Soybean Food & Beverage Products Market by Type (Soybean Food Products, Soybean Additives/Ingredients, Soybean Oil), Source, Distribution Channel, Application (Bakery & Confectionery, Animal Feed, Dairy Products, Functional Food & Supplements, Meat Products, Infant Foods, & Other Applications), and Region - Global Forecast to 2027

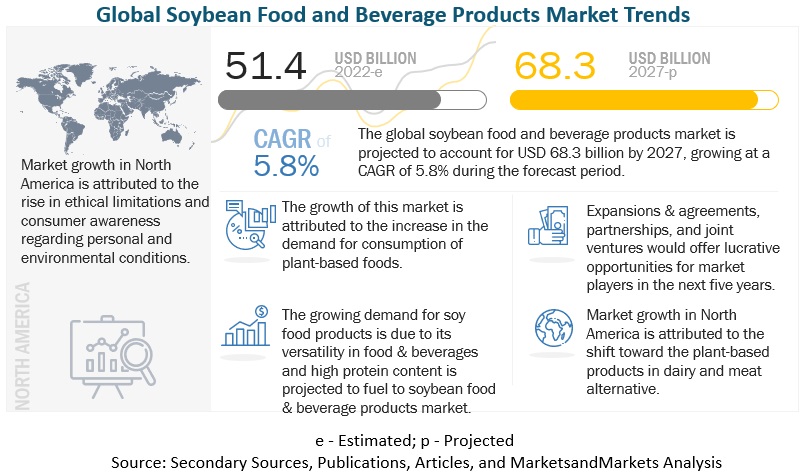

The global soybean food and beverage products market is estimated to be valued at USD 51.4 billion in 2022. It is projected to reach USD 68.3 billion by 2027, recording a CAGR of 5.8% during the forecast period. Soy-based proteins represent a growing opportunity in the current market scenario for alternative proteins. Meat has been the prime source of protein in developed markets for years, and there has been an increased appetite for traditional protein in developing markets in recent years. The changing consumer preference and interest in plant-based protein sources, due to its nutritional profile, inclination toward clean eating, rise in health concerns (lactose intolerance), environmental concerns, and animal welfare, resulting in the growth of the soybean food and beverage products market. The inclination of consumers toward plant-based protein has grown from its base applications in meat and dairy alternatives and has witnessed abundant usage in other segments, such as performance nutrition and infant nutrition.

To know about the assumptions considered for the study, Request for Free Sample Report

Rising incidence of lactose intolerant and milk allergies globally

Lactose is the major carbohydrate in milk and other dairy foods such as ice cream, cheese, and yogurt. The symptoms of lactose intolerance among individuals include abdominal pain, diarrhea, nausea, gut distension, flatulence, and constipation. According to the American Gastroenterological Association, cow’s milk is a major cause of food allergies among infants and children. The increasing number of lactose-intolerant and dairy-allergic consumers have accelerated the growth of the soybean food and beverage products market.

Market Dynamics

Drivers: Preferred alternative over meat and dairy proteins

Soy proteins are one of the most preferred alternatives to meat and dairy proteins, which has helped food manufacturers control costs and improve the profitability of their products. Due to their functional and nutritional characteristics, they are used for various food applications such as bakery, confectionery, emulsion-type sausages, dairy replacers, functional beverages and nutritional bars, and breakfast cereals. They are also used as nutritional ingredients in livestock feed, aquaculture, and pet food products. Since soy protein has several nutritional benefits, it is an easy replacement for meat and dairy proteins. The rise in prices of meat and dairy proteins has led manufacturers, and consumers to opt for it as a cheaper alternative that offers the same nutritional benefits.

Restraints: Allergies associated with plant-based protein sources, such as soy

According to the Food Allergy Research and Education (FARE) organization, 32 million Americans have a food allergy, with 5.6 million being under 18. Based on data from studies conducted in 2018 and 2019, approximately 1.9 million Americans present symptoms related to a soy food allergy. Soy allergies are more common in infants and young children than adults. Approximately 0.4% to 1.5% of infants in the United States have a soy food allergy. Which is restraining the soybean food and beverage products market. However, research shows that most children diagnosed with a soy allergy will outgrow their allergy by 10 years of age. GMO allergy statistics from 2019 reveal that 94% of soybean crops in America were genetically modified. Many consumers refrain from consuming GMOs from soybeans due to the possible increased levels of a known carcinogen, formaldehyde. Corn and cotton are other crops grown in America that are typically genetically modified. For this reason, considerable diligence is required by those who are allergic to soy protein because it is present in many commonly consumed foods. Sweet rice flour: As an alternative to soybean food and beverage products in gluten-free baking, sweet rice flour can be used. It is sticky and has higher starch content compared to regular rice. It also has a better binding capacity and helps in incorporating the ingredients between, as it is gluten-free.

Opportunities: Soy used for customization of food & beverage to create versatile products

Manufacturers have been using the functional properties of soy protein ingredients to develop versatile food products. Several new products, such as nut butter, cheese, burgers, and instant oatmeal’s have been launched by the manufacturers of soy protein ingredients. New sectors, such as healthcare foods and sports beverages, can provide a better market opportunity for soy proteins. These sectors can boost the growth of soy protein production if they are manufactured in a customized way. With advancements in technology, such as reverse micellar, enzyme-assisted, and membrane ultrafiltration technologies, soy proteins can be isolated and functional properties can be enhanced to provide a wider scope of application. There have been various food products awaiting market introduction that requires consumer appeal. The products are designed with the help of soy proteins to attract consumers based on their nutritive content and palatability. Examples of food product categories featuring plant-based alternatives are refrigerated dips; refrigerated whipped toppings, refrigerated salad dressings, refrigerated desserts, and frozen novelties. Though soy proteins have an uncharacteristic flavor, these limitations have been researched to be overcome by suitable changes in product formulation.

