Ultrasound Market by Technology (2D, 3D, Doppler, Contrast-Enhanced, HIFU, ESWL), Component (Workstation, Probe), Type (Cart, Handheld, PoC), Application (OB/GYN, CVD, Urology, Ortho), End User (Hospitals, Clinics, ASCs) & Region - Global Forecast to 2028

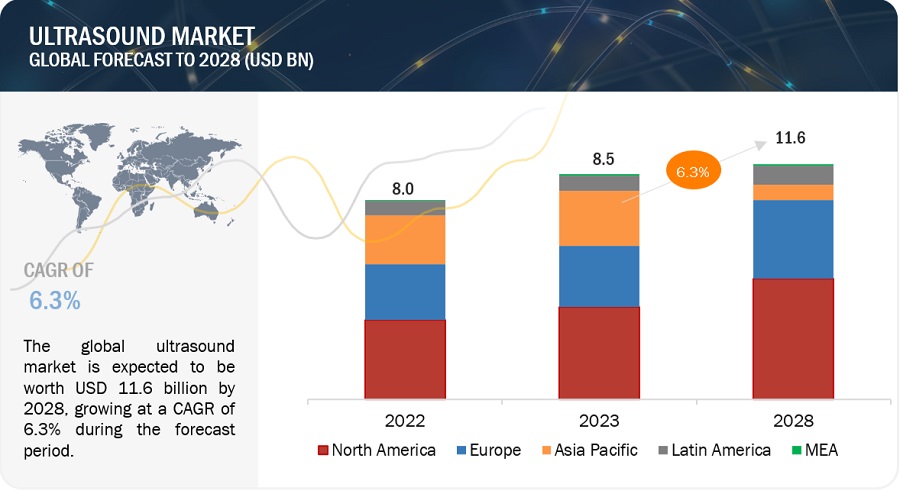

The global ultrasound market in terms of revenue was estimated to be worth $8.5 billion in 2023 and is poised to reach $11.6 billion by 2028, growing at a CAGR of 6.3% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The increasing patient population, rising prevalence of chronic diseases, and rising focus on non-invasive procedures are expected to drive the market during the forecast period.

Global Ultrasound Market

To know about the assumptions considered for the study, Request for Free Sample Report

e- Estimated; p- Projected

Ultrasound Market Dynamics

Driver: Increasing prevalence of target diseases

The burden of chronic and lifestyle diseases has increased in recent years. The burden of cancer, for example, is expected to increase from 14.1 million new cases to 19.3 million new cases during 2012– 2020 (Source: GLOBOCAN, 2020). The number of new cases reported annually in India and Africa is expected to increase from 1.0 million to 1.2 million and 0.84 million to 1.05 million, respectively, during 2012–2020. According to the American Cancer Society and the National Cancer Institute, in 2018, over 265,000 new cases of invasive breast cancer were diagnosed among women in the US, with 63,960 new cases of non-invasive (in situ) breast cancer (Source: Breastcancer.org). In Canada, as many as 26,900 women were diagnosed with breast cancer in 2019. Breast cancer accounted for around 25% of new cancer cases and 13% of cancer deaths in women (Source: Canadian Cancer Society).

The survival rate of breast cancer patients is six times higher if diagnosed in the early stage, as compared to the advanced stage. In the case of lung cancer patients, the survival rate is four times higher (Source: Cancer Research, UK). The possibility of quicker, easier treatment highlights the need for effective diagnostic modalities, such as ultrasound, in cancer treatment.

- Cardiovascular disease (CVD) is the leading cause of death globally, with an estimated 17.9 million deaths yearly, representing 31% of all global deaths. According to the American Heart Association (AHA), in the US alone, more than 102.7 million adults had at least one cardiovascular condition as of 2020. This number is projected to rise to 131.2 million by 2035. Heart disease costs the US government about USD 219 billion each year.

- Globally, ~12.8 million cosmetic procedures were performed in 2021, a 19.3% increase as compared to 2019, with more than 12.8 million surgical and 17.5 million non-surgical procedures performed worldwide. (Source: ISAPS)

Restraint: Unfavorable healthcare reforms in the US

In August 2012, the US government planned to reduce Medicare spending by USD 716 billion over the next 10 years (until 2022). As part of this, a 2% cut was announced in Critical Access Hospitals (CAH) Medicare payments (effective from April 2013). The government also imposed a 2.3% excise duty on the domestic sales of taxable medical devices effective from 2013 (under PPACA, 2010). Many industry participants expect that this health reform will negatively affect the cash flow for medical device companies operating in the US (including those involved in the manufacturing and marketing of ultrasound systems). This may limit the adoption of such devices in the US, as a number of healthcare facilities depend on government funds for purchasing high-end, highly expensive instruments.

