Telecom Service Assurance Market by Component (Solutions (Fault and Event Management, Performance Management, and Quality and Service Management) and Services), Operator Type, Deployment Type, Organization Size, and Region - Global Forecast to 2026

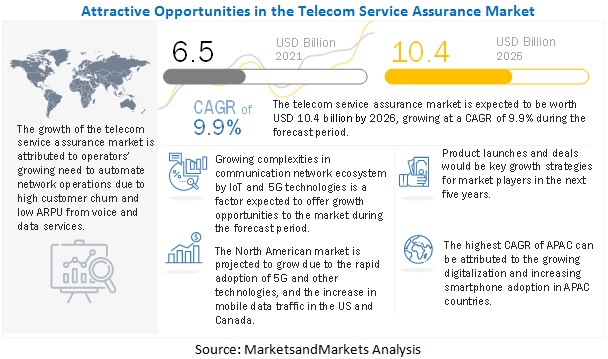

The global Telecom Service Assurance Market size was valued at $6.5 billion in 2021 and is predicted to reach $10.4 billion by 2026, increasing at a CAGR of 9.9% from 2021 to 2026. The presence of various key players in the ecosystem has led to competitive and diverse market. Automation appears to be crucial for CSPs who engage in digital transformation, including 5G, enabled by Software Defined Networking (SDN) and Network Functions Virtualization (NFV). To avoid customer churn and financial implications, it is required to detect and remediate network or performance issues not only at the network operations level but also at service and customer satisfaction levels. CSPs tend to fulfill orders on time and provide efficient and cost-effective services. Apart from managing orders efficiently, service assurance solution providers help telecommunication providers, internet service providers, and similar vendor companies with the capability to find the faults that take place while delivering any service, network management, and workforce automation.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 has impacted the global economy. It has had a significant economic impact on various financial and industrial sectors, such as energy, oil and gas, transportation and logistics, manufacturing, and aviation. It is predicted that the global economy will go into recession due to the loss of trillions of dollars. With the increasing number of countries imposing and extending lockdowns, economic activities are declining, which would impact the global economy. Every individual and government, irrespective of federal, state, central, local, and provinces, has been in constant touch with one other in the society to provide and get real-time information on COVID-19.

COVID-19 cases are growing day-by-day, as several infected cases have been on the rise. In line with individuals, COVID-19 has a massive impact on large enterprises and SMEs. Core industries, such as manufacturing, automotive, textile, transportation and logistics, travel and hospitality, and consumer goods, have been closed due to country-level lockdown across the globe. This would have a substantial impact on the global economy in terms of the decline in GDP. Since ages, SMEs are acting as the backbone of the economy. In the current situation, SMEs are the most affected due to the COVID-19 pandemic.

Market Dynamics

Driver: Technology enhancement forcing individuals to adapt to the latest technologies

Technology enhancements play an important role when an organization wants to increase its revenue. It is used for tracking customer needs that are expressed through different channels. These channels can be a platform-based approach, which will help telecom companies improve customer satisfaction and hence improve revenues. It is really important for telecom companies to relook at the telecom service assurance strategy. Traditionally contact centers could manage telecom customer queries. But the changing world have forced the telecom companies to reconsider and reorganize their business to remain in competition with the digital market.

Restraint: Issues with compatibility

When integrating the information to a telecom service assurance system, the most common issue faced by the customer is the issue of compatibility. This issue occurs when information from one system cannot operate satisfactorily on the other system. It is possible that some software components or systems may be compatible in one environment and incompatible in another. Training costs are also reduced if various systems are compatible. In particular, if all software in use is from the same supplier, common commands and processes will generally apply throughout, thus making it easier for users to be trained and become used to them.

Opportunity: Increased mobile communication in various businesses

The speed and reliability of mobile communication are expected to have a massive impact on Machine-to-Machine (M2M) and IoT. This requires smooth communication and assurance of network so that the communication is not broken in between. To achieve effective machine-to-machine communication, the existing capacity of mobile networks must be able to handle billions of nodes that are expected to increase in the next couple of years. Currently, the network capacity is inefficient to handle M2M and human-based communications as well as their different communication patterns, such as latency time.

Challenge: In-house service assurance solutions used by service providers

Many CSPs use some form of home-grown or commercial tools to address key areas, such as network management, trouble ticketing, fault management, outages, and service management. However, these tools help identify and fix service network and performance issues, but service-affecting issues are still not addressed. This leads to increased consumer dissatisfaction and a high churn rate. As home networks continue to evolve, the complexity of monitoring and managing the network increases. To address this challenge, operators need efficient telecom service assurance solutions that address service quality issues and help meet customer expectations.

The services to record a higher growth rate during the forecast period

In the telecom service assurance market by component, the services is expected to record a higher growth rate during the forecast period. The services segment has a key role to play in the telecom service assurance market. With the increasing adoption of telecom service assurance solutions among CSPs, the demand for support services is expected to gain traction among organizations. The telecom service assurance market based on services is segmented into professional services and managed services. The services market holds a substantial share of the total telecom service assurance market and is expected to grow at a high rate.

