Speech-to-text API Market by Component (Software and Services), Application (Fraud Detection & Prevention, Content Transcription, Subtitle Generation), Deployment Mode, Organization Size, Vertical, and Region - Global Forecast to 2026

Speech-to-text API Market Size

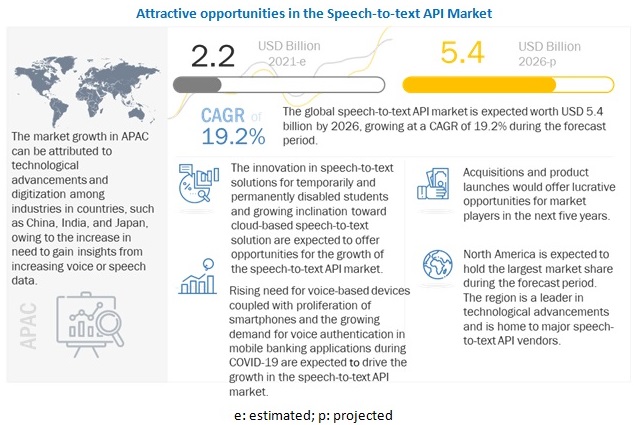

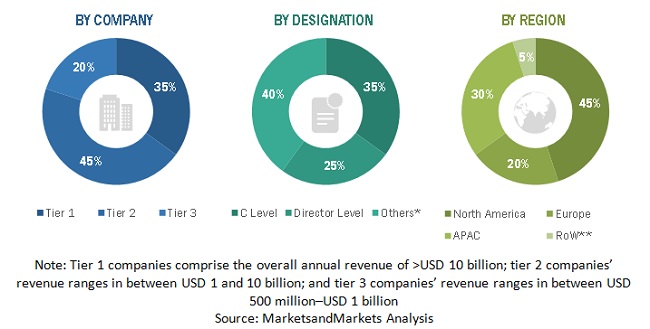

The global Speech-to-text API Market size was valued at $2.2 billion in 2021 and is predicted to reach $5.4 billion by 2026, increasing at a CAGR of 19.2% from 2021 to 2026.

To know about the assumptions considered for the study, Request for Free Sample Report

Speech-to-text API Market Share

The major factors driving the growth of the market are the rising need for voice-based devices coupled with the proliferation of smartphones and the growing demand for voice authentication in mobile banking applications during COVID-19. Furthermore, the innovation in speech-to-text solutions for temporarily and permanently disabled students and the growing inclination toward a cloud-based speech-to-text solution are the major factors adding value to the speech-to-text API offerings, which is expected to provide opportunities for enterprises operating in various verticals in the speech-to-text API market.

Cloud adoption is said to have increased in recent times because vendors are making use of Software-as-a-Service (SaaS) to deliver cloud-based solutions. Business users are always on the lookout to ensure they are providing the most effective yet economical solutions. Cloud-based solutions provide the ability to outsource the operational IT work to another company. With the help of the speech-to-text API technology, any video or audio-based content can be captioned and subtitled, which helps struggling listeners or learners with visual impairments understand correctly and do their work without taking help from others. For instance, speech-to-text APIs can enable learners with hearing loss to communicate with his/her teacher and classmates. The multilingual support for captioning and subtitling and building custom vocabulary across various verticals are the major challenges in the speech-to-text API market. Moreover, transcribing audio from multi-channels, and concerns regarding data privacy and security due to pandemic acts as a key restraining factor in the market

Speech-to-text API is a form of technology that utilizes speech-based assistants and facilitates stronger interactions and greater engagement at scale across users and platforms. It combines speech-based technology, NLP, and ML into a single platform to develop and build applications for specific as well as multiple use cases across verticals.

COVID-19 Impact

During the pandemic, many companies experienced a significant increase in pressure from customers, while their number of available employees decreased. Many contact centers were unable to cope with demand or closed because of lockdown restrictions, leading to long delays in customer service queries, which significantly affected the customer experience. As businesses develop a more strategic approach that delivers resilience into operations through flexibility and scalability while at the same time working to improve operational efficiencies, so speech-to-text API is rising to the forefront of technology enablers. Data analytics application builders seek medical speech recognition capabilities that help them efficiently and accurately transcribe video and audio containing COVID-19 terminology into text for downstream analytics. For instance, AWS offers Amazon Transcribe Medical, a fully managed speech recognition (ASR) service that makes it easy to add medical speech-to-text capabilities to any application. Powered by deep learning, the service offers a ready-to-use medical speech recognition model that users can integrate into a variety of voice applications in the healthcare and life sciences domain. Users can use the custom vocabulary feature to accurately transcribe specific medical terminologies, such as medicine names, product brands, medical procedures, illnesses, or COVID-19-related terminology.

Speech-to-text API Market Dynamics

Driver: Rising need for voice-based devices coupled with the proliferation of smartphones

With the growing technological adoption and massive proliferation of internet-based content, the need for smart devices, such as smart speakers and mobile phones, has been increasing from the last decade, which resulted in the increased need for making online video content accessible for every individual. Several new advanced devices are being introduced with voice-controlled features, which include voice processing features, such as content transcription, conference call analysis, enabling users to access educational, entertainment, and other content through their smart devices. Hence, speech-to-text applications have increased due to the increased need for understanding customer preferences. There are several companies, which collect customer’s data related to media content and convert it into texts to help content providers understand what type of content is being accepted and becoming more popular. Moreover, the demand for smart homes and smart appliances is increasing owing to various factors, including growing internet penetration, advancements in technology, and increasing awareness about automation. The COVID-19 pandemic has also resulted in the increasing use of smart devices and appliances in almost every aspect of daily life. People have been forced to work from home, which is increasing demand for speech-to-text API in the market.

Restraint: Transctribing audio from multichannel may hinder the adoption of Speech-to-text API market

Transcribing audio from multiple channels is a major restraining factor for this technology because defining multiple entities becomes difficult and can cause inaccurate transcriptions or captioning. Moreover, background noise, low-quality microphones, reverb and echo, and accent variations may hamper the transcription accuracy. Speech-to-text APIs should be trained properly for multi-channel speech recognition through numerous types of data sets; however, it becomes difficult for enterprises to gather a variety of data sets for building their approach and solution that accurately converts speech-to-text for multiple channels.

