Digital Rights Management Market

Digital Rights Management Market by Application (Audio Content, Images, Video Content, Confidential Documents, Software & Games, E-Books), DRM Solutions, DRM Services (Consulting, Integration, Operation & Maintenance) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The digital rights management market is projected to expand from USD 6.72 billion in 2025 to USD 11.05 billion by 2030, at a CAGR of 10.5% during the forecast period.

Digital rights management (DRM) refers to a set of technologies, tools, and strategies used to protect and manage the use, distribution, and access of digital content. It ensures that only authorized users can access or share protected digital assets, such as eBooks, music, videos, software, documents, and other intellectual property. The digital rights management market's growth is primarily driven by the increasing need for content protection and secure distribution in a rapidly evolving digital landscape. This shift is reinforced by the widespread proliferation of digital content across various platforms, including streaming services, e-commerce, and online publishing. These technologies help businesses safeguard intellectual property, prevent unauthorized access and piracy, and control content usage. The resulting benefits include enhanced revenue streams for content creators and distributors, increased consumer trust, and a more secure digital ecosystem.

KEY TAKEAWAYS

- The North America digital rights management market accounted for a 36.9% revenue share in 2025.

- By component, the services segment is expected to register the highest CAGR of 11.5%.

- By application, the software and game segment is projected to grow at the fastest rate from 2025 to 2030.

- Company Apple, Google, and Microsoft were identified as some of the star players in the digital rights management market (global), given their strong market share and product footprint.

- Companies Bynder, Vitrium systems, and Seclore among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The shift toward AI and cloud-native deployment is revolutionizing how enterprises secure digital content and enforce usage rights across platforms. These modern DRM technologies enable organizations to control access to digital assets in real time across streaming platforms, eBooks, enterprise documents, and software, while integrating seamlessly with cloud environments and content delivery networks (CDNs). Cloud-based DRM offers scalability, remote policy enforcement, and centralized license management, which is essential for supporting distributed consumption models in media, publishing, and corporate ecosystems. AI and machine learning play a growing role in DRM, powering anomaly detection, predictive piracy monitoring, and intelligent access control to prevent unauthorized sharing or leaks.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends or disruptions. Hot bets are the clients of digital rights management solution providers, and target applications are the clients of digital rights management solution providers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbets, which will further affect the revenues of digital rights management solution providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Proliferation of Digital Content and IP Protection Demand

-

Increase in Penetration of Digital Devices and Technology

Level

-

High Implementation Complexity and Interoperability Issues

-

Complex and Restrictive Licensing Models Limit Adoption

Level

-

AI-powered License Management and Analytics Integration

-

Expansion of OTT Platforms

Level

-

Balancing Security with Seamless User Experience

-

Vendor Lock-in Risks Restricting Flexibility for Content Owners.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Proliferation of Digital Content and IP Protection Demand

The explosive growth of digital content across streaming platforms, e-books, software, and enterprise documents is significantly driving the demand for Digital Rights Management solutions. As digital transformation accelerates, enterprises and content providers face increasing threats of piracy, unauthorized sharing, and intellectual property (IP) theft. DRM technologies are being rapidly adopted to enforce copyright protection, control access, and monitor content usage. Additionally, the rising value of data and creative assets, coupled with evolving monetization models such as subscription services and pay-per-use platforms, is reinforcing the need for dynamic, scalable DRM systems. The widespread digitization of educational content, confidential enterprise documents, and cloud-based creative workflows has also expanded the DRM use case beyond entertainment, positioning it as a foundational layer of enterprise content security.

Restraint: High Implementation Complexity and Interoperability Issues

Despite growing demand, DRM solutions face challenges due to complex implementation requirements and limited interoperability across content types and platforms. Many organizations struggle to integrate DRM with diverse content delivery networks (CDNs), content management systems (CMS), and user authentication protocols. This often leads to fragmented protection layers, inconsistent user experiences, and higher operational costs. In sectors such as publishing, media, and corporate environments, legacy systems and proprietary formats further complicate integration. Moreover, user resistance due to limited usability, access restrictions, and device compatibility issues can hinder adoption. Without seamless integration, businesses may find DRM more burdensome than beneficial, particularly in multi-device or BYOD environments.