To know about the assumptions considered for the study, download the pdf brochure

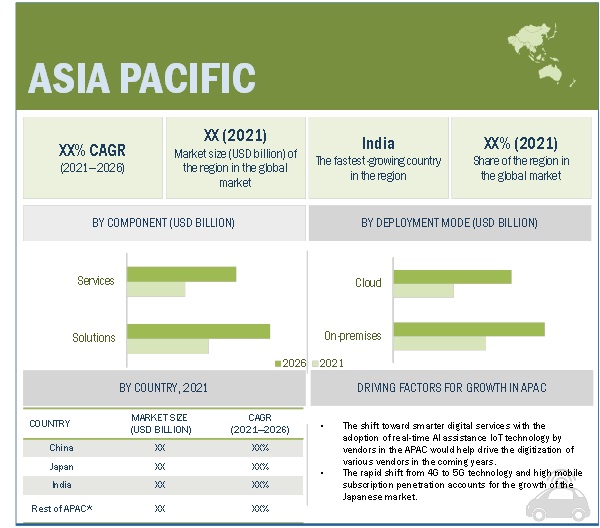

APAC to account for the highest market growth during the forecast period

APAC is expected to grow at the highest CAGR during the forecast period. Asian telecom service providers, vendors, and government firms are determined to take the lead in 5G research and deployment. Various countries in Asia have either initialized the implementation of smart city projects or are in the planning phase. China is the biggest marketplace in APAC for the development of smart cities. Delivering new video services through enhanced broadband was cited as the most important use case in APAC. Key drivers in Japan and South Korea are connected vehicles and IIoT, while connected healthcare is the most important driver in India, Australia, and Vietnam.

Market Players

The report covers the competitive landscape and profiles major market players, as NEC (Japan), Ericsson (Sweden), Amdocs (UK), NETSCOUT (US), Broadcom (US), HPE (US), Accenture (Ireland), Comarch (Poland), Huawei (China), Nokia (Finland), IBM (US), Intracom Telecom (Greece), Spirent (UK), TEOCO (US), EXFO (Canada), VMware (US), Cisco (US), CommScope (US), Anritsu (Japan), VIAVI Solutions (US), Enghouse Networks (Canada), MYCOM OSI (UK), RADCOM (Israel), Infovista (France), SysMech (UK), Itential (US), Aspire Technology (Ireland), Anodot (US), Matellio (US), Stixis (US). These players have adopted several organic and inorganic growth strategies, including new product launches, partnerships and collaborations, and acquisitions, to expand their offerings and market shares in the global Telecom service assurance market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2015-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Component, operator type, Deployment type, Organisation Size |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

NEC (Japan), Ericsson (Sweden), Amdocs (UK), NETSCOUT (US), Broadcom (US), HPE (US), Accenture (Ireland), Comarch (Poland), Huawei (China), Nokia (Finland), IBM (US), Intracom Telecom (Greece), Spirent (UK), TEOCO (US), EXFO (Canada), VMware (US), Cisco (US), CommScope (US), Anritsu (Japan), VIAVI Solutions (US), Enghouse Networks (Canada), MYCOM OSI (UK), RADCOM (Israel), Infovista (France), SysMech (UK), Itential (US), Aspire Technology (Ireland), Anodot (US), Matellio (US), Stixis (US) |

This research report categorizes the telecom service assurance to forecast revenue and analyze trends in each of the following submarkets:

Based on Component:

-

Solution

- Fault and Event Management

- Performance Management

- Quality and Service Management

- Intelligent Assurance and Analytics

-

Services

- Professional services

- Managed services

Based on Operator type:

- Mobile Operator

- Fixed Operator

Based on Deployment type:

- On-Premises

- Cloud

Based on Organisation Size:

- Small and Medium Enterprises

- Large Enterprises

Based on Regions:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments:

- In March 2021, NEC and Etisalat collaborated to help Etisalat complement its strategy of bringing new and innovative 5G services to market. This includes the automation of 5G slicing within a multi-vendor, cloud-native 5G core environment, and across the entire network. These functions can also be extended to the network edge to enable new high value 5G services and applications that require Multi-access Edge Computing (MEC) to meet Etisalat's stringent quality of experience needs.

- In April 2021, US Cellular collaborated with Ericsson to support increased mobile broadband capacity to customers in parts of Wisconsin, Iowa, Illinois, New Hampshire, Maine, and North Carolina, due to the increased demand for data usage during the pandemic.

- In March 2020, Amdocs and Google Cloud announced a strategic partnership to deliver Amdocs’ leading OSS and BSS systems on Google Cloud and create solutions and services to help communications companies modernize, automate, and digitize with the cloud.

Frequently Asked Questions (FAQ):

How big is the telecom service assurance market?

What is growth rate of the telecom service assurance market?

What are the solutions in telecom service assurance market?

Who are the key players in telecom service assurance market?

Who will be the leading hub for telecom service assurance market?

