Technical Textiles Market

Technical Textiles Market by Material (Natural Fiber, Synthetic Polymer, Metal, Mineral, Regenerated Fiber), Process (Woven, Knitted, Non-woven), Application (MobilTech, InduTech, SporTech, BuildTech, HomeTech, ClothTech, MediTech, AgroTech, ProTech, PackTech, OekoTech, GeoTech), and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The technical textiles market is projected to reach USD 324.83 billion by 2030 from USD 247.06 billion in 2025, at a CAGR of 5.6% from 2025 to 2030. The growth of the technical textiles market is driven by rising demand for high-performance materials in automotive, healthcare, construction, and protective applications. Increasing industrialization, advancements in fiber technology, and a shift toward sustainable, functional, and smart textiles are further accelerating market expansion globally.

KEY TAKEAWAYS

-

BY MATERIALBy material includes natural fiber, synthetic polymer, mineral, metal, regenarated fiber and other materials. The market growth is driven by the wide adoption of synthetic polymers and regenerated fibers offering superior strength, durability, and versatility. However, volatility in raw material prices and environmental concerns act as restraints, while advancements in bio-based and recyclable fibers present strong opportunities. Challenges include balancing performance with sustainability and cost efficiency.

-

BY PROCESSThe technical textiles market spans key process including woven, non-woven, knitted and other processes. Woven and knitted processes continue to grow with demand for high-strength and flexible fabrics, though high setup costs and limited recyclability restrain expansion. Technological innovations in composite and smart fabric manufacturing create new growth opportunities.

-

BY APPLICATIONThe technical textiles market serves diverse applications including Mobiltech, Indutech, Sportech, Buildtech, Meditech, Packtech, Hometech, Protech, Clothtech, Agrotech, Oekotech, Geotech and other applications. Technical textiles find diverse applications across mobility, healthcare, construction, and agriculture, driven by rising industrialization and functional performance requirements. Restraints include high production costs and regulatory complexities in certain end-use sectors. Growing demand for smart, sustainable, and high-performance textiles offers significant opportunities for future market expansion.

-

BY REGIONAsia Pacific is expected to grow fastest, with a CAGR of 6.6%, due to its strong industrial base, expanding infrastructure, and increasing adoption of advanced materials across key sectors such as automotive, healthcare, and construction. Countries like China, India, Japan, and South Korea are investing heavily in manufacturing capacity, R&D, and technological upgrades to meet domestic and export demand. Government initiatives such as India’s National Technical Textiles Mission and China’s “Made in China 2025” are further boosting production efficiency and innovation.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic collaborations, capacity expansions, and technological innovations from leading players such as Asahi Kasei Corporation (Japan), DuPont (US), Freudenberg Performance Materials (Germany), Berry Global Inc. (US), KCWW (US), 3M (US). These companies are advancing technical textiles and broadening end-use adoption, reflecting the growing demand for technical textiles productions in various applications

Technical textiles are engineered fabrics designed for functional and performance-oriented applications rather than aesthetic purposes, used across industries such as automotive, healthcare, construction, defense, and agriculture. These materials offer properties like durability, heat resistance, filtration efficiency, and protection. The market is witnessing strong growth due to rising industrialization, infrastructure expansion, and increasing demand for advanced materials with specialized functionalities.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The technical textiles market is experiencing significant disruption from emerging trends such as smart textiles, bio-based materials, and advanced manufacturing technologies like 3D weaving and nanofiber production. These innovations are shifting the industry from conventional performance fabrics to multifunctional, sustainable, and intelligent textile solutions. The integration of sensors, conductive fibers, and eco-friendly polymers is transforming end-use sectors including healthcare, automotive, and defense. This disruption is accelerating product differentiation, enhancing material efficiency, and creating new high-value applications, ultimately redefining competitiveness and innovation within the global technical textiles landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Expanding key end-use industries

-

•Government-led support and initiatives for innovation, supporting infrastructure development, and promoting sustainability

Level

-

•Requirement for high capital investment

-

•Lack of consumer awareness in emerging market

Level

-

•Increasing demand in medical & hygiene industry

-

•Rising demand for smart and e-textiles

Level

-

•Shortage of skilled labor

-

•Lack of specialized knowledge and complex manufacturing processes

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expanding key end-use industries

