Smart Stadiums Market

Smart Stadiums Market by Solutions (Digital Content Management, Stadium and Public Security, Building Automation, Event Management, Network Management, and Crowd Management), Stadium Type (Indoor, Outdoor, and Multi-Purpose) - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The smart stadiums market was estimated at USD 19.55 billion in 2024 and is expected to reach USD 41.68 billion by 2029, growing at a CAGR of 16.4%. A smart stadium refers to an arena that utilizes the latest technology to enhance the experiences of fans, operators, and other stakeholders. Instances of its facilities include dynamic digital signage, smart parking, and automated concession stands. Such innovations streamline operations, reduce the waiting time, and make attending more personalized and engaging. Data analytics enables Smart Stadiums to optimize seating arrangements, improve crowd flow, and reduce emergency response times.

KEY TAKEAWAYS

- The Europe smart stadiums market accounted for a 32.4% revenue share in 2024.

- By offering, the services segment is expected to register the highest CAGR of 17.6%.

- By stadium type, the multi-purpose segment is projected to grow at the fastest rate from 2024 to 2029.

- Company IBM, Cisco, and Huawei were identified as some of the star players in the smart stadiums market (global), given their strong market share and product footprint.

- Companies Edge Sound Research,Dignia Systems, and AllGoVision, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

Smart Stadiums substantially benefit organizations, including increased revenue, enhanced fan satisfaction, and improved operational efficiency. For instance, the AT&T Stadium utilizes advanced analytics to optimize seating layouts, while Wembley Stadium leverages technology to streamline operations and enhance the spectator experience. Similarly, the Johan Cruyff Arena utilizes data-driven insights to enhance fan engagement and operational efficiency.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends or disruptions. Hot belts are the clients of smart stadiums solution providers, and target applications are the clients of smart stadiums solution providers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbeds, which in turn will impact the revenues of smart stadiums solution providers. Smart stadiums enable organizations to understand user interactions and patterns by analyzing data from multiple touchpoints and activities. This leads to more informed decision-making, enabling personalized experiences, targeted marketing strategies, and improved customer engagement.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for enhanced fan experiences

-

Improved operational efficiency resulting in significant cost reduction

Level

-

High initial investment hinders smart stadium adoption

-

Complex system integration

Level

-

Explore new revenue streams

-

Data analytics to offer operational optimization insights

Level

-

Data privacy and security

-

Connectivity issues to disrupt service delivery

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for enhanced fan experiences

A key driver in the Smart Stadiums market is the enhanced fan experience, significantly impacting attendance and participation. Mobile apps, interactive displays, and high-speed connectivity offer customized services and real-time information, leading to increased spending and revenue for operators. Features like in-seat food ordering, augmented reality games, and instant replays enhance convenience. Cashless payment systems allow for quick transactions, while smart seating provides personalized control over lighting and sound. An integrated social media component fosters real-time sharing, and analytics from fan interactions help tailor future events and promotions. Some stadiums even offer virtual reality experiences for seat previews and player meet-and-greets. By continually improving fan experiences, smart stadiums promote loyalty and repeat attendance, driving sustainable revenue growth and industry leadership.

Restraint: High initial investment hinders smart stadium adoption

The main constraints in the smart stadiums market include the high upfront investment required for modernizing existing stadiums by utilizing technologies such as IoT, AI, and 5G. Such capital-intensive technologies require significant investment in various sensors, connectivity infrastructure, and security systems, which may be out of reach for small stadiums or other organizations with limited budgets. This financial cost is one of the reasons they cannot compete as strongly with the larger venues. In addition, the uncertain ROI also makes it less attractive to stakeholders, who often ask how soon they can recover their investment through additional revenue from ticket sales, concessions, and sponsorships.

Opportunity: Explore new revenue streams

New revenue streams open a huge market to smart stadiums, bringing venues cash without regard to ticket sales. A modern smart stadium will employ advanced technologies for personalizing ads, selling premium seat packages, and creating the fan experience that sponsors and advertisers cannot get from any other place. For instance, digital signage and interactive content enable targeted marketing based on fan preferences, making marketing campaigns more effective. The same data generated from IoT devices may be used to examine interactions with fans and, hence, personalize campaigns that better appeal to specific audiences.

