Video as a Service Market by Application (Corporate Communication, Training and Development, and Marketing and Client Engagement), Cloud Deployment Mode, Vertical (Healthcare and Life Sciences and BFSI), and Region - Global forecast to 2026

Video as a Service (VaaS) Market - Share & Forecast

The global Video as a Service Market is estimated to be worth USD 3.8 billion in 2021. It is projected to reach USD 6.2 billion by 2026 at a CAGR of 8.7% during the forecast period. Growing demand for real-time and remote access video services, adoption of cloud-based services by enterprises, increasing number of internet users around, and lower total cost of ownership are expected to be the major factors driving the growth of the VaaS market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact Analysis

Owing to the outbreak of COVID-19, various countries follow strict lockdowns, shutdowns, and mobility restrictions to avoid the spread of the virus. The video as a service market has been witnessing a positive impact as the use of video conferencing for collaboration and communication has increased by more than 100%. The pandemic also has disrupted business efficiency and employee productivity across the globe. Hence, the adoption of VaaS solutions and services has spurred significantly in the pandemic, which has positively impacted market growth. It is expected that the adoption of VaaS solutions for collaboration, training, client engagement, and marketing will continue to grow in the post-pandemic scenarios.

Video as a Service Market Growth Dynamics

Driver: Lower total cost of ownership

Business cloud service platforms are complicated to install and require a higher cost of ownership. Earlier, organizations had to appoint infrastructure teams for managing their cloud infrastructure on their own servers. In video as a service market, VaaS enables organizations to reduce investments in building the infrastructure as it is taken care of by managed services providers (MSPs). Cloud vendors have their service platforms deployed on their own servers. Organizations get their data onto their platforms and have to pay only for the resources they require to use the video conferencing services. By using shared video as a service infrastructure, organizations can reduce the Total Cost of Ownership (TCO) and can save money on infrastructure, licensing, and support costs.

Restraint: Data security and privacy concerns

In the video as a service market, the security and privacy of the video content shared across various platforms can pose major concerns for enterprises. Moreover, organizations are also concerned about copyright and Digital Rights Management (DRM) due to the possibilities of misuse, information leakages, and data breaches. The healthcare, finance, manufacturing, information, and public sectors witnessed the highest number of data breach incidents in 2019. To counter such challenges, enterprises need to restructure their strategies in employing video conferencing offerings before deploying these solutions. In the absence of policies and procedures for the proper management of video content, video conferencing solutions may witness a sluggish adoption rate. Furthermore, vendors need to offer interoperable and easy-to-use enterprise-grade video communication solutions that have in-built security features.

Opportunity: Rise of 5G to boost adoption of cloud services

5G technology will bring major improvements to the cloud computing world. This is because most technology innovations can be more efficient when cloud-dependent. 5G, in turn, improves that integration with its low to zero latency, making for smoother communications. Enhanced mobile broadband will deliver a seamless, high-quality experience for cloud video services such as conferencing, recording, and storage. Lower cost per bit will bring affordable and truly unlimited mobile data packages, better adapted to heavy media usage. Furthermore, newer technologies such as facial recognition and live transcripts using AI and ML will spur the adoption of video conferencing over 5G. The evolution of 5G is yet to realize its full transformational potential and provides a great growth opportunity for the video as a service market.

Challenge: Poor internet speed can reduce the quality of service

In the video as a service market, the lack of strong communication tools significantly limits employee productivity. Noise during video or low-quality video can create misunderstandings or consume more time of employees. Low quality of video streaming and disturbances during video conferences can significantly limit effective communication among workers, especially in the COVID-19 situation. Many people are frustrated due to the bad quality of video and other disturbances that occur during video conferences. According to a Cisco global survey focused on the future of work, 98% of workers stated that they experienced frustration from distractions during video meetings when working from home. Two of the top five frustrations called out were related to background noise-either from other participants or their own side of the call. Many video conferencing solutions providers are developing advanced noise cancellation technologies.

By Applications, the Marketing and Client Engagement segment to have a higher growth during the forecast period

The marketing and client engagement application of the video as a service market is expected to have a higher growth rate during the forecast period. With the help of video conferencing for marketing purposes, organizations can easily engage audiences, communicate with them more efficiently, and expand their reach. VaaS solutions help enhance customer engagement by enabling more communication with the clients, thus allowing them to have a better relationship with the enterprise.