Technical textiles market is witnessing robust growth due to growth in key end-use industries driven by their need for technical, high-performance materials possessing durability, functionality, and sustainability. For the automotive sector, the proliferation of electric vehicle manufacturing and stringent global safety norms are driving demand for lightweight composites, airbags, and sensor-integrated fabrics, primarily in rapidly growing countries like China and India. The building & construction, driven by Asia-Pacific's infrastructure boom and urbanization, relies on geotextiles for soil stabilization and architectural membranes used for durable roof coverings, with smart city construction being a driver of demand. The healthcare industry, boosted by population ageing and heightened hygiene awareness following a few disease collapses in recent times, is boosting the use of healthcare textiles like biocompatible implants and intelligent textiles to monitor patients, especially in North America and Europe. The outdoor and sportswear industry is growing with the increased consumer demand for fitness and eco-friendly sportswear, and aramid fibers and waterproof fabrics are in demand in areas such as Europe. Aerospace and defense companies, especially in the US and India, are growing use of aramid fibers and flame-resistant materials to achieve demanding safety requirements for airlines and military. Agriculture and environmental protection industries are utilizing agrotextiles to enhance crops and protective textiles for pollution management with support from sustainable farming activities in Europe and Asia-Pacific. This fusion of industry development, technological advancements, and regulatory backing is driving the technical textiles industry, with Asia-Pacific at the fore due to industrialization, with North America and Europe concentrating on environmental-friendly developments.

Restraint: Lack of consumer awareness in emerging market

Lack of consumer awareness in the emerging economies is the main restraining factor that hinders the demand for technical textiles industry since it limits uptake in key end-use sectors. Industries and consumers in such economies like Southeast Asia, Africa, and South America remain largely unaware of the benefit and application of technical textiles, such as GeoTech in construction, MediTech in the healthcare sector, or AgroTech in agriculture. This is due to the lack of effective marketing, poor training sessions, and emphasis on conventional textiles, which are deemed to be more affordable. For example, in markets that are predominantly agricultural, such as India and Nigeria, farmers might not know that AgroTech can increase production or minimize water consumption, and thus there will be minimal adoption. In the same way, small-scale construction firms in these areas pay little attention to GeoTech for the stabilization of soil because they lack knowledge about the long-term cost-effectiveness and lifespan of the products. Lack of major educational programs or government-sponsored awareness campaigns enlarges the gap, as does the lack of technical textile factories in rural or semi-urban towns. Systematic material choices with inadequate exposure to technological textile technology afflicted access to the market. Such restriction is particularly dominant in price-sensitive developing nations, where excessive initial costs of technical textiles inhibit adoption without open realization of their value.

Opportunity: Increasing demand in medical & hygiene industry

The expanding need in the medical and hygiene industry is creating huge opportunities for the market of technical textiles since the sector needs innovative, advanced, high-performance materials that are safe, functional, and innovative. The increased world-wide expenditure on health, driven by ageing populations, rising incidence of chronic diseases, and growing hygiene needs, has led to the development of demand for medical textiles such as surgical gowns, drapes, wound dressings, and implantable textiles. These fabrics provide essential attributes such as biocompatibility, antimicrobial resistance, and breathability to meet high healthcare standards. For example, non-woven fabrics, used in disposable masks, PPE, and sanitary products in large volumes, have experienced booming demand because of their affordable price and infection control capacity. Moreover, technologies such as smart textiles with integrated sensors for patient monitoring and drug-delivery systems are creating new growth opportunities, especially in the developed markets of North America and Europe. Emerging economies like India and China are also experiencing rising adoption through government efforts to encourage healthcare infrastructure and hygiene levels. The demand for green, environmentally friendly MediTech also aligns with global environmental agendas, which come with opportunities for clean technology product innovation.

