Vascular Closure Devices Market by Type (Passive Approximators, Active Approximators, External Hemostatic Devices), Access (Femoral, Radial), Procedure (Interventional Cardiology, Interventional Radiology/Vascular Surgery) & Region - Global Forecast to 2026

Market Growth Outlook Summary

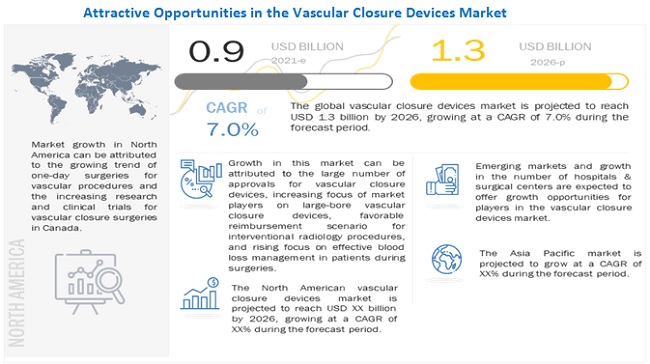

The global vascular closure devices market growth forecasted to transform from $0.9 billion in 2021 to $1.3 billion by 2026, driven by a CAGR of 7.0%. The growth in this market can be attributed to the large number of approvals for vascular closure devices, high prevalence of cardiovascular diseases, increasing prevalence of obesity, increasing focus of market players on large-bore vascular closure devices, growing geriatric population, favorable reimbursement scenario for interventional radiology procedures, and rising focus on effective blood loss management in patients during surgeries. Emerging markets providing growth opportunities for market players and growth in the number of hospitals & surgical centers are expected to offer strong growth opportunities for players in the market. In contrast, the need for highly skilled professionals, risks associated with vascular closure devices and stringent regulatory framework may challenge market growth to a certain extent. The vascular closure devices market is segmented based on type, access, procedure, and region.

Vascular Closure Devices Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Vascular Closure Devices Dynamics

Driver: High prevalence of cardiovascular diseases

Cardiovascular diseases (CVDs) are one of the leading causes of death worldwide. According to the American Heart Association (AHA), CVDs resulted in 18.6 million deaths in 2019, where most deaths were reported from Eastern Europe and Central Asia. The AHA estimates that by 2030, 40.5% of the US population is projected to have some form of CVD. The increase in the prevalence of CVDs is thus likely to increase the demand for catheterization and interventional procedures for diagnosing and treating CVDs. The increasing popularity of these procedures is likely to propel the market for vascular closure devices in the coming years.

Restraint: High cost of vascular closure devices

Vascular closure devices are relatively high-priced devices compared to manual compression devices. The average price of a vascular closure device is about USD 150–250, while that of a manual compression device is about USD 15–25. The cost of VCDs essentially adds up to the patient’s hospitalization bill, increases the per-patient cost for hospitals, and simultaneously reduces profits. The costs associated with manual compression devices, on the other hand, are very low compared to vascular closure devices. Thus, the high cost of vascular closure devices acts as a major factor limiting the market growth. Hospitals are also not reimbursed for vascular closure devices, which is another major factor restricting the demand for these devices.

Opportunity: Growth in the number of hospitals & surgical centers

The number of hospitals and surgical centers is increasing in both developed and emerging countries. The demand for surgical equipment (including medical devices such as vascular closure devices) is high in these newly established surgical centers and hospitals, owing to the increasing patient population base. For instance, in October 2020, the Prime Minister of the UK announced plans of investing USD 4.3 billion for 40 hospitals and certain schemes for future funding for 48 hospitals by 2030. In the last decade, developing countries such as India and China have witnessed significant improvements in their respective healthcare infrastructures. According to an article published in January 2020, China announced plans to invest USD 4.6 billion in the construction of hospitals in Wuhan. The significant growth in the number of hospitals and surgical centers is expected to support the growth of the vascular closure devices market, as these are key end users of vascular closure devices.