Opportunity: AI-powered License Management and Analytics Integration

The integration of artificial intelligence and machine learning into DRM platforms is opening new avenues for real-time content monitoring, adaptive license enforcement, and predictive risk mitigation. AI can analyze usage patterns, detect anomalies, and automate compliance checks, significantly reducing manual overhead and improving operational efficiency. For instance, AI-enhanced DRM can dynamically adjust access rights based on user behavior or flag suspicious activities like unauthorized downloads. As hybrid work, remote education, and digital collaboration become the norm, organizations are seeking intelligent DRM solutions that offer both security and flexibility. Vendors that embed AI capabilities to optimize rights allocation and provide actionable content analytics stand to gain significant market traction.

Challenge:Balancing Security with Seamless User Experience

Finding the right balance between stringent content protection and frictionless user access is one of the key challenges in the DRM market. While DRM is essential to secure high-value digital assets, overly restrictive policies can frustrate end-users, degrade content usability, and even push legitimate consumers toward piracy. Educational institutions, for example, need to ensure easy access for students while protecting intellectual material. Similarly, media consumers expect seamless multi-device access without repeated authentication hurdles. This tension between usability and protection is particularly critical as content consumption shifts to mobile, edge, and cloud platforms. Vendors must innovate user-centric DRM frameworks that combine robust encryption with adaptive, non-intrusive access control.

Digital Rights Management market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

DRM through FairPlay technology in iTunes, Apple Music, and Apple TV to protect music, movies, and app content across Apple devices. | Ensures secure content distribution, prevents piracy, and strengthens Apple’s closed ecosystem for monetization and user retention. |

|

Widevine DRM integrated into Chrome, Android, and YouTube, securing premium video streaming and content licensing. | Enables major OTT platforms (Netflix, Amazon Prime, Disney+) to deliver secure video, boosting Google’s position in media delivery and digital advertising. |

|

PlayReady DRM for Windows, Xbox, and Azure Media Services to safeguard video-on-demand and live streaming content. | Supports global broadcasters and OTT providers with scalable security, enhancing Microsoft’s cloud and entertainment ecosystem. |

|

Adobe Primetime DRM for protecting premium video content and eLearning material across multiple devices and browsers. | Strengthens Adobe’s position in media and publishing by enabling secure streaming, compliance with licensing agreements, and user experience consistency. |

|

DRM embedded in Oracle Digital Media Solutions to secure enterprise digital assets, eLearning modules, and proprietary software. | Provides enterprises with strong IP protection, regulatory compliance, and secure distribution of training and proprietary content. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The digital rights management market is highly competitive and comprises many vendors who offer solutions to a specific or niche market segment. Several changes have occurred in the market in recent years. The vendors are involved in various partnerships and collaborations to develop comprehensive solutions that address a wide range of requirements.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Digital Rights Management Market, By Component

The solutions segment led the market in 2024. DRM solutions address critical business issues related to the storage, discovery, management, distribution, and analysis of business-related digital information, such as images, designs, audio, videos, and content. Various companies, such as Digify, Seclore, CapLinked, and Vitrium Security, offer DRM solutions that allow content owners and publishers to protect their digital content. DRM solutions are driven by the increasing need to protect digital assets from unauthorized access and piracy, particularly in industries like media and entertainment. The rise in digital content consumption, fueled by streaming services, necessitates robust DRM solutions to enforce copyright and licensing agreements. Advancements in encryption, watermarking, and cloud-based DRM platforms enhance security and scalability, making solutions highly sought after.

REGION

North America to account for largest market share during forecast period

North America is estimated to lead the digital rights management (DRM) market globally. The North American DRM market is propelled by the region’s leadership in digital media and stringent copyright laws. The US and Canada drive growth through widespread adoption of streaming services and social media platforms like YouTube and Instagram, necessitating advanced DRM to protect intellectual property. The region’s high internet penetration, with over 90% of the population online, and the rise of 4G/5G networks amplify digital content consumption, increasing piracy risks. DRM solutions like Verimatrix and Irdeto are widely adopted to secure video-on-demand and mobile content. Additionally, significant cybersecurity investments, as noted by the US Department of Homeland Security, support the development of sophisticated DRM tools. The presence of tech giants and a mature IT ecosystem ensures North America remains a hub for DRM innovation and deployment.

