Thermoelectric Modules Market Size, Share, Statistics and Industry Growth Analysis Report by Model (Single Stage, Multi Stage), Type (Bulk, Micro, Thin Film), Functionality (General Purpose, Deep Cooling), End-Use Application (Consumer Electronics, Automotive), Offering and Region - Global Forecast to 2027

Updated on : Oct 23, 2024

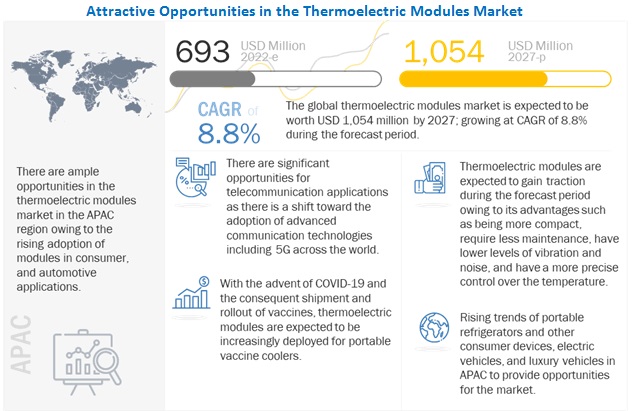

[210 Pages Report] The Thermoelectric Modules Market Size is projected to grow from USD 693 million in 2022 to USD 1,054 million by 2027; it is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.8% from 2022 to 2027.

Thermoelectric modules offers several advantages, such as compact design compared to conventional systems, simultaneous heating and cooling capabilities make TEMs suitable for various functions in different end-use applications. These advatnages in turn drives the adoption of thermoelectric modules. Additionally, the fast growing electric vehicles market is also driving the growth of thermoelectric modules industry owing to utilization of these modules in various functions of electric vehicles, such as control of car seat temperatures and stabilize the temperature of a car’s battery-operated system.

The objective of the report is to define, describe, and forecast the thermoelectric modules market share based on model, type, functionality, end-use application, offering, and region.

To know about the assumptions considered for the study, Request for Free Sample Report

Thermoelectric Modules Market Dynamics

Driver :Simultaneous heating and cooling properties of TEMs driving demand for several applications

TEMs use the Peltier effect to create a temperature difference by transferring heat between 2 electrical junctions. These modules are mainly used in cooling devices, but they also find application in heating devices. Thermoelectric coolers are capable of cooling or heating a system based on the polarity of the DC power applied. Therefore, the simultaneous heating and cooling ability of TEMs is utilized to produce hot and cold water for different functions. For instance, it can produce hot water for a bath while delivering cold water for air cooling. This property of TEMs is used in charged coupled devices, infrared detectors, laser diode coolers, weapons sights, and thermal viewers, as well as for integrated circuit cooling, microprocessor cooling, and electronic package cooling. Some recent applications of TEMs include PC processors that produce very large amounts of heat during their operation for reliable operating temperature for these electronic devices. TEMs have also been applied in scientific and laboratory equipment cooling for laser diodes and integrated circuit chips to reduce the thermal noise and leakage current of the electronic components where conventional passive cooling technologies cannot fully meet the heat dissipation requirements.

Restraint : High costs compared to traditional heating/cooling systems

Manufacturing thermoelectric systems includes significant material and manufacturing costs compared with conventional cooling and refrigeration systems. The high cost of tellurium and germanium is one of the primary reasons for the high cost of TEMs. Furthermore, the estimation of manufacturing costs of TEMs is extremely difficult because the materials and processes vary widely. For instance, according to the Fraunhofer Institute for Physical Measurement Techniques (Germany), during the mass production of TEMs in the semi-automatic production facility in 2016, the material cost of TEMs significantly decreased, while the initial capital investment had increased. Hence, companies that produce TEMs in large quantities benefit from greater economies of scale.

Opportunity : Development of TEMs for new application areas

TEMs are used in a wide range of industries, including automotive, consumer, electronics, aerospace & defense, medical & laboratories, oil & gas, energy & power, food & beverages, metal & mining, and telecommunications. The major growth area for the market is the medical equipment industry because of the growing need for large and small high-powered devices for treatment and analysis purposes. Medical electronics devices include medical devices, medical diagnostic tools, and monitoring devices. These devices, including surgical instruments and analyzers of automated immunoassays, need more precision, reliability, and efficiency in terms of thermal performance. To achieve this, medical equipment designers have introduced passive thermal control systems, which include heat pipes and vapor chambers. Also, designers ensure consistent temperature control and increase the power level of devices without increasing the operating temperature. Therefore, heat pipes, cooling medical devices, and vapor chambers are used in medical devices for thermal management solutions. Therefore, this is expected to increase the demand for TEMs in the coming years.

Challenge : Reliability and strength of TEMs

Applications involving thermal cycling show significantly worse reliability, especially when the TEMs are cycled up to high temperatures. For applications involving relatively steady-state cooling where DC power is being applied to the module on a continuous and uniform basis, the reliability and life-expectancy of TEMs are very high. Hence, there are numerous application parameters and conditions that will affect the result. A particular test conducted in a TEM may not be valid for other configurations.

Multistage Thermoelectric Modules Market to witness significant growth rate between 2022 and 2027

The multistage coolers (TEC) offer superior cooling capabilities over single-stage coolers while maintaining their solid-state benefits. They have higher heat pumping capability than single-stage thermoelectric modules. For various niche applications, companies are focusing on developing high-capacity multistage thermoelectric modules. Hence, the market for multistage thermoelectric modules is expected to witness a higher growth rate compared to the market for single-stage modules. Multistage modules are used in automotive, industrial, telecommunications, medical, and consumer applications.

