smart infrastructure intensify. Advancements in high-efficiency LEDs, LiFePO4 batteries, and MPPT controllers will enhance reliability and performance, while IoT-enabled control systems will enable remote monitoring and predictive maintenance. Governments are expected to expand investments in smart city lighting, off-grid electrification, and carbon-neutral infrastructure, further driving large-scale deployments. As technology costs continue to decline, the integration of hybrid solar-grid systems and adaptive lighting networks will become mainstream. Overall, solar lighting will evolve from a cost-saving alternative into a core element of sustainable urban and rural infrastructure, shaping the future of resilient, energy-independent communities worldwide.

Key Market Players

The top solar lighting system companies are Signify N.V. (Netherlands), Sunna Design (France), Solar Electric Power Company (SEPCO) (US), Greenshine New Energy (China), and Urja Global Ltd. (India).

Key Questions addressed in this report:

- Which application segment is currently the frontrunner in global Solar Lighting Systems?

- Which are the major companies in the Solar Lighting System market?

- What are the drivers for the Solar Lighting System market?

- Which region to drive the growth of the market in the next 5 years?

- What are the underlying opportunities in this market?

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Size By Bottom-Up Analysis

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Size By Top-Down Analysis

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insight (Page No. - 33)

4.1 Attractive Opportunities in Solar Lighting Systems Market

4.2 Market, By Offering

4.3 Market, By Light Source

4.4 Market, By Application

4.5 Market, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Need for Energy-Efficient Solar Lighting Systems for Highways

5.2.1.2 Increasing Use of Renewable Energy for Lighting

5.2.1.3 Rising Demand From Developing and Emerging Countries

5.2.1.4 Increasing Penetration and Decreasing Cost of LEDs

5.2.2 Restraints

5.2.2.1 Lack of Awareness About Finance and Payback Period

5.2.3 Opportunities

5.2.3.1 Decline in Cost of Solar Lighting Systems

5.2.3.2 Enhancement in Technological Aspects of Solar Lighting System

5.2.3.3 Favorable Government Initiatives

5.2.4 Challenges

5.2.4.1 Lack of Customer Ownership in Utility-Owned Solar Street Lighting

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Research and Product Development

6.2.2 Raw Material/Component Providers

6.2.3 Original Equipment Manufacturers (OEMs)

6.2.4 Key Technology Providers

6.2.5 Distributors/Sales Offices

6.2.6 End Users

6.3 Key Industry Trends

6.3.1 Smart Solar Street and Roadways Lighting Systems

6.3.2 Battery Industry Will Become More Competitive

7 Solar Lighting Market, By Offering (Page No. - 43)

7.1 Introduction

7.2 Hardware

7.2.1 Solar/Pv Panels

7.2.1.1 Solar Pv Panels are Among the Important Components of Solar Lighting System

7.2.2 Lighting Fixtures

7.2.2.1 LED, CFL and Induction Light are the Mainly Used in Solar Lighting Systems

7.2.3 Rechargeable Battery

7.2.3.1 Rechargeable Battery is the Main Revenue Generator Component for Hardware

7.2.4 Others (Controllers and Accessories)

7.2.4.1 Controllers and Accessories are the Other Component Driving Hardware Market of Solar Lighting

7.3 Software & Services

7.3.1 Software Play Crucial Role in Effective Management of Solar Lighting Systems

8 Solar Lighting Market, By Light Source (Page No. - 50)

8.1 Introduction

8.2 LED

8.2.1 Benefits Such as Long Life, Durability, and Efficiency Driving the Adoption of LED in Solar Lighting Market

8.3 Others

8.3.1 CFL and Induction Bulbs are the Other Light Sources in the Solar Lighting Systems

9 Solar Lighting Market, By Grid Type (Page No. - 54)

9.1 Introduction

9.2 Off-Grid

9.2.1 Off-Grid to Hold A Larger Share of Solar Lighting Market

9.3 Hybrid

9.3.1 Hybrid Solar Lighting System is A Less Expensive Than Off-Grid Solar Lighting System

10 Solar Lighting Market, By Application (Page No. - 58)

10.1 Introduction

10.2 Highways and Roadways

10.2.1 Highways and Roadways Segment to Grow at A Substantial CAGR

10.3 Industrial

10.3.1 Industrial Areas Likely to Deploy Solar Lighting System to Maintain Adequate Illumination and Enhance Productivity