Challenge: Data privacy and security

As the smart stadiums market collects various types of information on fans' preferences and behavior, along with data concerning payments, protection, and security, it becomes a major challenge. Being extremely reliant on technology, it is essential to protect this sensitive information from breaches and misuse, and to avoid issues such as mistrust and substantial legal consequences if not adequately protected. Indeed, past breaches have resulted in tremendous losses and a bad reputation for the venue, which deters fans from attending such places. Effective cybersecurity measures require significant investments in terms of both cost and effort, as constant updates are necessary, and continuous monitoring of new advancements, such as advanced encryption methods, multi-factor authentication, and periodic security audits, is required.

Smart Stadiums Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The client is responsible for operating multiple stadiums in Qatar, with the goal of enhancing operational efficiency and the fan experience, particularly in preparation for the FIFA World Cup 2022. These stadiums are pivotal in showcasing Qatar's capabilities in hosting major international events. | Significant reduction in energy consumption, leading to lower operational costs | Enhanced fan experience through improved comfort and security measures | Increased operational efficiency, allowing for better management of resources during high-capacity events |

|

River Plate Club is a prominent football club based in Buenos Aires, Argentina, known for its rich history and strong fan base. The club strives to deliver an exceptional experience for its fans and visitors, particularly during matches and events held at its stadium. | Significantly improved internet speeds and reliability, allowing fans to share their experiences in real time | Enhanced fan engagement using mobile applications and social media during events | Future-proofing the stadium's connectivity infrastructure, making it adaptable to emerging technologies and growing demands |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The smart stadiums market comprises a diverse ecosystem of various stakeholders, including solution providers and service providers. In this market, organizations offer comprehensive solutions that include fan behavior data analysis, machine learning algorithms, real-time monitoring tools, and secure data storage. These technologies enable stadium operators to gain deep insights into fan activities, enhance security measures, improve crowd management, and optimize overall operational efficiency in areas such as ticketing, concessions, event management, and stadium maintenance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Smart Stadiums Market, By Offering

Stadium and public security solutions will lead the Smart Stadiums market because they are the most essential features related to safety and security pertaining to the crowd, staff, and players. Advanced surveillance systems, facial recognition, biometric scanning, and metal detection can all prevent unlawful entry and effectively manage crowd control. Increasing large-scale events and soaring security concerns are factors behind such high demand for robust security measures. The real-time monitoring and threat detection capabilities will be supported by integrating AI and IoT technologies. With such features, these solutions would be a requirement for modern stadiums. This aspect of security will not only provide a safer environment but also give fans greater confidence, enriching their experiences and contributing to the largest market size during the forecast period.

Smart Stadiums Market, By Stadium Type

Multi-purpose stadiums are projected to experience the highest growth in the Smart Stadiums market due to their ability to host a wide range of events, including sports, concerts, and cultural activities. This versatility maximizes venue usage and increases revenue. Advanced technologies, such as IoT, AI, and 5G, enhance operational efficiency and fan experiences. The demand for venues that can accommodate multi-purpose events and enhance security management also drives the shift towards smart solutions in these stadiums. Additionally, significant investments in sports infrastructure and major global events contribute to this trend.

REGION

North America is estimated to account for the largest market share during the forecast period

The Asia Pacific is expected to experience a surge in growth during the forecast period in the smart stadium market. The region has rapidly adopted digital technologies and smart solutions to significantly improve its sports infrastructure. Countries such as China, Japan, India, and Australia are spending heavily in modernizing their stadiums for international events, which has boosted demand for smart stadium technologies. The popularity of professional sports leagues, such as the IPL in India or the NRL in Australia, is complemented by other major sporting and entertainment events, creating a favorable environment for the development of advanced stadium management solutions.