Market for bulk thermoelectric modules to hold largest share of Thermoelectric Modules Market by type throughout the forecast period

Bulk thermoelectric modules are suitable for a wide variety of applications and have no design constraints compared to micro or thin-film thermoelectric modules. These modules can be configured for different power draw and cooling capabilities based on their design. They are also less complex to design, and manufacture compared to smaller modules. Bulk thermoelectric modules are widely used to make related components such as thermoelectric generators (TEGs) and heat pumps.

Automotive to create lucrative growth opportunities for thermoelectric modules during the forecast period

Uses of thermoelectric modules in automotive applications include cooling laser diodes in head-up displays, cool cup holders and glove boxes in car cabins, cooling sensor devices such as LIDAR in autonomous vehicles, and cooling laser diodes in laser headlights. Hence, with the rise in vehicles equipped with convenience features and the high growth potential of electric and autonomous vehicles, the market for thermoelectric modules for automotive applications is expected to witness the fastest growth during the forecast period.

Thermoelectric Modules Market to witness highest growth and demand in APAC

APAC has emerged as a global focal point for large investments and business expansion opportunities. The increased demand for waste heat recovery, consumer goods, industrial automation, and healthcare monitoring devices is expected to drive this market in the region. Being a hub for global manufacturing industries, China holds a huge market for thermoelectric modules, and it is expected to be the largest market in APAC during the forecast period. Japan is one of the leading countries in terms of technological innovations. The country has well-established consumer electronics, healthcare, and automotive sectors which drives the market. Additionally, the flourishing automotive and telecommunication in South Korea is enabling adoption of thermoelectric modules, thus driving the growth of the market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major vendors in the Thermoelectric Modules Companies include Ferrotec (Japan), Laird Thermal Systems (US), II-VI Incorporated (US), Kelk (Japan), Guangdong Fuxin Technology (China), TE Technology (US), TEC Microsystems (Germany), Crystal (Russia), Kryotherm (Russia), and Phononic (US).

Thermoelectric Modules Market Report Scope:

|

Report Metric |

Detail |

|

Market size available for years |

2018—2027 |

|

Base year |

2021 |

|

Forecast period |

2022—2027 |

|

Units |

Value (USD Million), Volume (Million Units) |

|

Segments covered |

Model, Type, Functionality, End-Use Application, Offering, and Geography |

|

Geographic regions covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Ferrotec (Japan), Laird Thermal Systems (US), II-VI Incorporated (US), Kelk (Japan), Guangdong Fuxin Technology (China), TE Technology (US), TEC Microsystems (Germany), Crystal (Russia), Kryotherm (Russia), and Phononic (US) are the major players in the market. |

This report categorizes the Thermoelectric Modules market based on Model, Type, Functionality, End-Use Application, and Geography.

Based on Model, the Thermoelectric Modules Market been Segmented as follows:

- Single Stage

- Multi Stage

Based on Type, the Thermoelectric Modules Market been Segmented as follows:

- Bulk Thermoelectric Modules

- Micro Thermoelectric Modules

- Thin Film Thermoelectric Modules

Based on Functionality, the Thermoelectric Modules Market been Segmented as follows:

- General Purpose

- Deep Cooling

Based on End-Use Application, the Thermoelectric Modules Market been Segmented as follows:

- Consumer Electronics

- Industrial

- Telecommunications

- Autmomotive

- Medical & Laboratories

- Aerospace & Defense

- Oil & Gas and Mining

Based on Offering, the Thermoelectric Modules Market been Segmented as follows:

- Hardware

- Services

Based on Region, the Thermoelectric Modules Market been Segmented as follows:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- Rest of APAC

-

RoW

- Middle East & Africa

- South America

Recent Developments

- In May 2022, Phononic partnered with Google Cloud’s two new manufacturing data solutions: Manufacturing Data Engine and Manufacturing Connect. The partnership is aimed at achieving the analytics and insights needed to fully optimize Phononic’s operations.

- In July 2021, Laird Thermal Systems launched enhanced OptoTEC OTX/HTX Series of miniature thermoelectric coolers designed for high-temperature environments found in telecom, industrial, autonomous and photonics applications.

- In July 2021, Phononic secured growth investment led by $50 million from the Sustainable Investing business within Goldman Sachs Asset Management (Goldman Sachs). Phononic aims to expand its sales and marketing, domestic and international high-volume manufacturing capabilities, and expand its cooling and refrigeration product portfolio and platform through this investment.

- In August 2020, Laird Thermal Systems launched its Hi-Temp ETX Series thermoelectric coolers to deliver active cooling in high-temperature environments for autonomous systems, machine vision, digital light processors, and optical transceivers.

Frequently Asked Questions (FAQ):

Which are the major companies in the thermoelectric modules market? What are their major strategies to strengthen their market presence?

Ferrotec (Japan), Laird Thermal Systems (US), II-VI Incorporated (US), Kelk (Japan), Guangdong Fuxin Technology (China) are the top players in the market. These companies have adopted organic as well as inorganic growth strategies such as product launch, acquisitions, and partnerships to gain competitive advantage in the market.

Which is the potential market for thermoelectric modules in terms of the region?

