Video Encoders Market by Number of Channel (1-Channel, 2-Channel, 4-Channel, 8-Channel, 16-Channel, more than 16-Channel), Type (Standalone, Rack-mounted), Application (Broadcasting, Surveillance) and Geography - Global Forecast to 2027

Updated on : October 22, 2024

Video Encoders Market Size & Share

The global video encoders market is estimated to reach USD 3.3 billion by 2027 from USD 2.3 billion in 2022, growing at a CAGR of 7.6% from 2022 to 2027. A video encoder is an electronic device that transforms an analog video broadcast system into a digital or IP system so that it can be streamed over a network. Technological advancements have revolutionized the telecommunication industry, and the demand for innovative and efficient technologies is growing rapidly.

The market's growth can be attributed majorly to the adoption of high-efficiency video coding standards for video encoding, ease of connecting analog cameras using video encoder to a network, and the use of cloud services to store a large amount of data. Video encoders can be efficiently used to migrate an existing analog-based system to an IP-based system. Thus, manufacturers in the market invest heavily in research & development (R&D) activities to constantly innovate and improve the efficacy of video encoders. Increase in digitization and video content delivery network (CDN) among diverse businesses are also creating immense opportunities for the video encoder market. The video encoder industry has been segmented based on the number of channels, type, application, and region.

To know about the assumptions considered for the study, Request for Free Sample Report

Video encoders Market Dynamics

DRIVERS: Use of cloud services to store increasing amounts of data

The increasing population density in urban areas and demand for high-quality processing in video applications are pushing broadcast and communication networks to the limits of their bandwidth and performance capacities. Adding more equipment to handle these video streams is economically challenging. As a result, operators, service providers, and content providers are looking to cloud services for data storage. The adoption of cloud services reduces business costs and makes applications accessible from any location. While interoperability and data security issues may harm data, the future of cloud services seems promising for IT giants such as IBM (US), Google (US), Microsoft (US), and Salesforce.com (US). These companies are actively developing new solutions to address existing issues. The increasing adoption of cloud services is expected to increase the deployment of video encoders to deliver encoded videos to the desired platforms.

RESTRAINT: Limited capability to deliver 4K streaming and broadcasting services

4K TVs have become a mainstream technology. However, the limited availability of 4K content in the broadcasting and streaming network makes it difficult to utilize the full potential of 4K TVs. 4K streaming is not possible even at a bandwidth of 12–15 Mbps unless there is a 40% efficiency in encoding in HEVC. Even though OTT providers, such as Netflix, Hulu, and Prime, have some 4K content offerings, strong internet connections, high bandwidth, and high-efficiency video coding are required to stream such content. This requirement is difficult to meet with currently available internet connections, which has restricted the use of 4K, although Ultra HD (UHD) content can be compressed by reducing the frame rate or sacrificing the quality, in theory. Thus, streaming and broadcasting of 4K content are limited due to the low adoption of high-efficiency encoders, such as H.266 and AV1.

OPPORTUNITIES: Growth in number of mobile-streaming videos

There has been an increase in digitization and video content delivery network (CDN) among diverse businesses. This development has increased the use of mobile devices for streaming videos on a real-time basis. Mobile video streaming apps, such as Facebook and YouTube, help users watch, share, and store video from anywhere. The mobile network is growing rapidly to transfer video content, voice, and data applications. Mobile operators are compelled to increase the bandwidth capacity to accommodate the ever-increasing demand for data. Factors such as the use of high-speed 4G networks, the availability of HD screens, and the increasing reliance on smartphones are all increasing video generation and the traffic on communication channels. According to the Cisco Visual Networking Index (VNI), consumer internet video traffic will hold ~70% of the overall consumer internet traffic. A considerable amount of internet bandwidth is also consumed because of online education, social media platforms, and entertainment videos. To satisfy the demand for video services, mobile operators are extending video offerings to include both on-portal videos (e.g., mobile TV live cameras and IPTV) and videos from OTT (YouTube and Netflix). Operators are also making efforts to efficiently monetize mobile video services by cutting costs and improving customer satisfaction.

