Surgical Procedures Market by Type (Gastrointestinal, Cardiovascular, Dental, Cosmetic, Urologic, Ophthalmic, Orthopedic, ENT, Nervous System, Obstetric/Gynecologic), Channel (Physician Offices, Hospitals, ASCs) - US Forecast to 2028

Market Growth Outlook Summary

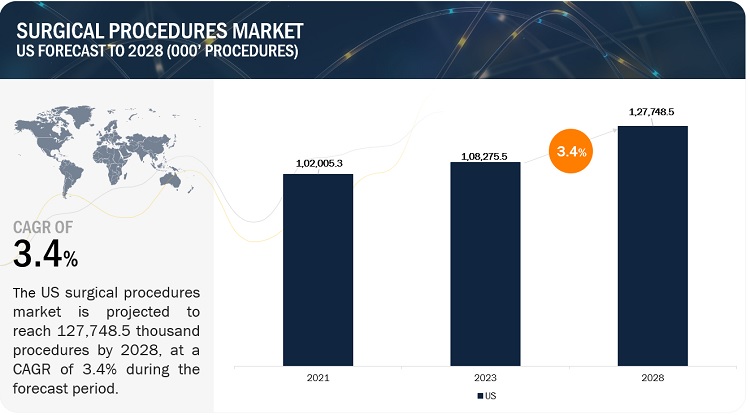

The global surgical procedures market, valued at US$1,02,005.3 thousand procedures in 2021, stood at US$1,08,275.5 thousand procedures in 2023 and is projected to advance at a resilient CAGR of 3.4% from 2023 to 2028, culminating in a forecasted valuation of US$1,27,748.5 thousand procedures by the end of the period. The growth of the US surgical procedures market is largely driven by the growing prevalence of chronic diseases, the rising geriatric population, advancements in surgical techniques, and increased investment in health facilities. On the other hand, stringent regulations and the high cost of medical devices are major restraints in the market.

Surgical Procedures Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Surgical Procedures Market Dynamics

Driver: Technological advancements in surgical procedures

US is considered a leader in medical technology innovation; most advanced surgical products and devices are developed and manufactured by US-based companies. The rapid growth of surgeries has been possible due to significant advancements in medical technology, which partly solved some of the technical and clinical challenges associated with surgical procedures. Hospitals and healthcare systems invest heavily in the latest technologies to provide the best possible care for their patients.

Of note is a six-year partnership between the National Aeronautics and Space Administration (NASA) (US) and the Skull Base Institute (US), which resulted in a 3D high-definition endoscope with a rotating tip: MARVEL (Multi-Angle Rear-Viewing Endoscopic tool). The small camera helps surgeons get a 3D view of a tumor during surgery. Due to its sub-4mm size, the camera requires a small incision; it can rotate 160 degrees to provide a better view.

Additionally, robotics has enabled surgeons to perform delicate or complex procedures that are extremely difficult or even impossible with other methods. Further, augmented reality (AR) technology has greatly enhanced surgical procedures by providing surgeons with real-time, interactive visual information and guidance during operations. For instance, AR-backed spinal fusion surgery, first conducted in 2020 in the US, helped surgeons to visualize the 3D spinal anatomy of a patient during surgery. The team at the Johns Hopkins Hospital praised the tool for its accuracy, safety, and operating efficiency. Thus, the launch of advanced technology products in this region has driven the surgical procedure market.

