Thermally Conductive Plastics Market by Type (Polyamide, PBT, Polycarbonate, PPS, PEI, Polysulfones), End-use (Electrical & Electronics, Automotive, Industrial, Aerospace, Healthcare, Telecommunications) and Region - Global Forecast to 2027

Updated on : May 23, 2024

Thermally Conductive Plastics Market

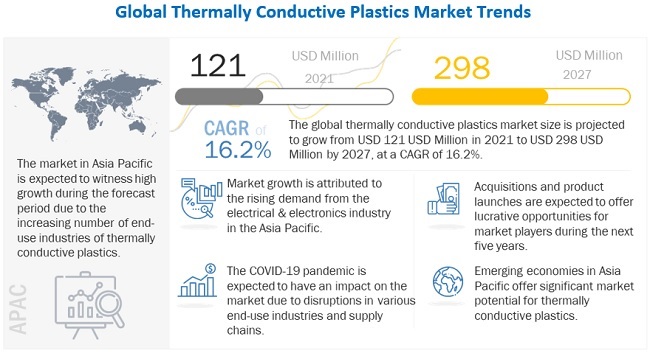

The global thermally conductive plastics market was valued at USD 121 million in 2021 and is projected to reach USD 298 million by 2027, growing at 16.2% cagr from 2022 to 2027. Rising demand for thermally conductive plastics from various end-use industries including electrical & electronics, automotive, industrial, healthcare, aerospace, and telecommunication for heat dissipation application is driving its market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact

During the COVID-19 pandemic every country in the world entered some form of lockdown and this has had a considerable impact on the world’s manufacturing industry. The disruptions in the production and supply chain have had a negative impact on the thermally conductive plastics market.

The thermally conductive plastics market is significantly concentrated in Asia Pacific and leading the market in terms of volume. Given that Asia Pacific countries such as China, Japan, India has become virus hotspots in the early outbreak of the COVID-19 pandemic, most of their manufacturing hubs remained under lockdowns to restrict the spread of the virus. Hence, the region underwent an intensive social distancing campaign, further affecting its manufacturing industries.

The COVID-19 pandemic spread through Asia Pacific countries such as China. As a result, Asia Pacific countries including China, Japan, India, and others were sealed to contain the spread of the virus. As a cascading effect of Chinese factories being forced into lockdown, there were supply chain disruptions in manufacturing industries, with exports to the country decreasing by almost 50% in 2020. China is the global hub for the manufacturing of electrical & electronics and automotive industry. The pandemic has not only caused production line disruptions and supply-chain stalls but also labor shortages and inactive logistics owing to mass lockdowns by countries across the world.

Thermally Conductive Plastics Market Dynamics

Driver: Miniaturization of electronic components and development of power electronics

Innovation in microelectronics and development of smaller electronic component demand advance thermal management solutions. Heat dissipation in microelectronics and power electronics is a critical challenge which can be addressed by thermally conductive plastics. Conventional materials such as aluminum have limited design freedom, whereas thermally conductive plastics can be over-molded to form complex designs of components. Concentration of heat in power electronics components such as LED may result in performance issues or component damage. Thermally conductive plastics are majorly used for heat dissipation and substitute material for metals and ceramics in electrical & electronics, automotive, and other industries for superior thermal management.

Restraint: Lower thermal conductivity than traditional metals

Thermally conductive plastics have low thermal conductivity than metals such as aluminum. These plastics are modified with thermally conductive fillers and additives to increase the thermal conductivity. Metals have certain drawbacks such as prone to corrosion and concentration of heat which leads to creation of hot spot on the surface which can be eliminated by thermally conductive plastics. Thermally conductive plastics are design-dependent and compatible with various polymer resins that can be processed in a variety of designs, shapes, and sizes for complex structures. However, the lower thermal conductivity of these plastics than traditional materials restrain the growth of the market.

Opportunity: Growing demand for heat dissipation in electronics, automotive, and telecommunications industries

Thermally conductive plastics are ideal for heat dissipation in high heat generating applications such as automotive lighting and LED luminaries. Rising demand of microelectronics for development of single multi-functional component demand thermally conductive plastics for efficient heat dissipation. Heat sinks, housings for electronics components, telecommunication radome, and cooling cell holders for automotive batteries are emerging opportunity for thermally conductive plastics manufacturers. Additionally, computer-aided component simulations and CAE analysis increases the development of customized thermally conductive plastics for high performance applications.

Challenge: Fluctuating crude oil prices to impact prices of polymer resin

Volatility in prices of crude oil owing to geopolitical uncertainties, production and storage cost, and high energy cost impact the prices of polymer resins. Raw materials for thermally conductive plastics are polymers derived from petroleum products, which are exposed to fluctuations in commodity prices. Oil prices remain volatile amid the COVID-19 pandemic and uncertain geopolitical situations in Europe. Thus, fluctuation in crude oil prices impact the prices of polymer resins and thermally conductive plastics.

Thermally Conductive Plastics Ecosystem

Polycarbonate is the fastest growing type in the thermally conductive plastics market during the forecast period.