Challenge: Shortage of skilled labor

Lack of skilled staff is one of the key challenges to the growth of the technical textiles industry. Production of high-performance textiles that is, InduTech, GeoTech, and MediTech are dependent on advanced knowledge of material science, nanotechnology, and electronic integration. Skilled professionals with specialization in these fields are still scarce in developed as well as emerging economies. The high velocity of innovation in textile technologies tends to outpace the ability of current systems of education and vocational training to supply properly qualified talent. In fast-growing areas such as Asia-Pacific, industrial growth is not accompanied by adequate industry-focused training schemes, leading to a mismatch between demand and supply of skilled manpower. Similarly, in mature economies such as Europe and North America, an aging population workforce and scant new intake into the sector are some of the major driving factors for labor shortages. Productivity is hit by such a shortage since it increases costs of production, decelerates R&D, and interferes with scalability of high-tech textile solutions. Major sectors such as aerospace, defense, and medical textiles are most affected, where precision and specialist manufacture is a demand. Addressing this shortage of skills through targeted education, industry collaboration, and manpower development schemes is vital to support sustainable growth and innovation in the technical textiles industry

Technical Textile Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops advanced nonwovens and performance fabrics for medical, hygiene, and industrial filtration applications. | Offers high absorbency, strength, and sustainable material options ensuring quality and environmental compliance. |

|

Produces engineered nonwovens and laminates for automotive, construction, and filtration sectors. | Provides customizable, durable, and sustainable textile solutions enhancing product performance and longevity. |

|

Manufactures high-performance fibers and fabrics like Kevlar, Nomex, and Tyvek for protective and industrial uses. | Ensures superior strength, flame resistance, and lightweight protection across safety-critical applications. |

|

Supplies nonwoven fabrics for hygiene, medical, and industrial filtration products. | Delivers exceptional absorbency, comfort, and hygiene compliance with scalable global production. |

|

Integrates technical textiles with coatings and adhesives for filtration, PPE, and acoustic insulation. | Provides high-efficiency, reliable, and multifunctional materials combining protection and performance. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Ecosystem mapping is a strategic process that visualizes relationships and interdependence among various stakeholders within a business environment comprising raw material suppliers, manufacturers, distributors, and end users. At the upstream level, polymer producers and fiber manufacturers supply materials such as polyester, nylon, aramid, and bio-based fibers to textile processors. Midstream players—including nonwoven, woven, and knitted fabric producers—add functionality through coating, lamination, and finishing technologies. Downstream, OEMs in automotive, healthcare, construction, and defense integrate these textiles into specialized applications. The ecosystem mapping highlights strong collaboration between material innovators, equipment manufacturers, and research institutes, driving advancements in smart, sustainable, and high-performance textile solutions across global value chains.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Technical Textiles Market, By Material

Synthetic polymer products possess the largest market share in the technical textiles industry because of their better performance properties, versatility, and economic viability. These include polyester, polypropylene, nylon, acrylic, and aramid fibers that find extensive applications in technical textiles owing to their high strength, durability, resistance to chemicals, thermal stability, and light weight. Such properties make synthetic polymers appropriate for high-performance applications across a range of industries such as automotive, construction, healthcare, agriculture, protective clothing, and industrial filtration. Their ability to be designed with desired properties—such as resistance to UV, flame retardancy, and repellence from water—also contributes to their use across the spectrum of various functional requirements. Further, synthetic fibers can be handled and blended with more high-tech applications more easily, such as smart textiles and composites that require uniform quality and structural performance. Their wide availability on a large scale, established production base, and relatively low cost of production facilitates their wide-scale acceptance in the world. The growth of this industry is dependent on continuing advances in polymer science, such as the development of recyclable and bio-based synthetic. Synthetic polymer materials maintain the sovereignty in the industry for these products because of their unparalleled versatility and performance as technical textiles demand increases in developing as well as developed countries

Technical Textiles Market, By Process

Woven process boasts the highest market share of technical textiles due to its dimensional stability, high strength, and versatility in many demanding applications. Woven products are created by cross-patterning two sets of yarns with each other perpendicularly, and this renders them a very stable as well as a hard material suitable for high-performance uses. These qualify them as highly suitable for applications such as construction, vehicle, industrial filtration, protective clothing, and geotextiles. Needle-punched geotextiles, for instance, find extensive use in civil engineering for resisting soil erosion and soil stabilization because they are highly tensile in strength and resistant to environmental stresses. Woven fabrics find better usage in the aerospace and defense industries for withstanding harsh conditions and mechanical stresses. Besides, woven fabrics could be built with different patterns and densities to obtain some technical properties like resistance to abrasion, fire-retarding, or moisture control. These can also be reused and last for a long time, contributing to cost-savings in production environments. Despite the advent of knitted and non-woven materials, the woven process remains supreme based on its proven dependability and flexibility for applications in both traditional and new technical uses, holding the largest share in the technical textiles industry

