Sports Technology Market Size, Share & Growth, 2030

Sports Technology Market Size, Share & Industry by Technology (Wearable, AR/VR, Smart Stadium, Sports & Stadium Analytics, Sports Camera, Building Automation, Smart Equipment, Smart Clothing, Crowd Management), Solution (AI-based, Conventional) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

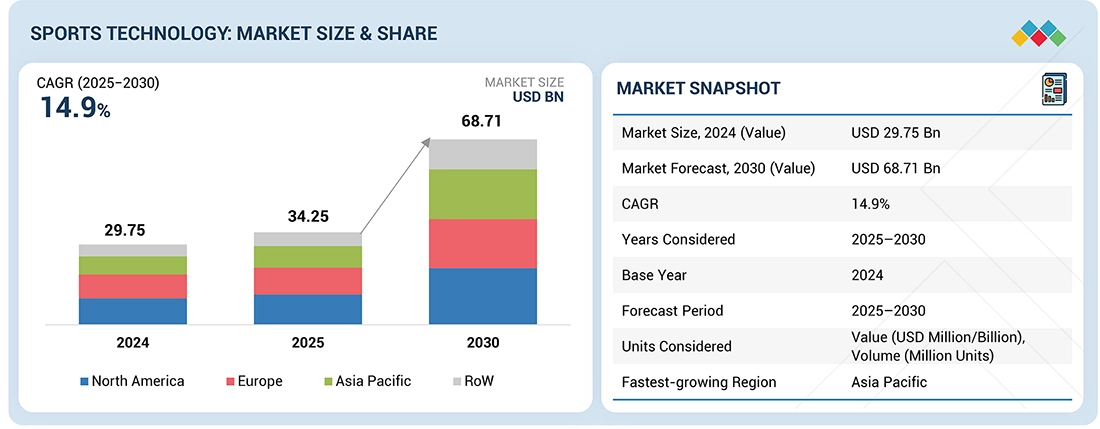

The global sports technology market size is projected to grow from USD 34.25 billion in 2025 to USD 68.71 billion by 2030, at a CAGR of 14.9% during the forecast period.

The market is experiencing robust growth driven by the increasing adoption of smart stadiums, wearable devices, and data analytics across various sports disciplines. In the sports associations and leagues segment, the integration of advanced analytics and AI-based platforms is enhancing performance tracking, fan engagement, and event management.

KEY TAKEAWAYS

-

By RegionThe North American sports technology market share accounted for a 33.0% revenue share in 2024. This strong market position highlights the region’s advanced adoption of analytics, AI-driven performance tools, and digital fan engagement technologies.

-

By TechnologyBy technology, the stadium analytics segment is projected to register the highest CAGR of 17.2%.

-

By PlatformBy platform, the AI-based platform segment is projected to grow at the fastest rate from 2025 to 2030.

-

By SportSport technology in Formula 1 is set to grow at the highest CAGR of 16.8% during the forecast period.

-

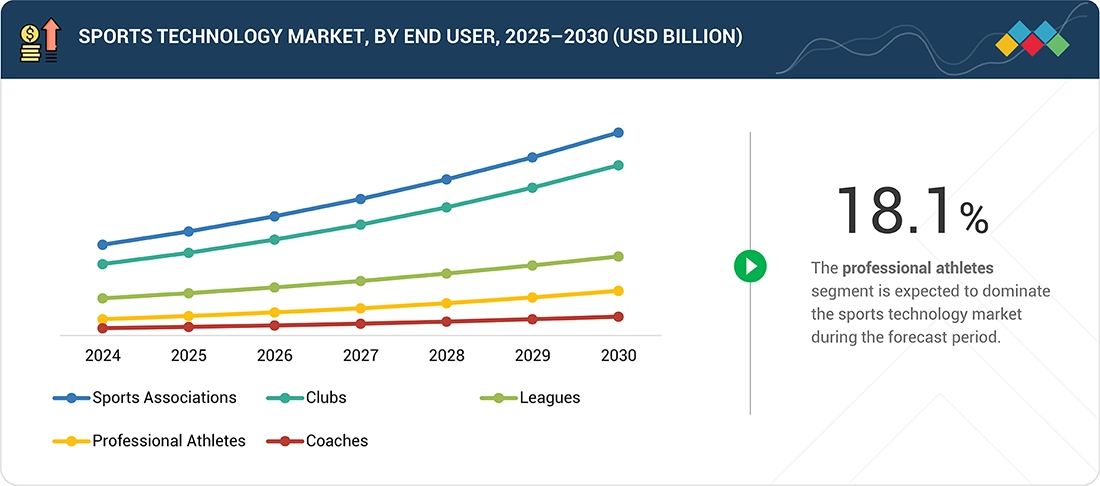

By End UserThe Sports Associations are estimated to hold almost half the share in 2025, supported by increasing investments in smart stadiums, the growth of AI-driven analytics, and the adoption of fan engagement technologies.