Polycarbonate based thermally conductive plastics are among the most dominant engineering plastics owing to their superior properties such as high impact strength, insulation, good heat resistance, high transparency, flame retardancy, and efficient recyclability. Polycarbonate based thermally conductive plastics have flexibility, impact resistance, and optical properties, which enable them to replace other engineering plastics that are used in similar applications. Additionally, the rising demand for lightweight and transparent materials driven by automotive, electrical & electronics, and medical applications has increased the consumption of polycarbonate based thermally conductive plastics.

Automotive is the fastest-growing end-use industry during the forecast period.

The automotive industry is driven by the development of hybrid electric vehicles (HEV) and electric vehicles (EV), which is expected to increase the demand for automotive electronics application of thermally conductive plastics. The substitution of mechanical components with thermally conductive engineered plastics due to the design flexibility of 3D components, weight reduction, and heat sinks for automotive LED lighting systems is increasing the demand for thermally conductive plastics.

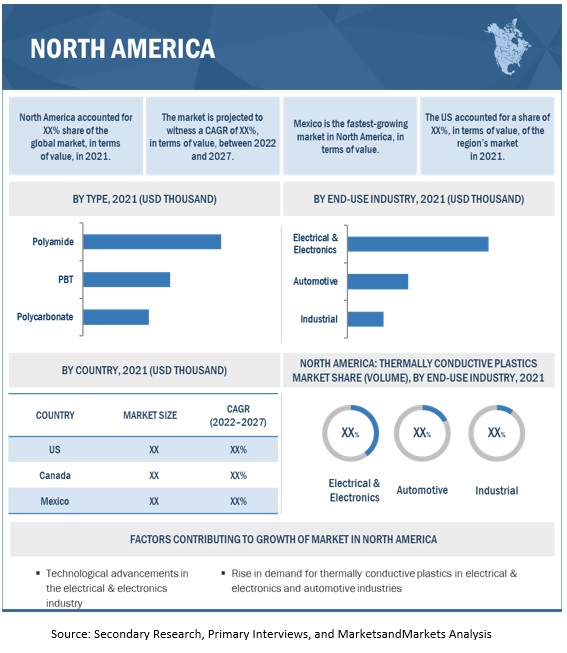

North America is the second-fastest growing region in the thermally conductive plastics market during the forecast period

Thermally conductive plastics market in the region in driven by innovation in electrical & electronics, automotive, and aerospace industry. The region has advance manufacturing ecosystem and export-oriented economies which support the growth of thermally conductive plastics market. Additionally, government initiatives to promote electric vehicles and rising investment in electricals & electronics industry is expected to increase the consumption of thermally conductive plastics during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players operating in the global thermally conductive plastics include Celanese Corporation (US), DSM (The Netherlands), SABIC (Saudi Arabia), BASF (Germany), DuPont (US), LANXESS (Germany), Mitsubishi Engineering-Plastics Corporation (Japan), Ensinger (Germany), TORAY INDUSTRIES, INC.( Japan), and KANEKA CORPORATION (Japan) among many others.

Thermally Conductive Plastics Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 121 million |

|

Revenue Forecast in 2027 |

USD 298 million |

|

CAGR |

16.2% |

|

Years considered for the study |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Thousand/Million), Volume (Ton) |

|

Segments |

By type, By end-use industry, and By Region |

|

Regions |

North America, APAC, Europe, South America, and the Middle East & Africa |

|

Companies |

Celanese Corporation (US), DSM (The Netherlands), SABIC (Saudi Arabia), BASF (Germany), DuPont (US), LANXESS (Germany), Mitsubishi Engineering-Plastics Corporation (Japan), Ensinger (Germany), TORAY INDUSTRIES, INC.( Japan), and KANEKA CORPORATION (Japan). Total 25 major players covered |

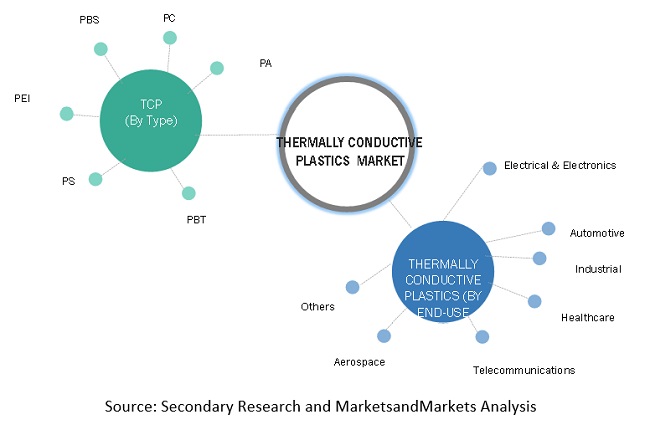

This research report categorizes the thermally conductive plastics market is segmented by type, by end-use industry, and by region.

Based on type:

- Polyamide

- Polycarbonate

- PPS

- PBT

- PEI

- Polysulfones

- Others

Based on end-use industry:

- Electrical & electronics

- Automotive

- Industrial

- Healthcare

- Aerospace

- Telecommunications

- Others

Based on the region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In February 2022, Celanese Corporation entered into a definitive agreement to acquire DuPont’s mobility & materials business segment. Celanese Corporation will acquire the product portfolio of various engineered thermoplastics and elastomers brands along with production assets.