Challenges: Concerns over quality of food and beverages due to alterations of GM

Soybean is among the prominent sources used to obtain plant-based protein and is highly produced in Brazil, the US, Argentina, China, and India. With the augmenting demand for plant-based food & beverages among consumers, the need for soy has also increased. Government regulators in Asia Pacific and Europe regions have made it mandatory to declare the GM/non-GM status of food ingredients on the packaging of all processed food & beverages. GM ingredients are associated with allergic reactions and might consist of herbicidal residues. Their production and usage for producing plant-based foods/ingredients are a challenge for the plant-based protein market. For instance, Impossible Burgers (US) launched GMO-based soybean burger patties but has earned some skepticism from consumers due to the presence of inorganic ingredients and herbicides, which hinders the growth of the soybean food and beverage products market. Thus, the consumption of plant-based food products manufactured by GM soybean has resulted in a point of concern for consumers globally.

To know about the assumptions considered for the study, download the pdf brochure

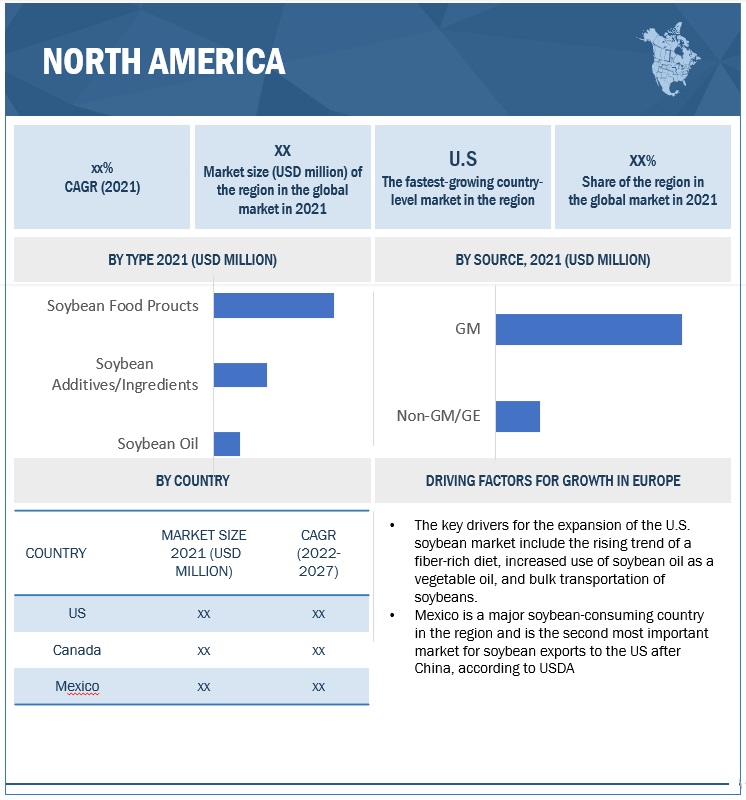

North America showed a significant growth in the soybean food and beverage products market, growing at a CAGR of 6.3% during the forecast period.

North America is the largest market for soy protein ingredients. In 2021, it accounted for a 21.3% share of the global soybean food & beverage products market. As per ERS of USDA, The United States and Brazil account for over 80 percent of global soybean exports. Much of this trade is influenced by the policies of importers, including China, many Asian countries, and the European Union (EU). Brazil, the world’s largest soybean exporter, is projected to increase in 2025/26 by 35 percent to 76.4 million tons. Soybean exports from the next largest exporter, the United States, are expected to grow 6 percent to reach 52.4 million tons in the same time period.

The world trade in soybeans is anticipated to grow by 22%, soybean meal by 20%, and soybean oil by 30%, according to USDA Agricultural Projections for 2025. Population and economic growth, fueling an increase in the demand for animal products worldwide, as well as policies put in place by major agricultural importers and exporters, are the main drivers of the global trade in soybeans and related products. These cover domestic and border regulations that deal with items made for cattle from soybeans.

Top Companies in the Soybean Food and Beverage Products Market

The key players in this market include Cargill, Incorporated (US), CHS Inc (US), ADM (US), Hain Celestial Group (US) and Eden Foods (US).

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 51.4 billion |

|

Market revenue prediction in 2027 |

USD 68.3 billion |

|

Market expansion rate |

CAGR of 5.8% |

|

Market size estimation |

2022–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments covered |

By type, end-user, source, and region |

|

Regions covered |

North America, Asia Pacific, Europe, South America, and RoW |

|

Companies studied |

|

This research report categorizes the soybean food and beverage products market, based on type, application, source, distribution channel and region

Target Audience:

- Soybean food and beverage products raw material suppliers

- Soybean food and beverage products manufacturers

- Intermediate suppliers, such as traders and distributors of soybean food and beverage products

- Manufacturers of food & beverages, feed, functional foods, infant foods

- Government and research organizations

-

Associations, regulatory bodies, and other industry-related bodies:

- Food and Agriculture Organization (FAO)

- United States Department of Agriculture (USDA)

- European Food Safety Agency (EFSA)

- European Association of Specialty Feed Ingredients and their Mixtures (FEFANA)

- Food Standards Australia New Zealand

- Organization for Economic Co-operation and Development (OECD)

- Good Food Institute (GFI)

- Plant-Based Food Association (PBFA)

Soybean food and beverage products Market Report Scope:

|

By Type |

By Application |

By Source |

By Distribution Channel |

By Region |

|

|

|

|

|

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the soybean food and beverage products market?

North America dominated the soybean food and beverage products market, with a value of USD 10,360.6 million in 2021; it is projected to reach USD 14,886.9 million by 2027, at a CAGR of 6.3% during the forecast period. people who are lactose intolerant live in the US, Europe, Africa, and Asia. Adding various flavors to soy products increases their appeal and demand among consumers. The price of soy is a major selling point because it is significantly less expensive than milk products. More customers are drawn to the products as a result.

What is the current size of the global soybean food and beverage products market?

The global soybean food and beverage products market is estimated to be valued at USD 51.4 billion in 2022. It is projected to reach USD 68.3 billion by 2027, recording a CAGR of 5.8% during the forecast period.

Which are the key players in the Soybean Food and Beverage Products Market, and how intense is the competition?