Challenge: Risks associated with vascular closure devices

The various risks associated with the use of vascular closure devices act as a major challenging factor for the growth of this market. Complications such as limb ischemia/arterial stenosis, infection on the access region, device failure, bleeding events, and thrombotic events may arise during or after the procedure. These risks can extend the hospitalization time as well as increase the overall treatment cost. Owing to these risks, most doctors are reluctant to use vascular closure devices and prefer manual compression for vascular closure. According to the Cardiovascular Research Foundation, serious concerns have been raised regarding the application of suture-based vascular closure devices that led to complications and even death; the analysis was done using the US FDA database of adverse events.

Passive approximators segment dominated the Vascular closure devices market in 2020.

Based on type, the vascular closure devices market is segmented into passive approximators, active approximators, and external hemostatic devices. Passive approximators account for the largest share of the vascular closure devices market. The large share of this segment can be attributed to the increasing number of approvals for vascular closure devices and the wide range of advantages associated with these devices, such as ease of use and reduced complication rate in patients.

The interventional radiology segment to witness the highest CAGR during the forecast period.

Based on procedure, the vascular closure devices market is segmented into interventional cardiology procedures and interventional radiology/vascular surgery. Interventional cardiology for the largest share of the vascular closure devices market. The large share is attributed to the diagnosis and treatment of numerous cardiovascular disorders due to advancements in angioplasty and cardiac stenting and the growing prevalence of cardiac disorders globally.

North America was the largest regional market for vascular closure devices market in 2020.

The global vascular closure devices market is segmented into North America (the US and Canada), Europe (E-3, and the Rest of Europe), Asia Pacific, and Rest of World. In 2020, North America dominated the global vascular closure devices market, followed by Europe. The large share of the North American market can be attributed to the rising prevalence of cardiovascular diseases, the growing trend of one-day surgeries for vascular procedures, increasing research and clinical trials for vascular closure devices in the US, the increasing number of cardiac arrest cases, and the long waiting periods for cardiac surgeries (which encourage the adoption of minimally invasive procedures) in Canada.

To know about the assumptions considered for the study, download the pdf brochure

Vascular Closure Devices Market Key Players

The prominent players operating in this market include Terumo Corporation (Japan), Abbott (US), Cardinal Health (US), Cardiva Medical, Inc. (US), and Medtronic Plc. (Ireland).

Scope of the Vascular Closure Devices Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$0.9 billion |

|

Projected Revenue Size by 2026 |

$1.3 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 7.0% |

|

Market Driver |

High prevalence of cardiovascular diseases |

|

Market Opportunity |

Growth in the number of hospitals & surgical centers |

This report categorizes the vascular closure devices market to forecast revenue and analyze trends in each of the following submarkets:

By Type

-

Passive Approximators

- Collagen Plugs

- Sealant or Gel-based Devices

- Compression Assist Devices

-

Active Approximators

- Suture-based Devices

- Clip-based Devices

- External Hemostatic Devices

By Access

- Femoral Access

- Radial Access

By Procedure

- Interventional Cardiology

- Interventional Radiology/Vascular Surgery

By Region

-

North America

- US

- Canada

-

Europe

- E-3

- Rest of Europe

- Asia Pacific

- Rest of World

Recent Developments:

- In 2021, Vivasure Medical Ltd. (Ireland) announced the development of its product, PerQseal Blue. This product is a large-bore vascular closure device used after interventional cardiovascular procedures.

- In 2021, Abbott (US) acquired Walk Vascular, LLC (US) to expand its portfolio of peripheral vascular devices.

- In 2020, Teleflex Incorporated (US) acquired Z-Medica, LLC (US), an industry-leading manufacturer of hemostatic products that will lead to revenue growth for the company by expanding its product portfolio in the Interventional segment.

- In 2018, Cardinal Health (US) launched MYNX Control, a sealant or gel-based device with extravascular sealing and resorbability properties.

Frequently Asked Questions (FAQ):

What is the impact of COVID-19 on the vascular closure devices market?

The COVID-19 pandemic has a negative impact on vascular closure devices. The reduced use of vascular closure devices due to the declining volume of elective and non-essential procedures, the lower diagnosis, reduced capital spending by customers, and a decrease in research activity due to laboratory closures and reduced clinical testing have all affected the market.

Who are the key players in the vascular closure devices market?