APAC is the region with high growth opportunities owing to the presence of countries such as China and South Korea, which are the leaders the consumer electronics manufacturing industry. Rising adoption of 5G communication in China, South Korea, and Japan also facilitate growth to the market.

What are the opportunities for new market entrants?

Factors such as development of TEMs for new application areas and demand for thermoelectric coolers for storage and transport of COVID-19 vaccines are creating opportunities for the players in the market.

Which end-use applications are expected to drive the growth of the market in the next six years?

Consumer electronics is expected to remain the major end-use application driving significant demand for thermoelectric modules. Due to fast-changing consumer preferences, thermoelectric cooling solutions offer a competitive advantage by enabling OEMs to develop desirable products and bring them faster to the market. Additionally, market for automotive is expected to grow at a higher CAGR during the forecast period owing to fast growth of electric vehicles in the market. Thermoelectric modules are deployed for the cooling and heating of batteries in electric and hybrid vehicles. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 SEGMENTATION OF THERMOELECTRIC MODULES MARKET

1.3.1 YEARS CONSIDERED

1.4 CURRENCY & PRICING

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 THERMOELECTRIC MODULES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

2.1.2.1 List of key secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.1.3.2 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for estimating market size using top-down analysis (supply side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) — REVENUE GENERATED BY COMPANIES IN THERMOELECTRIC MODULES MARKET

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 7 THERMOELECTRIC MODULES MARKET: 2018–2027 (USD MILLION)

FIGURE 8 MULTI-STAGE THERMOELECTRIC MODULES SEGMENT EXPECTED TO EXPERIENCE FASTER GROWTH DURING FORECAST PERIOD

FIGURE 9 MICRO MARKET TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 10 MARKET IN AUTOMOTIVE APPLICATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 11 APAC ACCOUNTS FOR LARGEST SHARE OF MARKET IN 2022

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN THERMOELECTRIC MODULES MARKET

FIGURE 12 DEVELOPING ECONOMIES OFFER MAJOR GROWTH PROSPECTS IN MARKET

4.2 BULK MARKET, BY REGION

FIGURE 13 APAC TO WITNESS HIGHEST CAGR IN BULK THERMOELECTRIC MODULES SEGMENT DURING FORECAST PERIOD

4.3 MARKET, BY FUNCTIONALITY

FIGURE 14 GENERAL-PURPOSE THERMOELECTRIC MODULES TO LEAD MARKET DURING FORECAST PERIOD

4.4 MARKET IN APAC, BY END-USE APPLICATION VS. BY COUNTRY

FIGURE 15 CONSUMER ELECTRONICS IS LARGEST APPLICATION OF THERMOELECTRIC MODULES IN APAC

4.5 MARKET, BY COUNTRY

FIGURE 16 US ACCOUNTS FOR LARGEST SHARE OF MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 IMPACT OF DRIVERS AND OPPORTUNITIES ON MARKET

FIGURE 18 IMPACT OF RESTRAINTS AND CHALLENGES ON MARKET

5.2.1 DRIVERS

5.2.1.1 Benefits of TEMs over conventional systems

5.2.1.2 Simultaneous heating and cooling properties of TEMs driving demand in several applications

5.2.1.3 Growth of electric and luxury vehicles increasing demand for TEMs

5.2.2 RESTRAINTS

5.2.2.1 Inherent disadvantages and design complexities

5.2.2.2 High costs compared with traditional heating/cooling systems

5.2.3 OPPORTUNITIES

5.2.3.1 Development of TEMs for new application areas

5.2.3.2 Thermoelectric coolers for storage and transport of COVID-19 vaccines

5.2.4 CHALLENGES

5.2.4.1 Reliability and strength of TEMs

5.3 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS OF THERMOELECTRIC MODULES MARKET: R&D AND MANUFACTURING PHASES CONTRIBUTE MAXIMUM VALUE

5.4 ECOSYSTEM/MARKET MAP

FIGURE 20 MARKET ECOSYSTEM

5.4.1 THERMOELECTRIC MODULE OEMS

5.4.2 SUPPLIERS

5.4.3 DISTRIBUTORS

TABLE 2 MARKET: ECOSYSTEM

5.5 PRICING ANALYSIS

FIGURE 21 AVERAGE SELLING PRICE FORECAST OF THERMOELECTRIC MODULES (2020–2027)

TABLE 3 AVERAGE SELLING PRICE OF THERMOELECTRIC MODULES, 2020–2027 (USD)

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 22 REVENUE SHIFT FOR THERMOELECTRIC MODULES MARKET

5.7 TECHNOLOGY ANALYSIS

5.7.1 KEY TECHNOLOGIES

5.7.1.1 Thermoelectric generators

5.7.1.2 Thermoelectric heat pumps

5.7.2 ADJACENT TECHNOLOGY

5.7.2.1 Traditional heat pumps

5.8 TECHNOLOGY TRENDS

5.8.1 NEW MATERIALS USED FOR MANUFACTURING THERMOELECTRIC MODULES

5.8.2 MINIATURIZATION OF THERMOELECTRIC MODULES

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 THERMOELECTRIC MODULES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 DEGREE OF COMPETITION