CHALLENGES: Capital expenditures due to transition of technology

The latest video compression technology, HEVC or H.265, provides more efficiency than previous standards such as MPEG-4 and MPEG-2. Although changing video codecs provide uncertainty in patent licensing terms, bandwidth advantages, , and implementation costs are creating challenges for the market. The increasing cost might affect the overall profitability of end users. Broadcasters might face problems while switching from one video codec to another. For instance, while changing from MPEG-2 to MPEG-4, they must change or upgrade equipment to support MPEG-4 at a significant cost.

Rack-Mounted Video Encoders To Account For Largest Share Of Video Encoder Market During Forecast Period

The market for rack-mounted video encoders held the largest share of the video encoder market in 2021. The rack-mounted video encoder market is witnessing significant traction with the growing number of product launches. For instance, Haivision launched the Makito X4 Encoder in 2020, which can be installed as blades within rack-mounted chassis. Also, these video encoders are useful in instances where large installations with analog cameras are required. However, standalone video encoders are cost-efficient and are beneficial in situations where only a few cameras are to be connected.

1-Channel Video Encoders To Hold Larger Share Of Video Encoder Market During Forecast Period

The 1-channel video encoders segment is held a larger share of video encoders market in 2021. In the broadcast equipment industry, single-channel video encoders are in popular demand, especially for contribution applications. These encoders allow the broadcasting of content to global audiences in real-time while retaining the resolution of the original video feed. Single-channel video encoders are compact and cost-effective solutions. They are ideal for converting an analog surveillance system into an IP-based system. As IP cameras are costly, an encoder plays a major role in allowing end users to save additional investments by using their present analog systems. D-Link, Axis Communications, Hangzhou Hikvision Digital, and Vicon Industries are providers of 1-channel encoders used in various applications.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific held the second largest share of the video encoder market in 2021

The market in Asia Pacific is projected to grow at the second highest CAGR during forecast period. The increasing popularity of social networking websites has boosted broadcasting services such as live streaming, further boosting the demand for video encoders in Asia Pacific. A rise in terrorist activities, growing crime rates, data thefts, remote monitoring, and growth of public infrastructure are some of the factors that have driven the demand for surveillance cameras in Asia Pacific. The rising adoption of video surveillance cameras is expected to drive the demand and uptake of video encoders in several Asia Pacific countries in the coming years. However, North America is estimated to be the largest market for video encoders. North America has shown the maximum adoption of video encoder platforms because of their early implementation in a majority of applications. The growing cultural diversity throughout North America has also led to an increase in the number of broadcast channels, which, in turn, has boosted the demand for video encoders in the region.

Top Video Encoders Companies - Key Market Players:

The video encoders companies such as Hikvision (China), VITEC (France), Harmonic (US), Motorola Solutions (US), and CISCO (US), among others.

Video Encoders Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2022 | USD 2.3 Billion |

| Revenue Forecast in 2027 | USD 3.3 Billion |

| Growth Rate | 7.6% |

|

Market Size Available for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Key Market Driver | Use of cloud services to store increasing amounts of data |

| Key Market Opportunity | Growth in number of mobile-streaming videos |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Rack-Mounted Video Encoders |

| Highest CAGR Segment | 1-Channel Video Encoders |

This research report segments the video encoders market based on type, application, number of channel, and region.

Video Encoders Market , By Number Of Channel

- 1-Channel Video Encoder

- 2-Channels Video Encoder

- 4-Channels Video Encoder

- 8-Channels Video Encoder

- 16-Channels Video Encoder

- More Than 16-Channels Video Encoder

Video Encoders Market , By Type

- Standalone

- Rack-Mounted

Video Encoder Market , By Application

- Broadcast

- Surveillance

Video Encoder Market By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments

- In April 2022, VITEC announced its latest broadcast-quality openGear (OG) card encoder, the MGW diamond+ OG, a 4k/multichannel HD, HEVC, H.264, and MPEG-2 encoder with SDI and SMPTE-2110 input in an openGear card format.

