Textile Yarn Market by Source (Chemical, Plant, Animal), Type (Artificial, Natural), Application (Apparel, Home Textile, Industrial), and Region (North America, Europe, Asia Pacific, Rest of the World) - Global Forecast to 2028

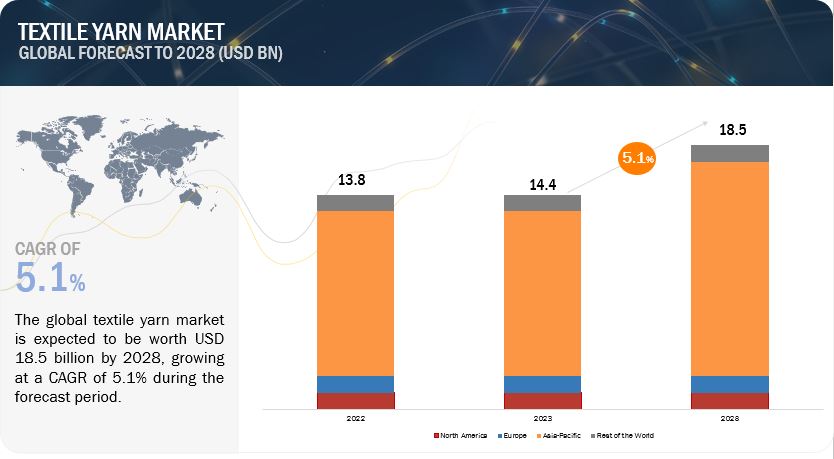

The global textile yarn market is projected to reach USD 18.5 billion by 2028 from USD 14.4 billion by 2023, at a CAGR of 5.1% during the forecast period in terms of value. The market has witnessed significant growth and established its dominance in the global textile industry. With the ever-increasing demand for textiles and a variety of applications, the market has experienced a surge in production and consumption of yarns. According to OECD, Asia’s share of total middle-class consumer spending worldwide will be 42% by 2020, which may rise to 59% by 2030. Thus, as the middle-class population expands and consumer spending power rises, individuals have more disposable income to spend on various goods, including textiles and clothing. This increased purchasing power directly translates into higher demand for textile products, which, in turn, drives the demand for textile yarns.

Moreover, the industry's focus on sustainability and eco-friendly practices has led to the development of yarns made from recycled fibers and organic materials, further driving market growth. With a global presence and trade networks, the market has become a competitive and dynamic landscape, with key players constantly striving to meet the demands of the textile industry and maintain their dominance in the market. As emerging markets continue to witness rapid urbanization and economic growth, the textile yarn market is poised for further expansion and is expected to retain its position as a crucial component of the global textile sector.

To know about the assumptions considered for the study, Request for Free Sample Report

Textile Yarn Market Dynamics

Drivers: Increasing Global Population Drives Growth in the Market

The market has seen tremendous growth in recent years, driven by a range of factors. One of the most significant factors is the growing emphasis on sustainability and eco-friendliness in the textile industry. In addition to this, the increasing global population and changing fashion trends drive the demand for textiles, thereby stimulating the demand for textile yarns. The world's population continues to grow steadily, leading to a larger consumer base for textile products. With more people needing clothing, home textiles, and other fabric-based items, the demand for textiles rises. This, in turn, drives the need for textile yarns to produce the fabrics and materials required to meet this growing demand.

Restraints: Dependency on raw materials availability is restraining the growth of the market

While the textile yarn market has many advantages, there are also some potential drawbacks to consider. One of the main concerns for manufacturers is the availability and prices of raw materials, especially natural fibers, it can be influenced by factors like weather conditions, geopolitical events, and changing trade policies, which can impact the overall supply chain and pose restraints on production. The market is significantly dependent on the availability of raw materials. Raw materials, such as natural fibers (cotton, wool, silk, linen) and synthetic fibers (polyester, nylon, acrylic), are crucial to produce textile yarns. The availability, quality, and pricing of these raw materials directly impact the manufacturing and pricing of yarns.

Opportunities: Innovation in yarn development and technological advancements presents opportunities in the growing market

The market presents an opportunity for new product development and innovation in yarn development. As the market continues to grow and expand into new geographies, there is a need for companies to differentiate themselves and stand out from competitors. There are ample opportunities for manufacturers to develop innovative yarns with enhanced properties, such as stretchability, moisture-wicking, and antibacterial features, to cater to the evolving demands of consumers and various industries. The expansion of the market into new geographies also presents an opportunity for companies to adapt their products to meet the needs and preferences of consumers in different regions. The textile yarn market offers a promising opportunity for companies to develop new and innovative products that can meet the evolving needs and preferences of consumers.

To know about the assumptions considered for the study, download the pdf brochure

Challenges: Consumers may not be aware of the risks and limitations of Textile Yarns.

The textile yarn market is becoming increasingly competitive, making it challenging for companies to differentiate themselves and stand out from the crowd. The volatility in prices of raw materials, such as cotton, polyester, and other fibers, poses a challenge for manufacturers in managing their production costs and pricing strategies. The textile industry face challenges for its environmental impact, including water usage, chemical pollution, and waste generation. Manufacturers must address these concerns and adopt sustainable practices, which can pose challenges in terms of investments and operational changes.

Artificial Yarn was one of the Type Which Accounted Highest Market Share in North America

Artificial yarn is a type of textile yarn that is becoming increasingly popular. Artificial yarn has witnessed a surge in demand in North America due to its various advantages. Synthetic fibers such as polyester, nylon, and acrylic offer durability, versatility, and affordability, making them popular choices for textile applications. The increasing demand for synthetic yarns in industries such as apparel, home textiles, automotive textiles, and industrial textiles has contributed to the growth of the market in North America.

Changing fashion trends and evolving consumer preferences in North America have influenced the dominance of artificial yarns. Synthetic fibers offer a wide range of design options, vibrant color, and unique textures, allowing designers and manufacturers to create fashionable and trendy products. The versatility of artificial yarns enables the production of fabrics for diverse styles and applications, driving their dominance in the textile yarn market.