- In February 2022, DSM expanded the production capacity of its high-performance engineering materials in Jiangsu Province, China. DSM increased its compounding line to fulfil the growing demand for high-performance polymer materials, including Stanyl, Akulon, Arnite, and other brands, to cater to the electronics and automotive industries in China.

- In April 2022, Covestro AG acquired the resins & functional materials business of DSM, a Europe-based manufacturer of specialty materials and chemicals. Covestro AG aims to enhance its business through its technological capabilities and increase its customer base.

- In November 2021, LANXESS expanded the production capacity of high-tech plastics by 30,000 metric tons per year in its manufacturing facility in China. The company will add second compounding lines for Durethan and Pocan engineering plastics, which have a strong demand in the automotive and electronics industries.

Frequently Asked Questions (FAQ):

What is the current size of the global thermally conductive plastics market?

The global thermally conductive plastics market is estimated to be USD 121 million in 2021 and is projected to reach USD 298 million by 2027, at a CAGR of 16.2%

What are the factors influencing the growth of thermally conductive plastics market?

The growth of this market can be attributed to rising demand for heat dissipation application in electrical & electronics industry.

What is the biggest restraint for thermally conductive plastics?

The low thermal conductivity of plastics is restraining the growth of the market.

Who are the major manufacturers?

Major manufacturers include Celanese Corporation, DSM, SABIC, BASF, DuPont, LANXESS, Mitsubishi Engineering-Plastics Corporation, Ensinger, TORAY INDUSTRIES, INC., and KANEKA CORPORATION among many others.

What is the impact of COVID-19 on the overall thermally conductive plastics market?

Thermally conductive plastics are used in various end use industries including electrical & electronics, automotive, industrial, healthcare, telecommunication, aerospace, and others. Due to the ongoing pandemic, these industries have been severely affected throughout the world. Manpower shortage, logistical restrictions, material unavailability, and other restrictions have slowed the growth of the industry in a considerable manner.

What will be the growth prospects of the thermally conductive plastics market?

Growing electrical & electronics industry is expected to offer significant growth opportunities to manufacturers of thermally conductive plastics market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 THERMALLY CONDUCTIVE PLASTICS MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 2 THERMALLY CONDUCTIVE PLASTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.3 PRIMARY INTERVIEWS

2.1.3.1 Primary interviews – demand and supply sides

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION APPROACH

2.2.1 TOP-DOWN APPROACH

2.2.1.1 Approach for arriving at market size using top-down approach

FIGURE 4 TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

2.2.2.1 Approach for arriving at market size using bottom-up approach

FIGURE 5 BOTTOM-UP APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 FACTOR ANALYSIS

2.5 ASSUMPTIONS

2.6 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 7 POLYAMIDE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 8 ELECTRICAL & ELECTRONICS END-USE INDUSTRY TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 9 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 EMERGING ECONOMIES TO WITNESS HIGH GROWTH IN THERMALLY CONDUCTIVE PLASTICS MARKET

FIGURE 10 ASIA PACIFIC TO OFFER ATTRACTIVE OPPORTUNITIES DURING FORECAST PERIOD

4.2 THERMALLY CONDUCTIVE PLASTICS MARKET, BY TYPE

FIGURE 11 POLYAMIDE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.3 THERMALLY CONDUCTIVE PLASTICS MARKET, BY END-USE INDUSTRY

FIGURE 12 ELECTRICAL & ELECTRONICS INDUSTRY TO LEAD MARKET BY 2027

4.4 GLOBAL THERMALLY CONDUCTIVE PLASTICS MARKET, BY COUNTRY

FIGURE 13 MARKET IN INDIA TO GROW AT HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THERMALLY CONDUCTIVE PLASTICS MARKET

5.2.1 DRIVERS

5.2.1.1 Miniaturization of electronic components and development of power electronics

5.2.1.2 Rising demand for lightweight and customizable parts in automotive industry

5.2.1.3 Advancements in E-mobility and telecommunications

5.2.2 RESTRAINTS

5.2.2.1 Lower thermal conductivity than traditional metals

5.2.2.2 Sluggish growth of electronics industry due to geopolitical uncertainties

5.2.2.3 Stringent regulations on plastic recycling and disposal to increase capital expenditure for manufacturers

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for heat dissipation in electronics, automotive, and telecommunications industries

5.2.3.2 Replacing conventional plastics & metals for weight reduction and superior thermal management

5.2.4 CHALLENGES

5.2.4.1 Fluctuating crude oil prices to impact prices of polymer resin

5.2.4.2 High production cost and complex processing

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 THERMALLY CONDUCTIVE PLASTICS MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 1 THERMALLY CONDUCTIVE PLASTICS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

FIGURE 16 THERMALLY CONDUCTIVE PLASTICS VALUE CHAIN

5.4.1 RAW MATERIAL SUPPLIERS

5.4.2 MANUFACTURERS

5.4.3 FILLER & ADDITIVE PRODUCERS

5.4.4 COMPOUNDERS

5.4.5 CONVERTERS

5.4.6 DISTRIBUTORS

5.4.7 END-USE INDUSTRIES

5.5 ECOSYSTEM MAPPING

FIGURE 17 THERMALLY CONDUCTIVE PLASTICS ECOSYSTEM

5.6 TRADE ANALYSIS

TABLE 2 IMPORT DATA FOR PLASTICS AND RELATED MATERIALS (USD THOUSAND)