- In March 2022, Matrox launched the Monarch EDGE 4K/Multi-HD H.264 webcasting and remote production encoder. It can deliver broadcast-quality video resolutions up to 3840x2160 at 60 fps or quad 1920x1080 at 60 fps.

- In June 2021, Motorola Solutions announced the release of two MPEG-4 encoder solutions that will dramatically enhance the operational efficiency of distributing HD and standard definition (SD) video for service and content providers.

Frequently Asked Questions (FAQs):

What is the total CAGR expected to be recorded for the video encoders market during 2022-2027?

The global video encoders market is expected to record a CAGR of 7.6% from 2022–2027.

What are the driving factors for the video encoders?

Major drivers for the video encoder market in this region are collaborations between the government and network arenas, institutional partnerships between video encoder manufacturers and research collaborations, and large-scale investments in cloud-based services.

Which are the significant players operating in the video encoders market?

Hikvision (China), VITEC (France), Harmonic (US), Motorola Solutions (US), and CISCO (US) are some of the major companies operating in the video encoders market.

Which region will lead the video encoders market in the future?

North America is expected to lead the video encoders market during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 VIDEO ENCODER MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 VIDEO ENCODER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

FIGURE 3 VIDEO ENCODERS MARKET: RESEARCH APPROACH

2.1.2 SECONDARY DATA

2.1.2.1 Major secondary sources

2.1.2.2 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE OF COMPANIES FROM VIDEO ENCODERS

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up approach (demand side)

FIGURE 5 VIDEO ENCODER MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down approach (supply side)

FIGURE 6 VIDEO ENCODER MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 8 RACK-MOUNTED VIDEO ENCODERS TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

FIGURE 9 1-CHANNEL VIDEO ENCODERS TO HOLD LARGEST MARKET SHARE FROM 2022–2027

FIGURE 10 BROADCASTING TO REMAIN LARGEST APPLICATION SEGMENT DURING FORECAST PERIOD

FIGURE 11 MIDDLE EAST & AFRICA EXPECTED TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES IN VIDEO ENCODERS MARKET

FIGURE 12 CONTINUOUS TECHNOLOGICAL ADVANCEMENTS TO BOOST MARKET GROWTH

4.2 VIDEO ENCODER MARKET, BY TYPE

FIGURE 13 RACK-MOUNTED VIDEO ENCODERS TO HOLD MAJOR MARKET SHARE DURING FORECAST PERIOD

4.3 VIDEO ENCODERS MARKET, BY NUMBER OF CHANNELS

FIGURE 14 1-CHANNEL VIDEO ENCODERS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2027

4.4 VIDEO ENCODERS MARKET, BY APPLICATION

FIGURE 15 BROADCASTING APPLICATIONS TO HOLD LARGEST MARKET SHARE IN 2027

4.5 VIDEO ENCODER MARKET, BY REGION

FIGURE 16 NORTH AMERICA TO DOMINATE MARKET IN 2027

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

FIGURE 17 VIDEO ENCODERS MARKET DRIVERS AND THEIR IMPACT

5.2.1.1 Ease of connecting analog cameras using video encoders to a network

5.2.1.2 Use of cloud services to store increasing volumes of data

5.2.1.3 Adoption of HEVC standard for video encoding

5.2.2 RESTRAINTS

FIGURE 18 VIDEO ENCODERS MARKET RESTRAINTS AND THEIR IMPACT

5.2.2.1 Limited capability to deliver 4K streaming and broadcasting services

5.2.3 OPPORTUNITIES

FIGURE 19 VIDEO ENCODERS MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.3.1 Increasing use of mobile devices to stream videos

5.2.3.2 Optimization of network bandwidth for cable operators

5.2.3.3 Developing countries witnessing increased OTT consumption

5.2.4 CHALLENGES

FIGURE 20 VIDEO ENCODER MARKET CHALLENGES AND THEIR IMPACT

5.2.4.1 High cost associated with adoption of newer technologies

5.3 TARIFFS AND REGULATIONS

5.4 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS: VIDEO ENCODERS MARKET