U.K. is one of the Major Market for Textile Yarn in Europe

U.K. is one of the largest markets for Textile Yarns in Europe. The popularity of Textile Yarns has increased significantly in recent years due to various factors, including technological advancements, focus on sustainability and quality, fashion, and design influence, etc. Europe has a rich heritage and long-standing tradition in the textile industry. The U.K. region is known for its expertise in textile manufacturing, including spinning, weaving, and dyeing. This strong foundation has contributed to the growth and dominance of textile yarn production in U.K.

The UK is known for its technological advancements in the textile sector. The industry has embraced automation, digitalization, and innovative spinning techniques, leading to the development of high-quality and diverse textile yarns. These technological advancements have enhanced production efficiency, improved yarn quality, and expanded the range of options available to manufacturers and designers.

There is a growing emphasis on sustainability and ethical practices in the UK's textile yarn market. Consumers are increasingly conscious of the environmental and social impact of their purchases. British textile manufacturers have responded by adopting sustainable and ethical practices, including the use of organic and recycled fibers, minimizing waste, and ensuring fair working conditions. This commitment to sustainability and ethics has positioned UK-made textile yarns as desirable options for environmentally conscious consumers.

Key Market Players in the Textile Yarn Market

The key players in this market include Celanese Corporation (US), Asahi Kasei Corporation. (Japan). TORAY INDUSTRIES, INC. (Japan), Indorama Ventures Public Company (Thailand), KURARAY CO., LTD. (Japan), PARKDALE. (US), Vardhman Textiles Limited. (India), Huvis (Korea), Grasim Industries Limited. (India), Raymond (India), Weiqiao Textile Company Limited (China), Arvind Advanced Materials (India), Masood Textile Mills Ltd (Pakistan), Hengli Group Co., Ltd. (China) and Kipas Holding. (Turkey).

Scope of the Textile Yarn Market Report

|

Report Metric |

Details |

|

Market valuation in 2023 |

USD 14.4 billion |

|

Market prediction in 2028 |

USD 18.5 billion |

|

Progress rate |

CAGR of 5.1% from 2023 to 2028 |

|

Segments covered |

By Type, Source, Application, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies studied |

|

Target Audience of the Textile Yarn Market

- Textile yarn producers, suppliers, distributors, importers, and exporters

- Large-scale textile yarn manufacturers, and research organizations

- Related government authorities, commercial research & development (R&D) institutions, FDA, EFSA, USDA, FSANZ, EUFIC government agencies & NGOs, and other regulatory bodies

- Food product consumers

- Regulatory bodies, including government agencies and NGOs.

- Commercial research & development (R&D) institutions and financial institutions

- Government and research organizations

Textile Yarn Market Report Segmentation:

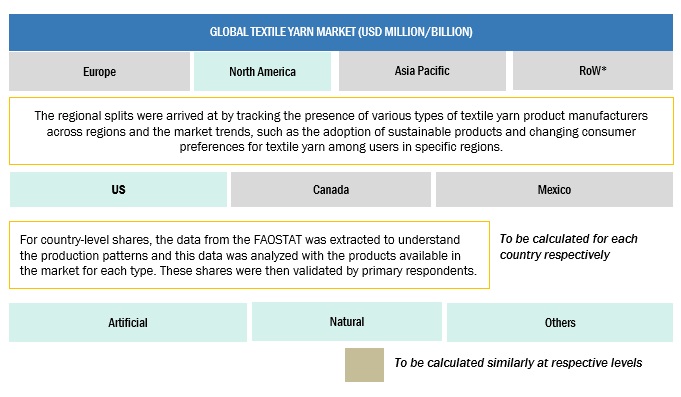

This research report categorizes the market, based on type, source, application, and region.

|

Aspect |

Details |

|

By Source |

|

|

By Type |

|

|

By Application |

|

|

By Region |

|

Recent Developments in the Textile Yarn Market

- In June 2022, Huvis (Korea) made a business agreement with Jakomo (South Korea) for contributing to the spread of eco-friendly products. This enabled the company to supply non-toxic substance-free staple fiber products.

- In September 2021, Celanese Corporation (US) launched Hostaform RF a new product, a low permeation acetyl copolymer tailored for small Off-Toad Engine and marine fuel tanks, hydraulic reservoirs, and industrial bulk containers.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share of the Textile Yarn market?

The market is expected to grow in Asia Pacific and is expected to dominate during the forecast period. The international textile market is now witnessing developing markets in the Asia Pacific region. The market is gaining traction in Asia Pacific, majorly due to the increasing fashion trends and consumer preferences. Increasing availability of textile yarn products in the market drive market growth in Asia Pacific.

What is the current size of the Textile Yarn market?

The global Textile Yarn market is projected to reach USD 18.5 billion by 2028 from USD 14.4 billion by 2023, at a CAGR of 5.1% during the forecast period in terms of value.

Which are the key players in the market, and how intense is the competition?

The key players in this market include Celanese Corporation (US), Asahi Kasei Corporation. (Japan). TORAY INDUSTRIES, INC. (Japan), Indorama Ventures Public Company (Thailand), KURARAY CO., LTD. (Japan), PARKDALE. (US), Vardhman Textiles Limited. (India), Huvis (Korea), Grasim Industries Limited. (India), Raymond (India), Weiqiao Textile Company Limited (China), Arvind Advanced Materials (India), Masood Textile Mills Ltd (Pakistan), Hengli Group Co., Ltd. (China) and Kipas Holding. (Turkey).

The Textile Yarn market witnesses increased scope for growth. The market is seeing an increase in the number of mergers and acquisitions and new product launches. Moreover, the companies involved in the production of Textile Yarns are investing a considerable proportion of their revenues in research and development activities.

Which type is projected to account for the largest share of the textile yarn market?

Artificial yarn type is expected to dominate the textile yarn market during the forecast period. Artificial yarn, such as synthetic fibers, has been widely used in the textile industry for many years. Synthetic fibers like polyester, nylon, and acrylic offer several advantages over natural fibers, including durability, wrinkle resistance, moisture-wicking properties, and ease of care. These characteristics make them suitable for a variety of applications in clothing, home textiles, and industrial fabrics, making it to dominate the textile yarn market.