Key players in this market include Willmar International Limited (Singapore), Cargill, Incorporated (US), CHS Inc (US), ADM (US) and Kikkoman Group (Japan) . Since soybean food and beverage products is a fast-growing market, the existing players are fixated upon improving their market shares, while startups are being established rapidly. The soybean food and beverage products market can be classified as a fragmented market as it has a large number of organized players, accounting for a major part of the market share, present at the global level, and unorganized players present at the local level in several countries. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSGROWING TREND OF MEAT AND DAIRY ALTERNATIVESGROWING VEGAN AND FLEXITARIAN POPULATION WORLDWIDEINCREASED SOYBEAN PRODUCTION

-

5.3 MARKET DYNAMICSDRIVERS- Rising instances of lactose intolerance and milk allergies globally- Innovations & developments related to plant-based protein to augment vegan trend- Preferred alternative over meat and dairy proteinsRESTRAINTS- Allergies associated with plant-based protein sources- Possibilities of nutritional & vitamin deficiencies among vegansOPPORTUNITIES- Soy used for customization of food & beverage to create versatile productsCHALLENGES- Concerns over quality of food & beverages due to adulteration of GM ingredients

- 6.1 INTRODUCTION

-

6.2 REGULATORY FRAMEWORKREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- China- IndiaSOUTH AMERICA- Argentina- Brazil

-

6.3 PATENT ANALYSIS

-

6.4 VALUE CHAIN ANALYSISRESEARCH & DEVELOPMENTSOURCING OF RAW MATERIALSPRODUCTION & PROCESSINGDISTRIBUTION, MARKETING, AND SALES

-

6.5 TRENDS/DISRUPTIONS IMPACTING BUYERS IN SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET

-

6.6 MARKET ECOSYSTEMDEMAND SIDESUPPLY SIDE

-

6.7 TRADE ANALYSISSOYBEAN OILSOYBEANS

-

6.8 PRICING ANALYSISAVERAGE SELLING PRICE ANALYSIS: SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD/KG)AVERAGE SELLING PRICE ANALYSIS: SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD/KG)

-

6.9 TECHNOLOGY ANALYSIS3-D PRINTINGISOLATED SOYBEAN PROTEINSEXTRUSION

-

6.10 CASE STUDIESADM AND BENSON HILL PARTNER TO SCALE INNOVATION IN ULTRA-HIGH PROTEIN SOYCDF CORPORATION AND KIKKOMAN GROUP COLLABORATE TO PACK AND TRANSPORT SOY SAUCE SAFELY

- 6.11 KEY CONFERENCES & EVENTS, 2022–2023

-

6.12 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.14 RECESSION IMPACT ON SOYBEAN FOOD & BEVERAGE PRODUCTS MARKETMACROECONOMIC INDICATORS OF RECESSION

- 7.1 INTRODUCTION

-

7.2 SOYBEAN FOOD PRODUCTSSOYBEAN FOOD PRODUCTS TO BOOST SOYBEAN FOOD MARKETFERMENTED- Fermented foods rich in antioxidants to provide health benefits- Soy Sauce- Natto- Tempeh- Miso- Soy Cheese- Soy Yogurt- Soy Nut Butter- Tofu- Soy Mayonnaise- Yuba- Other Fermented Soybean Food ProductsNON-FERMENTED- Demand for gluten-free, organic, and natural food products- Soy Flour- Soy Grits- Soymilk- Soy Nuts

-

7.3 SOYBEAN ADDITIVES/INGREDIENTSHIGH NUTRITIONAL VALUE OF SOY ADDITIVES TO CATER TO DEMAND AMONG POPULATIONSOY PROTEIN CONCENTRATE- Paleo diet to impact soy protein concentrate marketSOY PROTEIN ISOLATES- Consumer awareness toward environment to drive market for soy protein isolateTEXTURED SOY PROTEIN- Significant rise in demand for plant-based meat alternativesSOY FIBER- Demand for soy fibers to cater demand of vegetarians and vegansOTHER SOYBEAN ADDITIVES/INGREDIENTS

-

7.4 SOYBEAN OILSDEMAND FOR SOYBEAN OIL TO INCREASE DUE TO ITS RISING USAGE IN PREPARED FOODSPROCESSED SOYBEAN OIL- High smoke point of soybean oil to increase demand in food industriesLECITHIN- Usage of lecithin in food & beverage and pharmaceutical industry

- 8.1 INTRODUCTION

-

8.2 BAKERY & CONFECTIONERYUSE OF SOY FLOUR AS A BINDING AGENT TO PROPEL DEMAND

-

8.3 DAIRY PRODUCTSSOYMILK AN ALTERNATIVE TO COW MILK TO BOOST BEVERAGE MARKET

-

8.4 MEAT PRODUCTSSOY AS AN ALTERNATIVE TO MEAT PRODUCTS TO SURGE DEMAND

-

8.5 FUNCTIONAL FOOD & SUPPLEMENTSSOY FOODS SHOW LOWER CHOLESTEROL LEVEL WHEN INCORPORATED IN FUNCTIONAL FOODS

-

8.6 INFANT FOODSRISING INSTANCES OF LACTOSE INTOLERANCE TO DRIVE DEMAND FOR SOY-BASED INGREDIENTS

-

8.7 ANIMAL FEED & PET FOODHIGH DIGESTIBILITY OF SOY AND LOW FIBER INTAKE IN CATTLE TO DRIVE DEMAND FOR SOY MEAL

- 8.8 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 NON-GM/GESIGNIFICANT SHIFT TOWARD NUTRITIOUS AND HEALTHY PLANT-BASED DRINKS TO CATER DEMAND FOR NON-GMO BEVERAGES

-

9.3 GMGENETICALLY MODIFIED FOOD MARKET TO GROW DUE TO INCREASED AWARENESS TOWARD HEALTHY LIFESTYLE

- 10.1 INTRODUCTION

-

10.2 SUPERMARKETSWIDE RANGE OF SOY PRODUCTS AT LOWER PRICES TO ATTRACT CUSTOMERS

-

10.3 HYPERMARKETSAVAILABILITY OF SOYMILK, TOFU, AND SOY CHEESE TO DRIVE DEMAND

-

10.4 CONVENIENCE STOREREADY-TO-EAT MEALS TO SURGE DEMAND FOR CONVENIENCE STORES

-

10.5 DEPARTMENTAL STORESAVAILABILITY OF WIDE RANGE OF GOODS IN DEPARTMENTAL STORES

-

10.6 SPECIALTY STORESPREMIUM PRODUCTS IN SPECIALTY STORES TO INCREASE DEMAND FOR SOY-BASED PRODUCTS

-

10.7 ONLINE RETAILERSCONVENIENCE AND USER-FRIENDLY PLATFORMS TO BECOME VIABLE CHOICE

- 10.8 OTHER DISTRIBUTION CHANNELS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Rising inclination toward fiber-rich diet to augment demand for soy-based flourCANADA- Canada exports most of its soybean to cater to needs of consumers globallyMEXICO- Rising demand for soybean meal in animal feed industry to spur market demand