5.5 VIDEO ENCODER ECOSYSTEM

FIGURE 22 MARKET MAP OF VIDEO ENCODERS

5.6 AVERAGE SELLING PRICE

TABLE 1 AVERAGE SELLING PRICE OF VIDEO ENCODERS FOR SURVEILLANCE APPLICATIONS, 2021

5.7 KEY USE CASES

5.7.1 GLOBO SETS NEW QUALITY STANDARDS IN 4K WITH BITMOVIN

5.7.2 NETFLIX UPDATES VIDEO CODECS FOR EFFICIENT ENCODING

5.7.3 TERRACE CITY COUNCIL TO BUY VIDEO ENCODERS

5.7.4 GOOGLE AND SAMSUNG OFFER SOLUTIONS TO SUPPORT AV1 CODEC

5.8 PATENT ANALYSIS

5.8.1 HEVC TECHNOLOGY PATENT

FIGURE 23 TOP COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS RELATED TO HEVC TECHNOLOGY

FIGURE 24 PATENT ANALYSIS RELATED TO HEVC TECHNOLOGY

TABLE 2 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

5.9 MAJOR NEXT-GENERATION VIDEO ENCODER TECHNOLOGIES

5.9.1 HEVC

5.9.2 VVC

5.9.3 AOMEDIA VIDEO 1 (AV1)

5.9.4 VP9

6 VIDEO ENCODER MARKET, BY COMPONENT (Page No. - 55)

6.1 INTRODUCTION

6.2 ANALOG VIDEO INPUT

6.3 COAXIAL CABLES

6.4 PROCESSORS

6.5 MEMORY

6.6 SERIAL PORTS

6.7 LANS

6.8 NETWORK SWITCHES

7 VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS (Page No. - 57)

7.1 INTRODUCTION

FIGURE 25 VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS

FIGURE 26 1-CHANNEL VIDEO ENCODER SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 3 VIDEO ENCODERS MARKET, BY NUMBER OF CHANNELS, 2018–2021 (USD MILLION)

TABLE 4 VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS, 2022–2027 (USD MILLION)

7.2 1-CHANNEL VIDEO ENCODERS

7.2.1 IN DEMAND FOR CONTRIBUTION APPLICATIONS

TABLE 5 1-CHANNEL: VIDEO ENCODERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 6 1-CHANNEL: VIDEO ENCODERS MARKET , BY TYPE, 2022–2027 (USD MILLION)

TABLE 7 1-CHANNEL: VIDEO ENCODER MARKET , BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 8 1-CHANNEL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.3 2-CHANNEL VIDEO ENCODERS

7.3.1 VIDEO SURVEILLANCE INDUSTRY SWITCHING TO IP-BASED SYSTEMS

TABLE 9 2-CHANNEL: VIDEO ENCODER MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 10 2-CHANNEL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 11 2-CHANNEL: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 12 2-CHANNEL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.4 4-CHANNEL VIDEO ENCODERS

7.4.1 USED IN IPTV, LIVE STREAMING, AND SURVEILLANCE/MONITORING APPLICATIONS

TABLE 13 4-CHANNEL: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 14 4-CHANNEL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 15 4-CHANNEL: VIDEO ENCODER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 16 4-CHANNEL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.5 8-CHANNEL VIDEO ENCODERS

7.5.1 USED IN COMMERCIAL, INSTITUTIONAL, AND RETAIL APPLICATIONS

TABLE 17 8-CHANNEL: VIDEO ENCODERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 18 8-CHANNEL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 19 8-CHANNEL: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 20 8-CHANNEL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.6 16-CHANNEL VIDEO ENCODERS

7.6.1 EASIER TO DEPLOY THAN EXPENSIVE IP-BASED SYSTEMS

TABLE 21 16-CHANNEL: VIDEO ENCODER MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 22 16-CHANNEL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 23 16-CHANNEL: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 24 16-CHANNEL: VIDEO ENCODERS MARKET , BY APPLICATION, 2022–2027 (USD MILLION)