The prominent players operating in this market include Terumo Corporation (Japan), Abbott (US), Cardinal Health (US), Cardiva Medical, Inc. (US), and Medtronic Plc. (Ireland).

Which product type dominates the vascular closure devices market?

Passive approximators account for the largest share of the vascular closure devices market. The large share of the passive approximators segment can be attributed to the increasing number of approvals for vascular closure devices and the wide range of advantages associated with these devices, such as ease of use and reduced complication rate in patients.

What factors are driving the vascular closure devices market?

Market growth is largely driven by factors such as to large number of approvals for vascular closure devices, high prevalence of cardiovascular diseases, increasing prevalence of obesity, increasing focus of market players on large-bore vascular closure devices, growing geriatric population, favorable reimbursement scenario for interventional radiology procedures, and rising focus on effective blood loss management in patients during surgeries.

What is the market for global vascular closure devices?

The global vascular closure devices market is projected to reach USD 1.3 billion by 2026 from USD 0.9 billion in 2021, at a CAGR of 7.0% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

FIGURE 1 VASCULAR CLOSURE DEVICES MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.2 SECONDARY DATA

2.2.1 SECONDARY SOURCES

2.3 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.3.1 KEY DATA FROM PRIMARY SOURCES

2.3.2 KEY INDUSTRY INSIGHTS

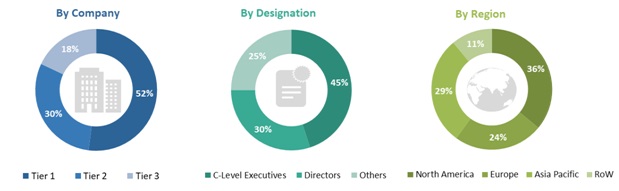

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.4 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.4.1 GROWTH FORECAST

FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 7 TOP-DOWN APPROACH

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.6 MARKET SHARE ANALYSIS

2.7 ASSUMPTIONS FOR THE STUDY

2.7.1 COVID-19-SPECIFIC ASSUMPTIONS

2.8 LIMITATIONS

2.9 RISK ASSESSMENT

2.10 COVID-19 ECONOMIC ASSESSMENT

2.11 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 9 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 10 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 11 VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 12 VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2021 VS. 2026 (USD MILLION)

FIGURE 13 VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2021 VS. 2026 (USD MILLION)

FIGURE 14 VASCULAR CLOSURE DEVICES MARKET, BY REGION, 2021 VS. 2026 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 VASCULAR CLOSURE DEVICES MARKET OVERVIEW

FIGURE 15 LARGE NUMBER OF APPROVALS FOR VASCULAR CLOSURE DEVICES TO DRIVE MARKET GROWTH

4.2 VASCULAR CLOSURE DEVICES MARKET, BY TYPE (2021–2026)

FIGURE 16 PASSIVE APPROXIMATORS SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 NORTH AMERICA: VASCULAR CLOSURE DEVICES MARKET, BY TYPE AND COUNTRY (2020)

FIGURE 17 THE US ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN VASCULAR CLOSURE DEVICES MARKET IN 2020

4.4 VASCULAR CLOSURE DEVICES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 18 US TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

FIGURE 19 VASCULAR CLOSURE DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing approvals of vascular closure devices

TABLE 1 APPROVALS OF VASCULAR CLOSURE DEVICES

5.2.1.2 High prevalence of cardiovascular diseases

5.2.1.3 Increasing prevalence of obesity

5.2.1.4 Increasing focus of market players on large-bore vascular closure devices

5.2.1.5 Growing geriatric population

5.2.1.6 Favorable reimbursement scenario for interventional radiology procedures

TABLE 2 REIMBURSEMENTS FOR INTERVENTIONAL RADIOLOGY PROCEDURES IN THE US

5.2.1.7 Rising focus on effective blood loss management in patients during surgeries

5.2.1.8 Increasing investments, funds, and grants for research on vascular devices

5.2.2 RESTRAINTS

5.2.2.1 Increasing preference for interventional procedures using radial artery access

5.2.2.2 High cost of vascular closure devices

5.2.2.3 Product recalls and failures

TABLE 3 RECENT RECALLS OF VASCULAR CLOSURE DEVICES

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging markets providing growth opportunities for market players