5.9.2 BARGAINING POWER OF SUPPLIERS

5.9.3 BARGAINING POWER OF BUYERS

5.9.4 THREAT FROM SUBSTITUTES

5.9.5 THREAT OF NEW ENTRANTS

5.10 CASE STUDIES

5.10.1 LAIRD THERMAL SYSTEMS USED THERMOELECTRIC MODULES FOR COOLING OPTICAL SENSORS

5.10.2 LAIRD THERMAL SYSTEMS USED THERMOELECTRIC MODULES FOR VISION SYSTEMS

5.10.3 LAIRD THERMAL SYSTEMS USED THERMOELECTRIC MODULES FOR PRESERVING MEDICAL REAGENTS

5.10.4 II-VI MARLOW SHOWCASED THERMOELECTRIC COOLER FOR THERMAL CYCLING

5.10.5 II-VI MARLOW SHOWCASED THERMOELECTRIC MODULES FOR ENERGY HARVESTING

5.10.6 CRYSTAL DEVELOPED PROTOTYPE FOR LABORATORY RESEARCH EQUIPMENT

5.10.7 MAHLE TESTING THERMOELECTRIC TECHNOLOGY IN AUTOMOTIVE APPLICATIONS

5.10.8 PHONONIC LEVERAGED THERMOELECTRIC TECHNOLOGY TO DEVELOP CPU COOLER

5.10.9 PHONONIC PROVIDED SOLID-STATE REFRIGERATION SOLUTIONS USING THERMOELECTRIC TECHNOLOGY

5.10.10 PHONONIC OFFERED THERMOELECTRIC FREEZERS TO CONVENIENCE STORES

5.11 TRADE ANALYSIS

5.11.1 TRADE DATA

FIGURE 23 IMPORT DATA FOR HS CODE 8418, BY COUNTRY, 2017–2021

FIGURE 24 EXPORT DATA FOR HS CODE 8418, BY COUNTRY, 2017–2021

5.12 PATENT ANALYSIS

FIGURE 25 NUMBER OF PATENTS GRANTED PER YEAR, 2012–2021

FIGURE 26 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 5 TOP 20 PATENT OWNERS IN LAST 10 YEARS

TABLE 6 LIST OF A FEW PATENTS IN THERMOELECTRIC MODULES MARKET, 2018–2021

5.13 TARIFFS AND REGULATIONS

5.13.1 TARIFFS RELATED TO THERMOELECTRIC MODULES

5.13.2 REGULATIONS

5.13.2.1 Europe

5.13.2.1.1 RoHS

5.13.2.2 US

5.13.2.2.1 Telcordia GR-468

5.13.2.2.2 ITAR

5.13.3 GLOBAL

5.13.3.1 Space qualifications

6 THERMOELECTRIC MODULES MARKET, BY MODEL (Page No. - 76)

6.1 INTRODUCTION

FIGURE 27 MULTI-STAGE THERMOELECTRIC MODULES TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 7 MARKET, BY MODEL, 2018–2021 (USD MILLION)

TABLE 8 MARKET, BY MODEL, 2022–2027 (USD MILLION)

6.2 SINGLE-STAGE

6.2.1 SINGLE-STAGE THERMOELECTRIC MODULES HAVE ONLY ONE STAGE OR LAYER TO ACHIEVE STANDARD TEMPERATURE DIFFERENCES

6.3 MULTI-STAGE

6.3.1 MULTI-STAGE THERMOELECTRIC MODULES HAVE HIGH-TEMPERATURE DIFFERENTIALS BETWEEN HOT AND COLD SIDES OF MODULES

7 THERMOELECTRIC MODULES MARKET, BY TYPE (Page No. - 79)

7.1 INTRODUCTION

FIGURE 28 MICRO THERMOELECTRIC MODULES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 9 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 10 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 11 MARKET, BY TYPE, 2021–2027 (MILLION UNITS)

7.2 BULK THERMOELECTRIC MODULES

7.2.1 BULK THERMOELECTRIC MODULES HAVE HIGHER POWER OUTPUT AND VOLTAGE COMPARED TO OTHER MODULES

TABLE 12 BULK MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 13 BULK MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 MICRO THERMOELECTRIC MODULES

7.3.1 MICRO THERMOELECTRIC MODULES HELP IN REDUCING ENERGY CONSUMPTION OF ELECTRIC DEVICES

TABLE 14 MICRO MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 15 MICRO MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 THIN-FILM THERMOELECTRIC MODULES

7.4.1 THESE MODULES PRODUCE MAXIMUM HEAT FLUX

TABLE 16 THIN-FILM MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 17 THIN-FILM MARKET, BY REGION, 2022–2027 (USD MILLION)

8 THERMOELECTRIC MODULES MARKET, BY FUNCTIONALITY (Page No. - 85)

8.1 INTRODUCTION

FIGURE 29 GENERAL-PURPOSE THERMOELECTRIC MODULES TO LEAD MARKET DURING FORECAST PERIOD

TABLE 18 MARKET, BY FUNCTIONALITY, 2018–2021 (USD MILLION)

TABLE 19 MARKET, BY FUNCTIONALITY, 2022–2027 (USD MILLION)

8.2 GENERAL-PURPOSE

8.2.1 TELECOMMUNICATIONS TO REMAIN LARGEST APPLICATION OF GENERAL-PURPOSE THERMOELECTRIC MODULES

TABLE 20 GENERAL-PURPOSE MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 21 GENERAL-PURPOSE MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

8.3 DEEP COOLING

8.3.1 CONSUMER ELECTRONICS TO REMAIN LARGEST END USER OF DEEP COOLING THERMOELECTRIC MODULES

TABLE 22 DEEP COOLING MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 23 DEEP COOLING MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