10.4 Commercial

10.4.1 Commercial Segment is Expected to Hold Largest Share of Market

10.5 Residential

10.5.1 Residential Townships are Increasingly Deploying Solar Lighting Systems

10.6 Others

10.6.1 Asia Pacific Dominate the Others Segment of Market

11 Geographic Analysis (Page No. - 64)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 US is Expected to Hold Largest Share of Solar Lighting Market in North America

11.2.2 Canada

11.2.2.1 Canada is Expected to Grow at A Significant Rate as Due to Rising Awareness About Energy Efficiency Through Solar Lighting

11.2.3 Mexico

11.2.3.1 Government Initiatives is Driving the Solar Lighting Market in Mexico

11.3 Europe

11.3.1 UK

11.3.1.1 Rising Need for Energy Conservation Systems is Driving the Solar Lighting Systems in UK

11.3.2 Germany

11.3.2.1 Germany is Expected to Hold Significant Share of Solar Lighting Market in the Europe

11.3.3 France

11.3.3.1 Government Initiatives Such as Approved Large-Scale Solar Projects are Driving Solar Lighting Market in France

11.3.4 Rest of Europe

11.3.4.1 Rest of Europe Hold the Largest Share of Europe Solar Lighting Market

11.4 APAC

11.4.1 Japan

11.4.1.1 Increasing Investment in Solar Lighting Infrastructure to Boost the Market Growth in Japan

11.4.2 China

11.4.2.1 China is Expected to Hold Largest Share of Solar Lighting Market in Asia Pacific

11.4.3 Australia

11.4.3.1 Investment Opportunities and Government Policies Boosting the Growth of Solar Lighting Market in Australia

11.4.4 South Korea

11.4.4.1 Government of South Korea Unveiled New Plans to Boost Solar Energy in the Country

11.4.5 India

11.4.5.1 India is Expected to Grow at Highest Rate in Solar Lighting Market in Asia Pacific

11.4.6 Rest of APAC

11.4.6.1 Developing Economies of Rest of APAC Opens Huge Opportunities for Solar Lighting Market

11.5 RoW

11.5.1 South America

11.5.1.1 Increasing Awareness and Government Support are Driving Factors for the Solar Alighting Market in South America

11.5.2 Middle East

11.5.2.1 Middle East is Expected to Grow at Highest Rate in Solar Lighting Market in Rest of the World

11.5.3 Africa

11.5.3.1 Africa is Expected to Hold Largest Share in Solar Lighting Market in Rest of the World

12 Competitive Landscape (Page No. - 93)

12.1 Introduction

12.2 Ranking of Top Players in Solar Lighting Market (2018)

12.3 Competitive Situations and Trends

12.3.1 Product Launches and Product Developments

12.3.2 Partnerships, Contracts, Agreements, Collaborations, and Expansions

12.4 Competitive Leadership Mapping, 2018

12.4.1 Visionary Leaders

12.4.2 Dynamic Differentiators

12.4.3 Innovators

12.4.4 Emerging Companies

13 Company Profile (Page No. - 100)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1 Key Players

13.1.1 Signify Holding (Philips)

13.1.2 Eaton

13.1.3 Solar Electric Power Company (SEPCO)

13.1.4 Sol

13.1.5 Su-Kam Power Systems

13.1.6 Clear Blue Technologies

13.1.7 Jinhua Sunmaster Solar Lighting Co. Ltd

13.1.8 Solarone Solutions

13.1.9 Solar Street Lights Usa

13.1.10 Solar Lighting International

13.2 Other Important Players

13.2.1 Jiangsu Sokoyo Solar Lighting Co., Ltd.

13.2.2 Exide Industries Ltd

13.2.3 Greenshine New Energy

13.2.4 Halonix Technologies Pvt Ltd.

13.2.5 Zhuhai Bomin Solar Technology Co., Ltd

13.3 Startup Ecosystem

13.3.1 Azuri Technologies Ltd

13.3.2 Flexsol Solutions

13.3.3 Sunna Design

13.3.4 Nokero

13.3.5 Solektra International

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

14 Appendix (Page No. - 124)

14.1 Insights From Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (61 Figures)

Table 1 Solar Lighting Market, By Offering, 2016–2024 (USD Billion)

Table 2 Market for Hardware, By Component, 2016–2024 (USD Billion)