-

11.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISSPAIN- Robust growth of plant-based food sectorGERMANY- Increasing demand for meat alternatives and flexitarian diet to spur growthFRANCE- Government initiatives and measures to increase production of plant-based proteinUK- Increase in demand for tofu as a meat alternative and a ready-to-eat productITALY- Soy-based food & beverage products to boost marketTHE NETHERLANDS- Vegan substitutes to grow tremendously to prevent greenhouse gas emissionsBELGIUM- Farmers grow soy crops to cut down on import pricesRUSSIA- Soybean is consumed as an animal alternative proteinREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- China requires soybean meal to feed pigsINDIA- Health benefits of plant-based beverages to increase market for soymilkJAPAN- Increase in consumption of protein-rich soy-based food for aging population to drive marketAUSTRALIA & NEW ZEALAND- Soy food consumed as a health supplement to spur market growthSOUTH KOREA- Rise in demand for vegan food to spur market growthREST OF ASIA PACIFIC

-

11.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Boost in soybean production and processing ecosystem to drive marketARGENTINA- Rise in obesity rate to drive demand for protein-enriched food productsREST OF SOUTH AMERICA

-

11.6 REST OF THE WORLD (ROW)REST OF THE WORLD SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET: RECESSION IMPACT ANALYSISMIDDLE EAST- Modification of soybean into various forms and flavors to drive marketAFRICA- Rising demand for functional foods fortified with protein to drive market

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 MARKET SHARE ANALYSIS

- 12.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

-

12.5 KEY PLAYER EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 12.6 PRODUCT FOOTPRINT (KEY PLAYERS)

-

12.7 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF OTHER PLAYERS

-

12.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

13.1 KEY PLAYERSWILMAR INTERNATIONAL LIMITED- Business overview- Products/Solutions offered- Recent developments- MnM viewCARGILL, INCORPORATED- Business overview- Products/Solutions offered- Recent developments- MnM viewCHS INC.- Business overview- Products/Solutions offered- Recent developments- MnM viewADM- Business overview- Products/Solutions offered- Recent developments- MnM viewKIKKOMAN GROUP- Business overview- Products/Solutions offered- Recent developments- MnM viewALPRO- Business overview- Products/Solutions offered- Recent developments- MnM viewBARENTZ- Business overview- Products/Solutions offered- Recent developments- MnM viewEDEN FOODS- Business overview- Products/Solutions offered- MnM viewCARAMURU- Business overview- Products/Solutions offered- Recent developments- MnM viewHAIN CELESTIAL GROUP- Business overview- Products/Solutions offered- MnM viewPATANJALI FOODS LIMITED- Business overview- Products/Solutions offered- MnM viewVITASOY- Business overview- Products/Solutions offered- Recent developments- MnM viewGALAXY NUTRITIONAL FOODS- Business overview- Products/Solutions offered- MnM viewFOODCHEM INTERNATIONAL CORPORATION- Business overview- Products/Solutions offered- MnM viewCROWN SOYA PROTEIN GROUP- Business overview- Products/Solutions offered- MnM view

-

13.2 STARTUPS/SMES/OTHER PLAYERSTHE SCOULAR COMPANY- Business overview- Products/Solutions offered- MnM viewNORTHERN SOY- Business overview- Products/Solutions offered- MnM viewSOLBAR LTD- Business overview- Products/Solutions offered- MnM viewFARBEST TALLMAN FOODS CORPORATION- Business overview- Products/Solutions offered- MnM viewPERDUE AGRIBUSINESS- Business overview- Products/Solutions offered- MnM viewSOTEXPROBREMILL GROUPRIO PARDO PROTEINA VEGETAL S.A.GOOD CATCH FOODSLIVING FOODS

- 14.1 INTRODUCTION

- 14.2 RESEARCH LIMITATIONS

-

14.3 SOY PROTEIN INGREDIENTS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

14.4 PROTEIN INGREDIENTS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

14.5 PLANT-BASED PROTEIN MARKETMARKET DEFINITIONMARKET OVERVIEW

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2017–2021

- TABLE 2 ASSUMPTIONS

- TABLE 3 LIMITATIONS & ASSOCIATED RISKS

- TABLE 4 SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET SNAPSHOT, 2022 VS. 2027

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 SOYMILK COMPOSITION

- TABLE 11 LIST OF KEY PATENTS PERTAINING TO SOYBEAN FOOD AND BEVERAGE PRODUCTS, 2018–2022

- TABLE 12 SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET: ECOSYSTEM VIEW

- TABLE 13 TOP 10 IMPORTERS OF CRUDE SOYBEAN OIL, 2021 (USD)

- TABLE 14 TOP 10 EXPORTERS OF CRUDE SOYBEAN OIL, 2021 (USD)

- TABLE 15 EXPORT VALUE OF SOYBEAN FOR KEY COUNTRIES, 2021 (USD)

- TABLE 16 IMPORT VALUE OF SOYBEAN FOR KEY COUNTRIES, 2021 (USD)

- TABLE 17 COMPOSITION OF ISP (% WEIGHT) IN SOYBEAN PROTEIN PRODUCTS

- TABLE 18 SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

- TABLE 19 SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING FOR TOP THREE APPLICATIONS

- TABLE 21 KEY BUYING CRITERIA FOR SOYBEAN FOOD AND BEVERAGE PRODUCTS APPLICATIONS

- TABLE 22 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 23 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 24 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (KILOTONS)

- TABLE 25 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (KILOTONS)