9 THERMOELECTRIC MODULES MARKET, BY OFFERING (Page No. - 90)

9.1 INTRODUCTION

FIGURE 30 HARDWARE COMPONENT TO HOLD LARGER SHARE OF MARKET THROUGHOUT FORECAST PERIOD

TABLE 24 MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 25 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.2 HARDWARE

9.2.1 HARDWARE OF THERMOELECTRIC MODULES INCLUDES VARIOUS ELEMENTS AND COMPONENTS THAT WORK AS A UNIT

9.3 SERVICES

9.3.1 SERVICES INCLUDE PROTOTYPING, DESIGNING, ENGINEERING, TESTING, AND COMPLIANCE

10 THERMOELECTRIC MODULES MARKET, BY END-USE APPLICATION (Page No. - 93)

10.1 INTRODUCTION

FIGURE 31 MARKET TO REGISTER HIGHEST CAGR IN AUTOMOTIVE APPLICATION DURING FORECAST PERIOD

TABLE 26 MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 27 MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

10.2 CONSUMER ELECTRONICS

10.2.1 CONSUMER ELECTRONICS HELD LARGEST SHARE OF THERMOELECTRIC MODULES MARKET

TABLE 28 MARKET IN CONSUMER ELECTRONICS, BY FUNCTIONALITY, 2018–2021 (USD MILLION)

TABLE 29 MARKET IN CONSUMER ELECTRONICS, BY FUNCTIONALITY, 2022–2027 (USD MILLION)

TABLE 30 MARKET IN CONSUMER ELECTRONICS, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 MARKET IN CONSUMER ELECTRONICS, BY REGION, 2022–2027 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET IN CONSUMER ELECTRONICS , BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET IN CONSUMER ELECTRONICS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 34 EUROPE: MARKET IN CONSUMER ELECTRONICS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 35 EUROPE: MARKET IN CONSUMER ELECTRONICS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 36 APAC: MARKET IN CONSUMER ELECTRONICS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 37 APAC: MARKET IN CONSUMER ELECTRONICS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 38 ROW: MARKET IN CONSUMER ELECTRONICS, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 ROW: MARKET IN CONSUMER ELECTRONICS, BY REGION, 2022–2027 (USD MILLION)

10.3 INDUSTRIAL

10.3.1 USE OF THERMOELECTRIC MODULES IN FOOD & BEVERAGES INDUSTRY DRIVING OVERALL MARKET

TABLE 40 THERMOELECTRIC MODULES MARKET IN INDUSTRIAL, BY FUNCTIONALITY, 2018–2021 (USD MILLION)

TABLE 41 MARKET IN INDUSTRIAL, BY FUNCTIONALITY, 2022–2027 (USD MILLION)

TABLE 42 MARKET IN INDUSTRIAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 MARKET IN INDUSTRIAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET IN INDUSTRIAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET IN INDUSTRIAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 46 EUROPE: MARKET IN INDUSTRIAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 47 EUROPE: MARKET IN INDUSTRIAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 48 APAC: MARKET IN INDUSTRIAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 49 APAC: MARKET IN INDUSTRIAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 50 ROW: MARKET IN INDUSTRIAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 ROW: MARKET IN INDUSTRIAL, BY REGION, 2022–2027 (USD MILLION)

10.4 TELECOMMUNICATIONS

10.4.1 APAC TO ACCOUNT FOR LARGEST MARKET SHARE IN TELECOMMUNICATIONS APPLICATION DURING FORECAST PERIOD

TABLE 52 THERMOELECTRIC MODULES MARKET IN TELECOMMUNICATIONS, BY FUNCTIONALITY, 2018–2021 (USD MILLION)

TABLE 53 MARKET IN TELECOMMUNICATIONS, BY FUNCTIONALITY, 2022–2027 (USD MILLION)

TABLE 54 MARKET IN TELECOMMUNICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 MARKET IN TELECOMMUNICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET IN TELECOMMUNICATIONS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET IN TELECOMMUNICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 58 EUROPE: MARKET IN TELECOMMUNICATIONS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 59 EUROPE: MARKET IN TELECOMMUNICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 60 APAC: MARKET IN TELECOMMUNICATIONS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 61 APAC: MARKET IN TELECOMMUNICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 62 ROW: MARKET IN TELECOMMUNICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 ROW: MARKET IN TELECOMMUNICATIONS, BY REGION, 2022–2027 (USD MILLION)

10.5 AUTOMOTIVE

10.5.1 MARKET IN AUTOMOTIVE APPLICATION TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 64 THERMOELECTRIC MODULES MARKET IN AUTOMOTIVE, BY FUNCTIONALITY, 2018–2021 (USD MILLION)

TABLE 65 MARKET IN AUTOMOTIVE, BY FUNCTIONALITY, 2022–2027 (USD MILLION)

TABLE 66 MARKET IN AUTOMOTIVE, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 MARKET IN AUTOMOTIVE, BY REGION, 2022–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET IN AUTOMOTIVE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET IN AUTOMOTIVE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 70 EUROPE: MARKET IN AUTOMOTIVE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 71 EUROPE: MARKET IN AUTOMOTIVE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 72 APAC: MARKET IN AUTOMOTIVE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 73 APAC: MARKET IN AUTOMOTIVE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 74 ROW: MARKET IN AUTOMOTIVE, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 ROW: MARKET IN AUTOMOTIVE, BY REGION, 2022–2027 (USD MILLION)