Table 3 Market for Hardware, By Region, 2016–2024 (USD Billion)

Table 4 Market for Solar/PV Panels, By Region, 2016–2024 (USD Billion)

Table 5 Market for Lighting Fixtures, By Region, 2016–2024 (USD Billion)

Table 6 Market for Rechargeable Batteries, By Region, 2016–2024 (USD Billion)

Table 7 Market for Others (Controllers And Accessories), By Region, 2016–2024 (Usd Billion)

Table 8 Market for Software & Services, By Region, 2016–2024 (USD Billion)

Table 9 Market, By Light Source, 2016–2024 (USD Billion)

Table 10 Market for LEDs, By Region, 2016–2024 (USD Billion)

Table 11 Market for Others, By Region, 2016–2024 (USD Million)

Table 12 Market, By Grid Type, 2016–2024 (USD Billion)

Table 13 Market for Off-Grid, By Region, 2016–2024 (USD Billion)

Table 14 Market for Hybrid, By Region, 2016–2024 (USD Billion)

Table 15 Market, By Application, 2016–2024 (USD Billion)

Table 16 Market for Highways and Roadways, By Region, 2016–2024 (USD Billion)

Table 17 Market for Industrial Applications, By Region, 2016–2024 (USD Billion)

Table 18 Market for Commercial Applications, By Region, 2016–2024 (USD Billion)

Table 19 Market for Residential Applications, By Region, 2016–2024 (USD Billion)

Table 20 Market for Other Applications, By Region, 2016–2024 (USD Billion)

Table 21 Market, By Region, 2016–2024 (USD Billion)

Table 22 Market in North America, By Country, 2016–2024 (USD Billion)

Table 23 Market in North America, By Offering, 2016–2024 (USD Billion)

Table 24 Market in North America, By Hardware Component, 2016–2024 (USD Billion)

Table 25 Market in North America, By Light Source, 2016–2024 (USD Billion)

Table 26 Market in North America, By Grid Type, 2016–2024 (USD Billion)

Table 27 Market in North America, By Application, 2016–2024 (USD Billion)

Table 28 Market in US, By Light Source, 2016–2024 (USD Million)

Table 29 Market in Canada, By Light Source, 2016–2024 (USD Million)

Table 30 Market in Mexico, By Light Source, 2016–2024 (USD Million)

Table 31 Market in Europe, By Country, 2016–2024 (USD Billion)

Table 32 Market in Europe, By Offering, 2016–2024 (USD Billion)

Table 33 Market in Europe, By Hardware Component, 2016–2024 (USD Billion)

Table 34 Market in Europe, By Light Source, 2016–2024 (USD Billion)

Table 35 Market in Europe, By Grid Type, 2016–2024 (USD Billion)

Table 36 Market in Europe, By Application, 2016–2024 (USD Billion)

Table 37 Market in UK, By Light Source, 2016–2024 (USD Million)

Table 38 Market in Germany, By Light Source, 2016–2024 (USD Million)

Table 39 Market in France, By Light Source, 2016–2024 (USD Million)

Table 40 Market in Rest of Europe, By Light Source, 2016–2024 (USD Million)

Table 41 Market in APAC, By Country, 2016–2024 (USD Billion)

Table 42 Market in APAC, By Offering, 2016–2024 (USD Billion)

Table 43 Market in APAC, By Hardware Component, 2016–2024 (USD Billion)

Table 44 Market in APAC, By Light Source, 2016–2024 (USD Billion)

Table 45 Market in APAC, By Grid Type, 2016–2024 (USD Billion)

Table 46 Market in APAC, By Application, 2016–2024 (USD Billion)

Table 47 Market in Japan, By Light Source, 2016–2024 (USD Million)

Table 48 Market in China, By Light Source, 2016–2024 (USD Million)

Table 49 Market in Australia, By Light Source, 2016–2024 (USD Million)

Table 50 Market in South Korea, By Light Source, 2016–2024 (USD Million)

Table 51 Market in India, By Light Source, 2016–2024 (USD Million)

Table 52 Market in Rest of APAC, By Light Source, 2016–2024 (USD Million)

Table 53 Market in RoW, By Region, 2016–2024 (USD Billion)

Table 54 Market in RoW, By Offering, 2016–2024 (USD Billion)

Table 55 Market in RoW, By Hardware Component, 2016–2024 (USD Billion)