Technical Textiles Market, By Application

MobilTech, or mobile textiles, commands the highest market share in technical textile markets due to extensive use of high-tech textile materials in automotive, aerospace, rail, and naval applications. With mobility industries continually evolving with high emphasis on safety, comfort, fuel efficiency, and cosmetics, there is a very high demand for high-performance textiles. MobilTech products consist of seat belts, airbags, upholstery, carpeting, insulation, tire reinforcement, and soundproofing products—all of which need to be lightweight, strong, fire-retardant, and resistant to wear and the environment. The increasing worldwide automotive sector, especially in developing regions, has strongly induced demand for price-conscious yet quality-oriented materials, thereby technical textiles becoming a choice of preference. Besides, stringent laws on vehicle safety and exhaust emission have promoted the use of high-performance textile solutions that help minimize weight and improve fuel efficiency. Aerospace and rail sectors also adopt technical textiles to use in light composite components, sound damping, and thermal heating insulation. With continued innovation and progress in electric vehicles and clean mobility, MobilTech remains a priority area of investment and innovation, making it the most critical application segment in technical textiles

REGION

Asia Pacific to be fastest-growing region in global technical textiles market during forecast period

Asia Pacific region boasts the largest market share in the technical textiles industry because of its strong manufacturing capacity, industrialization, and rising demand in different applications such as MobilTech, GeoTech, AgroTech, MediTech, and PackTech. China, India, Japan, and South Korea are major contributors, fueled by enormous raw material availability, low-cost labor, and mass production capabilities. Regional governments are encouraging the development of technical textiles through supportive policies, subsidies, and infrastructure investment—for example, India's National Technical Textiles Mission and China's focus on high-performance textile innovation. The rising middle class, urbanization, and heightened health and environmental consciousness are also fueling demand for functional and sustainable textile products. In addition, Asia Pacific is becoming a consumption and export center globally for technical textiles based on competitive pricing and growing domestic demand. The region is also blessed with the presence of local and international players investing in R&D and establishing manufacturing facilities to serve regional and international demand. With the innovation in smart textiles, nonwovens, and environmentally friendly materials, the Asia Pacific remains the leading technical textiles market and the most vibrant one in the world. Asia Pacific region is home to several technical textiles manufacturing companies such as Asahi Kasei Corporation (Japan), TORAY INDUSTRIES, INC. (Japan), Mitsui Chemicals, Inc. (Japan), Toyobo Textile Co., Ltd. (Japan), SRF Limited (India), Arrow Technical Textiles Pvt. Ltd. (India), Khosla Profil Pvt. Ltd. (India), Nikol Advanced Materials Pvt. Ltd. (India), Nobletex Industries Ltd. (India) and others

Technical Textile Market: COMPANY EVALUATION MATRIX

In the technical textiles market matrix, Asahi Kasei Corporation (Star), a Japanese company, leads the market through its manufacturing and distribution of technical textiles products. The company's strong portfolio of high-performance fibers, nonwovens, and engineered fabrics that cater to diverse applications such as medical, hygiene, automotive, and industrial filtration. The company leverages advanced fiber technologies, including biodegradable and specialty polymers, to deliver superior durability, functionality, and sustainability. Its integrated R&D capabilities, global manufacturing footprint, and focus on innovation enable rapid commercialization of customized solutions, making Asahi Kasei a trusted and influential leader in the global technical textiles ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 234.6 Billion |

| Market Forecast in 2030 (value) | USD 324.8 Billion |

| Growth Rate | CAGR of 5.6% from 2025–2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Kilo Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Technical Textile Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| U.S.-based Technical Textile Manufacturer | Competitive benchmarking of synthetic, natural, and specialty fiber producers (cost structures, product portfolio) • Mapping customer landscape across automotive, healthcare, construction, and industrial applications • Analysis of upstream supply chain partnerships and raw material sourcing | Identify cost-efficiency and material optimization opportunities • Detect adoption trends of high-performance textiles across industries • Highlight untapped customer segments for new product integration |

| Textile Converter / Composite Manufacturer | Segmentation of technical textile demand by automotive, aerospace, industrial, and protective applications • Benchmarking adoption against conventional textiles (cotton, polyester) • Evaluation of switching barriers such as certification, performance, and processing compatibility | Insights on revenue migration from conventional to high-performance textiles • Pinpoint substitution risks & opportunities in cost-sensitive applications • Enable targeting of sustainable, premium-margin textile solutions |