Opportunity: Innovation in speech-to-text solutions for temporarily and permanently disabled students

With the help of the speech-to-text API technology, any video or audio-based content can be converted by a computer into text, which helps struggling listeners or hard of hearing students read correctly and do their work without taking help from others. For instance, speech-to-text software can enable a deaf-mute student to communicate with his/her teachers and classmates. Hence, this system works as assistive technology, helping disabled people benefit from the ICT. The Individuals with Disabilities Education Act (IDEA) provides interactive software for disabled students. These students are unable to hear properly in the classroom. To overcome this, Gaylen Kapperman and Jodi Sticken of Northern Illinois University developed an interactive software tutorial that helps these students study the Nemeth code (a Braille code for mathematics) with the help of speech-to-text technology. The software is installed in Braille Lite—a small, portable Braille Notemaker that is equipped with synthetic speech software and a refreshable Braille display.

Challenge: Multilingual support for captioning and subtitling

The language differentiation across the globe is the major concern for content creators to create transcripts and subtitles accurately for every language. Speech-to-text API solutions have been difficult to implement in countries that have several regional and local languages. As consumers and enterprises located across different parts of a country speak a variety of local languages, approaching them with a generic solution will not add any value to their business and would not lead to the successful penetration of speech-to-text API solutions. Moreover, solutions must be different in terms of functionality and platform from mainstream mobility solutions. Several speech-to-text API solution providers are making efforts to ensure users who speaks a single language and cannot speak other languages apart from their local dialect would get an opportunity to access speech-to-text features on their smartphones as well. Huge benefits can be achieved by designing speech-to-text API solutions for micro-linguistics and local languages.

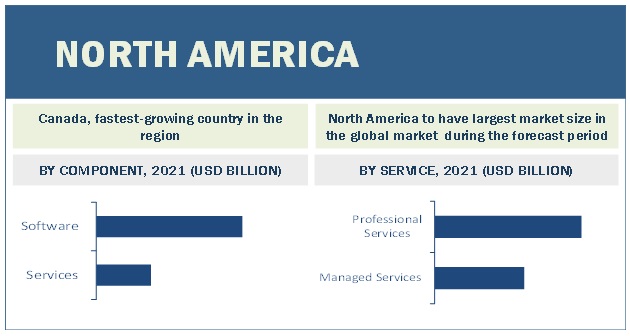

The software segment is expected to account for the largest market size during the forecast period

The market for the software segment currently holds a higher market share. The software segment consists of APIs and Software Development Kits (SDKs) that enable existing software or application to translate video-based content to text format. The vendors also offer associated services to streamline the operations and achieve results smoothly. The major companies in various industries are adopting speech-to-text API to deal with the rapidly increasing video-based content. This is helping companies find new ways to tap the wealth of data to develop new products, services, and processes, thus gaining a competitive advantage.

North America to account for largest market size during the forecast period

Among these regions, The market in the US is expected to hold a larger market size in 2021, while Canada to hold a higher CAGR during the forecast period. The US dominates the North American speech-to-text API industry due to its large technology spending and easy availability of solutions with a significant presence of vendors. The speech-to-text API market in Canada will gain traction in the coming years due to the rising need to extract meaningful insights from voice data.

To know about the assumptions considered for the study, download the pdf brochure

Speech-to-text API Market - Key Players

Google (US), Microsoft (US), AWS (US), IBM (US), Verint (US), Baidu (China), Twilio (US), Speechmatics (UK), VoiceCloud (US), VoiceBase (US), Voci (US), Kasisto (US), Nexmo (US), Contus (India), GoVivace (US), GL Communications (US), Wit.ai (US), VoxSciences (US), Rev (US), Vocapia Research (France), Deepgram (US), Otter.ai (US), AssemblyAI (US), Verbit (US), Behavioral Signals (US), Chorus.ai (US), Gnani.ai (India), Sayint.ai (India), and Amberscript (Netherlands).

Scope of the Report

|

Report Metrics |

Details |

|

Market Revenue in 2021 |

US $2.2 billion |

|

Market Revenue for 2026 |

US $5.4 billion |

|

Growth Rate |

19.2% CAGR |

|

Largest Market |

North America |

|

Market Segmentation |

Component, Deployment Mode, Organization Size, Application, Vertical, And Region |

|

Market Growth Drivers |

|

|

Market Opportunities |

|

|

Geographies covered |

North America, Europe, APAC, Latin America and MEA |

|

Companies covered |

Google (US), Microsoft (US), AWS (US), IBM (US), Verint (US), Baidu (China), Twilio (US), Speechmatics (UK), VoiceCloud (US), VoiceBase (US), Voci (US), Kasisto (US), Nexmo (US), Contus (India), GoVivace (US), GL Communications (US), Wit.ai (US), VoxSciences (US), Rev (US), Vocapia Research (France), Deepgram (US), Otter.ai (US), AssemblyAI (US), Verbit (US), Behavioral Signals (US), Chorus.ai (US), Gnani.ai (India), Sayint.ai (India), and Amberscript (Netherlands). |

This research report categorizes the Speech-to-text API market based on components, deployment mode, organization size, application, vertical, and region.

Speech-to-text API Market By Component:

- Software

-

Services

-

Professional Services

- Training and Consulting

- Deployment and Integrations

- Support and Maintenance

- Managed Services

-

Professional Services

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Large enterprises

- Small and medium-sized enterprises (SMEs)

Speech-to-text API Market By Applications

- Risk and Compliance Management

- Fraud Detection and Prevention

- Customer Management

- Content Transcription

- Contact Center Management

- Subtitle Generation

- Other Applications (conference call analysis, business process monitoring, and quality management)

By Vertical

- Banking Finance Services and Insurance (BFSI)

- IT and Telecom

- Media and Entertainment

- Healthcare and Life Sciences

- Retail and eCommerce

- Travel and Hospitality

- Government and Defence

- Education

- Other Verticals (manufacturing, automotive, and transportation and logistics)

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- India

- Japan

- China

- Australia and New Zealand (ANZ)

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia (KSA)

- UAE

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In September 2021, Google Cloud announced the strategic partnership with Scotiabank to deepen the bank cloud first commitment and accelerate the global data and analytics strategy Google Cloud will help create a more personal and predictive banking experience for Scotiabank customers in the Americas and across the globe.

- In September 2021, IBM collaborated with IntelePeer, one of the leading communications platform-as-a-service providers, to set up and test a voice agent and a new agent app designed to enable a seamless hand-off to a live agent while maintaining the conversation's context.

- In September 2021, Baidu and China Gas Holdings, a leading gas operator and service provider in China, inked a strategic cooperation agreement to drive digital and intelligent transformation in the energy and power sector with innovative solutions based on Baidu AI Cloud.

- In April 2021, Verint launched Verint Virtual Assistant (IVA), a low-code Speech-to-text API offering, which can rapidly turn the existing conversation data into automated self-service experiences. It allows business professionals to quickly deploy a production-ready chatbot to deflect calls and support customers. Verint IVA enables businesses to expand capabilities across the enterprise with boundless intelligence for both voice and digital.