Digital Rights Management market: COMPANY EVALUATION MATRIX

In the digital rights management market matrix, Apple Inc. (Star) leads with a strong market presence and comprehensive DRM ecosystem, securing digital content across devices, applications, and platforms. Its large-scale adoption in media, education, and enterprise solutions reinforces its leadership. OpenText Corporation (Emerging Leader) is gaining momentum with enterprise-grade DRM solutions, particularly in document security, compliance, and enterprise content management. While Apple dominates with scale and ecosystem integration, OpenText shows strong growth potential to advance toward the leaders’ quadrant with its expanding enterprise security portfolio.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.00 Billion |

| Market Forecast in 2030 (Value) | USD 11.05 Billion |

| Growth Rate | CAGR of 12.6% from 2025-2030 |

| Actual data | 2019–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Digital Rights Management market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|

RECENT DEVELOPMENTS

- June 2023 : CDNetworks partnered with Irdeto to integrate CDNetworks’ Media Delivery platform with built-in DRM capabilities. This integrated solution provides content creators and distributors with one-stop digital content protection for their video streaming business.

- June 2022 : OpenText entered into a partnership with Scheer Group to expand its presence in the DACH region. Scheer would resell OpenText Enterprise Content Management (ECM), including OpenText Extended ECM.

- March 2022 : Google added Android 12L Feature Drop in the Widevine DRM to fix the broken pixel issue in streaming video.

- February 2022 : IBM acquired Sentaca, one of the leading telco consulting services and solutions providers. This acquisition would accelerate IBM’s hybrid cloud consulting business, adding critical skills to help Communications Service Providers (CSPs) and media giants modernize on multiple cloud platforms, innovate, and transform their businesses.

- February 2022 : Teamcenter DRM was developed by NextLabs and integrated with Siemens Teamcenter PLM. It was an advanced solution based on the SkyDRM technology, which protected files of various formats automatically or manually before sharing.

Table of Contents

Methodology

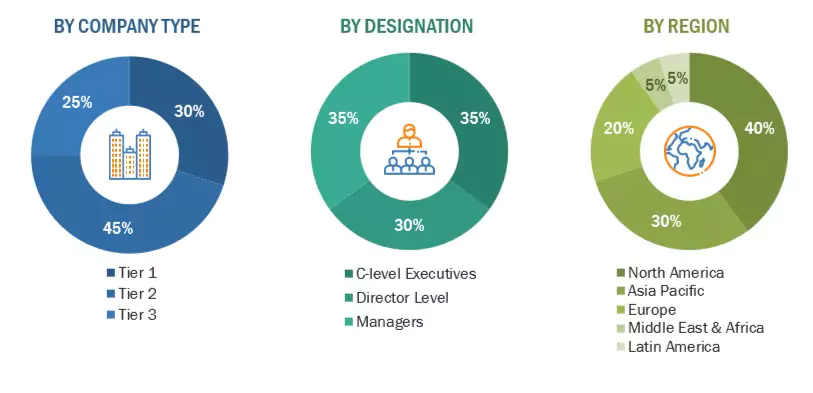

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B), Hoovers, and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the digital rights management market. The primary sources have been mainly industry experts from the core and related industries, and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market size of companies offering digital rights management worldwide was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolio of major companies and rating them based on their performance and quality. In the secondary research process, various secondary sources were referred to identify and collect information for the study. The secondary sources include annual reports, press releases & investor presentations of companies, white papers, journals, and certified publications & articles from recognized authors, directories, and databases. Research reports from a few consortia and councils, such as the RSA Security, the States’ Digital Millennium Copyright Act, and the European Union’s Information Society Directive, have also been referred to for structuring qualitative content.

Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain and to identify key players through various solutions and services, market classification and segmentation according to offerings of major players, industry trends related to technologies, applications, and regions, and key developments from both market-oriented and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams; related key executives from digital rights management solution vendors, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using digital rights management solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of digital rights management solutions, which would impact the overall digital rights management market.