| Healthcare & Medical Device OEM | Technical and functional evaluation of advanced nonwovens, antimicrobial fabrics, and protective textiles • Lifecycle and sustainability benefits modeling • Forecast of technical textile adoption in medical devices, PPE, and hygiene products by 2030 | Support entry into high-growth healthcare and hygiene segments • Uncover long-term sustainability-driven revenue streams • Strengthen ESG positioning through adoption of eco-friendly, certified textiles |

| European Technical Textile Supplier | Global and regional capacity benchmarking of production facilities • Tracking of new entrants, technological innovations (nanofibers, coated fabrics, smart textiles) • Customer profiling across healthcare, automotive, construction, and consumer goods | Strengthen supply chain integration and strategic partnerships • Identify high-demand sectors for long-term supply contracts • Assess regional supply-demand imbalances for competitive advantage |

RECENT DEVELOPMENTS

- September 2024 : Asahi Kasei had launched a new grade of its LASTAN flame-retardant nonwoven fabric, designed to enhance the safety of electric vehicle (EV) batteries. This advanced material has offered superior resistance to flames and particle blasts, making it an ideal solution for thermal runaway protection in EV battery packs

- July 2023 : Freudenberg Performance Materials had launched new production line for EnkaMat 3D mats in Changzhou, China, which focused on erosion control.

- February 2021 : DuPont had expanded its technical textiles portfolio by acquiring Tex Tech's Core Matrix Technology, a patented monolithic fabric structure designed to enhance ballistic protection. This technology has significantly reduced backface trauma and improves fragmentation resistance, offering lightweight and flexible solutions that meet the latest National Institute of Justice (NIJ) standards for durability.

Table of Contents

Methodology

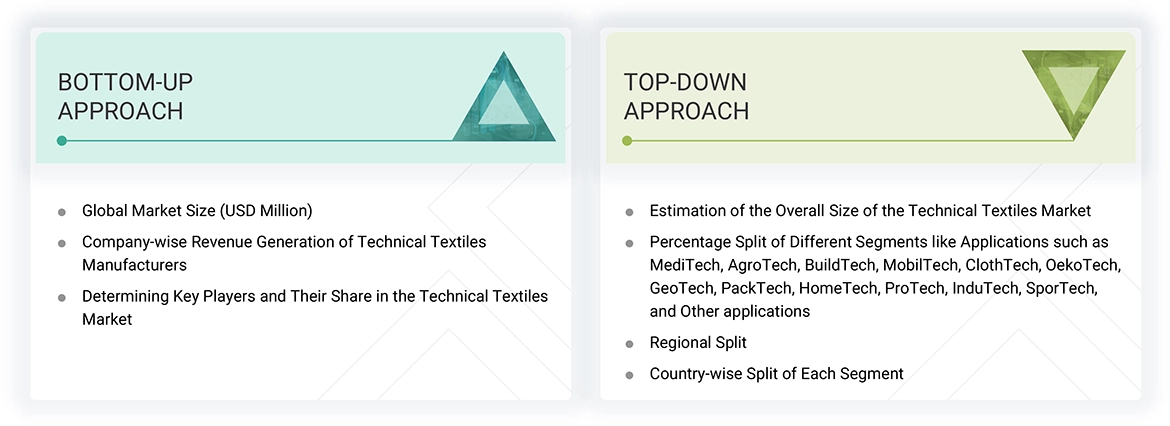

The study involves two major activities in estimating the current market size for the technical textiles market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering technical textiles and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to determine the overall size of the technical textiles market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the technical textiles market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from technical textiles industry vendors; material providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the various trends related to material, process, application, and region. Stakeholders from the demand side such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking technical textiles services were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of technical textiles and future outlook of their business which will affect the overall market.

