Transportation Management System Market by Offering (Solutions, Services), Transportation Mode (Roadways, Railways, Airways, Maritime), End User, Solutions (Consulting, Implementation & Integration ), Services, Vertical & Region - Global Forecast to 2028

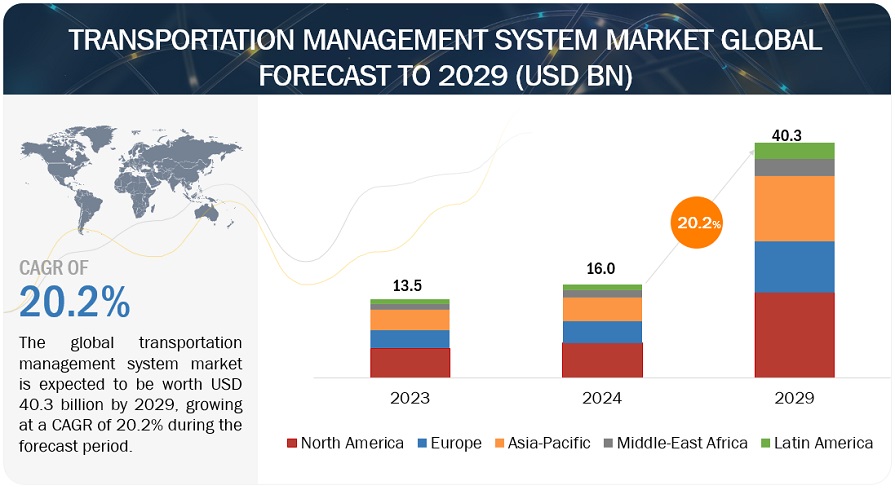

[333 Pages Report] MarketsandMarkets forecasts the global Transportation Management System market size is expected to grow from USD 13.5 billion in 2023 to USD 33.3 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period. Intelligent TMS solutions can dynamically optimize routes, predict disruptions, recommend carrier selection, and automate administrative tasks, thereby increasing operational efficiency and driving the growth of the transportation management system market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Transportation Management System Market Dynamics

Driver: Cloud-based SaaS solutions to drive the transportation management system market.

Modern businesses are mostly dependent on technology, in which large enterprises have their own IT department for managing and maintaining business processes, where as, most start-ups and SMEs do not have a proper IT department system. The reason is that managing and maintaining an IT department requires an extra cost. The majority of SMEs and startups use cloud-based transport management systems because they may benefit from an IT department without having to hire additional people or incurring additional fees. This enables internal staff to concentrate on ongoing business operations. The cloud-based transport management system's storage flexibility provides scalability, which is crucial for SMEs and will aid them in coping with unanticipated growth during the first year of business operation. The cloud-based transport management system provides cost savings and an alluring pay-as-you-go model, such real-time payment over the cloud, when purchasing products, allowing SMEs to position themselves as effective and competitive competitors among other firms.

Restraint: Inaccuracies in data sets

The rise of big data across industry verticals has helped companies analyze data sets to make strategic decisions. However, inaccuracies among data sets are the major concern of data scientists across the globe. Inaccuracies, missing information, or outdated data among data sets could potentially topple the whole purpose of implementing a proper transportation management analytics initiative by the companies.

Opportunity: Evolving 5G to transform the transportation management system

The emergence of 5G technology brings forth a range of possibilities for the Transportation Management System (TMS) market. These opportunities include improved connectivity, real-time communication, and data exchange between vehicles and TMS platforms. With 5G, vehicles can share information about road conditions, traffic, and accidents, enabling better route planning and optimization. TMS platforms can also benefit from 5G by gathering real-time data from vehicles and using advanced analytics for proactive decision-making, efficient fleet management, and predictive maintenance. Additionally, 5G facilitates seamless integration between TMS platforms and supply chain stakeholders, enabling real-time visibility, inventory management, and responsive coordination. The deployment of autonomous vehicles and platooning systems can also leverage 5G's high-speed, low-latency connectivity. Also, 5G-powered TMS platforms can contribute to intelligent traffic management, optimizing traffic flow, reducing congestion, and enhancing road safety through real-time data analysis and dynamic adjustments. Overall, 5G presents significant prospects for the TMS market, offering enhanced operational efficiency, improved resource allocation, and safer transportation management system solutions.