-

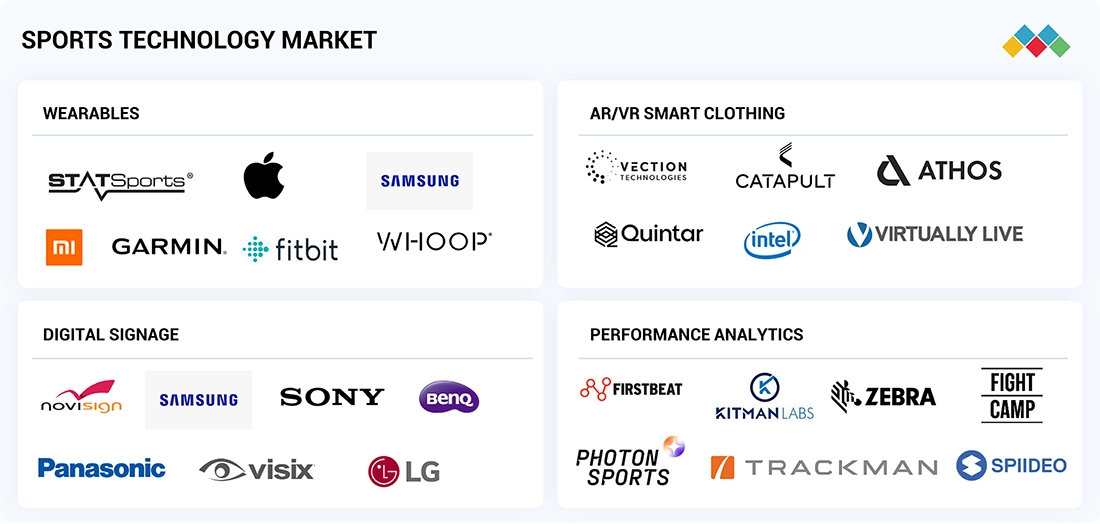

Competitive LandscapeApple Inc., Catapult, and Samsung were identified as some of the star players in the wearable segment of the sports technology market trends, given their strong market share and product footprint.

The sports tech industry is primarily driven by the increasing demand for data-driven performance optimization, enhanced fan engagement, and improved operational efficiency across global sports ecosystems. Advancements in AI, IoT, and wearable technologies are enabling real-time performance analytics, injury prevention, and athlete monitoring. The increasing adoption of smart stadium solutions, including automated ticketing, crowd management, and immersive viewing experiences, is transforming the fan experience and stadium operations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