7.7 MORE THAN 16-CHANNEL VIDEO ENCODERS

7.7.1 OFFERS ADVANCED NETWORK CAPABILITIES, BETTER AUDIO QUALITY, AND EFFECTIVE VIDEO PERFORMANCE

TABLE 25 MORE THAN 16-CHANNEL: VIDEO ENCODERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 26 MORE THAN 16-CHANNEL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 27 MORE THAN 16-CHANNEL: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 28 MORE THAN 16-CHANNEL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8 VIDEO ENCODER MARKET, BY TYPE (Page No. - 69)

8.1 INTRODUCTION

FIGURE 27 VIDEO ENCODER MARKET, BY TYPE

FIGURE 28 RACK-MOUNTED VIDEO ENCODERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 29 VIDEO ENCODER MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 30 MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.2 STANDALONE

8.2.1 ELIMINATES NEED FOR ADDITIONAL CABLING

TABLE 31 STANDALONE: VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS, 2018–2021 (USD MILLION)

TABLE 32 STANDALONE: MARKET, BY NUMBER OF CHANNELS, 2022–2027 (USD MILLION)

8.3 RACK-MOUNTED

8.3.1 RISING PRODUCT LAUNCHES PROVIDING TRACTION

TABLE 33 RACK-MOUNTED: VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS, 2018–2021 (USD MILLION)

TABLE 34 RACK-MOUNTED: MARKET, BY NUMBER OF CHANNELS, 2022–2027 (USD MILLION)

9 VIDEO ENCODER MARKET, BY APPLICATION (Page No. - 74)

9.1 INTRODUCTION

FIGURE 29 VIDEO ENCODER MARKET, BY APPLICATION

FIGURE 30 BROADCASTING TO HOLD LARGEST MARKET SIZE IN 2027

TABLE 35 VIDEO ENCODER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 36 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 BROADCASTING

9.2.1 ENCODERS CRUCIAL IN BROADCASTING, 4K RECORDING/OVER IP, AND SUPPORTING CAMERAS

TABLE 37 BROADCASTING: VIDEO ENCODER MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 38 BROADCASTING: VIDEO ENCODERS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 39 BROADCASTING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 BROADCASTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 41 BROADCASTING: MARKET, BY NUMBER OF CHANNELS, 2018–2021 (USD MILLION)

TABLE 42 BROADCASTING: VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS, 2022–2027 (USD MILLION)

9.2.1.1 Pay TV

TABLE 43 PAY TV: VIDEO ENCODER MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 PAY TV: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2.1.2 Over-the-top (OTT) services

TABLE 45 OTT: VIDEO ENCODER MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 OTT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 SURVEILLANCE

9.3.1 VIDEO SURVEILLANCE INDUSTRY SWITCHING TO IP-BASED SYSTEMS

TABLE 47 SURVEILLANCE: VIDEO ENCODER MARKET, 2018–2021 (THOUSAND UNIT)

TABLE 48 SURVEILLANCE: MARKET, 2022–2027 (THOUSAND UNIT)

TABLE 49 SURVEILLANCE: VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS, 2018–2021 (USD MILLION)

TABLE 50 SURVEILLANCE: MARKET, BY NUMBER OF CHANNELS, 2022–2027 (USD MILLION)

TABLE 51 SURVEILLANCE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 52 SURVEILLANCE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 53 SURVEILLANCE: VIDEO ENCODERS MARKET , BY REGION, 2018–2021 (USD MILLION)

TABLE 54 SURVEILLANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3.1.1 Retail

TABLE 55 RETAIL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 RETAIL: VIDEO ENCODERS MARKET , BY REGION, 2022–2027 (USD MILLION)

9.3.1.2 Transportation

TABLE 57 TRANSPORTATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 TRANSPORTATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3.1.3 Commercial

TABLE 59 COMMERCIAL: VIDEO ENCODER MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 COMMERCIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3.1.4 Residential

TABLE 61 RESIDENTIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 RESIDENTIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3.1.5 Institutional

TABLE 63 INSTITUTIONAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 INSTITUTIONAL: VIDEO ENCODERS MARKET , BY REGION, 2022–2027 (USD MILLION)