What is the telecom service assurance market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 6 GLOBAL TELECOM SERVICE ASSURANCE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

FIGURE 7 BREAKUP OF PROFILES OF PRIMARY PARTICIPANTS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 TOP-DOWN APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 3 TOP-DOWN (DEMAND SIDE): SHARE OF TELECOM SERVICE ASSURANCE THROUGH THE OVERALL TELECOM SERVICE ASSURANCE SPENDING

2.3.2 BOTTOM-UP APPROACH

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY ?APPROACH 1 (SUPPLY SIE): REVENUE OF SOLUTIONS/SERVICES OF THE TELECOM SERVICE ASSURANCE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 2 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF THE MARKET

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 12 TELECOM SERVICE ASSURANCE MARKET SIZE, 2019–2026

FIGURE 13 LARGEST SEGMENTS IN THE MARKET, 2021

FIGURE 14 MARKET ANALYSIS, 2021

FIGURE 15 ASIA PACIFIC TO BE THE BEST MARKET FOR INVESTMENTS DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE OPPORTUNITIES IN THE TELECOM SERVICE ASSURANCE MARKET

FIGURE 16 LARGE-SCALE IMPLEMENTATION OF SDN AND NFV TO DRIVE THE GROWTH OF THE MARKET

4.2 NORTH AMERICAN MARKET, 2021

FIGURE 17 SOLUTIONS SEGMENT AND UNITED STATES TO HOLD LARGEST MARKET SHARES DURING THE FORECAST PERIOD

4.3 ASIA PACIFIC MARKET, 2021

FIGURE 18 SOLUTIONS SEGMENT AND CHINA TO HOLD LARGEST MARKET SHARES DURING THE FORECAST PERIOD

4.4 MARKET, BY COUNTRY

FIGURE 19 INDIA TO PROVIDE WHOLESOME OPPORTUNITIES FOR GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: TELECOM SERVICE ASSURANCE MARKET

5.2.1 DRIVERS

5.2.1.1 Operators’ growing need to automate network operations due to high customer churn and low ARPU from voice and data services

FIGURE 21 SUBSCRIBER PENETRATION AND SMARTPHONE ADOPTION TRENDS BY 2025

5.2.1.2 Large-scale implementation of SDN and NFV

5.2.1.3 Technology enhancement forcing individuals to adapt to the latest technologies

5.2.2 RESTRAINTS

5.2.2.1 Concerns over data privacy

5.2.2.2 Issues with compatibility

5.2.3 OPPORTUNITIES

5.2.3.1 Growing complexities in communication network ecosystem by IoT and 5G technologies

FIGURE 22 NUMBER OF IOT CONNECTIONS BY 2025 (BILLION)

5.2.3.2 COVID-19: Need for network resiliency and the push for telecom service providers to transform their business model as digital service providers

5.2.3.3 Demand for SDN and NFV-based cloud-native solutions to replace traditional networking model

5.2.3.4 Increasing mobile communication in various businesses

FIGURE 23 CELLULAR IOT CONNECTIONS, 2018 VS. 2024

5.2.4 CHALLENGES

5.2.4.1 Complexity and cost involved in upgrading traditional network infrastructure

5.2.4.2 In-house service assurance solutions used by service providers

5.2.4.3 Exponential increase in network traffic with large customer churn and fall in exchange rates due to COVID-19 pandemic

5.3 INDUSTRY TRENDS

5.3.1 VALUE CHAIN ANALYSIS

FIGURE 24 TELECOM SERVICE ASSURANCE MARKET: VALUE CHAIN

5.3.2 ECOSYSTEM

TABLE 4 MARKET: ECOSYSTEM

5.3.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 IMPACT OF EACH FORCE ON THE MARKET

5.3.3.1 Threat of new entrants

5.3.3.2 Threat of substitutes

5.3.3.3 Bargaining power of suppliers

5.3.3.4 Bargaining power of buyers

5.3.3.5 Degree of competition

5.3.4 TECHNOLOGY ANALYSIS

5.3.4.1 Big data and Analytics

5.3.4.2 Cloud Computing

5.3.4.3 AI and ML

5.3.4.4 5G

5.3.4.5 Internet of Things

5.3.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS/BUYERS

FIGURE 25 TRENDS/DISTRUPTIONS IMPACTING BUYERS IN THE TELECOM SERVICE ASSURANCE MARKET

5.3.6 PATENT ANALYSIS

FIGURE 26 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 6 TOP TWENTY PATENT OWNERS IN THE MARKET

FIGURE 27 NUMBER OF PATENTS GRANTED IN A YEAR OVER THE LAST TEN YEARS

5.3.7 AVERAGE SELLING PRICE ANALYSIS

TABLE 7 AVERAGE SELLING PRICE RANGES OF THE SUBSCRIPTION-BASED TELECOM SERVICE ASSURANCE SYSTEMS

5.3.8 USE CASES

TABLE 8 USE CASE 1: COMARCH

TABLE 9 USE CASE 2: AMDOCS

TABLE 10 USE CASE 3: COMARCH

TABLE 11 USE CASE 4: HUAWEI

TABLE 12 USE CASE 5: HUAWEI

5.4 COVID-19 PANDEMIC-DRIVEN MARKET DYNAMICS AND FACTOR ANALYSIS

5.4.1 OVERVIEW

5.4.2 DRIVERS AND OPPORTUNITIES

5.4.3 RESTRAINTS AND CHALLENGES

5.4.4 CUMULATIVE GROWTH ANALYSIS

TABLE 13 MARKET: CUMULATIVE GROWTH ANALYSIS

6 TELECOM SERVICE ASSURANCE MARKET, BY COMPONENT (Page No. - 81)

6.1 INTRODUCTION

FIGURE 28 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 14 MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 15 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 SOLUTIONS