- In April 2020, Microsoft and SAS announced an extensive technology and the go-to-market strategic partnership. The two companies will enable customers to easily run their SAS workloads in the cloud, expanding their business solutions and unlocking critical value from their digital transformation initiatives. As part of the partnership, the companies will migrate SAS’ analytical products and industry solutions onto Microsoft Azure as the preferred cloud provider for the SAS Cloud.

- In July 2020 MachineHack, in association with AWS, brings to the ML community an exciting way to showcase both AWS and ML skill sets. This hackathon enables the participants to pick any problem of their choice and solve it using the wide range of services offered by AWS.

Frequently Asked Questions (FAQ):

What is Speech-to-text API?

Speech-to-text APIs enable users to convert speech or audio content into textual formats. Such solutions are helpful in transcribing audio or video content into searchable formats, which help in marketing, customer care, and fraud detection and prevention applications. Call centers, nowadays, are flooded with large volumes of customer data accumulated through hours of interactions each day.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, and other European countries in the European region.

Which are the Deployment mode in Speech-to-text API market?

The deployment mode in the speech-to-text API market includes on-premises and cloud. Speech-to-text API can be deployed on any one deployment mode based on security, availability, and scalability. Mostly speech-to-text APIs are getting deployed on the cloud as it offers advantages, such as pay-per-use and low installation and maintenance costs. This deployment mode is expected to show high growth soon. The growing adoption of SaaS applications by enterprises is generating huge growth prospects for cloud-based speech-to-text software.

What are the various vertical in Speech-to-text API market?

The speech-to-text API market based on verticals, such as BFSI, healthcare and life sciences, IT and telecom, retail and eCommerce, travel and hospitality, media and entertainment, government and defense, education, and other verticals (manufacturing, transportation and logistics, and automotive).

Who are the Major vendors in the Speech-to-text API market?

Some of the major vendors in the speech-to-text API market include Google (US), Microsoft (US), AWS (US), IBM (US), Verint (US), Baidu (China), Twilio (US), Speechmatics (UK), VoiceCloud (US), VoiceBase (US), Voci (US), Kasisto (US), Nexmo (US), Contus (India), GoVivace (US), GL Communications (US), Wit.ai (US), VoxSciences (US), Rev (US), Vocapia Research (France), Deepgram (US), Otter.ai (US), AssemblyAI (US), Verbit (US), Behavioral Signals (US), Chorus.ai (US), Gnani.ai (India), Sayint.ai (India), and Amberscript (Netherlands). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 43)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2021

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 52)

2.1 RESEARCH DATA

FIGURE 5 SPEECH-TO-TEXT API MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOFTWARE/SERVICES OF THE SPEECH-TO-TEXT API MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE/SERVICES OF THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE/SERVICES OF THE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF SPEECH-TO-TEXT API THROUGH OVERALL SPEECH-TO-TEXT API SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 12 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 13 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

2.9 IMPLICATIONS OF COVID-19 ON THE SPEECH-TO-TEXT API MARKET

FIGURE 14 QUARTERLY IMPACT OF COVID-19 DURING 2020–2021

3 EXECUTIVE SUMMARY (Page No. - 68)

TABLE 4 GLOBAL SPEECH-TO-TEXT API MARKET SIZE AND GROWTH RATE, 2017–2020 (USD MILLION, Y-O-Y %)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2021–2026 (USD MILLION, Y-O-Y %)

FIGURE 15 MARKET SNAPSHOT, BY COMPONENT

FIGURE 16 MARKET SNAPSHOT, BY SERVICE

FIGURE 17 MARKET SNAPSHOT, BY PROFESSIONAL SERVICE

FIGURE 18 MARKET SNAPSHOT, BY DEPLOYMENT MODE

FIGURE 19 MARKET SNAPSHOT, BY ORGANIZATION SIZE

FIGURE 20 MARKET SNAPSHOT, BY APPLICATION

FIGURE 21 MARKET SNAPSHOT, BY VERTICAL

FIGURE 22 MARKET SNAPSHOT, BY REGION

4 PREMIUM INSIGHTS (Page No. - 74)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE SPEECH-TO-TEXT API MARKET

FIGURE 23 RISING NEED FOR VOICE-BASED DEVICES COUPLED WITH THE PROLIFERATION OF SMARTPHONES TO DRIVE THE GROWTH OF THE MARKET

4.2 MARKET: TOP THREE APPLICATIONS

FIGURE 24 CONTENT TRANSCRIPTION APPLICATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 MARKET: BY REGION

FIGURE 25 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE IN 2021

4.4 MARKET IN NORTH AMERICA, TOP THREE APPLICATIONS AND VERTICALS

FIGURE 26 FRAUD DETECTION AND PREVENTION APPLICATION AND BFSI VERTICAL TO ACCOUNT FOR THE LARGEST SHARES IN THE MARKET IN 2021

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 77)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SPEECH-TO-TEXT API MARKET

5.2.1 DRIVERS

5.2.1.1 Rising need for voice-based devices coupled with the proliferation of smartphones

TABLE 6 SMART DEVICES CONSUMPTION

5.2.1.2 Stringent regulations and compliance to boost the demand for speech technology

5.2.1.3 Increasing usability of speech and voice technology for transcription

5.2.1.4 Growing demand for voice authentication in mobile banking applications during COVID-19

5.2.2 RESTRAINTS

5.2.2.1 Transcribing audio from multi-channels may hinder the adoption of speech-to-text API

5.2.2.2 Concerns regarding data privacy and security due to pandemic

5.2.2.3 Huge investments and costs to incur while implementing speech technology

5.2.3 OPPORTUNITIES

5.2.3.1 Innovation in speech-to-text solutions for temporarily and permanently disabled students

5.2.3.2 Development of speech-to-text API for micro-linguistics and local languages

5.2.3.3 Growing inclination toward cloud-based speech-to-text software

5.2.4 CHALLENGES

5.2.4.1 Multilingual support for captioning and subtitling

5.2.4.2 Building custom vocabulary across various verticals

5.2.4.3 Excessive background noise or echoes may increase the error rate

5.2.5 CUMULATIVE GROWTH ANALYSIS

5.3 SPEECH-TO-TEXT API: EVOLUTION

FIGURE 28 EVOLUTION OF SPEECH-TO-TEXT API MARKET

5.4 ECOSYSTEM

FIGURE 29 MARKET: ECOSYSTEM

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 30 SUPPLY CHAIN ANALYSIS

TABLE 7 MARKET: SUPPLY CHAIN

5.6 MARKET: COVID-19 IMPACT

FIGURE 31 MARKET TO WITNESS MINIMAL SLOWDOWN IN GROWTH IN 2020

5.7 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF THE MARKET

FIGURE 32 SPEECH-TO-TEXT API MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.8 REGULATORY IMPLICATIONS

5.8.1 GENERAL DATA PROTECTION REGULATION

5.8.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.8.3 CALIFORNIA CONSUMER PRIVACY ACT