- TABLE 26 SOYBEAN FOOD PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 27 SOYBEAN FOOD PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 28 SOYBEAN FOOD PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 29 SOYBEAN FOOD PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 30 FERMENTED SOYBEAN FOOD PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 31 FERMENTED SOYBEAN FOOD PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 32 FERMENTED SOYBEAN FOOD PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 33 FERMENTED SOYBEAN FOOD PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 34 SOY SAUCE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 35 SOY SAUCE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 36 NATTO: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 37 NATTO: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 38 TEMPEH: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 39 TEMPEH: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 40 MISO: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 41 MISO: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 42 SOY CHEESE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 43 SOY CHEESE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 44 SOY YOGURT: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 45 SOY YOGURT: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 46 SOY NUT BUTTER: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 47 SOY NUT BUTTER: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 48 TOFU: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 49 TOFU: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 50 SOY MAYONNAISE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 51 SOY MAYONNAISE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 52 YUBA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 53 YUBA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 54 OTHER FERMENTED SOYBEAN FOOD PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 55 OTHER FERMENTED SOYBEAN FOOD PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 56 NON-FERMENTED SOYBEAN FOOD PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 57 NON-FERMENTED SOYBEAN FOOD PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 58 NON-FERMENTED SOYBEAN FOOD PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 59 NON-FERMENTED SOYBEAN FOOD PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 60 SOY FLOUR: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 61 SOY FLOUR: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 62 SOY GRITS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 63 SOY GRITS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 64 SOYMILK: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 65 SOYMILK: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 66 SOY NUTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 67 SOY NUTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 68 SOYBEAN ADDITIVES/INGREDIENTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 69 SOYBEAN ADDITIVES/INGREDIENTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 70 SOYBEAN ADDITIVES/INGREDIENTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 71 SOYBEAN ADDITIVES/INGREDIENTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 72 SOY PROTEIN CONCENTRATES: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 73 SOY PROTEIN CONCENTRATES: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 74 SOY PROTEIN ISOLATES: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 75 SOY PROTEIN ISOLATES: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 76 TEXTURED SOY PROTEIN: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 77 TEXTURED SOY PROTEIN: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 78 SOY FIBER: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 79 SOY FIBER: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 80 OTHER SOYBEAN ADDITIVES/INGREDIENTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 81 OTHER SOYBEAN ADDITIVES/INGREDIENTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 82 SOYBEAN OILS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 83 SOYBEAN OILS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 84 SOYBEAN OILS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 85 SOYBEAN OILS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 86 PROCESSED SOYBEAN OILS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 87 PROCESSED SOYBEAN OILS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 88 LECITHIN: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 89 LECITHIN: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 90 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 91 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 92 BAKERY & CONFECTIONERY: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 93 BAKERY & CONFECTIONERY: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 94 DAIRY PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 95 DAIRY PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 96 MEAT PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 97 MEAT PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 98 FUNCTIONAL FOOD & SUPPLEMENTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 99 FUNCTIONAL FOOD & SUPPLEMENTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 100 INFANT FOODS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 101 INFANT FOODS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 102 ANIMAL FEED & PET FOOD: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 103 ANIMAL FEED & PET FOOD: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 104 OTHER APPLICATIONS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 105 OTHER APPLICATIONS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 106 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY SOURCE, 2017–2021 (USD MILLION)

- TABLE 107 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 108 NON-GM/NON-GE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 109 NON-GM/NON-GE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 110 GM: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 111 GM: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 112 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2017–2021 (USD MILLION)

- TABLE 113 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

- TABLE 114 SUPERMARKETS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 115 SUPERMARKETS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 116 HYPERMARKETS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 117 HYPERMARKETS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 118 CONVENIENCE STORES: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 119 CONVENIENCE STORES: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 120 DEPARTMENTAL STORES: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 121 DEPARTMENTAL STORES: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 122 SPECIALTY STORES: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 123 SPECIALTY STORES: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 124 ONLINE RETAILERS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 125 ONLINE RETAILERS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 126 OTHER DISTRIBUTION CHANNELS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 127 OTHER DISTRIBUTION CHANNELS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 128 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 129 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 130 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2017–2021 (KILOTONS)

- TABLE 131 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY REGION, 2022–2027 (KILOTONS)

- TABLE 132 NORTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 133 NORTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, 2022–2027 (USD MILLION)

- TABLE 134 NORTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 135 NORTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 136 NORTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (KILOTONS)

- TABLE 137 NORTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (KILOTONS)

- TABLE 138 NORTH AMERICA: SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 139 NORTH AMERICA: SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 140 NORTH AMERICA: FERMENTED SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 141 NORTH AMERICA: FERMENTED SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 142 NORTH AMERICA: NON-FERMENTED SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 143 NORTH AMERICA: NON-FERMENTED SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 144 NORTH AMERICA: SOYBEAN ADDITIVES/INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 145 NORTH AMERICA: SOYBEAN ADDITIVES/INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 146 NORTH AMERICA: SOYBEAN OIL MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 147 NORTH AMERICA: SOYBEAN OIL MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 148 NORTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 149 NORTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 150 NORTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2017–2021 (USD MILLION)

- TABLE 151 NORTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

- TABLE 152 NORTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY SOURCE, 2017–2021 (USD MILLION)

- TABLE 153 NORTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 154 US: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 155 US: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 156 CANADA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 157 CANADA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 158 MEXICO: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 159 MEXICO: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 160 EUROPE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 161 EUROPE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, 2022–2027 (USD MILLION)

- TABLE 162 EUROPE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 163 EUROPE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 164 EUROPE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (KILOTONS)

- TABLE 165 EUROPE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (KILOTONS)

- TABLE 166 EUROPE: SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 167 EUROPE: SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 168 EUROPE: FERMENTED SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 169 EUROPE: FERMENTED SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 170 EUROPE: NON-FERMENTED SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 171 EUROPE: NON-FERMENTED SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 172 EUROPE: SOYBEAN ADDITIVES/INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 173 EUROPE: SOYBEAN ADDITIVES/INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 174 EUROPE: SOYBEAN OIL MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 175 EUROPE: SOYBEAN OIL MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 176 EUROPE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 177 EUROPE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 178 EUROPE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2017–2021 (USD MILLION)