Opportunity: Increasing Adoption Of Outpatient Surgeries

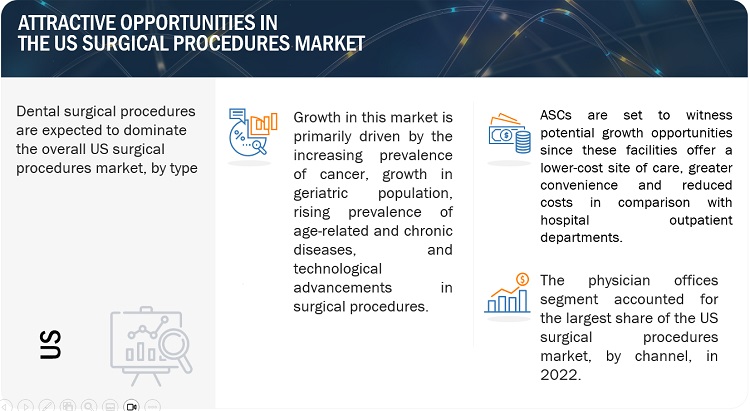

Ambulatory surgery centers (ASCs) are freestanding facilities specializing in surgical, diagnostic, and preventive procedures that do not require hospital admission. Medical procedures are moving into these outpatient facilities due to technological advances such as minimally invasive surgical procedures and value-based care incentives. Health systems have also been acquiring or partnering with physicians and physician practices, further driving the volume of services performed in outpatient settings. The cost-effectiveness of ASCs provides significant savings for governments, third-party payers, and patients. A study conducted by Healthcare BlueBook (a provider of data for healthcare services) and HealthSmart (a provider of health plans for self-funded employers) concluded that ASCs decreased the cost of outpatient surgery by USD 38 billion annually since these facilities offer a lower-cost site of care in comparison with hospital outpatient departments.

Challenge: Complications associated with surgical procedures

A few complications are associated with surgical procedures, resulting in additional healthcare costs. Most complications associated with surgeries are minor, but some can be quite serious. The patient’s discomfort after surgery depends on many things, including the type of surgery. Typical discomforts may include nausea and vomiting from general anesthesia, sore throat caused by the tube placed in the windpipe for breathing during surgery, soreness, pain, & swelling around the incision site or minor pain around the IV site and restlessness & sleeplessness among others. However, certain surgeries can also be high risk owing to patient-specific factors or operation-specific factors. Certain health factors can increase surgery risks. Some major patient-specific risks associated with surgical procedures may include obesity, postoperative delirium, postoperative cognitive dysfunction (POCD) and sleep apnea among others.

Surgical Procedures Market Overview

By type, the US surgical procedures market is segmented into dental, orthopedic, gastrointestinal, ophthalmic, cardiovascular, obstetric/gynecologic, cosmetic, ENT, urologic, and other surgical procedures. The large share of this segment can be attributed to the high incidence of dental disorders, growing expenditure on dental care, increasing elderly population and associated tooth loss, as well as rising awareness of oral hygiene in the US. However, ophthalmic surgical procedures are expected to witness highest growth during the forecast period due to the increasing prevalence of various ophthalmic disorders such as glaucoma, cataract, and diabetic retinopathy and the associated increase in eye diseases due to longer screen time.

To know about the assumptions considered for the study, download the pdf brochure

By channel, physician offices, hospitals, and ambulatory surgery centres make up the three segments of the US surgical procedures market. The hospitals segment is further divided into inpatient surgeries and outpatient surgeries. While physician offices segment dominated the US market in 2022, the ambulatory surgery centers market is anticipated to show fastest growth throughout the projected timeframe. The potential for cost reductions, the growing patient population, and the rising demand for better and quicker care among patients is likely to drive growth in the ASCs.

Scope of the Surgical Procedures Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

1,08,275.5 thousand procedures |

|

Projected Revenue Size by 2028 |

1,27,748.5 thousand procedures |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 3.4% |

|

Market Driver |

Technological advancements in surgical procedures |

|

Market Opportunity |

Increasing Adoption Of Outpatient Surgeries |

The study categorizes the surgical procedures market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Gastrointestinal Surgical Procedures

- Cardiovascular Surgical Procedures

- Dental Surgical Procedures

- Cosmetic Surgical Procedures

- Urologic Surgical Procedures

- Ophthalmic Surgical Procedures

- Orthopedic Surgical Procedures

- ENT Surgical Procedures

- Obstetric/Gynecologic Surgical Procedures

- Other Surgical Procedures

Note: Other surgical procedures include procedures targeting the nervous system, the endocrine system, and the integumentary system.