5.8.4 CHILDREN'S ONLINE PRIVACY PROTECTION ACT

5.8.5 AMERICANS WITH DISABILITIES ACT

5.8.6 OFFICE OF COMMUNICATIONS

5.8.7 POLISH CIVIL CODE

5.8.8 FEDERAL COMMUNICATIONS COMMISSION

5.9 CASE STUDY ANALYSIS

5.9.1 RETAIL AND ECOMMERCE: USE CASES

5.9.1.1 Rev supported Home Depot to deliver captions, foreign language subtitles, and translations to the users

5.9.2 MEDIA AND ENTERTAINMENT: USE CASES

5.9.2.1 Spotify implemented Rev’s transcribe solution to provide on-demand content to the users

5.9.2.2 Rev’s Temi software helped Richard in transcribing the podcast and build a comprehensive solution that creates a full transcript of the podcast automatically

5.9.3 HEALTHCARE AND LIFE SCIENCES: USE CASES

5.9.3.1 Cerner deployed Amazon transcribe to lower medical transcription costs and provide data security

5.9.3.2 AWS benefitted Houston Methodist to improve clinical efficiency and alleviate nursing and physician burnout with voice-activated technology

5.9.4 BANKING, FINANCIAL SERVICES, AND INSURANCE: USE CASES

5.9.4.1 KPMG deployed Microsoft cognitive services to support its customers automate transcription

5.9.5 IT AND TELECOM: USE CASES

5.9.5.1 Call Rail implemented speech-to-text API offered by AssemblyAI to improve call transcription accuracy

5.9.5.2 Deepgram offered Red Box a customizable Automated Speech Recognition (ASR) solution to provide more accuracy, speed, and customization process

5.9.5.3 Sharpen technologies deployed Deepgram’s ASR platform that enables customers to maintain compliance without breaking the bank

5.9.5.4 Audioburst deployed Amazon Transcribe solution to convert audio streams into text at a reasonable cost

5.9.6 ENERGY AND UITILITES: USE CASES

5.9.6.1 AWS offered Amazon Transcribe to Octopus Energy to train custom speech recognition models and analyze contact center calls per month

5.9.7 OTHER VERTICALS: USE CASES

5.9.7.1 Keypath Education deployed speech-to-text software offered by Verbit to enhance quality of online education to the students

5.9.7.2 The university of Glasgow implemented Verbit’s speech-to-text API to offer students with effective online learning program

5.9.7.3 Rev provided Shapiro+Raj a reliable transcription solution to get in-depth insights from client’s data

5.9.7.4 Echo360 selected Amazon transcribe to improve the learning experience for all students and reduce overall costs

5.9.7.5 Epiq deployed Amazon Transcribe to automate and accelerate transcription courtroom proceedings and multimedia assets

5.10 TECHNOLOGY ANALYSIS

5.10.1 NATURAL LANGUAGE PROCESSING AND SPEECH-TO-TEXT API

5.10.2 ARTIFICIAL INTELLIGENCE AND SPEECH-TO-TEXT API

5.11 PATENT ANALYSIS

5.11.1 METHODOLOGY

5.11.2 DOCUMENT TYPE

TABLE 8 PATENTS FILED, 2018-2021

5.11.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 33 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2018–2021

5.11.3.1 Top applicants

FIGURE 34 TOP 10 COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2018–2021

5.12 PRICING MODEL ANALYSIS, 2021

TABLE 9 SPEECH-TO-TEXT API MARKET: PRICING MODEL ANALYSIS, 2021

5.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 IMPACT OF EACH FORCE ON THE MARKET

FIGURE 35 PORTER’S FIVE FORCES ANALYSIS

5.13.1 THREAT OF NEW ENTRANTS

5.13.2 THREAT OF SUBSTITUTES

5.13.3 BARGAINING POWER OF SUPPLIERS

5.13.4 BARGAINING POWER OF BUYERS

5.13.5 INTENSITY OF COMPETITIVE RIVALRY

5.14 SCENARIO

TABLE 11 CRITICAL FACTORS TO IMPACT THE GROWTH OF THE MARKET

6 SPEECH-TO-TEXT API MARKET, BY COMPONENT (Page No. - 105)

6.1 INTRODUCTION

6.1.1 COMPONENTS: COVID-19 IMPACT

FIGURE 36 SERVICES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 12 MARKET SIZE, BY COMPONENT2017–2020 (USD MILLION)

TABLE 13 MARKET SIZE, BY COMPONENT2021–2026 (USD MILLION)

6.2 SOFTWARE

6.2.1 GROWING INCLINATION TOWARD VOICE-BASED TECHNOLOGY TO ENHANCE THE CUSTOMER EXPERIENCE TO BOOST THE DEMAND FOR SPEECH-TO-TEXT API AND SOFTWARE

TABLE 14 SOFTWARE: MARKET SIZE, BY REGION2017–2020 (USD MILLION)

TABLE 15 SOFTWARE: MARKET SIZE, BY REGION2021–2026 (USD MILLION)

6.3 SERVICES

FIGURE 37 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 16 SPEECH-TO-TEXT API MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 17 MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 18 SERVICES: MARKET SIZE, BY REGION2017–2020 (USD MILLION)

TABLE 19 SERVICES: MARKET SIZE, BY REGION2021–2026 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

FIGURE 38 TRAINING AND CONSULTING SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 20 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 21 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 22 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 PROFESSIONAL SERVICES: SPEECH-TO-TEXT API MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1.1 Training and consulting

6.3.1.1.1 Technicalities involved in implementing speech-to-text API and services to boost the demand for training and consulting services

TABLE 24 TRAINING AND CONSULTING: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 TRAINING AND CONSULTING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1.2 Deployment and integration

6.3.1.2.1 Growing need to overcome system-related issues effectively to drive the demand for system integration and deployment services

TABLE 26 DEPLOYMENT AND INTEGRATION: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 DEPLOYMENT AND INTEGRATION: SPEECH-TO-TEXT API MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1.3 Support and maintenance

6.3.1.3.1 Growing deployment of speech-to-text API and software tools to boost the demand for support and maintenance services

TABLE 28 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2 MANAGED SERVICES

6.3.2.1 Increasing need to monitor and maintain tool operations and reduce overhead costs to drive the demand for managed services