Smart Stadiums Market: COMPANY EVALUATION MATRIX

In the smart stadiums market matrix, IBM (Star) leads with a strong market presence and offering advanced AI, analytics, IoT, and cloud solutions that optimize venue operations, enhance fan engagement, and deliver real-time crowd management and security. Verizon (Emerging Leader) is driving next-generation fan experiences and stadium efficiencies through 5G network infrastructure, ultra-low latency connectivity, and digital transformation partnerships. While IBM dominates with scale and ecosystem integration, Verizon shows strong growth potential to advance toward the leaders’ quadrant with its expanding enterprise security portfolio.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 16.51 Billion |

| Market Forecast in 2029 (Value) | USD 41.68 Billion |

| Growth Rate | CAGR of 16.4% from 2024-2029 |

| Years Considered | 2018–2029 |

| Base Year | 2023 |

| Forecast Period | 2024–2029 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: Smart Stadiums Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (US) |

|

|

| Company Information | Detailed analysis and profiling of additional market players (up to 5) |

|

RECENT DEVELOPMENTS

- September 2024 : Arsenal and NTT DATA announced a multi-year partnership aimed at enhancing the club’s digital transformation, focusing on smart stadium initiatives through advanced data analytics, machine learning, and personalized fan experiences.

- June 2024 : Johnson Controls announced a collaboration with Middle East sustainability firm IGCC to enhance Smart Stadiums by integrating advanced energy solutions, optimizing sustainability, and improving overall operational efficiency through innovative technologies.

- February 2024 : Orange Business and Cisco have partnered to develop a smart power consumption solution at the Orange Vélodrome in Marseille. This initiative enhances energy efficiency by converting the stadium’s always-on Wi-Fi network to an on-demand system, reducing energy usage and supporting sustainability goals.

- March 2023 : The networking hardware company Cisco and the Spanish professional football club Real Madrid CF announced a global, multi-year collaboration agreement at Real Madrid City to transform the new Santiago Bernabéu Stadium into one of the most technologically advanced sports venues in the world.

- November 2021 : Ericsson and Ooredoo Qatar partnered to ensure that hundreds of thousands of football fans from around the world could enjoy the best next-gen 5G connectivity experiences possible, inside several event stadiums and across the country when Qatar hosted a major global football tournament from November to December 2022.

Table of Contents

Methodology

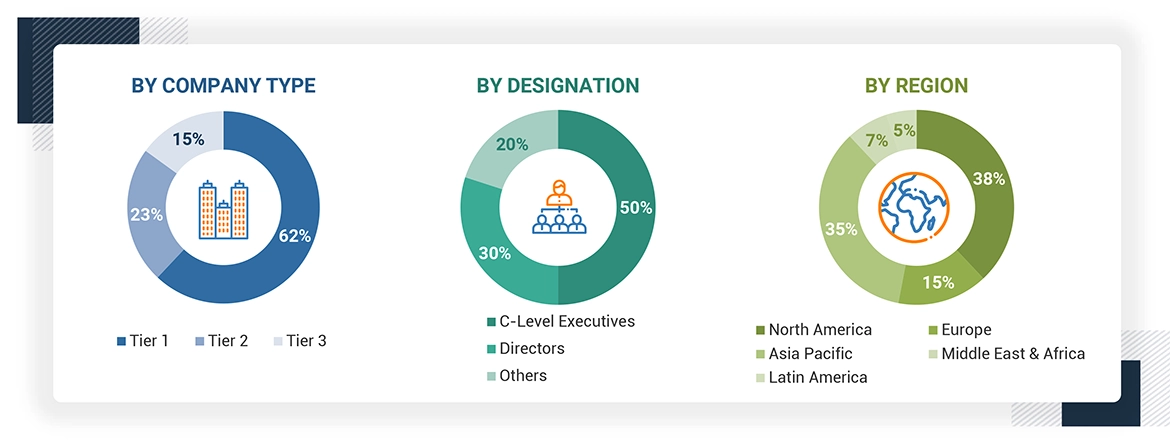

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect valuable information for a technical, market-oriented, and commercial study of the Smart Stadiums market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and associations, such as Stadium Innovation Conference 2024, SMART Conference 2024, Stadium Innovation Conference, World Stadium Congress, World of Stadiums, were also referred to. Secondary research was used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Smart Stadiums market. The primary sources from the demand side included Smart Stadiums end users, consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

*Others include sales managers, marketing managers, and product managers.