By Verticals, the BFSI segment to dominate the market during the forecast period

In the video as a service market, solutions enable Banking, Financial Services and Insurance (BFSI) enterprises to transform branches into sales and service channels without employing additional onsite staff. These solutions facilitate enhanced internal communication, knowledge sharing, and investor relations. Live or on-demand videos enable these enterprises to carry out announcements regarding executive messaging and policies, investor relations, external communication, and collaborations among their geographically dispersed teams.

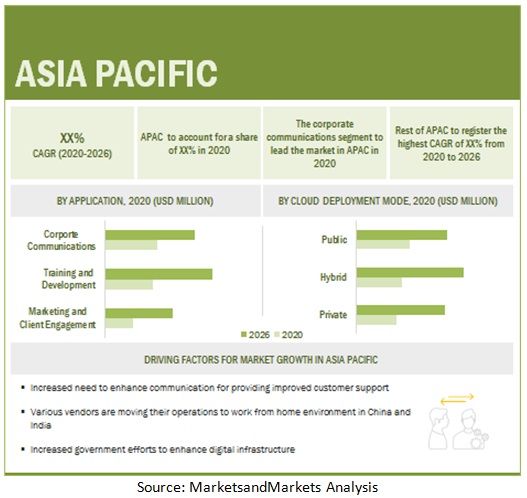

By region, Asia Pacific to record the highest growth during the forecast period

The video as a service market in APAC region is estimated to have strong growth in the future. Government initiatives to promote the digital infrastructure are responsible for driving the adoption of VaaS solutions in the region. Several technological service providers in this region are partnering with solution providers to enhance and provide customized offerings as per the business requirements of local clients. There is a huge untapped market for video as a service vendors in the developing countries of APAC. The major contributors to the APAC VaaS market are China, Japan, ANZ, and the rest of APAC.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The report includes the study of key players offering VaaS solutions and services. The major vendors in the video as a service market include Microsoft (US), Zoom Video Communications (US), Cisco (US), Adobe (US), Avaya (US), Google (US), AWS (US), Poly (US), LogMeIn (US), and RingCentral (US). These players have adopted various strategies to grow in the global market.

The study includes an in-depth competitive analysis of these key players in the video as a service market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2020 |

$3.8 Billion |

|

Market size value in 2026 |

$6.2 Billion |

|

Growth Rate |

8.7% CAGR |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Historical data |

2017-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2020-2026 |

|

Segments covered |

By Application, Cloud Deployment mode, Vertical, Region |

|

Regions covered |

North America, Europe, APAC, MEA, Latin America |

|

Companies covered |

Microsoft (US), Zoom Video Communications (US), Cisco (US), Adobe (US), Avaya (US), Google (US), AWS (US), Poly (US), LogMeIn (US), RingCentral (US), Zoho Corporation (India), PGi (US), Wickr (US), Pexip (Norway), Starleaf (UK), BlueJeans Network (US), Enghouse Systems (Canada), Qumu (US), Sonic Foundry (US), ON24 (US), Lifesize (US), Kaltura (US), Kollective (US), VIDIZMO (US), and VBrick (US). |

This research report categorizes the video as a service market to forecast revenues and analyze trends in each of the following subsegments:

Market by Application:

- Corporate communications

- Training and development

- Marketing and client engagement

Market by Cloud Deployment mode:

- Public cloud

- Private cloud

- Hybrid cloud

Market by Vertical:

- Banking, Financial services and Insurance

- It and ITeS

- Healthcare and life sciences

- Education

- Media and entertainment

- Government and Public sector

- Retail and consumer goods

- Other verticals

Market by Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- ANZ

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In September 2020, Zoom Video Communications partnered with Lumen to allow Lumen to offer Zoom as part of its Unified Communications and Collaboration Suite. This will enhance the user experience for the Unified Communications and Collaboration Suite and will provide enhanced customer reach for Zoom.

- In May 2020, Sony Semiconductor Solutions and Microsoft partnered to make AI-powered smart cameras and video analytics solutions more accessible for customers. With this partnership, both companies will embed Microsoft Azure’s AI capabilities on Sony’s intelligent vision sensor IMX500, which extracts useful information out of images in smart cameras and other devices.