TABLE 30 MANAGED SERVICES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 MANAGED SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 SPEECH-TO-TEXT API MARKET, BY DEPLOYMENT MODE (Page No. - 117)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT MODES: COVID-19 IMPACT

FIGURE 39 CLOUD SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 32 MARKET SIZE, BY DEPLOYMENT MODE2017–2020 (USD MILLION)

TABLE 33 MARKET SIZE, BY DEPLOYMENT MODE2021–2026 (USD MILLION)

7.2 ON-PREMISES

7.2.1 DATA-SENSITIVE ORGANIZATIONS TO ADOPT THE ON-PREMISES DEPLOYMENT MODE TO DEPLOY SPEECH-TO-TEXT API ACROSS THE GLOBE

TABLE 34 ON-PREMISES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 ON-PREMISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 CLOUD

7.3.1 THE INCREASING DEMAND FOR SCALABLE, EASY-TO-USE, AND COST-EFFECTIVE SPEECH-TO-TEXT API TO ACCELERATE THE GROWTH OF THE CLOUD DEPLOYMENT MODE

TABLE 36 CLOUD: MARKET SIZE, BY REGION2017–2020 (USD MILLION)

TABLE 37 CLOUD: MARKET SIZE, BY REGION2021–2026 (USD MILLION)

8 SPEECH-TO-TEXT API MARKET, BY ORGANIZATION SIZE (Page No. - 122)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZES: COVID-19 IMPACT

FIGURE 40 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 38 MARKET SIZE, BY ORGANIZATION SIZE2017–2020 (USD MILLION)

TABLE 39 MARKET SIZE, BY ORGANIZATION SIZE2021–2026 (USD MILLION)

8.2 LARGE ENTERPRISES

8.2.1 INCREASING USE OF ADVANCED TECHNOLOGIES TO BOOST THE ADOPTION OF SPEECH-TO-TEXT API IN LARGE ENTERPRISES

TABLE 40 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

8.3.1 AVAILABILITY OF THE CLOUD-BASED COST-EFFECTIVE SOLUTIONS TO FUEL THE ADOPTION OF SPEECH-TO-TEXT API IN SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 42 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 SPEECH-TO-TEXT API MARKET, BY APPLICATION (Page No. - 127)

9.1 INTRODUCTION

9.1.1 APPLICATIONS: COVID-19 IMPACT

FIGURE 41 CONTENT TRANSCRIPTION SEGMENT TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 44 MARKET SIZE, BY APPLICATION2017–2020 (USD MILLION)

TABLE 45 MARKET SIZE, BY APPLICATION2021–2026 (USD MILLION)

9.2 RISK AND COMPLIANCE MANAGEMENT

9.2.1 RISING NON-COMPLIANCE COSTS TO COMPELL COMPANIES TO ADOPT SPEECH-TO-TEXT API

TABLE 46 RISK AND COMPLIANCE MANAGEMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 47 RISK AND COMPLIANCE MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 FRAUD DETECTION AND PREVENTION

9.3.1 INCREASING INSTANCES OF FRAUDS TO PROMPT BANKS AND FINANCIAL INSTITUTIONS TO ADOPT ADVANCED SPEECH-TO-TEXT API

TABLE 48 FRAUD DETECTION AND PREVENTION: SPEECH-TO-TEXT API MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 FRAUD DETECTION AND PREVENTION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 CUSTOMER MANAGEMENT

9.4.1 NEED TO EXTRACT MEANINGFUL DATA FROM CUSTOMER INTERACTIONS TO BOOST THE DEMAND FOR SPEECH-TO-TEXT API

TABLE 50 CUSTOMER MANAGEMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 CUSTOMER MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 CONTENT TRANSCRIPTION

9.5.1 GROWING NEED TO PROVIDE UNDERSTANDABLE AND SEARCHABLE TRANSCRIPTION OF AUDIO AND VIDEO DATA TO FUEL THE ADOPTION OF SPEECH-TO-TEXT API

TABLE 52 CONTENT TRANSCRIPTION: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 CONTENT TRANSCRIPTION: SPEECH-TO-TEXT API MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.6 CONTACT CENTER MANAGEMENT

9.6.1 GROWING NEED TO MANAGE DAILY OPERATIONS OF THE CONTACT CENTER TO FUEL THE ADOPTION OF SPEECH-TO-TEXT API

TABLE 54 CONTACT CENTER MANAGEMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 CONTACT CENTER MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.7 SUBTITLE GENERATION

9.7.1 GROWING NEED TO GENERATE AUTOMATIC CAPTIONS TO BOOST THE ADOPTION OF SPEECH-TO-TEXT API FOR SUBTITLE GENERATION APPLICATION

TABLE 56 SUBTITLE GENERATION: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 SUBTITLE GENERATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.8 OTHER APPLICATIONS

TABLE 58 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 SPEECH-TO-TEXT API MARKET, BY VERTICAL (Page No. - 137)

10.1 INTRODUCTION

10.1.1 VERTICALS: COVID-19 IMPACT

FIGURE 42 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO GROW AT THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 60 MARKET SIZE, BY VERTICAL2017–2020 (USD MILLION)

TABLE 61 MARKET SIZE, BY VERTICAL2021–2026 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

10.2.1 RISING NEED FOR AUTOMATED CUSTOMER SERVICE AND QUERY RESOLVER TO FUEL THE ADOPTION OF SPEECH-TO-TEXT API

TABLE 62 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 63 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.3 IT AND TELECOM

10.3.1 WIDESPREAD ADOPTION OF 4G/5G TECHNOLOGY TO BOOST THE ADOPTION OF SPEECH-TO-TEXT API ACROSS IT AND TELECOM SECTOR

TABLE 64 IT AND TELECOM: SPEECH-TO-TEXT API MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 IT AND TELECOM: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.4 MEDIA AND ENTERTAINMENT

10.4.1 INCREASED DEMAND FOR CONTENT TRANSCRIPTION TO BOOST THE ADOPTION OF SPEECH-TO-TEXT API IN MEDIA AND ENTERTAINMENT

TABLE 66 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 67 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.5 HEALTHCARE AND LIFE SCIENCES

10.5.1 GROWING REGULATORY REQUIREMENTS AND NEED FOR DOCUMENTATION TO FUEL THE ADOPTION OF SPEECH-TO-TEXT API ACROSS HEALTHCARE AND LIFE SCIENCES VERTICAL

TABLE 68 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 69 HEALTHCARE AND LIFE SCIENCES: SPEECH-TO-TEXT API MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.6 RETAIL AND ECOMMERCE

10.6.1 NEED TO DELIVER REAL-TIME CUSTOMER EXPERIENCE TO DRIVE THE ADOPTION OF SPEECH-TO-TEXT API IN RETAIL AND ECOMMERCE VERTICAL