6.2.1 SOLUTIONS: MARKET DRIVERS

6.2.2 SOLUTIONS: COVID-19 IMPACT

FIGURE 29 INTELLIGENT ASSURANCE AND ANALYTICS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 16 MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 17 MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 18 SOLUTIONS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 19 SOLUTIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.3 FAULT AND EVENT MANAGEMENT

TABLE 20 FAULT AND EVENT MANAGEMENT: TELECOM SERVICE ASSURANCE MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 21 FAULT AND EVENT MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.4 PERFORMANCE MANAGEMENT

TABLE 22 PERFORMANCE MANAGEMENT: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 23 PERFORMANCE MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.5 QUALITY AND SERVICE MANAGEMENT

TABLE 24 QUALITY AND SERVICE MANAGEMENT: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 25 QUALITY AND SERVICE MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.6 INTELLIGENT ASSURANCE AND ANALYTICS

TABLE 26 INTELLIGENT ASSURANCE AND ANALYTICS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 27 INTELLIGENT ASSURANCE AND ANALYTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

6.3.1 SERVICES: TELECOM SERVICE ASSURANCE MARKET DRIVERS

6.3.2 SERVICES: COVID-19 IMPACT

FIGURE 30 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 28 MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 29 MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 30 SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 31 SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.3 PROFESSIONAL SERVICES

TABLE 32 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 33 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.4 MANAGED SERVICES

TABLE 34 MANAGED SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 35 MANAGED SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 TELECOM SERVICE ASSURANCE MARKET, BY OPERATOR TYPE (Page No. - 95)

7.1 INTRODUCTION

FIGURE 31 MOBILE OPERATOR SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 36 MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 37 MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

7.2 MOBILE OPERATOR

7.2.1 MOBILE OPERATOR: MARKET DRIVERS

7.2.2 MOBILE OPERATOR: COVID-19 IMPACT

TABLE 38 MOBILE OPERATOR: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 39 MOBILE OPERATOR: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 FIXED OPERATOR

7.3.1 FIXED OPERATOR: MARKET DRIVERS

7.3.2 FIXED OPERATOR: COVID-19 IMPACT

TABLE 40 FIXED OPERATOR: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 41 FIXED OPERATOR: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 TELECOM SERVICE ASSURANCE MARKET, BY DEPLOYMENT MODE (Page No. - 101)

8.1 INTRODUCTION

FIGURE 32 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 42 MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 43 MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

8.2 ON-PREMISES

8.2.1 ON-PREMISES: MARKET DRIVERS

8.2.2 ON-PREMISES: COVID-19 IMPACT

TABLE 44 ON-PREMISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 45 ON-PREMISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 CLOUD

8.3.1 CLOUD: MARKET DRIVERS

8.3.2 CLOUD: COVID-19 IMPACT

TABLE 46 CLOUD: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 47 CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 TELECOM SERVICE ASSURANCE MARKET, BY ORGANIZATION SIZE (Page No. - 108)

9.1 INTRODUCTION

FIGURE 33 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 48 MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 49 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

9.2.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

9.2.2 SMALL AND MEDIUM-SIZED ENTERPRISES: COVID-19 IMPACT

TABLE 50 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 51 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 LARGE ENTERPRISES

9.3.1 LARGE ENTERPRISES: MARKET DRIVERS

9.3.2 LARGE ENTERPRISES: COVID-19 IMPACT

TABLE 52 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 53 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 TELECOM SERVICE ASSURANCE MARKET, BY REGION (Page No. - 113)

10.1 INTRODUCTION

FIGURE 34 NORTH AMERICA TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 54 MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 55 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

FIGURE 35 ASIA PACIFIC TO BE THE FASTEST-GROWING MARKET DURING THE FORECAST PERIOD

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: REGULATIONS

10.2.3 NORTH AMERICA: IMPACT OF COVID-19

FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

TABLE 56 NORTH AMERICA: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.2.4 UNITED STATES

10.2.4.1 Smart Infrastructure in the US to boost the adoption of 5G

TABLE 70 UNITED STATES: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 71 UNITED STATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 72 UNITED STATES: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 73 UNITED STATES: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 74 UNITED STATES: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 75 UNITED STATES: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 76 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 77 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 78 UNITED STATES: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 79 UNITED STATES: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 80 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 81 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.2.5 CANADA

10.2.5.1 Focus of the Canadian Government on the development of the 5G network across the country

TABLE 82 CANADA: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 83 CANADA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 84 CANADA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 85 CANADA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 86 CANADA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 87 CANADA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 88 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 89 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 90 CANADA: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 91 CANADA: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 92 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 93 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: REGULATIONS

10.3.3 EUROPE: IMPACT OF COVID-19

TABLE 94 EUROPE: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 96 EUROPE: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 97 EUROPE: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 99 EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.4 UNITED KINGDOM

10.3.4.1 Enterprises to adopt digital transformation initiatives in the UK

TABLE 108 UNITED KINGDOM: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 109 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 110 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 111 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 112 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 113 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 114 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 115 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 116 UNITED KINGDOM: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 117 UNITED KINGDOM: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 118 UNITED KINGDOM: SSURANCE MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 119 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.3.5 GERMANY