- In January 2020, Avaya and VExpress, an Australian ICT distributor, signed a Master Agent agreement to enable channel partners to fastrack the operational recovery efforts of Australia’s midmarket organizations and SMEs with the help of cloud communications and collaboration solutions from Avaya.

- In August 2019, Cisco acquired Voicea, a meeting and voice specialist, for Webex ‘game-changer’. With Voicea’s technology, Cisco would enhance its Webex portfolio of products with a powerful transcription service to boost collaboration in meetings and calls. Voicea's technology would be a game-changer for Cisco Webex customers to experience more productive and actionable meetings.

Frequently Asked Questions (FAQ):

How big is the Video as a Service Market?

What is the Video as a Service Market growth?

Which region has the largest market share in the Video as a Service Market?

Which application is expected to hold a larger market size during the forecast period?

Which vertical is expected to hold a larger market size during the forecast period?

Who are the major vendors in the video as a service market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.7 YEARS CONSIDERED FOR THE STUDY

1.8 CURRENCY CONSIDERED

1.9 STAKEHOLDERS

1.10 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 6 VIDEO AS A SERVICE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 1 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primaries

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES OF THE VIDEO AS A SERVICE MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1- BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF SOLUTIONS AND SERVICES OF THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2 (DEMAND SIDE): MARKET

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 STUDY ASSUMPTIONS

2.5.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 11 VIDEO AS A SERVICE MARKET, 2018–2026 (USD MILLION)

FIGURE 12 LEADING SEGMENTS IN THE MARKET IN 2020

FIGURE 13 MARKET: REGIONAL SNAPSHOT

FIGURE 14 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS DURING 2020–2026

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES IN THE VIDEO AS A SERVICE MARKET

FIGURE 15 INCREASING USE OF VIDEO AS A SERVICE SOLUTIONS TO ENHANCE COMMUNICATION AND COLLABORATION AMONG ENTERPRISES

4.2 NORTH AMERICA MARKET, BY APPLICATION AND COUNTRY

FIGURE 16 CORPORATE COMMUNICATIONS SEGMENT AND UNITED STATES TO ACCOUNT FOR HIGH SHARES IN THE NORTH AMERICAN MARKET IN 2020

4.3 ASIA PACIFIC MARKET, BY CLOUD DEPLOYMENT MODE AND COUNTRY

FIGURE 17 PUBLIC SEGMENT AND CHINA TO HOLD THE HIGHEST MARKET SHARES IN THE ASIA PACIFIC MARKET IN 2020

4.4 VIDEO AS A SERVICE MARKET: MAJOR COUNTRIES

FIGURE 18 AUSTRALIA NEW ZEALAND AND UNITED ARAB EMIRATES TO GROW AT HIGHEST CAGRS DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 VIDEO AS A SERVICE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing demand for real-time and remote access video services

FIGURE 20 ZOOM: GROWTH IN QUARTERLY REVENUE (IN USD MILLION)