5.2.3.2 Growth in the number of hospitals & surgical centers

5.2.4 CHALLENGES

5.2.4.1 Need for highly skilled professionals

5.2.4.2 Risks associated with vascular closure devices

5.2.4.3 Stringent regulatory frameworks

5.3 COVID-19 IMPACT ON THE VASCULAR CLOSURE DEVICES MARKET

6 VASCULAR CLOSURE DEVICES MARKET, BY TYPE (Page No. - 60)

6.1 INTRODUCTION

TABLE 4 VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 5 VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.2 PASSIVE APPROXIMATORS

TABLE 6 PASSIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 7 PASSIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 8 PASSIVE APPROXIMATORS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 9 PASSIVE APPROXIMATORS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.1 COLLAGEN PLUGS

6.2.1.1 Growing number of approvals for collagen-based vascular closure devices to drive market growth during the forecast period

TABLE 10 COLLAGEN PLUGS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 11 COLLAGEN PLUGS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2 SEALANT OR GEL-BASED DEVICES

6.2.2.1 Sealant or gel-based devices to register the highest growth rate during the forecast period

TABLE 12 SEALANT OR GEL-BASED DEVICES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 13 SEALANT OR GEL-BASED DEVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.3 COMPRESSION ASSIST DEVICES

6.2.3.1 Compression assist devices do not leave behind any foreign body in the tissue artery—a major advantage of these devices

TABLE 14 COMPRESSION ASSIST DEVICES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 15 COMPRESSION ASSIST DEVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3 ACTIVE APPROXIMATORS

TABLE 16 ACTIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 17 ACTIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 18 ACTIVE APPROXIMATORS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 ACTIVE APPROXIMATORS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.1 SUTURE-BASED DEVICES

6.3.1.1 Increasing applications of suture-based devices to favor market growth

TABLE 20 SUTURE-BASED ACTIVE APPROXIMATORS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 SUTURE-BASED ACTIVE APPROXIMATORS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2 CLIP-BASED DEVICES

6.3.2.1 Growing innovation in the field of clip-based devices to aid market growth

TABLE 22 CLIP-BASED ACTIVE APPROXIMATORS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 CLIP-BASED ACTIVE APPROXIMATORS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.4 EXTERNAL HEMOSTATIC DEVICES

6.4.1 RISING ADOPTION OF MINIMALLY INVASIVE THERAPEUTIC PROCEDURES TO DRIVE MARKET GROWTH

TABLE 24 EXTERNAL HEMOSTATIC DEVICES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 EXTERNAL HEMOSTATIC DEVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

7 VASCULAR CLOSURE DEVICES MARKET, BY ACCESS (Page No. - 73)

7.1 INTRODUCTION

TABLE 26 VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2017–2020 (USD MILLION)

TABLE 27 VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2021–2026 (USD MILLION)

7.2 FEMORAL ACCESS

7.2.1 ADVANTAGES ASSOCIATED WITH FEMORAL ACCESS, SUCH AS GREATER COMFORT LEVEL FOR PATIENTS AND REDUCED COST OF HOSPITALIZATION, TO DRIVE MARKET GROWTH

TABLE 28 FEMORAL ACCESS: RESEARCH STUDIES

TABLE 29 FEMORAL ACCESS VASCULAR CLOSURE DEVICES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 30 FEMORAL ACCESS VASCULAR CLOSURE DEVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3 RADIAL ACCESS

7.3.1 TRANSRADIAL APPROACH REDUCES VASCULAR COMPLICATIONS COMPARED TO THE FEMORAL ARTERY ACCESS APPROACH—A KEY FACTOR DRIVING MARKET GROWTH

TABLE 31 RADIAL ACCESS VASCULAR CLOSURE DEVICES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 RADIAL ACCESS VASCULAR CLOSURE DEVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

8 VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE (Page No. - 79)

8.1 INTRODUCTION

TABLE 33 VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2017–2020 (USD MILLION)

TABLE 34 VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

8.2 INTERVENTIONAL CARDIOLOGY

8.2.1 ASSOCIATED BENEFITS OF INTERVENTIONAL CARDIOLOGY PROCEDURES, SUCH AS REDUCED SCARRING AND LESS PAIN, TO DRIVE MARKET GROWTH