Note: Tier 1 companies’ revenue is more than USD 1 billion; Tier 2 companies ‘revenue ranges between

USD 500 million to 1 billion; and Tier 3 companies’ revenue ranges in between USD

100 million and USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

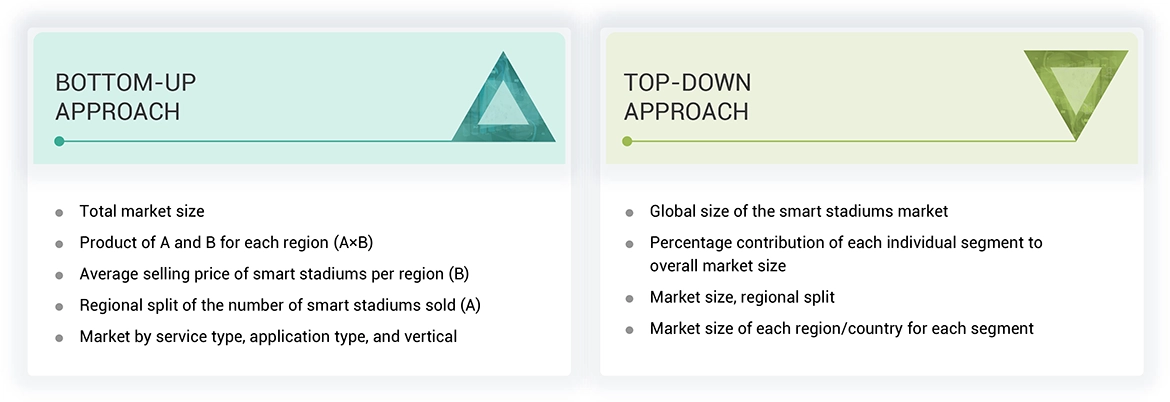

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the Smart Stadiums market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of Smart Stadiums.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Smart Stadiums market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Smart Stadiums Market : Top-Down and Bottom-Up Approach

Data Triangulation

A Smart Stadium, is an application of smart technology integrated solutions and hardware in the stadium's infrastructure. Advanced digital technologies such as IoT, high-density Wi-Fi, integrated security systems, as well as mobile applications, are used to serve a better experience of sports and entertainment viewing, increased profitability, and improved security within the stadium.

According to Intel, a Smart Stadium may be defined as an arena where IoT, 5G connectivity, cloud computing, and AI-driven analytics deliver an immersed fan experience, improved stadium operations, enhanced safety, and revenue generation through data-driven decision-making.

Market Definition

Digital identity solutions refer to the tools and systems that enable individuals, organizations, and anything else related to computers, smartphones, and IoT devices, systems, services, and applications to establish and verify identities in a digital environment.

Stakeholders

- Stadium Owners and Operators

- Sports Teams and Leagues

- Event Organizers

- Fans and Spectators

- Technology Providers

- Network Operators

- Security Service Providers

- Government Agencies

- Facility Management Companies

- Infrastructure Providers

- Payment Solution Providers

- Broadcast and Media Companies

- Fan Engagement and Marketing Solution Providers

- Data Analytics Providers

- Sponsorship and Advertising Partners

- Health and Safety Providers

- Sustainability and Energy Management Providers

- Food and Beverage Service Providers

- Parking and Transportation Providers

- Digital Content Providers

Report Objectives

- To determine, segment, and forecast the Smart Stadiums market based on offering (solutions and services), stadium type, and region in terms of value

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze the macro and micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies2

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and R&D activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Country-wise information

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Smart Stadiums Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Smart Stadiums Market