- TABLE 179 EUROPE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

- TABLE 180 EUROPE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY SOURCE, 2017–2021 (USD MILLION)

- TABLE 181 EUROPE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 182 SPAIN: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 183 SPAIN: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 184 GERMANY: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 185 GERMANY: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 186 FRANCE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 187 FRANCE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 188 UK: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 189 UK: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 190 ITALY: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 191 ITALY: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 192 THE NETHERLANDS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 193 THE NETHERLANDS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 194 BELGIUM: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 195 BELGIUM: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 196 RUSSIA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 197 RUSSIA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 198 REST OF EUROPE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 199 REST OF EUROPE: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 200 ASIA PACIFIC: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 201 ASIA PACIFIC: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, 2022–2027 (USD MILLION)

- TABLE 202 ASIA PACIFIC: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY COUNTRY, 2017–2021 (KILO TON)

- TABLE 203 ASIA PACIFIC: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, 2022–2027 (KILO TON)

- TABLE 204 ASIA PACIFIC: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 205 ASIA PACIFIC: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 206 ASIA PACIFIC: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (KILOTONS)

- TABLE 207 ASIA PACIFIC: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (KILOTONS)

- TABLE 208 ASIA PACIFIC: SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 209 ASIA PACIFIC: SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 210 ASIA PACIFIC: FERMENTED SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 211 ASIA PACIFIC: FERMENTED SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 212 ASIA PACIFIC: NON-FERMENTED SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 213 ASIA PACIFIC: NON-FERMENTED SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 214 ASIA PACIFIC: SOYBEAN ADDITIVES/INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 215 ASIA PACIFIC: SOYBEAN ADDITIVES/INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 216 ASIA PACIFIC: SOYBEAN OIL MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 217 ASIA PACIFIC: SOYBEAN OIL MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 218 ASIA PACIFIC: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 219 ASIA PACIFIC: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 220 ASIA PACIFIC: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2017–2021 (USD MILLION)

- TABLE 221 ASIA PACIFIC: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

- TABLE 222 ASIA PACIFIC: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY SOURCE, 2017–2021 (USD MILLION)

- TABLE 223 ASIA PACIFIC: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 224 CHINA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 225 CHINA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 226 INDIA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 227 INDIA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 228 JAPAN: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 229 JAPAN: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 230 AUSTRALIA AND NEW ZEALAND: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 231 AUSTRALIA AND NEW ZEALAND: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 232 SOUTH KOREA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 233 SOUTH KOREA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 234 REST OF ASIA PACIFIC: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 235 REST OF ASIA PACIFIC: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 236 SOUTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 237 SOUTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, 2022–2027 (USD MILLION)

- TABLE 238 SOUTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY COUNTRY, 2017–2021 (KILOTONS)

- TABLE 239 SOUTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, 2022–2027 (KILOTONS)

- TABLE 240 SOUTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 241 SOUTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 242 SOUTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (KILOTONS)

- TABLE 243 SOUTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (KILOTONS)

- TABLE 244 SOUTH AMERICA: SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 245 SOUTH AMERICA: SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 246 SOUTH AMERICA: FERMENTED SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 247 SOUTH AMERICA: FERMENTED SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 248 SOUTH AMERICA: NON-FERMENTED SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 249 SOUTH AMERICA: NON-FERMENTED SOYBEAN FOOD PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 250 SOUTH AMERICA: SOYBEAN ADDITIVES/INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 251 SOUTH AMERICA: SOYBEAN ADDITIVES/INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 252 SOUTH AMERICA: SOYBEAN OIL MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 253 SOUTH AMERICA: SOYBEAN OIL MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 254 SOUTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 255 SOUTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 256 SOUTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2017–2021 (USD MILLION)

- TABLE 257 SOUTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

- TABLE 258 SOUTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY SOURCE, 2017–2021 (USD MILLION)

- TABLE 259 SOUTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 260 BRAZIL: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 261 BRAZIL: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 262 ARGENTINA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 263 ARGENTINA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 264 REST OF SOUTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 265 REST OF SOUTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 266 REST OF THE WORLD: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 267 REST OF THE WORLD: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, 2022–2027 (USD MILLION)

- TABLE 268 REST OF THE WORLD: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY COUNTRY, 2017–2021 (KILO TON)

- TABLE 269 REST OF THE WORLD: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, 2022–2027 (KILO TON)

- TABLE 270 REST OF THE WORLD: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 271 REST OF THE WORLD: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 272 REST OF THE WORLD: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (KILOTONS)

- TABLE 273 REST OF THE WORLD: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (KILOTONS)

- TABLE 274 REST OF THE WORLD: SOYBEAN FOOD PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 275 REST OF THE WORLD: SOYBEAN FOOD PRODUCTS: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 276 REST OF THE WORLD: FERMENTED SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 277 REST OF THE WORLD: FERMENTED SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 278 REST OF THE WORLD: NON-FERMENTED SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 279 REST OF THE WORLD: NON-FERMENTED SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 280 REST OF THE WORLD: SOYBEAN ADDITIVES/INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 281 REST OF THE WORLD: SOYBEAN ADDITIVES/INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 282 REST OF THE WORLD: SOYBEAN OIL MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 283 REST OF THE WORLD: SOYBEAN OIL MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 284 REST OF THE WORLD: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 285 REST OF THE WORLD: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 286 REST OF THE WORLD: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2017–2021 (USD MILLION)

- TABLE 287 REST OF THE WORLD: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

- TABLE 288 REST OF THE WORLD: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY SOURCE, 2017–2021 (USD MILLION)

- TABLE 289 REST OF THE WORLD: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 290 MIDDLE EAST: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 291 MIDDLE EAST: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 292 AFRICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 293 AFRICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 294 STRATEGIES ADOPTED BY KEY SOYBEAN FOOD & BEVERAGE PRODUCTS MANUFACTURERS

- TABLE 295 SOY FOODS AND BEVERAGES PRODUCT MARKET: DEGREE OF COMPETITION

- TABLE 296 COMPANY FOOTPRINT, BY TYPE (KEY PLAYERS)

- TABLE 297 COMPANY FOOTPRINT, BY APPLICATION (KEY PLAYERS)