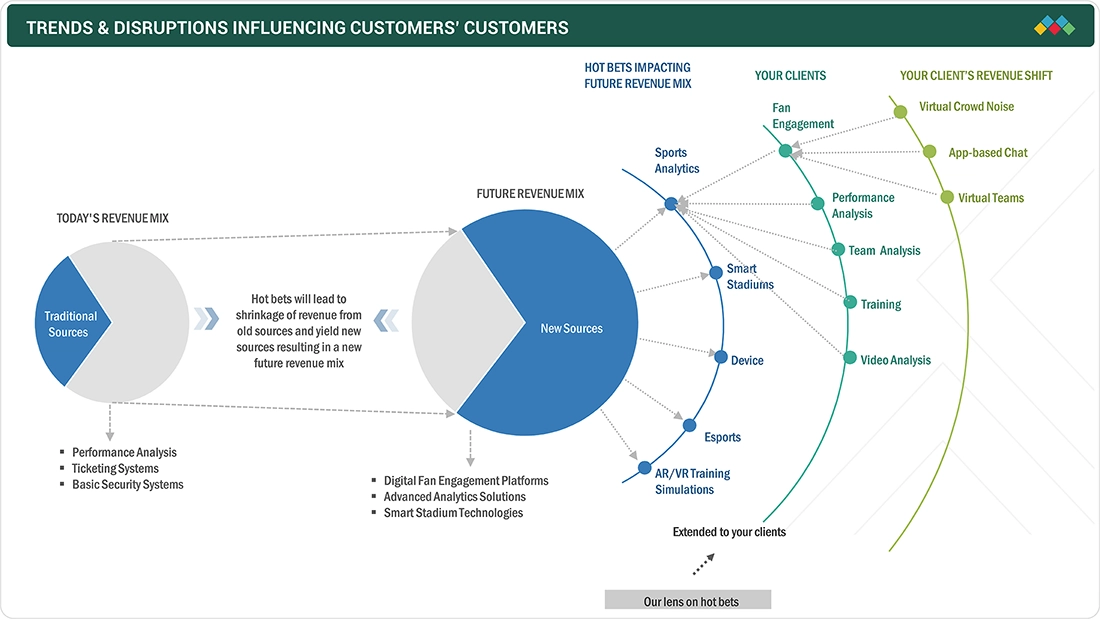

The sports tech market is driven by several key trends and disruptions, including the growing adoption of data analytics and AI to enhance player performance and fan engagement. The rise of esports and virtual sports is shifting consumer behavior toward digital-first experiences, creating new revenue streams. Additionally, augmented reality (AR) and virtual reality (VR) are transforming how fans interact with sports content, offering immersive experiences.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising implementation of IoT technologies for efficient management of stadium infrastructure

-

Increasing focus on fan engagement in stadiums

Level

-

High initial investments and budget constraints

-

Lack of standardized interoperability protocols

Level

-

Emergence of sports leagues and events with large prize pools

-

Increasing adoption of AR and VR in sports

Level

-

Lack of professionals with analytical skills

-

Complexities in upgrading and replacing legacy systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising implementation of IoT technologies for efficient management of stadium infrastructure

The increasing integration of IoT technologies is transforming stadium operations by enabling real-time monitoring of crowd flow, lighting, energy usage, and security. Smart sensors and connected devices improve operational efficiency, safety, and fan experience, driving widespread adoption of IoT-based solutions across modern sports arenas and facilities.

Restraint: High initial investments and budget constraints

The deployment of advanced sports technologies requires substantial capital for hardware, software, and integration. Smaller sports clubs and organizations often face budget constraints, which restrict their ability to adopt large-scale initiatives. High installation and maintenance costs for smart stadiums, analytics systems, and wearable devices pose significant financial challenges to market expansion.

Opportunity: Emergence of sports leagues and events with large prize pools

The growing number of professional sports leagues and tournaments offering significant prize money is fueling investments in technology-driven training and performance solutions. Enhanced sponsorships and fan engagement opportunities encourage teams and organizers to adopt advanced analytics, AI platforms, and smart wearables to gain a competitive edge.

Challenge: Lack of professionals with analytical skills

The effective utilization of sports technologies depends on skilled professionals capable of analyzing complex performance data. However, the shortage of data analysts, sports scientists, and AI experts limits the full potential of technology integration. This talent gap poses a challenge to achieving data-driven efficiency in sports management.

Sports Technology Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Wearable devices and health monitoring solutions for athletes and fitness enthusiasts | Real-time performance tracking | Seamless health data synchronization | Enhanced user experience through AI-driven analytics | Strong ecosystem integration |

|

Smart wearables and sensor-enabled sports equipment for performance and wellness applications | High-precision biometric tracking | Durable and ergonomic design | Fast data transmission via 5G | Optimized energy efficiency for extended use |

|

AI and cloud-based analytics for performance optimization, fan engagement, and video analysis | Advanced predictive analytics | Automated performance insights | Enhanced viewer personalization | Scalable data infrastructure for sports organizations |

|

Smart stadium connectivity and IoT network infrastructure for live event management | Ultra-reliable network coverage | Seamless crowd and facility management | Real-time data sharing | Enhanced fan experience through connected environments |

|

AI-powered sports analytics platforms and cloud-based decision-support systems for teams and leagues | Data-driven performance insights | Automated match strategy recommendations | Predictive injury prevention | Comprehensive data security and scalability |