10.3.5.1 Large amount of data generated by IIoT 2.0 in Germany

TABLE 120 GERMANY: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 121 GERMANY: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 122 GERMANY: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 123 GERMANY: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 124 GERMANY: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 125 GERMANY: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 126 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 127 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 128 GERMANY: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 129 GERMANY: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 130 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 131 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.3.6 FRANCE

10.3.6.1 Government of France to focus on smart cities’ development and manufacturing companies that can use IoT

TABLE 132 FRANCE: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 133 FRANCE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 134 FRANCE: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 135 FRANCE: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 136 FRANCE: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 137 FRANCE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 138 FRANCE: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 139 FRANCE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 140 FRANCE: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 141 FRANCE: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 142 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 143 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.3.7 REST OF EUROPE

TABLE 144 REST OF EUROPE: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 145 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 146 REST OF EUROPE: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 147 REST OF EUROPE: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 148 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 149 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 150 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 151 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 152 REST OF EUROPE: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 153 REST OF EUROPE: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 154 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 155 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

10.4.2 ASIA PACIFIC: REGULATIONS

10.4.3 ASIA PACIFIC: IMPACT OF COVID-19

FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 156 ASIA PACIFIC: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 165 ASIA PACIFIC: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 166 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 167 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 168 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 169 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.4.4 CHINA

10.4.4.1 Rapid implementation of 5G in the near future in China

TABLE 170 CHINA: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 171 CHINA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 172 CHINA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 173 CHINA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 174 CHINA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 175 CHINA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 176 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 177 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 178 CHINA: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 179 CHINA: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 180 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 181 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.4.5 JAPAN

10.4.5.1 Telecom service providers to invest highly in telecom service assurance solutions

TABLE 182 JAPAN: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 183 JAPAN: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 184 JAPAN: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 185 JAPAN: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 186 JAPAN: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 187 JAPAN: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 188 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 189 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 190 JAPAN: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 191 JAPAN: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 192 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 193 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.4.6 INDIA

10.4.6.1 India is an emerging country in terms of 5G deployments

TABLE 194 INDIA: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 195 INDIA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 196 INDIA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 197 INDIA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 198 INDIA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 199 INDIA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 200 INDIA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 201 INDIA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 202 INDIA: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 203 INDIA: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 204 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 205 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.4.7 REST OF ASIA PACIFIC

TABLE 206 REST OF ASIA PACIFIC: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 207 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 208 REST OF ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 209 REST OF ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 210 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 211 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 212 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 213 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 214 REST OF ASIA PACIFIC: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 215 REST OF ASIA PACIFIC: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 216 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 217 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: REGULATIONS

10.5.3 MIDDLE EAST AND AFRICA: IMPACT OF COVID-19

TABLE 218 MIDDLE EAST AND AFRICA: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 219 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 220 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 221 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 222 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 223 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 224 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 225 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 226 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 227 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 228 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 229 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 230 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SUB-REGION, 2015–2020 (USD MILLION)

TABLE 231 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SUB-REGION, 2021–2026 (USD MILLION)

10.5.4 MIDDLE EAST AND NORTH AFRICA

10.5.4.1 GCC countries to majorly focus on technological advancements and smart cities

TABLE 232 MIDDLE EAST AND NORTH AFRICA: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 233 MIDDLE EAST AND NORTH AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 234 MIDDLE EAST AND NORTH AFRICA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 235 MIDDLE EAST AND NORTH AFRICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 236 MIDDLE EAST AND NORTH AFRICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 237 MIDDLE EAST AND NORTH AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 238 MIDDLE EAST AND NORTH AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 239 MIDDLE EAST AND NORTH AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 240 MIDDLE EAST AND NORTH AFRICA: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 241 MIDDLE EAST AND NORTH AFRICA: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 242 MIDDLE EAST AND NORTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 243 MIDDLE EAST AND NORTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.5.5 SUB-SAHARAN AFRICA

10.5.5.1 Investments in Sub-Saharan Africa to boost the market

TABLE 244 SUB-SAHARAN AFRICA: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 245 SUB-SAHARAN AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 246 SUB-SAHARAN AFRICA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 247 SUB-SAHARAN AFRICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 248 SUB-SAHARAN AFRICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 249 SUB-SAHARAN AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 250 SUB-SAHARAN AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 251 SUB-SAHARAN AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 252 SUB-SAHARAN AFRICA: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 253 SUB-SAHARAN AFRICA: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 254 SUB-SAHARAN AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 255 SUB-SAHARAN AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: REGULATIONS

10.6.3 LATIN AMERICA: IMPACT OF COVID-19

TABLE 256 LATIN AMERICA: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 257 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 258 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 259 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 260 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 261 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 262 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 263 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 264 LATIN AMERICA: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 265 LATIN AMERICA: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 266 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 267 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 268 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 269 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.6.4 MEXICO

10.6.4.1 Major telecom companies in Latin America are based in Mexico

TABLE 270 MEXICO: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 271 MEXICO: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 272 MEXICO: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 273 MEXICO: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 274 MEXICO: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 275 MEXICO: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 276 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 277 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 278 MEXICO: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 279 MEXICO: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 280 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 281 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.6.5 BRAZIL