Which source is projected to dominate the textile yarn market?

Chemical source is projected to dominate the textile yarn market, particularly in synthetic fibers as it offers a high degree of versatility and performance compared to natural fibers. Synthetic fibers are engineered to possess specific properties such as strength, durability, elasticity, moisture-wicking abilities, and resistance to wrinkles, shrinkage, and fading. These characteristics make them suitable for a wide range of applications, including clothing, home textiles, technical textiles, and industrial fabrics.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

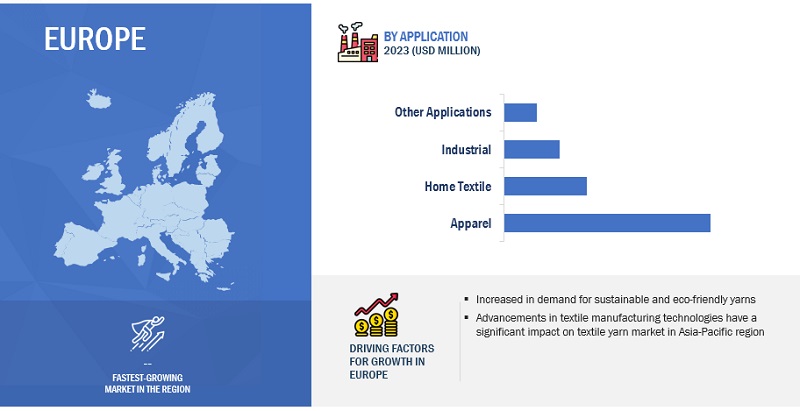

5.2 MACROECONOMIC INDICATORSRISING DEMAND FOR SUSTAINABLE AND ECO-FRIENDLY YARNSINCREASING INDUSTRIAL APPLICATIONS

-

5.3 MARKET DYNAMICSDRIVERS- Rising demand for textile yarns in apparel and home textile sectors- Innovations in production process and end-use industriesRESTRAINTS- Stringent rules and regulations- Volatility in raw material prices and their availabilityOPPORTUNITIES- Growing demand for organic yarns- Development of new yarn varieties and blendsCHALLENGES- High inventory holding costs- Unfair competition between textile yarn producers in developed and developing economies- Increased competition from lower-cost suppliers due to Trans-Pacific partnership hindering growth

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRAW MATERIAL EXTRACTIONYARN MANUFACTURINGYARN TESTINGMARKETING AND DISTRIBUTIONEND-USE INDUSTRY

- 6.3 SUPPLY CHAIN ANALYSIS

-

6.4 MARKET MAP AND ECOSYSTEM OF TEXTILE YARN MARKETTEXTILE YARN: DEMAND SIDETEXTILE YARN: SUPPLY SIDEECOSYSTEM/MARKET MAP

-

6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS IN TEXTILE YARN MARKET

- 6.6 TECHNOLOGY ANALYSIS

-

6.7 PRICING ANALYSISTEXTILE YARN: AVERAGE SELLING PRICE ANALYSISTEXTILE YARN MARKET: AVERAGE SELLING PRICE OFFERED BY KEY PLAYERS, BY SOURCETEXTILE YARN: AVERAGE SELLING PRICE, BY SOURCE

-

6.8 PATENT ANALYSIS

-

6.9 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

6.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.12 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY FRAMEWORK- US- CanadaEUROPE- Regulation on consumer products in EU by REACH- Regulatory framework by EUINDIA- Raw Material Supply Scheme (RMSS) by Ministry of Textiles

-

6.13 CASE STUDIES

- 6.14 KEY CONFERENCES & EVENTS, 2023–2024

- 7.1 INTRODUCTION

-

7.2 APPARELINCREASING POPULATION AND NEED FOR ECO-FRIENDLY APPAREL TO DRIVE MARKET

-

7.3 HOME TEXTILEDEMAND FOR COMFORT AND AESTHETIC APPEAL TO PROPEL MARKET

-

7.4 INDUSTRIALNEED FOR HIGH-TENACITY, HIGH HEAT RESISTANCE, AND VERSATILITY TO DRIVE DEMAND FOR TEXTILE YARN

- 7.5 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 NATURAL YARNRISING DEMAND FOR ECO-FRIENDLY YARNS AND AWARENESS REGARDING LOW WASTAGE TO DRIVE MARKETANIMAL YARN- Need for enhanced softness, breathability, durability, and ease of dyeing to propel market- Silk yarn- Wool yarnPLANT YARN- Need for moisture-absorbent textiles to increase demand for plant yarn- Cotton yarn- Flax yarn- Hemp yarn- Jute yarn- Ramie yarn

-

8.3 ARTIFICIAL YARNABILITY TO REPEL MOISTURE AND PRICE AFFORDABILITY TO DRIVE DEMAND FOR ARTIFICIAL YARNPOLYESTER- High strength, durability, color retention, and resistance to wrinkling, stretching, and shrinking to propel marketNYLON- Need for adaptability, high performance, lightweight texture, high strength, and low absorbency to propel marketACRYLIC- Ability to decompose without melting and dissolve in solvent to boost demandVISCOSE- Cotton-like properties, cost-effectiveness, and easy availability to drive market

- 8.4 OTHER TYPES

- 9.1 INTRODUCTION

-

9.2 CHEMICAL SOURCENEED FOR STRENGTH, DURABILITY, AND ELASTICITY AND SIGNIFICANT ENVIRONMENTAL BENEFITS TO DRIVE MARKET

-

9.3 PLANT SOURCERISING DEMAND FOR ORGANIC YARNS FOR ITS SOFTNESS, BREATHABILITY, AND VERSATILITY TO DRIVE MARKET

-

9.4 ANIMAL SOURCENEED FOR HIGHLY RESILIENT YARNS TO PROPEL MARKET

- 9.5 OTHER SOURCES

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- High-tech innovation and enhanced research and development to boost marketCANADA- Need for sustainable and eco-friendly yarns to drive marketMEXICO- Rising focus on producing yarns from recycled materials to boost market