|

5G and IoT-enabled connectivity solutions for smart stadiums and immersive fan experiences | High-speed, low-latency communication | Improved real-time streaming quality | Support for AR/VR fan engagement | Robust connectivity for large-scale events |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The sports tech industry ecosystem is a dynamic network of innovative companies and technologies enhancing sports performance, fan engagement, and operational efficiency. Key players, such as STATSports, Garmin, and Whoop, dominate the wearables segment, offering advanced tracking solutions for athletes. Meanwhile, Samsung and Apple integrate fitness technology into their broader consumer products. In AR/VR and smart clothing, companies like Catapult and Athos utilize cutting-edge materials and virtual experiences, supported by tech giants such as Intel. Digital signage from Panasonic and Sony enhances stadium experiences, and performance analytics from Firstbeat and Trackman provide data-driven insights. This ecosystem fosters collaboration across sports, technology, and regional markets.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Sports Technology Market, by Technology

The smart stadium segment is estimated to be the largest market share, owing to the growing integration of IoT, AI, and advanced connectivity for real-time crowd management, energy optimization, and fan engagement. Enhanced digital infrastructure and rising investments in stadium modernization are driving widespread adoption across global sports venues.

Sports Tech Market, by Sport

Soccer dominates the sports tech market due to its massive global following and increasing adoption of analytics, wearable tracking, and video-assisted technologies. Clubs and leagues are leveraging AI-driven tools for performance optimization, injury prevention, and enhancing fan engagement, thereby fueling the integration of technology across stadiums and training facilities worldwide.

Sports Tech Industry, by Platform

Conventional platforms account for the largest market share as established sports organizations continue to rely on proven, scalable, and cost-effective technologies. These platforms support reliable performance tracking, event management, and audience engagement systems, ensuring seamless integration with existing infrastructure and minimizing the complexities of transition across large sports ecosystems.

Sports Technology Market, by End User

The professional athletes segment is expected to register the highest CAGR, driven by increasing adoption of wearable devices, AI-based performance analytics, and smart equipment. Athletes are utilizing real-time data insights for personalized training, recovery optimization, and injury prevention, leading to a higher demand for cutting-edge sports technologies globally.

REGION

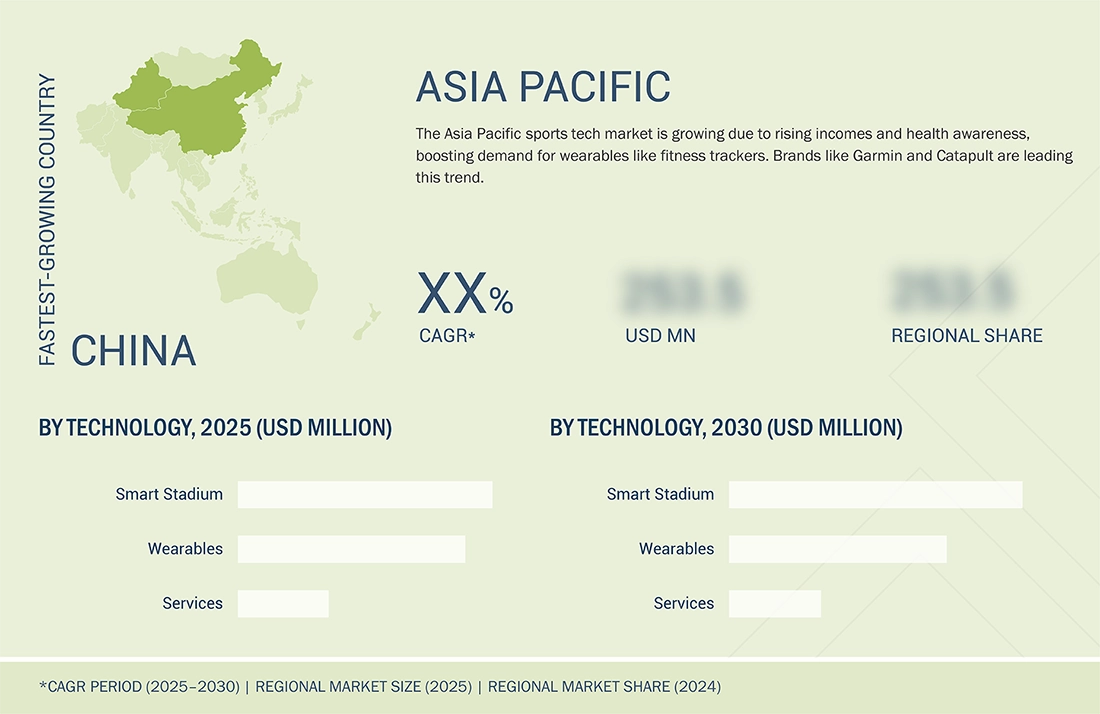

Asia Pacific to record significant growth in the global sports tech market during the forecast period