Challenge: Lack of awareness of the benefits of TMS among the end-users

Transportation management system offers several benefits that can reduce the overall expenses of the end-users in the supply chain industry. However, the users are still ignorant of the benefits due to a lack of exposure to digital technology and consistent use of traditional methods for operations like the use of spreadsheets, fax, or manual monitoring over the phone of vehicles etc. The end users are neither technically advanced nor they have exposure to the latest technologies like AI, Big Data etc. Therefore, they remain unaware of how much the advanced TMS software can benefit their business.

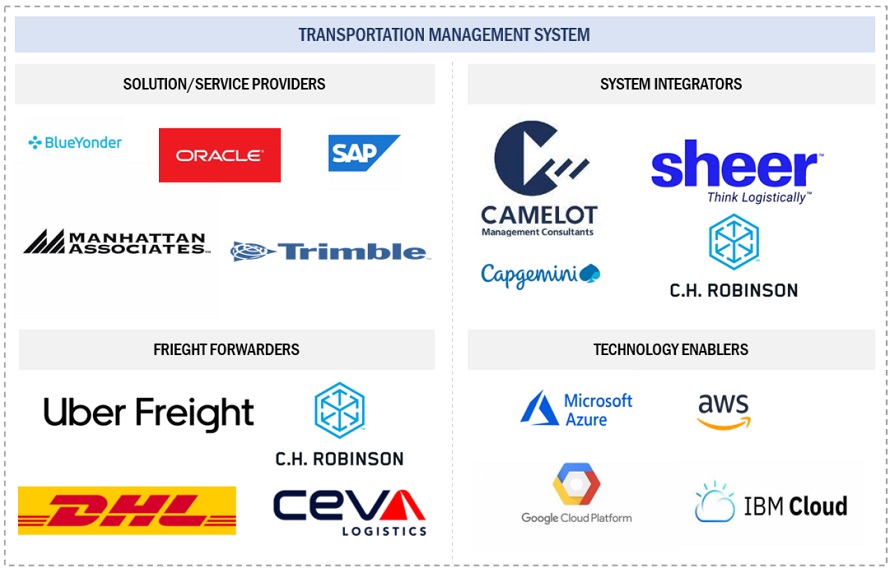

Transportation Management System Market Ecosystem

Prominent companies in this market include a well-established, financially stable provider of Transportation management system solutions and services. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Oracle (US), SAP (Germany), Manhattan Associates (US), C.H. Robinson (US), and Blue Yonder (US).

By vertical, the healthcare and pharmaceutical segment is expected to register a higher CAGR during forecast period

Healthcare enterprises are facing a huge demand due to the pandemic. However, global supply chain and logistics disruptions are making it difficult for enterprises to cater to this demand. Geographically dispersed locations, frequent delivery schedules, coordination specifications, and logistics requirements are affecting internal capabilities and lowering operating margins. Hence, healthcare enterprises are turning to TMS solutions to tackle these challenges, gain complete visibility over their transport network, and reduce shipping costs. TMS helps streamline the healthcare logistics process to support employees in their day-to-day work and reduce administrative duties.

Based on end user, the shipper segment is expected to hold the largest market size during the forecast

Shippers are responsible for organizing and transporting goods from one point to another. TMS is extremely robust for shippers, providing them with capabilities ranging from route planning and scheduling to cloud-based freight audit, carrier management, and load building tools. TMS is a robust platform that benefits both shippers and service providers within the supply chain. The advantages of TMS for shippers include simplifying transportation execution and planning, providing control of inventory management and freight delivery communication, and reducing invoicing errors. Also, shippers are adopting TMS solutions and service to host advanced customer relationship management, supplier relationship management systems, route planning, rating, and tracking systems.

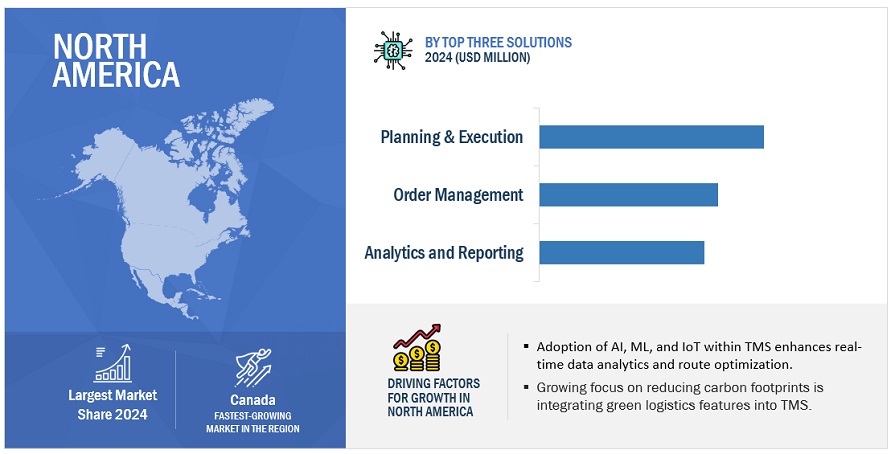

By region, North Amercia is expected to hold the largest market size during the forecast