TABLE 3 EXPORT DATA FOR PLASTICS AND RELATED MATERIALS (USD THOUSAND)

5.7 PRICING ANALYSIS

FIGURE 18 AVERAGE PRICING ANALYSIS, BY REGION

FIGURE 19 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP 3 END-USE INDUSTRIES

TABLE 4 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP 3 END-USE INDUSTRIES (USD)

5.8 IMPACT OF COVID-19 ON THERMALLY CONDUCTIVE PLASTICS MARKET

5.8.1 IMPACT OF COVID-19 ON ELECTRONICS INDUSTRY

5.8.2 IMPACT OF COVID-19 ON AUTOMOTIVE INDUSTRY

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 20 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.10 PATENT ANALYSIS

5.10.1 INTRODUCTION

5.10.2 METHODOLOGY

5.10.3 DOCUMENT TYPE

FIGURE 21 GRANTED PATENTS

FIGURE 22 NUMBER OF PATENTS PUBLISHED IN LAST 10 YEARS

5.10.4 INSIGHTS

5.10.5 LEGAL STATUS OF PATENTS

FIGURE 23 LEGAL STATUS

FIGURE 24 TOP JURISDICTION - BY DOCUMENT

5.10.6 TOP COMPANIES/APPLICANTS

FIGURE 25 TOP 10 PATENT APPLICANTS

TABLE 5 LIST OF PATENTS BY DUPONT

TABLE 6 LIST OF PATENTS BY LG CHEM

TABLE 7 LIST OF PATENTS BY SABIC GLOBAL TECHNOLOGIES BV.

TABLE 8 TOP PATENT OWNERS (US) IN LAST 10 YEARS

5.11 TECHNOLOGY ANALYSIS

5.11.1 DEPLOYMENT OF 5G TELECOMMUNICATIONS AND INTEGRATION OF IOT

5.11.2 DEVELOPMENT OF E-MOBILITY

5.12 CASE STUDY ANALYSIS

5.12.1 HEAT MANAGEMENT OPTIMIZATION IN LED LIGHTING WITH MAKROLON THERMALLY CONDUCTIVE PLASTICS BY COVESTRO AG

5.12.2 REPLACEMENT OF METAL HEAT SINKS WITH AVIENT’S THERMALLY CONDUCTIVE PLASTICS IN SWIMMING POOL LIGHTING

5.13 RAW MATERIAL ANALYSIS

5.13.1 POLYAMIDE

5.13.2 POLYCARBONATE

5.13.3 POLYPHENYLENE SULFIDE

5.13.4 POLYBUTYLENE TEREPHTHALATE

5.13.5 POLYETHERIMIDE

5.13.6 POLYSULFONES

5.14 MARKETING CHANNELS

5.15 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 9 THERMALLY CONDUCTIVE PLASTICS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.16 TARIFF AND REGULATORY LANDSCAPE

5.16.1 NORTH AMERICA

5.16.2 EUROPE

5.16.3 ASIA PACIFIC

5.16.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.17 OPERATIONAL DATA

5.17.1 TRENDS IN AUTOMOTIVE INDUSTRY

TABLE 14 GOVERNMENT INCENTIVES FOR EVS IN 2021, BY COUNTRY

FIGURE 26 GLOBAL SALES OF ELECTRIC CARS IN MAJOR COUNTRIES (THOUSAND UNIT)

5.17.2 TRENDS IN ELECTRICAL & ELECTRONICS INDUSTRY

FIGURE 27 MARKET SHARE OF SEMICONDUCTOR MANUFACTURING COUNTRIES (2018–2020)

TABLE 15 GOVERNMENT INCENTIVES FOR SEMICONDUCTOR MANUFACTURING IN 2021, BY COUNTRY

5.17.3 TRENDS IN TELECOMMUNICATIONS INDUSTRY

5.18 KEY FACTORS AFFECTING BUYING DECISIONS

5.18.1 QUALITY

TABLE 16 UNMET NEEDS AFFECTING BUYING DECISION

5.18.2 SERVICE

FIGURE 28 KEY STAKEHOLDERS & BUYING CRITERIA

5.19 MACROECONOMIC ANALYSIS

TABLE 17 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE) OF KEY COUNTRIES, 2018–2025

6 THERMALLY CONDUCTIVE PLASTICS MARKET, BY TYPE (Page No. - 91)

6.1 INTRODUCTION

FIGURE 29 POLYCARBONATE TO BE FASTEST-GROWING TYPE DURING FORECAST PERIOD

TABLE 18 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (USD THOUSAND)

TABLE 19 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (USD THOUSAND)

TABLE 20 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 21 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (TON)

6.2 POLYAMIDE

TABLE 22 POLYAMIDE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 23 POLYAMIDE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (TON)

6.3 POLYCARBONATE

TABLE 24 POLYCARBONATE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 25 POLYCARBONATE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (TON)