The sports technology market in the Asia Pacific region is set for significant growth, driven by rising disposable incomes and an expanding middle class, particularly in China, India, and Japan. Increasing health consciousness among consumers has led to a surge in demand for wearable technologies, like fitness trackers and smartwatches, alongside performance analytics tools. Major brands such as Garmin and Catapult are capitalizing on this trend by offering innovative solutions that enhance athletic performance and overall fitness.

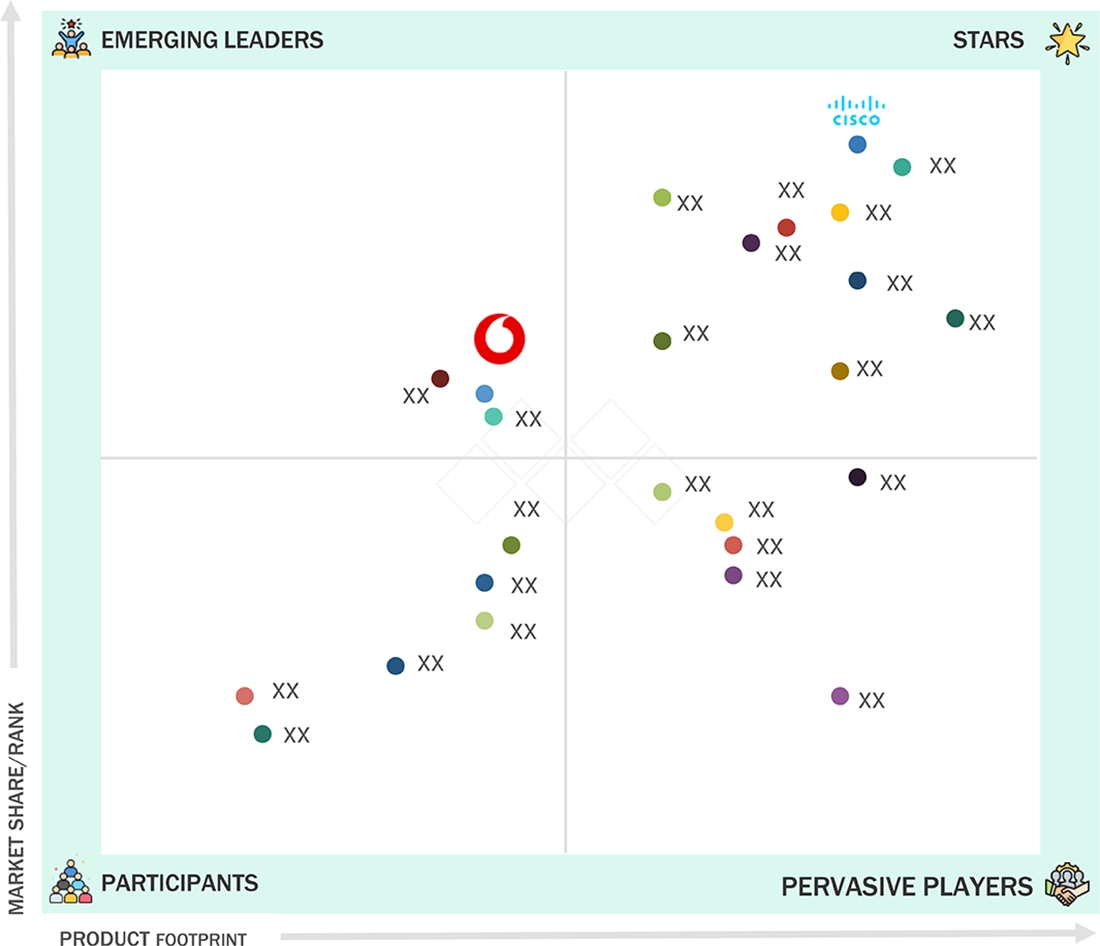

Sports Technology Market: COMPANY EVALUATION MATRIX

In the sports tech industry matrix, Cisco Systems, Inc. (Star) leads with a strong market presence and an extensive product portfolio, enabling widespread adoption of networking, analytics, and IoT solutions, enabling seamless connectivity, real-time data monitoring, and performance optimization in stadiums and professional sports. Vodafone Group (Emerging Leader) is steadily gaining traction with innovative sensor solutions focused on smart stadiums, fan engagement platforms, and wearable sports devices. While Cisco Systems, Inc. dominates through scale and an established customer base, Vodafone Group demonstrates solid growth potential, advancing toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