Since the US accounts for the second-largest share in the global ultrasound industry, ongoing healthcare reforms in the US can be expected to affect the market as a whole.

Opportunity: Expanding applications of therapeutic ultrasound

Minimally invasive therapies and image-guided procedures are increasingly being adopted by healthcare professionals and patients across the world. The ultrasound industry has witnessed a significant shift from being a conventional diagnostic modality for OB/GYN imaging to a therapeutic technique for renal stones, cancers, and other clinical conditions. This trend is expected to be further propelled by ongoing clinical studies to establish the efficacy & safety profile for ultrasound in specific applications. A few of the major clinical studies in this field initiated during 2010–2019 are mentioned below:

In November 2021, Shantou Institute of Ultrasonic Instruments Co., Ltd. (China) has introduced Apogee 6 series of color doppler ultrasound imaging solutions. The series includes the Apogee 6200, Apogee 6300 and Apogee 6500 color Doppler ultrasound systems that provides comprehensive solution for cardiac, abdominal, vascular, musculoskeletal, urology, and OB/GYN clinical applications.

- In March 2020, Philips Healthcare received 510(k) clearance from the FDA to market its ultrasound solutions portfolio for the management of lung and cardiac complications associated with COVID-19.

- In October 2018, researchers at the University of Maryland Medical Center became the first team in the US to treat neuropathic pain using noninvasive focused ultrasound therapy.

- In May 2018, Havard Dalen (from the Norwegian University of Science and Technology) initiated a study to evaluate the feasibility and reliability of implementing handheld focused cardiac ultrasound for the diagnosis of heart failure.

The expanding applications of ultrasound have allowed for newer advancements and the development of application-specific systems. It can be expected that such efforts will open up new avenues for revenue growth for manufacturers in this market.

Challenge: Growing end-user preference for refurbished equipment

Due to the high prices of novel ultrasound technologies (such as focused ultrasound) and budgetary constraints faced by small-sized healthcare providers, the preference for refurbished ultrasound equipment has grown. For instance, a typical 3D/4D ultrasound system costs USD 20,000–75,000 in North America, while a refurbished 3D/4D ultrasound system costs USD 5,000–40,000. The growing preference for refurbished systems is therefore expected to pose a significant challenge to market growth.

Several independent associations and government organizations (such as the US FDA and Japan Federation of Medical Devices Associations) are increasingly promulgating guidelines for the diagnostic use of refurbished ultrasound equipment. Several ultrasound product manufacturers (such as General Electric Company, Koninklijke Philips N.V., and Siemens AG) are also focusing on providing refurbished ultrasound equipment at affordable and competitive prices to cater to such end-user segments.

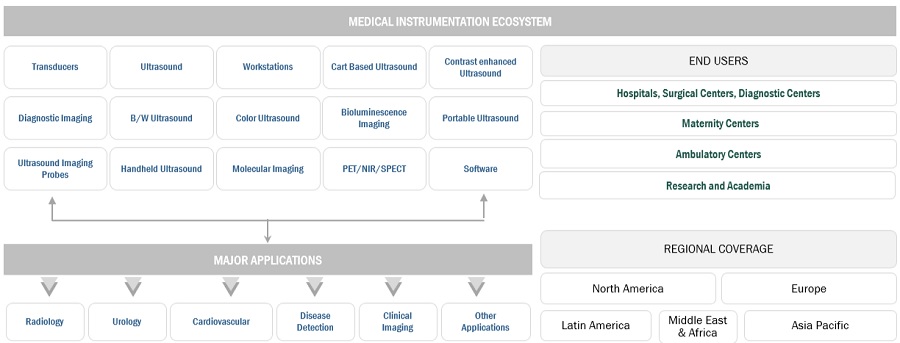

Ultrasound Market Ecosystem

By technology, the NIR devices segment accounted for the largest share of the ultrasound industry in 2022

Based on technology, the global ultrasound market is segmented into therapeutic, diagnostic, and contrast enhanced ultrasound. In 2022, the diagnostic ultrasound segment accounted for the largest market share. The rising adoption for the non-invasive procedures and the need for better turnaround time, high-image resolution, real-time image guidance during surgeries and enhanced precision is driving the segment growth.

By application, the preclinical applications segment of the ultrasound industry to register significant growth in the near future

Based on application, the ultrasound market is divided into eight segments—radiology/general imaging applications, obstetrics/gynecology applications, cardiology applications, urological applications, vascular applications, orthopedic & musculoskeletal applications, pain management applications, and other applications. Major share of the segment is attributed to the increasing number of radiology centers and the growing use of ultrasound for general imaging and diagnosis purpose.