6.4 POLYPHENYLENE SULFIDE

TABLE 26 POLYPHENYLENE SULFIDE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 27 POLYPHENYLENE SULFIDE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (TON)

6.5 POLYBUTYLENE TEREPHTHALATE

TABLE 28 POLYBUTYLENE TEREPHTHALATE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 29 POLYBUTYLENE TEREPHTHALATE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (TON)

6.6 POLYETHERIMIDE

TABLE 30 POLYETHERIMIDE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 31 POLYETHERIMIDE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (TON)

6.7 POLYSULFONES

TABLE 32 POLYSULFONES: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 33 POLYSULFONES: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (TON)

6.8 OTHERS

6.8.1 POLYETHER ETHER KETONE

6.8.2 POLYPROPYLENE

6.8.3 ACRYLONITRILE BUTADIENE STYRENE

6.8.4 LIQUID CRYSTAL POLYMER

TABLE 34 OTHER TYPES: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 35 OTHER TYPES: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (TON)

7 THERMALLY CONDUCTIVE PLASTICS MARKET, BY END-USE INDUSTRY (Page No. - 104)

7.1 INTRODUCTION

FIGURE 30 ELECTRICAL & ELECTRONICS TO BE LARGEST END-USE INDUSTRY DURING FORECAST PERIOD

TABLE 36 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 37 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 38 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 39 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

7.2 ELECTRICAL & ELECTRONICS

7.2.1 LED LIGHTING

7.2.2 ELECTRONIC DEVICES

7.2.3 OTHERS

TABLE 40 ELECTRICAL & ELECTRONICS: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 41 ELECTRICAL & ELECTRONICS: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (TON)

7.3 AUTOMOTIVE

7.3.1 ELECTRIC VEHICLE (EV)

7.3.2 BATTERIES

7.3.3 CHARGING INFRASTRUCTURE

7.3.4 OTHERS

TABLE 42 AUTOMOTIVE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 43 AUTOMOTIVE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (TON)

7.4 INDUSTRIAL

7.4.1 HVAC

7.4.2 ENERGY

7.4.3 OTHERS

TABLE 44 INDUSTRIAL: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 45 INDUSTRIAL: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (TON)

7.5 HEALTHCARE

TABLE 46 HEALTHCARE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 47 HEALTHCARE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (TON)

7.6 AEROSPACE

TABLE 48 AEROSPACE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 49 AEROSPACE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (TON)

7.7 TELECOMMUNICATIONS

7.7.1 WIRELESS DEVICES

7.7.2 OTHERS

TABLE 50 TELECOMMUNICATIONS: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 51 TELECOMMUNICATIONS: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (TON)

7.8 OTHERS

7.8.1 DEFENSE & SECURITY

7.8.2 MARINE

TABLE 52 OTHER END-USE INDUSTRIES: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 53 OTHER END-USE INDUSTRIES: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020–2027 (TON)

8 THERMALLY CONDUCTIVE PLASTICS MARKET, BY REGION (Page No. - 119)

8.1 INTRODUCTION

FIGURE 31 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

TABLE 54 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 55 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 56 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 57 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2022–2027 (TON)

8.2 NORTH AMERICA

FIGURE 32 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SNAPSHOT

TABLE 58 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 59 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 60 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 61 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 62 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (USD THOUSAND)

TABLE 63 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (USD THOUSAND)

TABLE 64 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 65 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 66 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 67 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 68 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 69 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.2.1 US

8.2.1.1 Miniaturization of electronic components to drive market

TABLE 70 US: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 71 US: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 72 US: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 73 US: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.2.2 CANADA

8.2.2.1 Automotive industry to propel demand for thermally conductive plastics

TABLE 74 CANADA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 75 CANADA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 76 CANADA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 77 CANADA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.2.3 MEXICO

8.2.3.1 Rising investments in electrical & electronics sector to boost market

TABLE 78 MEXICO: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 79 MEXICO: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 80 MEXICO: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 81 MEXICO: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.3 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SNAPSHOT

TABLE 82 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 83 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 84 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 85 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 86 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (USD THOUSAND)

TABLE 87 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (USD THOUSAND)

TABLE 88 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 89 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 90 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 91 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 92 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 93 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.3.1 CHINA

8.3.1.1 Government initiatives for EV manufacturing to propel market

TABLE 94 CHINA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 95 CHINA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 96 CHINA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 97 CHINA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.3.2 JAPAN

8.3.2.1 Diversified end-use industries to increasingly consume thermally conductive plastics

TABLE 98 JAPAN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 99 JAPAN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 100 JAPAN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 101 JAPAN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.3.3 INDIA

8.3.3.1 Growing automotive industry and government investments in semiconductor industry to drive market

TABLE 102 INDIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 103 INDIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 104 INDIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 105 INDIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.3.4 SOUTH KOREA

8.3.4.1 Growing electronics industry and skilled workforce to boost market

TABLE 106 SOUTH KOREA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 107 SOUTH KOREA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 108 SOUTH KOREA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 109 SOUTH KOREA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.3.5 TAIWAN

8.3.5.1 Established electronics industry and investments in telecommunications industry to drive market

TABLE 110 TAIWAN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 111 TAIWAN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 112 TAIWAN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 113 TAIWAN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.3.6 INDONESIA