Table 56 Market in RoW, By Light Source, 2016–2024 (USD Billion)

Table 57 Market in RoW, By Grid Type, 2016–2024 (USD Billion)

Table 58 Market in RoW, By Application, 2016–2024 (USD Billion)

Table 59 Market in South America, By Light Source, 2016–2024 (USD Million)

Table 60 Market in Middle East, By Light Source, 2016–2024 (USD Million)

Table 61 Market in Africa, By Light Source, 2016–2024 (USD Million)

List of Figures (36 Figures)

Figure 1 Solar Lighting Market Segmentation

Figure 2 Solar Lighting Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Solar Lighting Market, 2016–2024

Figure 7 Hardware to Dominate Market During Forecast Period

Figure 8 LED to Dominate Market During Forecast Period

Figure 9 Commercial Segment to Hold Largest Size of Market By 2024

Figure 10 APAC Held Largest Share of Market in 2018

Figure 11 Shift Toward Renewable Energy for Lighting is Driving Market

Figure 12 Hardware Segment Held Larger Share of Market in 2018

Figure 13 LED Accounted for Larger Market Share, in Terms of Light Source, in 2018

Figure 14 Commercial Application Held Largest Share of Market in 2018

Figure 15 APAC to Witness Highest CAGR in Market From 2019 to 2024

Figure 16 Solar Lighting Market: Value Chain Analysis

Figure 17 Smart Solar Street and Roadways Lighting Systems in Market—Leading Trend Among Key Market Players

Figure 18 Solar Lighting Market, By Offering

Figure 19 Solar Lighting Market, By Light Source

Figure 20 Solar Lighting Market, By Grid Type

Figure 21 Solar Lighting Market, By Application

Figure 22 Solar Lighting Market, By Region

Figure 23 Geographic Snapshot: Solar Lighting Market

Figure 24 Solar Lighting Market in North America

Figure 25 North America: Snapshot of Solar Lighting Market

Figure 26 Solar Lighting Market in Europe

Figure 27 Europe: Snapshot of Solar Lighting Market

Figure 28 Solar Lighting Market in APAC

Figure 29 APAC: Snapshot of Solar Lighting Market

Figure 30 Solar Lighting Market in RoW

Figure 31 Strategies Adopted By Top Players in Market

Figure 32 Market Player Ranking (2018)

Figure 33 Solar Lighting Market (Global) Competitive Leadership Mapping, 2018

Figure 34 Signify Holdings (Philips): Company Snapshot

Figure 35 Eaton: Company Snapshot

Figure 36 Clear Blue Technologies: Company Snapshot

The study involved 4 major activities in estimating the current size of the solar lighting system market. Exhaustive secondary research was done to collect information on the market, including the peer market and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, solar lighting-related journals, IEST publications; directories; and databases. The secondary data has been collected and analyzed to arrive at the overall market size estimations, which has been further validated by primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information relevant to this report. Extensive primary research has been conducted after understanding and analyzing the solar lighting system market through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across four regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW). RoW comprises South America and the Middle East & Africa. Approximately 45% of the primary interviews have been conducted with the demand side and 55% with the supply side. This primary data has been collected mainly through telephonic interviews, which accounted for 80% of the total primary interviews. Besides, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were implemented to estimate and validate the total size of the solar lighting system market. These methods were also used extensively to estimate the size of the markets based on various subsegments. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides across different end-use applications.

Study Objectives

- To describe and forecast the global solar lighting system market, in terms of value, by offering, light source, grid type, and application

- To describe and forecast the market size for various segments by region: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors, namely drivers, restraints, opportunities, and challenges influencing the growth of the solar lighting system market

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments in the solar lighting system market

- To strategically profile key players and comprehensively analyze their market ranking in terms of revenue and core competencies

- To study the complete value chain and industry segments and perform a value chain analysis of the global solar lighting system market

- To analyze strategies such as product launches and product developments, partnerships/ contracts/agreements/collaborations, expansions, and mergers, and acquisitions, adopted by major players in the solar lighting system market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

Reginal Analysis

- Country-wise breakdown of various regions such as the Americas, Europe, APAC, and RoW

- Further segmentation of the application segments of the solar lighting system market

- Comprehensive coverage of regulations followed in each region (North America, APAC, and Europe)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Solar Lighting System Market