TABLE 70 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.7 TRAVEL AND HOSPITALITY

10.7.1 INCREASING COMPETITION AMONG PLAYERS TO DRIVE THE ADOPTION OF SPEECH-TO-TEXT API IN TRAVEL AND HOSPITALITY

TABLE 72 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.8 GOVERNMENT AND DEFENSE

10.8.1 GROWING GOVERNMENT INITIATIVES TO DRIVE THE ADOPTION OF SPEECH-TO-TEXT API IN THE GOVERNMENT AND DEFENSE SECTOR

TABLE 74 GOVERNMENT AND DEFENSE: SPEECH-TO-TEXT API MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 75 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.9 EDUCATION

10.9.1 GROWING DEMAND FOR ONLINE LEARNING SOFTWARE TO DRIVE THE ADOPTION OF SPEECH-TO-TEXT API ACROSS THE EDUCATION SECTOR

TABLE 76 EDUCATION: MARKET SIZE, BY REGION2017–2020 (USD MILLION)

TABLE 77 EDUCATION: MARKET SIZE, BY REGION2021–2026 (USD MILLION)

10.10 OTHER VERTICALS

TABLE 78 OTHER VERTICALS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 79 OTHER VERTICALS: MARKET SIZE, BY REGION 2021–2026 (USD MILLION)

11 SPEECH-TO-TEXT API MARKET, BY REGION (Page No. - 150)

11.1 INTRODUCTION

FIGURE 43 INDIA TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 44 ASIA PACIFIC TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 80 MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 81 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: COVID-19 IMPACT

11.2.2 NORTH AMERICA: REGULATIONS

11.2.2.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

11.2.2.2 Gramm–Leach–Bliley Act

11.2.2.3 Health Insurance Portability and Accountability Act of 1996

11.2.2.4 Health Level Seven (HL7)

11.2.2.5 Occupational Safety and Health Administration (OSHA)

11.2.2.6 Federal Information Security Management Act (FISMA)

11.2.2.7 Federal Information Processing Standards

11.2.2.8 California Consumer Privacy Act

FIGURE 45 NORTH AMERICA: MARKET SNAPSHOT

TABLE 82 NORTH AMERICA: SPEECH-TO-TEXT API MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 90 NORTH AMERICA: SPEECH-TO-TEXT API MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY VERTICAL 2021–2026 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.3 UNITED STATES

11.2.3.1 Rapid growth of technology and innovation that led to the adoption of the speech-to-text API market in the US

TABLE 98 UNITED STATES: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 99 UNITED STATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 100 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 101 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.2.4 CANADA

11.2.4.1 Rising government focus on R&D activities to boost the adoption of the speech-to-text API market in Canada

TABLE 102 CANADA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 103 CANADA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 104 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 105 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: COVID-19 IMPACT

11.3.2 EUROPE: REGULATIONS

11.3.2.1 General Data Protection Regulation

11.3.2.2 Payment Card Industry Data Security Standard

11.3.2.3 European Committee for Standardization

TABLE 106 EUROPE: SPEECH-TO-TEXT API MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY SERVICE2017–2020 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY SERVICE2021–2026 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 116 EUROPE: SPEECH-TO-TEXT API MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY VERTICAL2017–2020 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY VERTICAL2021–2026 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY COUNTRY2017–2020 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY COUNTRY2021–2026 (USD MILLION)

11.3.3 UNITED KINGDOM

11.3.3.1 Rising adoption of advanced technologies, coupled with stringent regulations, to boost the speech-to-text API market growth in the UK

TABLE 122 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 123 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 124 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 125 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.3.4 GERMANY

11.3.4.1 Growing adoption of speech technology for extrapolating audio-visual content and enabling interaction in business-to-business applications across Germany

TABLE 126 GERMANY: SPEECH-TO-TEXT API MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 127 GERMANY: MARKET SIZE, BY COMPONENT 2021–2026 (USD MILLION)

TABLE 128 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 129 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.3.5 FRANCE

11.3.5.1 Significant fundings from startups and ongoing efforts from private companies to drive the speech-to-text API market growth in France

TABLE 130 FRANCE: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 131 FRANCE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 132 FRANCE: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 133 FRANCE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 134 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 135 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 136 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 137 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: COVID-19 IMPACT

11.4.2 ASIA PACIFIC: REGULATIONS

11.4.2.1 Personal Data Protection Act

11.4.2.2 Act on the Protection of Personal Information (APPI)

11.4.2.3 International Organization for Standardization 27001

FIGURE 46 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 138 ASIA PACIFIC: SPEECH-TO-TEXT API MARKET SIZE, BY COMPONENT 2017–2020 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 147 ASIA PACIFIC: SPEECH-TO-TEXT API MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Increase in government investment, technology innovation, and digitalization to boost the speech-to-text API market growth in India

TABLE 154 INDIA: MARKET SIZE, BY COMPONENT2017–2020 (USD MILLION)

TABLE 155 INDIA: MARKET SIZE, BY COMPONENT2021–2026 (USD MILLION)

TABLE 156 INDIA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 157 INDIA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.4.4 JAPAN

11.4.4.1 Increasing use of virtual assistants and chatbots across telecom and retail verticals to drive the adoption of speech-to-text API in Japan

TABLE 158 JAPAN: SPEECH-TO-TEXT API MARKET SIZE, BY COMPONENT2017–2020 (USD MILLION)

TABLE 159 JAPAN: MARKET SIZE, BY COMPONENT2021–2026 (USD MILLION)

TABLE 160 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE 2017–2020 (USD MILLION)

TABLE 161 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.4.5 CHINA

11.4.5.1 Increasing need for automation across healthcare institutions and BFSI organizations to drive the speech-to-text API market growth in China

TABLE 162 CHINA: MARKET SIZE, BY COMPONENT2017–2020 (USD MILLION)

TABLE 163 CHINA: MARKET SIZE, BY COMPONENT2021–2026 (USD MILLION)

TABLE 164 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 165 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.4.6 AUSTRALIA AND NEW ZEALAND

11.4.6.1 Increasing need to make timely business and communication decisions to drive the growth of the speech-to-text API market across the telecom vertical in ANZ

TABLE 166 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 167 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 168 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 169 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

TABLE 170 REST OF ASIA PACIFIC: SPEECH-TO-TEXT API MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 171 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 172 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 173 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

