Surgical Robots Market by Product & Service (Instruments, Robotic Systems, Services), Application ( General Surgery, Gynecological Surgery, Orthopedic Surgery, Neurosurgery), End User (Hospitals, Ambulatory Surgery Center) & Region - Global Forecast to 2027

Updated on : April 12, 2023

The global surgical robots market in terms of revenue was estimated to be worth $8.5 billion in 2022 and is poised to reach $18.4 billion by 2027, growing at a CAGR of 16.6% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Technological advancements in surgical robots and the advantages of robotic-assisted surgery are the factors contributing to the growth of the surgical robot market.

Global Surgical Robots Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Surgical Robots Market Dynamics

Driver: Advantages of robotic-assisted surgery

Globally, due to the advantages such as smaller incisions, fewer cuts, decreased scarring, reduced pain, increased safety, faster recovery periods, and considerable cost savings, minimally invasive surgeries (MIS) are on the rise. Robotic minimally invasive surgery adds to these advantages by ensuring greater accuracy, repeatability, control, and efficiency. These procedures also offer highly advanced visualisation capabilities that aid surgeons with a superior view of the operating area and use HD cameras to illustrate microscopic structures. These systems provide greater dexterity than the human hand; given their ability to rotate 360 degrees and superior maneuverability, robots can allow surgeons to reach hard-to-access areas. These benefits of surgical robots, as well as rising demand for better, faster healthcare services, are expected to drive the growth of the market in the coming years.

Restraint: high cost of robotic systems

Robot-assisted surgeries are more expensive than minimally invasive surgeries. It is recommended by the American Congress of Obstetricians and Gynecologists that robotic hysterectomy should only be used for unusual and complex clinical conditions. The association states that in the US, the adoption of robotic surgery for all hysterectomies would add an estimated USD 960 million to the annual cost of hysterectomy surgeries. SS Innovations (India) launched Mantra, a robotic surgical system that costs around Rs 4.5 crore, whereas the Da Vinci system, one of the most commonly used robotic systems, costs between USD 1.5 million and USD 2.5 million (Rs 15 crore) (Source: Business Standard, September 2022). The rising cost of surgeries due to the use of robotic systems is thus expected to restrain the growth of the medical robot market.

Opportunity: Increasing penetration of surgical robots in ASCs

Outpatient surgery, also known as ambulatory surgery, day surgery, day case surgery, or same-day surgery, does not require an overnight hospital stay. The term "outpatient" means patients may enter and leave the facility on the same day. Greater convenience and reduced costs are the advantages of outpatient surgery over inpatient surgery. Ambulatory surgery centres (ASCs) are freestanding facilities specialising in surgical, diagnostic, and preventive procedures that do not require hospital admission. The cost-effectiveness of ASCs provides significant savings for governments, third-party payers, and patients. Medicare and its beneficiaries save each year because they pay significantly less for procedures performed in ASCs than the rates paid to hospitals for the same procedures. Patient co-payments are also significantly lower when care is received at an ASC. Owing to these cost benefits, there has been a rapid increase in the number of surgical procedures performed in ASCs and outpatient settings, while hospital in-patient visits have decreased.

Challenge: Surgical Errors

Surgical errors are a serious public health problem and a leading cause of death. Surgical errors are a leading cause of injury in healthcare systems. Globally, unsafe surgical care procedures cause complications in up to 25% of patients. Every year, approximately 7 million people experience surgical complications, among which more than 1 million people die (source: WHO, Patient Safety 2019). According to the NCBI, at least 4,000 surgical errors occur each year in the US. Therefore, many patients are reluctant to undergo surgical procedures, hindering the adoption of surgical robots by surgeons.

The instruments and accessories segment accounted for the largest share of the surgical robots market.

Based on product and service, the market has been segmented into robotic systems, instruments and accessories, and services. In 2021, the instruments and accessories segment accounted for the largest share of the surgical robot market. Growth in this segment is largely attributed to the recurrent purchase of instruments and accessories instead of robotic systems.

The laparoscopy robotic system segment held the largest share of the surgical robots market.

Based on robotic systems, the market has been segmented into laparoscopy robotic systems, orthopaedic robotic systems, neurosurgical robotic systems, and other systems. The laparoscopy robotic system segment held the largest share of the market in 2021. The growing number of laparoscopic surgeries is the key factor supporting the segment's largest share.

The urological surgery segment accounted for the second largest share of the surgical robots market.

By application, the market has been segmented into general surgery, urological surgery, gynaecological surgery, orthopaedic surgery, neurosurgery, and other applications. The orthopaedic robotic system segment held the second-largest share of the market in 2021. An increasing number of robotic urological surgeries will fuel the demand for surgical robots.

The ambulatory surgery centres segment accounted for the second largest share of the surgical robots market.

Based on end users, the market is segmented into hospitals, clinics, and ambulatory surgery centers. Hospitals and clinics will account for the largest share of the market. In 2021, the ambulatory surgery centres segment accounted for the second-largest share of the surgical robot market. The large share of this segment can be attributed to the adoption of surgical procedures offered by ASCs at a lower cost than hospitals.