SPORTS TECHNOLOGY MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 29.75 Billion |

| Market Forecast, 2030 (Value) | USD 68.71 Billion |

| Growth Rate | CAGR of 14.9% from 2025 to 2030 |

| Years Considered | 2021–2024 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) and Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, RoW |

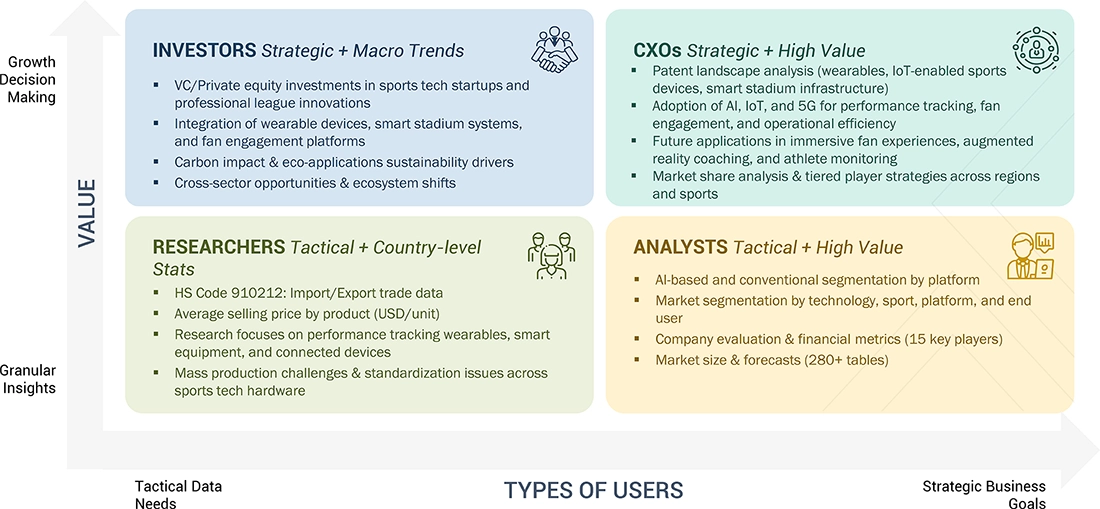

WHAT IS IN IT FOR YOU: Sports Technology Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Sports Wearables Manufacturer |

|

|

| European Smart Stadium Technology Provider |

|

|

| Sports Analytics Software Developer (APAC) |

|

|

| Global Sports Equipment OEM |

|

|

| Middle East Sports Association |

|

|

| Asia Pacific Esports Technology Platform |

|

|

RECENT DEVELOPMENTS

- October 2024 : EXLSERVICE Holdings partnered with Quilt.AI, a company specializing in the use of AI to analyze and interpret internet data on a large scale. This collaboration sought to combine EXL’s expertise in data, AI, and industry knowledge with Quilt.AI’s advanced AI-driven platform, which converts big data into actionable human insights and cultural understanding.

- September 2024 : Viettel extended its partnership with Ericsson through a major 5G network award. This agreement included the development of smart cities and venues, including stadiums. Enhanced 5G networks could enable advanced technologies such as real-time data analytics, improved fan experiences, and more efficient stadium operations, which are key components of smart stadiums.

- August 2024 : Cisco was named the official WiFi infrastructure partner of the Allianz Arena in Munich. Starting with the 2024-2025 Bundesliga season, this partnership included deploying 1,500 WiFi 6 access points, with plans for WiFi 7. This was expected to enhance the fan experience by providing fast, efficient WiFi for numerous fans.

- June 2024 : Telefónica Tech collaborated with IBM to develop AI, analytics, and data management solutions. This collaboration aimed to deploy an open, hybrid, multi-cloud platform to enhance business initiatives and improve digital transformation efforts for enterprises.