-

10.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISTURKEY- Expertise in textile production and substantial investments to modernize textile manufacturing to boost marketUK- Focus on development of high-quality and innovative yarns to drive marketGERMANY- Flexibility in innovation and manufacturing in textile industry to boost marketFRANCE- Focus on high-quality and luxury textile to propel marketITALY- Need for high-quality yarns and emphasis on fashion industry to boost marketROMANIA- Strong textile manufacturing activities to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Availability of natural resources and advanced infrastructure to drive marketINDIA- Strong raw material production base, cheap labor, good export potential, and low import content to fuel marketPAKISTAN- High-quality cotton production, favorable climatic conditions, fertile land, and skilled labor force to propel marketAUSTRALIA- Focus on premium wool production, innovative design culture, and government support to boost marketBANGLADESH- Extensive cultivation of jute and focus on sustainability and compliance standards to drive marketREST OF ASIA PACIFIC

-

10.5 ROWROW: RECESSION IMPACT ANALYSISSOUTH AMERICA- Availability of raw materials, diverse consumer market, and government support to propel marketMIDDLE EAST & AFRICA- Growing textile industry and focus on reducing import dependency to drive market

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS, 2021

- 11.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2018–2022

- 11.4 KEY PLAYERS’ ANNUAL REVENUE VS GROWTH

- 11.5 KEY PLAYERS IN EBITDA

- 11.6 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

11.8 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.9 PRODUCT FOOTPRINT

-

11.10 EVALUATION QUADRANT FOR STARTUPS/SMES, 2021PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 11.11 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

11.12 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSCELANESE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewASAHI KASEI CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTORAY INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHAIRAYON.COM- Business overview- Products/Solutions/Services offered- MnM viewFORMOSA TAFFETA CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKURARAY CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewPARKDALE.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVARDHMAN TEXTILES LIMITED- Business overview- Products/Solutions/Services offered- MnM viewHUVIS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHENGLI GROUP CO., LTD.- Business overview- Products/solutions/services offered- MnM viewRAYMOND- Business overview- Products/Solutions/Services offered- MnM viewWEIQIAO TEXTILE COMPANY LIMITED- Business overview- Products/Solutions/Services offered- MnM viewKIPAS HOLDING.- Business overview- Products/Solutions/Services offered- MnM viewARVIND ADVANCED MATERIALS- Business overview- Products/Solutions/Services offered- MnM viewMASOOD TEXTILE MILLS LTD- Business overview- Products/Solutions/Services offered- MnM viewINDORAMA VENTURES PUBLIC COMPANY LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGRASIM INDUSTRIES LIMITED- Business overview- Products/Solutions/Services offered- MnM viewBONAR YARNS SC008924CANAN TEXTILE DESIGN BY MEDYAMIMBIRKO

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 ECO FIBERS MARKETMARKET DEFINITIONMARKET OVERVIEWECO-FIBERS MARKET, BY TYPE- INTRODUCTION

-

13.4 TECHNICAL TEXTILE MARKETMARKET DEFINITIONMARKET OVERVIEWTECHNICAL TEXTILE MARKET, BY MATERIAL- INTRODUCTIONTECHNICAL TEXTILE MARKET, BY REGION- Introduction

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 US DOLLAR EXCHANGE RATES CONSIDERED, 2019–2022

- TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 3 TEXTILE YARN MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 4 TEXTILE YARN MARKET: ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE, BY SOURCE, 2022 (USD/TON)

- TABLE 6 CHEMICAL SOURCE TEXTILE YARN: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/TON)

- TABLE 7 PLANT SOURCE TEXTILE YARN: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/TON)

- TABLE 8 ANIMAL SOURCE TEXTILE YARN: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/TON)

- TABLE 9 OTHER SOURCES TEXTILE YARN: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/TON)

- TABLE 10 KEY PATENTS PERTAINING TO TEXTILE YARN MARKET, 2021–2023

- TABLE 11 TOP TEN IMPORTERS OF JUTE AND OTHER TEXTILE FIBERS

- TABLE 12 TOP TEN EXPORTERS OF JUTE AND OTHER TEXTILE BAST FIBERS

- TABLE 13 TEXTILE YARN MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

- TABLE 15 KEY BUYING CRITERIA FOR TEXTILE YARN APPLICATION

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 CUSTOM TARIFF SCHEDULE BY CBSA