8.3.6.1 Industrial equipment and manufacturing industries to boost demand for thermally conductive plastics

TABLE 114 INDONESIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 115 INDONESIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 116 INDONESIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 117 INDONESIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.3.7 REST OF ASIA PACIFIC

TABLE 118 REST OF ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 119 REST OF ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 120 REST OF ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 121 REST OF ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.4 EUROPE

FIGURE 34 AUTOMOTIVE TO BE FASTEST-GROWING END-USE INDUSTRY IN EUROPE

TABLE 122 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 123 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 124 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 125 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 126 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (USD THOUSAND)

TABLE 127 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (USD THOUSAND)

TABLE 128 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 129 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 130 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 131 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 132 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 133 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.4.1 GERMANY

8.4.1.1 Presence of leading market players to spur growth

TABLE 134 GERMANY: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 135 GERMANY: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 136 GERMANY: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 137 GERMANY: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.4.2 UK

8.4.2.1 Government’s plan to achieve net-zero carbon emissions to boost E-mobility

TABLE 138 UK: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 139 UK: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 140 UK: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 141 UK: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.4.3 FRANCE

8.4.3.1 Government investments in technology infrastructure to support market growth

TABLE 142 FRANCE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 143 FRANCE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 144 FRANCE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 145 FRANCE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.4.4 ITALY

8.4.4.1 Presence of luxury automobile industry to drive market

TABLE 146 ITALY: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 147 ITALY: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 148 ITALY: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 149 ITALY: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.4.5 SPAIN

8.4.5.1 Adoption of E-mobility by aerospace industry to propel market

TABLE 150 SPAIN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 151 SPAIN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 152 SPAIN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 153 SPAIN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.4.6 REST OF EUROPE

TABLE 154 REST OF EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 155 REST OF EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 156 REST OF EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 157 REST OF EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.5 MIDDLE EAST & AFRICA

TABLE 158 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 159 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 160 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 161 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 162 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (USD THOUSAND)

TABLE 163 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (USD THOUSAND)

TABLE 164 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 165 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 166 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 167 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 168 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 169 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.5.1 SAUDI ARABIA

8.5.1.1 Positive trends in automotive and electrical & electronics industries to drive market

TABLE 170 SAUDI ARABIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 171 SAUDI ARABIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 172 SAUDI ARABIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 173 SAUDI ARABIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.5.2 SOUTH AFRICA

8.5.2.1 Developments in electrical & electronics, industrial processing, and automotive industries to favor market growth

TABLE 174 SOUTH AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 175 SOUTH AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 176 SOUTH AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 177 SOUTH AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.5.3 UAE

8.5.3.1 IoT-related applications in various industries to boost demand for thermally conductive plastics

TABLE 178 UAE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 179 UAE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 180 UAE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 181 UAE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 182 REST OF MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 183 REST OF MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 184 REST OF MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 185 REST OF MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.6 SOUTH AMERICA

TABLE 186 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 187 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 188 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 189 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 190 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (USD THOUSAND)

TABLE 191 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (USD THOUSAND)

TABLE 192 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 193 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 194 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 195 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 196 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 197 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.6.1 BRAZIL

8.6.1.1 Investments in automotive industry to propel market

TABLE 198 BRAZIL: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 199 BRAZIL: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 200 BRAZIL: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 201 BRAZIL: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.6.2 ARGENTINA

8.6.2.1 Government initiatives for E-mobility to increase consumption of thermally conductive plastics

TABLE 202 ARGENTINA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 203 ARGENTINA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 204 ARGENTINA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 205 ARGENTINA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

8.6.3 REST OF SOUTH AMERICA

TABLE 206 REST OF SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 207 REST OF SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD THOUSAND)

TABLE 208 REST OF SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 209 REST OF SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

9 COMPETITIVE LANDSCAPE (Page No. - 196)

9.1 INTRODUCTION

9.2 STRATEGIES ADOPTED BY KEY PLAYERS

FIGURE 35 COMPANIES ADOPTED INVESTMENT & EXPANSION AND NEW PRODUCT LAUNCH AS KEY GROWTH STRATEGIES BETWEEN 2017 AND 2022

9.3 MARKET EVALUATION MATRIX

TABLE 210 MARKET EVALUATION MATRIX

9.4 REVENUE ANALYSIS OF TOP PLAYERS

TABLE 211 THERMALLY CONDUCTIVE PLASTICS MARKET: REVENUE ANALYSIS (USD)

9.5 MARKET RANKING ANALYSIS

FIGURE 36 RANKING OF TOP FIVE PLAYERS IN THERMALLY CONDUCTIVE PLASTICS MARKET, 2021

9.6 MARKET SHARE ANALYSIS

FIGURE 37 THERMALLY CONDUCTIVE PLASTICS MARKET SHARE, BY COMPANY, 2021

TABLE 212 THERMALLY CONDUCTIVE PLASTICS MARKET: DEGREE OF COMPETITION

9.6.1 CELANESE CORPORATION

9.6.2 DSM

9.6.3 SABIC

9.6.4 BASF

9.6.5 DUPONT

9.7 COMPANY EVALUATION MATRIX

9.7.1 STARS

9.7.2 EMERGING LEADERS

9.7.3 PERVASIVE PLAYERS

9.7.4 PARTICIPANTS

FIGURE 38 THERMALLY CONDUCTIVE PLASTICS MARKET: COMPANY EVALUATION MATRIX, 2021

9.8 COMPETITIVE BENCHMARKING

TABLE 213 THERMALLY CONDUCTIVE PLASTICS MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 214 THERMALLY CONDUCTIVE PLASTICS MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