Note: Tier 1 companies’ revenue is more than USD 1 billion; Tier 2 companies’ revenue ranges between USD 500 million to

1 billion; and Tier 3 companies’ revenue ranges between USD 100 million and USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

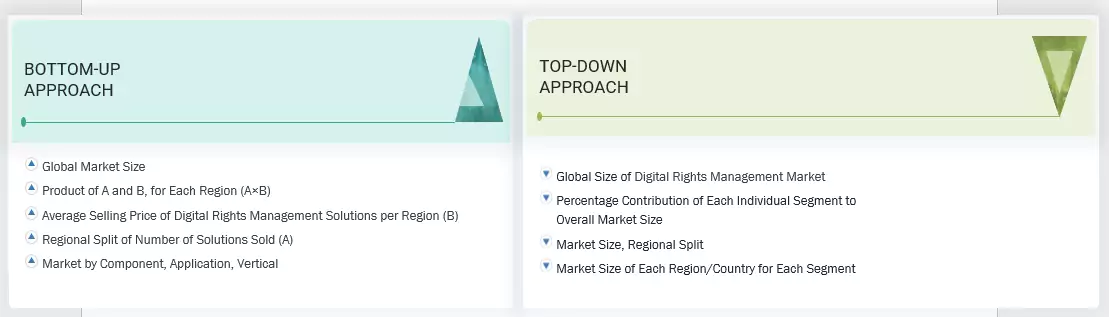

Multiple approaches were adopted to estimate and forecast the size of the digital rights management market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of digital rights management solutions.

Top-down and bottom-up approaches were used to estimate and validate the total size of the digital rights management market. These methods were also extensively used to estimate the size of various market segments. The research methodology used to evaluate the market size is listed below.

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Digital Rights Management Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size, the digital rights management market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Digital Rights Management (DRM) refers to the algorithms and processes that were created to enforce copyright compliance when accessing audio, documents, images, video content, and eBooks, among others. This mechanism prevents users from copying, converting, or redistributing content in a way that is not explicitly authorized by the content provider. It is a widely used and trusted method for protecting the copyright of digital media assets and files. It helps individuals and businesses control the access and usage of their digital assets, which is vital in the age of social media and widespread file sharing.

Stakeholders

- DRM vendors

- Research organizations

- Software vendors

- System integrators

- Cloud providers

- Suppliers, distributors, and contractors

- Value-added resellers (VARs)

- Service providers and distributors

- Investors and venture capitalists

- Government security agencies

- IT security agencies

- IT solution providers

- Wireless service providers

- Consulting firms

Report Objectives

- To determine and forecast the global digital rights management market by component (solutions and services), application, vertical, and region

- To forecast the size of the market segments for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the digital rights management market

- To analyze each submarket concerning individual growth trends, prospects, and contributions to the overall digital rights management market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the digital rights management market

- To profile the key market players, provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the market’s competitive landscape

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and research and development (R&D) activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations to meet the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

What is the definition of the digital rights management market?

Digital Rights Management (DRM) refers to a set of technologies, tools, and strategies used to protect and manage the use, distribution, and access of digital content. It ensures that only authorized users can access or share protected digital assets, such as eBooks, music, videos, software, documents, and other intellectual property. DRM systems typically use encryption, access controls, licensing agreements, and watermarking to prevent unauthorized copying, redistribution, editing, or consumption of digital content.

What is the market size of the digital rights management market?

The digital rights management market is projected to grow from USD 6.72 billion in 2025 to USD 11.05 billion by 2030 at a CAGR of 10.5% from 2025 to 2030.

What are the major drivers of the digital rights management market?

The major drivers of the digital rights management market include rising demand for secure content distribution, increasing cases of digital piracy and intellectual property theft, and the growing adoption of digital media across industries such as entertainment, publishing, and education.

Who are the key players operating in the digital rights management market?

The key players profiled in the digital rights management market include Adobe Systems (US), Google LLC (US), Microsoft Corporation (US), Apple (US), Oracle (US), IBM (US), Irdeto (Netherlands), OpenText (Canada), Kudelski Group (Switzerland), Sony Corporation (Japan), Verisign Inc (US), Acquia (US), OVH Cloud (France), Fortra (US), Vitrium Systems (Canada), NextLabs (US), Verimatrix (France), Seclore (US), Digify (US), Bitmovin (US), EditionGuard (US), EZDRM (US), Intertrust Technologies (Us), ArtistScope (Australia), CapLinked (US), Vaultize (India), and Bynder (Netherlands).

What are the key technological trends prevailing in the digital rights management market?

The key technology trends in the digital rights management (DRM) market include the integration of AI and blockchain technology, the rise of cloud-based DRM solutions, and a growing emphasis on data security and compliance. These trends are driven by the increasing need to protect digital content across various platforms and the evolving digital landscape, including streaming services and e-learning.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Digital Rights Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Digital Rights Management Market