- TABLE 298 COMPANY FOOTPRINT, BY REGION (KEY PLAYERS)

- TABLE 299 OVERALL COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 300 DETAILED LIST OF OTHER PLAYERS

- TABLE 301 COMPETITIVE BENCHMARKING OF OTHER PLAYERS

- TABLE 302 PRODUCT LAUNCHES, 2017–2022

- TABLE 303 DEALS, 2017–2022

- TABLE 304 OTHERS, 2017–2022

- TABLE 305 WILMAR INTERNATIONAL LIMITED: BUSINESS OVERVIEW

- TABLE 306 WILLMAR INTERNATIONAL LIMITED: PRODUCTS OFFERED

- TABLE 307 WILLMAR INTERNATIONAL LIMITED: DEALS

- TABLE 308 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- TABLE 309 CARGILL, INCORPORATED: PRODUCTS OFFERED

- TABLE 310 CARGILL, INCORPORATED: DEALS

- TABLE 311 CARGILL, INCORPORATED: OTHERS

- TABLE 312 CHS INC.: BUSINESS OVERVIEW

- TABLE 313 CHS INC.: PRODUCTS OFFERED

- TABLE 314 CHS INC: OTHERS

- TABLE 315 ADM: BUSINESS OVERVIEW

- TABLE 316 ADM: PRODUCTS OFFERED

- TABLE 317 ADM: DEALS

- TABLE 318 ADM: OTHERS

- TABLE 319 KIKKOMAN GROUP: BUSINESS OVERVIEW

- TABLE 320 KIKKOMAN GROUP: PRODUCTS OFFERED

- TABLE 321 KIKKOMAN GROUP: PRODUCT LAUNCHES

- TABLE 322 ALPRO: BUSINESS OVERVIEW

- TABLE 323 ALPRO: PRODUCTS OFFERED

- TABLE 324 ALPRO: PRODUCT LAUNCHES

- TABLE 325 ALPRO: DEALS

- TABLE 326 ALPRO: OTHERS

- TABLE 327 BARENTZ: BUSINESS OVERVIEW

- TABLE 328 BARENTZ: PRODUCTS OFFERED

- TABLE 329 BARENTZ: DEALS

- TABLE 330 EDEN FOODS: BUSINESS OVERVIEW

- TABLE 331 EDEN FOODS: PRODUCTS OFFERED

- TABLE 332 CARAMURU: BUSINESS OVERVIEW

- TABLE 333 CARAMURU: PRODUCTS OFFERED

- TABLE 334 CARAMURU: DEALS

- TABLE 335 HAIN CELESTIAL GROUP: BUSINESS OVERVIEW

- TABLE 336 HAIN CELESTIAL GROUP: PRODUCTS OFFERED

- TABLE 337 PATANJALI FOODS LIMITED: BUSINESS OVERVIEW

- TABLE 338 PATANJALI FOODS LIMITED: PRODUCTS OFFERED

- TABLE 339 VITASOY: BUSINESS OVERVIEW

- TABLE 340 VITASOY: PRODUCTS OFFERED

- TABLE 341 VITASOY: PRODUCT LAUNCHES

- TABLE 342 GALAXY NUTRITIONAL FOODS: BUSINESS OVERVIEW

- TABLE 343 GALAXY NUTRITIONAL FOODS: PRODUCTS OFFERED

- TABLE 344 FOODCHEM INTERNATIONAL CORPORATION: BUSINESS OVERVIEW

- TABLE 345 FOODCHEM INTERNATIONAL CORPORATION: PRODUCTS OFFERED

- TABLE 346 CROWN SOYA PROTEIN GROUP: BUSINESS OVERVIEW

- TABLE 347 CROWN SOYA PROTEIN GROUP: PRODUCTS OFFERED

- TABLE 348 THE SCOULAR COMPANY: BUSINESS OVERVIEW

- TABLE 349 THE SCOULAR COMPANY: PRODUCTS OFFERED

- TABLE 350 NORTHERN SOY: BUSINESS OVERVIEW

- TABLE 351 NORTHERN SOY: PRODUCTS OFFERED

- TABLE 352 SOLBAR LTD: BUSINESS OVERVIEW

- TABLE 353 SOLBAR LTD: PRODUCTS OFFERED

- TABLE 354 FARBEST TALLMAN FOODS CORPORATION: BUSINESS OVERVIEW

- TABLE 355 FARBEST TALLMAN FOODS CORPORATION: PRODUCTS OFFERED

- TABLE 356 PERDUE AGRIBUSINESS: BUSINESS OVERVIEW

- TABLE 357 PERDUE AGRIBUSINESS: PRODUCTS OFFERED

- TABLE 358 SOTEXPRO: BUSINESS OVERVIEW

- TABLE 359 BREMILL GROUP: BUSINESS OVERVIEW

- TABLE 360 RIO PARDO PROTEINA VEGETAL S.A.: BUSINESS OVERVIEW

- TABLE 361 GOOD CATCH FOODS: BUSINESS OVERVIEW

- TABLE 362 LIVING FOODS: BUSINESS OVERVIEW

- TABLE 363 ADJACENT MARKETS

- TABLE 364 SOY PROTEIN INGREDIENTS MARKET, BY FORM, 2018–2021 (USD MILLION)

- TABLE 365 SOY PROTEIN INGREDIENTS MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 366 PROTEIN INGREDIENTS MARKET, BY SOURCE, 2020–2025 (USD MILLION)

- TABLE 367 PLANT-BASED PROTEIN MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 368 PLANT-BASED PROTEIN MARKET, BY TYPE, 2022–2027 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 6 SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2022 VS. 2027

- FIGURE 11 SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET: REGIONAL SNAPSHOT

- FIGURE 13 RISE IN DEMAND FOR PLANT-BASED PRODUCTS TO FUEL DEMAND FOR SOYBEAN FOOD AND BEVERAGE PRODUCTS

- FIGURE 14 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 15 CHINA CONSUMED MAJORITY OF SOYBEAN FOOD AND BEVERAGE PRODUCTS IN 2021

- FIGURE 16 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 17 US: ANNUAL SALES OF PLANT-BASED FOOD & BEVERAGES, 2018–2021 (USD BILLION)