By end user, the hospitals and surgical centers companies segment accounted for the largest share of the ultrasound industry in 2022

On the basis of end user, the ultrasound market has been segmented into hospitals, surgical centers, and diagnostic centers; ambulatory care centers; maternity centers; research and academia; and other end users (including physiotherapy centers, independent industry associations, government organizations, and sports academies). However, the ambulatory care centers segment is estimated to grow at the highest CAGR during the forecast period.

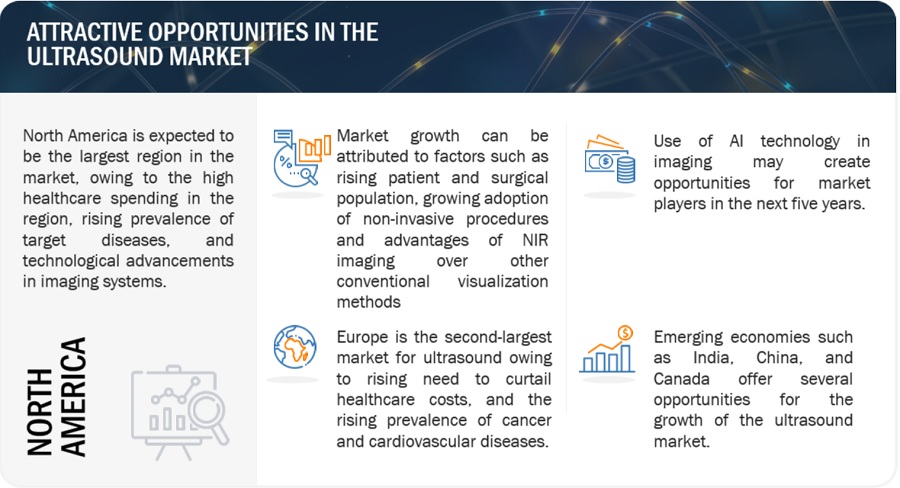

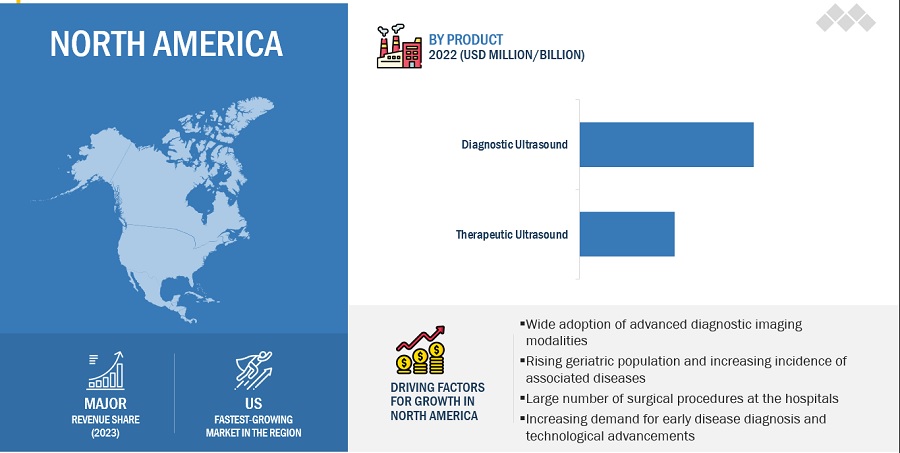

By region, North America is expected to be the largest region in the ultrasound industry during the forecast period

North America, comprising the US and Canada, accounted for the largest market share in 2022. The large share of ultrasound market can primarily be attributed to the high healthcare spending, rising geriatric population, the rising prevalence of target diseases, growing number of cosmetic surgeries, and rapid adoption of technologically advanced imaging systems.

To know about the assumptions considered for the study, download the pdf brochure

As of 2022, prominent players in the market are GE Healthcare (US), Koninklijke Philips N.V. (Netherlands), Canon Medical Systems Corporation (Japan), Siemens AG (Germany), Fujifilm Corporation (Japan), and Hologic, Inc. (US)

Scope of the Ultrasound Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$8.5 billion |

|

Projected Revenue by 2028 |

$11.6 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 6.3% |

|

Market Driver |

Increasing prevalence of target diseases |

|

Market Opportunity |

Expanding applications of therapeutic ultrasound |

This report has segmented the global ultrasound market to forecast revenue and analyze trends in each of the following submarkets:

By Technology

-

Diagnostic Ultrasound

- 2D Ultrasound

- 3D & 4D Ultrasound

- Doppler Ultrasound

- Contrast-Enhanced Ultrasound

-

Therapeutic Ultrasound

- High-Intensity Focused Ultrasound (HIFU)

- Extracorporeal Shockwave Lithotripsy (ESWL)

By Display

- Color Ultrasound

- Black and White Ultrasound

By Portability

-

Diagnostic Ultrasound

- Trolly/ Cart based Ultrasound Systems

- Compact/Handheld Ultrasound Systems

- POC Ultrasound Systems

By Component

-

Transducers/Probes

- Curvilinear/ Convex Array Probes

- Linear Array Probes

- Phased Array Probes

- Other Probes

- Workstations

- Other Components

By Application

- Radiology/General Imagin

- OB/Gyn

- Cardiology

- Urology

- Vascular

- Orthopedic and Musculoskeletal

- Pain Management

- Other Applications

By End User

- Hospital, Surgical Centers, Diagnostic Centers

- Maternity Center

- Ambulatory Centers

- Research and Academia

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

Recent Developments of Ultrasound Industry

- In February 2023, GE HealthCare has acquired Caption Health, thereby expanding the capabilities of ultrasound technology to assist new users through FDA-cleared, AI-powered image guidance. By leveraging Caption AI applications, ultrasound examinations can be streamlined, accelerating the process and empowering a wider range of healthcare professionals to perform fundamental echocardiogram exams.

- In November 2022, Canon Inc. revealed its plans to form a new subsidiary called Canon Healthcare USA, Inc. With this strategic move, Canon intends to enhance its position within the influential American medical market and expedite the expansion of its medical business.

- In April 2022, The enhanced partnership between GE HealthCare and Sinopharm focuses on the development and commercialization of medical equipment designed to meet the specific healthcare requirements of China.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global ultrasound market?

The global ultrasound market boasts a total revenue value of $11.6 billion by 2028.

What is the estimated growth rate (CAGR) of the global ultrasound market?

The global ultrasound market has an estimated compound annual growth rate (CAGR) of 6.3% and a revenue size in the region of $8.5 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current size of the ultrasound market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial ultrasound market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the ultrasound market. The primary sources from the demand side include hospitals, clinics, research labs, and pharmaceutical and biotechnology companies. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

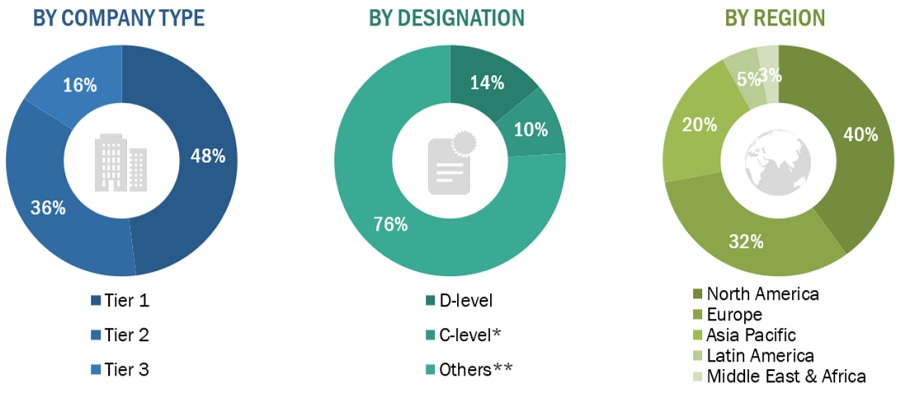

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The tiers of the companies are defined based on their total revenue. As of 2022: Tier 1 => USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 =< USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

In this report, the ultrasound market’s size was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the market business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