11.5.2 MIDDLE EAST AND AFRICA: REGULATIONS

11.5.2.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

11.5.2.2 GDPR Applicability in KSA

11.5.2.3 Protection of Personal Information Act

TABLE 174 MIDDLE EAST AND AFRICA: SPEECH-TO-TEXT API MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 175 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 176 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 177 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 178 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 181 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 182 MIDDLE EAST AND AFRICA: SPEECH-TO-TEXT API MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 183 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 184 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 185 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 186 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 187 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 188 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 189 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.5.3 KINGDOM OF SAUDI ARABIA

11.5.3.1 Growing investments for AI projects to lead to the speech-to-text API market growth in the KSA

TABLE 190 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 191 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 192 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 193 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.5.4 UNITED ARAB EMIRATES

11.5.4.1 Rising demand for speech-to-text API to upsurge during the forthcoming period in the region

TABLE 194 UNITED ARAB EMIRATES: SPEECH-TO-TEXT API MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 195 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 196 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 197 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.5.5 SOUTH AFRICA

11.5.5.1 Increasing demand for speech recognition technology to drive the adoption of the speech-to-text API market in South Africa

TABLE 198 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 199 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 200 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 201 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.5.6 REST OF MIDDLE EAST AND AFRICA

TABLE 202 REST OF MIDDLE EAST AND AFRICA: SPEECH-TO-TEXT API MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 203 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 204 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 205 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: COVID-19 IMPACT

11.6.2 LATIN AMERICA: REGULATIONS

11.6.2.1 Brazil Data Protection Law

11.6.2.2 Argentina Personal Data Protection Law No. 25.326

11.6.2.3 Federal Law on Protection of Personal Data Held by Individuals

TABLE 206 LATIN AMERICA: SPEECH-TO-TEXT API MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET SIZE, BY SERVICE 2021–2026 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 214 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 215 LATIN AMERICA: SPEECH-TO-TEXT API MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 216 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 217 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 218 LATIN AMERICA: MARKET SIZE, BY VERTICAL 2017–2020 (USD MILLION)

TABLE 219 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 220 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 221 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.6.3 BRAZIL

11.6.3.1 Technological advancements to drive the growth of the speech-to-text API market in Brazil

TABLE 222 BRAZIL: MARKET SIZE, BY COMPONENT2017–2020 (USD MILLION)

TABLE 223 BRAZIL: MARKET SIZE, BY COMPONENT2021–2026 (USD MILLION)

TABLE 224 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE 2017–2020 (USD MILLION)

TABLE 225 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.6.4 MEXICO

11.6.4.1 Growing demand for voice recognition technologies to fuel the adoption of speech-to-text API software in Mexico

TABLE 226 MEXICO: SPEECH-TO-TEXT API MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 227 MEXICO: MARKET SIZE, BY COMPONENT 2021–2026 (USD MILLION)

TABLE 228 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 229 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.6.5 REST OF LATIN AMERICA

TABLE 230 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 231 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 232 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 233 REST OF LATIN AMERICA: SPEECH-TO-TEXT API MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 216)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES

12.3 REVENUE ANALYSIS

FIGURE 47 REVENUE ANALYSIS FOR KEY COMPANIES IN THE PAST FIVE YEARS

12.4 MARKET SHARE ANALYSIS

FIGURE 48 MARKET SHARE ANALYSIS FOR KEY COMPANIES

TABLE 234 SPEECH-TO-TEXT API MARKET: DEGREE OF COMPETITION

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE

12.5.4 PARTICIPANT

FIGURE 49 KEY MARKET PLAYERS, COMPANY EVALUATION QUADRANT, 2021

12.6 COMPETITIVE BENCHMARKING

12.6.1 COMPANY PRODUCT FOOTPRINT

FIGURE 50 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MARKET

FIGURE 51 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE SPEECH-TO-TEXT API MARKET

TABLE 235 COMPANY OFFERING FOOTPRINT

TABLE 236 COMPANY REGION FOOTPRINT

12.7 STARTUP/SME EVALUATION QUADRANT

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 DYNAMIC COMPANIES

12.7.4 STARTING BLOCKS

FIGURE 52 STARTUP/SME SPEECH-TO-TEXT API MARKET EVALUATION QUADRANT, 2021

12.8 STARTUP/SME COMPETITIVE BENCHMARKING

12.8.1 COMPANY PRODUCT FOOTPRINT

FIGURE 53 PRODUCT PORTFOLIO ANALYSIS OF STARTUP/SME IN THE MARKET

FIGURE 54 BUSINESS STRATEGY EXCELLENCE OF STARTUP/SME IN THE MARKET

TABLE 237 STARTUP/SME COMPANY OFFERING FOOTPRINT

TABLE 238 STARTUP/SME COMPANY REGION FOOTPRINT

12.9 COMPETITIVE SCENARIO AND TRENDS

12.9.1 PRODUCT LAUNCHES

TABLE 239 MARKET: PRODUCT LAUNCHES, APRIL 2020–AUGUST 2021

12.9.2 DEALS

TABLE 240 SPEECH-TO-TEXT API MARKET: DEALS, MAY 2019–OCTOBER 2021

13 COMPANY PROFILES (Page No. - 233)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business and financial overview, Solutions offered, Recent developments, COVID-19 development, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

13.2.1 GOOGLE

TABLE 241 GOOGLE: BUSINESS AND FINANCIAL OVERVIEW

FIGURE 55 GOOGLE: COMPANY SNAPSHOT

TABLE 242 GOOGLE: SOLUTIONS OFFERED

TABLE 243 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 244 GOOGLE: DEALS

13.2.2 MICROSOFT

TABLE 245 MICROSOFT: BUSINESS OVERVIEW

FIGURE 56 MICROSOFT: COMPANY SNAPSHOT

TABLE 246 MICROSOFT: SERVICES OFFERED

TABLE 247 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 248 MICROSOFT: DEALS

13.2.3 AWS

TABLE 249 AWS: BUSINESS OVERVIEW

FIGURE 57 AWS: COMPANY SNAPSHOT

TABLE 250 AWS: SERVICES OFFERED

TABLE 251 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 252 AWS: DEALS

13.2.4 IBM

TABLE 253 IBM: BUSINESS OVERVIEW

FIGURE 58 IBM: COMPANY SNAPSHOT

TABLE 254 IBM: SERVICES OFFERED

TABLE 255 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 256 IBM: DEALS AND OTHERS

13.2.5 VERINT

TABLE 257 VERINT: BUSINESS OVERVIEW

FIGURE 59 VERINT: COMPANY SNAPSHOT

TABLE 258 VERINT: SOLUTIONS OFFERED

TABLE 259 VERINT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 260 VERINT: DEALS

13.2.6 BAIDU

TABLE 261 BAIDU: BUSINESS OVERVIEW

FIGURE 60 BAIDU: COMPANY SNAPSHOT

TABLE 262 BAIDU: SOLUTIONS OFFERED

TABLE 263 BAIDU: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 264 BAIDU: DEALS