10.6.5.1 Brazil has been investing heavily to develop its network infrastructure

TABLE 282 BRAZIL: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 283 BRAZIL: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 284 BRAZIL: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 285 BRAZIL: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 286 BRAZIL: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 287 BRAZIL: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 288 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 289 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 290 BRAZIL: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 291 BRAZIL: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 292 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 293 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.6.6 REST OF LATIN AMERICA

TABLE 294 REST OF LATIN AMERICA: TELECOM SERVICE ASSURANCE MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 295 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 296 REST OF LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 297 REST OF LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 298 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 299 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 300 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 301 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 302 REST OF LATIN AMERICA: MARKET SIZE, BY OPERATOR TYPE, 2015–2020 (USD MILLION)

TABLE 303 REST OF LATIN AMERICA: MARKET SIZE, BY OPERATOR TYPE, 2021–2026 (USD MILLION)

TABLE 304 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 305 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 201)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 38 MARKET EVALUATION FRAMEWORK, 2019–2021

11.3 KEY MARKET DEVELOPMENTS

11.3.1 PRODUCT LAUNCHES

TABLE 306 TELECOM SERVICE ASSURANCE MARKET: PRODUCT LAUNCHES, FEBRUARY 2019–OCTOBER 2021

11.3.2 DEALS

TABLE 307 MARKET: DEALS, DECEMBER 2020–OCTOBER 2021

11.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 308 MARKET: DEGREE OF COMPETITION

FIGURE 39 MARKET SHARE ANALYSIS OF COMPANIES IN THE MARKET

11.5 HISTORICAL REVENUE ANALYSIS

FIGURE 40 HISTORICAL REVENUE ANALYSIS, 2018–2020

11.6 COMPANY EVALUATION MATRIX OVERVIEW

11.7 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 309 PRODUCT FOOTPRINT WEIGHTAGE

11.7.1 STAR

11.7.2 EMERGING LEADERS

11.7.3 PERVASIVE

11.7.4 PARTICIPANTS

FIGURE 41 TELECOM SERVICE ASSURANCE MARKET, COMPANY EVALUATION MATRIX, 2021

11.8 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 310 COMPANY PRODUCT FOOTPRINT

TABLE 311 COMPANY OFFERING FOOTPRINT

TABLE 312 COMPANY ORGANIZATION SIZE FOOTPRINT

TABLE 313 COMPANY REGION FOOTPRINT

11.9 COMPANY MARKET RANKING ANALYSIS

FIGURE 42 RANKING OF KEY PLAYERS IN THE MARKET, 2021

11.10 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 314 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.10.1 PROGRESSIVE COMPANIES