- TABLE 22 EUROPEAN UNION: TARIFFS ON TEXTILES, APPAREL, FOOTWEAR, AND TRAVEL GOODS

- TABLE 23 UTILIZATION OF WASTE HEAT FROM BOILERS IN DYEING UNITS AS ENERGY SOURCE FOR WASTEWATER RECYCLING IN TIRPUR

- TABLE 24 TEXTILE YARN MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 25 TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 26 TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 27 TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 28 TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 29 APPAREL: TEXTILE YARN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 APPAREL: TEXTILE YARN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 APPAREL: TEXTILE YARN MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 32 APPAREL: TEXTILE YARN MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 33 HOME TEXTILE: TEXTILE YARN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 HOME TEXTILE: TEXTILE YARN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 HOME TEXTILE: TEXTILE YARN MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 36 HOME TEXTILE: TEXTILE YARN MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 37 INDUSTRIAL: TEXTILE YARN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 INDUSTRIAL: TEXTILE YARN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 INDUSTRIAL: TEXTILE YARN MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 40 INDUSTRIAL: TEXTILE YARN MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 41 OTHER APPLICATIONS: TEXTILE YARN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 OTHER APPLICATIONS: TEXTILE YARN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 OTHER APPLICATIONS: TEXTILE YARN MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 44 OTHER APPLICATIONS: TEXTILE YARN MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 45 TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 46 TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 47 TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 48 TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 49 NATURAL YARN: TEXTILE YARN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 NATURAL YARN: TEXTILE YARN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 NATURAL YARN: TEXTILE YARN MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 52 NATURAL YARN: TEXTILE YARN MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 53 ARTIFICIAL YARN: TEXTILE YARN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 ARTIFICIAL YARN: TEXTILE YARN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 ARTIFICIAL YARN: TEXTILE YARN MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 56 ARTIFICIAL YARN: TEXTILE YARN MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 57 OTHER TYPES: TEXTILE YARN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 OTHER TYPES: TEXTILE YARN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 OTHER TYPES: TEXTILE YARN MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 60 OTHER TYPES: TEXTILE YARN MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 61 TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 62 TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 63 TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 64 TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 65 CHEMICAL SOURCE: TEXTILE YARN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 66 CHEMICAL SOURCE: TEXTILE YARN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 CHEMICAL SOURCE: TEXTILE YARN MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 68 CHEMICAL SOURCE: TEXTILE YARN MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 69 PLANT SOURCE: TEXTILE YARN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 70 PLANT SOURCE: TEXTILE YARN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 PLANT SOURCE: TEXTILE YARN MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 72 PLANT SOURCE: TEXTILE YARN MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 73 ANIMAL SOURCE: TEXTILE YARN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 74 ANIMAL SOURCE: TEXTILE YARN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 ANIMAL SOURCE: TEXTILE YARN MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 76 ANIMAL SOURCE: TEXTILE YARN MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 77 OTHER SOURCES: TEXTILE YARN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 78 OTHER SOURCES: TEXTILE YARN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 OTHER SOURCES: TEXTILE YARN MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 80 OTHER SOURCES: TEXTILE YARN MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 81 NORTH AMERICA: TEXTILE YARN MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: TEXTILE YARN MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: TEXTILE YARN MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 84 NORTH AMERICA: TEXTILE YARN MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 85 NORTH AMERICA: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 88 NORTH AMERICA: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 89 NORTH AMERICA: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 92 NORTH AMERICA: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 93 NORTH AMERICA: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 96 NORTH AMERICA: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 97 US: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 98 US: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 99 US: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 100 US: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 101 US: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 102 US: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 103 US: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 104 US: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 105 US: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 106 US: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 US: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 108 US: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 109 CANADA: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 110 CANADA: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 111 CANADA: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 112 CANADA: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 113 CANADA: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 114 CANADA: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 115 CANADA: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 116 CANADA: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 117 CANADA: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 118 CANADA: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 CANADA: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 120 CANADA: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 121 MEXICO: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 122 MEXICO: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 123 MEXICO: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 124 MEXICO: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 125 MEXICO: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 126 MEXICO: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 127 MEXICO: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 128 MEXICO: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 129 MEXICO: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 130 MEXICO: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 131 MEXICO: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 132 MEXICO: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 133 EUROPE: TEXTILE YARN MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 134 EUROPE: TEXTILE YARN MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 135 EUROPE: TEXTILE YARN MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 136 EUROPE: TEXTILE YARN MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 137 EUROPE: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 138 EUROPE: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 139 EUROPE: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 140 EUROPE: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 141 EUROPE: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 142 EUROPE: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 143 EUROPE: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 144 EUROPE: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 145 EUROPE: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 146 EUROPE: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 147 EUROPE: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 148 EUROPE: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 149 TURKEY: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 150 TURKEY: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 151 TURKEY: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 152 TURKEY: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 153 TURKEY: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 154 TURKEY: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 155 TURKEY: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 156 TURKEY: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 157 TURKEY: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 158 TURKEY: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 159 TURKEY: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 160 TURKEY: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 161 UK: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 162 UK: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 163 UK: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 164 UK: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 165 UK: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 166 UK: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 167 UK: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 168 UK: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 169 UK: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 170 UK: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 171 UK: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 172 UK: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 173 GERMANY: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 174 GERMANY: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 175 GERMANY: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 176 GERMANY: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 177 GERMANY: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 178 GERMANY: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 179 GERMANY: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 180 GERMANY: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 181 GERMANY: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 182 GERMANY: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 183 GERMANY: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 184 GERMANY: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 185 FRANCE: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 186 FRANCE: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 187 FRANCE: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 188 FRANCE: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 189 FRANCE: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 190 FRANCE: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 191 FRANCE: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 192 FRANCE: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 193 FRANCE: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 194 FRANCE: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 195 FRANCE: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 196 FRANCE: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 197 ITALY: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 198 ITALY: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 199 ITALY: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 200 ITALY: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 201 ITALY: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 202 ITALY: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 203 ITALY: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 204 ITALY: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 205 ITALY: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 206 ITALY: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 207 ITALY: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 208 ITALY: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 209 ROMANIA: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 210 ROMANIA: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 211 ROMANIA: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 212 ROMANIA: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 213 ROMANIA: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 214 ROMANIA: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 215 ROMANIA: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 216 ROMANIA: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 217 ROMANIA: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 218 ROMANIA: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 219 ROMANIA: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 220 ROMANIA: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 221 REST OF EUROPE: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 222 REST OF EUROPE: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 223 REST OF EUROPE: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 224 REST OF EUROPE: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 225 REST OF EUROPE: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 226 REST OF EUROPE: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 227 REST OF EUROPE: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 228 REST OF EUROPE: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 229 REST OF EUROPE: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 230 REST OF EUROPE: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 231 REST OF EUROPE: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 232 REST OF EUROPE: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 233 ASIA PACIFIC: TEXTILE YARN MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 234 ASIA PACIFIC: TEXTILE YARN MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 235 ASIA PACIFIC: TEXTILE YARN MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 236 ASIA PACIFIC: TEXTILE YARN MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 237 ASIA PACIFIC: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 238 ASIA PACIFIC: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 239 ASIA PACIFIC: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 240 ASIA PACIFIC: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 241 ASIA PACIFIC: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 242 ASIA PACIFIC: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 243 ASIA PACIFIC: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 244 ASIA PACIFIC: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 245 ASIA PACIFIC: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 246 ASIA PACIFIC: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 247 ASIA PACIFIC: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 248 ASIA PACIFIC: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 249 CHINA: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 250 CHINA: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 251 CHINA: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 252 CHINA: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 253 CHINA: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 254 CHINA: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 255 CHINA: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 256 CHINA: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 257 CHINA: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 258 CHINA: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 259 CHINA: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 260 CHINA: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 261 INDIA: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 262 INDIA: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 263 INDIA: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 264 INDIA: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 265 INDIA: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 266 INDIA: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 267 INDIA: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 268 INDIA: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 269 INDIA: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 270 INDIA: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 271 INDIA: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 272 INDIA: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 273 PAKISTAN: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 274 PAKISTAN: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 275 PAKISTAN: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 276 PAKISTAN: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 277 PAKISTAN: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 278 PAKISTAN: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 279 PAKISTAN: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 280 PAKISTAN: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 281 PAKISTAN: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 282 PAKISTAN: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 283 PAKISTAN: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 284 PAKISTAN: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 285 AUSTRALIA: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 286 AUSTRALIA: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 287 AUSTRALIA: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 288 AUSTRALIA: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 289 AUSTRALIA: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 290 AUSTRALIA: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 291 AUSTRALIA: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 292 AUSTRALIA: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 293 AUSTRALIA: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 294 AUSTRALIA: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 295 AUSTRALIA: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 296 AUSTRALIA: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 297 BANGLADESH: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 298 BANGLADESH: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 299 BANGLADESH: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 300 BANGLADESH: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 301 BANGLADESH: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 302 BANGLADESH: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 303 BANGLADESH: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 304 BANGLADESH: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 305 BANGLADESH: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 306 BANGLADESH: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 307 BANGLADESH: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 308 BANGLADESH: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 309 REST OF ASIA PACIFIC: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 310 REST OF ASIA PACIFIC: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 311 REST OF ASIA PACIFIC: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 312 REST OF ASIA PACIFIC: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 313 REST OF ASIA PACIFIC: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 314 REST OF ASIA PACIFIC: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 315 REST OF ASIA PACIFIC: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 316 REST OF ASIA PACIFIC: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 317 REST OF ASIA PACIFIC: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 318 REST OF ASIA PACIFIC: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 319 REST OF ASIA PACIFIC: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 320 REST OF ASIA PACIFIC: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 321 ROW: TEXTILE YARN MARKET, BY SUBREGION, 2018–2022 (USD MILLION)