TABLE 35 VASCULAR CLOSURE DEVICES MARKET FOR INTERVENTIONAL CARDIOLOGY PROCEDURES, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 VASCULAR CLOSURE DEVICES MARKET FOR INTERVENTIONAL CARDIOLOGY PROCEDURES, BY REGION, 2021–2026 (USD MILLION)

8.3 INTERVENTIONAL RADIOLOGY/VASCULAR SURGERY

8.3.1 GROWTH IN THE PREVALENCE OF PAD IS INCREASING THE DEMAND FOR ENDOVASCULAR INTERVENTIONAL PROCEDURES

TABLE 37 VASCULAR CLOSURE DEVICES MARKET FOR INTERVENTIONAL RADIOLOGY/VASCULAR SURGERY PROCEDURES, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 VASCULAR CLOSURE DEVICES MARKET FOR INTERVENTIONAL RADIOLOGY/VASCULAR SURGERY PROCEDURES, BY REGION, 2021–2026 (USD MILLION)

9 VASCULAR CLOSURE DEVICES MARKET, BY REGION (Page No. - 85)

9.1 INTRODUCTION

TABLE 39 VASCULAR CLOSURE DEVICES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 VASCULAR CLOSURE DEVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 20 NORTH AMERICA: VASCULAR CLOSURE DEVICES MARKET SNAPSHOT

TABLE 41 NORTH AMERICA: VASCULAR CLOSURE DEVICES MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 42 NORTH AMERICA: VASCULAR CLOSURE DEVICES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 43 NORTH AMERICA: VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 44 NORTH AMERICA: VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 45 NORTH AMERICA: PASSIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 46 NORTH AMERICA: PASSIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 47 NORTH AMERICA: ACTIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 48 NORTH AMERICA: ACTIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 49 NORTH AMERICA: VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2017–2020 (USD MILLION)

TABLE 50 NORTH AMERICA: VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2021–2026 (USD MILLION)

TABLE 51 NORTH AMERICA: VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2017–2020 (USD MILLION)

TABLE 52 NORTH AMERICA: VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

9.2.1 US

9.2.1.1 The US dominates the North American vascular closure devices market

TABLE 53 REIMBURSEMENTS FOR INTERVENTIONAL CARDIOLOGY PROCEDURES, 2020

TABLE 54 US: KEY MACROINDICATORS

TABLE 55 US: VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 56 US: VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 57 US: PASSIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 58 US: PASSIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 59 US: ACTIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 60 US: ACTIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 61 US: VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2017–2020 (USD MILLION)

TABLE 62 US: VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2021–2026 (USD MILLION)

TABLE 63 US: VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2017–2020 (USD MILLION)

TABLE 64 US: VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Rising prevalence of target diseases to drive market growth

TABLE 65 CANADA: KEY MACROINDICATORS

TABLE 66 CANADA: VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 67 CANADA: VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 68 CANADA: PASSIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 69 CANADA: PASSIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 70 CANADA: ACTIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 71 CANADA: ACTIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 72 CANADA: VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2017–2020 (USD MILLION)

TABLE 73 CANADA: VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2021–2026 (USD MILLION)

TABLE 74 CANADA: VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2017–2020 (USD MILLION)

TABLE 75 CANADA: VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

9.3 EUROPE

TABLE 76 NUMBER OF SURGICAL PROCEDURES PER 100,000 POPULATION, BY COUNTRY, 2018

TABLE 77 EUROPE: VASCULAR CLOSURE DEVICES MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 78 EUROPE: VASCULAR CLOSURE DEVICES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 79 EUROPE: VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 80 EUROPE: VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 81 EUROPE: PASSIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 82 EUROPE: PASSIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 83 EUROPE: ACTIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 84 EUROPE: ACTIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 85 EUROPE: VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2017–2020 (USD MILLION)

TABLE 86 EUROPE: VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2021–2026 (USD MILLION)

TABLE 87 EUROPE: VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2017–2020 (USD MILLION)