By Channel

- Physician Offices

-

Hospitals

- Inpatient Surgeries

- Outpatient Surgeries

- Ambulatory Surgery Centre

Frequently Asked Questions (FAQ):

What is the projected growth rate of the US surgical procedures market between 2023 and 2028?

The global surgical procedures market is projected to grow from 1,08,275.5 thousand procedures in 2023 to 1,27,748.5 thousand procedures by 2028, demonstrating a robust CAGR of 3.4%.

What are the main drivers of growth in the US surgical procedures market?

Key drivers of growth in the US surgical procedures market include technological advancements in surgical techniques, increased investment in healthcare facilities, and the growing geriatric population, which increases the demand for surgical interventions.

What challenges does the US surgical procedures market face?

The US surgical procedures market faces challenges such as stringent regulations, high costs associated with medical devices, and complications that may arise during surgical procedures, which can lead to increased healthcare costs and impact patient outcomes.

Which surgical procedures are expected to see significant growth?

Ophthalmic surgical procedures are projected to witness the highest growth due to the increasing prevalence of eye disorders like glaucoma and cataracts. Additionally, dental and orthopedic procedures are also expected to see substantial demand due to chronic conditions associated with aging.

How are ambulatory surgery centers (ASCs) influencing the surgical procedures market?

ASCs are becoming increasingly popular due to their cost-effectiveness and ability to provide high-quality outpatient surgical care. This shift from traditional hospital settings to ASCs is driving growth in the market as procedures become more outpatient-oriented.

What role does technology play in the US surgical procedures market?

Technology plays a critical role in the US surgical procedures market by enabling advancements such as robotics, augmented reality (AR), and minimally invasive techniques, which enhance the precision and safety of surgeries while improving patient recovery times.

What is the impact of the geriatric population on the surgical procedures market?

The growing geriatric population significantly impacts the surgical procedures market as older adults often require more surgical interventions due to age-related health issues. This demographic trend is driving demand for various types of surgical procedures across the US.

What types of surgical procedures are categorized in the US market?

The US surgical procedures market includes various types of surgeries, such as gastrointestinal, cardiovascular, dental, orthopedic, ophthalmic, cosmetic, urologic, obstetric/gynecologic, ENT, and other specialized procedures targeting different body systems.

What are some complications associated with surgical procedures?

Complications from surgical procedures can include minor discomforts such as nausea, pain, and swelling, as well as more serious risks like postoperative delirium and cognitive dysfunction. Patient-specific factors, like obesity, can also increase these risks.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing prevalence of cancer requiring surgical treatment- Growth in geriatric population and rise in chronic disease prevalence- Increasing rate of organ transplantation- Technological advancements in surgical proceduresOPPORTUNITIES- Increasing adoption of outpatient surgeries- Improved surgical techniques in bariatric proceduresCHALLENGES- Surgical errors- Complications associated with surgical procedures- Shortage of surgeons

-

6.1 INDUSTRY TRENDSMINIMALLY INVASIVE SURGERYINCREASING ADOPTION OF ADVANCED ROBOTICS IN ASCS

- 6.2 PRICING ANALYSIS

- 6.3 REIMBURSEMENT SCENARIO

- 6.4 TECHNOLOGY ANALYSIS

- 6.5 REGULATORY LANDSCAPE

- 7.1 INTRODUCTION

-

7.2 DENTAL SURGICAL PROCEDURESRISING PREVALENCE OF ORAL DISEASES AND GROWING AWARENESS OF DENTAL CARE TO DRIVE GROWTH

-

7.3 ORTHOPEDIC SURGICAL PROCEDURESAVAILABILITY OF TECHNOLOGICALLY ADVANCED DEVICES TO INCREASE PROCEDURAL VOLUMES

-

7.4 GASTROINTESTINAL SURGICAL PROCEDURESINCREASING NUMBER OF GASTROINTESTINAL CANCER CASES TO BOOST MARKET

-

7.5 OPHTHALMIC SURGICAL PROCEDURESRISING PREVALENCE OF GLAUCOMA, CATARACT, AND DIABETIC RETINOPATHY TO DRIVE DEMAND FOR OPHTHALMIC SURGERY