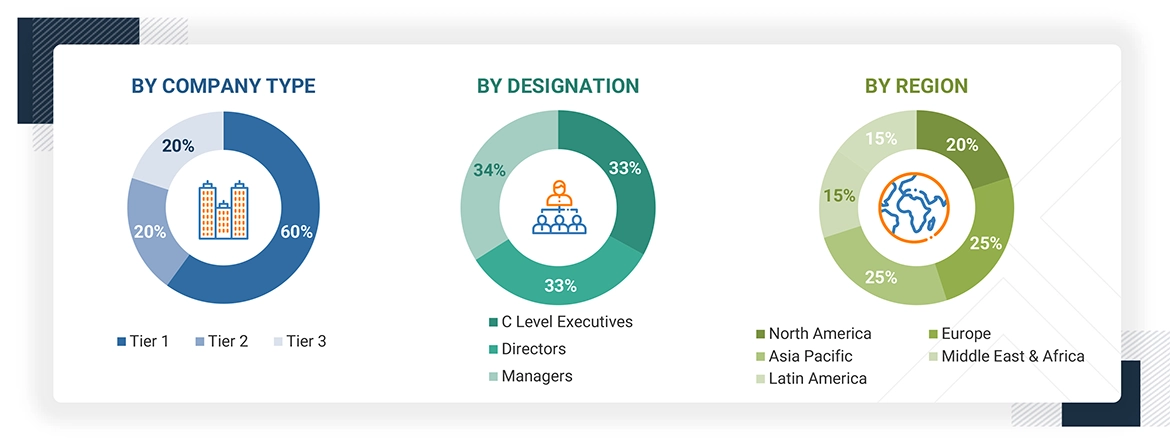

Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the technical textiles market includes the following details. The market sizing was undertaken from the demand side. The market was upsized based on the demand for technical textiles in different applications at a regional level. Such procurements provide information on the demand aspects of the technical textiles industry for each application. All possible segments of the technical textiles market were integrated and mapped for each application.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Technical textiles represent a category of advanced textile materials rigorously designed and manufactured to prioritize technical performance and functional properties over aesthetic or decorative considerations. These textiles are tailored to meet the specific requirements of a variety of applications, including MediTech, AgroTech, BuildTech, MobilTech, ClothTech, OekoTech, GeoTech, PackTech, HomeTech, ProTech, InduTech, and SporTech. They offer specialized attributes such as enhanced strength, durability, flame resistance, chemical resistance, and moisture management. Unlike conventional textiles typically used in apparel and home furnishings, technical textiles emphasize functionality, seamlessly integrating into products and processes where performance is paramount. They can be constructed from an extensive range of materials, including natural fibers, synthetic polymers, metals, and minerals, and may be employed independently or as integral components within composite products. Examples of applications include medical implants, geotextiles for soil stabilization, agrotextiles for crop protection, and protective garments designed for firefighters and military personnel. The technical textiles sector is experiencing rapid growth, fueled by ongoing innovation and the increasing demand for more efficient, cost-effective, and high-performance alternatives to traditional materials across a broad spectrum of industries.

Stakeholders

- Technical textile manufacturers

- Technical textile distributors and suppliers

- Applications

- Universities, governments, and research organizations

- Associations and industrial bodies

- R&D institutes

- Environmental support agencies

- Investment banks and private equity firms

- Research and consulting firms

Report Objectives

- To define, describe, and forecast the technical textiles market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global technical textiles market by material, process, application, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and product developments/product launches, to draw the competitive landscapeTo strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Who are the major companies in the technical textiles market? What key strategies have market players adopted to strengthen their market presence?

Major companies include Asahi Kasei Corporation (Japan), DuPont (US), Freudenberg (Germany), Berry Global (US), 3M (US), Ahlstrom (Finland), TORAY (Japan), Mitsui Chemicals (Japan), Milliken (US), Toyobo (Japan), SRF Limited (India), TenCate (Netherlands), and others. Deals and expansions are the key strategies adopted to strengthen market presence.

What are the drivers and opportunities for the technical textiles market?

Key drivers and opportunities include expanding end-use industries, government support, rising demand from the medical & hygiene sectors, and advancements in smart & e-textiles.

Which region is expected to hold the largest market share?

The Asia Pacific region is expected to hold the largest market share due to its strong industrial base, regulatory enforcement, and technological leadership in key industries.

What is the projected growth rate of the technical textiles market over the next five years?

The technical textiles market is projected to grow at a CAGR of 5.6% during the forecast period.

How is the technical textiles market aligned for future growth?

The market shows significant growth potential, driven by regional players expanding production capacities and strategic business moves. This indicates a strong future alignment for continued expansion in the technical textiles sector.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Technical Textiles Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Technical Textiles Market