9.8.1 COMPANY FOOTPRINT

TABLE 215 OVERALL COMPANY FOOTPRINT

9.8.2 COMPANY END-USE INDUSTRY FOOTPRINT

TABLE 216 OVERALL END-USE INDUSTRY FOOTPRINT

9.8.3 COMPANY TYPE FOOTPRINT

TABLE 217 OVERALL TYPE FOOTPRINT

9.8.4 COMPANY REGION FOOTPRINT

TABLE 218 OVERALL REGION FOOTPRINT

9.9 STRENGTH OF PRODUCT PORTFOLIO

9.10 BUSINESS STRATEGY EXCELLENCE

9.11 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

9.11.1 PROGRESSIVE COMPANIES

9.11.2 RESPONSIVE COMPANIES

9.11.3 STARTING BLOCKS

9.11.4 DYNAMIC COMPANIES

FIGURE 39 THERMALLY CONDUCTIVE PLASTICS MARKET: START-UPS AND SMES MATRIX, 2021

9.12 COMPETITIVE SCENARIO

9.12.1 NEW PRODUCT LAUNCHES

TABLE 219 NEW PRODUCT LAUNCHES, 2017–2022

9.12.2 DEALS

TABLE 220 DEALS, 2017–2022

9.12.3 OTHER DEVELOPMENTS

TABLE 221 OTHER DEVELOPMENTS, 2017–2022

10 COMPANY PROFILES (Page No. - 219)

10.1 KEY PLAYERS

(Business overview, Products/Solutions offered, Recent Developments, MNM view)*

10.1.1 CELANESE CORPORATION

TABLE 222 CELANESE CORPORATION: COMPANY OVERVIEW

FIGURE 40 CELANESE CORPORATION: COMPANY SNAPSHOT

TABLE 223 CELANESE CORPORATION: PRODUCT OFFERINGS

TABLE 224 CELANESE CORPORATION: DEALS

TABLE 225 CELANESE CORPORATION: OTHERS

10.1.2 DSM

TABLE 226 DSM: COMPANY OVERVIEW

FIGURE 41 DSM: COMPANY SNAPSHOT

TABLE 227 DSM: PRODUCT OFFERINGS

TABLE 228 DSM: PRODUCT LAUNCHES

TABLE 229 DSM: DEALS

TABLE 230 DSM: OTHERS

10.1.3 SABIC

TABLE 231 SABIC: COMPANY OVERVIEW

FIGURE 42 SABIC: COMPANY SNAPSHOT

TABLE 232 SABIC: PRODUCT OFFERINGS

TABLE 233 SABIC: OTHERS

10.1.4 BASF

TABLE 234 BASF SE: COMPANY OVERVIEW

FIGURE 43 BASF SE: COMPANY SNAPSHOT

TABLE 235 BASF: PRODUCT OFFERINGS

TABLE 236 BASF: PRODUCT LAUNCHES

TABLE 237 BASF: DEALS

TABLE 238 BASF: OTHERS

10.1.5 DUPONT

TABLE 239 DUPONT: COMPANY OVERVIEW

FIGURE 44 DUPONT: COMPANY SNAPSHOT

TABLE 240 DUPONT: PRODUCT OFFERINGS

TABLE 241 DUPONT: PRODUCT LAUNCHES

10.1.6 COVESTRO AG

TABLE 242 COVESTRO AG: COMPANY OVERVIEW

FIGURE 45 COVESTRO AG: COMPANY SNAPSHOT

TABLE 243 COVESTRO AG: PRODUCT OFFERINGS

TABLE 244 COVESTRO: DEALS

TABLE 245 COVESTRO: OTHERS

10.1.7 AVIENT CORPORATION

TABLE 246 AVIENT CORPORATION: COMPANY OVERVIEW

FIGURE 46 AVIENT CORPORATION: COMPANY SNAPSHOT

TABLE 247 AVIENT CORPORATION: PRODUCT OFFERINGS

TABLE 248 AVIENT CORPORATION: DEALS

10.1.8 KANEKA CORPORATION

TABLE 249 KANEKA CORPORATION: COMPANY OVERVIEW

FIGURE 47 KANEKA CORPORATION: COMPANY SNAPSHOT

TABLE 250 KANEKA CORPORATION: PRODUCT OFFERINGS

10.1.9 ENSINGER

TABLE 251 ENSINGER: COMPANY OVERVIEW

TABLE 252 ENSINGER: PRODUCT OFFERINGS

TABLE 253 ENSINGER: PRODUCT LAUNCHES

10.1.10 MITSUBISHI ENGINEERING-PLASTICS CORPORATION

TABLE 254 MITSUBISHI ENGINEERING-PLASTICS CORPORATION: COMPANY OVERVIEW

TABLE 255 MITSUBISHI ENGINEERING-PLASTICS CORPORATION: PRODUCT OFFERINGS

10.1.11 TORAY INDUSTRIES, INC.

TABLE 256 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

FIGURE 48 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

TABLE 257 TORAY INDUSTRIES, INC.: PRODUCT OFFERINGS

TABLE 258 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES

TABLE 259 TORAY INDUSTRIES, INC.: OTHERS

10.1.12 LANXESS

TABLE 260 LANXESS: COMPANY OVERVIEW

FIGURE 49 LANXESS: COMPANY SNAPSHOT

TABLE 261 LANXESS: PRODUCT OFFERINGS

TABLE 262 LANXESS: PRODUCT LAUNCHES

TABLE 263 LANXESS: DEALS

TABLE 264 LANXESS: OTHERS

*Details on Business overview, Products/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

10.2 OTHER PLAYERS

10.2.1 SUMITOMO BAKELITE CO., LTD.