5.2.1.2 Adoption of cloud-based services by enterprises

FIGURE 21 GLOBAL CLOUD SERVICES MARKET

5.2.1.3 Increasing number of internet users around the world

FIGURE 22 NUMBER OF INTERNET USERS, BY REGION

5.2.1.4 Lower total cost of ownership

5.2.2 RESTRAINTS

5.2.2.1 Data security and privacy concerns

5.2.2.2 Network connectivity and infrastructure issues

5.2.3 OPPORTUNITIES

5.2.3.1 Rise of 5G to boost adoption of cloud services

FIGURE 23 5G MARKET SIZE, BY REGION

5.2.3.2 High adoption of VaaS among SMEs

5.2.3.3 Increasing adoption of BYOD and CYOD trends

FIGURE 24 DRIVERS FOR BRING YOUR OWN DEVICE AND CARRY YOUR OWN DEVICE MODELS

5.2.4 CHALLENGES

5.2.4.1 Limited interoperability of different video conferencing solutions

5.2.4.2 Poor internet speed can reduce the quality of service

5.2.5 VIDEO AS A SERVICE MARKET: ECOSYSTEM

5.2.6 MARKET: VALUE CHAIN ANALYSIS

5.2.7 PATENT ANALYSIS

FIGURE 25 VIDEO PATENT APPLICANTS, BY COUNTRY, 2015 - 2020

5.2.8 AVERAGE SELLING PRICE

TABLE 3 PRICING ANALYSIS

5.2.9 VIDEO AS A SERVICE MARKET: TECHNOLOGICAL LANDSCAPE

5.2.9.1 Cloud services

5.2.9.2 Artificial Intelligence and Machine Learning

5.2.9.3 Facial Recognition and Voice Recognition

5.2.9.4 5G network

5.2.10 CASE STUDY ANALYSIS

5.2.10.1 Case study 1: Cisco provides Cisco Connected Classrooms and Cisco Webex Meetings solutions to A.T. Kearney

5.2.10.2 Case study 2: Ecoegg implemented Microsoft Teams to solve their communication-related challenges

5.2.10.3 Case study 3: Coastal Bend College implemented Lifesize video systems across four campuses

5.2.10.4 Case study 4: Northumberland County Council implemented Google Meet to help firefighters

5.2.10.5 Case study 5: Canadian Foundation for Healthcare Improvement implemented Adobe Connect to Deliver Virtual Bilingual Events

5.2.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 VIDEO AS A SERVICE PORTER’S FIVE FORCES MODEL

5.2.11.1 Threat of new entrants

5.2.11.2 Threat of substitutes

5.2.11.3 Bargaining power of buyers

5.2.11.4 Bargaining power of suppliers

5.2.11.5 Competition rivalry

5.3 COVID-19 MARKET OUTLOOK FOR VIDEO AS A SERVICE SOLUTIONS

TABLE 4 VIDEO AS A SERVICE MARKET: ANALYSIS OF DRIVERS AND OPPORTUNITIES IN THE COVID-19 ERA

TABLE 5 VIDEO AS A SERVICE: ANALYSIS OF CHALLENGES AND RESTRAINTS IN THE COVID-19 ERA

5.3.1 CUMULATIVE GROWTH ANALYSIS

TABLE 6 MARKET: CUMULATIVE GROWTH ANALYSIS

6 VIDEO AS A SERVICE MARKET, BY APPLICATION (Page No. - 69)

6.1 INTRODUCTION

6.1.1 APPLICATIONS: MARKET DRIVERS

6.1.2 APPLICATIONS: COVID-19 IMPACT

FIGURE 27 MARKETING AND CLIENT ENGAGEMENT SEGMENT TO GROW AT THE HIGHEST CAGR IN THE MARKET FROM 2020 TO 2026

TABLE 7 MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 8 MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

6.2 CORPORATE COMMUNICATIONS

TABLE 9 CORPORATE COMMUNICATIONS: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 10 CORPORATE COMMUNICATIONS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 TRAINING AND DEVELOPMENT

TABLE 11 TRAINING AND DEVELOPMENT: VIDEO AS A SERVICE MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 12 TRAINING AND DEVELOPMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.4 MARKETING AND CLIENT ENGAGEMENT

TABLE 13 MARKETING AND CLIENT ENGAGEMENT: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 14 MARKETING AND CLIENT ENGAGEMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 VIDEO AS A SERVICE MARKET, BY CLOUD DEPLOYMENT MODE (Page No. - 75)

7.1 INTRODUCTION

7.1.1 CLOUD DEPLOYMENT MODE: MARKET DRIVERS

7.1.2 CLOUD DEPLOYMENT MODE: COVID-19 IMPACT

FIGURE 28 HYBRID SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 15 MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 16 MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2020–2026 (USD MILLION)

7.2 PUBLIC CLOUD

TABLE 17 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 18 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3 PRIVATE CLOUD

TABLE 19 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 20 PRIVATE CLOUD: VIDEO AS A SERVICE MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.4 HYBRID CLOUD

TABLE 21 HYBRID CLOUD: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 22 HYBRID CLOUD: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8 VIDEO AS A SERVICE MARKET, BY VERTICAL (Page No. - 81)