-

7.6 CARDIOVASCULAR SURGICAL PROCEDURESRISING PREVALENCE OF HEART DISEASE TO BOOST DEMAND FOR SURGERY

-

7.7 OBSTETRIC/GYNECOLOGIC SURGICAL PROCEDURESINCREASING INCIDENCE OF GYNECOLOGICAL DISEASES TO DRIVE MARKET GROWTH

-

7.8 COSMETIC SURGICAL PROCEDURESADVENT OF MINIMALLY INVASIVE SURGICAL PROCEDURES TO PROPEL ADOPTION OF COSMETIC SURGERIES

-

7.9 ENT SURGICAL PROCEDURESRISING DISPOSABLE INCOME AND INCREASING AFFORDABILITY TO BOOST GROWTH OF ENT SURGICAL PROCEDURES

-

7.10 UROLOGIC SURGICAL PROCEDURESINCREASING KIDNEY DISEASE INCIDENCE TO BOOST PROCEDURAL VOLUME

- 7.11 OTHER SURGICAL PROCEDURES

- 8.1 INTRODUCTION

-

8.2 PHYSICIAN OFFICESPHYSICIAN OFFICES TO DOMINATE END-USER MARKET DUE TO TECHNOLOGICAL ADVANCES AND GROWING FEASIBILITY

-

8.3 HOSPITALSINPATIENT SURGERIES- Increasing incidence of cardiovascular, neurological, and intestinal disorders to drive market growthOUTPATIENT SURGERIES- Convenience and lower cost to boost demand for outpatient surgeries

-

8.4 AMBULATORY SURGERY CENTERSLOWER COSTS AND SHORTER PATIENT STAYS TO PROPEL GROWTH

- 9.1 DISCUSSION GUIDE

- 9.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 9.3 RELATED REPORTS

- 9.4 AUTHOR DETAILS

- TABLE 1 RISK ASSESSMENT: US SURGICAL PROCEDURES MARKET

- TABLE 2 US: SINGLE-ORGAN TRANSPLANTS PERFORMED, 2016–2020

- TABLE 3 BARIATRIC SURGERIES PERFORMED, 2016–2020

- TABLE 4 COMPLICATIONS ASSOCIATED WITH SURGICAL PROCEDURES

- TABLE 5 TYPICAL AVERAGE COSTS FOR SOME COMMON SURGERIES

- TABLE 6 LIST OF SURGICAL PROCEDURE CODES

- TABLE 7 COSMETIC SURGERY PROCEDURE CODES

- TABLE 8 US SURGICAL PROCEDURES MARKET, BY TYPE, 2021–2028 (THOUSANDS)

- TABLE 9 US: DENTAL SURGICAL PROCEDURES, BY TYPE, 2021–2028 (THOUSANDS)

- TABLE 10 US: ORTHOPEDIC SURGICAL PROCEDURES, BY TYPE, 2021–2028 (THOUSANDS)

- TABLE 11 US: GASTROINTESTINAL SURGICAL PROCEDURES, BY TYPE, 2021–2028 (THOUSANDS)

- TABLE 12 US: OPHTHALMIC SURGICAL PROCEDURES, BY TYPE, 2021–2028 (THOUSANDS)

- TABLE 13 US: NUMBER OF CVD CASES, 2015–2035 (MILLION)

- TABLE 14 US: CARDIOVASCULAR SURGICAL PROCEDURES, BY TYPE, 2021–2028 (THOUSANDS)

- TABLE 15 US: OBSTETRIC/GYNECOLOGIC SURGICAL PROCEDURES, BY TYPE, 2021–2028 (THOUSANDS)