10.6 MEDICAL & LABORATORIES

10.6.1 NEED FOR TEMPERATURE STABILIZATION BOOSTING DEMAND FOR THERMOELECTRIC MODULES IN MEDICAL & LABORATORIES

TABLE 76 THERMOELECTRIC MODULES MARKET IN MEDICAL & LABORATORIES, BY FUNCTIONALITY, 2018–2021 (USD MILLION)

TABLE 77 MARKET IN MEDICAL & LABORATORIES, BY FUNCTIONALITY, 2022–2027 (USD MILLION)

TABLE 78 MARKET IN MEDICAL & LABORATORIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 MARKET IN MEDICAL & LABORATORIES, BY REGION, 2022–2027 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET IN MEDICAL & LABORATORIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET IN MEDICAL & LABORATORIES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: MARKET IN MEDICAL & LABORATORIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 83 EUROPE: MARKET IN MEDICAL & LABORATORIES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 84 APAC: MARKET IN MEDICAL & LABORATORIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 85 APAC: MARKET IN MEDICAL & LABORATORIES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 86 ROW: MARKET IN MEDICAL & LABORATORIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 87 ROW: MARKET IN MEDICAL & LABORATORIES, BY REGION, 2022–2027 (USD MILLION)

10.7 AEROSPACE & DEFENSE

10.7.1 MARLOW AND RMT ARE AMONG KEY COMPANIES CATERING TO DEMAND IN AEROSPACE & DEFENSE APPLICATION

TABLE 88 THERMOELECTRIC MODULES MARKET IN AEROSPACE & DEFENSE, BY FUNCTIONALITY, 2018–2021 (USD MILLION)

TABLE 89 MARKET IN AEROSPACE & DEFENSE, BY FUNCTIONALITY, 2022–2027 (USD MILLION)

TABLE 90 MARKET IN AEROSPACE & DEFENSE, BY REGION, 2018–2021 (USD MILLION)

TABLE 91 MARKET IN AEROSPACE & DEFENSE, BY REGION, 2022–2027 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET IN AEROSPACE & DEFENSE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET IN AEROSPACE & DEFENSE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 94 EUROPE: MARKET IN AEROSPACE & DEFENSE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 95 EUROPE: MARKET IN AEROSPACE & DEFENSE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 96 APAC: MARKET IN AEROSPACE & DEFENSE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 97 APAC: MARKET IN AEROSPACE & DEFENSE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 98 ROW: MARKET IN AEROSPACE & DEFENSE, BY REGION, 2018–2021 (USD MILLION)

TABLE 99 ROW: MARKET IN AEROSPACE & DEFENSE, BY REGION, 2022–2027 (USD MILLION)

10.8 OIL & GAS AND MINING

10.8.1 THERMOELECTRIC MODULES USED IN GAS ANALYZERS, METERING EQUIPMENT, AND REMOTE TELEMETRY UNITS

TABLE 100 THERMOELECTRIC MODULES MARKET IN OIL & GAS AND MINING, BY FUNCTIONALITY, 2018–2021 (USD MILLION)

TABLE 101 MARKET IN OIL & GAS AND MINING, BY FUNCTIONALITY, 2022–2027 (USD MILLION)

TABLE 102 MARKET IN OIL & GAS AND MINING, BY REGION, 2018–2021 (USD MILLION)

TABLE 103 MARKET IN OIL & GAS AND MINING, BY REGION, 2022–2027 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET IN OIL & GAS AND MINING, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET IN OIL & GAS AND MINING, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 106 EUROPE: MARKET IN OIL & GAS AND MINING, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 107 EUROPE: MARKET IN OIL & GAS AND MINING, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 108 APAC: MARKET IN OIL & GAS AND MINING, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 109 APAC: MARKET IN OIL & GAS AND MINING, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 110 ROW: MARKET IN OIL & GAS AND MINING, BY REGION, 2018–2021 (USD MILLION)

TABLE 111 ROW: MARKET IN OIL & GAS AND MINING, BY REGION, 2022–2027 (USD MILLION)

11 GEOGRAPHIC ANALYSIS (Page No. - 127)

11.1 INTRODUCTION

FIGURE 32 THERMOELECTRIC MODULES MARKET IN APAC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 112 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 113 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 114 MARKET, BY REGION, 2021–2027 (MILLION UNITS)

11.2 NORTH AMERICA

FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

TABLE 115 NORTH AMERICA: MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 118 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 119 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 120 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Industrial clusters using thermoelectric modules to improve efficiency and provide clean energy

11.2.2 CANADA

11.2.2.1 Industrial and automotive applications driving growth of market in Canada

11.2.3 MEXICO

11.2.3.1 Growing automotive and industrial applications driving thermoelectric modules

11.3 EUROPE

FIGURE 34 EUROPE: THERMOELECTRIC MODULES MARKET SNAPSHOT

TABLE 121 EUROPE: MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 122 EUROPE: MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

TABLE 123 EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 124 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 125 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 126 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Germany estimated to hold largest share of market in Europe

11.3.2 UK

11.3.2.1 Growing industrial and automotive sectors to drive market in UK

11.3.3 FRANCE

11.3.3.1 Government incentives to reduce emissions to boost market growth in France

11.3.4 ITALY

11.3.4.1 Presence of luxury and high-performance automotive manufacturers to drive market in Italy

11.3.5 REST OF EUROPE

11.4 ASIA PACIFIC

FIGURE 35 APAC: THERMOELECTRIC MODULES MARKET SNAPSHOT

TABLE 127 APAC: MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 128 APAC: MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