9.3.1.6 Military and defense

TABLE 65 MILITARY AND DEFENSE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 MILITARY AND DEFENSE: VIDEO ENCODERS MARKET , BY REGION, 2022–2027 (USD MILLION)

10 VIDEO ENCODER MARKET, BY REGION (Page No. - 90)

10.1 INTRODUCTION

FIGURE 31 MARKET IN INDIA EXPECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 32 VIDEO ENCODER MARKET IN ROW TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 67 VIDEO ENCODER MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 VIDEO ENCODER MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 33 NORTH AMERICA: VIDEO ENCODERS MARKET SNAPSHOT

FIGURE 34 US TO CONTINUE TO LEAD VIDEO ENCODER MARKET IN NORTH AMERICA DURING FORECAST PERIOD

TABLE 69 SURVEILLANCE: VIDEO ENCODER MARKET IN NORTH AMERICA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 70 SURVEILLANCE: MARKET IN NORTH AMERICA, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 71 BROADCASTING: VIDEO ENCODERS MARKET IN NORTH AMERICA, BY TYPE, 2018–2021 (USD MILLION)

TABLE 72 BROADCASTING: MARKET IN NORTH AMERICA, BY TYPE, 2022–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET , BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 74 NORTH AMERICA: VIDEO ENCODER MARKET , BY COUNTRY, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 US held largest share of video encoder market in North America in 2021

10.2.2 CANADA

10.2.2.1 Many cities installing CCTV street cameras

10.2.3 MEXICO

10.2.3.1 Upsurge in demand for personal safety from private sector

10.3 EUROPE

FIGURE 35 EUROPE: VIDEO ENCODER MARKET SNAPSHOT

FIGURE 36 GERMANY TO LEAD VIDEO ENCODERS MARKET IN EUROPE IN 2022

TABLE 75 SURVEILLANCE: MARKET IN EUROPE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 76 SURVEILLANCE: VIDEO ENCODERS MARKET IN EUROPE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 77 BROADCASTING: MARKET IN EUROPE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 78 BROADCASTING: VIDEO ENCODERS MARKET IN EUROPE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 79 EUROPE: VIDEO ENCODER MARKET , BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 80 EUROPE: MARKET , BY COUNTRY, 2022–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 Heightened city surveillance

10.3.2 GERMANY

10.3.2.1 Increased CCTV camera installations in public areas and transport networks

10.3.3 FRANCE

10.3.3.1 Dynamic broadcasting industry to boost market

10.3.4 SPAIN

10.3.4.1 Demand for video surveillance to boost market

10.3.5 ITALY

10.3.5.1 Broadcasters offering better video quality to subscribers

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: VIDEO ENCODERS MARKET SNAPSHOT

FIGURE 38 JAPAN TO EXHIBIT HIGHEST CAGR IN ASIA PACIFIC DURING FORECAST PERIOD

TABLE 81 SURVEILLANCE: MARKET IN ASIA PACIFIC, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 82 SURVEILLANCE: VIDEO ENCODERS MARKET IN ASIA PACIFIC, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 83 BROADCASTING: MARKET IN ASIA PACIFIC, BY TYPE, 2018–2021 (USD MILLION)

TABLE 84 BROADCASTING: VIDEO ENCODER MARKET IN ASIA PACIFIC, BY TYPE, 2022–2027 (USD MILLION)

TABLE 85 ASIA PACIFIC: MARKET , BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 86 ASIA PACIFIC: MARKET , BY COUNTRY, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Surveillance applications to drive demand

10.4.2 JAPAN

10.4.2.1 Active video surveillance systems to ensure safety of citizens

10.4.3 INDIA

10.4.3.1 Video encoder market to grow at highest pace

10.4.4 SOUTH KOREA

10.4.4.1 Increasing security camera installations

10.4.5 REST OF ASIA PACIFIC

10.5 REST OF THE WORLD

FIGURE 39 MIDDLE EAST TO RECORD HIGHEST CAGR IN ROW DURING FORECAST PERIOD

TABLE 87 SURVEILLANCE: VIDEO ENCODERS MARKET IN ROW, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 88 SURVEILLANCE: MARKET IN ROW, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 89 BROADCASTING: MARKET IN ROW, BY TYPE, 2018–2021 (USD MILLION)