TABLE 88 EUROPE: VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

9.3.1 E-3

9.3.1.1 Increase in number of radial procedures to boost the market demand

TABLE 89 GERMANY: KEY MACROINDICATORS

TABLE 90 UK: KEY MACROINDICATORS

TABLE 91 FRANCE: KEY MACROINDICATORS

TABLE 92 E-3: VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 93 E-3: VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 94 E-3: PASSIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 95 E-3: PASSIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 96 E-3: ACTIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 97 E-3: ACTIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 98 E-3: VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2017–2020 (USD MILLION)

TABLE 99 E-3: VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2021–2026 (USD MILLION)

TABLE 100 E-3: VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2017–2020 (USD MILLION)

TABLE 101 E-3: VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

9.3.2 REST OF EUROPE

TABLE 102 ROE: HEALTHCARE EXPENDITURE, BY COUNTRY, 2010 VS. 2018 (% OF GDP)

TABLE 103 ROE: VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 104 ROE: VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 105 ROE: PASSIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 106 ROE: PASSIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 107 ROE: ACTIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 108 ROE: ACTIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 109 ROE: VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2017–2020 (USD MILLION)

TABLE 110 ROE: VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2021–2026 (USD MILLION)

TABLE 111 ROE: VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2017–2020 (USD MILLION)

TABLE 112 ROE: VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

9.4 ASIA PACIFIC

9.4.1 INCREASING HEALTH EXPENDITURE TO DRIVE MARKET GROWTH IN APAC

FIGURE 21 ASIA PACIFIC: VASCULAR CLOSURE DEVICES MARKET SNAPSHOT

TABLE 113 CHINA: KEY MACROINDICATORS

TABLE 114 JAPAN: KEY MACROINDICATORS

TABLE 115 INDIA: KEY INDICATORS

TABLE 116 ASIA PACIFIC: VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 117 ASIA PACIFIC: VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 118 ASIA PACIFIC: PASSIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 119 ASIA PACIFIC: PASSIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 120 ASIA PACIFIC: ACTIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 121 ASIA PACIFIC: ACTIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 122 ASIA PACIFIC: VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2017–2020 (USD MILLION)

TABLE 123 ASIA PACIFIC: VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2021–2026 (USD MILLION)

TABLE 124 ASIA PACIFIC: VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2017–2020 (USD MILLION)

TABLE 125 ASIA PACIFIC: VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

9.5 REST OF THE WORLD

9.5.1 GOVERNMENT INITIATIVES TO PROMOTE HEALTHCARE SERVICES TO SUPPORT MARKET GROWTH

TABLE 126 ROW: VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 127 ROW: VASCULAR CLOSURE DEVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 128 ROW: PASSIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 129 ROW: PASSIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 130 ROW: ACTIVE APPROXIMATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 131 ROW: ACTIVE APPROXIMATORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 132 ROW: VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2017–2020 (USD MILLION)

TABLE 133 ROW: VASCULAR CLOSURE DEVICES MARKET, BY ACCESS, 2021–2026 (USD MILLION)

TABLE 134 ROW: VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2017–2020 (USD MILLION)

TABLE 135 ROW: VASCULAR CLOSURE DEVICES MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 131)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 136 OVERVIEW OF STRATEGIES ADOPTED BY KEY VASCULAR CLOSURE DEVICES MARKET PLAYERS

10.3 REVENUE SHARE ANALYSIS

FIGURE 22 REVENUE SHARE ANALYSIS OF KEY PLAYERS IN THE VASCULAR CLOSURE DEVICES MARKET

10.4 MARKET SHARE ANALYSIS

FIGURE 23 VASCULAR CLOSURE DEVICES MARKET SHARE ANALYSIS, 2020

TABLE 137 VASCULAR CLOSURE DEVICES MARKET: DEGREE OF COMPETITION (2020)

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 24 VASCULAR CLOSURE DEVICES MARKET: COMPANY EVALUATION QUADRANT (2020)

10.6 COMPANY EVALUATION QUADRANT: SMES/START-UPS

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 RESPONSIVE COMPANIES

10.6.4 DYNAMIC COMPANIES

FIGURE 25 VASCULAR CLOSURE DEVICES MARKET: COMPANY EVALUATION QUADRANT FOR SMES & START-UPS (2020)