TABLE 129 APAC: MARKET , BY TYPE, 2018–2021 (USD MILLION)

TABLE 130 APAC: MARKET , BY TYPE, 2022–2027 (USD MILLION)

TABLE 131 APAC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 132 APAC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 China to hold largest share of market in APAC during forecast period

11.4.2 JAPAN

11.4.2.1 Consumer electronics market driving growth of thermoelectric modules in Japan

11.4.3 SOUTH KOREA

11.4.3.1 Thermoelectric modules market in South Korea dominated by telecommunications and automotive applications

11.4.4 REST OF APAC

11.5 ROW

TABLE 133 ROW: MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 134 ROW: MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

TABLE 135 ROW: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 136 ROW: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 137 ROW: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 138 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5.1 SOUTH AMERICA

11.5.1.1 South America to hold larger share of market in RoW

11.5.2 MIDDLE EAST & AFRICA

11.5.2.1 Oil & gas industry to drive adoption of thermoelectric modules in Middle East

12 COMPETITIVE LANDSCAPE (Page No. - 145)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 139 OVERVIEW OF STRATEGIES ADOPTED BY KEY THERMOELECTRIC MODULE MANUFACTURERS

12.3 REVENUE ANALYSIS OF TOP COMPANIES

FIGURE 36 REVENUE ANALYSIS OF TOP FIVE PLAYERS IN MARKET

12.4 MARKET SHARE ANALYSIS: MARKET, 2021

TABLE 140 MARKET: DEGREE OF COMPETITION, 2021

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE COMPANIES

12.5.4 PARTICIPANTS

FIGURE 37 MARKET: COMPANY EVALUATION QUADRANT, 2021

12.6 START-UPS/SMALL- AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

TABLE 141 LIST OF START-UPS IN THERMOELECTRIC MODULES MARKET

12.6.1 PROGRESSIVE COMPANIES

12.6.2 RESPONSIVE COMPANIES

12.6.3 DYNAMIC COMPANIES

12.6.4 STARTING BLOCKS

FIGURE 38 MARKET, START-UPS/SMES EVALUATION QUADRANT, 2021

12.7 COMPANY FOOTPRINT

TABLE 142 OVERALL COMPANY FOOTPRINT

TABLE 143 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 144 COMPANY END-USE APPLICATION FOOTPRINT

TABLE 145 COMPANY REGION FOOTPRINT

12.8 COMPETITIVE SCENARIO

12.8.1 PRODUCT LAUNCHES

TABLE 146 PRODUCT LAUNCHES, 2019–2022

12.8.2 DEALS

TABLE 147 DEALS, 2019–2022

13 COMPANY PROFILES (Page No. - 158)

13.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

13.1.1 FERROTEC

TABLE 148 FERROTEC: BUSINESS OVERVIEW

FIGURE 39 FERROTEC: COMPANY SNAPSHOT

13.1.2 LAIRD THERMAL SYSTEMS

TABLE 149 LAIRD THERMAL SYSTEMS: BUSINESS OVERVIEW

13.1.3 II-VI INCORPORATED

TABLE 150 II-VI INCORPORATED: BUSINESS OVERVIEW

FIGURE 40 II-VI INCORPORATED: COMPANY SNAPSHOT

13.1.4 KELK

TABLE 151 KELK: BUSINESS OVERVIEW

13.1.5 GUANGDONG FUXIN TECHNOLOGY

TABLE 152 GUANGDONG FUXIN TECHNOLOGY: BUSINESS OVERVIEW

13.1.6 TE TECHNOLOGY

TABLE 153 TE TECHNOLOGY: BUSINESS OVERVIEW

13.1.7 TEC MICROSYSTEMS

TABLE 154 TEC MICROSYSTEMS: BUSINESS OVERVIEW

13.1.8 CRYSTAL

TABLE 155 CRYSTAL: BUSINESS OVERVIEW

13.1.9 KRYOTHERM

TABLE 156 KRYOTHERM: BUSINESS OVERVIEW

13.1.10 THERMION COMPANY

TABLE 157 THERMION COMPANY: BUSINESS OVERVIEW

13.1.11 Z-MAX

TABLE 158 Z-MAX: BUSINESS OVERVIEW

13.1.12 PHONONIC

TABLE 159 PHONONIC: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13.2 OTHER KEY PLAYERS

13.2.1 ALIGN SOURCING

13.2.2 EVERREDTRONICS

13.2.3 HITECH TECHNOLOGIES

13.2.4 HI-Z TECHNOLOGY

13.2.5 HUI MAO

13.2.6 INHECO INDUSTRIAL HEATING & COOLING

13.2.7 KJLP (SHENZHEN) ELECTRONICS

13.2.8 KYOCERA CORPORATION

13.2.9 MERIT TECHNOLOGY GROUP

13.2.10 P&N TECHNOLOGY

13.2.11 THERMONAMIC ELECTRONICS

13.2.12 WELLEN TECHNOLOGY

13.2.13 XIAMEN HICOOL ELECTRONICS

14 ADJACENT & RELATED MARKETS (Page No. - 193)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 ENERGY HARVESTING MARKET, BY COMPONENT

TABLE 160 ENERGY HARVESTING SYSTEM MARKET, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 161 ENERGY HARVESTING SYSTEM MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

14.4 TRANSDUCERS

14.4.1 PHOTOVOLTAICS

14.4.1.1 Photovoltaic transducers market driven by building automation, consumer electronics, and transportation applications