- June 2024 : Johnson Controls collaborated with Middle East sustainability firm IGCC to enhance smart stadiums by integrating advanced energy solutions, optimizing sustainability, and improving overall operational efficiency through innovative technologies.

Table of Contents

Methodology

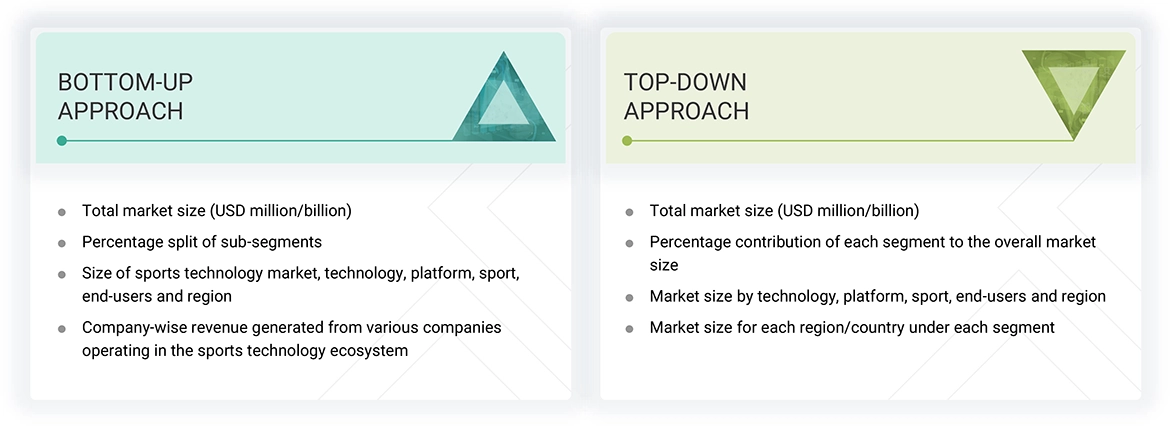

The study involved four major activities in estimating the current size of the sports technology market—exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain critical information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

List of major secondary sources

|

Source |

Web Link |

|

Consumer Technology Association |

|

|

Wearable Robotics Association |

|

|

Universal Mentors Association |

|

|

VR/AR Association |

|

|

Institute of Electrical and Electronics Engineers (IEEE) |

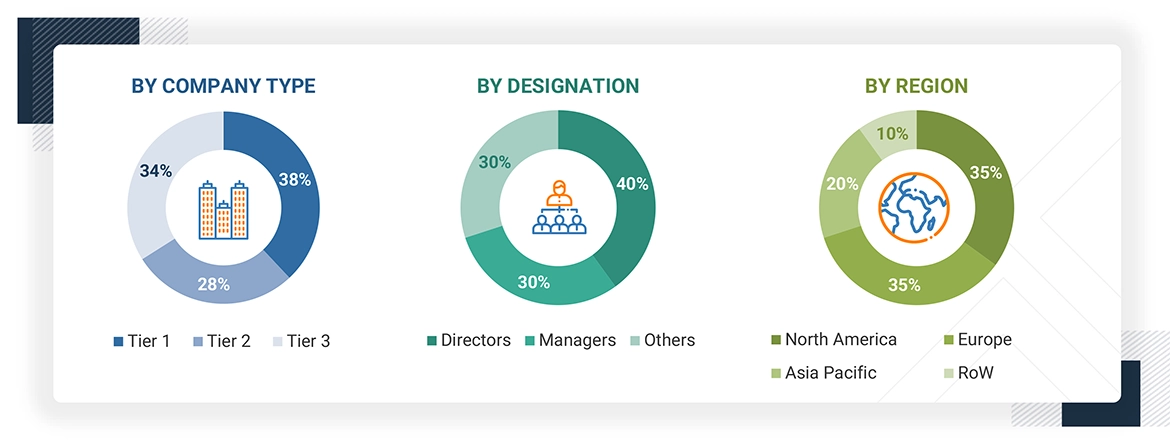

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the blockchain market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of blockchain solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Note: Other designations include sales managers, marketing managers, and product managers.