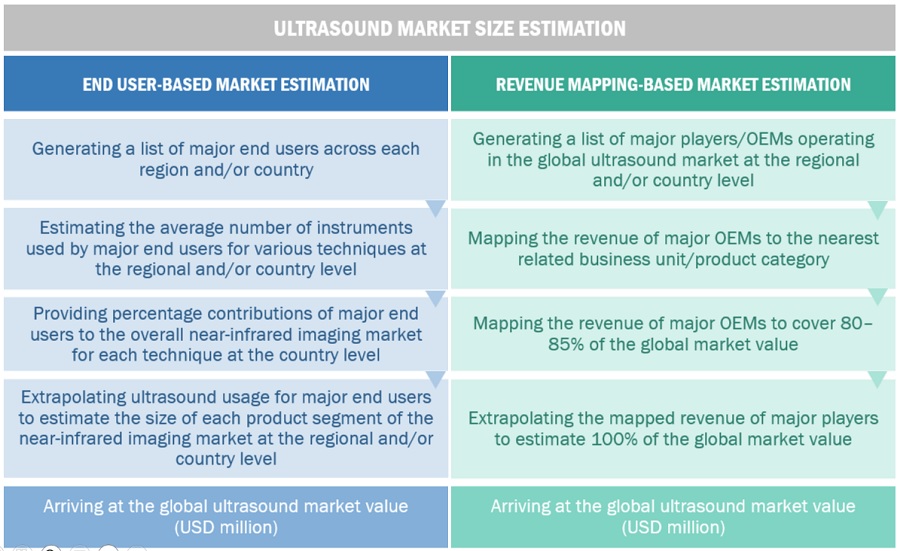

Segmental revenues were calculated based on the revenue mapping of major solution/service providers to calculate the global market value. This process involved the following steps:

- Generating a list of major global players operating in the market.

- Mapping annual revenues generated by major global players from the product segment (or nearest reported business unit/product category)

- Revenue mapping of major players to cover a major share of the global market share, as of 2022

- Extrapolating the global value of the market industry

Bottom-up approach

In this report, the size of the global ultrasound market was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the ultrasound business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and marketing executives.

Approach 1: Company revenue estimation approach

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/product providers. This process involved the following steps:

- Generating a list of major global players operating in the ultrasound market

- Mapping the annual revenues generated by major global players from the ultrasound segment (or the nearest reported business unit/product category)

- Mapping the revenues of major players to cover at least 80–85% of the global market share as of 2022

- Extrapolating the global value of the ultrasound industry

Approach 2: Customer-based market estimation

During preliminary secondary research, the total sales revenue of ultrasound was estimated and validated at the regional and country level, triangulated, and validated to estimate the global market value. This process involved the following steps:

- Generating a list of major customer facilities across each region and country

- Identifying the average number of ultrasound product supplies used by major customer facilities across each product type at the regional/country level, annually

- Identifying the percentage contribution of major customer facilities to the overall ultrasound expenditure and usage at the regional/country level, annually

- Extrapolating the annual usage patterns for various products across major customer facilities to estimate the size of each product segment at the regional/country level, annually

- Identifying the percentage contributions of individual market segments and subsegments to the overall ultrasound market at the regional/country level

Ultrasound Market Size Estimation: Bottom-Up Approach

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global ultrasound market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market was validated using top-down and bottom-up approaches.

Market Definition

Ultrasound, also known as sonography, is a medical imaging technique that utilizes high-frequency sound waves to produce real-time images of the internal structures of the body. It has become an essential diagnostic tool in healthcare due to its non-invasive nature, safety, versatility, and ability to provide real-time imaging. Ultrasound is widely used in obstetrics and gynecology for monitoring fetal development, assessing reproductive health, and guiding procedures such as amniocentesis. In addition, it plays a crucial role in cardiology for evaluating heart function and detecting abnormalities, in radiology for visualizing organs and tissues, and in emergency medicine for rapid assessment and guidance of interventions. The portability of ultrasound machines has further expanded its utility, allowing healthcare professionals to perform examinations at the patient's bedside, in rural areas, and in disaster response situations. With continuous technological advancements, including improved image quality, 3D/4D imaging, and advanced ultrasound-guided interventions, ultrasound has revolutionized medical practice, enabling accurate diagnoses, guiding interventions, and improving patient care across various medical disciplines.

Key Stakeholders

- Ultrasound product manufacturers

- Original equipment manufacturers (OEMs)

- Suppliers, distributors, and channel partners

- Healthcare service providers

- Hospitals and academic medical centers

- Radiologists

- Research laboratories

- Health insurance providers

- Government bodies/organizations

- Regulatory bodies

- Medical research institutes

- Business research and consulting service providers

- Venture capitalists and other public-private funding agencies

- Market research and consulting firms

Objectives of the Study

- To define, describe, and forecast the ultrasound market based on technology, display, component, portability, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to four regions, namely, North America, Europe, the Asia Pacific, Latin America, Middle East and Africa

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To benchmark players within the market using a proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of market share and product footprint

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the present global ultrasound market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Geographic Analysis

- Further breakdown of the Rest of Europe ultrasound market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal, among others

- Further breakdown of the Rest of Asia Pacific ultrasound market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Rest of Latin America (RoLATAM), which comprises Argentina, Chile, Peru, Colombia, and Cuba

- Further breakdown of the RoW market into Latin America and MEA regions

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ultrasound Market

Ultrasound is used in many ways according to technology