TABLE 265 SUMITOMO BAKELITE CO., LTD.: COMPANY OVERVIEW

10.2.2 LOTTE CHEMICAL

TABLE 266 LOTTE CHEMICAL: COMPANY OVERVIEW

10.2.3 LATI INDUSTRIA TERMOPLASTICI S.P.A.

TABLE 267 LATI INDUSTRIA TERMOPLASTICI S.P.A.: COMPANY OVERVIEW

10.2.4 LEHMANN&VOSS&CO.

TABLE 268 LEHMANN&VOSS&CO.: COMPANY OVERVIEW

10.2.5 KRAIBURG TPE GMBH & CO. KG

TABLE 269 KRAIBURG TPE GMBH & CO. KG: COMPANY OVERVIEW

10.2.6 KENNER MATERIAL & SYSTEM CO., LTD

TABLE 270 KENNER MATERIAL & SYSTEM CO., LTD: COMPANY OVERVIEW

10.2.7 ASCEND PERFORMANCE MATERIALS

TABLE 271 ASCEND PERFORMANCE MATERIALS: COMPANY OVERVIEW

10.2.8 UGENT TECH SDN BHD.

TABLE 272 UGENT TECH SDN BHD.: COMPANY OVERVIEW

10.2.9 WITCOM ENGINEERING PLASTICS BV

TABLE 273 WITCOM ENGINEERING PLASTICS BV: COMPANY OVERVIEW

10.2.10 XIAMEN KEYUAN PLASTIC CO., LTD

TABLE 274 XIAMEN KEYUAN PLASTIC CO., LTD: COMPANY OVERVIEW

10.2.11 DONGGUAN ZIITEK ELECTRONIC MATERIAL AND TECHNOLOGY LTD.

TABLE 275 DONGGUAN ZIITEK ELECTRONIC MATERIAL AND TECHNOLOGY LTD.: COMPANY OVERVIEW

10.2.12 RADICAL MATERIALS LTD

TABLE 276 RADICAL MATERIALS LTD: COMPANY OVERVIEW

10.2.13 COOLMAG THERMO CONDUCTIVE, S.L.

TABLE 277 COOLMAG THERMO CONDUCTIVE, S.L.: COMPANY OVERVIEW

11 APPENDIX (Page No. - 267)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATION OPTIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

The study involved four major activities to estimate the current market size of thermally conductive plastics. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Factiva, Zauba, Hoovers, and Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulations form agencies such as Association for the Development and Promotion of Electric Mobility, China Association of Automobile Manufacturers, European Automobile Manufacturers' Association (ACEA), and others.

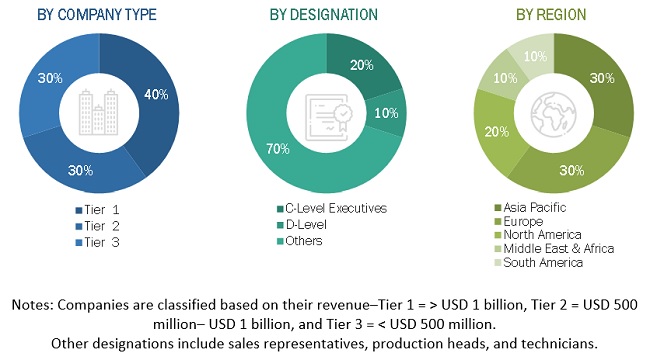

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the thermally conductive plastics market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (thermally conductive plastics manufacturers) and supply-side (end-product manufacturers, buyers, and distributors) players across four major regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America. Approximately 70% and 30% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of thermally conductive plastics market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Thermally Conductive Plastics Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the thermally conductive plastics market size, terms of value, and volume.

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To define, describe, and forecast the market by type, by end-use industries, and by region.

- To forecast the size of the market with respect to five regions, namely, Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa (MEA), along with their countries

- To strategically analyze micro markets with respect to individual growth trends, future prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments such as new product launch, merger & acquisition, and investment & expansion in the market

- To strategically profile the key players and comprehensively analyze their revenue and core competencies.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the thermally conductive plastics market report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the thermally conductive plastics market, by segments

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Thermally Conductive Plastics Market