14.4.2 ELECTRODYNAMIC, PIEZOELECTRIC, AND ELECTROMAGNETIC

14.4.2.1 Electrodynamics

14.4.2.1.1 Electrodynamic systems used in harsh conditions, such as centrifugal acceleration, high axial and radial static displacement, and tilting movement

14.4.2.2 Piezoelectric

14.4.2.2.1 Piezoelectric energy harvesters used in switches, boots, and other small equipment that provide pressure and strain

14.4.2.3 Electromagnetic

14.4.2.3.1 Electromagnetic transducers can be installed in rail tracks, bridges, helicopter dampers, and car suspensions

14.4.3 THERMOELECTRIC

14.4.3.1 Thermoelectric transducers are mainly used for energy harvesting in industries and automobiles

14.4.4 RADIOFREQUENCY (RF) TRANSDUCERS

14.4.4.1 RF transducers predominantly used in switches, fitness trackers, smartwatches, wireless charging headphones, smart cards, and RFID tags

TABLE 162 ENERGY HARVESTING SYSTEM MARKET FOR TRANSDUCERS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 163 ENERGY HARVESTING SYSTEM MARKET FOR TRANSDUCERS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 164 ENERGY HARVESTING SYSTEM MARKET FOR TRANSDUCERS, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 165 ENERGY HARVESTING SYSTEM MARKET FOR TRANSDUCERS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

14.5 POWER MANAGEMENT INTEGRATED CIRCUITS

14.5.1 PMIC PLAYS CRUCIAL ROLE IN MANAGEMENT OF POWER GENERATED THROUGH ENERGY-HARVESTING DEVICES

TABLE 166 ENERGY HARVESTING SYSTEM MARKET FOR PMICS, BY TECHNOLOGY, 2018–2020 (USD THOUSAND)

TABLE 167 ENERGY HARVESTING SYSTEM MARKET FOR PMICS, BY TECHNOLOGY, 2021–2026 (USD THOUSAND)

14.6 SECONDARY BATTERIES

14.6.1 LITHIUM-ION BATTERIES MAINLY USED AS SECONDARY BATTERIES IN ENERGY-HARVESTING SYSTEMS

TABLE 168 ENERGY HARVESTING SYSTEM MARKET FOR SECONDARY BATTERIES, BY TYPE, 2018–2020 (USD MILLION)

TABLE 169 ENERGY HARVESTING SYSTEM MARKET FOR SECONDARY BATTERIES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 170 ENERGY HARVESTING SYSTEM MARKET FOR SECONDARY BATTERIES, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 171 ENERGY HARVESTING SYSTEM MARKET FOR SECONDARY BATTERIES, BY TECHNOLOGY, 2021–2026 (USD MILLION)

15 APPENDIX (Page No. - 203)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

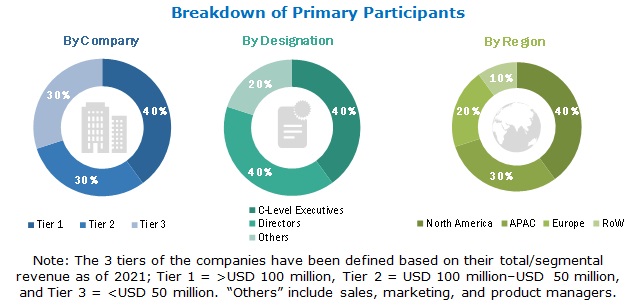

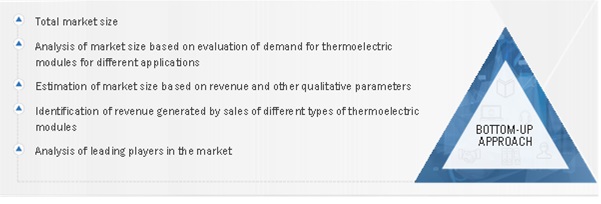

The study involved four major activities in estimating the size for thermoelectric modules market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, thermoelectric module-related journals, and certified publications; articles by recognized authors; gold and silver standard websites; directories; and databases like Factiva.

Secondary research was mainly conducted to obtain key information about the industry supply chain, the market value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain the qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the thermoelectric modules market.

Extensive primary research was conducted after obtaining information about the thermoelectric modules market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides. Primary data has been mainly collected through telephonic interviews, which constitute approximately 80% of the overall primary interviews. Moreover, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the thermoelectric modules market.

Key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involves the study of the annual and financial reports, Factiva data of top players, as well as interviews with industry experts, such as chief executive officers, vice presidents, directors, and marketing executives, for both quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Thermoelectric Modules Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the thermoelectric modules market from the estimation process explained above, the total market was split into several segments and subsegments. The market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the thermoelectric modules market, in terms of value, based on model, type, functionality, end-use application, and offering

- To describe and forecast the market size of the thermoelectric module market, in terms of value, with regard to four main regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the supply chain of the thermoelectric module ecosystem

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the thermoelectric modules market

- To benchmark players within the market using the proprietary “Competitive Leadership Mapping” framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape of the market

- To analyze competitive developments such as acquisitions, product launches and developments, expansions, partnerships, and acquisitions in the thermoelectric modules market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Thermoelectric Modules Market

We want to get more information on the expected market development for thermoelectric modules for cooling applications when used as Peltier elements.

Which are the major Chinese manufacturers of TE modules? How much China contribute in the global market?