- TABLE 322 ROW: TEXTILE YARN MARKET, BY SUBREGION, 2023–2028 (USD MILLION)

- TABLE 323 ROW: TEXTILE YARN MARKET, BY SUBREGION, 2018–2022 (KILOTON)

- TABLE 324 ROW: TEXTILE YARN MARKET, BY SUBREGION, 2023–2028 (KILOTON)

- TABLE 325 ROW: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 326 ROW: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 327 ROW: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 328 ROW: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 329 ROW: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 330 ROW: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 331 ROW: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 332 ROW: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 333 ROW: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 334 ROW: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 335 ROW: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 336 ROW: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 337 SOUTH AMERICA: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 338 SOUTH AMERICA: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 339 SOUTH AMERICA: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 340 SOUTH AMERICA: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 341 SOUTH AMERICA: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 342 SOUTH AMERICA: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 343 SOUTH AMERICA: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 344 SOUTH AMERICA: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 345 SOUTH AMERICA: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 346 SOUTH AMERICA: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 347 SOUTH AMERICA: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 348 SOUTH AMERICA: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 349 MIDDLE EAST & AFRICA: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 350 MIDDLE EAST & AFRICA: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 351 MIDDLE EAST & AFRICA: TEXTILE YARN MARKET, BY SOURCE, 2018–2022 (KILOTON)

- TABLE 352 MIDDLE EAST & AFRICA: TEXTILE YARN MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 353 MIDDLE EAST & AFRICA: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 354 MIDDLE EAST & AFRICA: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 355 MIDDLE EAST & AFRICA: TEXTILE YARN MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 356 MIDDLE EAST & AFRICA: TEXTILE YARN MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 357 MIDDLE EAST & AFRICA: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 358 MIDDLE EAST & AFRICA: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 359 MIDDLE EAST & AFRICA: TEXTILE YARN MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 360 MIDDLE EAST & AFRICA: TEXTILE YARN MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 361 TEXTILE YARN MARKET: DEGREE OF COMPETITION

- TABLE 362 STRATEGIES ADOPTED BY KEY TEXTILE YARN MANUFACTURERS

- TABLE 363 COMPANY TYPE FOOTPRINT

- TABLE 364 COMPANY APPLICATION FOOTPRINT

- TABLE 365 COMPANY REGIONAL FOOTPRINT

- TABLE 366 COMPANY OVERALL FOOTPRINT

- TABLE 367 TEXTILE YARN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 368 TEXTILE YARN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 369 TEXTILE YARN MARKET: NEW PRODUCT LAUNCHES, 2018–2022

- TABLE 370 TEXTILE YARN MARKET: DEALS, 2018–2022

- TABLE 371 TEXTILE YARN MARKET: OTHERS, 2018–2022

- TABLE 372 CELANESE CORPORATION: BUSINESS OVERVIEW

- TABLE 373 CELANESE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 374 CELANESE CORPORATION: PRODUCT LAUNCHES

- TABLE 375 CELANESE CORPORATION: DEALS

- TABLE 376 CELANESE CORPORATION: OTHERS

- TABLE 377 ASAHI KASEI CORPORATION: BUSINESS OVERVIEW

- TABLE 378 ASAHI KASEI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 379 ASAHI KASEI CORPORATION: OTHERS

- TABLE 380 TORAY INDUSTRIES, INC.: BUSINESS OVERVIEW

- TABLE 381 TORAY INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 382 TORAY INDUSTRIES, INC.: OTHERS

- TABLE 383 THAIRAYON.COM: BUSINESS OVERVIEW

- TABLE 384 THAIRAYON.COM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 385 FORMOSA TAFFETA CO., LTD.: BUSINESS OVERVIEW

- TABLE 386 FORMOSA TAFFETA CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 387 FORMOSA TAFFETA CO., LTD.: PRODUCT LAUNCHES

- TABLE 388 KURARAY CO., LTD.: BUSINESS OVERVIEW

- TABLE 389 KURARAY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 390 PARKDALE.: BUSINESS OVERVIEW

- TABLE 391 PARKDALE.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 392 PARKDALE.: DEALS