The market for transportation management systems in this region will hold to show a significant growth as a result of factors such favorable government initiatives and regulations that are driving the expansion of the transportation sector. Due to escalating global rivalry, an increase in the adoption of smart, connected machines, and rising investments in smart cities, North America is currently seeing rapid growth. A rapid outpouring of enormous volumes of data has resulted from the rise of connected solutions that use sensors and RFID tags in developing nations like US and Canada. Also, many organizations are focused on developing innovative TMS solutions integrated with technological advancements, such as analytics, AI, and ML. As a result, TMS is already a well-known element of this area's expanding transportation and logistics industry.

Key Market Players

The report includes the study of key players in transportation management system market. The major vendors covered in the transportation management system market include Oracle (US), SAP (Germany), Manhattan Associates (US), C.H. Robinson (US), Trimble (US), WiseTech Global (Australia), Descartes (Canada), E2open (US), Generix Group (France), MercuryGate (US), Blue Yonder (US), Uber Freight (US), Alpega Group (Belgium), Worldwide Express (US), Infor (US), 3Gtms (US), Shipwell (US), 3T Logistics & Technology Group (UK), Ratelinx (US), oTMS (China), nShift (UK), BlueRock Logistics (Netherlands), Elemica (US), TESISQUARE (Italy), DDS Logistics (France), vTradEx (China), Shiptify (France), GlobalTranz (US), InMotion Global (US), Kinaxis (Canada), Logistically (US), One Network Enterprises (US), IntelliTrans (US), Allotrac (Australia), Revenova (US), Princeton TMX (US), CTSI Global (US), and PCS Software (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the transportation management system market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Offering, Transportation Mode, Vertical, Solutions, Services, End User, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Oracle (US), SAP (Germany), Manhattan Associates (US), C.H. Robinson (US), Trimble (US), WiseTech Global (Australia), Descartes (Canada), E2open (US), Generix Group (France), MercuryGate (US), Blue Yonder (US), Uber Freight (US), Alpega Group (Belgium), Worldwide Express (US), Infor (US), 3Gtms (US), Shipwell (US), 3T Logistics & Technology Group (UK), Ratelinx (US), oTMS (China), nShift (UK), BlueRock Logistics (Netherlands), Elemica (US), TESISQUARE (Italy), DDS Logistics (France), vTradEx (China), Shiptify (France), GlobalTranz (US), InMotion Global (US), Kinaxis (Canada), Logistically (US), One Network Enterprises (US), IntelliTrans (US), Allotrac (Australia), Revenova (US), Princeton TMX (US), CTSI Global (US), and PCS Software (US). |

This research report categorizes the transportation management system market to forecast revenues and analyze trends in each of the following submarkets:

By Offering:

- Solution

- Services

By Solution:

- Planning And Execution

- Order Management

- Audit, Payment and Claims

- Analytics And Reporting

- Routing And Tracking

By Services:

- Consulting

- Implementation And Integration

- Support And Maintenance

By Transportation Mode:

- Roadways

- Railways

- Airways

- Maritime

By Vertical :

- Retail

- Healthcare and Pharmaceutical

- Manufacturing

- Transportation and Logistics

- Energy and Utilities

- Government

- Others

By End User:

- Shippers

- 3PL

- Others

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Spain

- Italy

- Nordic

- Rest of Europe

-

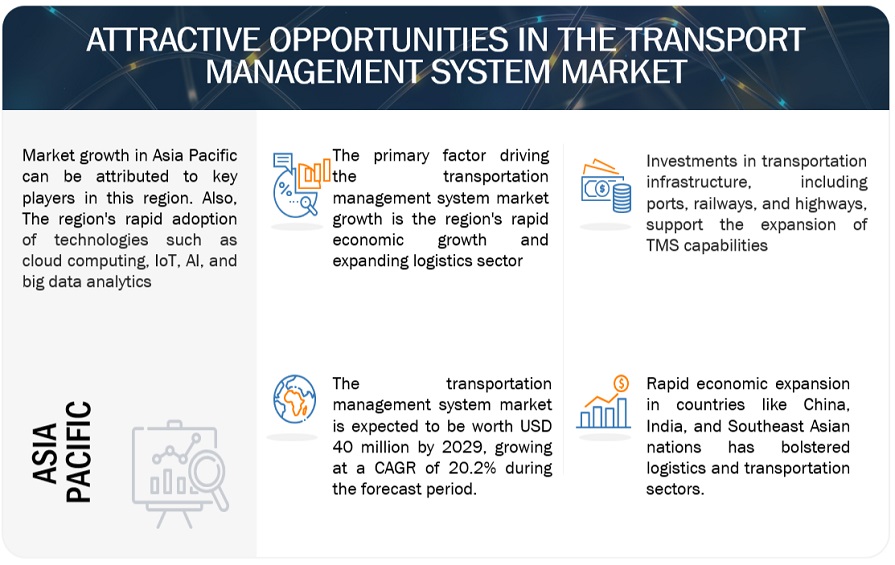

Asia Pacific

- China

- India

- Japan

- ANZ

- Rest of Asia Pacific

-

Middle East and Africa

- UAE

- KSA

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In May 2023, Manhattan Associates announced its Manhattan Active Yard Management solution. It redesigned yard management to work seamlessly with its warehouse and transportation management solutions on a single cloud-native platform.

- In April 2023, Trimble announced it completed the acquisition of its previously announced acquisition of Transporeon. Transporeon's software platform provides modular applications that power a global network for 145,000 carriers and 1,400 shippers and load recipients with an integrated sourcing, planning, execution, monitoring and settlement tools.

- In April 2023, Descartes acquired Localz, a 10-year-old start-up that helps retailers engage with customers on the day they deliver goods or services. Localz technology platform combines real-time vehicle location tracking and communications to transform the customer delivery experience.

- In February 2023, WiseTech Global announced its acquisition of Blume Global, a leading solution provider facilitating intermodal rail in North America.

- In January 2023, Oracle introduced new logistics capabilities within Oracle Fusion Cloud Supply Chain & Manufacturing (SCM). The new capabilities within Oracle Transportation Management are such as New Oracle Transportation Management Mobile App and more.

Frequently Asked Questions (FAQ):

What is a transportation management system?

A Transportation Management System (TMS) is a software solution designed to streamline and optimize various aspects of transportation and logistics operations. It is commonly used by businesses and organizations that deal with the movement of goods, such as manufacturers, distributors, retailers, and third-party logistics providers.

What is the market size of the transportation management system market?

The transportation management system market size is projected to grow from USD 13.5 billion in 2023 to USD 33.3 billion by 2028, at a CAGR of 19.7% during the forecast period.

What are the major drivers in the transportation management system market?

The key drivers supporting the growth of the transportation management system market include the Cloud-based SaaS solutions to drive the transportation management system market, Mergers & acquisitions of top-tier TMS product players with start-up solutions, Strengthening bilateral trade relations between various countries and growth in global trade, Technological advancements in the transportation and logistics industry, Exponential growth in the eCommerce industry, and the Need to replace and update the existing conventional transportation management systems.

Who are the key players operating in the transportation management system market?

The key vendors operating in the transportation management system market include Oracle (US), SAP (Germany), Manhattan Associates (US), C.H. Robinson (US), Trimble (US), WiseTech Global (Australia), Descartes (Canada), E2open (US), Generix Group (France), MercuryGate (US), Blue Yonder (US), Uber Freight (US), Alpega Group (Belgium), Worldwide Express (US), Infor (US), 3Gtms (US), Shipwell (US), 3T Logistics & Technology Group (UK), Ratelinx (US), oTMS (China), nShift (UK), BlueRock Logistics (Netherlands), Elemica (US), TESISQUARE (Italy), DDS Logistics (France), vTradEx (China), Shiptify (France), GlobalTranz (US), InMotion Global (US), Kinaxis (Canada), Logistically (US), One Network Enterprises (US), IntelliTrans (US), Allotrac (Australia), Revenova (US), Princeton TMX (US), CTSI Global (US), and PCS Software (US).

What are the opportunities for new market entrants in the transportation management system market?