10.7 COMPETITIVE SCENARIO

10.7.1 PRODUCT LAUNCHES & APPROVALS

TABLE 138 PRODUCT LAUNCHES & APPROVALS

10.7.2 DEALS

TABLE 139 DEALS

10.7.3 OTHER DEVELOPMENTS

TABLE 140 OTHER DEVELOPMENTS

11 COMPANY PROFILES (Page No. - 142)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1.1 TERUMO CORPORATION

TABLE 141 TERUMO CORPORATION: BUSINESS OVERVIEW

FIGURE 26 TERUMO CORPORATION: COMPANY SNAPSHOT (2020)

TABLE 142 EXCHANGE RATES (USED FOR THE CONVERSION OF YEN TO USD)

11.1.2 ABBOTT LABORATORIES

TABLE 143 ABBOTT LABORATORIES: BUSINESS OVERVIEW

FIGURE 27 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2020)

11.1.3 CARDINAL HEALTH

TABLE 144 CARDINAL HEALTH: BUSINESS OVERVIEW

FIGURE 28 CARDINAL HEALTH: COMPANY SNAPSHOT (2021)

11.1.4 CARDIVA MEDICAL, INC.

TABLE 145 CARDIVA MEDICAL, INC.: BUSINESS OVERVIEW

11.1.5 MEDTRONIC PLC

TABLE 146 MEDTRONIC PLC: BUSINESS OVERVIEW

FIGURE 29 MEDTRONIC PLC: COMPANY SNAPSHOT (2021)

11.1.6 MORRIS INNOVATIVE, INC.

TABLE 147 MORRIS INNOVATIVE, INC.: BUSINESS OVERVIEW

11.1.7 TELEFLEX INCORPORATED

TABLE 148 TELEFLEX INCORPORATED: BUSINESS OVERVIEW

FIGURE 30 TELEFLEX INCORPORATED: COMPANY SNAPSHOT (2020)

11.1.8 MERIT MEDICAL SYSTEMS, INC.

TABLE 149 MERIT MEDICAL SYSTEMS, INC.: BUSINESS OVERVIEW

FIGURE 31 MERIT MEDICAL SYSTEMS, INC.: COMPANY SNAPSHOT (2020)

11.1.9 VASORUM LTD.

TABLE 150 VASORUM LTD.: BUSINESS OVERVIEW

11.1.10 TZ MEDICAL, INC.

TABLE 151 TZ MEDICAL INC.: BUSINESS OVERVIEW

11.2 OTHER PLAYERS

11.2.1 VIVASURE MEDICAL LTD.

11.2.2 TRICOL BIOMEDICAL

11.2.3 SCION BIOMEDICAL

11.2.4 ADVANCED VASCULAR DYNAMICS

11.2.5 MARINE POLYMER TECHNOLOGIES, INC.

11.2.6 TRANSLUMINAL TECHNOLOGIES

11.2.7 REX MEDICAL

11.2.8 MERIL LIFE SCIENCES PVT. LTD.

11.2.9 MEDAS USA

11.2.10 VYGON COMPANY

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 176)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the vascular closure devices market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the vascular closure devices market. The secondary sources used for this study include European Society of Radiology/European Congress of Radiology (ESR/ECR), Society of Interventional Radiology (SIR), World Heart Federation (WHF), Society for Cardiac Angiography and Interventions (SCAI), American College of Cardiology (ACC), American Heart Association (AHA), European Association of Percutaneous Cardiovascular Interventions (EAPCI), Canadian Association of Interventional Cardiology (CAIC), Asian Pacific Society of Interventional Cardiology (APSIC), Organisation for Economic Co-operation and Development (OECD), American Association for Cancer Research (AACR), US Food and Drug Administration (US FDA), American Medical Association (AMA), Centers for Disease Control and Prevention (CDC), World Health Organization (WHO), Eurostat, SEC Filings, Annual Reports, Expert Interviews, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the vascular closure devices market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the vascular closure devices business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global vascular closure devices market based on type, access, procedure, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall vascular closure devices market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, and agreements in the vascular closure devices market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- An additional five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Vascular Closure Devices Market