TABLE 90 BROADCASTING: MARKET IN ROW, BY TYPE, 2022–2027 (USD MILLION)

TABLE 91 ROW: VIDEO ENCODER MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 92 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Growing demand for HD content

10.5.2 MIDDLE EAST

10.5.2.1 Increasing use of security cameras

10.5.3 AFRICA

10.5.3.1 African viewers enjoy HD and SD video experience, IPTV, and pay TV at affordable price

11 COMPETITIVE LANDSCAPE (Page No. - 115)

11.1 OVERVIEW

FIGURE 40 KEY DEVELOPMENTS BY KEY PLAYERS IN VIDEO ENCODER MARKET (2020–2022)

11.2 MARKET SHARE ANALYSIS, 2021

TABLE 93 VIDEO ENCODER MARKET: MARKET SHARE ANALYSIS

11.3 COMPANY EVALUATION QUADRANT

11.3.1 STARS

11.3.2 EMERGING LEADERS

11.3.3 PERVASIVE PLAYERS

11.3.4 PARTICIPANTS

FIGURE 41 VIDEO ENCODERS MARKET: (GLOBAL) COMPANY QUADRANT, 2021

11.4 START-UP/SME EVALUATION QUADRANT

11.4.1 PROGRESSIVE COMPANIES

11.4.2 RESPONSIVE COMPANIES

11.4.3 DYNAMIC COMPANIES

11.4.4 STARTING BLOCKS

FIGURE 42 VIDEO ENCODERS MARKET: START-UP/SME QUADRANT, 2021

11.5 COMPETITIVE SCENARIO

11.5.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 94 PRODUCT LAUNCHES AND DEVELOPMENTS

11.5.2 DEALS

TABLE 95 DEALS

12 COMPANY PROFILES (Page No. - 123)

12.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions offered, Recent Developments, MnM view, Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

12.1.1 HIKVISION

TABLE 96 HIKVISION: BUSINESS OVERVIEW

FIGURE 43 HIKVISION: COMPANY SNAPSHOT

12.1.2 VITEC

TABLE 97 VITEC: BUSINESS OVERVIEW

12.1.3 HARMONIC

TABLE 98 HARMONIC: BUSINESS OVERVIEW

FIGURE 44 HARMONIC: COMPANY SNAPSHOT

12.1.4 MOTOROLA SOLUTIONS

TABLE 99 MOTOROLA SOLUTIONS: BUSINESS OVERVIEW

FIGURE 45 MOTOROLA SOLUTIONS: COMPANY SNAPSHOT

12.1.5 CISCO

TABLE 100 CISCO: BUSINESS OVERVIEW

FIGURE 46 CISCO: COMPANY SNAPSHOT

12.1.6 COMMSCOPE

TABLE 101 COMMSCOPE: BUSINESS OVERVIEW

FIGURE 47 COMMSCOPE: COMPANY SNAPSHOT

12.1.7 AXIS COMMUNICATIONS

TABLE 102 AXIS COMMUNICATIONS: BUSINESS OVERVIEW

12.1.8 MATROX ELECTRONIC SYSTEMS

TABLE 103 MATROX ELECTRONIC SYSTEMS: BUSINESS OVERVIEW

12.1.9 DAHUA TECHNOLOGY

TABLE 104 DAHUA TECHNOLOGY.: BUSINESS OVERVIEW

FIGURE 48 DAHUA TECHNOLOGY: COMPANY SNAPSHOT

12.1.10 HAIVISION

TABLE 105 HAIVISION: BUSINESS OVERVIEW

12.1.11 BOSCH SECURITY SYSTEMS

TABLE 106 BOSCH SECURITY SYSTEMS: BUSINESS OVERVIEW

12.1.12 ATEME

TABLE 107 ATEME: BUSINESS OVERVIEW

FIGURE 49 ATEME: COMPANY SNAPSHOT

12.1.13 TELESTE

TABLE 108 TELESTE: BUSINESS OVERVIEW

FIGURE 50 TELESTE: COMPANY SNAPSHOT

*Details on Business Overview, Products/Services/Solutions offered, Recent Developments, MnM view, Key strengths/Right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 VIDICORE