8.1 INTRODUCTION

FIGURE 29 HEALTHCARE AND LIFE SCIENCES SEGMENT TO GROW AT THE HIGHEST CAGR IN THE MARKET DURING THE FORECAST PERIOD

8.1.1 VERTICALS: MARKET DRIVERS

8.1.2 VERTICALS: COVID-19 IMPACT

TABLE 23 MARKET SIZE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 24 MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

8.2 BANKING, FINANCIAL SERVICES AND INSURANCE

TABLE 25 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 26 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.3 IT AND ITES

TABLE 27 IT AND ITES: VIDEO AS A SERVICE MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 28 IT AND ITES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.4 HEALTHCARE AND LIFE SCIENCES

TABLE 29 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 30 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.5 EDUCATION

TABLE 31 EDUCATION: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 32 EDUCATION: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.6 MEDIA AND ENTERTAINMENT

TABLE 33 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 34 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.7 GOVERNMENT AND PUBLIC SECTOR

TABLE 35 GOVERNMENT AND PUBLIC SECTOR: VIDEO AS A SERVICE MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 36 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.8 RETAIL AND CONSUMER GOODS

TABLE 37 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 38 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.9 OTHER VERTICALS

TABLE 39 OTHER VERTICALS: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 40 OTHER VERTICALS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9 VIDEO AS A SERVICE MARKET, BY REGION (Page No. - 93)

9.1 INTRODUCTION

FIGURE 30 NORTH AMERICA TO LEAD THE MARKET FROM 2020 TO 2026

FIGURE 31 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 41 MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 42 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: MARKET REGULATORY IMPLICATIONS

9.2.2 NORTH AMERICA: MARKET DRIVERS

9.2.3 NORTH AMERICA: COVID-19 IMPACT

FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

TABLE 43 NORTH AMERICA: VIDEO AS A SERVICE MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 49 NORTH AMERICA: VIDEO AS A SERVICE SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.2.4 UNITED STATES

TABLE 51 UNITED STATES: VIDEO AS A SERVICE MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 52 UNITED STATES: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 53 UNITED STATES: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 54 UNITED STATES: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

9.2.5 CANADA

TABLE 55 CANADA: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 56 CANADA: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 57 CANADA: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 58 CANADA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

9.3 EUROPE

9.3.1 EUROPE: VIDEO AS A SERVICE MARKET REGULATORY IMPLICATIONS

9.3.2 EUROPE: MARKET DRIVERS

9.3.3 EUROPE: COVID-19 IMPACT

TABLE 59 EUROPE: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 60 EUROPE: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 62 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 64 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 65 EUROPE: VIDEO AS A SERVICE SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 66 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.3.4 UNITED KINGDOM

TABLE 67 UNITED KINGDOM: VIDEO AS A SERVICE MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 68 UNITED KINGDOM: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 69 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 70 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

9.3.5 GERMANY

TABLE 71 GERMANY: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 72 GERMANY: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 73 GERMANY: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 74 GERMANY: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

9.3.6 FRANCE

TABLE 75 FRANCE: VIDEO AS A SERVICE MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 76 FRANCE: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 77 FRANCE: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 78 FRANCE: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

9.3.7 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: MARKET REGULATORY IMPLICATIONS

9.4.2 ASIA PACIFIC: MARKET DRIVERS

9.4.3 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 79 ASIA PACIFIC: VIDEO AS A SERVICE MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 81 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 82 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 84 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 85 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 86 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.4.4 CHINA

TABLE 87 CHINA: VIDEO AS A SERVICE MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 88 CHINA: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 89 CHINA: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 90 CHINA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

9.4.5 JAPAN

TABLE 91 JAPAN: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 92 JAPAN: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 93 JAPAN: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 94 JAPAN: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

9.4.6 AUSTRALIA AND NEW ZEALAND

TABLE 95 AUSTRALIA AND NEW ZEALAND: VIDEO AS A SERVICE MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 96 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 97 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 98 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

9.4.7 REST OF ASIA PACIFIC

9.5 MIDDLE EAST AND AFRICA

9.5.1 MIDDLE EAST AND AFRICA: MARKET REGULATORY IMPLICATIONS

9.5.2 MIDDLE EAST AND AFRICA: MARKET DRIVERS

9.5.3 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 99 MIDDLE EAST AND AFRICA: VIDEO AS A SERVICE MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 100 MIDDLE EAST AND AFRICA: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 101 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 102 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 103 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 104 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 105 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 106 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.5.4 KINGDOM OF SAUDI ARABIA