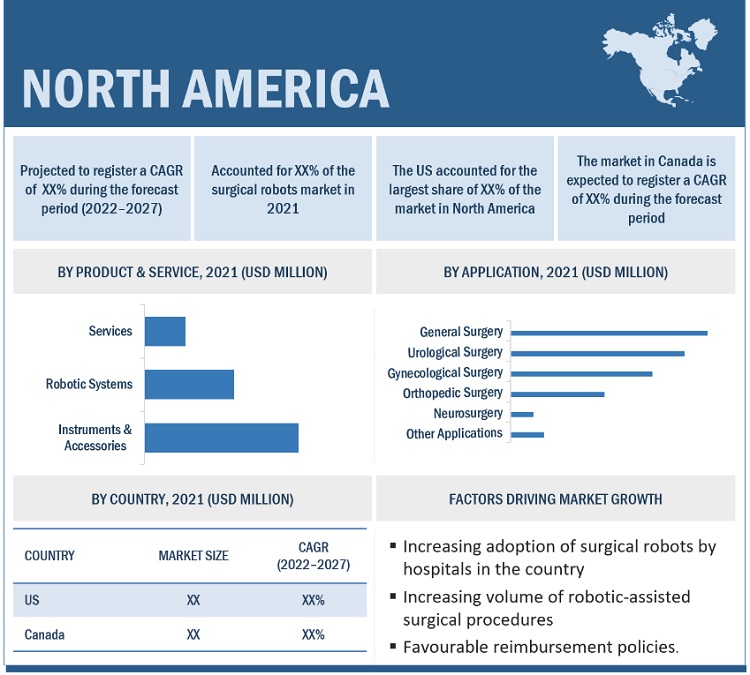

North America accounted for the largest share of the surgical robots market.

North America will account for the largest share of the market. The region's large share can be attributed to the surge in the adoption of surgical robots by hospitals in the country, the increasing volume of robotic-assisted surgical procedures, and the favourable reimbursement policies.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the surgical robot market are Intuitive Surgical (US), Stryker Corporation (US), Medtronic Plc (Ireland), Smith & Nephew (UK), Zimmer Biomet (US), Asensus Surgical (US), Siemens Healthineers (Germany), CMR Surgical (UK), Johnson & Johnson (US), and Renishaw Plc. (UK).

Surgical Robots Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$8.5 billion |

|

Projected Revenue by 2027 |

$18.4 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 16.6% |

|

Market Driver |

Advantages of robotic-assisted surgery |

|

Market Opportunity |

Increasing penetration of surgical robots in ASCs |

The study categorizes the Surgical robots market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

- Instruments & Accessories

- Robotic Systems

- Laparoscopy Robotic Systems

- Orthopedic Robotic Systems

- Neurosurgical Robotic Systems

- Other Systems

- Services

By Application

- General Surgery

- Gynecological Surgery

- Orthopedic Surgery

- Urological Surgery

- Neurosurgery

- Other Applications

By End User

- Hospitals & Clinics

- Ambulatory Surgery Centers

By Region

-

North America

- Canada

- US

-

Europe

- UK

- Germany

- Italy

- France

- Spain

- Switzerland

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- Rest of APAC

- Latin America

- Middle East & Africa

Recent Developments

- In 2022, BGS Beta-Gamma-Service GmbH & Co. KG expanded its laboratory in Wiehl to meet the increased need for sterilisation services in the sectors of biotechnology, medicine, and diagnostics for radiation cross-linking.

- In 2022, Sterigenics expanded its electron beam facility located in Columbia City, Indiana. This facility provides mission-critical E-beam sterilisation services to help ensure the safety of medical devices and drug products.

- In 2021, STERIS acquired Cantel, which is a provider of infection prevention services, and this acquisition will strengthen STERIS' leadership in infection prevention by bringing together two complementary businesses.

- In 2020, STERIS added X-rays to its product portfolio in addition to the existing gamma irradiation by expanding its facility in Thailand.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global surgical robots market?

The global surgical robots market boasts a total revenue value of $18.4 billion by 2027.

What is the estimated growth rate (CAGR) of the global surgical robots market?

The global market for surgical robots has an estimated compound annual growth rate (CAGR) of 16.6% and a revenue size in the region of $8.5 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study used widespread secondary sources; directories; databases such as Dun & Bradstreet, Bloomberg BusinessWeek, and Factiva; white papers; annual reports; and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global surgical robots market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

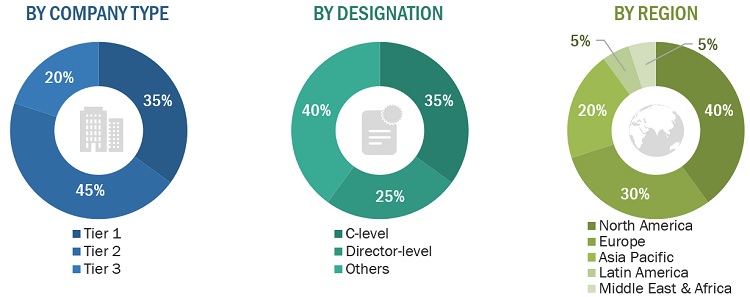

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the surgical robots market. The primary sources from the demand side include key executives from hospitals, physicians, clinicians, and research institutes.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2021: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the surgical robots market was arrived at after data triangulation from different approaches. After each approach, the weighted average of the approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast the surgical robots market by product & service, application, end user, and region

- To provide detailed information about factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in five main regions (along with their respective key countries), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players in the market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as product launches & approvals, acquisitions, venture launch, expansion, product payment approval, partnerships, deployment, agreements, collaborations, and joint ventures of the leading market players

- To benchmark players within the surgical robots market using the “Company Evaluation Quadrant” framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Portfolio Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company (Top 3 companies)

Geographic Analysis

- Further breakdown of the Rest of Europe market into Denmark, Russia, Austria and others

- Further breakdown of the Rest of the Asia Pacific market into South Korea, Singapore, and others

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Surgical Robots Market