- TABLE 16 US: COSMETIC SURGICAL PROCEDURES, BY TYPE, 2021–2028 (THOUSANDS)

- TABLE 17 US: ENT SURGICAL PROCEDURES, BY TYPE, 2021–2028 (THOUSANDS)

- TABLE 18 US: UROLOGIC SURGICAL PROCEDURES, BY TYPE, 2021–2028 (THOUSANDS)

- TABLE 19 US: OTHER SURGICAL PROCEDURES, BY TYPE, 2021–2028 (THOUSANDS)

- TABLE 20 US: NERVOUS SYSTEM SURGICAL PROCEDURES, BY TYPE, 2021–2028 (THOUSANDS)

- TABLE 21 US: ENDOCRINE SYSTEM SURGICAL PROCEDURES, BY TYPE, 2021–2028 (THOUSANDS)

- TABLE 22 US SURGICAL PROCEDURES MARKET, BY CHANNEL, 2021–2028 (THOUSANDS)

- TABLE 23 US: NUMBER OF REGISTERED HOSPITALS, BY NUMBER OF BEDS (2019)

- TABLE 24 US SURGICAL PROCEDURES MARKET FOR HOSPITALS, BY TYPE, 2021–2028 (THOUSANDS)

- FIGURE 1 US SURGICAL PROCEDURES MARKET

- FIGURE 2 RESEARCH METHODOLOGY: US SURGICAL PROCEDURES MARKET

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, OPPORTUNITIES, AND CHALLENGES (2023–2028)

- FIGURE 5 DATA TRIANGULATION METHODOLOGY

- FIGURE 6 US HEALTHCARE INFLATION-PERCENT INCREASE

- FIGURE 7 US SURGICAL PROCEDURES MARKET, BY TYPE, 2023 VS. 2028 (THOUSAND PROCEDURES)

- FIGURE 8 DENTAL SURGICAL PROCEDURES, BY TYPE, 2023 VS. 2028 (THOUSAND PROCEDURES)

- FIGURE 9 ORTHOPEDIC SURGICAL PROCEDURES, BY TYPE, 2023 VS. 2028 (THOUSAND PROCEDURES)

- FIGURE 10 GASTROINTESTINAL SURGICAL PROCEDURES, BY TYPE, 2023 VS. 2028 (THOUSAND PROCEDURES)

- FIGURE 11 OPHTHALMIC SURGICAL PROCEDURES, BY TYPE, 2023 VS. 2028 (THOUSAND PROCEDURES)

- FIGURE 12 CARDIOVASCULAR SURGICAL PROCEDURES, BY TYPE, 2023 VS. 2028 (THOUSAND PROCEDURES)

- FIGURE 13 OBSTETRIC/GYNECOLOGIC SURGICAL PROCEDURES MARKET, BY TYPE, 2023 VS. 2028 (THOUSAND PROCEDURES)

- FIGURE 14 COSMETIC SURGICAL PROCEDURES, BY TYPE, 2023 VS. 2028 (THOUSAND PROCEDURES)

- FIGURE 15 ENT SURGICAL PROCEDURES MARKET, BY TYPE, 2023 VS. 2028 (THOUSAND PROCEDURES)

- FIGURE 16 UROLOGIC SURGICAL PROCEDURES, BY TYPE, 2023 VS. 2028 (THOUSAND PROCEDURES)

- FIGURE 17 US SURGICAL PROCEDURES MARKET, BY CHANNEL, 2023 VS. 2028 (THOUSAND PROCEDURES)

- FIGURE 18 TECHNOLOGICAL ADVANCEMENTS IN SURGICAL PROCEDURES TO DRIVE MARKET GROWTH

- FIGURE 19 DENTAL SURGICAL PROCEDURES ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 20 INPATIENT SURGERIES TO DOMINATE MARKET OVER FORECAST PERIOD

- FIGURE 21 US SURGICAL PROCEDURES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 US: ESTIMATED NEW CASES AND DEATHS FOR EACH COMMON CANCER TYPE IN 2023