9.5.5 UNITED ARAB EMIRATES

9.5.6 SOUTH AFRICA

9.5.7 REST OF MIDDLE EAST AND AFRICA

9.6 LATIN AMERICA

9.6.1 LATIN AMERICA: VIDEO AS A SERVICE MARKET REGULATORY IMPLICATIONS

9.6.2 LATIN AMERICA: MARKET DRIVERS

9.6.3 LATIN AMERICA: COVID-19 IMPACT

TABLE 107 LATIN AMERICA: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 108 LATIN AMERICA: MARKET SIZE, BY CLOUD DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 109 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 110 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 111 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 112 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 113 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 114 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.6.4 BRAZIL

9.6.5 MEXICO

9.6.6 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 128)

10.1 INTRODUCTION

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 34 MARKET EVALUATION FRAMEWORK

10.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 35 TOP PLAYERS IN THE VIDEO AS A SERVICE MARKET

10.4 HISTORICAL REVENUE ANALYSIS

10.4.1 INTRODUCTION

FIGURE 36 HISTORIC FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS

10.5 RANKING OF KEY PLAYERS IN THE MARKET, 2020

FIGURE 37 RANKING OF KEY PLAYERS, 2020

10.6 MARKET: COMPANY EVALUATION MATRIX

10.6.1 STAR

10.6.2 PERVASIVE

10.6.3 PARTICIPANT COMPANIES

10.6.4 EMERGING LEADERS

FIGURE 38 GLOBAL VIDEO AS A SERVICE MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

10.6.5 PRODUCT PORTFOLIO AND BUSINESS STRATEGY ANALYSIS OF VIDEO AS A SERVICE VENDORS

FIGURE 39 PRODUCT PORTFOLIO ANALYSIS OF VIDEO AS A SERVICE VENDORS

FIGURE 40 BUSINESS STRATEGY ANALYSIS OF VIDEO AS A SERVICE VENDORS

10.7 STARTUP/SME EVALUATION MATRIX OVERVIEW

10.7.1 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

FIGURE 41 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

10.7.1.1 Progressive companies

10.7.1.2 Responsive companies

10.7.1.3 Dynamic companies

10.7.2 STARTUP/SME EVALUATION MATRIX, 2020

FIGURE 42 VIDEO AS A SERVICE MARKET: STARTUP/SME EVALUATION MATRIX, 2020

11 COMPANY PROFILES (Page No. - 137)

11.1 INTRODUCTION

(Business Overview, Solutions and Services Offered, Recent Developments, Response to COVID-19, MNM View, Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats)*

11.2 MICROSOFT

FIGURE 43 MICROSOFT: COMPANY SNAPSHOT

11.3 ZOOM VIDEO COMMUNICATIONS

FIGURE 44 ZOOM VIDEO COMMUNICATIONS: COMPANY SNAPSHOT

11.4 CISCO

FIGURE 45 CISCO: COMPANY SNAPSHOT

11.5 ADOBE

FIGURE 46 ADOBE: COMPANY SNAPSHOT

11.6 AVAYA

FIGURE 47 AVAYA: COMPANY SNAPSHOT

11.7 GOOGLE

FIGURE 48 ALPHABET: COMPANY SNAPSHOT

11.8 AWS

FIGURE 49 AWS: COMPANY SNAPSHOT

11.9 POLY

FIGURE 50 POLY: COMPANY SNAPSHOT

11.10 LOGMEIN

FIGURE 51 LOGMEIN: COMPANY SNAPSHOT

11.11 RINGCENTRAL

FIGURE 52 RINGCENTRAL: COMPANY SNAPSHOT

11.12 ZOHO CORPORATION

11.13 PGI

11.14 WICKR

11.15 PEXIP

11.16 STARLEAF

11.17 BLUEJEANS NETWORK

11.18 ENGHOUSE SYSTEMS

11.19 QUMU

11.20 SONIC FOUNDRY

11.21 ON24

11.22 LIFESIZE

11.23 KALTURA

11.24 KOLLECTIVE

11.25 VIDIZMO

11.26 VBRICK

*Details on Business Overview, Solutions and Services Offered, Recent Developments, Response to COVID-19, MNM View, Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 187)