Evolving 5G to transform the transportation management system, Autonomous and connected vehicles to transform the transportation and logistics industry, and Increasing adoption of cloud-based technology and Industry 4.0 are the various opportunities for new market entrants in the transportation management system market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

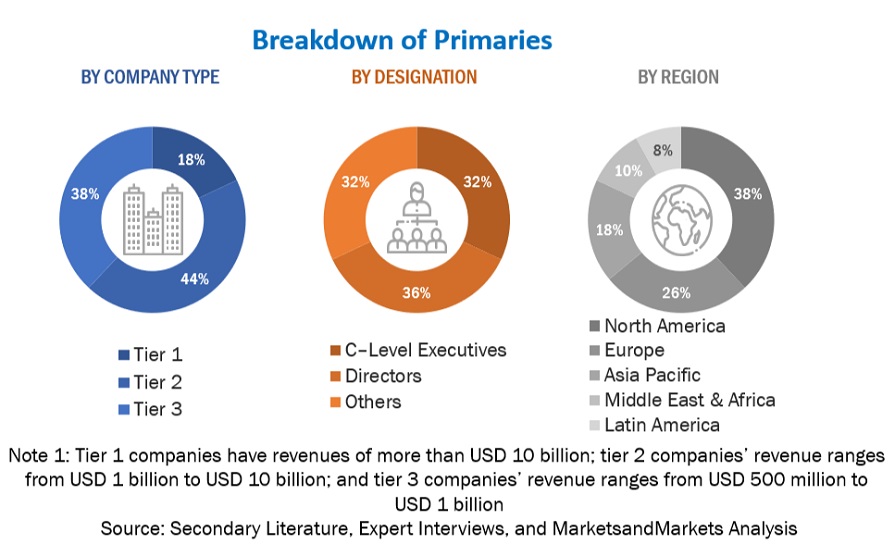

This research study extensively used secondary sources, directories, and databases such as Dun and Bradstreet (D&B) Hoovers, and Bloomberg BusinessWeek to identify and collect valuable information for a technical, market-oriented, and commercial study of the transportation management system market. The primary sources were mainly industry experts from the core and related industries and preferred suppliers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews were conducted with primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information. The following illustrative figure shows the market research methodology applied in making this report on the transportation management system market.

Secondary Research

The market size of companies offering TMS solutions and services was determined based on the secondary data available through paid and unpaid sources and by analyzing the product portfolio of the major companies in the ecosystem and rating them according to their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both markets and technology-oriented perspectives, all of which were further validated by primary sources.

Some of the sources that helped in the research study included the following:

- International Trade Administration (ITA)

- American Transportation Alliance (ATA)

- World Economic Forum

- Canadian Transportation Agency (CTA)

- Bureau of Transportation Statistics

- United Nations Economic Commission for Europe (UNECE)

- International Transport Forum

- Vendor Websites, Whitepapers, and Press Releases

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from transportation management system solution vendors, system integrators, professional and managed service providers, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the products and services, market breakups, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and installation teams of the governments/end users who are using transportation management system solutions were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage of transportation management system solutions, which will affect the overall transportation management system market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the market size of the TMS market. The first approach involves estimating the market size by summing up revenues generated by companies through the sale of solutions and services.

The research methodology used to estimate the market size includes the following details:

- Analyzing the size of the global location-based entertainment and then identifying revenues generated through the technology

- Identifying the key players in the market and their revenue contribution in the respective regions

- Estimating the size of the location-based entertainment market

- Estimating the market size of other location-based entertainment technology providers

Transportation Management System Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Transportation Management System Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size, the overall transportation management system market was divided into several segments and subsegments. The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

The transportation management system is a software system that helps companies manage logistics associated with the movement of physical goods – by land, air, sea or a combination of transportation modes. Part of the larger supply chain management system, TMS logistics software helps ensure the timely delivery of goods by optimizing loads and delivery routes, tracking freight across local and global routes, and automating previously time-consuming tasks, such as trade compliance documentation and freight billing. A TMS system reduces costs for both businesses and end customers.

Key Stakeholders

- TMS vendors

- Technology partners

- Consulting firms

- Resellers and distributors

- Enterprise users

- Technology providers

- System integrators

- Support service providers

- Consulting service providers

- Logistics service providers

- Government and standardization bodies

Report Objectives

- To determine and forecast the global transportation management system market based on offering (solutions and services), transportation mode, end-user, verticals, size, end users, and region from 2023 to 2028

- To analyze the various macroeconomic and microeconomic factors affecting the market growth

- To forecast the size of the market segments with respect to five key regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information related to the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the transportation management system market

- To analyze each sub-segment for individual growth trends, prospects, and contributions to the total transportation management system market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the transportation management system

- To profile key market players comprising top vendors and start-ups; provide comparative analysis based on business overview, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscapes

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Transportation Management System Market