12.2.2 HAIWEITECH

12.2.3 BEAMR

12.2.4 ACTI

12.2.5 ERICSSON

12.2.6 HONEYWELL SECURITY GROUP

12.2.7 LILIN

13 ADJACENT AND RELATED MARKETS (Page No. - 155)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 VIDEO SURVEILLANCE MARKET

13.3.1 VIDEO SURVEILLANCE MARKET, BY SYSTEM

13.3.1.1 Introduction

TABLE 109 VIDEO SURVEILLANCE MARKET, BY SYSTEM, 2017–2020 (USD MILLION)

TABLE 110 VIDEO SURVEILLANCE MARKET, BY SYSTEM, 2021–2026 (USD MILLION)

13.3.2 ANALOG VIDEO SURVEILLANCE SYSTEMS

13.3.2.1 Mainly consist of analog cameras and DVRs

13.3.3 IP VIDEO SURVEILLANCE SYSTEMS

13.3.3.1 Offer enhanced security and better resolution

14 APPENDIX (Page No. - 158)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE – VIDEO ENCODERS MARKET

14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 CUSTOMIZATION OPTIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the video encoders market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Finally, both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to identify and collect information relevant to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly conducted to obtain key information about the industry’s supply chain, value chain of the market, total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

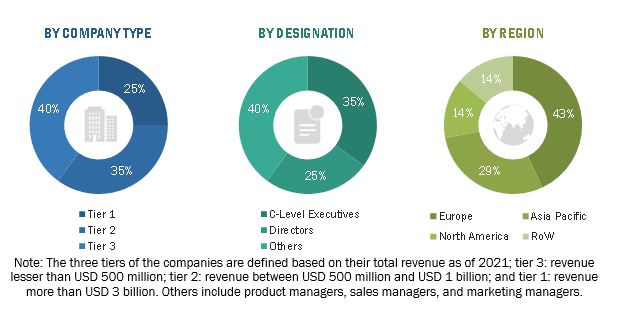

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include experts such as CEOs, VPs, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the video encoders ecosystem. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the overall video encoders market and the market based on segments. The research methodology used to estimate the market size has been given below:

- Major players operating in the video encoders market have been identified and considered for the report through extensive secondary research.

- The supply chain and market size of the video encoders market, both in terms of value and units, have been estimated/determined through secondary and primary research processes.

- All estimations and calculations, including percentage share, revenue mix, splits, and breakdowns have been determined through use of secondary sources which are further verified through primary sources.

Global video encoders market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides, including the impact of COVID-19. Along with this, the market has been validated using both top-down and bottom-up approaches.

Report Objectives:

- To describe and forecast the video encoders market, in terms of value, based on type, end user, application, and component

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific (APAC), and the Rest of World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the value chain of the video encoders ecosystem

- To provide a detailed analysis of the impact of the COVID-19 crisis on the video encoders market, its segments, and market players

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and details of the competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies

- To analyze the major growth strategies implemented by key market players, such as contracts, agreements, acquisitions, product launches, expansions, and partnerships

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Video Encoders Market

1) What level of information does the report have on pricing trends for video encoders, i.e. by geography, by product, by manufacturer? 2) Can we buy by the slice – i.e. not the whole report?

Our company is doing the video encoder and would like to know more about the market to promote to the ICP. Have you included latest or future trends such as AI, IoT, etc. in the scope of the report?

Try to find a blue ocean for the encoder market. Currently, big main players eat those encoder market like as AWS and Azure (AWS Media Convert, Microsoft Azure Media Service). Is there any idea to take these market for small players like as our company (less than 50 person )?

I am an industry veteran executive acted as the CTO of MX1 (SES Video) until less than a month ago. I am now working on a new venture for which I consider this report or part of it. Can you help me with new trends in the market such as AI, IoT, etc. that would impact this market? Which would be the hot bets for this market?