12.1 ADJACENT/RELATED MARKET

12.1.1 LIMITATIONS OF THE STUDY

12.1.2 VIDEO STREAMING SOFTWARE MARKET – GLOBAL FORECAST TO 2025

12.1.2.1 Market definition

12.1.2.2 Market overview

12.1.2.3 Video streaming software market, by component

TABLE 115 VIDEO STREAMING SOFTWARE MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 116 VIDEO STREAMING SOFTWARE MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.1.2.4 Video streaming software market, by solution

TABLE 117 VIDEO STREAMING SOFTWARE MARKET SIZE, BY SOLUTION, 2014–2018 (USD MILLION)

TABLE 118 VIDEO STREAMING SOFTWARE MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

12.1.2.5 Video streaming software market, by service

TABLE 119 VIDEO STREAMING SOFTWARE MARKET SIZE, BY SERVICE, 2014–2018 (USD MILLION)

TABLE 120 VIDEO STREAMING SOFTWARE MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

12.1.2.6 Video streaming software market, by streaming type

TABLE 121 VIDEO STREAMING SOFTWARE MARKET SIZE, BY STREAMING TYPE, 2014–2018 (USD MILLION)

TABLE 122 VIDEO STREAMING SOFTWARE MARKET SIZE, BY STREAMING TYPE, 2019–2025 (USD MILLION)

12.1.2.7 Video streaming software market, by deployment type

TABLE 123 VIDEO STREAMING SOFTWARE SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 124 VIDEO STREAMING SOFTWARE SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

12.1.2.8 Video streaming software market, by vertical

TABLE 125 VIDEO STREAMING SOFTWARE SIZE, BY VERTICAL, 2014–2018 (USD MILLION)

TABLE 126 VIDEO STREAMING SOFTWARE SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

12.1.2.9 Video streaming software market, by region

TABLE 127 VIDEO STREAMING SOFTWARE MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 128 VIDEO STREAMING SOFTWARE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.1.3 VIDEO ANALYTICS MARKET – GLOBAL FORECAST TO 2025

12.1.3.1 Market definition

12.1.3.2 Market overview

12.1.3.3 Video analytics market, by component

TABLE 129 VIDEO ANALYTICS MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

12.1.3.4 Video analytics market, by deployment

TABLE 130 VIDEO ANALYTICS MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

12.1.3.5 Video analytics market, by application

TABLE 131 VIDEO ANALYTICS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.1.3.6 Video analytics market, by type

TABLE 132 VIDEO ANALYTICS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

12.1.3.7 Video analytics market, by vertical

TABLE 133 VIDEO ANALYTICS MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

12.1.3.8 Video analytics market, by region

TABLE 134 VIDEO ANALYTICS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

12.1.4 UNIFIED COMMUNICATIONS AS A SERVICE MARKET – GLOBAL FORECAST TO 2024

12.1.4.1 Market definition

12.1.4.2 Market overview

12.1.4.3 Unified communications as a service market, by component

TABLE 135 UNIFIED COMMUNICATIONS AS A SERVICE MARKET, BY COMPONENT, 2017–2024 (USD MILLION)

12.1.4.4 Unified communications as a service market, by organization size

TABLE 136 UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

12.1.4.5 Unified communications as a service market, by vertical

TABLE 137 UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

12.1.4.6 Unified communications as a service market, by region

TABLE 138 UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 2017-2024 (USD MILLION)

12.1.5 VIDEO ON DEMAND MARKET – GLOBAL FORECAST TO 2024

12.1.5.1 Market definition

12.1.5.2 Market overview

12.1.5.3 Video on demand market, by component

TABLE 139 VIDEO ON DEMAND MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

12.1.5.4 Video on demand market, by solution

TABLE 140 VIDEO ON DEMAND MARKET SIZE, BY SOLUTION, 2017–2024 (USD MILLION)

12.1.5.5 Video on demand market, by monetization model

TABLE 141 VIDEO ON DEMAND MARKET SIZE, BY MONETIZATION MODEL, 2017–2024 (USD MILLION)