- FIGURE 18 GLOBAL VEGAN POPULATION, 2014-2022

- FIGURE 19 SOYBEAN PRODUCTION, 2016–2020 (MILLION TONS)

- FIGURE 20 SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 NUMBER OF PATENTS APPROVED FOR SOYBEAN FOOD AND BEVERAGE PRODUCTS, 2012–2021

- FIGURE 22 JURISDICTIONS WITH HIGHEST PATENT APPROVALS FOR SOYBEAN FOOD AND BEVERAGE PRODUCTS, 2012-2021

- FIGURE 23 SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET: VALUE CHAIN

- FIGURE 24 REVENUE SHIFT FOR SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET

- FIGURE 25 SOYBEAN FOOD AND BEVERAGE PRODUCTS: MARKET MAP

- FIGURE 26 IMPORT VALUE OF SOYBEAN FOOD AND BEVERAGE PRODUCTS FOR KEY COUNTRIES, 2017-2021

- FIGURE 27 EXPORT VALUE OF SOYBEAN FOOD AND BEVERAGE PRODUCTS FOR KEY COUNTRIES, 2017-2021

- FIGURE 28 EXPORT VALUE OF SOYBEAN FOR KEY COUNTRIES, 2017-2021

- FIGURE 29 IMPORT VALUE OF SOYBEAN FOR KEY COUNTRIES, 2017-2021

- FIGURE 30 PRICING ANALYSIS FOR SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET, BY TYPE, 2017-2021 (USD/KG)

- FIGURE 31 PRICING ANALYSIS FOR SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET, BY REGION, 2017-2021 (USD/KG)

- FIGURE 32 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2017–2021 (USD/KG AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2017–2021 (USD/KG)

- FIGURE 33 PRODUCTION OF ISOLATED SOYBEAN PROTEINS: TECHNOLOGY ANALYSIS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING SOYBEAN FOOD AND BEVERAGE PRODUCTS APPLICATION

- FIGURE 35 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- FIGURE 36 INDICATORS OF RECESSION

- FIGURE 37 WORLD INFLATION RATE: 2011-2021

- FIGURE 38 GLOBAL GDP: 2011-2021 (USD TRILLION)

- FIGURE 39 GLOBAL FOOD INGREDIENTS MARKET: EARLIER FORECAST VS RECESSION FORECAST

- FIGURE 40 RECESSION INDICATORS AND THEIR IMPACT ON SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET

- FIGURE 41 GLOBAL SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET: EARLIER FORECAST VS RECESSION FORECAST

- FIGURE 42 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 43 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 44 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

- FIGURE 45 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2022 VS. 2027 (USD MILLION)

- FIGURE 46 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 47 NORTH AMERICA: SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET SNAPSHOT

- FIGURE 48 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2018-2021

- FIGURE 49 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 50 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2018–2021

- FIGURE 51 EUROPEAN SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 52 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 54 ASIA PACIFIC SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 55 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2018-2021

- FIGURE 56 SOUTH AMERICA SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 57 REST OF THE WORLD: INFLATION RATES, BY KEY COUNTRY, 2018–2021

- FIGURE 58 REST OF THE WORLD SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 59 FIVE-YEAR SEGMENTAL ANALYSIS OF KEY PLAYERS IN THE MARKET, 2017–2021 (USD BILLION)

- FIGURE 60 SOYBEAN FOOD & BEVERAGE PRODUCTS MARKET COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 61 SOYBEAN FOOD AND BEVERAGE PRODUCTS MARKET COMPANY EVALUATION QUADRANT, 2022 (STARTUP/SME)

- FIGURE 62 WILMAR INTERNATIONAL LIMITED: COMPANY SNAPSHOT

- FIGURE 63 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 64 CHS INC.: COMPANY SNAPSHOT

- FIGURE 65 ADM: COMPANY SNAPSHOT

- FIGURE 66 KIKKOMAN GROUP: COMPANY SNAPSHOT

- FIGURE 67 BARENTZ: COMPANY SNAPSHOT

- FIGURE 68 CARAMURU: COMPANY SNAPSHOT

- FIGURE 69 PATANJALI FOODS LIMITED: COMPANY SNAPSHOT

- FIGURE 70 VITASOY: COMPANY SNAPSHOT

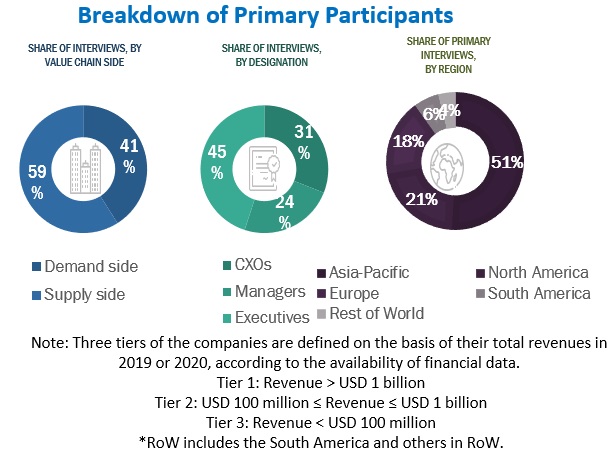

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the soybean food and beverage products market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects. The following figure depicts the research design applied in drafting this report on the soybean food and beverage products market.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the soybean food and beverage products market.

To know about the assumptions considered for the study, download the pdf brochure

Soybean Food & Beverage Products Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the soybean food and beverage products market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues of major soybean food and beverage products manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- All macroeconomic and microeconomic factors affecting the growth of the soybean food and beverage products market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Soybean Food & Beverage Products Market Report Objectives

- To define, segment, and project the global market for soybean food and beverage products on the basis of type, end-user, source, and regio

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the soybean food and beverage products market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for soybean food and beverage products into the Switzerland, Greece, Poland, Denmark, and other EU and non-EU countries

- Further breakdown of the Rest of South America market for soybean food and beverage products into Colombia, Peru, Paraguay, Chile and Venezuela

- Further breakdown of other countries in the Asia Pacific market for soybean food and beverage products into Malaysia, Thailand, Singapore, Indonesia, Philippines, Vietnam, and other ASEAN countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Soybean Food & Beverage Products Market