11.10.2 RESPONSIVE COMPANIES

11.10.3 DYNAMIC COMPANIES

11.10.4 STARTING BLOCKS

FIGURE 43 TELECOM SERVICE ASSURANCE MARKET (GLOBAL): STARTUP/SME EVALUATION MATRIX, 2021

12 COMPANY PROFILES (Page No. - 218)

(Business overview, Products offered, Recent Developments, MNM view)*

12.1 MAJOR PLAYERS

12.1.1 NEC

TABLE 315 NEC: BUSINESS OVERVIEW

FIGURE 44 NEC: COMPANY SNAPSHOT

TABLE 316 NEC: PRODUCTS OFFERED

TABLE 317 NEC: MARKET: DEALS

12.1.2 ERICSSON

TABLE 318 ERICSSON: BUSINESS OVERVIEW

FIGURE 45 ERICSSON: COMPANY SNAPSHOT

TABLE 319 ERICSSON: PRODUCTS OFFERED

TABLE 320 ERICSSON: MARKET: PRODUCT LAUNCHES

TABLE 321 ERICSSON: TELECOM SERVICE ASSURANCE MARKET: DEALS

12.1.3 AMDOCS

TABLE 322 AMDOCS: BUSINESS OVERVIEW

FIGURE 46 AMDOCS: COMPANY SNAPSHOT

TABLE 323 AMDOCS: PRODUCTS OFFERED

TABLE 324 AMDOCS: MARKET: PRODUCT LAUNCHES

TABLE 325 AMDOCS: MARKET: DEALS

12.1.4 NETSCOUT

TABLE 326 NETSCOUT: BUSINESS OVERVIEW

FIGURE 47 NETSCOUT: COMPANY SNAPSHOT

TABLE 327 NETSCOUT: PRODUCTS OFFERED

TABLE 328 NETSCOUT: RANCE MARKET: PRODUCT LAUNCHES

TABLE 329 NETSCOUT: MARKET: DEALS

12.1.5 BROADCOM

TABLE 330 BROADCOM: BUSINESS OVERVIEW

FIGURE 48 BROADCOM: COMPANY SNAPSHOT

TABLE 331 BROADCOM: PRODUCTS OFFERED

TABLE 332 BROADCOM: TELECOM SERVICE ASSURANCE MARKET: PRODUCT LAUNCHES

TABLE 333 BROADCOM: MARKET: DEALS

12.1.6 HPE

TABLE 334 HPE: BUSINESS OVERVIEW

FIGURE 49 HPE: COMPANY SNAPSHOT

TABLE 335 HPE: PRODUCTS OFFERED

TABLE 336 HPE: MARKET: PRODUCT LAUNCHES

TABLE 337 HPE: MARKET: DEALS

12.1.7 ACCENTURE

TABLE 338 ACCENTURE: BUSINESS OVERVIEW

FIGURE 50 ACCENTURE: COMPANY SNAPSHOT

TABLE 339 ACCENTURE: PRODUCTS OFFERED

TABLE 340 ACCENTURE: MARKET: DEALS

12.1.8 COMARCH

TABLE 341 COMARCH: BUSINESS OVERVIEW

FIGURE 51 COMARCH: COMPANY SNAPSHOT

TABLE 342 COMARCH: PRODUCTS OFFERED

TABLE 343 COMARCH: TELECOM SERVICE ASSURANCE MARKET: DEALS

12.1.9 HUAWEI

TABLE 344 HUAWEI: BUSINESS OVERVIEW

FIGURE 52 HUAWEI: COMPANY SNAPSHOT

TABLE 345 HUAWEI: PRODUCTS OFFERED

TABLE 346 HUAWEI: MARKET: PRODUCT LAUNCHES

TABLE 347 HUAWEI: MARKET: DEALS

12.1.10 NOKIA

TABLE 348 NOKIA: BUSINESS OVERVIEW

FIGURE 53 NOKIA: COMPANY SNAPSHOT

TABLE 349 NOKIA: PRODUCTS OFFERED

TABLE 350 NOKIA: MARKET: PRODUCT LAUNCHES

TABLE 351 NOKIA: MARKET: DEALS

12.1.11 IBM

12.1.12 INTRACOM TELECOM

12.1.13 SPIRENT

12.1.14 TEOCO

12.1.15 EXFO

12.1.16 VMWARE

12.1.17 CISCO

12.1.18 COMMSCOPE

12.1.19 ANRITSU

12.1.20 VIAVI SOLUTIONS

12.1.21 ENGHOUSE NETWORKS

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12.2 SME/STARTUP PLAYERS

12.2.1 MYCOM OSI

12.2.2 RADCOM

12.2.3 INFOVISTA

12.2.4 SYSMECH

12.2.5 ITENTIAL

12.2.6 ASPIRE TECHNOLOGY

12.2.7 STIXIS

12.2.8 ANODOT

12.2.9 MATELLIO

13 ADJACENT/RELATED MARKET (Page No. - 279)

13.1 INTRODUCTION

13.1.1 LIMITATIONS

13.2 NETWORK ANALYTICS MARKET—GLOBAL FORECAST 2024

13.2.1 MARKET DEFINITION

13.2.2 MARKET OVERVIEW

TABLE 352 GLOBAL NETWORK ANALYTICS MARKET SIZE AND GROWTH RATE, 2017–2024 (USD MILLION AND Y-O-Y %)

13.2.2.1 Network analytics market, by component

TABLE 353 NETWORK ANALYTICS MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 354 NETWORK ANALYTICS MARKET SIZE, BY SERVICE, 2017–2024 (USD MILLION)

TABLE 355 NETWORK ANALYTICS MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2024 (USD MILLION)

13.2.2.2 Network analytics market, by deployment mode

TABLE 356 NETWORK ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2017–2024 (USD MILLION)

13.2.2.3 Network analytics market, by organization size

TABLE 357 NETWORK ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

13.2.2.4 Network analytics market, by end user

TABLE 358 NETWORK ANALYTICS MARKET SIZE, BY END USER, 2017–2024 (USD MILLION)

13.2.2.5 Network analytics market, by application

TABLE 359 NETWORK ANALYTICS MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

13.2.2.6 Network analytics market, by region

TABLE 360 NETWORK ANALYTICS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 361 NORTH AMERICA: NETWORK ANALYTICS MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 362 EUROPE: NETWORK ANALYTICS MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 363 ASIA PACIFIC: NETWORK ANALYTICS MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 364 MIDDLE EAST AND AFRICA: NETWORK ANALYTICS MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 365 LATIN AMERICA: NETWORK ANALYTICS MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

13.3 NETWORK MANAGEMENT SYSTEM MARKET – GLOBAL FORECAST 2024

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

TABLE 366 GLOBAL NETWORK MANAGEMENT SYSTEM MARKET SIZE AND GROWTH RATE, 2017–2024 (USD MILLION AND Y-O-Y %)

13.3.2.1 Network management system market, by component

TABLE 367 NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 368 NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY SOLUTION, 2017–2024 (USD MILLION)

TABLE 369 NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY SERVICE, 2017–2024 (USD MILLION)

13.3.2.2 Network management system market, by deployment mode

TABLE 370 NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY DEPLOYMENT MODE, 2017–2024 (USD MILLION)

13.3.2.3 Network Management System market, by organization size

TABLE 371 NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

13.3.2.4 Network management system market, by end user

TABLE 372 NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY END USER, 2017–2024 (USD MILLION)

13.3.2.5 Network management system market, by service provider

TABLE 373 NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY SERVICE PROVIDER, 2017–2024 (USD MILLION)

13.3.2.6 Network management system market, by vertical

TABLE 374 NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

13.3.2.7 Network management system market, by region

TABLE 375 NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 376 NORTH AMERICA: NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 377 EUROPE: NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 378 ASIA PACIFIC: NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 379 MIDDLE EAST AND AFRICA: NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 380 LATIN AMERICA: NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