12.1.5.6 Video on demand market, by vertical

TABLE 142 VIDEO ON DEMAND MARKET SIZE, BY INDUSTRY VERTICAL, 2017–2024 (USD MILLION)

12.1.5.7 Video on demand market, by region

TABLE 143 VIDEO ON DEMAND MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

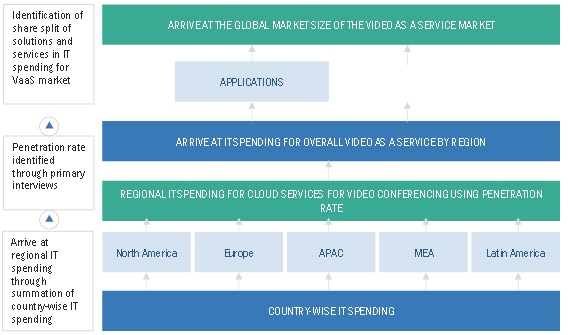

The study involved four major activities in estimating the current size of the video as a service market. Exhaustive secondary research was done to collect information on the logistics industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the VaaS market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; regulatory bodies; trade directories; and databases.

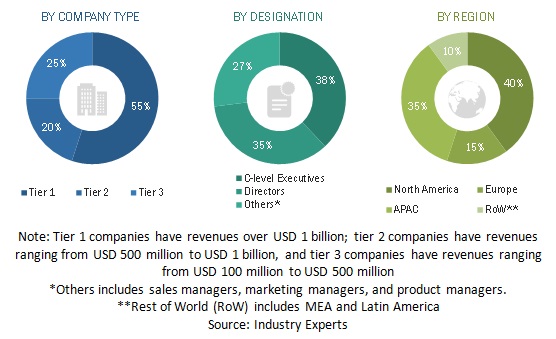

Primary Research

The video as a service market comprises several stakeholders, such as video equipment manufacturers, network service providers, video service providers, cloud service providers, venture capitalists, government organizations, regulatory authorities, policymakers, and financial organizations, consulting firms, research organizations, academic institutions, resellers and distributors, and training providers. The demand side includes Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and installation teams of governments/end users using VaaS solutions. The supply side includes VaaS providers, offering VaaS services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Video as a Service Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global video as a service market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors offering solutions and services in the VaaS market was prepared while using the top-down approach. The market share for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its offering (solutions and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

In the top-down approach, an exhaustive list of countries contributing ~90% of the Gross Domestic Product (GDP) of the world was prepared. For all the listed counties, the overall Information Technology (IT) spending was identified using government databases, such as the Organization for Economic Co-operation and Development (OECD) and World Economic Outlook (WEO). These countries were further classified among different regions, and the IT spending of these countries were added to identify the regional IT spending. Out of the overall regional spending, the share of IT-based spending for enterprise collaboration was acknowledged using the regional IT penetration rate, which was obtained from primary respondents in different regions. After arriving at the overall IT spending or enterprise collaboration, the share of the spending in VaaS was ascertained. The spending in VaaS solutions and services were coupled to arrive at the overall market size of the VaaS market. These two areas formed the base for the identification of solutions and services offered in the video as a service market.

Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Global VaaS Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the size of the video as a service market by application, cloud deployment mode, vertical, and region

- To describe and forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the VaaS market

- To analyze the impact of COVID-19 on the video as a service market

- To analyze micro markets with respect to the individual growth trends, prospects, and contributions to the overall VaaS market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments

- To profile key market players, including top vendors and startups, provide comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as Mergers and Acquisitions (M&A); new product launches and product enhancements; agreements, partnerships, and collaborations; expansions; and Research and Development (R&D) activities in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information:

- Detailed analysis and profiling of additional market players (Up to 5)

Geographic analysis:

- Further breakdown of the Germany video as a service market

- Further breakdown of the France VaaS market

- Further breakdown of China VaaS market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Video as a Service Market

Businesses can access video-based communication and collaboration tools thanks to the rapidly expanding video as a service (VaaS) sector. VaaS providers will nevertheless encounter a number of significant difficulties as the market changes, which must be overcome if they are to keep expanding. These difficulties include, among others: • Competition • Scalability • Security and privacy • User experience • Integration with existing systems • Technical support • Pricing

What will be key challenges for growing video as a service business in the future Market?