- TABLE 393 VARDHMAN TEXTILES LIMITED: BUSINESS OVERVIEW

- TABLE 394 VARDHMAN TEXTILES LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 395 HUVIS: BUSINESS OVERVIEW

- TABLE 396 HUVIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 397 HUVIS: DEALS

- TABLE 398 HENGLI GROUP CO., LTD.: BUSINESS OVERVIEW

- TABLE 399 HENGLI GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 400 RAYMOND: BUSINESS OVERVIEW

- TABLE 401 RAYMOND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 402 WEIQIAO TEXTILE COMPANY LIMITED: BUSINESS OVERVIEW

- TABLE 403 WEIQIAO TEXTILE COMPANY LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 404 KIPAS HOLDING.: BUSINESS OVERVIEW

- TABLE 405 KIPAS HOLDING.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 406 ARVIND ADVANCED MATERIALS: BUSINESS OVERVIEW

- TABLE 407 ARVIND ADVANCED MATERIALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 408 MASOOD TEXTILE MILLS LTD: BUSINESS OVERVIEW

- TABLE 409 MASOOD TEXTILE MILLS LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 410 INDORAMA VENTURES PUBLIC COMPANY LIMITED: BUSINESS OVERVIEW

- TABLE 411 INDORAMA VENTURES PUBLIC COMPANY LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 412 INDORAMA VENTURES PUBLIC COMPANY LIMITED: DEALS

- TABLE 413 GRASIM INDUSTRIES LIMITED: BUSINESS OVERVIEW

- TABLE 414 GRASIM INDUSTRIES LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 415 ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 416 ECO FIBERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 417 TECHNICAL TEXTILE MARKET, BY MATERIAL, 2018–2025 (USD BILLION)

- TABLE 418 TECHNICAL TEXTILE MARKET, BY MATERIAL, 2018–2025 (MILLION TON)

- TABLE 419 TECHNICAL TEXTILE MARKET, BY REGION, 2018–2025 (USD BILLION)

- TABLE 420 TECHNICAL TEXTILE MARKET, BY REGION, 2018–2025 (MILLION TON)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 TEXTILE YARN MARKET, BY REGION

- FIGURE 3 TEXTILE YARN MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

- FIGURE 5 TEXTILE YARN MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 TEXTILE YARN MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 TEXTILE YARN MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 8 TEXTILE YARN MARKET SIZE ESTIMATION, BY TEXTILE YARN TYPE (SUPPLY SIDE)

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 ASSUMPTIONS

- FIGURE 11 RECESSION INDICATORS AND THEIR IMPACT ON TEXTILE YARN MARKET

- FIGURE 12 GLOBAL TEXTILE YARN MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 13 TEXTILE YARN MARKET SIZE, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 TEXTILE YARN MARKET SIZE, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 TEXTILE YARN MARKET SIZE, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 TEXTILE YARN MARKET SHARE, BY REGION, 2022

- FIGURE 17 GROWING POPULATION AND RISING DEMAND FOR APPAREL TO DRIVE GROWTH OF TEXTILE YARN MARKET

- FIGURE 18 CHEMICAL SEGMENT AND CHINA TO ACCOUNT FOR LARGEST MARKET SHARES IN ASIA PACIFIC, 2022

- FIGURE 19 TURKEY AND INDIA TO REGISTER AT HIGHEST CAGRS DURING FORECAST PERIOD

- FIGURE 20 ASIA PACIFIC TO DOMINATE TEXTILE YARN MARKET DURING FORECAST PERIOD

- FIGURE 21 ARTIFICIAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 22 APPAREL SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 23 GLOBAL LEADING EXPORTING COUNTRIES OF TEXTILE YARN (2021)

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: TEXTILE YARN MARKET

- FIGURE 25 GLOBAL APPAREL REVENUE, 2022 (USD BILLION)

- FIGURE 26 GLOBAL TEXTILE TRADE PATTERNS, 2021, BY VALUE

- FIGURE 27 GLOBAL COTTON AND POLYESTER YARN PRICES, 2021 (MILLION METRIC TONS)

- FIGURE 28 GLOBAL ORGANIC AGRICULTURAL LAND, BY REGION, 2021 (%)

- FIGURE 29 TEXTILE YARN MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 TEXTILE YARN MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 31 TEXTILE YARN MARKET: MARKET MAP

- FIGURE 32 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 33 AVERAGE SELLING PRICE OF TEXTILE YARN OFFERED BY KEY PLAYERS, BY SOURCE (USD/KG)

- FIGURE 34 AVERAGE SELLING PRICE, BY SOURCE, 2018–2022 (USD/TON)

- FIGURE 35 PATENTS GRANTED FOR TEXTILE YARN MARKET, 2013–2022

- FIGURE 36 REGIONAL ANALYSIS OF PATENTS GRANTED FOR TEXTILE YARN MARKET, 2022

- FIGURE 37 IMPORT VALUE OF JUTE AND OTHER TEXTILE FIBERS

- FIGURE 38 EXPORT VALUE OF JUTE AND OTHER TEXTILE FIBERS

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

- FIGURE 40 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- FIGURE 41 TEXTILE YARN MARKET SIZE, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 42 TEXTILE YARN MARKET SIZE, BY APPLICATION, 2023 VS. 2028 (KILOTON)

- FIGURE 43 TEXTILE YARN MARKET SIZE, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 44 TEXTILE YARN MARKET SIZE, BY TYPE, 2023 VS. 2028 (KILOTON)

- FIGURE 45 TEXTILE YARN MARKET SIZE, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 46 TEXTILE YARN MARKET SIZE, BY SOURCE, 2023 VS. 2028 (KILOTON)

- FIGURE 47 NORTH AMERICAN TEXTILE YARN MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 48 EUROPE TEXTILE YARN MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 49 ASIA PACIFIC TEXTILE YARN MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 50 ROW TEXTILE YARN MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 51 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2018–2022 (USD BILLION)

- FIGURE 52 ANNUAL REVENUE, 2022 (USD BILLION) VS REVENUE GROWTH, 2020–2022 (%)