13.4 AI IN TELECOMMUNICATION MARKET—GLOBAL FORECAST 2022

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

TABLE 381 GLOBAL AI IN TELECOMMUNICATION MARKET SIZE AND GROWTH RATE, 2015–2022 (USD MILLION AND Y-O-Y %)

13.4.2.1 AI in the telecommunication market, by technology

TABLE 382 AI IN TELECOMMUNICATION MARKET SIZE, BY TECHNOLOGY, 2015–2022 (USD MILLION)

13.4.2.2 AI in the telecommunication market, by application

TABLE 383 AI IN TELECOMMUNICATION MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

13.4.2.3 AI in the telecommunication market, by component

TABLE 384 AI IN TELECOMMUNICATION MARKET SIZE, BY COMPONENT, 2015–2022 (USD MILLION)

TABLE 385 SOLUTIONS: AI IN TELECOMMUNICATION MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 386 SERVICES: AI IN TELECOMMUNICATION MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

13.4.2.4 AI in the telecommunication market, by deployment mode

TABLE 387 AI IN TELECOMMUNICATION MARKET SIZE, BY DEPLOYMENT MODE, 2015–2022 (USD MILLION)

13.4.2.5 AI in the telecommunication market, by region

TABLE 388 AI IN TELECOMMUNICATION MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 389 NORTH AMERICA: AI IN TELECOMMUNICATION MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 390 EUROPE: AI IN TELECOMMUNICATION MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 391 ASIA PACIFIC: AI IN TELECOMMUNICATION MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 392 MIDDLE EAST AND AFRICA: AI IN TELECOMMUNICATION MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 393 LATIN AMERICA: AI IN TELECOMMUNICATION MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

14 APPENDIX (Page No. - 303)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

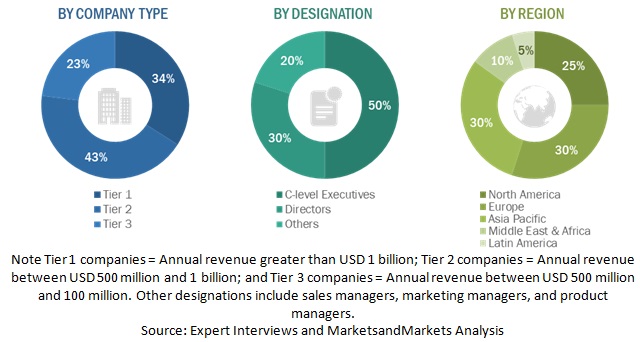

This research study involved the Extensive secondary sources, directories, and databases, such as Factiva, Hoovers, GSM Association, GSMA Intelligence, and Bloomberg Businessweek, were used to identify and collect information useful for this comprehensive market research study on the global telecom service assurance market. The primary sources were mainly various industry experts from core and related industries, preferred telecom service assurance and service vendors, third-party system integrators, and commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, as well as assess the market’s prospects. Various macro and microeconomic factors were considered for constructing the global market. The following illustrative figure shows the market research methodology applied in making this report on the global telecom service assurance market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources. Moreover, journals and telecom blogs, such as GSMA Intelligence, Farm Journal Media, AI Time Journal, Mobile Marketing Association, and The Next Web, have been referred to for consolidating the report. Secondary research was mainly used to obtain key information about the industry insights, market’s monetary chain, overall pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both demand and supply sides were interviewed to obtain qualitative and quantitative information for the global telecom service assurance report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the global telecom service assurance market. After the complete market engineering process (which included calculations for market statistics, market breakup, market size estimation, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the numbers arrived at through the estimation process. Primary research was also conducted to identify the segmentation types; industry trends; key players; competitive landscape of the major telecom service assurance market vendors; and key market dynamics, such as drivers, restraints, opportunities; and key strategies.

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the CEM market and various other dependent submarkets in the overall market. In the top-down approach, an exhaustive list of all the vendors who offer software and services in the telecom service assurance market was prepared. The revenue contribution for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on their products/services by technology, component, industry vertical, and region. The aggregate of all companies’ revenue was extrapolated to reach the overall market size. Furthermore, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives. These market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation. In the bottom-up approach, the adoption of telecom service assurance products and services in different end users in key countries with respect to their region that contributes to the majority of the market share was identified. Furthermore, for cross-validation, the adoption of telecom service assurance products and services in different industries along with different use cases with respect to their region has been identified and extrapolated. In addition, weightage has been given to the use cases identified in different regions for the calculation. Based on these numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the telecom service assurance market’s regional penetration. Based on the secondary research, the regional spending on Artificial Intelligence (AI), big data and Information and Communications Technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of the major telecom service assurance providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and validation of data through primaries, the exact values of the overall telecom service assurance market size and its segments’ market size were determined and confirmed using this study.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub segments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the telecom service assurance market based on component, Operator type, deployment type, organisation size with regions covered.

- To forecast the size of the market segments with respect to five regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To provide detailed information related to the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the global market.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global telecom service assurance market.

- To profile the key market players, such as top and emerging vendors; provide a comparative analysis based on their business overviews, regional presence, product offerings, and business strategies; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments in the market, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (Up to 5)

Geographic Analysis

- Further breakdown of the European Telecom service assurance Market

- Further breakdown of the APAC Market

- Further breakdown of the MEA Market

- Further breakdown of the Latin American Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Telecom Service Assurance Market