13.2.7 TWILIO

TABLE 265 TWILIO: BUSINESS OVERVIEW

FIGURE 61 TWILIO: COMPANY SNAPSHOT

TABLE 266 TWILIO: SOLUTIONS OFFERED

TABLE 267 TWILIO: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 268 TWILIO: DEALS AND OTHERS

13.2.8 SPEECHMATICS

TABLE 269 SPEECHMATICS: BUSINESS OVERVIEW

TABLE 270 SPEECHMATICS: SOLUTIONS OFFERED

TABLE 271 SPEECHMATICS: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 272 SPEECHMATICS: DEALS

13.2.9 VOICECLOUD

TABLE 273 VOICECLOUD: BUSINESS OVERVIEW

TABLE 274 VOICE CLOUD: SOLUTIONS OFFERED

TABLE 275 VOICE CLOUD: SERVICES OFFERED

13.2.10 VOICEBASE

TABLE 276 VOICEBASE: BUSINESS OVERVIEW

TABLE 277 VOICEBASE: SOLUTIONS OFFERED

TABLE 278 VOICEBASE: DEALS

13.2.11 VOCI

13.2.12 KASISTO

13.2.13 NEXMO

13.2.14 CONTUS

13.2.15 GOVIVACE

13.2.16 GL COMMUNICATIONS

13.2.17 WIT.AI

13.2.18 VOXSCIENCES

13.2.19 REV

13.2.20 VOCAPIA RESEARCH

13.3 SMES/START UPS

13.3.1 DEEPGRAM

13.3.2 OTTER.AI

13.3.3 ASSEMBLYAI

13.3.4 AISENSE

13.3.5 VERBIT

13.3.6 BEHAVIORAL SIGNALS

13.3.7 CHORUS.AI

13.3.8 GNANI.AI

13.3.9 SAYINT.AI

13.3.10 AMBERSCRIPT

*Details on Business and financial overview, Solutions offered, Recent developments, COVID-19 development, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 272)

14.1 INTRODUCTION

14.2 SPEECH ANALYTICS MARKET - GLOBAL FORECAST TO 2025

14.2.1 MARKET DEFINITION

14.2.2 MARKET OVERVIEW

14.2.2.1 Speech analytics market, by component

TABLE 279 SPEECH ANALYTICS MARKET SIZE, BY COMPONENT2014–2019 (USD MILLION)

TABLE 280 SPEECH ANALYTICS MARKET SIZE, BY COMPONENT2019–2025 (USD MILLION)

14.2.2.2 Speech analytics market, by service

TABLE 281 SPEECH ANALYTICS MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 282 SPEECH ANALYTICS MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

14.2.2.3 Speech analytics market, by application

TABLE 283 SPEECH ANALYTICS MARKET SIZE, BY APPLICATION2014–2019 (USD MILLION)

TABLE 284 SPEECH ANALYTICS MARKET SIZE, BY APPLICATION2019–2025 (USD MILLION)

14.2.2.4 Speech analytics market, by deployment mode

TABLE 285 SPEECH ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE2014–2019 (USD MILLION)

TABLE 286 SPEECH ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE2019–2025 (USD MILLION)

14.2.2.5 Speech analytics market, by organization size

TABLE 287 SPEECH ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE2014–2019 (USD MILLION)

TABLE 288 SPEECH ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE2019–2025 (USD MILLION)

14.2.2.6 Speech analytics market, by vertical

TABLE 289 SPEECH ANALYTICS MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 290 SPEECH ANALYTICS MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

14.2.2.7 Speech analytics market, by region

TABLE 291 SPEECH ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 292 SPEECH ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

14.3 NLP MARKET - GLOBAL FORECAST TO 2026

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.3.2.1 NLP market, by component

TABLE 293 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 294 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

14.3.2.2 NLP market, by solution

TABLE 295 SOLUTIONS: NATURAL LANGUAGE PROCESSING MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 296 SOLUTIONS: NATURAL LANGUAGE PROCESSING MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

14.3.2.3 NLP market, by service

TABLE 297 SERVICES: NATURAL LANGUAGE PROCESSING MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 298 SERVICES: NATURAL LANGUAGE PROCESSING MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

14.3.2.4 NLP market, by deployment mode

TABLE 299 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 300 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

14.3.2.5 NLP market, by type

TABLE 301 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY TYPE2015–2019 (USD MILLION)

TABLE 302 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY TYPE2019–2026 (USD MILLION)

14.3.2.6 NLP market, by vertical

TABLE 303 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 304 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY VERTICAL, 2019–2026 (USD MILLION)

14.3.2.7 NLP market, by region

TABLE 305 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY REGION 2015–2019 (USD MILLION)

TABLE 306 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

15 APPENDIX (Page No. - 285)

15.1 INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

The research study for the speech-to-text API market involved extensive secondary sources, directories, and several journals, including the Journal of Intelligent Learning Systems and Applications, International Journal of Advanced Science and Technology, and International Research Journal of Engineering and Technology (IRJET). Primary sources were mainly industry experts from the core and related industries, preferred speech-to-text API providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, speech-to-text API spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, functionality, applications, verticals, and regions, and key developments from both market and technology-oriented perspectives

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and Speech-to-text API expertise; related key executives from Speech-to-text API solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using speech-to-text API solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of speech-to-text API solutions and services, which would impact the overall speech-to-text API market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the Speech-to-text API market. The first approach involves estimating the market size by summation of companies’ revenue generated through the sale of solutions and services.

Key market players were not limited to such as Google (US), Microsoft (US), AWS (US), IBM (US), Verint (US), Baidu (China), Twilio (US), Speechmatics (UK), VoiceCloud (US), VoiceBase (US), Voci (US), Kasisto (US), Nexmo (US), Contus (India), GoVivace (US), GL Communications (US), Wit.ai (US), VoxSciences (US), Rev (US), Vocapia Research (France), Deepgram (US), Otter.ai (US), AssemblyAI (US), Verbit (US), Behavioral Signals (US), Chorus.ai (US), Gnani.ai (India), Sayint.ai (India), and Amberscript (Netherlands).

The market players were identified through extensive secondary research, and their revenue contribution in respective regions was determined through primary and secondary research.

- The entire procedure included studying annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the Speech-to-text API market by component (software and services), organization size, deployment mode, application, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the Speech-to-text API market

- To analyze the impact of the COVID-19 pandemic on the Speech-to-text API market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American Speech-to-text API market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company Information

- Detailed analysis and profiling of additional market players up to 10

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Speech-to-text API Market