- FIGURE 23 US: CANCER CASES, BY TYPE, 2020–2040 (THOUSANDS)

- FIGURE 24 US: NEW CANCER CASES, 2012–2022 (MILLION INDIVIDUALS)

- FIGURE 25 US: NUMBER OF PEOPLE WITH CHRONIC CONDITIONS, 1995–2030 (MILLION)

- FIGURE 26 US: R&D INVESTMENTS IN MEDICAL TECHNOLOGY, 2013-2018 (MILLION)

- FIGURE 27 US: STOMACH CANCER INCIDENCE, 2020–2040 (THOUSANDS)

This study involved the extensive use of both primary and secondary sources to identify and collect information useful for the technical, market-oriented, and commercial research of the US surgical procedures market. Various factors affecting the industry were studied to identify the segmentation and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends.

Secondary Research

This research study involved the usage of widespread secondary sources; directories; databases such as Hoover’s, Bloomberg Business, Factiva, and Avention; and white papers. Secondary research was used to identify and collect information for the extensive, technical, market-oriented, and commercial study of the US surgical procedures market. Some non-exclusive secondary sources include the World Health Organization (WHO), Organisation for Economic Co-operation and Development (OECD), National Center for Biotechnology Information (NCBI), GLOBOCAN, International Agency for Research on Cancer (IARC) and American Cancer Society (ACS) among others. It was also used to obtain important information about market classification and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various participants from the US were interviewed to obtain qualitative and quantitative information for this report. Primary sources included personnel from hospitals, breast imaging medical centers, cancer research centers & institutes, medical schools & universities, and clinical research organizations. In-depth interviews were conducted with primary respondents, such as key industry participants, subject-matter experts (SMEs), and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the growth prospects of the overall US surgical procedures market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total number of US surgical procedures was arrived at after data triangulation from the different approaches, as mentioned below:

- The total number of procedures for each listed surgery was retrieved from various secondary sources from 2016 to 2022 for the US

- Based on historical data, the year-on-year growth for each procedure was estimated to forecast the data to 2028

- The impact of COVID-19 and the recession was calculated based on secondary data and utilized to forecast the data for each of the considered surgical procedure

- The estimated data was further split into inpatient and outpatient procedures based on secondary research, which was further validated through primary interviews

Data Triangulation

After arriving at the market size, the total market was divided into several segments and sub-segments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data was triangulated by studying various factors and trends for different procedure types and channels.

Market Definition

A surgical procedure or surgery is a medical specialty that uses operative manual and instrumental techniques on a person to investigate or treat a pathological condition such as a disease or injury to help improve bodily function and appearance or repair unwanted ruptured areas. Surgery can involve cutting, abrading, suturing, or physically changing body tissues and organs.

Key Stakeholders

- Hospitals

- Ambulatory Surgery Centers

- Physician Offices

- Outpatient Settings

- Oncology Centers

- Health Insurance Payers

- Research Institutes

- Government associations

Report Objectives

- To define, describe, and forecast the US surgical procedures market based on type and channel

- To provide detailed information on the major factors influencing the market growth (drivers, restraints, opportunities, and challenges).

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market.

- To forecast the number of various surgical procedures in the US

- To provide the number of surgical procedures performed in healthcare facilities (such as inpatient and outpatient departments of hospitals, ambulatory surgery centers, emergency centers, and physician offices)

- To provide detailed information regarding the key trends in the inpatient and outpatient surgeries performed in hospitals, ASCs, and physician offices

- To estimate and study the number of surgeries conducted in healthcare settings in the US by type

- To evaluate the impact of the COVID-19 pandemic and the economic recession on the US surgical procedures market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Surgical Procedures Market

What is the impact of the COVID-19 pandemic on the US surgical procedures market?

What are the key trends in outpatient surgeries in hospitals, ASCs, and physician offices offered by the US Surgical Procedures Market?

Which growth strategies are adopted by key players to dominate the global US Surgical Procedures Market?