- FIGURE 53 EBITDA, 2022 (USD BILLION)

- FIGURE 54 TEXTILE YARN MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 55 TEXTILE YARN MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 56 TEXTILE YARN MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- FIGURE 57 CELANESE CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 60 THAIRAYON.COM: COMPANY SNAPSHOT

- FIGURE 61 FORMOSA TAFFETA CO., LTD.: COMPANY SNAPSHOT

- FIGURE 62 KURARAY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 63 VARDHMAN TEXTILES LIMITED: COMPANY SNAPSHOT

- FIGURE 64 RAYMOND: COMPANY SNAPSHOT

- FIGURE 65 WEIQIAO TEXTILE COMPANY LIMITED: COMPANY SNAPSHOT

- FIGURE 66 ARVIND ADVANCED MATERIALS: COMPANY SNAPSHOT

- FIGURE 67 INDORAMA VENTURES PUBLIC COMPANY LIMITED.: COMPANY SNAPSHOT

- FIGURE 68 GRASIM INDUSTRIES LIMITED: COMPANY SNAPSHOT

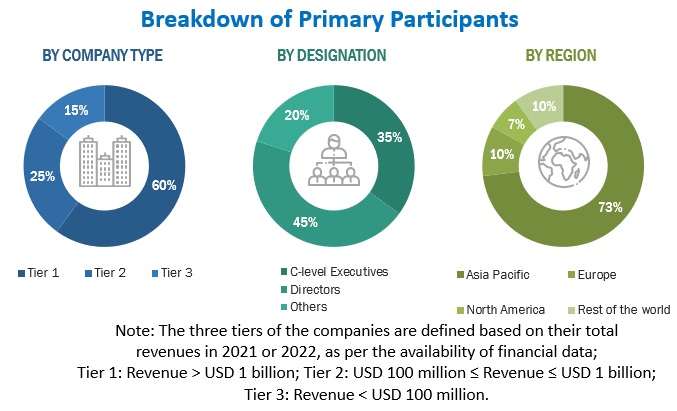

The study involved four major activities in estimating the current size of the textile yarn market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information. This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the textile yarn market.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the textile yarn market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, and Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, research and development teams, and related key executives from distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to types of textile yarns, form, application, and region. Stakeholders from the demand side, such as food and beverage companies and health and personal care companies who are using textile yarn were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of textile yarn and outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

designation |

|

Celanese Corporation (US) |

General Manager |

|

Asahi Kasei Corporation. (Japan) |

Sales Manager |

|

TORAY INDUSTRIES, INC. (Japan) |

Director |

|

Indorama Ventures Public Company (Thailand) |

Individual Industry Expert |

|

KURARAY CO., LTD. (Japan) |

Marketing Manager |

|

PARKDALE. (US) |

Sales Executive |

|

Vardhman Textiles Limited. (India) |

Sales Manager |

|

Huvis (Korea) |

Individual Industry Expert |

|

Grasim Industries Limited. (India) |

Manager |

|

Raymond (India) |

Individual Industry Expert |

Textile Yarn Market Size Estimation

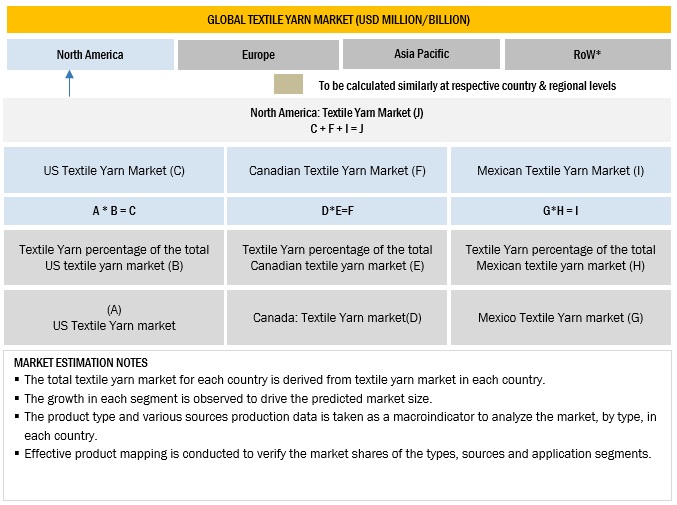

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- The revenues of the major textile yarn players were determined through primary and secondary research, which were used as the basis for market sizing and estimation.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global Textile Yarn Market: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Textile yarn Market: Top Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Textile Yarn Market Definition

Textile yarn refers to the market for various types of yarns that are used in the production of textiles. Yarn is a continuous strand of fibers that is twisted or spun together to form a cohesive thread. It serves as the basic building block for fabric and is used in various textile applications such as apparel, home furnishings, industrial textiles, and more.

The market encompasses a wide range of yarn types, including natural fibers such as cotton, wool, silk, and linen, as well as synthetic and man-made fibers such as polyester, nylon, acrylic, and rayon. Yarns can also be blended, combining different fibers to achieve desired properties or characteristics.

Textile Yarn Market Report Objectives

- Determining and projecting the size of the market, with respect to type, source, application, and regions, over five years, ranging from 2023 to 2028

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- Impact of macro- and microeconomic factors on the market

- Impact of recession on the global market

- Shifts in demand patterns across different subsegments and regions.

- Identifying and profiling the key market players in the market

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

Key Stakeholders of the Textile Yarn Market

- Government regulatory authorities and research bodies

- Global Organic Textile Standard (GOTS)

- OEKO-TEK

- Fairtrade Textile Standard

- US Cotton Trust Protocol

- Textile yarn manufacturers

- Raw material suppliers

- Distributors & suppliers

- Importers & exporters of textile yarn

- Traders of textile yarn

- End-use industries

- Industry associations

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis of the Textile Yarn Market

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe into the Netherlands, Poland, Belgium, Sweden, and other EU & non-EU countries

- Further breakdown of the Rest of Asia Pacific into Indonesia, Malaysia, Thailand, the Philippines, Singapore, and Vietnam.

- Further breakdown of Rest of the World into South America and Middle East and Africa.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Textile Yarn Market