The three tiers of the companies have been defined based on their total revenue as of 2023: tier 1: revenue greater than USD 1 billion, tier 2: revenue between USD 500 million and USD 1 billion, and tier 3: revenue less than USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

Sports Technology Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the market has been split into several segments and subsegments. The data triangulation procedure has been employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Technology in sports refers to using different data analytical technologies for various applications, such as enhancing player performance, sports analytics, video analysis, etc. Sports technology also refers to the application of smart technology solutions and hardware deployed in the stadium’s infrastructure. The sports technologies covered in this report include sports data analytics, smart stadium, esports, and devices.

Key Stakeholders

- Sports technology companies

- Stadium Owners

- Sports Associations

- IT Service Providers

- Mobile Application Providers

- Network Solution Providers

- Sports Equipment Manufacturers

- System Integrators

- Cloud Service Providers

- Original Equipment Manufacturers (OEMs)

- Market Research and Consulting Firms

- Associations, Organizations, Forums, and Alliances Related to Sports Technology

- Technology Investors

- Governments and Financial Institutions

- Venture Capitalists, Private Equity Firms, and Start-ups

Report Objectives

- To define, describe, and forecast the sports technology market, by technology, platform, sport, end-user and region, in terms of value

- To describe and forecast the market for various segments with respect to four main regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

- To describe and forecast the sports technology market for wearable technology, in terms of volume

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, value chain analysis, porters five forces analysis, trade analysis, case study analysis, technology analysis, influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments of the sports technology market

- To align with the market scope, the market size for temperature and sports technology is also included in the sports technology market size.

- To benchmark players within the market using the proprietary ‘Company Evaluation Matrix’ framework, which analyzes market players on various parameters within the broad categories of market rank and product offering

- To strategically profile the key players and comprehensively analyze their market share and core competencies2 and provide a detailed competitive landscape for market leaders

- To analyze competitive developments, such as partnerships, collaborations, agreements, mergers & acquisitions, expansions, and product launches & developments, in the sports technology market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the sports technology market

Regional Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company in the sports technology market.

Key Questions Addressed by the Report

What is the expected CAGR for the sports technology market from 2025 to 2030?

The global sports technology market is expected to record a CAGR of 14.9% between 2025 and 2030.

Which regions are expected to pose significant demand for sports technology during the forecast period?

The Asia Pacific and North America regions are projected to experience substantial growth in the sports technology market. This growth is driven by increasing adoption of AI-driven analytics, rising demand for smart wearables, and expanding digital sports infrastructure in major economies such as China, India, Japan, the US, and Germany.

What are the significant growth opportunities in the sports technology market?

The sports technology market presents significant opportunities driven by advancements in AI, IoT, and data analytics for athlete performance optimization. The rising demand for smart wearables, virtual training platforms, and immersive fan engagement solutions further accelerates growth. Increasing investments in smart stadiums and digital broadcasting enhance viewer experiences, while the expanding popularity of e-sports and online fitness platforms creates new revenue streams, making sports technology a rapidly evolving and lucrative market.

Which are the key players operating in the sports technology market?

Key players operating in the sports technology market are Apple Inc. (US), SAMSUNG (South Korea), Alphabet Inc. (US), Cisco Systems, Inc. (US), IBM (US), Telefonaktiebolaget LM Ericsson (Sweden), Catapult (Australia), Garmin Ltd. (US), Johnson Controls (Ireland), and Schneider Electric (France).

What are the major end users of sports technology?

Sports associations, clubs, leagues, and professional athletes are the major sports technology end users.

How can companies benefit from investing in the sports technology market?

Companies can leverage the sports technology market to create new revenue streams through solutions such as performance analytics, wearable devices, fan engagement platforms, and smart stadium technologies. These innovations help sports organizations improve athlete performance, reduce injury risks, enhance fan experiences, and optimize operations. For technology providers, partnerships with leagues, clubs, and fitness brands also offer strong opportunities for brand visibility and long-term contracts.

What are the key challenges companies should consider before entering the sports technology market?

Key challenges include high development costs, data privacy and security concerns, and the need for accurate, real-time data analytics. Companies must also navigate regulatory requirements, ensure compatibility with existing sports infrastructure, and demonstrate clear ROI to teams and sports organizations. Success often depends on continuous innovation, strong data credibility, and the ability to customize solutions for different sports and performance needs.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Sports Technology Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Sports Technology Market

Matt

May, 2022

How big is the basketball tech market? Only interested in US & EU..

Michael

Apr, 2022

Hi, I am interested in Customer segments within the sports technology market..